Evaluation of the Canada Disability Savings Program: Phase 2

From: Employment and Social Development Canada

On this page

- Executive summary

- Management response and action plan

- 1. Introduction

- 2. Canada Disability Savings Program

- 3. Evaluation strategy

- 4. Relevance

- 5. Performance

- 6. Efficiency and effectiveness

- 7. Conclusion

- 8. Recommendations

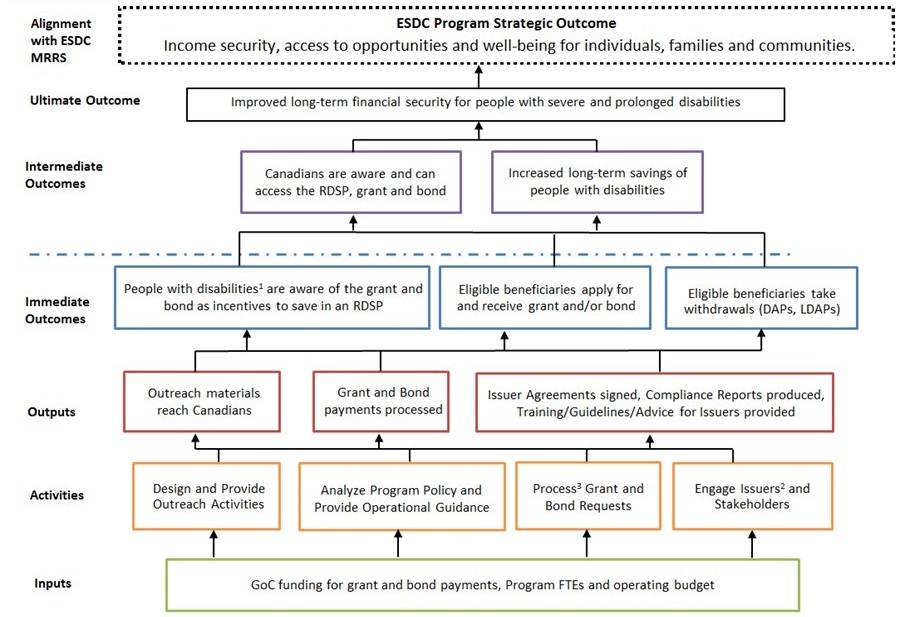

- Appendix A - Canada Disability Savings Program logic model

- Appendix B - Evaluation matrix for Canada Disability Savings Program Evaluation Phase 2

- Appendix C – Methodology

- Appendix D – Program changes

- Appendix E – Additional questions

- Appendix F – References

Alternate formats

Evaluation of the Canada Disability Savings Program: Phase II [PDF - 623 KB]

Large print, braille, MP3 (audio), e-text and DAISY formats are available on demand by ordering online or calling 1 800 O-Canada (1-800-622-6232). If you use a teletypewriter (TTY), call 1-800-926-9105.

List of tables

- Table 1: Contribution match rates for the Canada Disability Savings Grant

- Table 2: Bond eligibility rates for the Canada Disability Savings Bond

- Table 3: Average contributions by income and total excess contributions after maximizing grants, 2008 to 2017

- Table 4: Helpfulness of the Registered Disability Savings Plan, Canada Disability Savings Grant and Canada Disability Savings Bond in Terms of Saving for the Future

List of figures

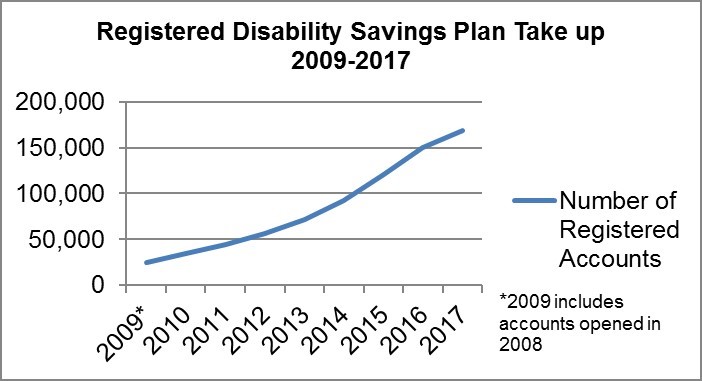

- Figure 1: Registered Disability Savings Plan Accounts Opened, 2009 to 2017

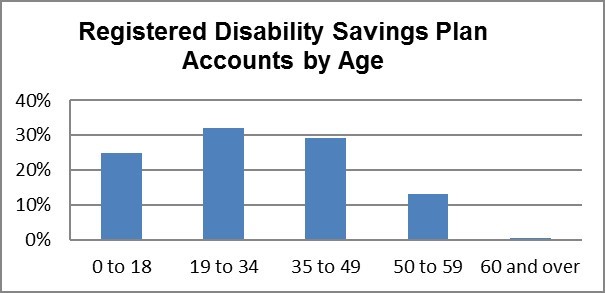

- Figure 2: Registered Disability Savings Plan Accounts by Age, 2009 to 2017

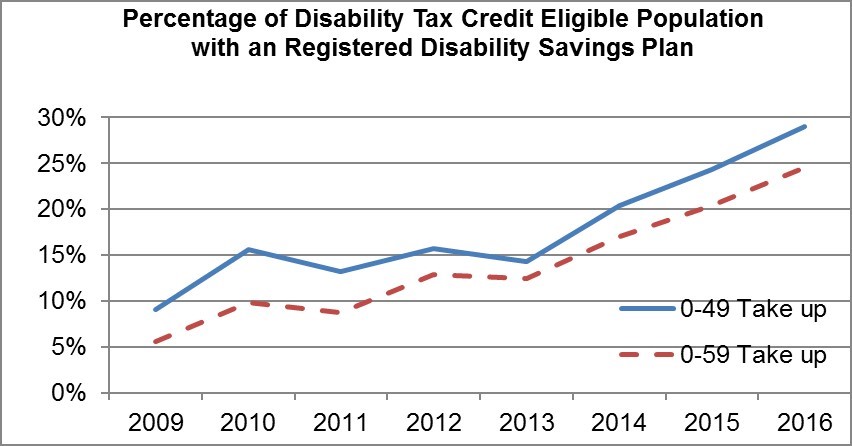

- Figure 3: Percentage of Disability Tax Credit Eligible Persons with a Registered Disability Savings Plan 2009 to 2016

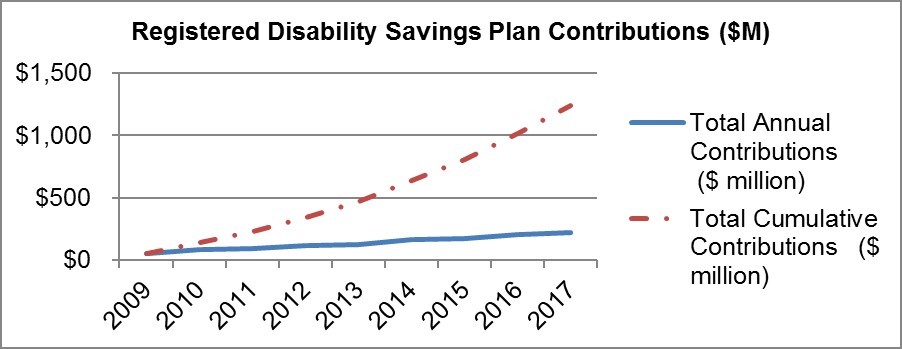

- Figure 4: Annual and Cumulative Registered Disability Savings Plan Contributions, 2009 – 2017

- Figure 5: Annual average Registered Disability Savings Plan contributions

- Figure 6: Total Contributions by Income Group in Nominal Dollars, 2009 to 2017

- Figure 7: Cost / beneficiary by year for Registered Education Savings Plan and Registered Disability Savings Plan, 2013 to 2016

- Figure 8: Number and Total Dollar Value of Grants Paid to Low- and Modest-Income Beneficiaries as a Percentage of the Total Number of Grants and Total Dollar Value, April 2010-March 2018

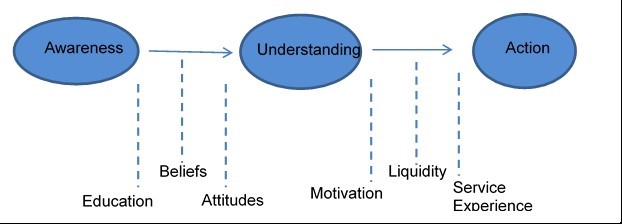

- Figure 9: Canada Disability Savings Program Road map to Long Term Financial Security

Executive summary

The Canada Disability Savings Program was designed to encourage long-term savings to help ensure the financial security of people with severe and prolonged disabilities. Footnote 1 The program consists of 3 components: the Registered Disability Savings Plan, the Canada Disability Savings Grant and the Canada Disability Savings Bond.

To be eligible for a Registered Disability Savings Plan, the beneficiary must have applied and received eligibility for the Disability Tax Credit, be under 60 years of age, be a Canadian resident and have a Social Insurance Number. A beneficiary must have a Plan in order to be eligible for the Canada Disability Savings Grant and the Canada Disability Savings Bond. Plans are registered by the Government of Canada and savings grow tax-free until the beneficiary makes withdrawals. The Canada Disability Savings Grant is a means-tested limited matching amount payable against contributions. Footnote 2 The Canada Disability Savings Bond is paid to beneficiaries with low- to modest- income, regardless of whether they contribute.

The Canada Disability Savings Program is jointly managed by Employment and Social Development Canada and the Canada Revenue Agency, which is also responsible for administering the Disability Tax Credit. The legislative authority for the Canada Disability Savings Grant and Canada Disability Savings Bond is the Canada Disability Savings Act and the Canada Disability Savings Regulations, for which Employment and Social Development Canada is responsible. Plans are governed by the Income Tax Act, for which the Department of Finance has responsibility.

This report presents the findings and conclusions of a summative evaluation, building on the findings of the Evaluation of the Canada Disability Savings Grant and Bond: Phase I. Phase 1 examined the first 4 years of the program's operations and early outcomes. Phase 2, the summative evaluation, builds on this earlier work to address the core evaluation issues of program effectiveness/performance, relevance, and efficiency, now examining 8 years of program results (2009 to 2017).

The Phase 2 evaluation found that both plan holders and key informants believe that the program is making progress towards its ultimate outcome of “Improved long-term financial security for people with severe and prolonged disabilities.” The evaluation generated significant evidence supporting achievement of the 2 intermediate program outcomes that will lead to this ultimate outcome:

Intermediate outcome one: Canadians are aware and can access the Registered Disability Savings Plan, grant and bond.

- In 2016, the take-up rate among persons aged 0 to 59 who had been approved for the Disability Tax Credit (such as, those eligible to open a plan) was 24.5%.

- The take up rate among those in the same group aged 0 to 49 (such as, those eligible for grant and bond payments) was 29%.Footnote 3, Footnote 4 Eighty-four percent of Registered Disability Saving Plans are held by persons with disabilities aged 0 to 49.Footnote 5

- By 2017, nearly 170,000 registered plans were in place, compared to about 72,000 in 2013.

- An ongoing program outreach strategy is increasing awareness of the program. The strategy includes dissemination of information through provincial/territorial government offices, engaging stakeholders, conference and event attendance, and Canada Revenue Agency mail-outs to individuals who are eligible for the Disability Tax Credit but who do not yet have a Registered Disability Savings Plan. Tracking volumes of calls and other inquiries showed that these efforts are effective in increasing the awareness of the Registered Disability Savings Plan.Footnote 6 Data limitations prevent a full understanding of awareness levels amongst eligible individuals who do not yet have a Registered Disability Savings Plan.

Intermediate outcome two: Increased long-term savings of people with disabilities

- The asset value of the Registered Disability Saving Plans has increased every year and is over $4 billion as of December 2017. While many people remain who would benefit from opening a Registered Disability Savings Plan, the program is increasing savings and improving financial security for existing beneficiaries.

- By the end of 2017, the Government of Canada had paid $1.8 billion in Grants and $837.5 million in Bonds while total personal contributions amounted to $1.24 billion. 86% of Registered Disability Saving Plan holders had received at least one grant and/or a bond payment to assist them and their families to save for their long-term financial security.

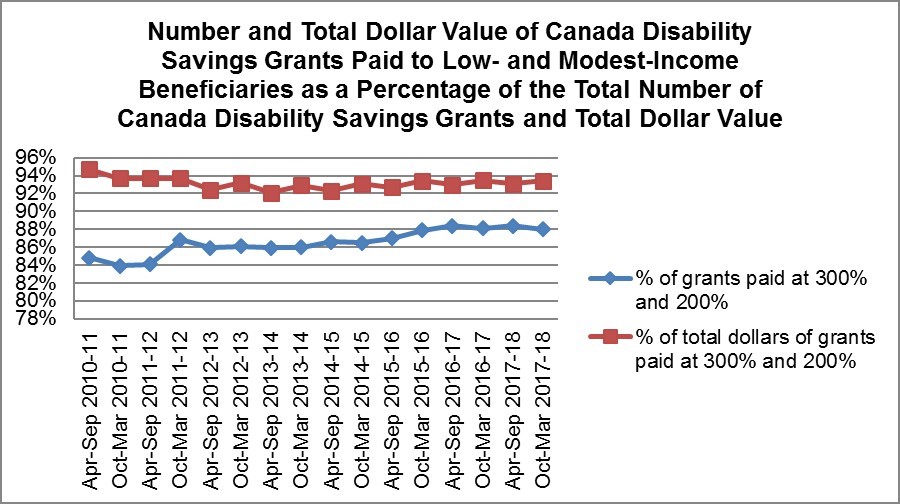

- The program has been successful in reaching its primary target of low-to modest-income people with disabilities. In fact, 94% of Canada Disability Savings Grant funds were paid to low- and modest-income beneficiaries and 90% of Canada Disability Savings Bond funds were paid to beneficiaries in low income.

- Beneficiaries in the low income category have the largest amount of savings (average $36.7K) in their Registered Disability Savings Plans and the lowest amount (average $9.2K) in other savings. Those in the high income category have less savings in their Registered Disability Savings Plan (average $22.8K) and more (average $37.7K) in other savings.Footnote 7

- The program's target group, those with severe and prolonged disabilities, have lower labour market attachment, lower current levels of income and significantly higher living costs than other Canadians, all affecting the ability to save.

Gender-based Analysis +

The summative evaluation examined participants' results using a gender-based analysis plus lens, including, for example, intersections between gender, disability, and age.Footnote 8 Examination of other intersections such as Indigenous groups, ethnicity, new Canadian and region was not possible due to data limitations. Key gender-based analysis plus findings are:

- For the Registered Disability Savings Plans opened between 2008 and 2017, about 40% of beneficiaries are female while about 60% are male.Footnote 9

- Most (69.4%) of the funds in Registered Disability Savings Plan holdings are from the Canada Disability Savings Grant or Canada Disability Savings Bond. Women, and individuals in the lower 3 income brackets, were more likely to say that the larger portion of their Registered Disability Savings Plan came from government money as compared to men and people in the higher income bracket.Footnote 10

Findings on program relevance and efficiency

Relevance: The Canada Disability Savings Program is one of a suite of programs, tax incentives and financial support measures established by the federal government aimed at persons with disabilities.Footnote 11The Government of Canada reiterated this commitment most recently in Budget 2016, as it promised to “eliminate systemic barriers and deliver equality of opportunity to all Canadians living with disabilities”.Footnote 12

Efficiency: Following an initial start-up period when costs were incurred to implement necessary processes and systems, unit costs to administer the Canada Disability Savings Program have dropped rapidly as the number of registered plans rises while administration costs have also been declining.

Challenges

- Raising awareness among the most difficult to reach segments of the population, such as those in the lowest income bracket in order to communicate the benefit of opening an Registered Disability Savings Plan.

- Addressing the knowledge gaps that continue to exist amongst financial institution / issuer partners and Canadians seeking information regarding the Registered Disability Savings Plan, Canada Disability Savings Grant and Canada Disability Savings Bond.

- Enhancing the service experience of all those who attempt to open or maintain a Registered Disability Savings Plan, invest or withdraw funds, particularly the experience of those with multiple vulnerabilities (for example, Indigenous, new arrivals, or LGBT persons with severe and prolonged disabilities.)

Recommendations

Recommendation 1:

Continue working with all partners to increase awareness amongst people with severe and prolonged disabilities, and their families of the benefits of having a Registered Disability Savings Plan and accessing the Canada Disability Savings Bond and Canada Disability Savings Grant.

Recommendation 2:

Continue working with all partners involved in delivering the Registered Disability Savings Plan, the Canada Disability Savings Bond and Canada Disability Savings Grant to identify and address knowledge gapsFootnote 13 that persist within partner organizations and among Registered Disability Savings Plan holders and beneficiaries.

Recommendation 3:

Continue working with all partners to identify and address the barriersFootnote 14 that hinder people with severe and prolonged disabilities who are aware of the Registered Disability Savings Plan from opening or maintaining one and to improve the service experience of those who attempt to do so.

Management response and action plan

The Canada Disability Savings Program helps Canadians with severe and prolonged disabilities and their families save for the future. It is comprised of 3 components: the Registered Disability Savings Plan, the Canada Disability Savings Grant and the Canada Disability Savings Bond. The Registered Disability Savings Plan, the Canada Disability Savings Grant and the Canada Disability Savings Bond complement other government measures that help support financial security for people with disabilities (that is tax support and benefits, earnings replacement and income support programs). As the bond is available to low and modest-income beneficiaries without requiring any contribution to the plan, it complements the Government of Canada's broader commitment to poverty reduction.

The Program administration and delivery is a shared responsibility between the Government of Canada (Employment and Social Development Canada, Canada Revenue Agency and Finance Canada) and participating financial institutions (issuers).

To ensure that the Registered Disability Savings Plan, Canada Disability Savings Grant and the Canada Disability Savings Bond continue to help meet the financial security needs of Canadians with severe and prolonged disabilities, Management has developed a response to the findings of the Phase 2 Evaluation of the Canada Disability Savings Bond and the resulting recommendations outlined below. Drawing on multiple lines of evidence, the Phase 2 Evaluation demonstrates the continued relevance of the Registered Disability Savings Plan, the Canada Disability Savings Grant and the Canada Disability Savings Bond.

This Management Response outlines how the Department will review and implement the recommendations in the report regarding program awareness, take-up and service experience.

Recommendation 1: Continue working with all partners to increase awareness amongst people with severe and prolonged disabilities, and their families of the benefits of having a Registered Disability Savings Plan and accessing the Canada Disability Savings Bond and Canada Disability Savings Grant.

Response

TheThe Department agrees with the recommendation to continue working with all partners to increase awareness amongst people with severe and prolonged disabilities, and their families, of the benefits of having a Registered Disability Savings Plan and accessing the Canada Disability Savings Bond and Canada Disability Savings Grant. The key actions include: continued collaboration with Canada Revenue Agency on mass mail-outs to potential beneficiaries including testing innovative models; improving the Canada.ca website; and working with the Employment and Social Development Canada Innovation Lab to identify approaches to better target hard-to-reach populations.

The Registered Disability Savings Plan, the Canada Disability Savings Grant and the Canada Disability Savings Bond are delivered through a relationship between the Government of Canada (Employment and Social Development Canada, Canada Revenue Agency and Finance Canada) and financial institutions (issuers). Since the program's implementation in 2008, a robust governance structure, (which consists of letters of agreement, memoranda of understanding and issuer agreements), and a collaborative partnership were established to ensure effective administration among partners.

Since 2012, Employment and Social Development Canada has been collaborating with the Canada Revenue Agency to deliver annual mass mail-outs targeted to Disability Tax Credit -eligible individuals across Canada. Up to 320,000 mail-out letters are sent every year. Over the past 3 years, an increase in the number of Registered Disability Savings Plans opened was observed within the first 2 months following each mail-out (approximately 50% to 80% increase in the average monthly rate). Employment and Social Development Canada will continue to collaborate with Canada Revenue Agency to facilitate the annual mail-out of letters and to inform Disability Tax Credit-eligible individuals about the program. Further approaches to better target the hard-to-reach population with disabilities (that is, Indigenous, low income, immigrants and people living in remote and rural areas) will also be explored in collaboration with the Employment and Social Development Canada Innovation Lab, which could include partnerships with other Employment and Social Development Canada programs that face similar challenges around program uptake, or the development of specific projects tailored to the Canada Disability Savings Program.

One of the ways that people access information about the Registered Disability Savings Plan, the Canada Disability Savings Grant and the Canada Disability Savings Bond is through searches for the program on the Internet. Canada.ca is the public website that lists all of the programs, services and initiatives of the Government of Canada and was set up to be a consolidated resource. Currently, information about the Registered Disability Savings Plan, the Canada Disability Savings Grant and the Canada Disability Savings Bond is posted to this site by both Employment and Social Development Canada and Canada Revenue Agency with different styles of wording and some duplication of information. Communicating more clearly to the target population, which includes people who lack financial literacy, requires the use of plain language and a more holistic and unified approach to how the program's information is presented on Canada.ca. Employment and Social Development Canada is currently updating web content and will coordinate efforts and messaging with the Canada Revenue Agency to improve and streamline the program's web presence on Canada.ca.

In order to help address regional realities, identifying at a more granular level the geographic locations of potential beneficiaries is needed. The program has initiated a study to break down the current take-up rate by more specific geographic details such as the first 3 digits of the postal code and/or census division. The program will engage Canada Revenue Agency in a discussion to obtain reports on Disability Tax Credit take-up with more detailed geographic locations. This analysis will help Canada Disability Savings Program Outreach target future promotional and stakeholder engagement activities.

Management action plan

- Collaborate with Canada Revenue Agency to facilitate the 2018 mail-out which will target potential Registered Disability Savings Plan beneficiaries aged 19 to 49.

- Completion date: October/November 2018

- Work with Employment and Social Development Canada's Innovation Lab to consider possible new approaches to better target the hard-to-reach population with disabilities.

- Completion date: September 2019

- Work with Employment and Social Development Canada Public Affairs and Stakeholder Relations Branch and collaborate with Canada Revenue Agency to improve and streamline program web content.

- Completion date: July 2019

- As part of the work to improve the program's web content, ensure that new tools and enhanced communication products are available in alternate formats.

- Completion date: September 2019

Recommendation 2: Continue working with all partners involved in delivering the Registered Disability Savings Plan, the Canada Disability Savings Grant and the Canada Disability Savings Bond to identify and address knowledge gaps that persist within partner organizations and among Registered Disability Savings Plan holders and beneficiaries.

Response

Management acknowledges the need to continue working with partners for the purpose of identifying and addressing knowledge gaps. Over the past years, work has been done to identify key knowledge gaps that persist among partner organizations and Registered Disability Savings Plan holders and beneficiaries.

To help issuers administer Registered Disability Savings Plans and explain the program to applicants, Employment and Social Development Canada will continue to provide a comprehensive suite (in various formats) of reference/training resources and regular updated bulletins to issuers. These resources will be regularly enhanced and refreshed based on client experiences and feedback from stakeholders.

2019 will mark 10 years since the initial payments of grant and bond were made into Registered Disability Savings Plans. The Program will put specific emphasis on communications products explaining the rules regarding withdrawals and repayments to avoid confusion among plan holders, beneficiaries and financial institution and to ensure that they are not negatively affected.

To help better address the key knowledge gaps faced by the employees of issuers who deal with Registered Disability Savings Plans, including any additional support as part of the program's ten-year anniversary, Employment and Social Development Canada will request more targeted feedback from issuers (through teleconferences and meetings) to both identify the gaps and develop potential solutions to address these gaps. This can be achieved by further strengthening the relationship with issuers through the Registered Disability Savings Plan Advisory Committee, created in 2012 to provide a forum for program delivery partners to discuss key issues. While these meetings have traditionally been held on an as needed basis, the last one being in June of 2017, increased consultation with issuers is being pursued. Employment and Social Development Canada and the Canada Revenue Agency co-chair the committee that brings together representatives from all issuers. The next Registered Disability Savings Plan Advisory Committee meeting is scheduled for October 2018. Engagement through the Registered Disability Savings Plan Advisory Committee will continue and participation in discussions by delivery partners will be encouraged.

Some identified program research gaps pose a challenge to being more strategic and targeted with outreach efforts. In particular, research and analysis are needed to determine the key demographic characteristics of the 'non-client' group, that is Disability Tax Credit-eligible individuals in the 0 to 49 age group who have not yet opened a Registered Disability Savings Plan. To this end, Employment and Social Development Canada will collaborate with Statistics Canada to carry out an ad-hoc survey on non-clients aimed at investigating the reason why they have not yet opened a Registered Disability Savings Plan and how this relates to demographic and socio-economic characteristics. In 2018, the program transferred its administrative data to Statistics Canada pursuant to a memorandum of understanding between Statistics Canada and Employment and Social Development Canada. In this regard, Employment and Social Development Canada has begun developing project parameters to have Statistics Canada link the Canada Disability Savings Program administrative data with tax file or survey data.

Management action plan

- Through reinvigorating the relationship with issuers by means of Registered Disability Savings Plan Advisory Committee meetings and teleconferences, solicit feedback from issuers regarding any potential issues evolving from knowledge gaps, for instance additional information on withdrawals may be needed to help issuers provide more clarity to holders in the event of the 10-year anniversary issue.

- Completion date: March 2019

- Work with Statistics Canada is beginning in fall 2018 to facilitate a survey of a sample from the non-clients group in order to better understand their reasons for not opening a Registered Disability Savings Plan. It is tentatively planned that the survey could go out in Spring 2019 and then results would be rolled up during Summer 2019. The subsequent analysis will help inform the Canada Disability Savings Program's future outreach and policy work.

- Completion date: September 2019

Recommendation 3:

Continue working with all partners to identify and address the barriers that hinder people with severe and prolonged disabilities who are aware of the Registered Disability Savings Plan from opening or maintaining one and to improve the service experience of those who attempt to do so.

Response

Management agrees with this recommendation. The Canada Disability Savings Program will continue to collaborate with partners to find ways to better address barriers that prevent people with disabilities from opening or maintaining a Registered Disability Savings Plan.

After 10 years of program delivery experience, feedback (anecdotal and quantitative) has been gathered to be able to identify some of the barriers that challenge potential beneficiaries with accessing the program. One of the key challenges is understanding how the Disability Tax Credit works and completing the application process. Recommendations are expected in 2019 from Canada Revenue Agency's Disability Advisory Committee, which was reinstated in 2017 to provide advice to the Minister of National Revenue and the Canada Revenue Agency Commissioner with respect to administrative issues evolving from disability tax measures (including the Disability Tax Credit). Employment and Social Development Canada will work with the Canada Revenue Agency and the Department of Finance to take into consideration the advice of the Disability Advisory Committee in developing the outreach strategy and to improve client service in the Program.

As part of the work to address knowledge gaps and barriers, Employment and Social Development Canada will continue to collaborate with stakeholders such as disability support organizations and financial planners and the program's delivery arm (that is the financial institutions) to focus on areas where further potential improvements to the service experience of both clients and non-clients is possible. Program officials will engage the issuers to identify areas where improvements to the service experience could be made at this Octobers Registered Disability Savings Plan Advisory Committee meeting and through teleconferences in the coming year.

In some jurisdictions it is the perception of some potential beneficiaries who are low-income that Registered Disability Savings Plan assets or income could negatively impact eligibility for provincial disability supports; and this perception prevents them from opening a Registered Disability Savings Plan. Program officials will continue to work with the provinces/territories and welcome further collaboration with the Ontario Disability Support Program. An engagement strategy is being developed to strengthen the program's collaboration with provincial/territorial counterparts and increase program promotion in particular in jurisdictions with lower take-up rates.

In addition to partnering with Statistics Canada to conduct a survey of the non-client group (as mentioned in Recommendation 2), program officials will consider other ways to solicit this type of information from the non-client group, for example through informal surveys of people who visit the Canada Disability Savings Program kiosk during conferences and events.

Management action plan

- Expand our current work with provincial and territorial representatives, especially in jurisdictions with lower take-up (for example Atlantic provinces, Quebec) — to help increase awareness and enhance understanding among provincial/territorial staff that work in the areas of social services programs/ benefits with a view to increasing take up rates across the country.

- Completion date: July 2019

- Through Registered Disability Savings Plan Advisory Committee meetings and teleconference discussions, solicit ideas from issuers regarding any potential areas where the service experience can be improved.

- Completion date: December 2019

1. Introduction

This report presents the findings and conclusions of the summative evaluation, building on the findings of the Evaluation of the Canada Disability Savings Grant and Bond: Phase I. Phase 1 examined the first 4 years of the program's operations and early outcomes. The summative evaluation builds on this earlier work to address the core evaluation issues of program relevance, effectiveness and efficiency, now examining 8 years of program results (2009 to 2017).Footnote 15

2. Canada Disability Savings Program

2.1 Program objective

The objective of the Canada Disability Savings Program is to encourage long-term savings to help ensure the financial security of people with severe and prolonged disabilities. The program was designed based on the final report of an expert panel that had been convened by the Government of Canada and given the mandate "to make recommendations on how families can provide for the future financial security of their family member with a disability".Footnote 16

2.2 Background

In 2006, the Government of Canada announced the appointment of an Expert Panel on Financial Security for Children with Severe Disabilities to examine ways to help parents save for the long-term financial security of their children. The concern was how best to ensure the financial security of a disabled child when parents are no longer able to provide support, as well as to help alleviate the poverty so disproportionately experienced by Canadians with disabilities.Footnote 17 In developing its recommendations, the panel was concerned with balancing 2 competing objectives: (1) to encourage long-terms savings and (2) to ensure that the beneficiary would benefit from those savings within his or her lifetime.

In Budget 2007, the Government of Canada, acting on the recommendations from the Panel’s final reportFootnote 18, announced the introduction of the tax deferredFootnote 19 Registered Disability Savings Plan. The Registered Disability Savings Plan was then introduced in 2008. As recommended by the Panel, the Registered Disability Savings Plan was modeled on the Registered Education Savings Plan emulating its higher matching rates for those in the low and modest income categories, thus producing more equitable distribution of public contributions.Footnote 20

2.3 Program description

The Canada Disability Savings Program consists of 3 components:

- The Registered Disability Savings Plan

- The Canada Disability Savings Grant

- The Canada Disability Savings Bond

Registered Disability Savings Plan

Registered Disability Savings Plans are available through major financial institutionsFootnote 21 in Canada. To be eligible for a Plan, the beneficiary must have applied and received eligibility for the Disability Tax Credit;Footnote 22 be under 60 years of age; be a Canadian resident; and have a Social Insurance Number.

Holders of a Plan may be the beneficiaries or they may be parents of beneficiaries who opened it when the beneficiary was still a minor, a qualifying family member (for example, parent or spouse), or a legal representative or government agency that is legally authorized to act for the beneficiary.

A beneficiary must have a Registered Disability Savings Plan in order to be eligible for the Canada Disability Savings Grant and the Canada Disability Savings Bond. Canada Disability Savings Grant and/or Canada Disability Savings Bond contributions are available to eligible beneficiaries up to December 31st of the year that the beneficiary turns 49.

Canada Disability Savings Grant

The Canada Disability Savings Grant is a matching amount the Government of Canada contributes to a Registered Disability Savings Plan. For a family with an income of $91,831 or less (income thresholds for 2017) the maximum grant available per year is $3,500 and is dependent on a personal contribution of $1,500 being made. For families with incomes greater than $91,831, the maximum grant is $1,000 (if a contribution of $1,000 is made) (see Table 1).

| Personal Contribution amount | Income ≤ $91,831 | Income ˃ $91,831 | ||

|---|---|---|---|---|

| Percentage | Dollars | Percentage | Dollars | |

| First $500 | 300% | $1,500 | - | - |

| First $1,000 | - | - | 100% | $1,000 |

| Next $1,000 | 200% | $2,000 | - | - |

| Total maximum grant | n/a | $3,500 | n/a | $1,000 |

Rates and income threshold as of January 2017

Dash (-) indicates that the program does not provide a matching grant for this particular contribution amount.

Canada Disability Savings Bond

The Canada Disability Savings Bond is an amount paid by the government into a Registered Disability Savings Plan. It is only available to low- and modest-income families. A personal contribution to the Registered Disability Savings Plan is not required in order to receive the Canada Disability Savings Bond. The maximum annual Canada Disability Savings Bond available is $1,000 and the lifetime maximum Canada Disability Savings Bond entitlement is $20,000 per Registered Disability Savings Plan beneficiary. Canada Disability Savings Bond payments are means-tested based on income level (see Table 2).

| Bond eligibility rates for the Canada Disability Savings Bond | Family income level | ||

|---|---|---|---|

| ≤ $30,000 | $30,000-$45,916 | > $45,916 | |

| Maximum bond available | $1,000 | Pro-rated portion of $1,000 | $0 |

Rates as of January 2017

Like the Canada Disability Savings Grant, the Canada Disability Savings Bond is subject to a ten-year holdback during which time any Canada Disability Savings Bond money paid into an Registered Disability Savings Plan cannot be accessed and must be paid back to the Government of Canada if the Registered Disability Savings Plan is closed.

2.4 Expected results

As articulated in the Performance Measurement Strategy for the Canada Disability Savings Program (2015),Footnote 25 the direct outcomes for the Canada Disability Savings Program are:

- People with disabilities are aware of the Canada Disability Savings Grant and Canada Disability Savings Bond as incentives to save in a Registered Disability Savings Plan.

- Eligible beneficiaries apply for and receive the Canada Disability Savings Grant and Canada Disability Savings Bond.

- Eligible beneficiaries take withdrawals.

Intermediate outcomes are:

- Canadians are aware of and can access the Registered Disability Savings Plan, Canada Disability Savings Grant and Canada Disability Savings Bond.

- Increased long-term savings of people with disabilities.

The ultimate outcome, "improved long-term financial security for people with severe and prolonged disabilities", is expected to happen over time due to the accumulation of savings in Registered Disability Savings Plans.

2.5 Delivery model

The Canada Disability Savings Program is jointly managed by Employment and Social Development Canada, the Canada Revenue Agency and the Department of Finance. Employment and Social Development Canada is responsible for program design and delivery, policy development, outreach, communications products, Federal/Provincial/Territorial relationships, business and system needs, evaluations and performance reporting.

In closing this section, it is worth noting that, since initial implementation in 2008, operational experience has led to numerous program changes (see Appendix D). However, the program has been relatively stable during the years covered by this evaluation report.

3. Evaluation strategy

The evaluation of the Canada Disability Savings Program comprised 2 phases, an early formative evaluation approved in October 2014 and the current summative evaluation whose results are contained in this report.Footnote 26

3.1 Phase 1

The Phase 1 Evaluation examined early results of the program from 2008 to 2012. The objective of Phase 1 was to examine the design and delivery of the program, its relevance, and early directional impacts. It confirmed that the Canada Disability Savings Grant and the Canada Disability Savings Bond had introduced important new instruments, namely asset-development, to provide financial security for persons with severe and prolonged disabilities. As expected, the evaluation found a number of areas for improvement in the program itself and its administration, such as enhancing performance measurement; improving communications and outreach; streamlining the application process; and supporting awareness and knowledge amongst delivery partners.

3.2 Phase 2

Evaluation scope

The evaluation of the Canada Disability Savings Program Phase 2 is based primarily on the period 2008-2009 to 2016-17, though occasionally, data from 2017 to 2018 are included.Footnote 27 Evaluation planning activities established twelve key questions to address the core issues of relevance, performance, and efficiency/economy (For more details see the Evaluation Matrix in Appendix B).

Methodology

The evaluation employed a mixed methods approach to respond to the evaluation questions and used 7 lines of evidence (Appendix C) including:

- a review of program documents and project files

- key informant interviews (n=31) with program staff from Employment and Social Development Canada, Finance Canada and the Canada Revenue Agency and representatives from key stakeholder groups: Provincial/Territorial governments, non-government organizations and financial institutionsFootnote 28

- Canada Disability Savings Program Administrative data

- technical studies/statistical analyses

- thirty case studies of families of a Registered Disability Savings Plan beneficiary

- analyses of various Statistics Canada population surveys

- Survey of Households of Canadians with Disabilities, a custom survey of Registered Disability Savings Plan clients and non-clients

Data limitations

In this phase of the evaluation, the Canada Revenue Agency did not permit Employment and Social Development Canada to link to their data on Disability Tax Credit-eligible individuals. As a result, the Agency’s information on personal income and income sources, employment, Registered Retirement Saving Plans, and deductions was not available to augment the analysis of program data. Canada Revenue Agency data concerning Disability Tax Credit status, income levels and participation or non-participation in the Canada Disability Savings Program could have provided information on the socio-economic profile of the eligible population. It could also have helped to determine the extent to which individuals and families are saving outside of a Registered Disability Savings Plan (for example, in a Registered Retirement Savings Plan). Also, questions related to the total population of persons eligible for the Disability Tax Credit could not be addressed.

Within these limitations, program data on matching Canada Disability Savings Grants and Canada Disability Savings Bonds clearly showed that the program significantly benefits low-income participants. In addition, the Survey for the Evaluation of Canada Disability Savings Program includes income data that shows the contributions made to the program by income group. Further, as documented in the Management Response to the evaluation, recent data sharing arrangements with Statistics Canada will now support the creation of new data linkages that will permit the department to address the above limitations.

The Canada Disability Savings Program administrative data does not contain information on the severity or type of disability, which are needed to fully examine variations in the program’s impact on the target audience. The Participation and Activity Limitation Survey (2006) was used to develop the profile of families of children with disabilities but its index categorizes the severity and type of a person’s disability differently than the eligibility criteria for the Disability Tax Credit. This survey contains data taken from prior to the introduction of the Registered Disability Savings Plan and thus does not contain any information about take up of the Registered Disability Savings Plan or its effects.

The Survey of Households of Canadians with Disabilities,Footnote 29 conducted for this evaluation, included Client and Non-Client Surveys. However, there was a very low response rate to the Non-Client Survey – non-clients being individuals who were eligible for a Registered Disability Savings Plan (and who were 49 years old or younger) but did not have one. Due to the small sample size (13 respondents), analysis of the data that was collected was not undertaken.

In examining levels of awareness, challenges were noted in isolating the impact of Employment and Social Development Canada-led promotional efforts from those of other jurisdictions (for example, the Province of British Columbia has made considerable efforts in promoting the program).Footnote 30 Despite this, the assessment of program awareness benefited from input from various sources of information at different levels (for example, departmental program staff, provincial and territorial representatives, NGO’s, case studies of program participants). This allowed for a greater triangulation of the information received.

4. Relevance

Evaluation evidence gathered demonstrates that the Canada Disability Savings Program is aligned with Governmental and Departmental roles, responsibilities and priorities and that it is meeting an ongoing need within the target population of persons with severe and prolonged disabilities.

4.1 Need for future savings for persons with disabilities

The need for people with disabilities to save for the future was strongly supported by all lines of inquiry. An overwhelming number of respondents to the Survey of Households of Canadians with Disabilities surveyFootnote 31 (98.5%) felt that they needed to save for the future; key informants concurred,Footnote 32 case studies supported this needFootnote 33 as did the technical studies of program data.Footnote 34 In addition, respondents to the Survey of Households of Canadians with Disabilities revealed a lack of confidence in their future regarding self-sufficiency with almost half (45.9%) indicating they will not have enough money in the future for either their wants or their needs.Footnote 35 There were no significant differences by gender or income level.

Interviewees for nearly all case studies anticipated that the beneficiary of the Registered Disability Savings Plan would need additional savings in the future to either pay for additional care required by their disability, or to supplement income – irrespective of whether that income was from employment or provincial income assistance and disability programs.Footnote 36 There were some case study participants who expected that beneficiaries would be eligible for, and live in, group homes or similar living arrangements, where costs of living would be provided by the province.Footnote 37 However, these case study participants noted that these programs cover only the “bare basics” such as shelter, food and care while other expenses such as clothing, entertainment or outings are not covered by these programs.Footnote 38

The Canada Disability Savings Grants and Canada Disability Savings Bonds available through the Registered Disability Savings Plan were seen as an incentive for saving,Footnote 39 particularly for those with low and modest incomes. The desire to save for anticipated future needs is further highlighted by the finding that some beneficiaries and account holders continue to contribute to a Registered Disability Savings Plan even after they reach the maximum grant (See section 5.4 for more details).

4.2 Barriers to accumulating desired savings

According to the Canadian Survey on Disability, people with disabilities and families of children with disabilities face significant economic barriers making it more difficult to contribute to a Registered Disability Savings Plan or otherwise save for the future. An analysis of the Canadian Survey on Disability (2012) found that people aged 15 to 59 with more severe disabilities differed from those with less severe disabilities in a number of important ways, including living in lower income households, and being less likely to have employment.Footnote 40

The Canadian Survey on Disability found that 22.7% of all people with disabilities were prevented from working due to their disabilities. Further examination shows that 34.6% of people with more severe disabilities are prevented from working while 11.3% of people with less severe disabilities are prevented from working due to their disabilities. Results from the Survey of Households of Canadians with Disabilities revealed that many Registered Disability Savings Plan beneficiaries were not currently employed (65.5%). Of those that were employed, a larger proportion was employed on a part-time basis (24.2%) than a full-time basis (10.3%).Footnote 41

As for families of children with disabilities, analysis of the Participation and Activity Limitation Survey (2006) found that many face job-related difficulties, including not taking a job (26.4%), working fewer hours (38.4%) and leaving (21.6%) or losing (6.2%) a job to care for the child with disabilities.Footnote 42 As with other issues, the prevalence was greater among families who had children with more severe disabilities than those who had children with less severe disabilities.

For these reasons, families of children with more severe disabilities have lower average household incomes ($65,310) than families with children with less severe disabilities ($71,530) or those without disabilities ($73,680).Footnote 43

Both the Canadian Survey on Disability (2012) and the Participation and Activity Limitation Survey (2006) provided evidence that people with more severe disabilities and families of children with more severe disabilities incur higher living costs than people with less severe disabilities and people without disabilities. For example, 34.3% of families of children with less severe disabilities indicated that they had out-of-pocket expenses for prescription or non-prescription drugs in the last 12 months compared to 41.4% of families of children with more severe disabilities.Footnote 44 In addition, people with disabilities can expect these costs to continue and likely increase as they age. Out-of-pocket expenses include health-related items, assistive aids and devices, caregiving services, transportation and others.Footnote 45

The Survey on Household Spending examined the period from 2010 to 2013 and concluded that households of persons with disabilities or of children with disabilities dedicate a greater percentage of expenses for food (11.7% versus 10.4%), shelter (21.5% versus 20.8%), household operation (6.8% versus 6.2%), furniture (2.8% versus 2.6%) and transportation (15.8% versus 14.9%) than comparable households without disability. They also spent more on health care and general consumption compared to households without people with disabilities or families of children with disabilities.Footnote 46 Higher living costs generally mean less capacity to save.

4.3 Alignment with federal government priorities

The Canada Disability Savings Program's objective is to encourage long-term savings to help ensure the financial security of people with severe and prolonged disabilities. This is consistent with the Departmental Results Framework / Program Inventory (2018 to 2019) and contributes to Employment and Social Development Canada's Strategic Outcome 4: Income security, access to opportunities and well-being for individuals, families and communities.Footnote 47

The Canada Disability Savings Program is one of a suite of programs, tax incentives and financial support measures established by the federal government aimed at persons with disabilities.Footnote 48 The Government of Canada reiterated this commitment most recently in Budget 2016, as it promised to “eliminate systemic barriers and deliver equality of opportunity to all Canadians living with disabilities”.Footnote 49

As part of the government's accessibility agenda, federal accessibility legislation was introduced to remove barriers to accessibility across sectors of federal jurisdiction. The Accessible Canada Program supports the meaningful participation of people with disabilities in the ongoing implementation and administration of federal accessibility legislation.

5. Performance

All lines of evidence suggest that the program has made considerable progress in achieving its core objective, noted as follows:

Awareness / information

- Various support tools, such as in-person training sessions and webinars, are provided to financial institutions to assist in front-line delivery; financial institutions in turn provide the target population with different ways to access or get information about the program. A majority of survey respondents reported they were satisfied with the information they received from their financial institution, but 25.7% stated they were not able to get all the information they needed.

- Awareness of the program is high, with 92% of respondents in one study indicating that their awareness had increased. The most frequently cited sources of information were disability organizations/service providers, financial institutions, friends or relatives, while the most effective outreach strategy was identified as the Canada Revenue Agency mail outs.

Take up / effectiveness

- Take-up of the Registered Disability Savings Plan, Canada Disability Savings Grant and Canada Disability Savings Bond has increased steadily since 2009 (from 24,259 total accounts opened in 2009 to 168,567 in 2017).Footnote 50 The average and total value of the Plans has been increasing, with take-up by age relatively evenly distributed across age groups under 50, and dropping for those older.

- Low-income groups have the highest total personal contributions and also have made the most in total contributions after maximizing the Canada Disability Savings Grant. Total contributions for low-income groups between 2008 and 2017 were approximately $742 million, compared to $113 million, $171 million and $172 million (for middle-, upper middle- and high-income groups, respectively.

- Most (69.4%) of the funds in Registered Disability Savings Plan holdings are from the Canada Disability Savings Grant or Canada Disability Savings Bond. Women, and individuals in the lower 3 income brackets, were more likely to say that the larger portion of their Registered Disability Savings Plan came from government money as compared to men and people in the higher income bracket.Footnote 51

- The program was perceived to have “greatly helped” the majority (66.0%) of people with disabilities save for their future.Footnote 52

5.1 Program delivery

The Canada Disability Savings Program provides support to financial institutions (referred to as "issuers") that offer the Registered Disability Savings Plan in order to ensure that the program requirements are clear and that the needs of the target population are met. As Canada Disability Savings Program stakeholders, financial institutions have a front line delivery role.

A file and document review indicates that the Program provides various support tools to financial institutions. Existing training materials are reviewed and modified on an ongoing basis in collaboration with financial institutions to meet their needs. In addition, in-person training sessions and webinars are offered to financial institutions to help them to better provide services to people with disabilities. The Program informs financial institutions of changes in program legislation and regulations, and how these changes may impact their administration of the program.

Financial institutions offer the target population different ways to access the program (for example, centralized telephone system, in-person service) as well as alternative formats for information about the program (for example, Braille, website accommodations). Most key informants from financial institutions indicated confidence in their ability to serve clients who were registering for Registered Disability Savings Plan accounts and processing the required transactions. They were also generally satisfied with the training and supports received from Employment and Social Development Canada. Most financial institutions interviewed rated their institution a "5" or above on a scale of 1 to 7 when asked to assess their institution on ‘registration and opening clients' accounts' and ‘processing unusual or usual transactions'.

Financial institutions admitted concerns over the complexity of the program and expressed interest in receiving more information on aspects of the program's policies, rules and regulations, including:

- identifying who is legally able to be a representative or holder;

- processes to follow regarding disposal of Registered Disability Savings Plan assets; and

- whether or not Registered Disability Savings Plans are entitled to creditor protection.Footnote 53

Results from the Survey of Households of Canadians with Disabilities (2017) revealed that the majority of people (74.3%) were satisfied with the information they received and the ease with which they were able to set up their Registered Disability Savings Plan, while 25.7% stated they were not able to get all the information needed.Footnote 54 Of those who were not satisfied, the most common observation was that the financial institution representative was not well informed about the program.

Case studies with Registered Disability Savings Plan beneficiaries found some similar results, with about one-half of case study participants reporting that the staff they dealt with at financial institutions were not knowledgeable about the program and had difficulty answering questions.Footnote 55 Areas where information was lacking included specifics of the Assistance Holdback Amount rules and the eligibility requirements to apply for the Registered Disability Savings Plan, Canada Disability Savings Grant and Canada Disability Savings Bond. At the same time, many case study participants also reported that staff was eager to find out needed information about the program to ensure that they received good service.

5.2 Awareness

People with disabilities (and/or their families/caregivers) are aware of the Canada Disability Savings Grant and Canada Disability Savings Bond as incentives to save in a Registered Disability Savings Plan. Program outreach activities were designed to increase awareness of the program with the expectation that would increase take-up.

The Program disseminated plain language print and internet information for people with disabilities and their families about the Registered Disability Savings Plan, Canada Disability Savings Grant and Canada Disability Savings Bond. Subsequent efforts focused on 5 initiatives:

- Developing a pan-Canadian promotional strategy targeting the parents of children with disabilities, adults with disabilities, and Indigenous people with disabilities

- Implementing service contracts to deliver information sessions and one-on-one support to people with disabilities

- Increasing outreach to community based organizations through print, conference attendance and in-person meetings

- Disseminating print information to provincial/territorial offices that provide income and social support to people with disabilities

- Producing accessible Canada Disability Savings Program information for the deaf and hard of hearing communities

The Program contracted non-governmental organizations to deliver group information sessions to people who wanted to learn more about the Registered Disability Savings Plan, including people with disabilities, parents, siblings, friends, support workers and financial professionals. Feedback from these initiatives showed that 92% of participants indicated that their knowledge of the Registered Disability Savings Plan, Canada Disability Savings Grant and Canada Disability Savings Bond had increased and 43% of respondents intended to open a Registered Disability Savings Plan in the near future, suggesting these are effective communication methods.Footnote 56

The case studies found that approximately one-half of all cases reported having seen promotional materials about the program. The most frequently reported forms of promotion were pamphlets and posters, either at service provider organizations or financial institutions. A few case study participants mentioned seeing promotion for the program in their annual notice of assessment from the Canada Revenue Agency, and some participants noted seeing advertisements in mass media (for example, newspapers, television). However, feedback from case study participants and from the Survey of Households of Persons with Disabilities (2017), suggests that advertising, posters, and pamphlets have not been highly successful in raising awareness of the program.

Financial institutions and program staff in the key informant interviews reported that the most effective outreach strategy was the Canada Revenue Agency mail-outs. Since 2013, the Program has conducted 6 mass mail-outs, in partnership with the Canada Revenue Agency, to Disability Tax Credit-eligible individuals. While causality is not certain, after each mail-out, the 1-800-O-Canada line experienced increased call volumes (on average a 125% increase)Footnote 57 and visits to the website. The Canada Disability Savings Program call centre and financial institutions that issue the Registered Disability Savings Plan also reported increased interest in the Registered Disability Savings Plan at the time of the mail-outs.Footnote 58

Understanding program requirements

Beyond awareness of the Registered Disability Savings Plan, Canada Disability Savings Grant and Canada Disability Savings Bond for people with disabilities (and their families/ caregivers) lies the expectation that they will also understand program requirements. After conducting key informant interviews, the least understood requirements were:

- The Assistance Holdback Amount: According to some key informants from financial institutions and non-governmental organizations many Registered Disability Savings Plan holders do not understand the rules governing withdrawals from their plan.

- Eligibility for the Registered Disability Savings Plan/Disability Tax Credit: key informants noted that many prospective clients did not understand the need to be eligible for the Disability Tax Credit before they could open a Registered Disability Savings Plan and some did not understand what the Disability Tax Credit is. Some did not realize that they must maintain eligibility for the Disability Tax Credit to continue in the program. Respondents to the Survey of Households of Canadians with Disabilities tended to be unaware that: (1) there is a lifetime personal contribution limit of $200,000 that can be deposited into a Registered Disability Savings Plan; and (2) a Canada Disability Savings Bond can be deposited into a Registered Disability Savings Plan even if no personal contributions have been made.

Other program elements where awareness could be improved include:

- The amount of Canada Disability Savings Grants and Canada Disability Savings Bonds available to participants;Footnote 59

- Eligibility for Canada Disability Savings Grants and Canada Disability Savings Bonds ends after December 31 of the year that the beneficiary turns 49 and no Canada Disability Savings Grant is paid on contributions made after this date;Footnote 60

- No personal contributions can be made after the year that the beneficiary turns 59;Footnote 61

- For eligible beneficiaries, Canada Disability Savings Bond eligibility is based only on family income level, not on contributions.Footnote 62

While program representatives in the key informant interviews described efforts to use plain language in promotional materials, non-governmental organization representatives stated that more plain language is needed in order to increase program understanding for many potential clients.Footnote 63 Survey findings indicated that people with lower income levels were more likely to understand the rules around the Registered Disability Savings Plan, Canada Disability Savings Grant and Canada Disability Savings Bond than people with higher incomes.Footnote 64

5.3 Registered Disability Savings Plan take-up

There has been steady increase in registered accounts, with a total of 168,567 at the end of 2017 (see Figure 1).

Text description of Figure 1

| Year | Number of registered accounts |

|---|---|

| 2009* | 24,259 |

| 2010 | 34,630 |

| 2011 | 44,007 |

| 2012 | 56,656 |

| 2013 | 71,770 |

| 2014 | 91,761 |

| 2015 | 120,090 |

| 2016 | 149,684 |

| 2017 | 168,567 |

| Total | 168,567 |

Source: Canada Disability Savings Program Administrative Data Analysis

*Registered Disability Savings Plans were made available to Canadians in December 2008; therefore, 2009 covers the period of December 2008 to end of December 2009.

The number of Registered Disability Savings Plans is almost evenly distributed and relatively high across younger age groups (about 30% for each age group) (see Figure 2). This number drops significantly for the older age groups (50 to 59 and 60+). This is due to the fact that eligibility for Canada Disability Savings Grant and Canada Disability Savings Bond payments ends after December 31 of the year when the beneficiary turns age 49 and people over age 60 are not eligible to open a Registered Disability Savings Plan.

Text description of Figure 2

| Take-up by Age | % of accounts by age |

|---|---|

| 0 to 18 | 25% |

| 19 to 34 | 32% |

| 35 to 49 | 29% |

| 50 to 59 | 13% |

| 60 and over | 1% |

| Total | 100% |

With respect to gender, females held about 40% while males held about 60% of the Registered Disability Savings Plans opened between 2008 and 2017.Footnote 65 These results align approximately with the Participation and Activity Survey (2006) finding that about one third of all children with more severe disabilities are female, and the Canadian Survey on Disability (2012) that approximately half of people aged 15 to 64 with more severe disabilities are women.Footnote 66

Eligibility for the Disability Tax Credit is required for Registered Disability Savings Plan eligibility. Therefore a key metric is the percentage of the Disability Tax Credit eligible population that has a Registered Disability Savings Plan. By 2016, approximately 29% of those aged 0 to 49 in Disability-Tax-Credit-eligible population had a Registered Disability Savings Plan while almost 24% of those under age 59 had one (See Figure 3).

Text description of Figure 3

| % of Disability Tax Credit Eligible Population with Registered Disability Savings Plan | Ages 0 to 49 Take up rate |

Ages 0 to 59 Take up rate |

|---|---|---|

| Year | ||

| 2009 | 9.10% | 5.62% |

| 2010 | 15.57% | 9.87% |

| 2011 | 13.24% | 8.76% |

| 2012 | 15.69% | 12.89% |

| 2013 | 14.28% | 12.40% |

| 2014 | 20.38% | 17.02% |

| 2015 | 24.33% | 20.38% |

| 2016 | 28.99% | 24.54% |

Program administration data show that take-up rates vary considerably by province. Rates are highest in British Columbia (over 30%). Alberta, Saskatchewan, Manitoba, and Ontario have take-up rates in the mid to high twenties. Quebec and Prince Edward Island take up is in the low twenties. The remaining Atlantic Provinces have take-up rates below twenty percent.

5.4 Contributions to Registered Disability Savings Plans

Savings accumulated in a Registered Disability Savings Plan come from 3 principal sources: (1) contributions from the Registered Disability Savings Plan holder or others, (2) Canada Disability Savings Bond and (3) Canada Disability Savings Grant deposits made by the program. Total annual contributions have been increasing slowly as the number of registered plans increases (see Figure 4). By the end of 2017, total cumulative contributions amounted to $1.239B.

Text description of Figure 4

| Year | Total annual contributions ($ million) | Total cumulative contributions ($ million) |

|---|---|---|

| 2009 | $55 | $55 |

| 2010 | $83 | $138 |

| 2011 | $91 | $229 |

| 2012 | $114 | $343 |

| 2013 | $129 | $472 |

| 2014 | $165 | $637 |

| 2015 | $173 | $810 |

| 2016 | $205 | $1,015 |

| 2017 | $223 | $1,239 |

Source: Canada Disability Savings Program Administrative Data

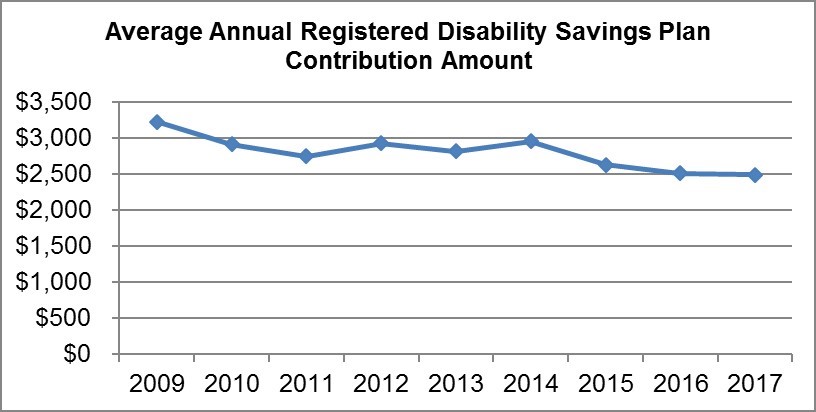

The average contribution has dropped slowly since 2009 (see Figure 5). This is likely due to maximization of contributions in the first year or 2 in order to attract the maximum Canada Disability Savings Grant and Canada Disability Savings Bond payments. Once full retroactive payments have been received, contributors may prefer to reduce their contributions.

Text description of Figure 5

| Years, 2009 to 2017 | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|---|---|---|---|---|

| Average annual contribution amount | $3,224 | $2,907 | $2,742 | $2,922 | $2,811 | $2,950 | $2,622 | $2,508 | $2,489 |

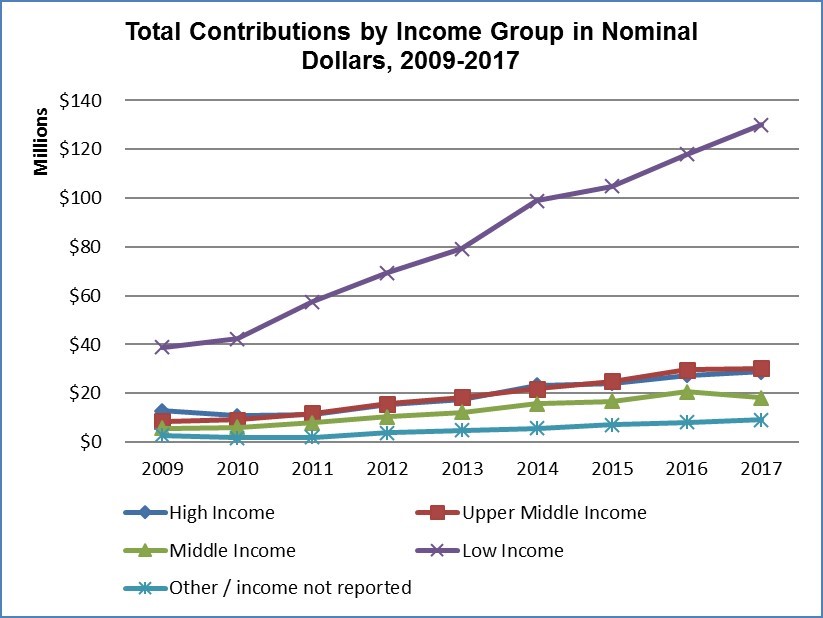

Analysis of contribution trends by income level since the beginning of the program revealed that it is the low-income groupFootnote 67 that had the highest total aggregate personal contributions (see Figure 6). Total contributions increased each year for all 4 income groups from 2010 to 2017. Both program administration data and the survey of Registered Disability Savings Plan holders conducted for the evaluation found that Registered Disability Savings Plan holders in the lowest income group made the highest average contributions,Footnote 68 though the differences in average contributions across the 4 income groups are relatively small. Thus the differences in total contributions are almost entirely explained by the relative number of plans in each income group. For example, the low-income group comprised 48% of all Registered Disability Savings Plan holders,Footnote 69 and total contributions by this group is slightly larger than the total contribution by the other 4 income groups combined.

Text description of Figure 6

| Total Contributions by Income Group | High Income Above second income threshold |

Upper Middle Income Below second income threshold |

Middle Income Below first threshold |

Low Income Below the phase out income* |

Other / income not reported |

|---|---|---|---|---|---|

| Year | |||||

| 2009 | $12,869,193 | $8,428,166 | $5,637,225 | $38,878,539 | $2,703,336 |

| 2010 | $10,722,914 | $9,138,104 | $6,110,996 | $42,255,189 | $1,684,737 |

| 2011 | $11,369,937 | $11,845,214 | $7,892,124 | $57,566,764 | $1,870,896 |

| 2012 | $15,403,866 | $15,632,931 | $10,340,711 | $69,336,679 | $3,742,881 |

| 2013 | $17,555,058 | $18,269,224 | $12,074,016 | $79,226,473 | $4,729,398 |

| 2014 | $23,159,966 | $21,751,108 | $15,726,918 | $98,933,473 | $5,594,687 |

| 2015 | $23,978,352 | $24,930,264 | $16,596,398 | $104,797,520 | $7,098,029 |

| 2016 | $27,345,284 | $29,593,413 | $20,547,643 | $117,888,729 | $8,047,641 |

| 2017 | $28,810,557 | $30,298,057 | $18,192,957 | $129,978,814 | $9,135,107 |

| Total | $171,215,127 | $169,886,480 | $113,118,989 | $738,862,180 | $44,606,712 |

Source: Canada Disability Savings Program Administrative Data

Registered Disability Savings Plan beneficiaries/holders from all income categories might continue to contribute to their Registered Disability Savings Plan after maximizing Canada Disability Savings Grants (see Table 3). The reasons for doing so include that, even without the Canada Disability Savings Grant, the Registered Disability Savings Plan is a tax deferred savings accountFootnote 70 and because Registered Disability Savings Plan income and assets are fully exempt for the determination of disability income supports in most provinces/territories.

| Income group | Total contributions | Excess contributions after maximizing grants* | Mean of total contributions |

|---|---|---|---|

| Low Income | $741,750,607 | $538,216,179 | $2,700 |

| Middle Income | $113,552,412 | $80,370,103 | $2,397 |

| Upper Middle Income | $171,089,422 | $115,635,168 | $2,192 |

| High Income | $172,331,317 | $124,071,767 | $2,402 |

| Agency | $837,664 | $634,679 | $1,151 |

| Other (No income, no match, other) | $44,256,921 | $32,962,607 | $2,353 |

| Totals | $1,243,818,343 | $891,890,503 | $2,199 |

Source: Canada Disability Savings Program Administrative data (timeframe from December 2008 to December 31, 2017)

*Includes contributions made after contributing $1,500, that is contributions > $1,500 in a given year

Private contributions from relatives and friends

The Registered Disability Savings Plan was designed to enable parents, beneficiaries and othersFootnote 71 to contribute to a Registered Disability Savings Plan. According to the Survey for the Evaluation of the Canada Disability Savings Program and case studies for this evaluation, a small proportion of survey respondents (6.2%)Footnote 72 stated that ‘other relatives’ had contributed to their Registered Disability Savings Plan and only 5 of the 30 case studies found contributors from ‘outside the household’ (mostly family members).Footnote 73

Borrowing to contribute to Registered Disability Savings Plans

The vast majority of survey respondents (96.6 %) stated that they were not borrowing money in order to contribute to their Registered Disability Savings Plan. There were no significant differences by gender or income level regarding likelihood to borrow money for Registered Disability Savings Plan.Footnote 74

5.5 Canada Disability Savings Grant and Canada Disability Savings Bond take-up

Program staff key informants noted that when Registered Disability Savings Plans were opened, applications for the Canada Disability Savings Grant and Canada Disability Savings Bond were made simultaneously. Informants were aware that the number of Canada Disability Savings Grants and Canada Disability Savings Bonds being paid out was increasing.

For over two-thirds (69.4%) of respondents, the largest part of their Registered Disability Savings Plan holdings came from the Canada Disability Savings Bond and/or Canada Disability Savings Grant (see Table 4). Similar proportions of the remaining respondents stated that the Canada Disability Savings Bond/ Canada Disability Savings Grant and the personal contributions were about equal (14.0%) or that their personal contributions made up the larger part of the Registered Disability Savings Plan (16.5%). These custom survey findings are broadly consistent with published information based on administrative data showing that 32% of total Registered Disability Savings Plan assets are derived from personal contributions, while 68% are derived from Canada Disability Savings Grants or Canada Disability Savings Bonds.Footnote 75

Gender differences were observed in the survey findings, with women more likely to say that the larger part of their Registered Disability Savings Plan holdings came from the Canada Disability Savings Bond and/or Canada Disability Savings Grant.Footnote 76

A majority of respondents (64%) indicated that the Canada Disability Savings Bond and Canada Disability Savings Grant made up the larger portion of their Registered Disability Savings Plan. Footnote 77 When the data were reviewed on the basis of income, respondents in the highest income group were significantly more likely to state that the Canada Disability Savings Bond/ Canada Disability Savings Grant and the personal contributions were about equal or that their personal contributions made up the larger part of the Registered Disability Savings Plan, while lower income individuals were less likely to say the same. This indicates that financial matching from the program is being received primarily by those least financially able to provide for their support needs. Indeed, this is how the program is designed. It suggests that the lowest income groups would be more financially vulnerable in the absence of the program.

5.6 Improvements in long-term financial security

Participants in the Survey of Households of Canadians with Disabilities were asked how helpful they found the Registered Disability Savings Plan, Canada Disability Savings Grant and Canada Disability Savings Bond to be in saving for the future. Key informants were also asked for their views on this question.

| On a scale of 1 to 7, how helpful has the following been: | Having a Registered Disability Savings Plan? (n=871) | The Canada Disability Savings Grant? (n=813) | The Canada Disability Savings Bond? (n=757) |

|---|---|---|---|

| 1(No help) | 2.0% | 3.0% | 11.4% |

| 2 | 1.5% | 2.5% | 2.4% |

| 3 | 4.4% | 3.0% | 3.8% |

| 4 | 4.7% | 4.8% | 4.3% |

| 5 | 11.4% | 10.4% | 10.1% |

| 6 | 10.1% | 9.2% | 9.3% |

| 7 (Greatly helped) | 66.0% | 67.2% | 58.6% |

| Total | 100.0% | 100.0% | *100.0% |

Survey for the Evaluation of the Canada Disability Savings Program (2017), Unweighted total n=884

*Total does not add to 100% due to rounding

The Registered Disability Savings Plan and the Canada Disability Savings Grant received similar helpfulness ratings as recorded in Table 4, while the score for the Canada Disability Savings Bond was lower for ‘greatly helped’ and higher for ‘no help’. This may reflect the fact that fewer people qualify for the Canada Disability Savings Bond, and those that do may qualify for only a portion of the Canada Disability Savings Bond and thus may not find it as helpful as the Registered Disability Savings Plan or Canada Disability Savings Grant.Footnote 78 Overall, informants supported the program but some believed that improvements to better reach very low-income and marginalized populations are still needed.

6. Efficiency and effectiveness

This section examines the Employment and Social Development Canada administrative costs of the program, how those costs compare with a similar program, whether the program is achieving results in the most effective and efficient way, and what internal and external factors influence the efficiency and effectiveness of the program. The costs related to the Income Tax Act, registering Registered Disability Savings Plans, administering the Disability Tax Credit and developing policy as undertaken by the Canada Revenue Agency and/or the Department of Finance were beyond the scope of this evaluation.

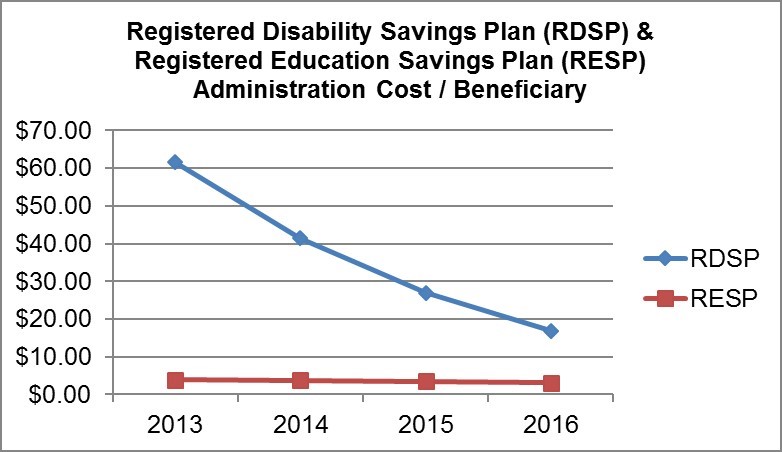

6.1 Administrative costsFootnote 79

To examine how the administrative costs of the Canada Disability Savings Program compared to a similar program, the Canada Education Savings Plan was chosen. The design of the Canada Disability Savings Program was based on the Canada Education Savings Program with program staff representatives confirming that most aspects of the Canada Disability Savings Program "piggy-backed" onto the Canada Education Savings Program (for example registration of plans, issuer agreements) in order to achieve administrative efficiencies.Footnote 80 As a result, the Canada Disability Savings Program has a similar delivery mechanism and components to that of the Canada Education Savings Program with grants and bonds delivered through partnerships with Canadian financial institutions.

Figure 7 compares the administration costs per beneficiary for the most recent 4 years of program operation.Footnote 81 The first few years of the Canada Disability Savings Program are excluded from this comparison as the program incurred substantial start-up costs to build the systems and other supports required to launch and operate the program during that period. While the program’s annual administrative costs have declined somewhat, the number of beneficiaries has risen substantially,Footnote 82 resulting in a significant decline in unit costs. The number of beneficiaries of the Canada Education Savings Program also grew over this period, but at a slower percentage rate due to the relative maturity of the Canada Education Savings Program compared to the Canada Disability Savings Program.

Analysis of cost/$1000 of savings held in registered plans shows an even steeper downward trend (chart not shown), as the total amount of savings held in Registered Disability Savings Plans (savings + bonds + grants) has increased even more rapidly than the total number of registered plans.

Text description of Figure 7

| Registered Disability Savings Plan | Unit cost | RESP | Unit cost |

|---|---|---|---|

| 2013 | $61.54 | 2013 | $3.95 |

| 2014 | $41.45 | 2014 | $3.73 |

| 2015 | $27.02 | 2015 | $3.46 |

| 2016 | $16.94 | 2016 | $3.12 |

The analysis here suggests that unit costs to administer the Canada Disability Savings Program have dropped rapidly as the number of registered plans rises while administration costs have also been declining. In light of other evaluation findings that many potential beneficiaries have not yet accessed the Registered Disability Savings Plan, this cost analysis suggests that there may be room to make new investments in reaching out to the target population and in overcoming obstacles to Registered Disability Savings Plan enrollment.

6.2 Effectiveness

In order to evaluate the effectiveness of the program, the evaluation considered whether the outcomes of the program were being achieved and whether the results-to-date demonstrate that the program is moving towards fully achieving its objectives. To address this issue, program staff key informants (10 of the 31 key informants) were asked whether they thought the program was achieving outcomes in the most effective way.Footnote 83 Almost all program staff interviewees reported being unaware of any redundancies or duplication of work in the delivery of the Canada Disability Savings Program.

Are the Registered Disability Savings Plan, Canada Disability Savings Grant, and Canada Disability Savings Bond helping to improve the long-term financial security of Canadians with disabilities?

The majority of financial institutions' and program staff key informants (17 of 25 interviewees) who responded to this question) stated that the program was contributing to improved financial security for persons with disabilities. A few of these interviewees stated that it was too early to tell, yet, whether the program would meet that long-term goal. A few others stated that the program, as it is currently designed, is helping to improve the long-term financial security of Canadians with disabilities, but that the help is being delivered to those who appear to need it less and they expressed concerns that very low-income and very marginalized groups are not benefiting as much as they could.