ESDC Financial overview: December 2019

From: Employment and Social Development Canada

Official title: ESDC Financial overview: Chief Financial Officer Branch - December 2019

Purpose

- To provide an overview of ESDCs finances, including

- To provide additional detailed financial information, including

ESDC overview

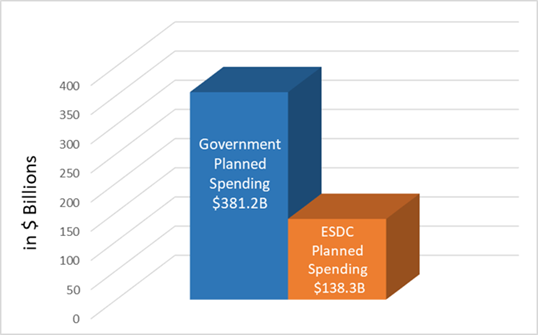

In the fiscal year ending March 31, 2020, ESDC’s planned spending of $ 138.3B represents 36% of all planned government expenditures ($381.2B).

Figure 1. 2019 to 2020 ESDC planned spending compared to the Government of Canada planned spending – Text version

| Fiscal Year 2019-2020 | Planned spending (in $B) |

|---|---|

| Government of Canada | 381.2 |

| Employment and Social Development Canada | 138.3 |

Figure 2. ESDC responsibilities – Text version

ESDC is responsible for developing, managing, and delivering social programs and services for Canadians including:

- Old Age Security

- Canada Pension Plan

- Employment Insurance

- Canada Student Loans

Canadians have access to ESDC services at approximately 590 points of service all over Canada. This includes Service Canada centres, scheduled outreach sites, call centres, and passport offices.

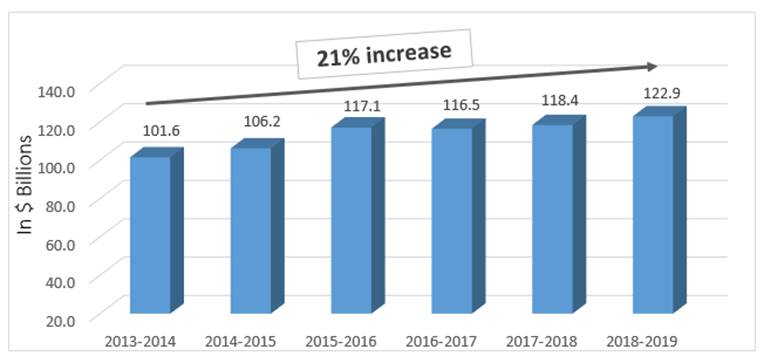

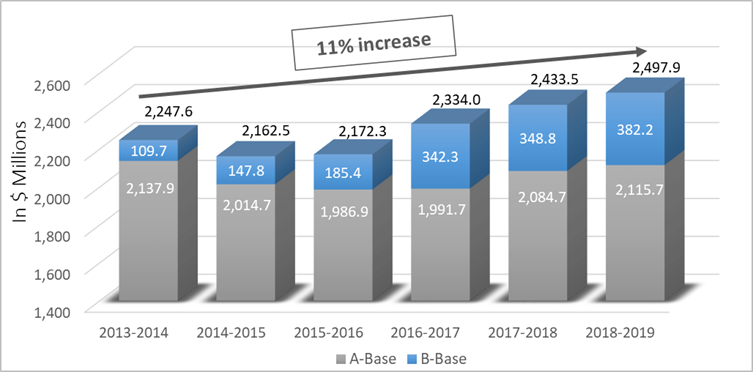

Over the last 6 years, ESDC operating budget has increased by just 11%, while statutory transfer payments have increased by 21%.

Figure 4. ESDC statutory transfer payments by fiscal year – Text version

| Fiscal Year | ESDC statutory transfer payments (in $B) |

|---|---|

| 2013 to 2014 | 101.6 |

| 2014 to 2015 | 106.2 |

| 2015 to 2016 | 117.1 |

| 2016 to 2017 | 116.5 |

| 2017 to 2018 | 118.4 |

| 2018 to 2019 | 122.9 |

Notes:

- ESDC statutory transfer payments have increased by 21% from 2013 to 2014 and 2018 to 2019.

- Amounts include EI, CPP, OAS and other statutory benefits but exclude budgetary gross expenditures.

Figure 5. ESDC operating budget payments by fiscal year – Text version

| Fiscal Year | A-Base operating budget (in $M) | B-Base operating budget (in $M) | Total ESDC operation budget (in $M) |

|---|---|---|---|

| 2013 to 14 | 2,137.9 | 109.7 | 2,247.6 |

| 2014 to 15 | 2,014.7 | 147.8 | 2,162.5 |

| 2015 to 16 | 1,986.9 | 185.4 | 2,172.3 |

| 2016 to 17 | 1,991.7 | 342.3 | 2,334.0 |

| 2017 to 18 | 2,084.7 | 348.8 | 2,433.5 |

| 2018 to 19 | 2,115.7 | 382.2 | 2,497.9 |

Notes:

- ESDC operating budget payments have increased by 11% from 2013 to 2014 and 2018 to 2019.

- Amounts include year-end regular operating budgets only. Are excluded

- Separately controlled allotments

- Vote-netted revenues (such as Passport and others)

- Overpayments

- Retro-payments for collective agreements

- Operating statutory (such as Employee benefit plan and others)

ESDC financial overview

In its 2019 to 2020 Departmental Plan, ESDC has planned budget of $138.3B in order to deliver on its wide array of policy, program, and delivery activities. Of this amount, 2.1% is directed to operating costs.

$131.0B (95%) of the $138.3B in planned spending directly benefits Canadians through the following statutory transfer payment programs:

- Old Age Security $56.2B

- Canada Pension Plan $49.7B

- Employment Insurance $20.8B

- Canada Student Loans and Grants and Apprentice Program $2.3B

- Canada Education and Savings Grant $1.0B

- Canada Disability Savings Program $0.8B

- Other smaller transfer payments $0.2B

Total $131.0B

Note: Other smaller transfer payments include:

- Canada Learning Bond

- Wage Earner Protection Program

- Universal Child Care Benefit

Figure 6. ESDC Total planned spending $138.3B – Text version

| Program | Planned budget (in $B) | Planned budget (in %) |

|---|---|---|

| Old Age Security | 56.2 | 40.6 |

| Canada Pension Plan | 49.7 | 36.0 |

| Employment Insurance | 20.8 | 15.0 |

| Canada Student Loans and Other Statutory Payments | 4.3 | 3.1 |

| Voted Grants and Contributions | 2.7 | 2.0 |

| Other - EI/CPP Recoveries and Workers Compensation | 1.7 | 1.2 |

| Gross Operating Costs | 2.9 | 2.1 |

ESDC funding complexities

ESDC Departmental Plan includes all planned spending but only funding authorities that are sourced from the Consolidated Revenue Fund (CRF) are included in the Main Estimates.

EI Operating Account and CPP Account (and other smaller items) are accounted separately in the books of Canada. Expenditures made pursuant to their respective legislations, including the costs of administering the accounts, are not part of voted appropriations.

| Funding authorities | Budget amount (in $M) |

|---|---|

| Statutory transfer payments (such as OAS, GIS, Education and Disability Savings programs) |

60,473.2 |

| Vote 1 – Operating (Consolidated Revenue Fund only) | 702.8 |

| Vote 5 - Grants and Contributions | 2,728.8 |

| Service Delivery Agreements ($194.5M) and other statutory operating budget (for example Employee Benefit Plan) |

531.8 |

| ESDC Main Estimates for the fiscal year ending as of March 31, 2020 | 64,436.6 |

| Employment Insurance benefits | 20,756.4 |

| Canada Pension Plan benefits | 49,722.4 |

| Other Government Departments’ EI and CPP charges | 1,690.4 |

| Government Annuities Account and Civil Service Insurance payments | 16.0 |

| Vote Netted Revenue Employment Insurance Administrative Costs - 1,279.2 Canada Pension Plan Administrative Costs - 266.6 Workers Compensation recovery from Other Government Departments and Other - 125.6 |

1,671.4 |

| ESDC total planned spending as per the 2019 to 2020 Departmental Plan | 138,293.2 |

Notes:

- ESDC Main Estimates for the fiscal year ending March 31, 2020 excludes Budget Implementation Votes of $333M.

- The following items are not in the Main Estimates since these are voted appropriations:

- Employment Insurance benefits

- Canada Pension Plan benefits

- Other Government Departments’ EI and CPP charges

- Government Annuities Account and Civil Service Insurance payments

- Vote Netted Revenue

- An overview of the methodologies to charge administration costs to the CPP and EI Operating Accounts is available in Annex 1.

ESDC gross operating model

For the fiscal year ending March 31, 2020, ESDC has an operating budget of $2,906M to deliver programs and services. The department has a complex funding model financed via voted appropriations from the Consolidated Revenue Fund, as well as the authority to recover costs from the EI Operating Account, the Canada Pension Plan Account, and several other entities under Service Delivery Partnership Agreements.

ESDC Gross Operating Expenditures totals $2,906M, including:

- $703M in Voted appropriations from the Consolidated Revenue Fund

- $1,279M Authority to recover costs from the EI Operating account

- $266M Authority to recover costs from the CPP account

- (Base of $194M plus an additional $72M)

- $195M Authority to recover from other entities under Service Delivery Partnership Agreements

- $463M from Other statutory operating (such as Employee Benefit Plan and Canada Student Loans Program direct financing)

ESDC internal departmental operating budget of $2,248M is made of the Voted appropriations from the Consolidated Revenue Fund and the Authority to recover costs for the EI Operating and the CPP Accounts.

ESDC allocates a single budget to departmental managers, as opposed to many budgets, to minimize complexity and administrative burden. This refers to the Gross Operating Model. In other words, the gross level of funding minus recoveries from EI and CPP equals the net level of funding voted through the estimates process (Consolidated Revenue Fund).

The Chief Financial Officer Branch administers Treasury Board approved cost allocation methodologies to ensure that the financial authority for each funding envelope is not exceeded.

Both the EI and CPP Accounts undergo a separate audit of financial statements on an annual basis.

ESDC's funding allocation and forecasting framework

ESDC has a robust financial management framework, which includes the establishment of multi-year budgets for effective longer term planning.

ESDC maintains 3 year rolling budgets on a historical basis, which are:

- updated on an annual basis as per the new year Annual Reference Level Update

- adjusted throughout the year for each approved Treasury Board submission

- costings developed with mature and rigorous costing tool

- Treasury Board submission funding allocated directly to each organizational entity

- using resource determination models for most Service Canada business lines

Updated notional multi-year branch and regional budgets are prepared in November each year, which are:

- based on departmental three years' base derivations

- adjusted for all year over year changes, as per new year Annual Reference Level Update

For the accounting period 6 and 8 multi-year forecast exercises, branch / regional heads identify:

- any surplus branch funding to be returned to the portfolio for realignment to priority areas

- priority activities for which funding is not available within a branch/regional budgetary envelope (pressure)

Assistant Deputy Ministers prepare and approve business cases for pressures funding, which are:

- aligned with the strategic framework;

- demonstrating :

- how it has been mitigated

- why branch cannot fund internally

- the impact if additional funds are not received

- challenged by the financial management community for reasonableness, accuracy, and validity

In December, the Chief Financial Officer Branch briefs Deputy Ministers, via a presentation to the Portfolio Management Board, on all pressures with a view to prioritization, including best use of available funds. The Chief Financial Officer Branch takes into account the use of in-year lapses, reserves, and estimated funding receivable from operating budget carry forward.

All data is refined and updated during January and February as follow:

- The Chief Financial Officer Branch performs ongoing consultations with branches and presents the financial strategy options to Deputy Ministers for final decisions

- The Chief Financial Officer Branch targets March Portfolio Management Board presentation for early budget allocations to ensure resources are available on April 1 of the new fiscal year

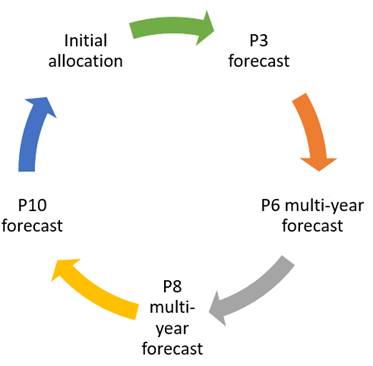

Figure 7. ESDC Forecasting cycle – Text version

ESDC Forecasting cycle:

- Initial allocation

- P3 forecast

- P6 multi-year forecast

- P8 multi-year forecast

- P10 forecast

At each forecasting period, branches/regions submit forecasts, including any financial pressures.

Accounting period 6 and 8 periodic reviews include a multi-year component to inform future year budgets.

Financial management advisors analyze, validate and challenge the forecasts.

The Chief Financial Officer Branch develops and recommends options to Deputy Ministers for decisions about:

- pressures funding

- risk management

- additional investments

- internal budget reductions

- etc.

Chief Financial Officer Branch presents the recommended strategy at the Portfolio Management Board and realigns resources at each periodic review based on approved strategy.

Note: Overarching Budget Allocation Considerations

- Strategic Framework

- Corporate Risk Profile

- Investment Framework (including MPIB)

- ADM Committee on Real Property

- IT Plan

Historical operating budget lapses and carry forward

Most government departments are allowed to carry forward up to 5% of their year-end budgetary lapse. This is a long standing financial management tool that recognizes that lapsing funds are a normal and expected consequence of any budgetary process. While lapses can be due to unexpected delays in the delivery of programs which occur as a regular part of business, this unspent funding is largely due to the fact that departments cannot legally exceed their Parliament-approved authorities, and therefore must spend under that amount.

While ESDC is eligible to carry forward up to 5% of its Vote 1 (Consolidated Revenue Fund) lapse, it is only eligible for up to $40M of its EI authorities, and is not eligible to carry forward any CPP authorities while in receipt of funding due to increased claim volumes. The department has been in receipt of this workload funding since the fiscal year ending March 31, 2009. Generally, ESDC’s maximum carry forward equates to approximately 3% of total authorities.

With the exception of the fiscal year ending March 31, 2017, and when excluding unspent funding for large scale projects, the department has lapsed approximately 2% of its operating budget over the last several years, indicating that budgetary flexibility is at a minimum.

| Fiscal Year | Lapse including project reprofiles - Amount (in $M) |

Lapse including project reprofiles - % of budget | Lapse excluding project reprofiles - Amount (in $M) |

Lapse excluding project reprofiles - % of budget | Carry forward - Amount (in $M) |

Carry forward - % of budget |

|---|---|---|---|---|---|---|

| 2018-2019 | 51.8 | 2.1 | 35.8 | 1.4 | 32.1 | 1.3 |

| 2017-2018 | 55.7 | 2.2 | 28.4 | 1.1 | 38.1 | 1.5 |

| 2016-2017 | 72.2 | 3.1 | 67.6 | 2.9 | 67.6 | 2.9 |

| 2015-2016 | 45.1 | 2.1 | 45.1 | 2.1 | 31.3 | 1.4 |

ESDC grants and contributions funding

In addition to the complexity of ESDC’s operating base, the department also administers approximately $5.5B in planned spending for grants and contributions via two different sources of funds, including:

- $3.0B of grants and contributions funded through the Consolidated Revenue Fund for the delivery of more than 30 programs, which support projects that meet the labour market and social development needs of Canadians.

- $2.5B of Grants and contributions funded through the EI Operating Account (Part II of the EI Act) to deliver EI Part II programs, as well as Labour Market Development Agreements to provinces and territories, for employment benefits and support measures to assist Canadians in areas such as skills development, self-employment, and wage subsidies.

Note: Source: December 2019 internal reporting. Please see details in Annex 2.

Annex 1 - CPP and EI operating cost recovery

Canada Pension Plan (CPP)

- The CPP Account is under the joint control of the Government of Canada and participating Provinces but is not consolidated as part of the reporting entity of the Government of Canada. Accordingly, its financial statements are not consolidated with the financial statements of the Government of Canada.

- The authority for charging the CPP Account with the costs of administering the CPP Program is contained in section 108(3) (c) of the CPP Legislation.

- All internal and external organizations / agencies providing services to the CPP have a signed Memoranda of Understanding. One of them is ESDC (including Service Canada), and is signed by the Chief Operating Officer.

- The Memoranda of Understanding lay out the basic principles regarding the services to be provided and the methodology for the calculating the administrative costs charged to the CPP Account.

- ESDC enters into a contract each year with an outside accounting firm to attest that the amounts charged to CPP are in accordance with the signed Memoranda of Understanding.

Employment Insurance (EI)

- With the implementation of the EI Act in 1996, ESDC negotiated a new agreement with the Treasury Board Secretariat for the recovery of expenditures (administrative costs) from the EI Account.

- TBS and ESDC both recognized that a rigorous cost attribution system could not meet all established criteria for :

- ease of administration

- compatibility with ESDC internal gross total budget concept

- funding stability

- clear linkages of any changes in the amount being charged for administration to a policy or workload change within the EI program

- TBS and ESDC agreed to use a multi-year incremental budgeting approach using the fiscal year ending March 31, 1998 approved reference levels as a baseline. [Two sentences redacted]

Annex 2 - Detailed grants and contributions

As of December 2019, ESDC is administering a total of $5.5 billion in grants and contributions funding ($3.0 billion in Consolidated Revenue Fund and $2.5 billion in EI Part II).

Fiscal year ending March 31, 2020 approved authorities by Minister, program and source of funds (Consolidated Revenue Fund or EI Part II) are as follows:

| Programs | 2019 to 2020 approved authorities |

|---|---|

| Adult Learning, Literacy and Essential Skills Program | 18,614,000 |

| Apprenticeship Grant | 112,804,322 |

| Enabling Fund for Official Language Minority Communities | 14,050,000 |

| Canadian Benefit for Parent of Young Victims of Crime | 10,000,000 |

| Foreign Credential Recognition Program | 21,420,000 |

| Indigenous Programs | 2019 to 2020 approved authorities |

| Indigenous Skills and Employment Training Strategy | 244,210,553 |

| Engagement Protocol Agreements | 2,450,000 |

| Skills and Partnership Fund | 49,981,450 |

| Organization for Economic Cooperation and Development | 100,000 |

| Grant Support LMI | 1,100,000 |

| Pathways to Education | 9,500,000 |

| Sector Initiative Program | 5,096,710 |

| Youth Employment and Skills Strategy | 2019 to 2020 approved authorities |

| Career Focus | 16,420,032 |

| Skills Link | 153,767,599 |

| Canada Summer Jobs / Summer Work Experience | 278,792,500 |

| Youth Access / Goal Getters | 9,000,000 |

| Work Placement Program | 92,606,853 |

| Union Training and Innovation Program | 22,286,083 |

| Skilled Trades Awareness and Readiness Program | 11,587,185 |

| Women in Construction | 4,566,470 |

| Canada Service Corps | 54,650,000 |

| Canada Learning Bond | n/a |

| Future Skills | 47,725,578 |

| Temporary Foreign Workers – Migrant Worker Support (TFW) | n/a |

| Enabling Accessibility Fund | 19,650,000 |

| Social Development Partnership Program (SDPP) - Disability | 12,346,257 |

| Accessible Canada | 2,587,155 |

| Opportunities Fund for Persons with Disabilities | 43,813,963 |

| Canada International Education Strategy | 10,000,000 |

| Consolidated Revenue Fund Total | 1,269,126,710 |

| Indigenous Skills and Employment Training Strategy | 121,530,000 |

| National Essential Skills Initiatives | 4,654,789 |

| Sectoral Initiatives Program | 19,287,124 |

| Work Integration Social Enterprise | 471,117 |

| Atlantic Apprenticeship Harmonization | 773,913 |

| Innovation and Employer Engagement Apprenticeship | 1,644,934 |

| EI Part II Total | 148,361,877 |

| Minister of Employment, Workforce Development and Disability Inclusion Total | 1,417,488,587 |

| Programs | 2019 to 2020 approved authorities |

|---|---|

| Social Development Partnership Program – Children & Families | 8,970,830 |

| Supporting Black Canadians Communities | 5,000,000 |

| Official Language Minority Communities | 3,664,170 |

| Reaching Home: Canada’s Homelessness Strategy | 181,231,722 |

| Early Learning and Child Care – Innovation | 7,687,397 |

| Indigenous Early Learning and Child Care | 92,521,675 |

| Sustainable Development Goals | 4,600,000 |

| Social Innovation and Social Finance (Investment Readiness) | 22,765,125 |

| Consolidated Revenue Fund Total | 326,440,919 |

| Enabling Fund for Official Language Minority Communities | n/a |

| EI Part II Total | n/a |

| Minister of Families, Children and Social Development Total | 326,440,919 |

| Programs | 2019 to 2020 approved authorities |

|---|---|

| Labour Funding Program (CRF) | 1,703,000 |

| Federal Workplaces Free of Harassment and Violence (CRF) | 3,500,000 |

| Minister of Labour Total | 5,203,000 |

| Program | 2019 to 2020 approved authorities |

|---|---|

| New Horizons for Seniors Program (CRF) | 63,140,000 |

| Minister of Seniors Total | 63,140,000 |

| Program by Minister | 2019 to 2020 approved authorities |

|---|---|

| Minister of Employment, Workforce Development and Disability Inclusion | |

| Workforce Development Agreements (CRF) | 953,445,289 |

| Minister of Families, Children and Social Development | |

| Early Learning and Child Care (CRF) | 399,347,695 |

| Labour Market Development Agreements (EI Part II) | 2,339,357,431 |

| Transfers to Provinces and Territories Total | 3,692,150,415 |