Employment Insurance Monitoring and Assessment Report for the fiscal year beginning April 1, 2017 and ending March 31, 2018

Chapter 2 - 7 Employment Insurance financial information

From: Employment and Social Development Canada

On this page

2.7. Employment Insurance financial information

The Employment Insurance (EI) program is financed through mandatory premium contributions made by both employers and employees across Canada. These contributions are based on the employees’ insurable earnings up to the annual Maximum Insurable Earnings (MIE).Footnote 98 Since January 2010, self-employed persons that have opted into the EI program are also required to pay EI premiums in order to be eligible for EI special benefits.

EI premiums and all other revenues related to the EI program under the authority of the Employment Insurance Act are first deposited into the Consolidated Revenue Fund (CRF)Footnote 99 and then credited to the Account (Account). All EI benefits paid and administrative costs provided for under the Employment Insurance Act are paid out of the CRF and debited from the Account.

The following section provides information on EI premium rates and recent trends in revenues and expenditures recorded for the Account.

2.7.1 Employment Insurance premium rate

The global recession in FY0809 led to an increase in the number of EI benefit recipients, which in turn increased EI benefit expenditures over a relatively short period of time. As a result, the Account reached a cumulative deficit of $9.2 billion in 2011. However, the Account has been recording annual surpluses since 2012 as unemployment started to fall with economic recovery.

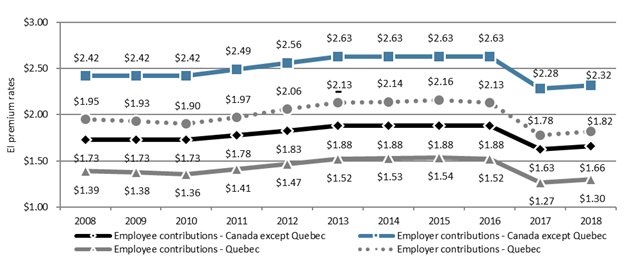

In order to ensure affordability, predictability and stability of EI premium rates, the Government froze the 2014 rate at the 2013 level of $1.88 for every $100 of insurable earnings, and legislated the 2015 and 2016 rates at that amount. In September 2014, the Government announced the introduction of the Small Business Job Credit for 2015 and 2016. This new credit effectively lowered EI premiums for small businesses, from the legislated rate of $1.88 to $1.60 for every $100 of insurable earnings in each of these years. Chart 36 shows the EI premium rates for employees and employers in Quebec and the rest of Canada in the past 10 years.

Chart 36 – Text version

| 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | |

|---|---|---|---|---|---|---|---|---|---|---|---|

| Employee contributions - Canada except Quebec | 1.73 | 1.73 | 1.73 | 1.78 | 1.83 | 1.88 | 1.88 | 1.88 | 1.88 | 1.63 | 1.66 |

| Employer contributions - Canada except Quebec | 2.42 | 2.42 | 2.42 | 2.49 | 2.56 | 2.63 | 2.63 | 2.63 | 2.63 | 2.28 | 2.32 |

| Employee contributions - Quebec | 1.39 | 1.38 | 1.36 | 1.41 | 1.47 | 1.52 | 1.53 | 1.54 | 1.52 | 1.27 | 1.30 |

| Employer contributions - Quebec | 1.95 | 1.93 | 1.9 | 1.97 | 2.06 | 2.13 | 2.14 | 2.16 | 2.13 | 1.78 | 1.82 |

- Source: Government of Canada, Public Accounts of Canada 2018, Volume I: Summary Report and Consolidated Financial Statements (Ottawa: Receiver General for Canada, October 2018).

Beginning with the 2017 EI premium rate, the Canada Employment Insurance Commission (CEIC) assumed the responsibility for setting the EI premium rate each year, according to a seven-year break-even mechanism (under which the projected balance for the Account is expected to be $0 in seven years), as forecasted by the EI Senior Actuary. Premium rates are therefore expected to generate sufficient premium revenue to cover expected EI expenditures over the following seven years and eliminate any existing surplus or deficit in the Account. Annual changes to the EI premium rate are legislatively limited to increases or decreases of no more than five cents each year.Footnote 100

The Senior Actuary’s forecasted EI premiums are calculated based on the forecasted insurable earnings by employees. EI premiums are paid for by employers, employees and self-employed persons who have opted into the EI program, for every $100 of insurable earnings up to the annual MIE threshold. In 2018, the MIE was $51,700, increasing by $400 from the previous year’s MIE of $51,300.

In 2018, the EI premium rate for employees (who were not covered by a provincial parental insurance plan) was set by CEIC at $1.66 per 100 of insurable earnings, up by three cents from the previous year. This made the maximum annual premium paid by employees to be $858 in 2018. Employers, on the other hand, pay EI premiums that are 1.4 times the employee rate (such that employers contribute approximately 58% of the total EI premium revenues versus approximately 42% contributed by the employees). This means that employers paid $2.32 for every $100 of insurable earnings of their employees in 2018, up to a maximum of $1,202. Self-employed persons who opted into the program pay the same EI premium rate as employees, and also pay premiums up to the annual MIE.Footnote 101

The EI program grants a reduction in the base EI premium rate paid on insurable earnings to employees who are covered by a provincial parental insurance plan. Quebec is the only province in Canada that administers its own parental insurance plan, known as the Quebec Parental Insurance Plan (QPIP), which provides paid parental, adoption, maternity and paternity benefits to eligible claimants and is financed by contributions made by workers and employers in Quebec. These benefits replace maternity and parental benefits provided by the EI program and, as such, EI premiums in Quebec are lower to reflect the savings that are generated for the EI program as a result of the existence of QPIP. In 2018, the EI premium rate for employees in Quebec was set at $1.30 per $100 of insurable earnings, while for employers it was $1.82 per $100 of insurable earnings of their employees (see Table 58).

| Category | Contributor | 2016 | 2017 | 2018 |

|---|---|---|---|---|

| Residents of a province without a provincial parental insurance plan | Employees | $1.88 | $1.63 | $1.66 |

| Employers | $2.63 | $2.28 | $2.32 | |

| Residents of a province with a provincial parental insurance plan (Quebec) | Employees | $1.52 | $1.27 | $1.30 |

| Employers | $2.13 | $1.78 | $1.82 | |

| Maximum insurable earnings | Employees | $50,800 | $51,300 | $51,700 |

| Annual maximum contribution | Employees | $955.04 | $836.19 | $858.22 |

| Employers | $1,137.06 | $1,170,67 | $1,201.51 |

- * Per $100 of insurable earnings.

- Source: Government of Canada, Public Accounts of Canada 2018, Volume I: Summary Report and Consolidated Financial Statements (Ottawa: Receiver General for Canada, October 2018).

Example: Employment Insurance premium contributions

Emily is an employee working at a call centre in Fredericton, New Brunswick, and earns $35,000 per year.

Based on Emily’s income level and assuming she remained employed throughout the year; her annual contribution to the EI program in 2018 would be $581 at the premium rate of $1.66 for every $100 of insurable earnings. Her employer would contribute $813.40 in EI premiums on her earnings, for a combined total of $1,394.40 in contributions made to the Account in 2018.

However, if Emily was working and living in Quebec, her annual contribution in 2018 would be reduced to $455, and her employer would have contributed $637 in EI premiums on her earnings, for a combined total of $1,092 in contributions made to the Account. At the premium rate of $0.548 for every $100 of insurable earnings, Emily’s contribution to the Quebec Parental Insurance Plan (QPIP) would be $191.80, while her employer’s contribution would be $268.50. Note that QPIP premiums are not set by the CEIC.

2.7.2 Premium Refund Provision

Under certain circumstances a share or all of EI premiums paid can be refunded to contributors if certain conditions are met.

The EI program includes a provision that grants EI premium refunds to employees with insurable earnings equal to or less than $2,000, as they have not worked enough hours to be eligible for EI benefits. In addition to this, some employees may pay EI premiums on earnings that exceed the MIE and the maximum annual contribution in a given tax year. Under these two circumstances, affected employees are entitled to receive a refund of all or a portion of their EI premiums paid in the year when filing their tax returns. It is important to note that employers do not receive a corresponding refund.

According to Canada Revenue Agency (CRA) data on T4 slipsFootnote 102 from employers, there were 925,400 individuals in 2016 that were eligible to receive full EI premium refund under the Premium Refund Provision, representing 5.2% of those with insurable earnings. Of these individuals who were eligible to receive full refund paid on EI premiums, 73.7% had filed income taxes and 65.3% received a full premium refund based on CRA T1 tax filer data. A total of $10.4 million in premiums were refunded to the eligible individuals in 2016, while on average each person received a refund amount of $17.17.

2.7.3 Premium Reduction Program

The Premium Reduction Program (PRP) was introduced in 1971 to encourage employers to provide short-term income protection coverage plans to their employees. The PRP recognized employer-based plans that already existed to ensure that they would not stop being offered as the EI sickness benefits became available. At that time, many workers were already covered against loss of wages due to non-occupational illnesses or accidents. It would have been unfair for both employers and employees who had coverage under such replacement plans to pay the same EI premiums as others who did not have this kind of coverage. Consideration for equity and a desire to recognize the role of existing wage-loss replacement plans contributed to the incorporation of the PRP.

Under the Employment Insurance Act, employers who provide qualified wage-loss plans, also known as short-term disability plans, to their employees that are at least equivalent to the protection provided by EI sickness benefits may be eligible to receive a reduction in the EI premiums payable through the PRP. The PRP puts less strain on the EI program as employees who are covered by such short-term disability plans may not have to collect EI benefits, or may collect them for a shorter period of time, as benefits from the registered plans have to be paid before EI benefits are paid.

There are two types of wage-loss replacement plans for which EI premium reductions may be granted: the cumulative paid sick leave plans and the weekly indemnity programs. These plans must also meet certain requirements established by the CEIC.Footnote 103 The premium reduction reflects the average savings generated to the EI Account due to the existence of these plans, and is provided directly to employers. As EI premiums are paid by both employers and employees in a proportion of 7/12 and 5/12, respectively, employers are required to ensure that their employees benefit from the reduction of the employers’ premium in an amount at least equal to 5/12 of the reduction.

In each calendar year, the rates of premium reduction are established based on four categories of qualified plans, with a distinct rate for each category, as explained below:

- Category 1: Cumulative paid sick leave plans that allow for a minimum monthly accumulation of at least one day and for a maximum accumulation of at least 75 days.

- Category 2: Enhanced cumulative paid sick leave plans that allow for a minimum monthly accumulation of at least one day and two-thirds and for a maximum accumulation of at least 125 days.

- Category 3: Weekly indemnity plans with a maximum benefit period of at least 15 weeks.

- Category 4: Special weekly indemnity plans with a maximum benefit period of at least 52 weeks (this reduction is available only to public and para-public employers of a province).

Rates of premium reduction are expressed as a percentage of the insurable earnings of employees. In 2018, the rates of reduction were 0.21%, 0.36%, 0.35% and 0.39% of insurable earnings for categories 1 through 4, respectively.Footnote 104 An estimated $867.8 million in premium reductions were generated by the wage-loss plans in 2016 (the most recent taxation year for which data is available), compared to $837.4 million in 2015 and $854.0 million in 2014.

During the period of 2000-2015, approximately 89.0% of all employers in the program offered a Category 3 plan with weekly indemnity to their employees.Footnote 105 Another 7.0% of employers offered Category 1 with cumulative paid sick leave plans, followed by 1.5% offering the combination of two or more types of short-term disability plan. The last 2.5% is shared between employers offering Type 2 plans with enhanced paid sick leave or Type 4 plans with Special with Weekly Indemnity. These breakdowns have remained stable during the 15 years.

2.7.4 Recent trends in revenues and expenditures

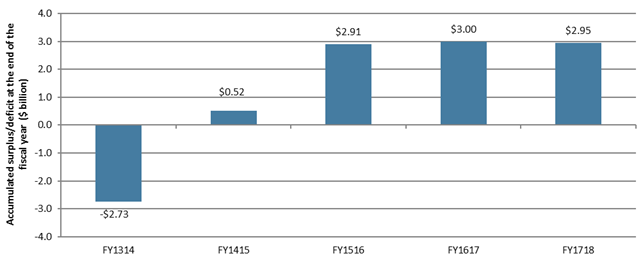

As required by Section 64 of the Financial Administration Act, the Receiver General prepares the Public Accounts of Canada annually to report on the financial transaction of the Government for the fiscal year. According to the Public Account of Canada, the total EI revenues were $21.6 billion in FY1718, down 4.4% from the previous year. The EI expenditures also decreased (-3.8%) over the same time period, from $22.5 billion in FY1617 to $21.7 billion in FY1718. This generated a net deficit of $48.0 million at the end of FY1718 (see Table 59). See Annex 5 for a detailed breakdown of the Account.

| Operating Account | FY1314 | FY1415 | FY1516 | FY1617 | FY1718 |

|---|---|---|---|---|---|

| Revenues* | $22,226.9 | $23,014.8 | $23,586.1 | $22,603.3 | $21,614.0 |

| Expenditures** | $18,997.2 | $19,759.3 | $21,192.9 | $22,518.9 | $21,662.0 |

| Employment Insurance benefits (Part I) | 81.7% | 82.2% | 83.2% | 83.5% | 82.4% |

| Employment benefits and support measures (Part II) | 10.5% | 10.4% | 9.7% | 9.7% | 10.0% |

| Benefit repayments | -1.1% | -1.2% | -1.2% | -1.2% | -1.4% |

| Administration costs | 8.8% | 8.4% | 7.8% | 7.9% | 8.7% |

| Bad debts | 0.1% | 0.3% | 0.6% | 0.1% | 0.3% |

| Annual surplus (deficit) | $3,229.7 | $3,255.4 | $2,393.2 | $84.4 | ($48.0) |

- Note: Data may not add up to the total due to rounding.

- * Includes all revenues and funding from EI premiums, interest owed on accounts receivable, penalties applied to claimants for violations of terms and conditions of the EI program and additional funding measures introduced for Employment Insurance for some years under the federal budget.

- ** Includes all expenses related to funding and operations of the EI program, including benefit payments under Part I of the EI program, Employment Benefit and Support Measure (EBSM) expenditures under Part II of the EI program, EI benefit repayments, administrative costs and outstanding debts counted as liabilities against the Account.

- Source: Government of Canada, Public Accounts of Canada 2018, Volume I: Summary Report and Consolidated Financial Statements (Ottawa: Receiver General for Canada, October 2018).

Chart 37 illustrates the financial position of the EI Operating account at the end of fiscal year for the past 5 years. On March 31, 2018, the accumulated surplus in the Account was $2.95 billion, decreasing slightly (-1.6%) from the previous fiscal year. This decrease in the accumulated surplus is mainly attributable to the decline (-$1.0 billion) in EI premiums collected in FY1718.

Chart 37 – Text version

| FY1314 | FY1415 | FY1516 | FY1617 | FY1718 | |

|---|---|---|---|---|---|

| Accumulated surplus/deficit at the end of the fiscal year ($ billion) | -$2.73 | $0.52 | $2.91 | $3.00 | $2.95 |

- Source: Government of Canada, Public Accounts of Canada 2018, Volume I: Summary Report and Consolidated Financial Statements (Ottawa: Receiver General for Canada, October 2018).