Employment Insurance Monitoring and Assessment Report for the fiscal year beginning April 1, 2017 and ending March 31, 2018

Chapter 4: Program administration

From: Employment and Social Development Canada

On this page

4. Program delivery

This chapter provides an overview of the delivery of Employment Insurance (EI) services to Canadians during FY1718. It follows the steps of the EI process from a client perspective, starting with general information gathering, through processing, to the end of the benefit period, focusing on interactions with both employees and employers along the way. Additionally, it outlines avenues of recourse for claimants via the EI Requests for Reconsideration and Appeals process and ESDC's role with respect to the Social Security Tribunal (SST). This chapter also touches on the reporting and quality measures used to monitor EI program delivery.

Information note:

This chapter refers to both claimants and clients. Claimants include individuals who are submitting or have submitted an EI claim (whether successful or unsuccessful) as well as those currently receiving benefits. Clients include claimants, employers and other interested parties.

In addition, in the EI program, the fiscal year runs from April 1 to March 31. This chapter uses "FY" with the last two digits of the specific year to indicate the fiscal year. For example, “FY1718" refers to the period starting on April 1, 2017 and ending on March 31, 2018.

The Canada Employment Insurance Commission (CEIC) has four members representing the interests of government, workers and employers. The CEIC has a legislated mandate to monitor and assess the EI program. It has delegated EI administration and day-to day operational responsibilities to Employment and Social Development Canada (ESDC) and Service Canada, which is part of ESDC. The CEIC retains a key role in overseeing the EI program, including reviewing and approving policies related to administration and delivery. For more information about the CEIC see The Canada Employment Insurance Commission.

4.1 Introduction and context of Employment Insurance service delivery

EI clients rely on ESDC for guidance and support throughout the EI process. These requests involve information gathering, claims submission, benefits receipt, and access to recourse mechanisms.

Claimants and employers can access Service Canada online, by phone or in-person. The processing and payment of EI benefits occurs through a service delivery network made up of processing sites and EI Specialized Call Centres located across the country. This service delivery network addresses seasonal fluctuations in workload while adjusting to unanticipated spikes caused by economic conditions or major disruptions such as natural disasters.

In their interactions with ESDC, clients expect high quality services. ESDC strives to engage with clients, understand their concerns, and improve services. In the past few years, ESDC has engaged with Canadians through the Service Quality Review (see Section 4.1.1) and Service Transformation initiatives (see Section 4.1.2). In FY1718, ESDC put in place a series of initiatives to enhance the service experience for EI clients, including providing better access to EI Call Centres. While the majority of calls are resolved in the Interactive Voice Response, which is virtually 100% accessible to clients, some enquiries need the assistance of a call centre agent. Through Budget 2016's two-year investments, EI call centre capacity was significantly increased, resulting in:

- Wait times were cut in half, from 13.6 minutes in FY1516 to 6.2 minutes this year; and

- Agent accessibilityFootnote 1 doubled, from 30.6% in FY1516 to 61.4% this year.

Clients' online experience was strengthened through more self-serve options such as the Alert Me function and providing feedback through the Record of Employment Web Application. Clients were engaged, through user testing, to improve the online experience. Now EI clients can find information quickly to better understand eligibility criteria and what they need to do to receive EI.

Additional initiatives were carried out to advance quality service delivery for Canadians. They include:

- Listening to Canadians by acting upon the Service Quality Review conducted in 2016;

- Surveying EI clients to get their perspective on how services could be improved;

- Transforming service delivery by implementing short-term, medium-term, and long-term solutions;

- Developing an action plan to strengthen the EI recourse system; and

- Investing in the EI program to sustain its integrity.

The results of these initiatives alongside with how the program is administered are presented in this section.

4.1.1 Service Quality Review recommendations

In May 2016, the Government launched the EI Service Quality Review (SQR). The SQR Panel, led by two Parliamentary Secretaries and another member of Parliament, asked Canadians from coast to coast to coast how to improve services for EI claimants. The public, Service Canada employees and key stakeholders were consulted via stakeholder roundtables, an online questionnaire, written submissions, and a survey.

Based on the feedback received, the SQR Panel developed ten recommendations, along five key themes on how to make EI service delivery more responsive to the needs of Canadians. The themes include an increased client-centric focus, employee engagement, operational improvements, the modernization of existing technology, and policy modifications.

The complete SQR report, including the full recommendations and panel findings, entitled “Making Citizens Central”, was published on February 1, 2017, and is available on Canada.ca.

Responding to the SQR Recommendations

Service Canada is working to address the SQR recommendations. Since the release of the report, significant progress has been made to advance the recommendations of the Panel and achieve EI SQR's goal of modern, high-quality, Canadian-centric service delivery for the EI program.

1. Citizen-centric approach

Recommendation: The Panel recommends that Service Canada adopt a citizen-centric approach to its service delivery, one that includes effective citizen feedback strategies to understand the needs and priorities of citizens for continuous service improvement, and measuring and setting targets for citizen satisfaction as a means to evaluate success.

2. Service standard review

Recommendation: The Panel recommends that Service Canada review and revamp its service standards, developing a citizen-centric service standard strategy that continually monitors the relevance of the standards based on citizen priorities and expectation of service. The standards results are to be measured, tracked, benchmarked, and publicly reported annually. A performance measurement strategy including key performance indicators needs to be developed and implemented to assist in delivering good citizen service and accountability.

Launched in April 2017, the EI Service Standards Review sought input from key stakeholders and the public on the current EI Service Standards and ways Service Canada can improve timeliness to EI services. This review covered both EI processing and call centre activities. The review indicated that current service standards are generally meeting client expectations. Enhancements to the client experience were identified as an area for improvement. In particular, program information needs to be easier for clients to find and communicated in plain language. In FY1819, Service Canada will conduct a plain language review of service standards, and update service standards on the program webpages. Client experience testing will be used to test if the new content is easy to read and formatted in a way that clients find easy to navigate. This approach would improve the transparency of service standards and better meet client expectations.

3. Enhanced assistance

Recommendation: The Panel recommends Service Canada identify and address access issues facing citizens and develop service delivery strategies such as enhanced assistance for citizens who face similar access challenges to ensure their needs are addressed and positive outcomes and satisfaction achieved.

In fall 2017, a new initiative was launched, called the First Point of Contact Resolution (FPCR). It was designed to improve services for EI claimants by promoting first-contact resolution. Under the FPCR initiative, in-person Citizen Service Officers complete EI transactional activities that would previously have been forwarded to EI Processing or to Call Centres for action. It has improved EI services for clients, by reducing the number of clients needing referral to EI Call Centres or waiting for EI processing agents to take action on their files. The initiative has resulted in increased capacity of Service Canada Centres to enhance the service experience of clients.

Additionally, the Department is currently leveraging existing video chat capabilities in select service centres to enhance the service experience of Canadians. Clients can connect to an available Citizen Service Officer in another office, rather than waiting in line.

4. Service excellence and employee engagement

Recommendation: The Panel recommends further developing a strong service culture in Service Canada by ensuring employees and management have the proper training, tools, and expertise necessary to provide service excellence, as well as developing and implementing an employee engagement plan that surveys and publicly reports annually on employee engagement to ensure Service Canada has satisfied and committed employees providing the best quality service possible to Canadians.

Service Canada has conducted various employee engagement activities to collect employee insight into service problems and to gauge knowledge of service transformation initiatives, including surveys, and employee consultations (such as EI Service Standard Review consultations).

Also, as part of the Department's service Transformation initiative, Service Canada employed a new, modern and innovative approach consisting of an agile co-design process with employees from across the country, clients and private sector experts. The approach involved clients, employees and private sector experts in all phases of developing solutions, from design to prototyping, to testing of the solution.

5. EI funding

Recommendation: The Panel recommends that Service Canada adopt a volume-based funding model for the Employment Insurance program to improve its ability to effectively accommodate fluctuations in the volume of claims received, to ensure that Canadians receive the benefits that they are entitled to in a timely and consistent manner.

The Government, through Budget 2018, is providing up to $90 million over three years, starting in FY1819, to enable the EI program to improve services by ensuring that Service Canada can quickly respond to changing economic conditions, while consistently providing Canadians with timely access to benefits.

6. ePayroll

Recommendation: The Panel recommends that Service Canada engage key stakeholders in the co-creation of a real-time payroll information sharing solution.

The Government, through Budget 2018, committed to minimizing the administrative burden on employers and announced that Service Canada "was working with stakeholders to develop ways to streamline employer reporting obligations under the EI program." In FY1718, Service Canada conducted a series of co-design activities with key stakeholders and the support of the Commissioners for Employers and Workers, to develop a conceptual ePayroll Service Model. The stakeholders included employers, payroll experts, Canadian Payroll Association, Canadian Federation of Independent Business, Canadian Labour Congress, and Canada Revenue Agency.

The co-design activities helped confirm that, with policy changes, payroll and employment data could be used to administer the EI program. It also demonstrated that real-time payroll information would be a valuable source of data for the Government of Canada. Given the Government’s digital agenda, other avenues will be pursued to strategically position ePayroll within the Government’s overarching digital OneGC strategy. In parallel, the Department will continue to advance Benefits Delivery Modernization (see Section 4.1.2), which will build the foundation necessary for EI to utilize a real-time information service.

7. Call Centre improvements

Recommendation: The Panel recommends that the department provide the necessary resources and flexibility in the short-, medium-, and long-term to improve Call Centre service quality while engaging the necessary private sector call centre expertise to assist in developing a long-term, high-quality, and cost-effective Call Centre improvement plan. This plan should include best practices and modern technology and factor in best value for money, enabling the kind of high-quality service citizens expect and need and that employees would like to deliver.

Following Budget 2016’s investment of $73 million over a two-year period beginning in FY1617 to enhance access to EI Specialized Call Centres, ESDC increased the number of call centre agents, which has cut wait times in half and improved the access to information and support that Canadians need.

With Budget 2018’s investment of $127.7 million, the Department will consolidate Budget 2016’s achievements and will continue to improve the access to information and support that Canadians need (see Section 4.4.1).

Also, the Department is advancing its Call Centre Improvement Strategy (see Section 4.4.2), which includes plans for the implementation of a Hosted Contact Centre Solution (HCCS), a modern and supported technology that will enhance functionalities to support the Department’s future business requirements.

8. Review of reconsideration and Social Security Tribunal

Recommendation: The Panel recommends that Service Canada undertake a root cause analysis of the entire reconsideration process to uncover the reasons that cause a large number of initial decisions to be overturned. Furthermore, the Panel supports the HUMA recommendation to undertake a review of the Social Security Tribunal to assess its efficiency, fairness and transparency.

The Department secured the services of a third-party expert to conduct a review of the Social Security Tribunal (SST) during the first two quarters of FY1718. The purpose of the review was to ensure that the SST is meeting the needs and expectations of Canadians, and to assess its fairness and transparency.

Details on the SST review as well as how the Department is addressing its recommendations are available in section 4.5.2.

9. Technology

Recommendation: The Panel recommends that Service Canada replace its technology systems with modern processing technology and Call Centre telephony, doing so with prudence through a phased-in approach, which will enable the organization to meet the needs of citizens.

Service Canada is advancing its technology agenda to migrate call centres to the HCCS, a new technology system that will improve the client service experience and open up new possibilities for enhancing service delivery (see Section 4.4.2).

In addition, Service Canada is investing in modern, sustainable processing technology in the longer term through the Benefits Delivery Modernization (BDM) program. Budget 2017 invested $12.1 million in FY1718 to develop modern approaches to service delivery, beginning with EI, followed by Canada Pension Plan (CPP) and Old Age Security (OAS). Through Budget 2018, the Government signaled ongoing commitment to the BDM program to improve Canadians’ access to services and benefits, including access to a broad range of e-services that are easy to use and speeding up application processes.

ESDC is currently exploring modern processing technologies that will support a dynamic business environment and ESDC's ability to respond to the changing needs and expectations of Canadians with respect to the benefits delivery of EI, CPP and OAS. ESDC is currently conducting the foundational work necessary to prepare for a phased implementation approach, which will demonstrate value early and ensure the Department can avoid service disruptions to clients.

10. Policy

Recommendation: The Panel recommends that the department review EI program policy with the goals of identifying the barriers that prevent the implementation of improvements to service quality and simplifying the policy to improve service delivery and find economies. This review would also consider administrative burdens and barriers for service to Indigenous peoples.

ESDC is actively engaged in reviewing EI policy with a goal of improving service delivery, reducing administrative burden and barriers for service for vulnerable groups including Indigenous peoples. EI program policy measures are at the discretion of the Government.

4.1.2 Service transformation to improve EI service delivery

In October 2016, ESDC launched an internal Service Strategy to support service improvement, which is aligned with the Government of Canada's direction in this regard. The Service Transformation Plan supports the Service Strategy. The Plan provides a roadmap for delivering service improvements and addressing some of the EI SQR recommendations.

The Plan strengthens the Department's capacity to focus on the needs and expectations of clients. It was co-designed by Canadians and ESDC employees and commits to addressing the issues that they identified as most worth solving. For example, clients were engaged in the development and testing of several solutions. Based on the areas of improvements identified during the SQR, the Plan was designed to improve four dimensions of client service excellence:

- Experience: Clients are provided with a world-class experience delivering benefits whenever they need them with an emphasis on digital self-service;

- Quality: Clients receive high-quality, accurate services and decisions, no matter where they live and, when possible, have their needs anticipated;

- Timeliness: Benefits and services are delivered to clients in a timely fashion and clients' issues are resolved at first point of contact; and

- Access: Services, delivered by a well-equipped and knowledgeable workforce, are 100% accessible to clients with digital by choice everywhere.

The Department identified commitments that could be delivered quickly, based on existing authorities (e.g. legislative and regulatory frameworks) and capacity. Between May 2017 and March 31, 2018, the Department completed five of the targets to improve service delivery for the EI program:

- Providing EI applicants with the ability to save their application (for more than 24 hours), and return at a later date to complete it – clients can now save their applications for EI on Appliweb for up to 72 hours;

- Using generic email notifications to prompt clients to log in to their My Service Canada Account for information on their EI claim;

- Maintaining the number of EI specialized call centre agents hired through investments in Budget 2016 through an investment in Budget 2018;

- Reviewing EI service standards to obtain stakeholder views from an experience, access, quality, and timeliness perspective; and

- Improving services for EI claimants by promoting first-contact resolution through assigning activities that are more transactional to In-Person Citizen Service Officers.

In FY1819, the Department will deliver on remaining short term commitments, including:

- Surveying clients more frequently on how to improve services; and

- Enhancing the toolset for mobile outreach, and expanding partnerships with provinces/territories to improve access to services in remote regions.

The Department continues to lay the groundwork for larger scale service transformation through foundational initiatives, including:

- Benefits Delivery Modernization, which is focused on increasing client self-service and automation, streamlining business processes and addressing the risks associated with aging information technology, including software; and

- The development of a modern technology system to ensure the continuity of ESDC contact centre services to clients and to enable ESDC contact centres to respond to current and emerging client expectations.

4.2 General information and enquiries on Employment Insurance

Canadians have access to information regarding EI benefits through multiple channels: on-line, by telephone and in person. This ensures that they access the information they need, when they need it, using their preferred method. This section provides an in-depth analysis of the management of these channels. Chapter two of the EI Monitoring and Assessment Report outlines the various EI benefits available.

4.2.1 On-line – Canada.ca

EI information is available on Canada.ca, the main website of the Government of Canada. Clients use Canada.ca and ESDC’s secure applications to access information and make online transactions. EI tasks are among the most popular services used on Canada.ca. This reporting year, Canadian viewed EI pages 78.9 million times.

Similar with previous years, the most viewed EI pages are:

- Internet reporting service (for biweekly reporting) – 23.7%;

- Employment Insurance benefits landing page – 17.9%;

- EI Regular Benefits – Overview – 6.9%;

- Access Record of Employment on the Web (ROE Web) – 5.7%;

- Contact for EI Individuals – 3.5%;

- Applying for Employment Insurance benefits online – 3.2%

- EI Regular Benefits – Apply – 3.5%;

- EI Regular Benefits – Eligibility – 2.7%;

- The Record of Employment on the Web – 2.5%; and

- EI Sickness Benefit – Overview – 2.1%.

FY1718 was the first full year that all EI content was located on Canada.ca. EI pages were improved to make the information easier to find, simple and more accessible. EI clients who participated in the ESDC Client Experience Survey reported that the website made it easy to access the EI program (82%). Over three-quarters of the surveyed clients (77%) could easily relate the information on the website to their specific situation. Additionally, the survey indicated that clients, who used the Web exclusively to access EI, were more satisfied with their experience than EI clients using other methods. For example, 83% of online EI clients were able to find the type of information they needed to provide when applying to the program compared to 77% of overall EI clients. As well, 79% of online clients understood information about the program versus 75% of overall EI clients. As in the previous year, the new website continues to have a positive impact on the overall client experience.

ESDC continues to engage with clients to improve the EI pages on Canada.ca with respect to plain language, findability, clarity of steps and overall client experience. For example, modifications were introduced to the online applications to allow clients to apply for the new benefits announced in Budget 2017 (e.g. the new Family Caregiver benefit for children and adults, the extended parental benefit). Through streamlined applications and help tools, clients were supported to provide complete and accurate information for the processing of these new benefits.

The updated EI Caregiver pages were published in December 2017 with the first round of improvements. This updated content accounted for 148,797 of the total 178,064 visits for the EI Caregiver content in FY1718.

There are strong indications that the new, user-tested content is easier for Canadians to use, as:

- Users spent 11% less time on pages reading content;

- Users went back and forth 37% less across pages; and

- The “Apply” page was used 13% more often than the old one.

Building on this success, ESDC will make a second round of improvements to EI Caregiver pages in FY1819, as it continues to improve the online presence for the broader EI program. These changes will continue to be guided over the coming years by user testing, web analytics and ESDC’s annual Client Experience Survey.

My Service Canada Account (MSCA)

Claimants can access My Service Canada Account (MSCA), a secure online transactional portal, to view and update their EI information. Service Canada provides features and functionalities within MSCA enabling Canadians to take advantage of self-serve options. Using the MSCA through Canada.ca, Canadians can interact and transact with Service Canada, when, how and where they choose. It enables them to better manage their accounts, check the status of their applications and transactions, and receive information from Service Canada on changes to their account. As a result, the MSCA portal contributes to more accessible, accurate and timely services for Canadians.

Each month, approximately 400,000 users log into MSCA to access EI services such as:

- Obtaining current and past claims information, status, payment information, and correspondence;

- Submitting new information, signing up for or changing Direct Deposit service;

- Viewing or printing a Record of Employment and/or tax slips; as well as

- Visiting the Canada Revenue Agency portal (My Account for Individual) within the same secure session.

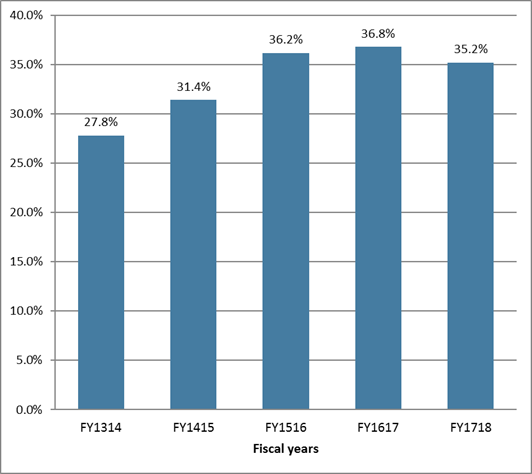

This fiscal year, an average of 35% of EI claimants used MSCA. Clients used MSCA primarily to view their last claim status (19%), to see their payment information (14%) and to access the Internet Reporting Services (4%).

Chart 1 – Text version

| Fiscal Year | FY1314 | FY1415 | FY1516 | FY1617 | FY1718 |

|---|---|---|---|---|---|

| Percentage | 27.8% | 31.4% | 36.2% | 36.8% | 35.2% |

- Source: Business Analysis and Information Management report (Employment Insurance report).

Since May 2017, EI claimants can register to a notification service, which sends timely emails when new and important messages concerning their EI claim are available in their protected MSCA. Since the release of this feature, over 300,000 EI claimants using MSCA have signed up for email alerts.

During FY1718, 9,396 surveyed MSCA users indicated they had attempted an EI-related task. Overall, 75% of the respondents indicated being able to complete their task during the session.

Service Canada continues to build upon clients' feedback to improve the overall client experience for conducting on-line transactions.

4.2.2 By telephone (call)

EI clients frequently contact 1 800 O-Canada for general enquiries related to EI. For more complex and client-specific enquiries, EI clients have the choice of calling the EI Specialized Call Centre or logging into their My Service Canada Account.

1 800 O-Canada

1 800 O-Canada supports Government of Canada communication activities, both in regular and in crises. It often serves as the first point of contact for callers regarding Government of Canada programs and services, including Employment Insurance.

The 1 800 O-Canada line is available Monday to Friday in more than 60 countries, with service in both official languages. In Canada, the service is available from 8:00 a.m. to 5:00 p.m. in each time zone. Callers outside of Canada can reach someone from 8:00 a.m. to 8:00 p.m. Eastern Standard Time.

Canadians can expect to be served within 18 seconds (or within three rings), 80% of the time. During FY1718, 1 800 O-Canada answered 81% of calls within 18 seconds. 1.66 million individuals called 1 800 O-Canada agents, a 7.2% decrease compared to the previous reporting year. There were 2.13 million enquiries (more than one enquiry may be asked per call) answered by 1 800 O-Canada agents. This included 384,763 EI specific enquiries, a decrease of 13% from the previous year.

1 800 O-Canada is equipped to provide general information on EI programs and how to access them, including:

- An overview of the benefits and eligibility criteria;

- Application process and forms;

- General information on payment dates (not applicable for the EI benefits as payment information is case specific);

- Direct deposit information; and

- Referral of contacts to specific programs, including the pertinent EI web pages and links necessary to complete their service delivery journey.

Clients with case-specific enquiries are advised to use the My Service Canada Account website, or to contact the EI Specialized Call Centre or Employer Contact Centre as required.

Most EI-related enquiries still require a referral to the EI Specialized Call Centres or to the program’s website for more detailed, complex and client-specific enquiries. During this reporting period, 81.3% of clients asking the EI-related questions were referred to the program.

Like most of ESDC's systems, 1 800 O-Canada operating technology is outdated. Acting on the Service Quality Review recommendations to modernize its technology, the Department successfully moved 1 800 O-Canada to an interim solution to mitigate risks posed by old technology. 1 800 O-Canada responded to EI-related enquiries with the same high quality during and after this change.

The 1 800 O-Canada’s mandate has remained largely unchanged in the last 10 years. The service adopted some enhancements through its ongoing effort to continuously improve service delivery, including being able to email out contact information on demand and proactively promote self-serve options, where these are available. The service provides primary and alternate service delivery contacts based on the type of transaction the caller needs to perform within a program.

4.2.3 In-person (visit)

Canadians can also obtain information on Service Canada services in-person through points of service.

Points of service

As of March 31, 2018, through our service delivery network, Canadians were able to access services at 590 in-person points of service across the country (320 Service Canada Centres, 238 scheduled outreach sites and 32 Passport Service sites). Service Canada employees in these locations help claimants submit applications and complete online applications. They also perform other support functions for the EI program, such as authenticating identity, validating supporting documents, and verifying information for completeness. Service Canada Centres (SCCs) are full-time or part-time offices, open up to five days a week, managed and staffed by Service Canada employees, offering general information and transactional services. SCCs may be stand-alone or co-located with other organizations.

Scheduled Outreach Sites are points of service that are located outside a SCC but offer similar services. Service Canada staff travel to a pre-determined location, typically in rural or remote areas, that are otherwise underserved.

ESDC aims to ensure that 90% of Canadians have access to an SCC or a Scheduled Outreach Site within a 50-kilometre driving distance from where they live. Over the last five years, this target has consistently been met. In the current reporting period, 96.2% of Canadians need to travel 50 kilometres or less for service.

In FY1718, Service Canada in-person points of service staff have completed nearly 2.5 million service requests related to EI, which represented nearly 30% of all service requests handled. Also, in the SCCs, close to 1.5 million activities related to EI were recorded in the self-help zones on the Citizen Access Workstation Services,Footnote 2 representing more than 30% of all Citizen Access Workstation Services activities.

The breakdown of the types of in-person services provided on the EI Program is as follows:

- General information – 50%;

- Follow-up assistance – 47.1%;

- Assistance with applications –2.5%; and

- Processing support – 0.3%.

Community Outreach

Service Canada also uses Community Outreach services to connect with communities across the country. They complement the services provided at Service Canada Centres and Scheduled Outreach Sites. Service Canada employees travel to communities in times of particular need. For example, Service Canada employees will travel to a community to provide information on specific topics when a company or industry conducts a mass layoff or during local emergencies such as natural disasters. Community Outreach services include EI information sessions.

Community Outreach services provide flexible services to Canadians living in communities where geography, technology, culture, language and other barriers prevent access to service. The Service Canada officers have access to an online toolkit they can take with them while out on the job. The toolkit contains links to all necessary information (for example forms, how-to guides, outreach materials, presentations, tracking tools, etc.). It is designed to enable clients, in those communities, to access the latest information and to be served appropriately. The Community Outreach services increase awareness of Service Canada programs and service offerings by providing general information such as:

- EI information at mass layoff sites;

- EI application assistance to apprentices;

- Social Insurance Number clinics to help youth apply for their first job; and

- Other Government of Canada programs and services for citizens and community organizations.

Service Canada delivers EI information sessions in times of duress and may adapt processes and create partnerships to meet clients’ needs more effectively with regard to EI. While some Service Canada employees make proactive calls to employers affected by a tragedy to establish their needs, others ensure potential claimants who lose their jobs can get the information required to submit their EI application. For example, in response to the anticipated unemployment increase and other needs by Canadians affected by the British Columbia wildfires in the summer of 2017, a regional response team was put in place to provide the planning and implementation of an integrated regional emergency response team. Ninety Service Canada staff participated on the response team, working out of 13 centres located in areas of high need, helping to coordinate regional efforts to provide service to evacuees. Service Canada attempted to reach the majority of employers in the affected region to determine areas of support, including supporting recovery plans to get affected individuals back to work and work-sharing options. In addition, information was provided to temporary foreign workers to encourage them to apply for EI, in line with employers’ contingency plans for future employment. Employers who came to a Service Canada Centre or one of the evacuation centres were provided information on EI services and the Employer Contact Centre.

Between July 7 and September 15, 2017, Service Canada Centres helped over 4,000 evacuees. In addition, the EI call centre answered more than 3,200 calls from clients affected by the fires. The processing of 5,623 applications for EI was facilitated.

EI information sessions are also delivered when Service Canada receives news of a mass layoff. Regional offices initiate contact with employers to organize information sessions and work with partners so that potential claimants receive on-site workshops on résumé writing, job search techniques, interview skills, and information on EI, the Job Bank, My Service Canada Account and available provincial support programs. Sessions are usually planned on very short notice and often in remote areas.

During FY1718, the following EI information sessions were delivered:

- 645 EI information sessions to citizens facing layoffs, with a total of 10,580 participants;

- 87 EI information sessions to workers on Work Sharing, with a total of 1,748 participants; and

- 251 EI information sessions to employers, with 535 companies and organizations participating.

The number of sessions delivered was 12% higher in this reporting period than the previous fiscal year.

Chart 2 breaks down the information sessions delivered to claimants by region, including employees facing layoffs and work sharing sessions.

Chart 2 – Text version

| Region | FY1112 | FY1213 | FY1314 | FY1415 | FY1516 | FY1617 | FY1718 |

|---|---|---|---|---|---|---|---|

| Atlantic | 219 | 209 | 114 | 119 | 133 | 115 | 106 |

| Quebec | 582 | 461 | 425 | 586 | 395 | 277 | 274 |

| Ontario | 1,021 | 1,003 | 1,029 | 632 | 470 | 381 | 440 |

| Western | 306 | 318 | 202 | 282 | 177 | 152 | 216 |

- Source: Mobile Outreach Administrative Data

4.3 Application intake and claim processing

Once claimants have the needed information, they are ready to submit an application. Claimants, employers and ESDC (Service Canada) all have a role to play. Claimants submit an application; employers submit a Record of Employment and Service Canada ensures that the information submitted is complete and renders a decision on the claim. Service Canada also reviews its work to ensure it meets its service standards related to speed and accuracy of payments. This section provides a snapshot of the activities related to application intake and claims processing.

4.3.1 Claimant application intake

Claimants can initiate service requests for benefits via the internet using the online form (AppliWeb), or in-person at any Service Canada Centre. Introduced nationally in 2002, AppliWeb allows claimants to apply for EI benefits 24 hours a day, seven days a week, from anywhere they can access the internet. Over the last nine years, usage has remained well above 95%, and it continues to be the most common method chosen by claimants applying for EI benefits, with 98.4% of applications submitted via AppliWeb during this reporting year.

Claim volumes

In FY1718, 2,786,829 initial and renewal claims were received, including claims for the new Family Caregiver benefit for children and adults and for the extended parental benefit. These new benefits were implemented as a result of legislation introduced as part of Budget 2017. In this reporting period, there was a 5.8% decrease (172,299 claims) in claim intake compared to FY1617. The majority of this decrease (160,000 claims) was in the Western Canada and the Territories. It can be attributed to the large number of claims in FY1617 because of high unemployment in Alberta due to the commodities downturn and the Fort McMurray wildfires.

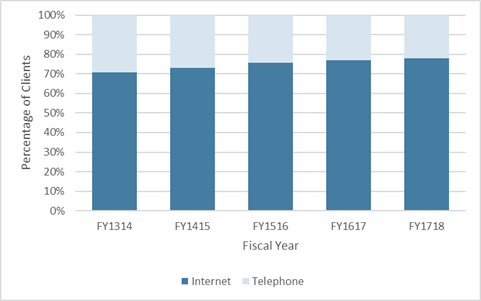

Electronic reporting

Most claimants must complete and submit biweekly reports to receive EI benefits. They may use the telephone reporting service or the internet reporting service. Claimants answer a series of questions that help determine on a week-by-week basis whether they continue to be eligible for the type of EI benefits they are claiming. In FY1718, electronic reporting experienced a minor increase to 77.9% from 77.1% in FY1617 (See chart below).

Chart 3 – Text version

| Fiscal Year | FY1314 | FY1415 | FY1516 | FY1617 | FY1718 |

|---|---|---|---|---|---|

| Internet | 70.6% | 73.1% | 75.5% | 77.1% | 77.9% |

| Telephone | 29.4% | 26.9% | 24.5% | 22.9% | 22.1% |

- Source: Service Canada, Employment Insurance (EI) administrative data.

4.3.2 Employer intake

Service Canada works with employers to ensure that the EI program is administered fairly and efficiently. Employers can obtain guidance and access to the most up-to-date information regarding the EI program through the Employer Contact Centre (ECC) and the Canada.ca website. This information helps them understand their responsibilities and learn about the various services and programs available to them.

Record of Employment (ROE)

ESDC uses the information provided on the Record of Employment (ROE) to determine if a person qualifies for EI benefits, the benefit rate and the claim duration. Over 10.2 million ROEs were issued in FY1718.

ESDC actively encourages the use of electronic ROEs (eROEs) by attending conferences and trade shows annually as well as increasing marketing materials through social media campaigns. Automating this activity creates organizational efficiencies and reduces administrative burden. Employers no longer need to order or store paper ROE forms or send copies to ESDC and their employees. The Department is continuing efforts to reach out to employers and target industry sectors identified as being large paper ROE users. This targeted approach resulted in an increase of eROE submissions by 2.3 percentage points, from 88.1% to 90.4%.

Employers suggested that a feedback function be introduced in the ROE Web Application in October 2016. This feature allows employers to communicate their service preferences and supports continuous improvements to the ROE Web Application. This function was enhanced in December 2017 to allow additional and more precise feedback. Since its inception, 22,447 respondents completed the ROE Web questionnaire. Over 90% of respondents indicated being "Very satisfied" or "Satisfied" with the ROE Web application.

4.3.3 Claims processing

EI benefits are delivered through a national network comprised of processing agents across Canada, working in tandem with automated EI claims processing and workload management systems. The network triages, assesses and adjudicates new applications, applications to reactivate an existing claim, as well as revised claims that are created when new information is received during the claim lifecycle.

There was a 5.8% decrease in claims received this reporting year. This resulted in 184,541 fewer claims processed in FY1718 compared to FY1617. In FY1718, 72.4% of EI claims were partially or fully automated, this represents a 0, 4% decrease from FY1617.

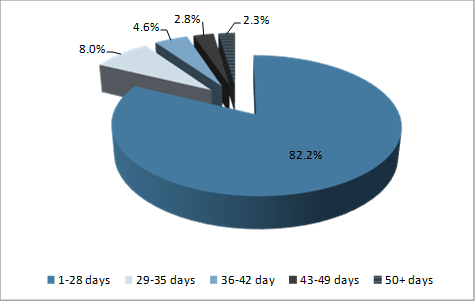

Speed of payment

Speed of payment refers to how fast the claimant receives the payment or non-payment notification once the claim is received. The Department uses this service standard to measure its ability to process claims in a timely manner. The national target is to pay (or notify of non-payment) 80% of claims within 28 calendar days of filing an application. A number of factors can affect the speed of pay. These factors include unanticipated economic factors or events, such as mass layoffs and natural disasters, and incomplete or complex applications, which require fact-finding with employers and third parties.

The implementation of new benefits and support measures in FY1718 involved additional work for the claims processing. However, 82.2% of clients received timely payments or non-payment notifications. This represents a small decrease of 1 percentage point from FY1617.

Of the claims that did not meet the 28-day speed of payment target, most are paid within 29-35 days (please see chart below).

Chart 4 – Text version

| Number of Days | Percentage |

|---|---|

| 1-28 days | 82.2% |

| 29-35 days | 8.0% |

| 36-42 day | 4.6% |

| 43-49 days | 2.8% |

| 50+ days | 2.3% |

- Source: EI administrative data.

There is a range of factors that affect EI processing performance—most notably seasonal fluctuations in workload demands where the Department experiences a higher than normal intake of claims. Other factors that can delay the payment of benefits beyond 28 days include incomplete applications requiring clarification of information, and complex applications requiring fact-finding with employers and third parties to render a fair and equitable decision.

While an increasing share of applications are automated by the system, there are still some applications that require agent intervention to address specific issue(s) before a claim can be processed. These manual interventions can create delays in the delivery of EI benefits. Issues include delays in receiving the record of employment (ROE), discrepancies between the application and the ROE, and employers failing to issue ROEs. In addition, unanticipated economic factors or events such as mass layoffs and natural disasters may have an impact on EI processing performance in any given year.

4.3.4 Service quality

As previously mentioned (see Section 4.1.1), Service Canada conducted a Client Experience Survey as part of the ESDC Service Strategy. The Client Experience Survey provided Service Canada with baseline performance data on the service experience and broad directional information by program, client group, and channel. These results will be used to track the impact of service transformation on the service delivery of programs and services over time

The survey was conducted by telephone with a sample of 4,001 Service Canada clients, randomly selected from clients who had recently completed a service experience, from gathering information to applying to receiving an initial decision. The sample included 703 EI clients who had received a decision during the period of March to June 2017. Both clients who were granted and denied benefits were included. Findings for Service Canada clients overall carry a margin of error of +/- 2.5% and results for EI clients alone have a margin of error of (+/- 4%).

The satisfaction rateFootnote 3 among Service Canada clients was 86%, with 63% very satisfied and 24% satisfied. Similarly, the satisfaction rate among EI clients was 83%, with 56% very satisfied and 26% satisfied. The service attributes that received the highest ratings among EI clients were the ease of the overall application process (84%), and, as part of that, the ease of completing the application (82%). EI, however, performs more poorly on confidence in timely processing (66%) and, among the half of clients who provided missing information or checked on the status after submitting an application, ease in following up (69%).

In addition to the Client Experience Survey, the Department has a Quality Monitoring procedure to ensure that clients receive quality service.

Quality Monitoring

Service Canada's policies, processes and Information Technology systems are designed to ensure that EI contributions are handled appropriately and that claims are handled correctly the first time.

Claimants receive assistance throughout the process of submitting EI applications to avoid unnecessary mistakes and delays. The program provides guidance at the start of the claims process and alerts claimants and employers to missing or incorrect details. For example, the EI mobile outreach sessions described above (see Section 4.2.3) proactively provide potential claimants with information about their eligibility and tools to help them find new employment. These sessions guides claimants through the first phases of submitting an EI application. Similarly, Service Canada's Information Technology systems help reduce employer errors by creating automatic alerts when a required field is left blank on the electronic Records of Employment. The Department is actively encouraging the move from paper Records of Employment to electronic Records of Employment to reduce errors.

The Department also has mechanisms in place to ensure that the calculated amounts claimants receive are accurate. These mechanisms include:

- The Employment Insurance Payment Accuracy Review;

- The Employment Insurance Processing Accuracy Review;

- The Individual Quality Feedback Review; and

- The National Quality Coaching Program for Call Centres (see Section 4.4.3).

Employment Insurance Payment Accuracy Review (PAAR)

By validating the information provided by the claimant, ESDC's goal is to reduce errors at the start of the claim's process. However, it is also important to review claims once they are established. This review ensures that the benefits paid are accurate and that no mistakes are made during the claim.

Using a Monetary Unit Sampling methodology, the EI Payment Accuracy Review (EI PAAR) estimates the accuracy of EI benefit payments. The Department reviews a statistically valid number of files each year to identify undetected errors that result in mispayments.

ESDC has an established target rate of 95%Footnote 4 accuracy in benefit payments per yearFootnote 5. This rate includes claimant, employer and ESDC errors. Together, claimants, employers and the Department have maintained an average accuracy rate of 95.0% over the last 15 years. During this reporting period, the overall accuracy rate reached 96.0%, up from 95.4% the previous year (see Table 1). Annual results can be found in the financial audit of the EI account, reported each year in the Public Accounts of Canada by the Office of the Auditor General.

| Fiscal Year | FY1617 | FY1718 | ||

|---|---|---|---|---|

| Total EI Benefit Payout | 19.1 billion | 18.3 billion | ||

| EI Payment Accuracy Rate | 95.4% | 96.0% | ||

| Errors by Source: | Estimated Financial Impact ($M) | Estimated Error Rate | Estimated Financial Impact ($M) | Estimated Error Rate |

| 887.7 million | 4.7% | 737.9 million | 4.0% | |

| Employer | $ 286.6 | 1.5% | $ 220.7 | 1.2% |

| Claimant | $ 361.7 | 1.9% | $ 379.1 | 2.1% |

| ESDC | $ 239.5 | 1.3% | $ 138.1 | 0.8% |

- Note: Estimated financial impacts are the sum of overpayments and underpayments.

- Source: Employment and Social Development Canada.

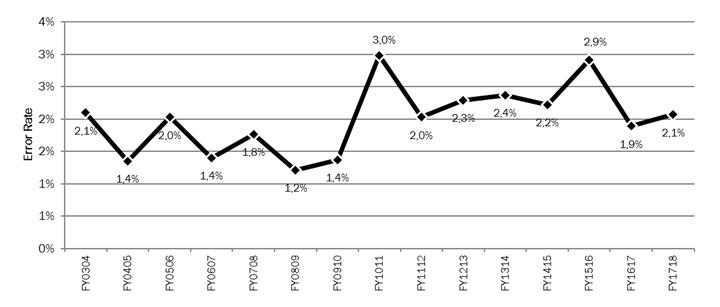

This year, the claimant error rate increased from 1.9% to 2.1% (see Chart 5). Most claimant errors (89.7%) occur when the claimant provides new information that changes the initial decision of their claim. For example, the claimant incorrectly reporting earnings caused 66.6% of errors. 23.1% of errors were caused by not reporting the refusal of a job, quitting a job or being dismissed from a job while in receipt of benefits. The Department continues to assess claimant errors to understand why they happen, the financial impact and ways to avoid them.

Chart 5 – Text version

| Fiscal Year | Claimant Error Rate |

|---|---|

| FY0304 | 2.1% |

| FY0405 | 1.4% |

| FY0506 | 2.0% |

| FY0607 | 1.4% |

| FY0708 | 1.8% |

| FY0809 | 1.2% |

| FY0910 | 1.4% |

| FY1011 | 3.0% |

| FY1112 | 2.0% |

| FY1213 | 2.3% |

| FY1314 | 2.4% |

| FY1415 | 2.2% |

| FY1516 | 2.9% |

| FY1617 | 1.9% |

| FY1718 | 2.1% |

- Note: Results are provided with a level of confidence of 95% and a margin of error of ± 5%.

- Source: Employment and Social Development Canada.

The employer error rate decreased this year, from 1.5% to 1.2%. In order to identify employer errors, the Department reviews all ROEs used to establish a claim. The percentage of eROEs reviewed in the EI PAAR sample continues to increase each year, from 65.1% in FY1415 to 87.2% in FY1819 (See Table 2). The increased use of electronic Records of Employment (eROEs) is likely the reason for the decrease in the error rate, as paper ROEs are more than twice as likely to contain an error.

ESDC continues to encourage employers to move to eROEs. In addition, the Department is integrating more tools to eliminate possible sources of error during the first steps of information and application submission. ESDC continues to analyze employer errors to understand why these mistakes happen, the financial value, and possible ways to avoid them.

| Fiscal Year | FY1314 | FY1415 | FY1516 | FY1617 | FY1718 | |||||

|---|---|---|---|---|---|---|---|---|---|---|

| ROEs validated | Count | Percentage by ROE type | Count | Percentage by ROE type | Count | Percentage by ROE type | Count | Percentage by ROE type | Count | Percentage by ROE type |

| Number of E-ROEs validated | 503 | 65.1% | 589 | 73.3% | 589 | 76.4% | 621 | 80.6% | 694 | 87.2% |

| Number of paper ROEs validated | 270 | 34.9% | 214 | 26.7% | 182 | 23.6% | 149 | 19.4% | 102 | 12.8% |

| Total ROEs Validated | 773 | 100.0% | 803 | 100.0% | 771 | 100.0% | 770 | 100.0% | 796 | 100.0% |

| Incorrect E-ROEs | 37 | 7.4% | 30 | 5.1% | 61 | 10.4% | 46 | 7.4% | 57 | 8.2% |

| Incorrect Paper ROEs | 38 | 14.1% | 21 | 9.8% | 38 | 20.9% | 26 | 17.4% | 19 | 18.6% |

- Source: Employment and Social Development Canada.

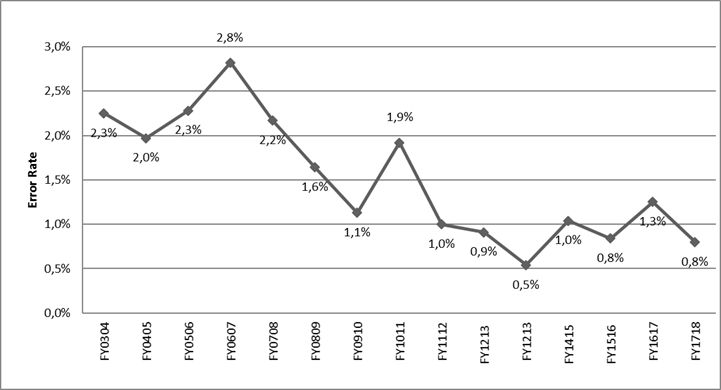

Chart 6 – Text version

| Fiscal Year | Service Canada Error Rate |

|---|---|

| FY0304 | 2.3% |

| FY0405 | 2.0% |

| FY0506 | 2.3% |

| FY0607 | 2.8% |

| FY0708 | 2.2% |

| FY0809 | 1.6% |

| FY0910 | 1.1% |

| FY1011 | 1.9% |

| FY1112 | 1.0% |

| FY1213 | 0.9% |

| FY1314 | 0.5% |

| FY1415 | 1.0% |

| FY1516 | 0.8% |

| FY1617 | 1.3% |

| FY1718 | 0.8% |

- Note: Results are provided with a level of confidence of 95% and a margin of error of ± 5%.

- Source: Employment and Social Development Canada.

ESDC's efforts to automate processing contributed to maintaining low levels of errors (see Chart 6). However, periods of high claim volume can shift the emphasis to speed of pay and generally require more manual data entry. Transcription errors and manual entry mistakes decreased significantly this fiscal year. The decrease in clerical errors helped to decrease ESDC’s error rate by 0.5%. The Department continues to explore opportunities for improvement, including increased automation.

Employment Insurance Processing Accuracy Review (PRAR)

The Employment Insurance Processing Accuracy Review (PRAR) is an important way to ensure that EI claims are processed consistently and that individuals applying for EI benefits receive timely and accurate payments across the country.

The EI PRAR consists of a review of a statistically valid random sample of 3080 claims per year. The PRAR verifies that the Department makes decisions and calculates benefits based on national operational policies and procedures. It estimates the percentage of applications that are treated consistently. The PRAR supports the Payment Accuracy Review Program by measuring the percentage of initial claims “in order”. ESDC has set a target that on 80%Footnote 7 of claims all criteria relevant to the review were met.

Automated Claims Processing was introduced in 2007. The processing accuracy rate for fully automated claims (claims requiring no human intervention) increased steadily from 96.5% in FY0708 to 100% in FY1011Footnote 8. In April 2011, fully automated claims were excluded from the sample. Currently, EI PRAR concentrates on partially automated and/or manually processed claims only as it is understood that automated claims are consistently processed accurately.

This year, the processing accuracy rate for claims requiring manual intervention increased to 86.9% from 85.5% the previous year, meeting its target this year and every year since FY0708.

Of the 3080 claims reviewed during the fiscal year, 2677 claims were deemed to be in order. The remaining 403 claims were found to have one or more errors on file at the time of review, totalling 499 errors. Table 3 provides the frequency of the top three errors identified.

| Number of times the error was identified | Description of Error |

|---|---|

| 170 | All decisions, contentious or non-contentious, were not adjudicated appropriately - for example, the reason for separation, including contradictions, was not clarified with all relevant parties; documentation/fact-finding or rationale was not on file, incomplete, inaccurate or not relevant; or the Policy on Levels of Decisions was not applied correctly. |

| 81 | The data displayed on the Support System for Agents, the Employment History File, the Record of Employment Capture Module and the National Workload System was entered incorrectly. |

| 63 | Inadequacies or inconsistencies with information provided by the client, employer and other sources were not followed up and/or explained satisfactorily. |

In order to resolve these types of errors, an analysis will be conducted to determine the causes with the intent to minimize the frequencies.

With a continual focus on quality, it is expected that the PRAR accuracy rate will stay above the 80% national target and will continue to rise.

Individual Quality Feedback

The Individual Quality Feedback (IQF) review is an internal Service Canada quality check assessing processing accuracy at the individual level. Reviewers sample an average of 10 to 20 random case files handled by each agent to verify accuracy and consistency. The results of these reviews help identify when training or additional coaching is required.

IQF launched in FY1617 and remains an important program in the suite of Quality Assurance tools. As part of departmental continuous improvement efforts, several enhancements to the IT platform and review tools utilized in this program are currently underway. These enhancements will increase the consistency of feedback provided to staff and greatly reduce the effort required to review files. The new IT platform will include an automated file upload process and random selection tool, pre-defined error and observation codes, increased reporting, and analysis capability. Once operationalized, these tools will have a direct impact on the quality of the work performed by processing staff as they will receive constructive and positive feedback they can utilize to improve services to Canadians.

4.4 Specialized call centres

Claimants and employers sometimes have questions that cannot be answered by the general information on the website or by calling 1 800 O-Canada. The EI specialized call centres are available to answer specific questions about an individual's claim. Employers may call the Employer Contact Centre (ECC) to get help and guidance. This section describes the availability of the specialized call centres to respond to those specific needs.

Two major events affected the operation of the specialized call centres this year:

- Budget 2016 provided funding to improve services to EI clients; and

- The results of the Service Quality Review provided information about the specific improvements Canadians want.

During this reporting period, specialized call centres focused on responding to the following recommendation from the Service Quality Review:

"The Panel recommends that the Department provide the necessary resources and flexibility in the short-, medium-, and long-term to improve call centre service quality while engaging the necessary private sector call centre expertise to assist in developing a long-term, high-quality, and cost-effective call centre improvement plan. This plan should include best practices and modern technology and factor in best value for money, enabling the kind of high-quality service citizens expect and need and that employees would like to deliver."

4.4.1 Overview of call centre performance

Employment Insurance specialized call centres

The EI Specialized Call CentreFootnote 9 network consists of ten call centres. It is the primary point of contact for EI client specific enquiries relating to the application process, status, benefit eligibility and delivery. Calls are distributed across the network, based on availability of resources, regardless of from where in the country they are coming.

Call centres are equipped with an Interactive Voice Response (IVR) system. The IVR allows clients to self-serve for some transactions, including application status, payment details and completing bi-weekly declarations. The total EI call volume reached almost 25.6 million calls during the current reporting year. Almost 65% of these calls (16.6 million) were resolved in the IVR without the need to speak to an agent, compared to 61% the previous year.

Specialized agents are available to help and guide clients through issues that cannot be resolved by self-service. For example, clients can call specialized agents to declare specific types of earnings including wage loss insurance and severance pay.

With investments from Budget 2016, the equivalents of 384 full-time call centre agents were added to increase access to the EI Specialized Call Centres. Over a two-year period beginning in FY1617, the $73 million from the Budget was used to retain 166 existing fully trained full-time agents and hire 218 new incremental ones. When compared to results prior to the Budget 2016 investment, call centre agents were able to answer 4.6 million calls (646, 074 more than the previous year), compared to 3.4 million calls in FY1516. Because of this increased capacity, significantly more Canadians were able access the information and support they needed.

Not only were more calls answered, but also they were answered more quickly, meaning improved wait times for clients. Although the published service level target for the EI specialized call centres is to answer 80% of calls within 10 minutes, the Budget 2016 commitment was to improve service level to 65% of calls answered in ten minutes by the end of March 2017 and to maintain an annualized average of 65% for FY1718. For the month of March 2017, the Department exceeded its commitment by achieving 83% service level and in FY1718, 73% of calls were answered within this 10-minute timeframe, an increase from the previous year's 48% and prior to Budget 2016 where service level was 37% for FY1516. On average, calls were answered in just over 6 minutes, as compared to 11.5 minutes in FY1617 and 13.6 minutes in FY 1516.

In consideration of its funding level, EI call centres must sometimes limit access to an agent to avoid excessive wait times or possible end-of-day disconnections. However, in FY1718 more clients were able to reach a call centre agent because of the additional hiring facilitated through the Budget 2016 funding. This reporting year, calls for which a client could not access an agent decreased from roughly 10.3 million prior to Budget 2016 to 3.6 million. It is a reduction of roughly 65% over the 2 years as a result of Budget 2016 funding. Abandoned calls also decreased; they dropped by 394,433Footnote 10, or about 37% over 2 years (See Table 4).

| Fiscal Year | FY1516 | FY1617 | FY1718 |

|---|---|---|---|

| Call answered by an agent | 3,418,976 | 3,961,890 | 4,607,964 |

| Calls for which a client could not access an agent | 10,272,442 | 6,870,008 | 3,597,707 |

| Abandoned calls | 1,107,348 | 1,086,340 | 691,907 |

- Source: Employment and Social Development Canada.

Budget 2016 provided funding to improve EI call centre accessibility to 60% by the end of March 2017 and to maintain an annualized average of 60% for FY1718. In FY1617, the Department exceeded its Budget 2016 commitment by reaching 80% accessibilityFootnote 11for the month of March 2017 and an annualized average of 61% accessibility in FY 1718. This improved accessibility and reduced wait times ensure that Canadians calling for assistance with EI are able to more easily access and get the help they need in a timely manner to ensure they receive the benefits to which they are entitled. Of note, the EI call centre Interactive Voice Response (IVR) was nearly 100% accessible, which is consistent with recent years.

The EI call centre performance resulting from the Budget 2016 investment addresses the initial component of the Service Quality Review recommendation to ensure the necessary resourcing to improve call centre service quality. With Budget 2018’s investment of $127.7 million, the Department has also received funding to maintain the agent level of Budget 2016 and to increase its performance further, thereby continuing to maintain and improve Canadians’ access to EI Specialized Call Centre agents.

Nature of enquiries

The top five main reasons clients requested agent assisted services were:

- enquiries regarding the status of a claim/decision (includes claims/decisions within or not the timeframes, as well as Initial, revised, renewals);

- claimants declaring a condition that affects their availability;

- enquiries about entitlement conditions for EI benefits, unrelated to a claim;

- guidance on how to file their application; and

- claimants declaring earnings received, such as vacation pay.

The most notable change was an increase of 3.25% of clients wanting to know the status of their claim or decision in comparison to FY1617.

The majority of clients' telephone enquiries are resolved at the call centre. Requests that are not well suited to be handled efficiently within a call centre environment are sent to the processing area for appropriate follow-up.

Specialized call centres track the volume of calls resolved at first point of contact. The call is considered resolved if the agent was able to address the client’s enquiry during the telephone interaction. It is important to note that it does not measure client satisfaction and is an internal organizational performance indicator. During this reporting year, the percentage of calls that were resolved by a call centre agent with no additional follow-up required dropped by 2.8% to 80.7%.Footnote 12 This reduction appears to be linked to the increased volume of claim status enquiries, and may also be linked to the change in the nature of enquiries as EI call centres become more accessible to clients.

Employer Contact Centre (ECC)

Launched in June 2011, the Employer Contact Centre (ECC) provides enhanced services to employers through an accessible, national, single point of contact. The three ECC sites are located in Vancouver, British Colombia; Bathurst, New Brunswick; and Sudbury, Ontario.

Employers contact the ECC to obtain information and assistance on a variety of service offerings. Employers call for a variety of reasons, from ordering Records of Employment (ROE) forms to getting information on Work-sharing.

In FY1718, the following are the top five reasons employers called the ECC to speak to an agent for assistanceFootnote 13:

- To order paper ROE forms;

- To enquire about ROE Web registration and login;

- To receive guidance about block specific information on ROEs;

- To receive guidance on how and when to issue an ROE; and

- To enquire about the status of an application for the Temporary Foreign Worker Program.

The ECC answered 479,070 calls in FY1718, compared with 558,596 calls in FY1617. Some of the possible causes of this decrease are EI call centres’ improved accessibility, enhancements to ROE Web, and an increase in ROE Web registration

In FY1718, 16.1% of ECC’s total call volume had to be referred to other programs or departments, as they were non-ECC related enquiries. 6.8% of the total call volume were referrals to EI that were not employer based (e.g. employees). With the implementation of the Hosted Contact Centre Solution in FY1819, an ECC Interactive Voice Response system may reduce these misdirected calls by automatically redirecting certain calls to the EI call centre.

The most common reason for calls is to order paper ROEs. Service Canada will continue to monitor call driver trends to see if promotion of electronic services reduces these calls. The ECC plays a key role in promoting ROE Web to employers, which will be enhanced by incorporating specific promotional messages in the new Interactive Voice Response system.

4.4.2 Call Centre Improvement Strategy

As part of its ongoing response to the recommendations of the Service Quality Review, the Department is advancing its Call Centre Improvement Strategy. This strategy is a transformation initiative that will leverage industry best practices and implement ongoing business and technology improvements to increase accessibility and enhance services to clients. The Strategy includes a number of key components such as:

Call Centre Platform: ESDC is planning for the implementation of a Hosted Contact Centre Solution (HCCS), a modern and supported technology that will enhance functionalities to support the Department’s future business requirements. In April 2017, ESDC began working with the HCCS vendor and federal government partners. Since then, ESDC has undertaken detailed discovery and design sessions and developed an implementation schedule for EI and ECC contact centre migrations. The Department has completed a significant redesign of the IVR system to simplify and clarify messages content and structure. In addition, the Department engaged with employers on the design of the IVR system for the ECC. It has also consulted with external organizations regarding industry best practices. Objectives in FY1819 include completing the functional design specifications, testing the EI IVR design with clients and completing the migration of the ECC.

Accountability Framework: The new call centre Accountability Framework was launched in January 2018 as a pilot to allow transition and further refinement of targets, measures, and reporting. It includes key performance metrics (e.g. Financial Management, Productivity, Quality, Client Satisfaction and Employee Satisfaction) which help monitor Service Canada's overall performance, take corrective measures where necessary, and assist in achieving improved service quality for Canadians.

Call Driver Root Cause Analysis: Since FY1516, Service Canada has conducted an annual Call Driver Root Cause Analysis to understand better why clients contact the call centre and promote service enhancement recommendations. FY1718 recommendations align with those made in FY1516: implement an enhanced telephony platform, increase online self-service options, and better manage client enquiries once received. Ongoing consultation with stakeholders within Service Canada is currently advancing the implementation of these recommendations.

Review of New Employee Training: In March 2018, a working group was created to review the New Hires Call Centre Curriculum for EI. This group’s mandate is to identify areas of improvement to training in order to increase the knowledge of call centre agents on the most common types of calls, and reduce the post training learning curve. ESDC is also working to develop a standardized post training strategy for new call centre employees, to facilitate the transition of new call centre employees from in-class learners to independent call centre agents. These efforts seek to improve client service through a better-trained and supported workforce.

National Quality and Coaching Program: The Department has undertaken an internal review of the National Quality and Coaching Program for Call Centres to identify opportunities to improve current practices by leveraging industry best practices, with a goal to enhance the client experience and explore the potential of the HCCS. Recommendations will be put forth to continue enhancing and shaping the future of the call centre quality program in FY1819.

4.4.3 National Quality Coaching Program for Call Centres

The National Quality Coaching Program ensures that clients receive consistent high quality service from specialized call centres, through the regular monitoring and coaching of agents.

The National Quality Coaching Program for Call Centres is part of the mechanisms that ESDC uses to make sure that clients are receiving high quality service. It complements the Processing Accuracy Review, which assesses the accuracy of transaction processing (see Section 4.3.4). In FY1718, EI call centre agents had a processing accuracy rate of 94%, well surpassing the target of 80%.

Agent calls are monitored on an ongoing basis and regular feedback is provided to ensure that agents provide accurate and complete information. Feedback may include coaching and the development of training plans tailored to individual needs. Additional monitoring can then be done as part of these plans to ensure continued performance improvements. National sessions are held on a regular basis to make sure that monitoring criteria are being applied the same way across all call centres.

Calls to the EI Specialized Call Centres are evaluated in terms of specific elements of the call. These elements include the greeting, the authentication of the client, the resolution of the client's need, and the closing. Each element is categorized as meeting, partially meetingFootnote 14, or not meeting quality expectations. In FY1718, 86% percent of the reviewed calls had an overall call score of meeting or exceeding quality expectations, or partially meeting expectations with only minor improvements required. For the specific element "Provides Accurate and Complete Information" which is a key indicator of the result achieved for the client, 88% of calls met or partially met quality expectations, with only minor improvements required.

Agent responses to calls to the ECC are assessed using the same elements. Ninety-two (92) % of calls monitored from the ECC, had an overall call score that was categorized as meeting or exceeding quality expectations, or partially meeting expectations with only minor improvements required. Ninety-three (93) % of calls met or partially met quality expectations for providing "Accurate and Complete Information" with only minor improvements required.

4.5 Recourse

Clients or employers may not agree with the decision made on an application. They may request that Service Canada reconsider the decision as Service Canada processes the requests on behalf of the Canada Employment Insurance Commissions (CEIC). If the client or employer remains unsatisfied with the reconsideration decision, he or she may file an official appeal with the Social Security Tribunal of Canada. This quasi-judicial, arms-length tribunal will review the decision. More information about recourses processing is available in this section.

4.5.1 Employment Insurance requests for reconsideration

EI clients who disagree with a decision related to a claim for benefits have the right to request a reconsideration of that decision within 30 days from the date the decision was communicated, or at a later time that the CEIC may allow. A formal request for reconsideration of a decision provides clients with a review of the decision, including the opportunity to submit new or additional information. Service Canada, on behalf of the CEIC, will review its decision to ensure that it is based on the accurate interpretation of legislation, program policies and jurisprudence, and is supported by complete information. The review is performed by a different Service Canada employee than the one who made the initial decision.

In FY1718, the CEIC received 49,618 requests for reconsideration and completed 50,069. The reconsiderations included requests submitted in FY1617.

| Source of request | Number of requests |

|---|---|

| Requests received from claimants | 48,677 |

| Requests received from employers | 792 |

| Requests received from other clients* | 149 |

| Total requests received | 49,618 |

- *Other client is any person who is subject to a decision of the Commission and is not a claimant or an employer

- Source: EI administrative data

The CEIC aims to complete requests for reconsideration reviews within 30 days from receipt of the request. The average time for completion was 29 days, with 67.3% of requests completed within the 30-day target (provided in detail in table below).

The CEIC's ability to make a decision regarding requests for reconsideration in a timely manner in FY1718 was 7.6% higher than the previous fiscal year. Clients waited in average 29 days, which is a decrease of 6 days compared to the previous year.

| Service | Service level |

|---|---|

| Requests completed | 50,069 |

| Percentage of requests completed within 30 days | 67.3% |

| Average time for completion (days) | 29 |

| Percentage of initial decisions reverse or adjusted following review | 49.9% |

- Source: EI administrative data

The EI Act allows clients to seek recourse on almost any decision related to a claim for benefits. While there are over 50 types of decisions or issues that can be subject to recourse, clients most frequently challenge the decision over six issues, as shown in Table 7. These issues generally involve a complete denial of benefits, such as a disqualification for voluntarily leaving employment without just cause, or a financial sanction for misrepresentation.

| Issues | FY1314 | FY1415 | FY1516 | FY1718 |

|---|---|---|---|---|

| Voluntary leaving- without just cause | 22.5% | 25.0% | 25.5% | 25.4% |

| Misrepresentation – penalty | 7.3% | 6.5% | 7.0% | 8.7% |

| Non availability for work | 8.6% | 9.5% | 9.4% | 8.9% |

| Benefit period not established | 12.7% | 14.1% | 13.3% | 11.5% |

| Misconduct | 9.6% | 10.2% | 10.3% | 9.5% |

| Earnings | 10.5% | 6.9% | 7.7% | 8.1% |

- Source: EI administrative data

4.5.2 Employment Insurance appeals and the Social Security Tribunal of Canada

The Social Security Tribunal (SST) of Canada is an independent administrative tribunal that makes quasi-judicial decisions on matters relating to the Canada Pension Plan, the Old Age Security Act and the Employment Insurance Act. The SST was created in April 2013 replacing the previous administrative tribunal systems including the Board of Referees. It operates at arm's length from the Department and the Canada Employment Insurance Commission (CEIC). For more information about the management of the SST, please visit their website at https://www1.canada.ca/en/sst/ .

The SST’s mandate is to offer Canadians an efficient, fair and transparent appeals process. It includes two levels of appeals - the General Division and the Appeal Division. All appeals to the SST must start with the General Division, first level of appeal. The General Division is comprised of two sections – one for deciding matters related to employment insurance (General Division-EI) and the other to income security (General Division-Income Security).

All decisions made by the General Division can be appealed to the Appeal Division of the SST, second level of appeal. A single member makes all decisions by the General and Appeal Divisions. For the purposes of this report, only Employment Insurance appeals to the General Division and the Appeal Division are examined.

SST - General Division, Employment Insurance section

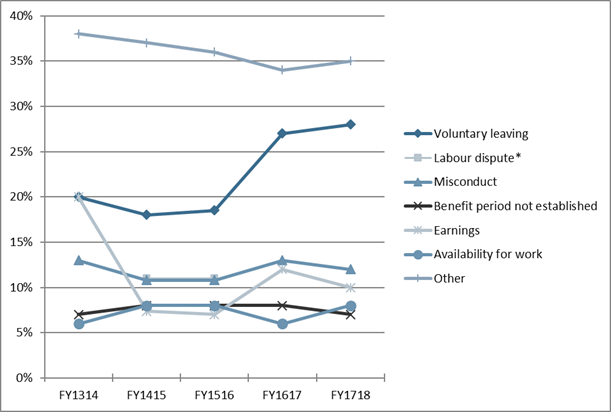

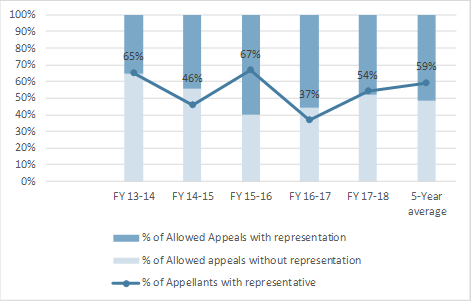

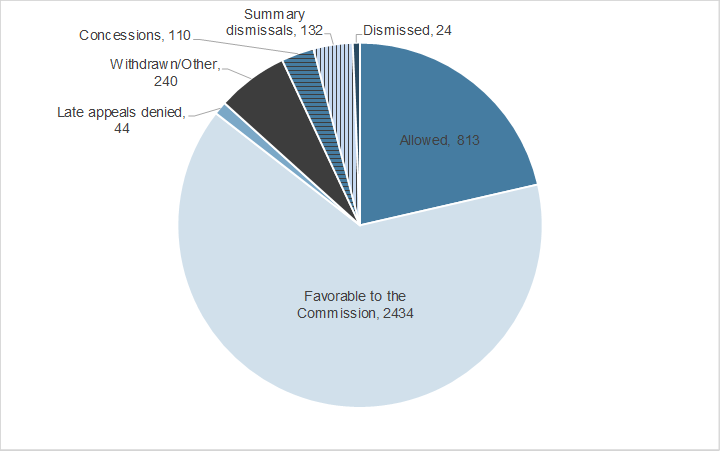

Within 30 calendar days of receipt of the reconsideration decision, a client who disagrees with a reconsideration decision made by the CEIC regarding a claim for EI benefits can dispute this decision before the SST’s General Division, EI section.