Chapter 2 - Impacts and effectiveness of Employment Insurance benefits (Part I of the Employment Insurance Act)

Official title: Employment Insurance Monitoring and Assessment Report for fiscal year beginning April 1, 2019 and ending March 31, 2020: Chapter 2: Impact and effectiveness of Employment Insurance benefits (Part I of the Employment Insurance Act)

In chapter 2

- List of abbreviations

- 2.0 Introduction

- 2.1 Employment Insurance benefits overview

- 2.2 Employment Insurance regular benefits

- 2.3 Employment Insurance support while on training

- 2.4 Employment Insurance fishing benefits

- 2.5 Employment Insurance Work-Sharing benefits

- 2.6 Employment Insurance special benefits

- 2.7 Employment Insurance financial information

List of abbreviations

This is the complete list of abbreviations for the Employment Insurance Monitoring and Assessment Report for the fiscal year beginning April 1, 2019 and ending March 31, 2020.

Abbreviations

- ADR

- Alternative Dispute Resolution

- ASETS

- Aboriginal Skills and Employment Training Strategy

- B/C Ratio

- Benefits-to-Contributions ratio

- B/U Ratio

- Benefits-to-Unemployed ratio

- B/UC Ratio

- Benefits-to-Unemployed Contributor ratio

- BDM

- Benefit Delivery Modernization

- CAWS

- Citizen Access Workstation Services

- CCAJ

- Connecting Canadians with Available Jobs

- CCDA

- Canadian Council of Directors of Apprenticeship

- CCIS

- Call Centre Improvement Strategy

- CEIC

- Canada Employment Insurance Commission

- CERB

- Canada Emergency Response Benefit

- COLS

- Community Outreach and Liaison Service

- CPI

- Consumer Price Index

- CPP

- Canada Pension Plan

- CRA

- Canada Revenue Agency

- CRF

- Consolidated Revenue Fund

- CX

- Client Experience

- EBSMs

- Employment Benefits and Support Measures

- ECC

- Employment Contact Centre

- EI

- Employment Insurance

- EICS

- Employment Insurance Coverage Survey

- EIR

- Employment Insurance Regulations

- EI SQR

- Employment Insurance Service Quality Review

- eROE

- Electronic Record of Employment

- ESDC

- Employment and Social Development Canada

- FLMM

- Forum of Labour Market Ministers

- FY

- Fiscal Year

- FY *

- Fiscal Year excluding the month of March

- G7

- Group of Seven

- GDP

- Gross Domestic Product

- HCCS

- Hosted Contact Centre Solution

- HRSDC

- Human Resources and Social Development Canada

- IQF

- Individual Quality Feedback

- IQP

- Integrated Quality Platform

- ISET

- Indigenous Skills and Employment Training

- IVR

- Interactive Voice Response

- LFS

- Labour Force Survey

- LMDA

- Labour Market Development Agreements

- LMI

- Labour Market Information

- LMP

- Labour Market Partnerships

- MAEST

- Ministry of Advanced Education, Skills and Training

- MIE

- Maximum Insurable Earnings

- MSCA

- My Service Canada Account

- MTESS

- Ministère du Travail, de l'Emploi et de la Solidarité sociale

- NAICS

- North American Industry Classification System

- NESI

- National Essential Skills Initiative

- NIS

- National Investigative Services

- NOS

- National Occupational Standards

- NWS

- National Workload System

- OAS

- Old Age Security

- OECD

- Organization for Economic Co-operation and Development

- PAAR

- Payment Accuracy Review

- PPEs

- Clients who are Premiums Paid Eligible

- P/Ts

- Provinces and Territories

- PRAR

- Processing Accuracy Review

- PRP

- Premium Reduction Program

- QPIP

- Quebec Parental Insurance Plan

- R&I

- Research and Innovation

- RAIS

- Registered Apprenticeship Information System

- ROE

- Record of Employment

- RSOS

- Red Seal Occupational Standards

- SA

- Social Assistance

- SCC

- Service Canada Centres

- SDP

- Service Delivery Partner

- SEPH

- Survey of Employment, Payrolls and Hours

- SIN

- Social Insurance Number

- SIR

- Social Insurance Registry

- SLAP

- Softwood Lumber Action Plan

- SME

- Small and medium sized enterprises

- SST

- Social Security Tribunal

- STDP

- Short-term disability plan

- SUB

- Supplemental Unemployment Benefit

- TRF

- Targeting, Referral and Feedback

- UV ratio

- Unemployment-to-vacancy ratio

- VBW

- Variable Best Weeks

- VER

- Variable Entrance Requirement

- WWC

- Working While on Claim

2.0 Introduction

This chapter of the Employment Insurance Monitoring and Assessment Report assesses income support provided by Employment Insurance (EI) Part I benefits:

- regular benefits

- fishing benefits

- Work-Sharing benefits, and

- special benefits

This chapter includes several key indicators, such as the number of new claims established, total amount paid, level of benefits, maximum duration and actual duration of benefits as well as the exhaustion of benefits. Throughout the chapter, key EI program provisions and recent changes made to the EI program are discussed. Indicators related to level of claims and level of benefits are presented for claims established within the fiscal year for which at least 1 dollar in EI benefits was paid. Indicators like maximum and actual duration are based on claims completed during the fiscal year for which at least 1 dollar was paid in EI benefits. Indicators related to amount of EI benefits paid are presented on a cash basis, which means the expenses are accounted for during the fiscal year in which they are paid. More information on the definitions of the indicators presented throughout this chapter can be found in annex 2.1 of this report.

In response to the economic and labour market disruptions due to the COVID-19 pandemic that started in March 2020, the Government of Canada introduced the Canada Emergency Response Benefit (CERB) on March 15, 2020 to provide income support for Canadians as part of Canada’s COVID-19 Economic Response Plan. The CERB provided financial support to eligible employed and self-employed Canadians who stopped working and lost their income due to COVID-19. As a result, eligible claimants who would have otherwise applied for EI regular or sickness benefits applied for CERB as of March 15, 2020 instead. Consequently, this chapter excludes data related to CERB during the FY1920 reporting period (from March 15, 2020 to March 31, 2020). This ensures continuity in the reported data on EI regular and sickness benefits from year to year and enables us to perform meaningful yearly comparisons in FY1920 with previous fiscal years. Eligible claimants who had applied for EI benefits and whose application had not been processed as of March 15, 2020 did not have to reapply for CERB and are included in the EI data estimates provided in this chapter. Furthermore, the results on amount of benefits paid cover the full period from April 1, 2019 to March 31, 2020.

This chapter relies on several sources of information to provide a comprehensive analysis of the EI program. EI administrative data, generally based on a 10% sample, underpins the majority of the analysis in this chapter. Some sections of this chapter also make use of tax data provided by the Canada Revenue Agency related to T4 tax slips with employment income or T1 returns. Statistics Canada’s Employment Insurance Coverage Survey provides the basis for deeper analysis of coverage, eligibility and access of EI benefits for unemployed people. Throughout the chapter, data for the FY1920 is compared with data from previous years and, in some instances, long-term trends are discussed.

Annex 2 of the report presents additional statistical information on benefits analyzed in this chapter and annex 7 provides an overview of major changes to the EI program between April 1996 and December 2020.

2.1 Employment Insurance benefits overview

In this section

- 2.1.1 Employment Insurance claims, amount paid and level of benefits

- 2.1.2 Combined Employment Insurance claims

- 2.1.3 Benefits-to-contributions ratios

The Employment Insurance (EI) program provides temporary income support to partially replace employment income for eligible unemployed contributors to the program while they search for work or upgrade their skills, and for those who are absent from work due to specific life circumstances. For example:

- sickness

- pregnancy

- providing care to a newborn or newly adopted child

- providing care and support to a critically ill family member, or

- providing end-of-life care to a family member with significant risk of death

In this chapter, EI benefits refer to regular benefits, special benefits, fishing benefits and Work-Sharing benefits (consult table 1). Special benefits include maternity benefits, parental benefits, sickness benefits, family caregiver benefits for adults or children, and compassionate care benefits. All EI benefit types are paid at a benefit rate of 55% of average weekly insurable earnings up to the maximum weekly benefit rate, except for extended parental benefits, which are paid at 33%. Subsection 2.1.1 covers the number of new claims established in the fiscal year, total amount paid over the fiscal year and benefit levels of claims established. Subsection 2.1.2 examines combined (or mixed) benefit claims. Subsection 2.1.3 provides an analysis of the usage of EI benefits relative to EI contribution premiums.

| Benefit type | Circumstance | Insurable employment entrance requirement | Maximum entitlement |

|---|---|---|---|

| Regular | Unemployed with a valid reason for separation and searching for suitable employment or retraining in certain cases | 420 to 700 hours depending on the Variable Entrance Requirement | 14 to 45 weeks, depending on insurable employment and regional unemployment rate1 |

| Fishing | Self-employed fishers without available work | Value of a catch between $2,500 and $4,200 depending on the Variable Entrance Requirement | 26 weeks per season (summer or winter) |

| Work-Sharing | Firm avoiding layoffs during a slowdown in business activity for reasons beyond the firm’s control with a recovery plan and a Work-Sharing agreement in place | 420 to 700 hours depending on the Variable Entrance Requirement and must be a year-round employee | 6 to 26 weeks, with the possibility of an extension by 12 weeks if warranted1 |

| Special2 - Maternity | Unavailable to work because of pregnancy or has recently given birth | 600 hours | 15 weeks |

| Special - Parental | Caring for a newborn or a newly adopted child | 600 hours | Standard parental: 35 weeks plus 5 additional weeks when benefits are shared Extended parental (at a lower replacement rate): 61 weeks plus 8 additional weeks when benefits are shared |

| Special - Sickness | Unavailable to work because of illness, injury or quarantine | 600 hours | 15 weeks |

| Special - Family caregiver for children | Providing care or support to a critically ill or injured child under the age of 18 | 600 hours | 35 weeks3 |

| Special - Family caregiver for adults | Providing care or support to a critically ill or injured person 18 years or older | 600 hours | 15 weeks3 |

| Special - Compassionate care | Providing care to a person of any age who requires end-of-life care | 600 hours | 26 weeks3 |

- 1Temporary Work-Sharing special measures were announced to support employers affected by the downturn in the forestry sector and the steel and aluminum sector. These measures extend the duration of Work-Sharing agreements across Canada from a maximum of 38 weeks to 76 weeks. The temporary special measure for the forestry sector were in effect from July 30, 2017 to March 28, 2020. The temporary special measure for the steel and aluminum sector are in effect from August 19, 2018 to March 27, 2021.

- 2Self-employed workers (other than fishers) who have opted into EI special benefits must meet an insurable earnings threshold for the calendar year preceding the claim. The threshold was $7,121 for claims established in 2019 and $7,279 for claims established in 2020.

- 3 Benefits can be shared between eligible claimants (that is parents or family members).

2.1.1 Employment Insurance claims, amount paid and level of benefits

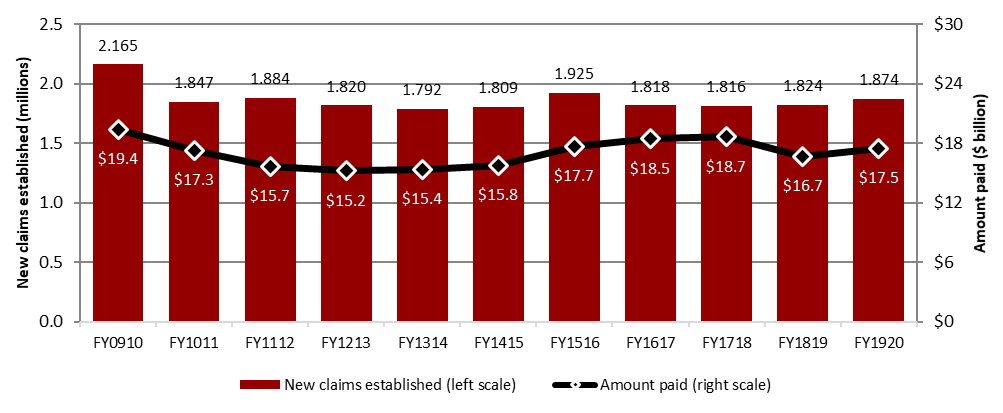

For the period beginning April 1, 2019, and ending March 31, 2020 (FY1920), the number of new EI claims increased by 2.7% (+50,150) to 1.87 million new claims (consult Chart 1). Total EI benefit payments increased by $817 million, or +4.9%, to $17.5 billion.

Text description of Chart 1

| Fiscal year | FY0910 | FY1011 | FY1112 | FY1213 | FY1314 | FY1415 | FY1516 | FY1617 | FY1718 | FY1819 | FY1920 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| New claims established (millions) (left scale) | 2.165 | 1.847 | 1.884 | 1.820 | 1.792 | 1.809 | 1.925 | 1.818 | 1.816 | 1.824 | 1.874 |

| Amount paid (billions) (right scale) | $19.4 | $17.3 | $15.7 | $15.2 | $15.4 | $15.8 | $17.7 | $18.5 | $18.7 | $16.7 | $17.5 |

- Note: Includes all claims for which at least $1 of Employment Insurance benefits was paid.

- Source: Employment and Social Development Canada, Employment Insurance (EI) administrative data. Data are based on a 10% sample of EI administrative data.

According to Statistics Canada, there were 740,000 beneficiaries receiving EI benefits on average each month in FY1920, representing an increase of 3.1% from 717,600 beneficiaries during the previous reporting period.Footnote 1

The average weekly benefit rate increased by 3.2% from $465 in FY1819 to $480 in FY1920.Footnote 2, Footnote 3 The proportion of claimants receiving the maximum weekly benefit increased from 48.0% in FY1819 to 48.6% in FY1920.

New Employment Insurance claims established

The slight increase in the number of new EI claims observed during the reporting period is largely due to an increase in claims for regular and parental benefits (consult table 2). Fishing, maternity, and sickness claims were relatively unchanged.

| Types of Employment Insurance benefit | New claims established FY1819 |

New claims established FY1920 |

New claims established Change (%) |

Amount paid ($ million) FY1819 |

Amount paid ($ million) FY1920 |

Amount paid Change (%) |

|---|---|---|---|---|---|---|

| Regular | 1,292,710 | 1,367,080 | 5.8% | $10,673.8 | $11,064.4 | 3.7% |

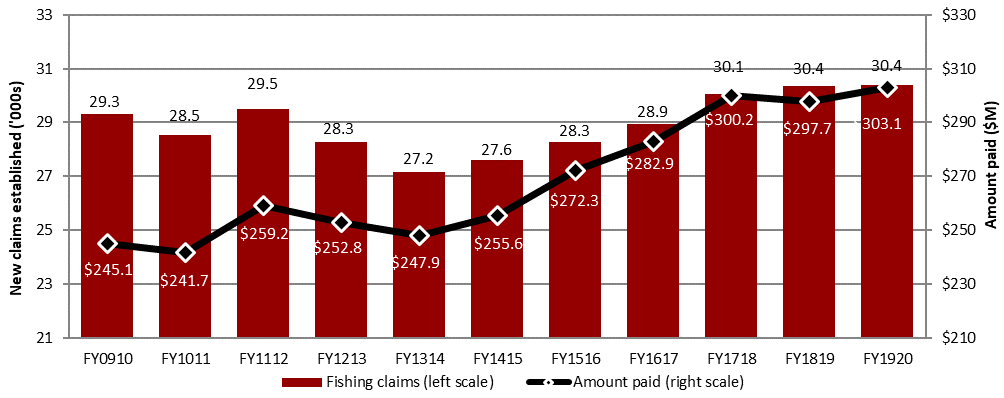

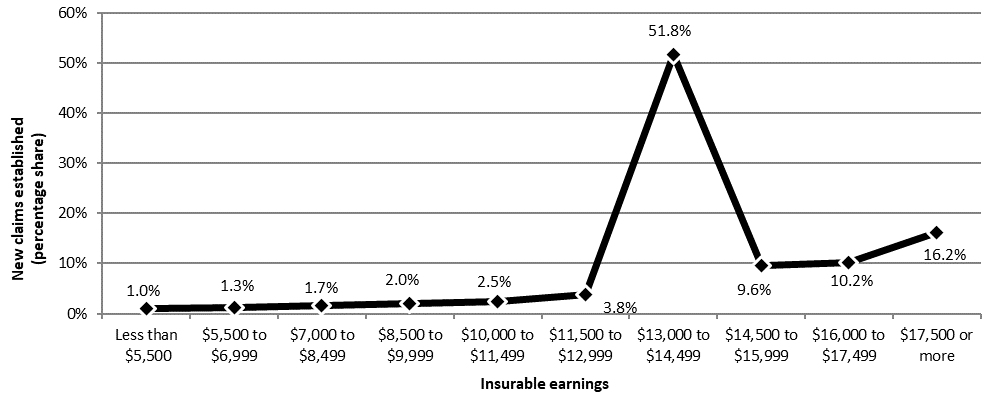

| Fishing | 30,367 | 30,385 | 0.1% | $297.7 | $303.1 | 1.8% |

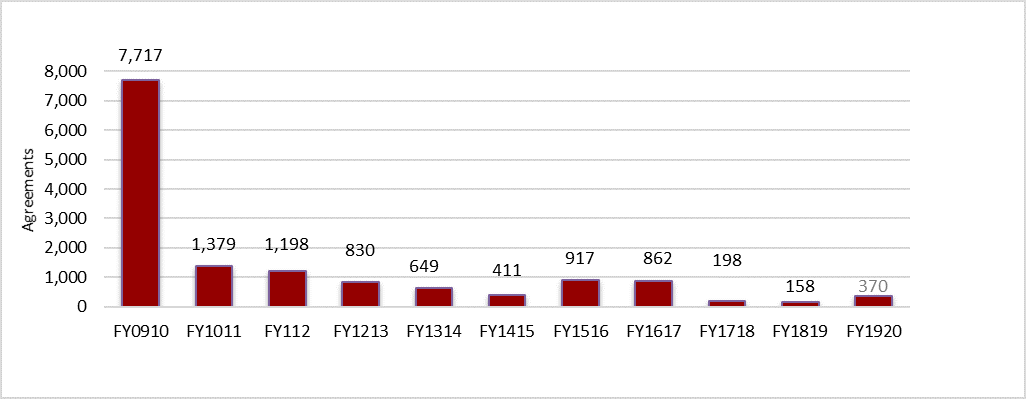

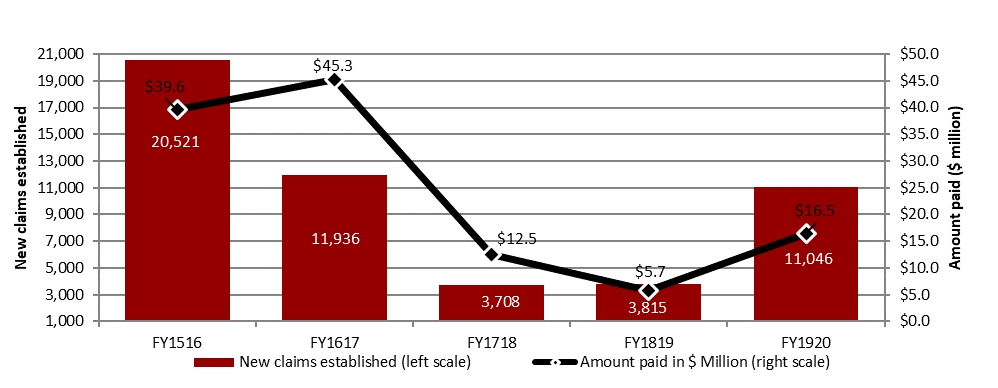

| Work-Sharing | 3,815 | 11,046 | 189.5% | $5.7 | $16.5 | 189.5% |

| Special | 606,540 | 619,270 | 2.1% | $5,796.2 | $6,150.1 | 5.6% |

| Maternity | 170,010 | 167,690 | -1.4% | $1,164.1 | $1,208.1 | 3.8% |

| Parental | 200,030 | 212,750 | 6.4% | $2,730.7 | $2,921.7 | 7.1% |

| Sickness | 420,840 | 421,140 | 0.1% | $1,769.6 | $1,888.8 | 6.7% |

| Family caregiver for children | 5,722r | 5,403 | -5.6% | $36.9r | $36.3 | -1.4% |

| Family caregiver for adults | 11,365r | 11,592 | 2.0% | $49.1r | $55.7 | 15.3% |

| Compassionate care | 8,385 | 7,581 | -9.6% | $45.8 | $39.6 | -13.5% |

| Canada | 1,824,330 | 1,874,480 | 2.7% | $16,685.3 | $17,502.7 | 4.9% |

- Notes: Totals may not add up due to rounding. Includes all claims for which at least $1 of Employment Insurance benefits was paid. The sum of claims by benefit type does not add up as multiple benefit types can be combined in 1 single claim.

- r Revised data.

- Source: Employment and Social Development Canada, Employment Insurance (EI) administrative data. Data are based on a sample of 10% of the EI administrative data, except for family caregiver, Work-Sharing and compassionate care benefits as well as claims for fishing benefits (100%).

The Atlantic provinces and territories all experienced declines in the number of new EI claims established between FY1819 and FY1920 while the rest of the provinces recorded increases. Ontario (+5.2%), Saskatchewan (+5.7%), British Columbia (+6.0%) and Alberta (+6.1%) recorded the largest increases over the reporting period (consult table 3).

| Category | New claims established FY1819 |

New claims established FY1920 |

New claims established change (%) |

Amount paid FY1819 |

Amount paid FY1920 |

Amount paid change (%) |

|---|---|---|---|---|---|---|

| Newfoundland and Labrador | 86,070 | 81,790 | -5.0% | $1,022.9 | $992.5 | -3.0% |

| Prince Edward Island | 22,480 | 21,770 | -3.2% | $231.1 | $226.0 | -2.2% |

| Nova Scotia | 84,570 | 82,540 | -2.4% | $845.1 | $851.3 | 0.7% |

| New Brunswick | 89,820 | 89,380 | -0.5% | $869.6 | $925.1 | 6.4% |

| Quebec | 473,060 | 475,220 | 0.5% | $3,106.0 | $3,210.3 | 3.4% |

| Ontario | 556,900 | 585,670 | 5.2% | $5,240.4 | $5,680.5 | 8.4% |

| Manitoba | 64,020 | 64,780 | 1.2% | $619.2 | $631.2 | 1.9% |

| Saskatchewan | 54,210 | 57,280 | 5.7% | $624.7 | $639.3 | 2.3% |

| Alberta | 188,870 | 200,450 | 6.1% | $2,171.0 | $2,266.4 | 4.4% |

| British Columbia | 198,240 | 210,060 | 6.0% | $1,878.1 | $2,004.3 | 6.7% |

| Yukon | 2,310 | 2,300 | -0.4% | $25.0 | $26.0 | 3.7% |

| Northwest Territories | 2,310 | 2,030 | -12.1% | $31.1 | $29.7 | -4.6% |

| Nunavut | 1,470 | 1,210 | -17.7% | $21.0 | $20.0 | -4.3% |

| Male | 988,250 | 1,018,710 | 3.1% | $8,416.6 | $8,833.7 | 5.0% |

| Female | 836,080 | 855,770 | 2.4% | $8,268.7 | $8,669.0 | 4.8% |

| 24 years old and under | 170,480 | 171,760 | 0.8% | $1,284.6 | $1,302.6 | 1.4% |

| 25 to 44 years old | 882,780 | 914,700 | 3.6% | $9,038.7 | $9,554.9 | 5.7% |

| 45 to 54 years old | 352,640 | 352,040 | -0.2% | $2,883.7 | $2,915.8 | 1.1% |

| 55 years old and over | 418,430 | 435,980 | 4.2% | $3,478.3 | $3,729.3 | 7.2% |

| Canada | 1,824,330 | 1,874,480 | 2.7% | $16,685.3 | $17,502.7 | 4.9% |

- Notes: Totals may not add up to the total due to rounding. Includes claims for which at least $1 of EI benefits was paid.

- Source: Employment and Social Development Canada, Employment Insurance (EI) administrative data. Data are based on a sample of 10% of the EI administrative data.

The number of new claims established by both men and women increased during FY1920. Men established 54.3% of all new claims. Levels of new EI claims only slightly decreased for workers aged 45 to 54 years old (-0.2%) while increasing for all other age groups.

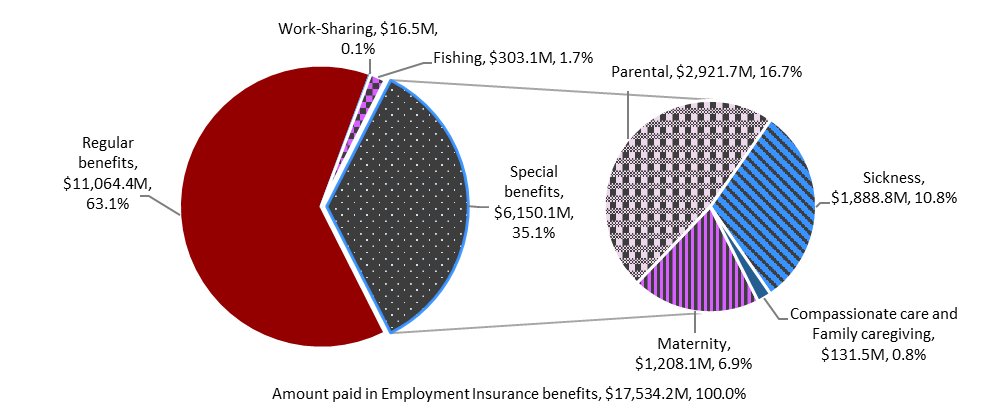

Total amount paid in Employment Insurance benefits

The amount paid for all types of EI benefits combined reached $17.5 billion in FY1920, an increase of $817 million or +4.9%. This increase was largely attributable to the increase in the amount paid in EI regular benefits ($390.6 million or +3.7%). The share of EI benefits paid by benefit type remains relatively unchanged compared to the previous reporting period.

Text description of Chart 2

| Benefit type | $ million | % share |

|---|---|---|

| Regular benefits | $11,064.4 | 63.2% |

| Work-Sharing benefits | $16.5 | 0.1% |

| Fishing benefits | $303.1 | 1.7% |

| Special benefits | $6,119.6 | 35.0% |

| Parental benefits | $2,921.7 | 16.7% |

| Sickness benefits | $1,888.8 | 10.8% |

| Maternity benefits | $1,208.1 | 6.9% |

| Compassionate care and Family caregiving benefits | $131.6 | 0.8% |

- *The total amount paid reported in Chart 2 does not correspond to the total reported in table 2 and 3 because data on compassionate care benefits and family caregiver benefits can only be reported on a 100% sampling basis on an aggregate level.

- Source: Employment and Social Development Canada, Employment Insurance (EI) administrative data. Data are based on a sample of 10% of the EI administrative data, except for Work-Sharing, family caregiver and compassionate care benefits (100%).

The amount paid in EI benefits increased in all but 4 provinces and territories: Newfoundland and Labrador (-3.0%), Prince Edward Island (-2.2%), Northwest Territories (-4.6%), and Nunavut (-4.3%) (consult table 3).

EI benefits received by both men and women increased from the previous fiscal year, with both experiencing similar growth (+5.0% and +4.8%, respectively). The amount paid in EI benefits also increased for each age group. Claimants aged 25 to 44 years old and those aged 55 years old and over saw particularly large increases (+5.7% and +7.2%, respectively).

Levels of benefits

For all claims, excluding those for extended parental benefitsFootnote 4, the average weekly benefit rate increased by 3.2% nationally to $480 over the reporting period (consult annex 2.3.2). This rise is higher than the 2.1% increase in maximum insurable earnings from 2019 to 2020 (consult section 2.7). All provinces and territories recorded increases. Nunavut had the highest average weekly benefit rate ($542), while Nova Scotia posted the lowest average rate ($453).

Nunavut also had the highest proportion of claimants receiving the maximum weekly benefit rate (85.0%) for FY1920, while Prince Edward Island and New Brunswick maintained their positions with the lowest proportions of claimants receiving the maximum rate (36.1% and 35.6%, respectively).

Northwest Territories, as in the last reporting period, had the highest proportion of claimants receiving the maximum weekly benefit rate (85.0%) for FY1920, while Prince Edward Island and New Brunswick also maintained their positions with the lowest proportions of claimants receiving the maximum rate (36.1% and 35.4%, respectively).

The average weekly benefit rate increased for male and female claimants to $506 and $448, respectively. Men were, once again, proportionally more likely to receive the maximum weekly benefit rate (60.4%) compared to women (34.1%) in FY1920.

The average weekly benefit rate also increased for all age groups compared to FY1819. Claimants aged 25 to 44 still received the highest average weekly benefit rate ($493) and were more likely to collect the maximum weekly benefit rate (53.5%). Claimants under 25 years of age received, on average, the lowest amount of weekly benefits ($434), and only 30.3% of them received the maximum weekly benefit rate in FY1920.

Calculating the weekly benefit rate: Variable Best Weeks (VBW)

Under the VBW provision the weekly benefit rate is calculated based on an EI claimant’s highest (best) weeks of insurable earnings during the qualifying period. The number of weeks used to calculate the weekly benefit rate ranges from 14 to 22, depending on the monthly regional unemployment rate

| Unemployment rate* | Number of weeks |

|---|---|

| 6.0% and under | 22 |

| 6.1% to 7.0% | 21 |

| 7.1% to 8.0% | 20 |

| 8.1% to 9.0% | 19 |

| 9.1% to 10.0% | 18 |

| 10.1% to 11.0% | 17 |

| 11.1% to 12.0% | 16 |

| 12.1% to 13.0% | 15 |

| More than 13.0% | 14 |

- *The monthly regional unemployment rates used for the EI program are a moving average of seasonally adjusted rates of unemployment produced by Statistics Canada, as per section 17 of the Employment Insurance Regulations.

Supplemental Unemployment Benefit plans

While the temporary support from EI benefits provide an income floor for unemployed workers, employers can use a Supplemental Unemployment Benefit (SUB) plan to increase their employees’ weekly earnings when they are unemployed due to a temporary stoppage of work, training, illness, injury or quarantine. These SUB plans need to be registered with Service Canada so that supplemental payments (or top-ups) are not considered as earnings and are not deducted from EI benefits.* A recent departmental study** examined the characteristics of employers and employees with SUB plans, and their pattern of utilization of the EI program.

From 2008 to 2017, an annual average of over 6,800 firms (0.5% of all firms in Canada) had active SUB plans, increasing over time. Around 63% of these plans were for illness, injury or quarantine, while plans for temporary stoppage of work, training and plans consisting of a combination of top-up plans accounted for around 10%, 7% and 20% respectively. Firms offering SUB plans were generally larger in size and more likely to be associated with the services industries.

Overall, EI claims that receive top-up payments through SUB plans constituted between 40,000 and 60,000 claims per year (around 3% of all EI claims). Most of these claims were for EI regular benefits, followed by claims for EI sickness benefits.

When firms offering SUB plans are compared with firms having similar characteristics but that do not offer SUB plans, results showed that the average number of EI claims and number of claims per worker were higher for firms offering SUB plans. However, EI claimants from firms offering SUB plans had shorter duration of EI benefits and lower EI exhaustion rates.

One of the main rationales behind a firm offering a SUB plan to their employees is to maintain the employee-employer relationship and facilitate employee retention. When comparing regular benefit claimants who previously worked in firms offering SUB plans, those who received SUB top-ups were more likely to return to the same firm after a claim compare to those who did not receive top-ups.***

- * Employers who provide supplemental payments to maternity, parental (including adoption) or caregiving benefits (including compassionate care, family caregiver benefit for children and family caregiver benefit for adults) do not have to register their plans with Service Canada. Those plans were not included in the study.

- ** ESDC, Supplemental Unemployment Benefit Plans (Ottawa: ESDC, Evaluation Directorate, 2021).

- *** The study found that among all EI claimants within SUB firms, only 13% received a top-up payment over the period examined. This suggests that not all employees in a given firm are entitled to SUB payments.

Family supplement provision

The Family supplement provision, which targets low-income families, provides additional benefits to EI claimants with children under the age of 18 who have an annual family net income equal to or less than $25,921. The claimant must also receive the Canada Child Benefit. Under the Family supplement provision, which is available to claims in all benefit types, the weekly amount of family supplement can increase a claimant’s benefit rate from 55% to a maximum of 80% of his or her weekly insurable earnings, subject to the maximum weekly benefit. The supplement provided to eligible claimants is determined by the claimant’s family net income, the number of children in the claimant’s family, and the age of the claimant’s children.Footnote 5

In FY1920, low-income families received a total of $70.1 million in additional benefits through the Family Supplement provision. A total of 65,910 claims received the family supplement in FY1920, a decrease of 9.6% from FY1819. The number of EI claims receiving the family supplement has now decreased for 18 consecutive years from a high of 187,300 claims in FY0102. This decrease can be explained by the fact that the eligibility threshold has not been indexed over time, as well as by changes in family composition and wage growth. Women (80.8%) and claimants aged 25 to 44 (73.5%) continue to be the main demographic groups benefitting from the Family Supplement provision. The average weekly family supplement was $45 in FY1920 and has remained relatively unchanged over the years (consult annex 2.23 for more statistics on the Family Supplement provision).

2.1.2 Combined Employment Insurance claims

Under certain provisions of the EI program, a claimant may receive multiple types of benefits as part of a single claim, assuming that the claimant meets each benefit type’s eligibility requirements.Footnote 6 A “pure” claim is one in which an EI claimant receives a single benefit type, while a “combined” claim is one in which the claimant receives more than 1 benefit type. Pure claims represented 80.3% of all completed claims in FY1920 (consult table 4).

| Benefit type* | Number of total claims ('000s) | Number of pure claims ('000s) | Share of pure claims (%) | Number of combined claims ('000s) | Share (%) | Benefit type most often combined with (share of combined claims) |

|---|---|---|---|---|---|---|

| Regular | 1,312.4 | 1,133.4 | 86.4% | 179.0 | 13.6% | Sickness (93.0%) |

| Fishing | 27.8 | 24.0 | 86.3% | 3.8 | 13.7% | Sickness (87.9%) |

| Work-Sharing | 3.9 | 2.9 | 76.1% | 0.9 | 23.9% | Regular (70.7%) |

| Maternity | 166.4 | 2.0 | 1.2% | 164.4 | 98.8% | Parental (98.4%) |

| Parental** | 208.0 | 40.9 | 19.6% | 167.2 | 80.4% | Maternity (96.8%) |

| Sickness | 422.6 | 222.9 | 52.7% | 199.7 | 47.3% | Regular (83.8%) |

| Compassionate care | 7.3 | 4.2 | 57.4% | 3.1 | 42.6% | Sickness (67.3%) |

| All claims*** | 1,780.6 | 1,430.2 | 80.3% | 350.4 | 19.7% | n/a |

- Note: Data may not add up to the total due to rounding. Includes claims for which at least $1 of EI benefits was paid. The sum of claims by benefit type for the “Total claims” and “Combined claims” columns does not add up to the total because more than 1 benefit type can be part of the same claim. This does not apply to pure claims that include only 1 benefit type

- * Excludes Family Caregiver Benefits for children and adults.

- ** Parental benefits include benefits for biological parents and adoptive parents.

- *** The total number of claims is based on claims completed during the fiscal year. This explains why the total number of claims here is different from the total numbers of claims in tables 2 and 3 which are based on established claims.

- Source: Employment and Social Development Canada, Employment Insurance (EI) administrative data. Data are based on a 10% sample of EI administrative data.

Women were more likely to claim more than 1 type of EI benefit (29.8%) than men (11.0%) mostly due to their high probability of claiming both maternity and parental benefits.

In fact, maternity benefits were the benefits most often combined with other types of benefits, usually parental benefits. However, a significant proportion also claimed sickness benefits with maternity benefits (16.9%), resulting in the claimant starting her leave before becoming eligible for maternity benefits (available 12 weeks prior to the child’s expected date of birth).Footnote 7 The combination of maternity, parental and sickness benefits was the most common among claims with 3 or more benefit types (26,400 claims representing 15.9% of completed claims for maternity benefits in FY1920).

Claims for parental benefits were combined at a slightly lower rate than maternity, as only 10.6% of men who claimed parental also received another benefit payment. Of those male claimants, 87.0% received regular benefits and 15.2% claimed sickness benefits. Among women, virtually all (99.5%) who combined parental benefits with other types of benefits combined them with maternity benefits.

Sickness benefits were the third most likely to be combined with other benefit types, mostly with regular benefits. Men combined their sickness benefits predominantly with regular benefits (96.2%), while sickness claims from women were most often combined with regular (71.0%), maternity (27.4%) and parental benefits (26.1%). Sickness also represented the greatest share of combined regular claims.

When combined, compassionate care benefits are most often shared with sickness benefits (67.3%) or regular benefits (46.8%). Men tended to combine compassionate care benefits with regular benefits (62.6%) more often than women (40.3%). Women were most likely to combine compassionate care benefits with sickness benefits (72.9%) compared to men (53.8%).

Almost a quarter of all work-sharing claims were combined with other benefit types (23.9%), predominantly regular benefits. This is attributable to the fact that both benefit types are typically used during a downturn in business activity, which increases the risk of layoffs (work-sharing benefits) and actual layoffs (regular benefits). Regular benefits are usually claimed following work-sharing benefits, reflecting a continued downturn in a participating firm’s activity that eventually leads to a downsizing of the firm’s labour force.

While fishers do have the possibility of sharing fishing benefits with other benefit types (under some restrictions), only 13.7% of fishing claims were combined claims. Of those claims, 87.9% were combined with sickness benefits. No fishing claims were shared with maternity, parental, compassionate care or Work-Sharing benefits during the reporting period.

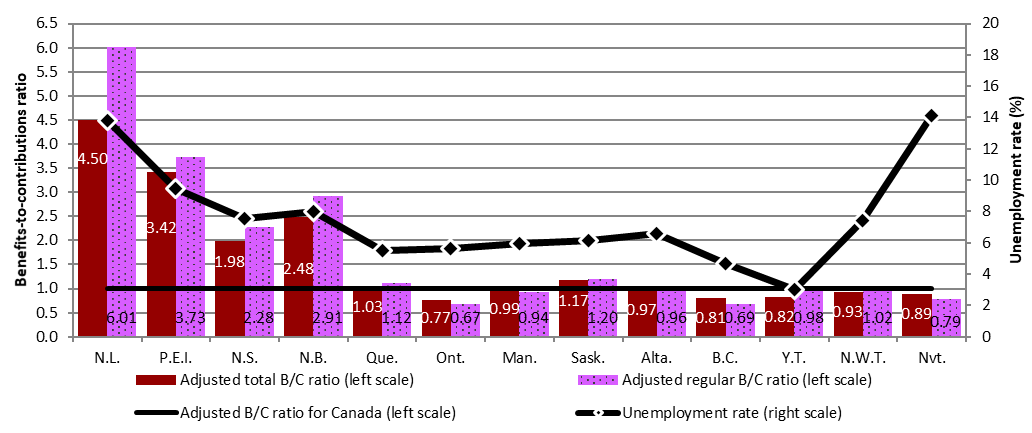

2.1.3 Benefits-to-contributions ratios

The benefits-to-contributions ratio (B/C ratio) is a measure of EI benefits paid by the program as a share of the contributions paid. It provides an estimate of the use of the EI program by claimants compared to the premiums paid. This section examines 2 different ratios: the total benefits-contributions ratio (total B/C ratio) and the regular benefits-contributions ratio (regular B/C ratio) for 2018.Footnote 8 As EI contributions are not assigned to a specific benefit type, the regular B/C ratio accounts for reductions in EI contributions related to special benefits.Footnote 9

This subsection presents adjusted ratios that are normalized, with Canada’s ratio set at 1.0. This provides a benchmark for examining the ratios based on certain sociodemographic characteristics. An adjusted ratio higher than 1.0 means that the underlying sub-population (such as province, territory, or industry) is a net beneficiary of the EI program, while those with an adjusted ratio lower than 1.0 are net contributors to the program relative to Canada as a whole.

ProvincesFootnote 10 with high numbers of seasonal claimants generally exhibit adjusted total B/C ratios that are above the national average. In 2018, Newfoundland and Labrador, Prince Edward Island, Nova Scotia and New Brunswick received more in EI benefits than they contributed, when compared to the national average (consult chart 3), highlighting these provinces’ greater usage of regular benefits compared to other regions. On the other hand, Ontario, Manitoba and British Columbia received fewer EI benefits and regular benefits per dollar contributed in premiums than the national average.

Text description of Chart 3

| Region | Adjusted total benefits-to-contributions ratio (left scale) | Adjusted regular benefits-to-contributions ratio (left scale) | Adjusted total benefits-to-contributions ratio for Canada (1.0) (left scale) | Unemployment rate (right scale) |

|---|---|---|---|---|

| Newfoundland and Labrador | 4.50 | 6.01 | 1.0 | 13.8 |

| Prince Edward Island | 3.42 | 3.73 | 1.0 | 9.5 |

| Nova Scotia | 1.98 | 2.28 | 1.0 | 7.6 |

| New Brunswick | 2.48 | 2.91 | 1.0 | 8.0 |

| Quebec | 1.03 | 1.12 | 1.0 | 5.5 |

| Ontario | 0.77 | 0.67 | 1.0 | 5.6 |

| Manitoba | 0.99 | 0.94 | 1.0 | 6.0 |

| Saskatchewan | 1.17 | 1.20 | 1.0 | 6.2 |

| Alberta | 0.97 | 0.96 | 1.0 | 6.6 |

| British Columbia | 0.81 | 0.69 | 1.0 | 4.7 |

| Yukon | 0.82 | 0.98 | 1.0 | 3.0 |

| Northwest Territories | 0.93 | 1.02 | 1.0 | 7.4 |

| Nunavut | 0.89 | 0.79 | 1.0 | 14.1 |

- Sources: Canada Revenue Agency (CRA), T4 slips with employment income (for data on contributions); Employment and Social Development Canada (ESDC), Employment Insurance (EI) administrative data (for data on benefits); and Statistics Canada, Labour Force Survey, Tables 14-10-0287-01 and 14-10-0292-01 (for data on unemployment rates). CRA data are based on a 10% sample of T4 slips with employment income, and ESDC data are based on a 10% sample of EI administrative data.

In 2018, women continued to receive more in EI benefits than they contributed in premiums compared to male claimants, with adjusted total B/C ratios of 1.10 and 0.92 respectively (consult table 5). Women aged 25 to 44 in particular receive more in benefits than they contribute with an adjusted total B/C ratio of 1.52, compared to women aged 45 to 54 with the lowest ratio (0.66) among women. This is likely due to the fact that women aged 25 to 44 claim maternity and/or parental benefits – their adjusted regular B/C ratio is much lower at 0.66.

| Age category | Adjusted total B/C ratio for men | Adjusted total B/C ratio for women | Adjusted total B/C ratio | Adjusted regular B/C ratio for men | Adjusted regular B/C ratio for women | Adjusted regular B/C ratio |

|---|---|---|---|---|---|---|

| 24 years old and under | 1.05 | 0.85 | 0.96 | 1.29 | 0.50 | 0.94 |

| 25 to 44 years old | 0.84 | 1.52 | 1.14 | 1.08 | 0.66 | 0.89 |

| 45 to 54 years old | 0.82 | 0.66 | 0.74 | 1.10 | 0.81 | 0.97 |

| 55 years old and over | 1.13 | 0.79 | 0.98 | 1.54 | 1.02 | 1.31 |

| Total | 0.92 | 1.10 | 1.00 | 1.20 | 0.76 | 1.00 |

- Sources: Canada Revenue Agency (CRA), T4 slips with employment income (for data on contributions); Employment and Social Development Canada (ESDC), Employment Insurance (EI) administrative data (for data on benefits). CRA data are based on a 10% sample of T4 slips with employment income, and ESDC data are based on a 10% sample of EI administrative data.

With respect to regular B/C ratios, the gender gap is reversed: men (ratio of 1.20) received more EI regular benefits than they contributed compared to women (ratio of 0.76). This is true for all age groups.

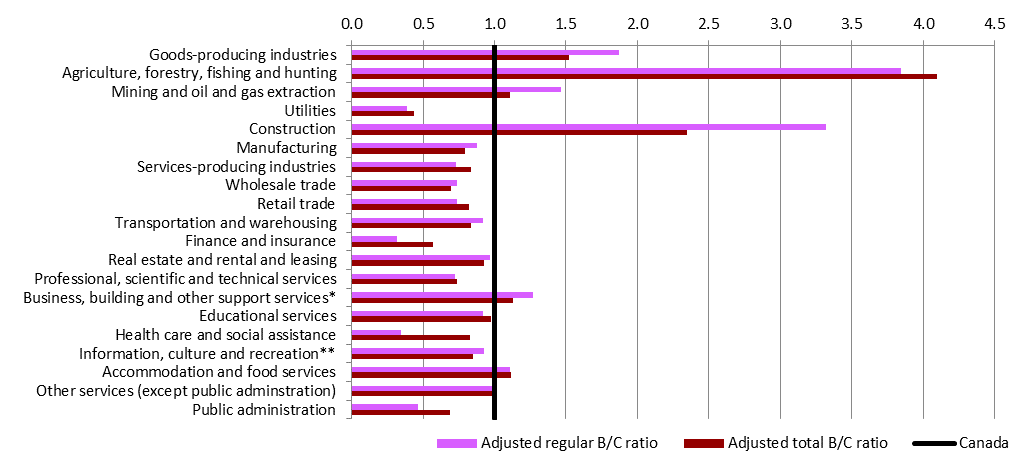

In 2018 claimants working in goods-producing industries were net beneficiaries of EI benefits with adjusted B/C ratios above the national average, while those in service-producing industries were, overall, net contributors (consult chart 4). The greater use of EI regular benefits by workers in goods-producing industries compared to those in service-producing industries may be related to the higher proportion of seasonal employment in these industries, particularly the construction and the agriculture, forestry, fishing and hunting industries. The difference between the adjusted B/C ratios of goods-producing industries compared to those of service-producing industries is smaller for the total B/C ratio. This may be explained in part by the fact that certain industries, such as the health care and social assistance industry and the educational services industry, have a large proportion of female workers who can claim maternity or parental benefits.

Text description of Chart 4

| Industry | Adjusted total benefits-to-contributions ratio | Adjusted regular benefits-to-contributions ratio |

|---|---|---|

| Goods-producing industries | 1.52 | 1.87 |

| Agriculture, forestry, fishing and hunting | 4.10 | 3.84 |

| Mining and oil and gas extraction | 1.11 | 1.47 |

| Utilities | 0.44 | 0.39 |

| Construction | 2.34 | 3.32 |

| Manufacturing | 0.80 | 0.88 |

| Services-producing industries | 0.84 | 0.73 |

| Wholesale trade | 0.70 | 0.74 |

| Retail trade | 0.82 | 0.74 |

| Transportation and warehousing | 0.84 | 0.92 |

| Finance and insurance | 0.57 | 0.32 |

| Real estate and rental and leasing | 0.93 | 0.97 |

| Professional, scientific and technical services | 0.74 | 0.72 |

| Business, building and other support services* | 1.13 | 1.27 |

| Educational services | 0.98 | 0.92 |

| Health care and social assistance | 0.83 | 0.35 |

| Information, culture and recreation** | 0.85 | 0.92 |

| Accommodation and food services | 1.12 | 1.11 |

| Other services (except public administration) | 0.99 | 0.99 |

| Public administration | 0.69 | 0.46 |

| Canada | 1.00 | 1.00 |

- * Includes management of companies and enterprises and administrative support, waste management and remediation services.

- ** Includes information and cultural industries and arts, entertainment and recreation services. Sources: Canada Revenue Agency (CRA), T4 slips with employment income (for data on contributions); Employment and Social Development Canada (ESDC), Employment Insurance (EI) administrative data (for data on benefits). CRA data are based on a 10% sample of T4 slips with employment income, and ESDC data are based on a 10% sample of EI administrative data.

Implicit income redistribution and the Employment Insurance program

Due to differences in income support provided by the EI program across socio-economic sub-populations, the program can act as an implicit income redistribution mechanism in Canada, providing greater income support (relative to contributions) to individuals in the lower part of the income distribution as compared to those with greater earnings. A 2012 evaluation study* showed that the benefit and contribution aspects of the program tend to be redistributive and that the impact of the program on the redistribution of earnings increased substantially during the late 2000s recession.

Moreover, a study on the financial impact of receiving EI benefits** concluded that the EI program has a considerable positive income redistribution effect, with lower income families having a higher adjusted total benefits-to-contributions ratio than higher income families. In fact, families with after-tax incomes below the median received 34% of total EI benefits and paid 18% of all premiums, representing an adjusted total benefits-to-contributions ratio of close to 2.0.

- *Ross Finnie and Ian Irvine, The Redistributional Impact of Employment Insurance 2007 to 2009 (Ottawa: HRSDC, Evaluation Directorate, 2013).

- **Constantine Kapsalis, Financial Impacts of Receiving Employment Insurance (Ottawa: Data Probe Economic Consulting Inc., 2010).

2.2 Employment Insurance regular benefits

In this section

- 2.2.1 Employment Insurance regular claims and benefits paid

- 2.2.2 Coverage, eligibility and access to Employment Insurance regular benefits for the unemployed population

- 2.2.3 Level of Employment Insurance regular benefits

- 2.2.4 Employment Insurance regular benefit entitlement

- 2.2.5 Employment Insurance regular benefits and seasonal claimants

- 2.2.6 Exhaustion of Employment Insurance regular benefits

- 2.2.7 Working while on claim

Employment Insurance (EI) regular benefits are designed to provide temporary income support to partially replace lost employment income for eligible claimants while they search for work or upgrade their skills.

In response to the economic and labour market disruptions due to the COVID-19 pandemic that started in March 2020, the Government of Canada introduced the Canada Emergency Response Benefit (CERB) on March 15, 2020 to provide income support for Canadians as part of Canada’s COVID-19 Economic Response Plan. The Canada Emergency Response Benefit (CERB) provided financial support to eligible employed and self-employed Canadians who stopped working and lost their income due to COVID-19. As a result, eligible claimants who would have otherwise applied for EI regular or sickness benefits applied for CERB as of March 15, 2020 instead. Consequently, the section on EI regular benefits in this year’s report excludes data related to CERB during the FY1920 reporting period (from March 15, 2020 to March 31, 2020). This ensures continuity in the reported data on EI regular benefits from year to year and enables to perform meaningful yearly comparisons in FY1920 with previous fiscal years. Eligible claimants who had applied for EI benefits and whose application had not been processed as of March 15, 2020 did not have to reapply for CERB and are included in the EI data estimates provided in this section. Furthermore, the results on amount of benefits paid out cover the full period from April 1, 2019 to March 31, 2020.

In order to qualify for EI regular benefits, unemployed individuals have to meet the following 3 eligibility criteria:

- the claimant must have had insurable employment and paid EI premiums during the qualifying period (defined as either the previous 52 weeks or since the establishment of their last claim, whichever is shorter)

- have a valid reason for job separation according to the Employment Insurance Act

- have worked a minimum number of insurable hours (ranging from 420 and 700 hours, depending on the regional unemployment rate where the claimant lived at the time of the claim) during the qualifying period

In addition to meeting these 3 eligibility criteria, claimants must also be available for and actively seeking suitable employment while claiming benefits.Footnote 11

2.2.1 Employment Insurance regular claims and benefits paid

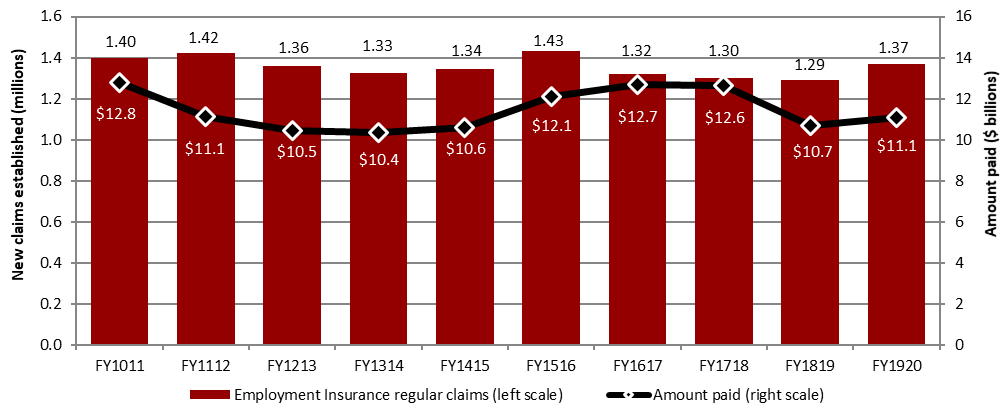

The number of EI regular claims established increased by 5.8% in the reporting fiscal year, increasing from 1.29 million claims established in FY1819 to 1.37 million claims established in FY1920. This marks an increase in the number of EI regular claims established after decreasing for the past 3 consecutive years (consult chart 5). The increase in the total number of EI regular claims established in FY1920 was mostly attributable to increases in Ontario (+30,300 claims), Quebec (+16,000 claims), British Columbia (+14,900 claims) and Alberta (+13,500 claim).

The total amount of EI regular benefits paid increased by 3.7% in the reporting fiscal year, increasing from $10.7 billion in FY1819 to $11.1 billion in FY1920. This marks an increase in the total amount paid in EI regular benefits after decreasing for the past 2 consecutive years (consult chart 5). The increase in the total amount of EI regular benefits paid in FY1920 is partly attributable to the pilot project that provided additional weeks of EI regular benefits to seasonal claimants in 13 EI economic regionsFootnote 12.

Text description of Chart 5

| Fiscal year | FY1011 | FY1112 | FY1213 | FY1314 | FY1415 | FY1516 | FY1617 | FY1718 | FY1819 | FY1920 |

|---|---|---|---|---|---|---|---|---|---|---|

| Regular claims (millions) (left scale) | 1.40 | 1.42 | 1.36 | 1.33 | 1.34 | 1.43 | 1.32 | 1.30 | 1.29 | 1.37 |

| Amount paid ($ billions) (right scale) | $12.8 | $11.1 | $10.5 | $10.4 | $10.6 | $12.1 | $12.7 | $12.6 | $10.7 | $11.1 |

- Note: Includes claims for which at least $1 of EI regular benefits was paid.

- Source: Employment and Social Development Canada, Employment Insurance (EI) administrative data. Data are based on a 10% sample of EI administrative data.

The number of new claims established tends to be influenced by labour market conditions and overall economic cycles, as well as initiatives (such as EI pilot projects). During periods of economic growth and robust labour market conditions, fewer claims for EI regular benefits are established, while the opposite is true during periods of economic stagnation and unfavourable labour market conditions. This is evident in chart 5—over the last decade, the number of new claims established was the highest at 1.43 million in FY1516 following the economic slowdown due to the downturn in commodity prices. Similar increases in the number of new EI regular claims were observed following the recession in FY0809. As discussed in Chapter I, the Canadian economy experienced a slowdown in growth in FY1920 as GDP increased by 1.4% compared to the previous year. Meanwhile, for the period of April 1, 2019 to February 29, 2020,Footnote 13 the labour force increased by 1.9% and the unemployment rate declined by 0.2 percentage points from the previous fiscal year. Despite the overall favourable economic and labour market conditions observed for most of the fiscal year in FY1920, the increase in the number of EI regular claims was mostly in the last quarter of the year, attributable to the rising unemployment rates in February 2020.Footnote 14 In addition, a particularly high number of EI regular claims were also established in the first 2 weeks of March 2020 (that is, the period in March 2020 for which data on EI regular benefits is included in this report), likely reflecting the effect of the COVID-19 pandemic before CERB came into effect on March 15, 2020.Footnote 15

On average, there were 459,900 beneficiaries receiving EI regular benefits each month in FY1920, up from 453,400 (+1.4%) in the previous fiscal year.Footnote 16 Because the number of beneficiaries is based on previously established claims, these 2 measures generally trend in the same direction, with the count of beneficiaries usually lagging behind the number of new claims established. To illustrate this, suppose there is an increase in the number of claims established for EI regular benefits after an economic shock. The number of beneficiaries will increase following the increase in claims. However, the count of beneficiaries can still remain elevated even after the volume of new claims have subsided once the labour market conditions improve, as payments continue to be made on previously established claims until benefits are exhausted or the claimants have found employment. In FY1920, the number of beneficiaries of EI regular benefits decreased from the previous year, despite the increase in the number of EI regular claims established during this period. The effect of the increase in the number of claims established will likely be reflected on the number of beneficiaries in the next reporting period.

Characteristics of EI regular benefits claimants with separation monies

Following a job separation, by no fault of the employees, workers are entitled to separation monies that are paid to compensate for a variety of reasons; including the loss of wages, other benefits related to employment, unused entitlement to certain benefits under the terms of employment and as a form of recognition for years of service. The addition of separation monies earned from a temporary or permanent layoff has an effect on the utilization of the EI program because the majority of these payments are considered earnings from employment. In some cases, individuals do not receive EI because the allocation of their separation monies do not allow for an interruption in earnings to occur. In other cases, individuals do not apply for EI knowing that they will end up not receiving benefits.

A recent departmental study* looked into the characteristics of claimants for EI regular benefits who received severance/vacation monies** between 2009 and 2018. The study found a general downward trend in the incidence of EI regular benefits claimants receiving severance/vacation monies during this period. This downward trend was observed in all provinces and territories, in all age groups and genders, in claimants from all industries and among all claimant types.

Among claimants, those in Atlantic Canada were much less likely to receive severance/vacation payments than those in the rest of the country. This is mainly because claimants in Atlantic Canada are much more likely to be seasonal claimants (on a temporary layoff) and the fact that temporary layoffs generally do not require payment of monies on separation. Other factors contributing to the variation across jurisdictions are differences in provincial/territorial employment legislation and differences in the composition of industries, such that the maximum severance pay in Western provinces is twice the maximum severance pay in Atlantic provinces. Claimants in the Atlantic provinces also had more variation among themselves in terms of age and gender in the likelihood of receiving severance/vacation monies. These claimants, along with those in Quebec, received relatively lower amounts of severance/vacation monies compared to their counterparts in Ontario and Western Canada, likely due to the higher average wages in the latter regions. Women were more likely to receive severance/vacation monies than men, although on average they received comparatively lower amounts, corresponding to the lower average employment income earned by them. Variations in the likelihood of receiving severance/vacation monies were also found across industries of previous work—over 50% of claimants who had worked in the Information and cultural industries or in the Finance and insurance industry received separation/vacation monies, whereas less than 15% of claimants who had worked in the Agriculture, forestry, fishing and hunting industry or in the Construction industry received these monies. In addition, claimants who received separation/vacation monies were more likely to be long-tenured workers or occasional claimants***, have longer entitlements for EI regular benefits and comparatively higher exhaustion rates.

- * ESDC, Characteristics and Trends of EI Regular Benefits Claimants and Claims With Separation Monies (Ottawa: ESDC, Employment Insurance Policy Directorate, 2021).

- ** The study focused on these two types of separation monies as they accounted for around 72% of all separation monies received by EI regular benefit claimants during the period considered.

- *** See Annex 2.1 for the definitions of EI claimant categories.

Employment Insurance regular claims and amount paid by province or territory, gender and age

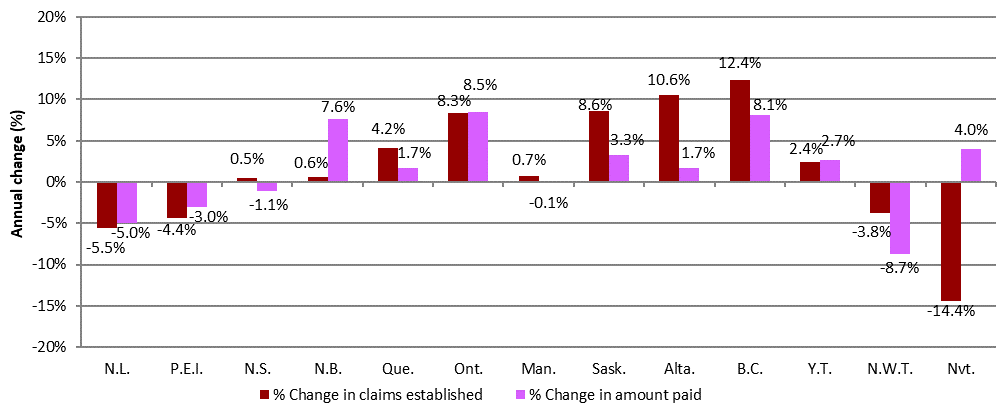

As illustrated in chart 6, the number of claims established for EI regular benefits increased in all provinces except for Newfoundland and Labrador (-5.5%) and Prince Edward Island (-4.4%) in FY1920 compared to the previous year. The number of EI regular claims established increased slightly in Yukon (+2.4%), while it decreased in the other 2 territories during this period. Among provinces and territories, the most significant relative changes in the number of EI regular claims in FY1920 were observed in Nunavut (-14.4%) and British Columbia (+12.4%).

The total amount paid in EI regular benefits increased in all provinces with the exception of Newfoundland and Labrador (-5.0%), Prince Edward Island (-3.0%) and Nova Scotia (-1.1%), and stayed relatively unchanged in Manitoba (-0.1%). Yukon and Nunavut both saw an increase in the total amount paid in EI regular benefits (+2.7% and 4.0%, respectively), while it decreased in the Northwest Territories (-8.7%) (consult chart 6). Similarly to previous years, Ontario and Quebec continued to account for more than half (58.1%) of total EI regular claims established, and just over half (50.9%) of the total amount paid in EI regular benefits in the reporting period.

Text description of Chart 6

| Province/territory | % Change claims established | % Change amount paid |

|---|---|---|

| Newfoundland and Labrador | -5.5% | -5.0% |

| Prince Edward Island | -4.4% | -3.0% |

| Nova Scotia | 0.5% | -1.1% |

| New Brunswick | 0.6% | 7.6% |

| Quebec | 4.2% | 1.7% |

| Ontario | 8.3% | 8.5% |

| Manitoba | 0.7% | -0.1% |

| Saskatchewan | 8.6% | 3.3% |

| Alberta | 10.6% | 1.7% |

| British Columbia | 12.4% | 8.1% |

| Yukon | 2.4% | 2.7% |

| Northwestern Territories | -3.8% | -8.7% |

| Nunavut | -14.4% | 4.0% |

- Note: Includes claims for which at least $1 of EI regular benefits was paid.

- Source: Employment and Social Development Canada, Employment Insurance (EI) administrative data. Data are based on a 10% sample of EI administrative data.

Table 6 outlines the number of EI regular claims established and the total amount paid by gender and age groups in FY1920 and the previous year (FY1819). The number of new claims established by both men and women increased during this period. Similar to previous years, men accounted for around 3 in every 5 (60.8%) EI regular claims in the reporting period. The total amount paid in EI regular benefits to men and women had similar relative increases in FY1920 from the previous year (+3.9% and +3.2%, respectively). In FY1920, men accounted for the nearly two-thirds (66.4%) of the total amount paid in EI regular benefits. This share has remained relatively stable in recent years as well.

Both the number of new EI regular claims established and the total amount paid increased in FY1920 compared to the previous year across all age groups. Younger claimants (aged below 25 years) had the highest increase (+8.0%) in the number of EI regular claims during this period. In terms of total amount paid in EI regular benefits, older claimants (aged over 54 years) had the highest increase (+6.0%) in FY1920 from FY1819. Similar to the previous years, claimants who were aged between 25 and 44 years continued to account for the largest shares of new regular claims (44.1%) and total amount paid (43.2%) in FY1920, while the smallest shares were for younger claimants aged less than 25 years (9.0% of claims and 8.5% of amount paid, respectively).

| Category | Number of claims FY1819 |

Number of claims FY1920 |

Number of claims Change (%) |

Amount paid ($ million) FY1819 |

Amount paid ($ million) FY1920 |

Amount paid Change (%) |

|---|---|---|---|---|---|---|

| Men | 791,220 | 830,770 | +5.0% | $7,072.5 | 7,348.8 | +3.9% |

| Women | 501,490 | 536,310 | +6.9% | $3,601.3 | 3,715.6 | +3.2% |

| 24 years old and under | 113,780 | 122,860 | +8.0% | $922.7 | 939.3 | +1.8% |

| 25 to 44 years old | 568,800 | 603,290 | +6.1% | $4,585.2 | 4,783.1 | +4.3% |

| 45 to 54 years old | 278,900 | 286,640 | +2.8% | $2,335.9 | 2,342.4 | +0.3% |

| 55 years old and over | 331,230 | 354,290 | +7.0% | $2,830.0 | 2,999.6 | +6.0% |

| Canada | 1,292,710 | 1,367,080 | +5.8% | $10,673.8 | 11,064.4 | +3.7% |

- Note: Data may not add up to the total due to rounding. Percentage change is based on unrounded numbers. Includes claims for which at least $1 of EI regular benefits was paid.

- Source: Employment and Social Development Canada, Employment Insurance (EI) administrative data. Data are based on a 10% sample of EI administrative data.

One notable trend that has been observed over the past few years is that, while the shares of new claims established by different age groups has been relatively stable, the share of new claims established by older claimants aged 55 years and over has increased slowly but steadily over the past several years. The trends observed for older claimants are likely attributable in part to Canada’s aging population and the labour force composition. Individuals in this age category accounted for 21.6% of the labour force in FY1920, up from 16.1% in FY0910, representing a 5.5 percentage points increase in the past decade.

Employment Insurance regular claims and amount paid by industry

As outlined in table 7, the number of new EI regular claims established in FY1920 increased in both goods-producing and services-producing industries from the previous year. The increase in the number of EI regular claims in the reporting year established by claimants who worked in the services-producing industries (+4.8%) was higher than the increase in those established by claimants who worked in the goods-producing industries (+3.6%). Among the goods-producing industries, notable increases were in the Manufacturing industry (+17.5%) and the Utilities industry (+17.3%), while the number of claims decreased in the rest of the industries. Among the services-producing industries, the highest increase in the number of claims established was observed in the Accommodation and food services industry (+14.0%), followed by the Retail trade industry (+9.8%). Notably, there was a significant increase in the number of claims (+83.2%) in the Unclassified industries category in FY1920 from the previous year. This was due to the missing information in the EI claims that is required to classify them. This indicates that the increases in the number of EI regular claims in some industries in FY1920 would have been even higher if these unclassified claims had been categorized. The distribution of claims in the goods and services-producing industries remained relatively unchanged in FY1920 from the previous year.

| Industry | Number of claims and % share of all claims FY1819 |

Number of claims and % share of all claims FY1920 |

Number of claims Change (%) |

Amount paid ($ million) and % share of total amount paid FY1819 |

Amount paid ($ million) and % share of total amount paid FY1920 |

Amount paid ($ million) Change (%) |

|---|---|---|---|---|---|---|

| Goods-producing industries | 505,200 (39.1%) |

523,350 (38.3%) |

+3.6% | $4,473.4 (41.9%) |

$4,590.7 (41.5%) | +2.6% |

| Agriculture, forestry, fishing and hunting | 52,440 (4.1%) |

51,240 (3.7%) |

-2.3% | $496.8 (4.7%) |

$525.8 (4.8%) |

+5.8% |

| Mining and oil and gas extraction | 24,980 (1.9%) |

24,130 (1.8%) |

-3.4% | $274.2 (2.6%) |

$270.0 (2.4%) | -1.6% |

| Utilities | 4,150 (0.3%) |

4,870 (0.4%) |

+17.3% | $36.4 (0.3%) |

$42.2 (0.4%) | +15.9% |

| Construction | 292,720 (22.6%) |

289,330 (21.2%) |

-1.2% | $2,640.3 (24.7%) |

$2,592.1 (23.4%) | -1.8% |

| Manufacturing | 130,910 (10.1%) |

153,780 (11.2%) |

+17.5% | $1,025.7 (9.6%) |

$1,160.7 (10.5%) | +13.2% |

| Services-producing industries | 764,220 (59.1%) |

801,070 (58.6%) |

+4.8% | $5,995.6 (56.2%) |

$6,151.8 (55.6%) | +2.6% |

| Wholesale trade | 38,920 (3.0%) |

41,670 (3.0%) |

+7.1% | $402.6 (3.8%) |

$425.2 (3.8%) |

+5.6% |

| Retail trade | 69,330 (5.4%) |

76,100 (5.6%) |

+9.8% | $620.9 (5.8%) |

$610.1 (5.5%) | -1.7% |

| Transportation and warehousing | 62,640 (4.8%) |

64,460 (4.7%) |

+2.9% | $466.0 (4.4%) |

$499.1 (4.5%) |

+7.1% |

| Finance and insurance | 12,630 (1.0%) |

12,480 (0.9%) |

-1.2% | $155.0 (1.5%) |

$148.8 (1.3%) |

-4.0% |

| Real estate, rental and leasing | 18,270 (1.4%) |

18,800 (1.4%) |

+2.9% | $175.4 (1.6%) |

$174.8 (1.6%) |

-0.4% |

| Professional, scientific and technical services | 50,950 (3.9%) |

55,220 (4.0%) |

+8.4% | $479.4 (4.5%) |

$516.5 (4.7%) |

+7.7% |

| Business, building and other support services* | 88,130 (6.8%) |

85,720 (6.3%) |

-2.7% | $768.8 (7.2%) |

$768.0 (6.9%) |

-0.1% |

| Educational services | 163,030 (12.6%) |

170,300 (12.5%) |

+4.5% | $774.6 (7.3%) |

$823.5 (7.4%) |

+6.3% |

| Health care and social assistance | 45,870 (3.5%) |

50,050 (3.7%) |

+9.1% | $349.6 (3.3%) |

$359.2 (3.2%) |

+2.8% |

| Information, culture and recreation** | 40,250 (3.1%) |

39,900 (2.9%) |

-0.9% | $324.7 (3.0%) |

$317.1 (2.9%) |

-2.3% |

| Accommodation and food services | 63,280 (4.9%) |

72,130 (5.3%) |

+14.0% | $487.2 (4.6%) |

$489.4 (4.4%) | +0.5% |

| Other services (excluding Public administration) | 42,010 (3.2%) |

45,450 (3.3%) |

+8.2% | $371.7 (3.5%) |

$376.7 (3.4%) |

+1.4% |

| Public administration | 68,910 (5.3%) |

68,790 (5.0%) |

-0.2% | $619.7 (5.8%) |

$643.4 (5.8%) | +3.8% |

| Unclassified*** | 23,290 (1.8%) |

42,660 (3.1%) |

+83.2% | $204.8 (1.9%) |

$321.8 (2.9%) |

+57.1% |

| Canada | 1,292,710 (100.0%) |

1,367,080 (100.0%) |

+5.8% | $10,673.8 (100.0%) |

$11,064.4 (100.0%) | +3.7% |

- Note: Data may not add up to the total due to rounding. Percentage change is based on unrounded numbers. Includes claims for which at least $1 of EI regular benefits was paid.

- * This industry sector comprises the industries with codes 55 (Management of companies and enterprises) and 56 (Administration and support, waste management and remediation services).

- ** This industry sector comprises the industries with codes 51 (Information and cultural industries) and 71 (Arts, entertainment and recreation).

- *** For some claims, this information was not available in the data.

- Source: Employment and Social Development Canada, Employment Insurance (EI) administrative data. Data are based on a 10% sample of EI administrative data.

The total amount paid in EI regular benefits in the goods and services-producing industries saw similar increases (+2.6%) in FY1920 from the previous year. Among the goods-producing industries, the highest increase in the total amount paid in EI regular benefits during this period was observed in the Utilities industry (+15.9%), followed by the Manufacturing industry (+13.2%). Among the services-producing industries, the highest increase in the total amount paid was observed in the Professional, scientific and technical services industry (+7.7%), while the highest decrease was observed in the Finance and insurance industry (-4.0%).

Benefit repayments in the 2018 tax year*

EI benefit payments are taxable income, regardless of the type of benefits. In accordance with the Employment Insurance Act, claimants must repay a percentage of EI benefits they have received if their net income** in a given year exceeds 1.25 times the maximum yearly insurable earnings. In the 2018 taxation year, claimants whose net income exceeded $64,625*** were required to repay 30% of the lesser of:

- the net income in excess of $64,625

- the total regular benefits, including regular fishing benefits, paid in the taxation year

However, claimants who received special benefits or less than 1 week of either regular or fishing benefits in the preceding 10 taxation years were exempt from the benefit repayment requirement.

In the 2018 taxation year, around 187,000 EI claimants repaid a total of $278.6 million in EI benefits. On average, each EI claimant subject to the benefit repayment provision repaid $1,490 in 2018, while they received $6,147 in EI benefits in the same year. Compared to the previous taxation year, changes in both the number of claimants who repaid benefits (-2,300 or -1.2%) and the total amount repaid (-$7.0 million or -2.4%) were relatively moderate in 2018. In addition, changes in the average amount of benefit repaid (-$19 or -1.3%) and the average benefit received (-$225 or -3.5%) by these EI claimants were also relatively moderate in 2018 compared to the previous taxation year.

In 2018, more than 2 out of 3 (68.2%) claimants who repaid benefits lived in Quebec, Ontario and Alberta. Together, these claimants accounted for 58.5% of the total amount repaid in EI benefits. In comparison, Atlantic provinces represented 15.2% of the total number of claimants who repaid benefits, accounting for 24.7% of the total amount repaid.

Generally, men are over-represented among claimants who repay EI benefits. In 2018, 88.6% of claimants who repaid EI benefits were men. Similarly, men accounted for 90.2% of the total amount repaid in EI benefits in 2018. These proportions have remained relatively unchanged in recent years.

Benefit repayments also vary by industry. In 2018, around two-thirds (66.9%) of claimants who repaid benefits had worked in the goods-producing industries, unchanged from 2017. These claimants accounted for 66.5% of the total amount repaid. In comparison, services-producing industries accounted for 29.2% claimants who repaid benefits and 30.8% of total amount repaid. These proportions have remained stable since 2011.

- * The most recent taxation year for which data are available is 2018.

- ** Net income includes employment income and EI benefits received during the taxation year.

- *** The maximum insurable earnings in 2018 was $51,700.

Impacts of Employment Insurance regular benefits on job match quality

An important aspect of the EI program to consider, beyond immediate income support, is the relative impact of receiving EI regular benefits on the suitability of a job a claimant accepts following receipt of benefits. That is to examine the extend to which receiving EI regular benefits provides additional time for individuals to find a more suitable job than they otherwise would have in the absence of benefits.

A recent departmental study* looked at this question by examining the impact of receiving EI regular benefits on job match quality for claimants with low labour market attachment.** The study compared the job outcomes of those EI regular claimants to the job outcomes of laid-off workers who were ineligible for EI benefits due to insufficient insurable hours. Three post-unemployment outcomes were examined: post-earnings, incidence of employment, and job tenure.

When comparing the EI regular claimants with a comparable group of ineligible laid-off workers (using a statistical methodology) a positive but moderate impact of receiving EI benefits was found on all three job outcomes. Results showed that within the first five years after layoff, EI claimants tend to earn more on average (the difference in post-claim earnings peaking in the third year to an average of +$1,204). Additionally, the incidence of employment (+1 percentage point in the first year to +4 percentage points in the fifth year post-claim) and job tenure (on average, +4% over the first five years) were slightly higher for EI claimants.

The study also conducted a complementary and more statistically robust analysis to examine the marginal effects of providing two additional weeks of EI regular benefits to claimants with low labour market attachment on the same job suitability outcomes.*** It found a small positive impact on earnings in the second and third year (on average +$560 and +$528, respectively) following a claim. However, having access to two additional entitlement weeks did not have a significant impact on incidence of employment or job tenure in the first five years following a claim for those workers.

- *ESDC, Employment Insurance Benefits and Job Match Quality (Ottawa: ESDC, Evaluation Directorate, 2021).

- ** Having worked between 420 and 1050 insurable hours in the qualifying period.

- *** This analysis used the discontinuities in the Variable Entrance Requirement table. That is when EI claimants with a similar level of labour force attachment (hours of insurable employment) and residing in the same EI economic region have access to a different number of weeks of benefits because the monthly regional unemployment rate has slightly changed.

Employment Insurance regular benefits and firms

According to the tax dataFootnote 17 available from Canada Revenue Agency (CRA), there were around 1.23 million firms operating in Canada in 2018, up slightly (+1.5%) from the previous year. Of those, 295,400 firms (24.0%) employed at least 1 employee who had received EI regular benefits in that year.

As outlined in table 8, the proportion of firms which employed at least 1 employee receiving EI regular benefits increased with firm sizeFootnote 18, with smaller firms being less likely to be the last employer of a claimant. In 2018, 18.6% of small-sized firms had at least 1 former employee who received EI regular benefits, compared to 71.4% of small-to-medium sized firms, 94.1% of medium-to-large sized firms and 99.4% of large-sized firms.

However, when the number of claimants for EI regular benefits is compared with distribution of workforce by firm size, employees from smaller firms are found to be over-represented among EI regular claimants. As shown in table 8, smaller firms accounted for 21.3% of the total workforce while they represented 26.6% of the total EI regular benefit claimants in 2018. Similarly, employees in the small-to-medium sized firms were also over-represented among EI regular claimants, as they accounted for 19.7% of the total employees and 24.1% of the total EI regular claimants in 2018. This gap between the share of employment and the share of EI regular claimants narrows for the medium-to-large sized firms. For the large-sized firms, however, the opposite can be observed—these firms represented 42.9% of the total workforce in Canada in 2018 but accounted for only 31.8% of the total EI regular claimants. The higher proportion of usage of EI regular benefits among employees in the smaller-sized firms suggest that smaller firms are more vulnerable to difficult business or economic conditions than larger firms, and need to make broader adjustments to their workforces. This results in a larger share of their employees claiming EI regular benefits as a result of layoffs following a reduction in business activities. Moreover, this trend can also be influenced by industry-related characteristics such as the greater prevalence of seasonal jobs in small-sized firms that are generally more likely to rely on EI, relative to the national average in some industries.Footnote 19

| Firm size | All firms | Firms with at least 1 employee receiving EI regular benefits | Employment distribution** (% share) | EI claimant distribution*** (% share) |

|---|---|---|---|---|

| Small | 1,112,500 | 207,070 | 21.3% | 26.6% |

| Small-medium | 97,220 | 69,460 | 19.7% | 24.1% |

| Medium-large | 16,540 | 15,570 | 16.2% | 17.6% |

| Large | 3,310 | 3,290 | 42.9% | 31.8% |

| Canada | 1,229,580 | 295,380 | 100.0% | 100.0% |

- Note: Data may not add up due to rounding.

- * The categories of firm size reflect those found in Business Dynamics in Canada, a Statistics Canada publication. Small-sized firms are defined as those that employ 1 to 19 employees. Small-to-medium sized firms employ 20 to 99 employees. Medium-to-large sized firms employ 100 to 499 employees. Large-sized firms employ 500 employees or more.

- ** The number of workers in a firm is the number of individuals with employment income in that firm, as indicated on a T4 form. The number of workers is adjusted so that each individual in the labour force is only counted once and individuals who work for more than 1 firm are taken into account. For example, if an employee that earned $25,000 in firm 1 and $25,000 in firm 2, then he or she was recorded as 0.5 employees at the first firm and 0.5 employees at the second firm.

- *** These are based on the number of people receiving EI regular benefits in 2018.

- Source: Employment and Social Development Canada, Employment Insurance (EI) administrative data. Data are based on a 100% sample of EI administrative data. Canada Revenue Agency, CRA administrative data. CRA data are based on a 100% sample.

Employment Insurance regular claims and amount paid by EI claimant category

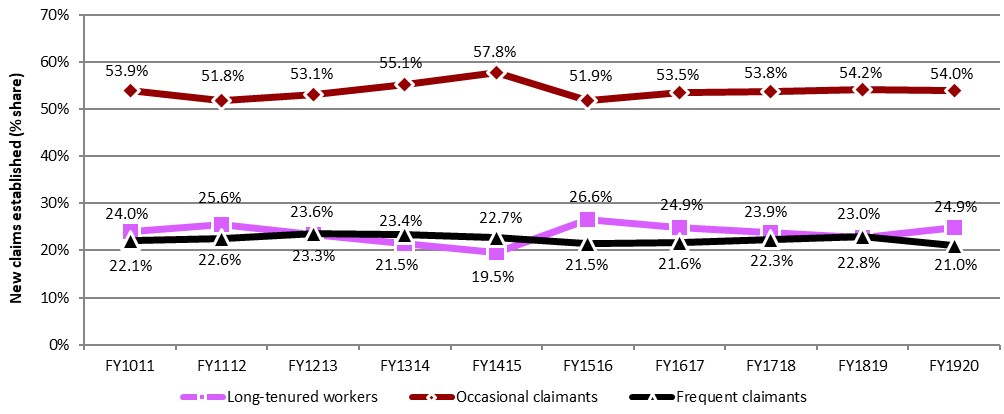

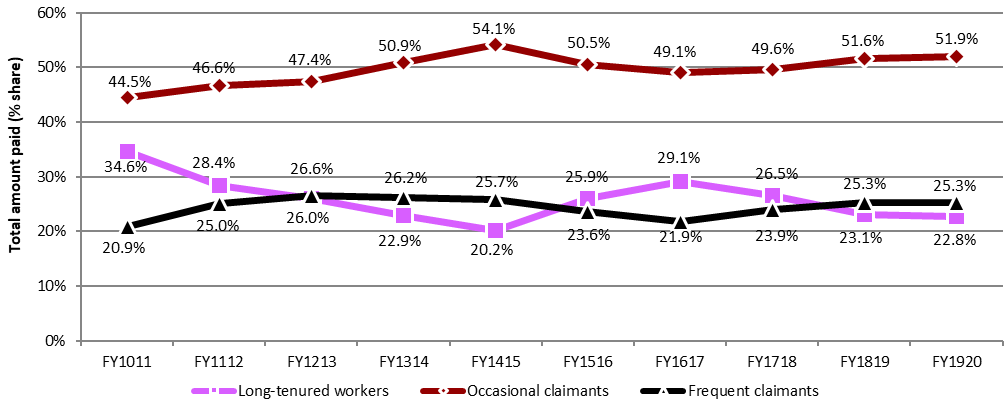

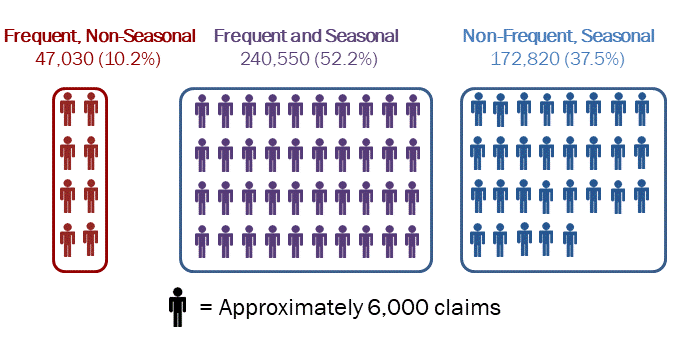

Table 9 outlines the number of claims established for EI regular benefits and amount paid by EI claimant category in the reporting fiscal year and the previous year.Footnote 20 In FY1920, the number of EI regular claims by long-tenured workers saw the highest relative increase (+15.6%) from FY1819, while the total amount paid to them had a moderate increase (+2.1%) during this period. The increase in the number of claims established by occasional claimants (+5.4%) was proportional to the increase in the total amount paid in EI regular benefits to them (+4.4%). However, the number of EI claims established by frequent claimants decreased by 3.3% in FY1920 from the previous year, but the total amount paid in EI regular benefits to them increased by 3.6% in this period. This is likely due to the pilot project introduced in August 2018 that provided additional weeks of EI regular benefits to eligible seasonal claimants in 13 EI economic regions, a large portion of whom can also be considered as frequent claimants.Footnote 21

In the reporting year, long-tenured workers and occasional claimants benefited proportionally less when their shares in the total number of claims and total amount paid are considered. Long-tenured workers accounted for 24.9% of all new regular claims established while they received 22.8% of the total amount paid. Occasional claimants accounted for 54.0% of all new regular claims established in FY1920 but received 51.9% of the total amount paid. Frequent claimants, on the other hand, benefited proportionally more, as they accounted for 21.0% of total new regular claims in FY1920 and received 25.3% of the total amount paid in EI regular benefits.

| Claimant category | Number of claims and % share of all EI regular claims FY1819 |

Number of claims and % share of all EI regular claims FY1920 |

Change (%) in number of claims | Amount paid ($ million) and % share of total amount paid for EI regular benefits FY1819 |

Amount paid ($ million) and % share of total amount paid for EI regular benefits FY1920 |

Change (%) in amount paid |

|---|---|---|---|---|---|---|

| Long-tenured workers | 294,820 (22.8%) |

340,900 (24.9%) |

+15.6% | $2,467.4 (23.1%) |

$2,518.1 (22.8%) |

+2.1% |

| Occasional claimants | 700,580 (54.2%) |

738,600 (54.0%) |

+5.4% | $5,505.2 (51.6%) |

$5,746.6 (51.9%) |

+4.4% |

| Frequent claimants | 297,310 (23.0%) |

287,580 (21.0%) |

-3.3% | $2,701.2 (25.3%) |

$2,799.7 (25.3%) |

+3.6% |

| Canada | 1,292,710 (100.0%) |

1,367,080 (100.0%) |

+5.8% | $10,673.8 (100.0%) |

$11,064.4 (100.0%) |

+3.7% |

- Note: Data may not add up to the total due to rounding. Percentage change is based on unrounded numbers. Includes claims for which at least $1 of EI regular benefits was paid.

- Source: Employment and Social Development Canada, Employment Insurance (EI) administrative data. Data are based on a 10% sample of EI administrative data.

Chart 7 and chart 8 illustrate the share of new EI regular claims established and the share of total amount paid by claimant categories in the past decade. During this period, the share of EI regular claims established by occasional claimants has ranged between 51.8% in FY1112 and 57.8% in FY1415. The share of claims established by long-tenured workers has experienced some variation in the last decade, while the share by frequent claimants has remained relatively unchanged.

Text description of Chart 7

| Claimant category | FY1011 | FY1112 | FY1213 | FY1314 | FY1415 | FY1516 | FY1617 | FY1718 | FY1819 | FY1920 |

|---|---|---|---|---|---|---|---|---|---|---|

| Long-tenured workers | 24.0% | 25.6% | 23.3% | 21.5% | 19.5% | 26.6% | 24.9% | 23.9% | 22.8% | 21.0% |

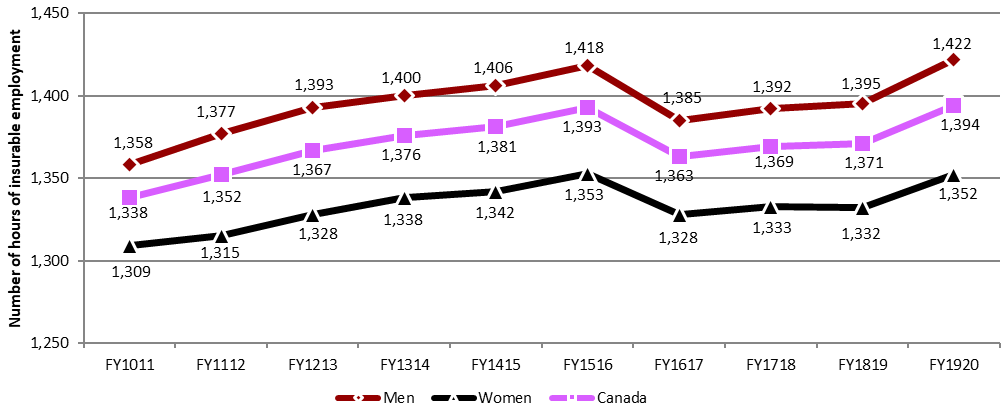

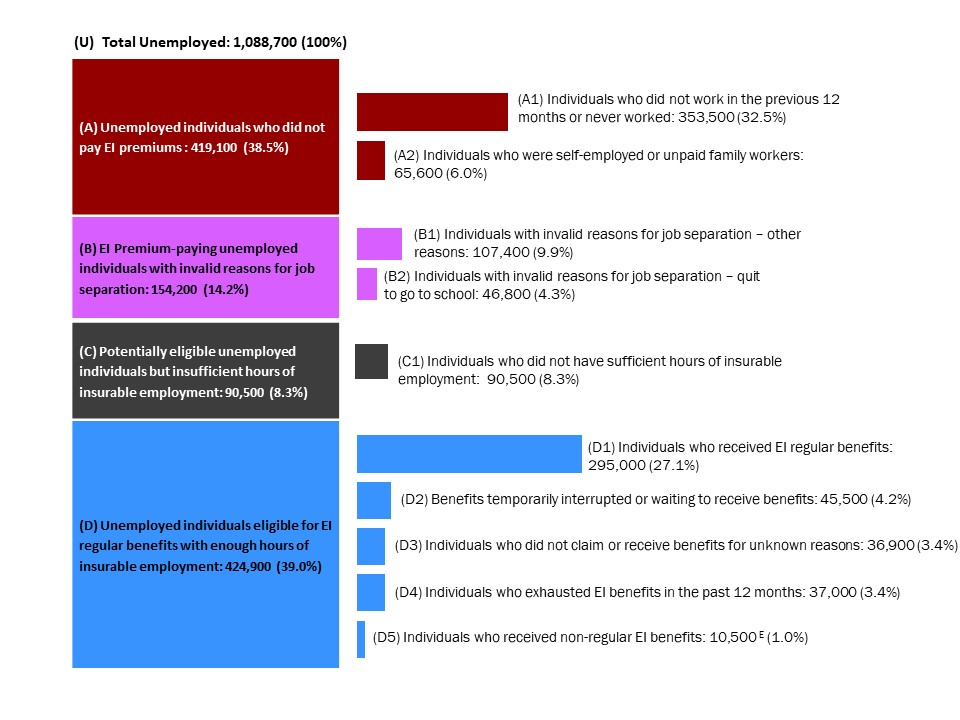

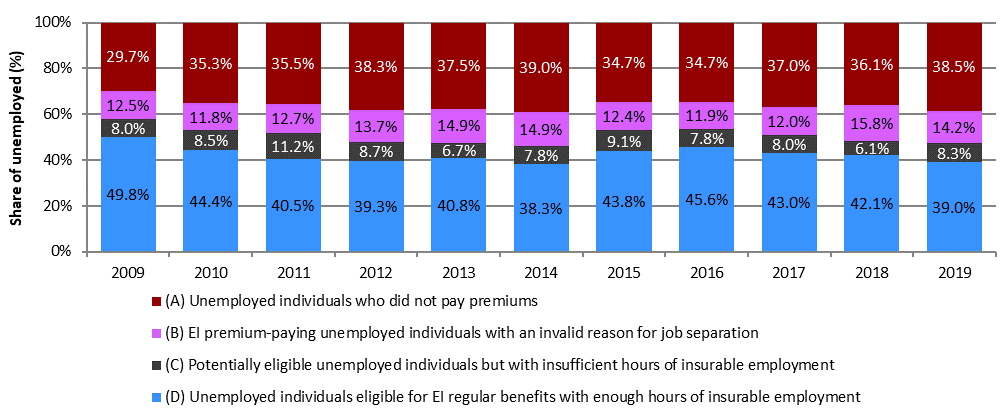

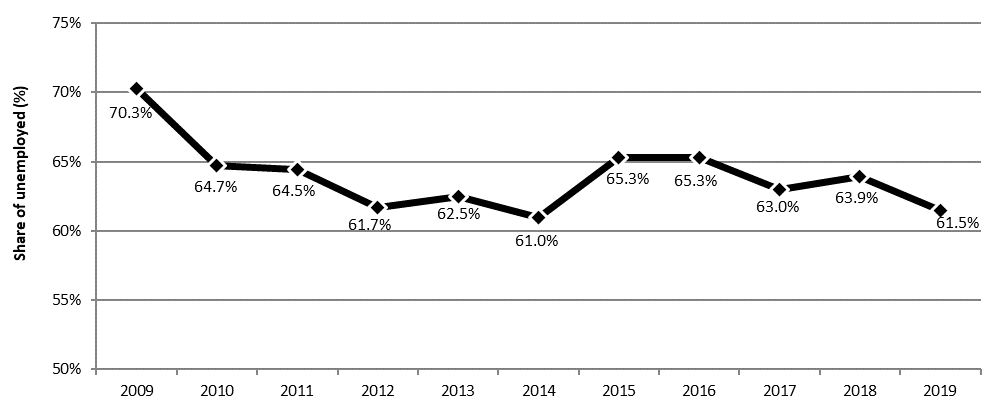

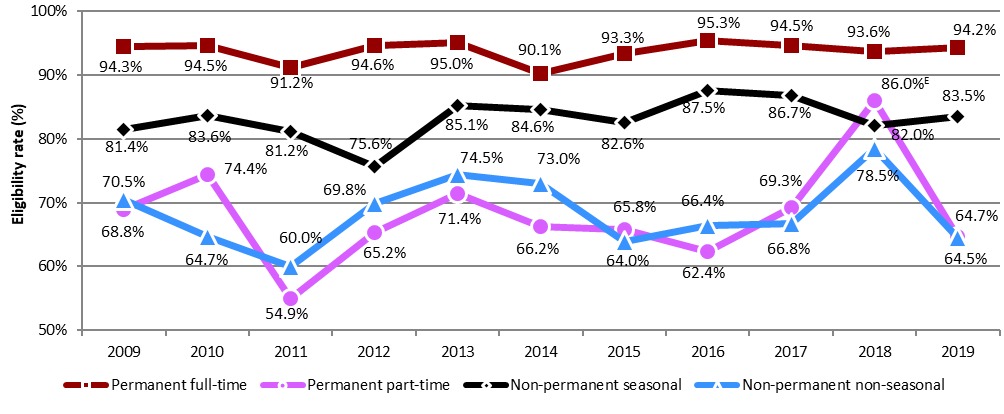

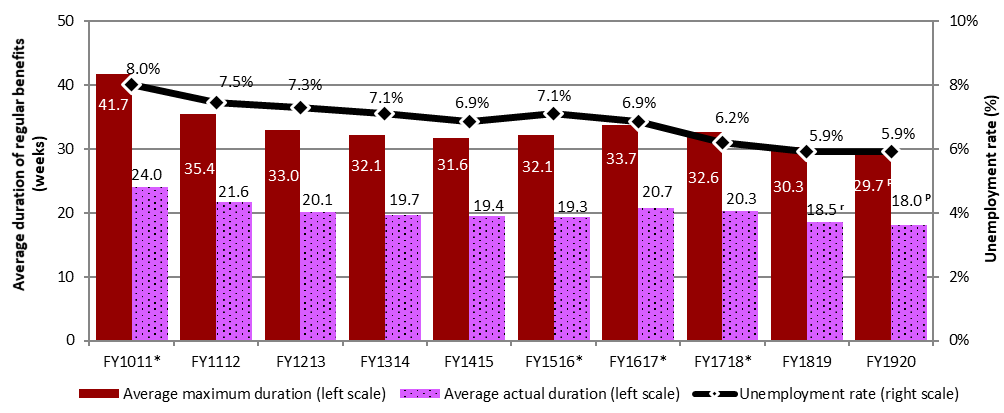

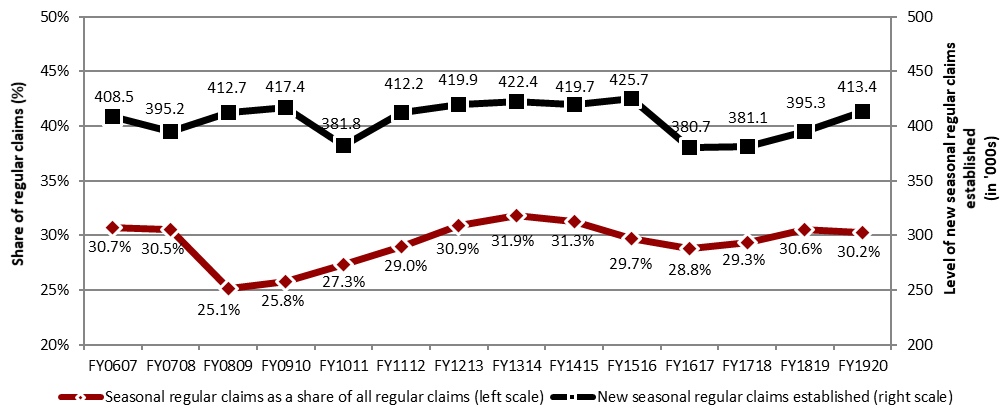

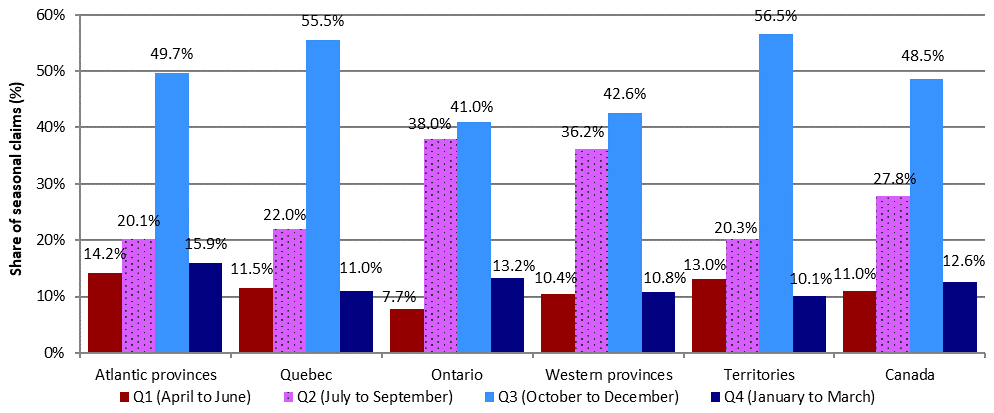

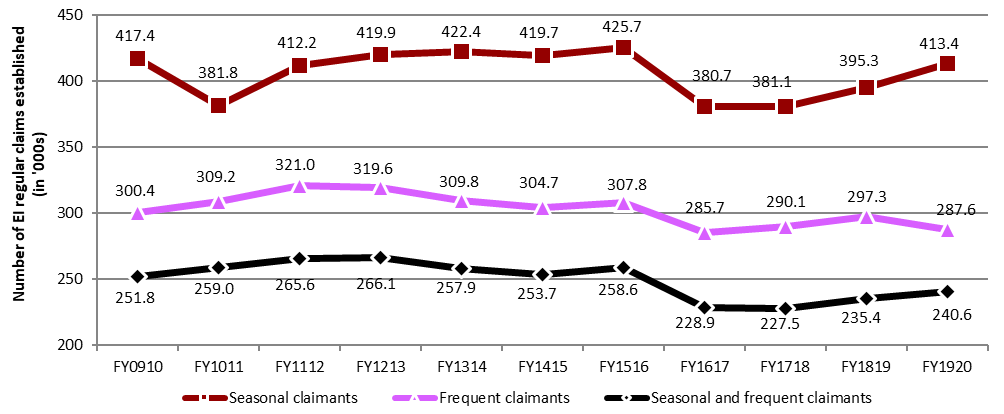

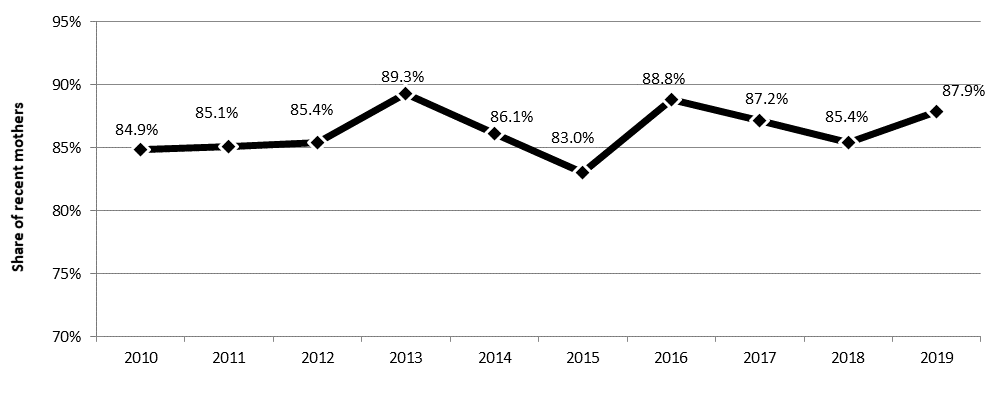

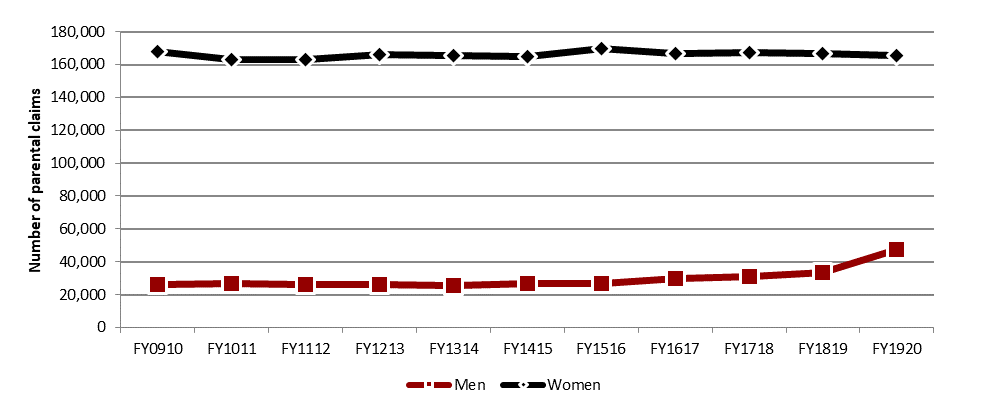

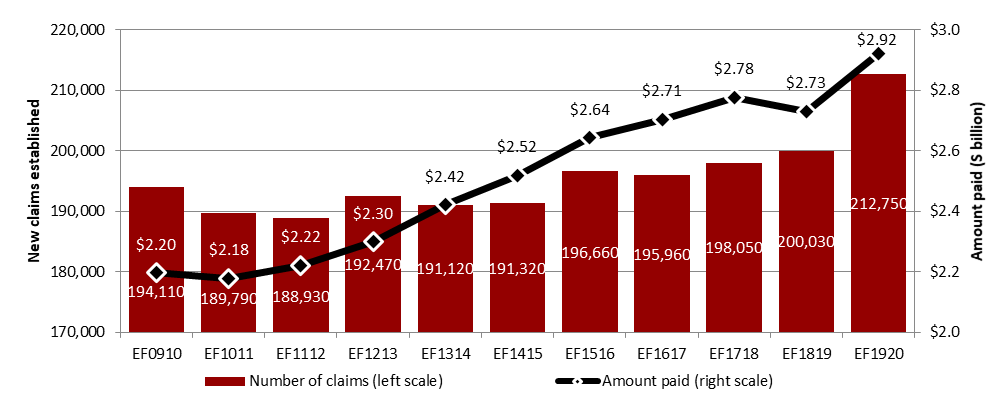

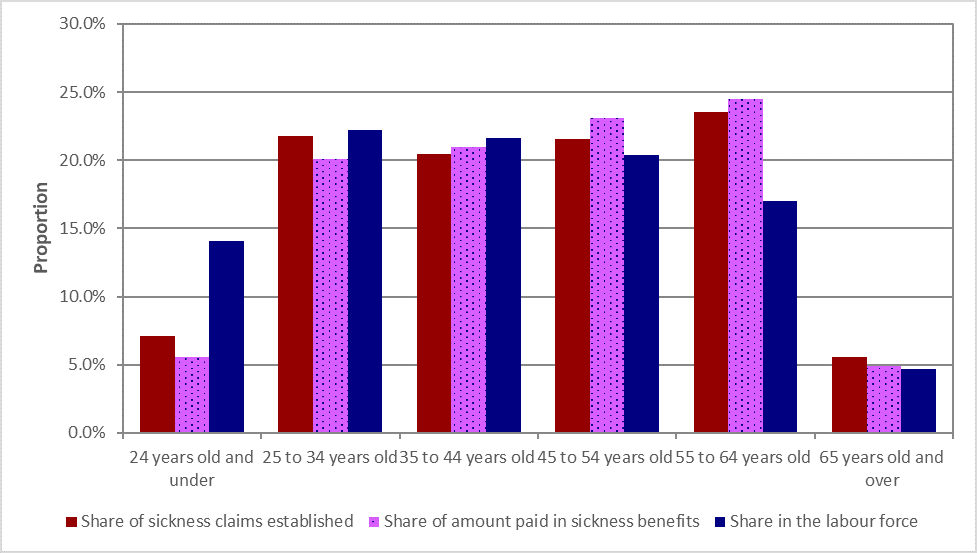

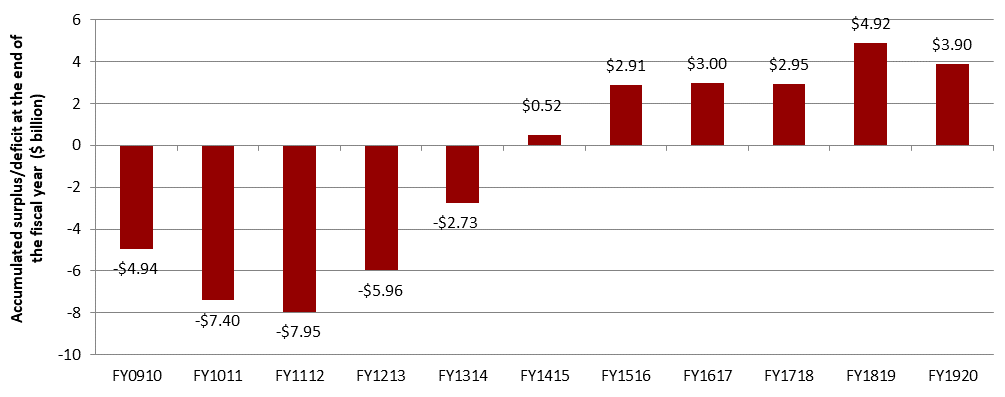

| Occasional claimants | 53.9% | 51.8% | 53.1% | 55.1% | 57.8% | 51.9% | 53.5% | 53.8% | 54.2% | 54.0% |