Federal labour standards protections for workers in non-standard work: Issue paper

From: Employment and Social Development Canada

Official title: Federal labour standards protections for workers in non-standard work: Issue paper

Disclaimer:

This paper is one of a series of papers prepared by the Secretariat to the Expert Panel on Modern federal labour standards as background information to stimulate the Panel's discussions. The papers do not necessarily reflect the views of the Government of Canada.

On this page

- Issue

- Background

- Non-standard work and the Canada Labour Code

- Situation in the federally regulated private sector

- What the research says

- Stakeholder perspectives

- Non-standard work and labour standards in other jurisdictions

- Non-standard work and other federal programs in Canada

- Issues for the panel’s consideration

- Selected bibliography

Alternate formats

Issue

Labour standards generally apply to workers in traditional employment relationships. Today, however, many workers are engaged in non-standard employment and may not have access to these protections. In this context, who should be covered by federal labour standards? What protections should apply to non-standard workers in the federally regulated private sector?

Background

Federal labour standards are based on the assumption that standard work, meaning work that is full time, permanent and part of an employment relationship with one employer (International Labour Organization (ILO), 2016), is the norm.

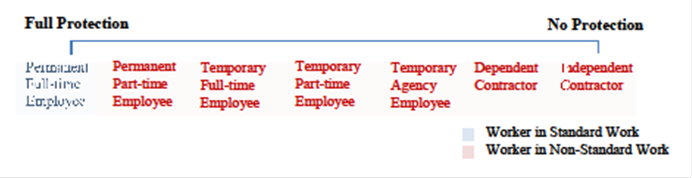

However, as the nature of work changes, a small but significant and potentially growing portion of workers are engaged in non-standard work, or work that differs from standard employment (ILO, 2016). This covers a broad spectrum of workers, including part-time, temporary and temporary help agency employees, as well as dependent and independent contractors (see Figure 1).

Figure 1 - Text version Spectrum of Work

Figure 1 displays the spectrum of workers, from full-protection to no protection. The progression is:

- permanent full-time employee (worker in standard work)

- the permanent part-time employee (worker in non-standard work)

- the temporary full-time employee (worker in non-standard work)

- the temporary part-time employee (worker in non-standard work)

- the temporary agency employee (worker in non-standard work)

- the dependent contractor(worker in non-standard work)

- the independent contractor (worker in non-standard work)

Only employees, including those in non-standard work, have full protection under Part III of the Canada Labour Code.

New types of work common in the gig economyFootnote 1 (also called the on-demand economy), such as gig work, task-based work and zero hours contracts (contracts with no guaranteed hours), as well as older forms such as freelance work, fall along different points of the spectrum and many workers do not fit neatly in one category. For example, a worker in task-based work could be treated by their employer or client as an employee, a dependent contractor or an independent contractor depending on a number of factors, including how much control they have over their work. They could also be considered a part-time or full-time worker, with that label changing depending on a given week or month if their hours vary. If they work under multiple contracts, it is possible that many different labels would apply to them at the same time.

For workers, non-standard work can offer flexibility, enabling them to meet personal and family obligations and contributing to improved work-life balance. It can also help employers remain competitive and increase profits by allowing them to build a flexible and agile workforce.

On the other hand, non-standard work can create financial, scheduling and other types of challenges for workers. For example, a freelance worker who becomes pregnant and wants to take a maternity leave would have no guarantee of retaining her clients at the end of her leave. This could cause budgeting problems, given that her future income is not secure, and could require her to take less leave, return to work during leave or make other concessions. Meanwhile, an employee in standard work who has met the eligibility requirement can take job-protected maternity leave knowing her position is secure.

In general, workers in non-standard work are also more likely to be in precarious work or work that is low-paid, insecure, with little worker control and without the protections provided by law or collective agreements (ILO, 2016). The issues associated with non-standard work are exacerbated for those whose work is also precarious.

Not all workers in non-standard work face the same challenges. Part-time, temporary and temporary agency employees are covered by labour standards protections. Employees who have been misclassified, some dependent contractors, and all independent contractors, however, are not protected because they are not considered employees. In these latter cases, workers do not get even basic protections like minimum wage and maximum hours of work, leaving them vulnerable to low income and overwork.

Similarly, workers in non-standard work who are considered employees are covered by federal programs like the Canada Pension Plan (CPP) and Employment Insurance (EI), while those who are not considered employees may lose out on coverage or have to pay more than the employee share of premiums.

Non-standard work and the Canada Labour Code

Part III (Labour Standards) of the Canada Labour Code (the Code) applies to, and in respect of, employees employed in or in connection to any federal work, undertaking or business (including employees of Crown corporations and excluding the federal public service). Part III of the Code is the only labour standards legislation in Canada that does not include a definition of “employee”.

While not explicitly stated, Part III does not treat independent contractors as employees. However, it does apply to them as employers if they have employees and operate in the federally regulated private sector (FRPS).

In the application of Part III, binary determinations of whether someone is a true employee (who would be covered by Part III) or a true independent contractor (who would not be covered by Part III) are made on a case-by-case basis by Labour Program inspectors, adjudicators and the courts.Footnote 2 If the relationship more closely resembles that of employee-employer, the worker will generally be deemed to be an employee.

In workplaces, employers and workers make these determinations on a day-to-day basis. They must interpret the application of Part III and weigh different factors to determine if they or someone performing work for them is an employee or not. The consequence of an incorrect determination is the denial of labour standards protection to an employee who should be protected, as well as the risk of an employer being found in contravention of Part III, which is associated with costs.

Recent changes to Part III set a precedent for extending protections to workers in non-standard work. Bill C-63, the Budget Implementation Act, 2017, No. 2, which received Royal Assent on December 14, 2017, made amendments to Part III intended to better protect unpaid internsFootnote 3 in the FRPS. Once necessary regulations come into force, these changes will eliminate unpaid internships in the FRPS unless they are part of an educational program, and make sure those unpaid interns whose internships are part of such a program receive basic labour standards protections.

Proposed changes to Part III were also introduced in Budget Implementation Act, 2018, No. 2 that would help prevent misclassification and protect misclassified employees. These changes received Royal Assent in December 2018 and, once in force, will prohibit employers from misclassifying employees and put the onus on employers to prove that a worker is not an employee.

Part I (Industrial Relations) of the Code recognizes the existence of “dependent contractors” and treats them as employees. In particular, Part I defines a “dependent contractor” as:

- the owner, purchaser or lessee of a vehicle used for hauling, other than on rails or tracks, livestock, liquids, goods, merchandise or other materials, who is a party to a contract, oral or in writing, under the terms of which they are:

- required to provide the vehicle by means of which they perform the contract and to operate the vehicle in accordance with the contract

- entitled to retain for their own use from time to time any sum of money that remains after the cost of their performance of the contract is deducted from the amount they are paid, in accordance with the contract, for that performance

- a fisher who, pursuant to an arrangement to which the fisher is a party, is entitled to a percentage or other part of the proceeds of a joint fishing venture in which the fisher participates with other persons

- any other person who, whether or not employed under a contract of employment, performs work or services for another person on such terms and conditions that they are, in relation to that other person, in a position of economic dependence on, and under an obligation to perform duties for, that other person

The rationale for providing dependent contractors with rights under Part I stems from arguments put forward by Professor Harry Arthurs in the 1960s. Arthurs argued that dependent contractors should not be excluded from collective bargaining simply because their employment relationship did not resemble a traditional employer-employee relationship. A key point was that collective bargaining is a means of correcting a power imbalance and, because dependent contractors occupy the same labour market space as employees, they should be eligible for unionization.

Situation in the federally regulated private sectorFootnote 4

Statistical data

The majority of employees in the FRPS are permanent, full-time employees. Based on the 2015 Federal Jurisdiction Workplace Survey (FJWS), 85% of the 910,000 employees in the FRPS are permanent, full-time employees, which is higher than the proportion of employees in Canada who are permanent, full-time (71%).

Nevertheless, non-standard work exists in the FRPS. The Labour Program’s analysis of the 2015 FJWS, the 2017 Labour Force Survey (LFS) and the 2017 Survey of Employment, Payroll, and Hours found that:

- approximately 10% of all employees in the FRPS worked part-time, which is less than the proportion of employees working part-time in Canada overall (18%)

- approximately 5.5% of employees in the FPRS were in temporary work, with about half of them in term or contract employment, and the rest in either seasonal employment or casual employment. In Canada overall, temporary employees constitute 14% of all employees

As for self-employed workers, the Labour Program, based principally on the 2015 FJWS and the 2017 Labour Force Survey (LFS), estimates the following:

- approximately 80,000 workers in the FRPS (8% of people working in the FRPS) were self-employed, of whom approximately 60,000 (75%) had no paid employees. Self-employment is slightly more common in the Canadian workforce overall (15%) than in the FRPS, of whom 70% had no paid employees

- the vast majority of self-employed workers in the FRPS (92% of those without employees and 85% of those with) were men. Notably, while non-Canadian born workers made up only 28% of employees in the FRPS, they accounted for over half (54%) of self-employed workers without employees

Tables 1 and 2 provide demographic profiles of workers in non-standard work in the federally regulated private sector.

| Demographic group | Temporary employees | Part-time employees |

|---|---|---|

| Women | 6% | 14% |

| Men | 5% | 8% |

| Non-Aboriginal persons | 5% | 10% |

| Aboriginal persons (off reserve) | 7% | 7% |

| Canadian born | 5% | 11% |

| Non-Canadian born | 6% | 9% |

Source: Labour Program analysis of the 2017 LFS and the 2015 FJWS.

| Demographic group | Self-employed without employees | Self-employed with employees |

|---|---|---|

| Women | 1% | 1% |

| Men | 9% | 3% |

| Non-Aboriginal persons | 6% | 2% |

| Aboriginal persons (off reserve) | 8% | 3% |

| Canadian born | 4% | 2% |

| Non-Canadian born | 12% | 3% |

Source: Labour Program analysis of the 2017 LFS and the 2015 FJWS.

Note: The denominator for each row includes both employees and the self-employed.

During informal discussions held with a small group of Labour Program officers (inspectors and early resolution officers) from across the country in August 2018, officers mentioned that the use of self-employed workers (for labour standards purposes, likely dependent or independent contractors) instead of employees has become an issue in the FRPS, mostly in the trucking industry. Labour Program officers said some employers are requiring workers to become incorporated self-employed workers. This allows employers to avoid paying taxes and avoid meeting labour standards for these workers. The officers indicated that some employers have raised this issue and that they have complained that this practice makes it more difficult for them to compete.

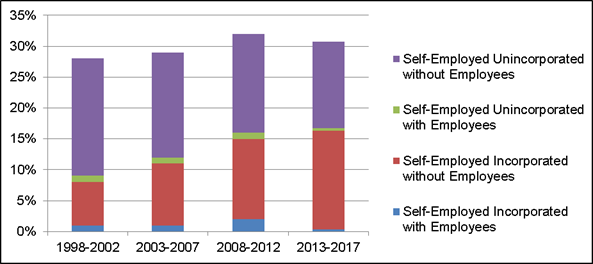

Analysis of data from the LFS 1998 to 2018Footnote 5 demonstrates that incorporated self-employment in the trucking sector in the FRPS is becoming more common, particularly incorporated self-employment without paid employees. According to the LFS, the proportion of self-employed workers without employees in the trucking industry has increased from 26% in 1998 to 2002 to 30% in 2013 to 2017. The increase can be attributed to the increased proportion of incorporated workers without employees, which more than doubled during the period, from 7% to 16% of workers in the trucking industry, while the proportion of unincorporated self-employed workers without employees decreased by 5 percentage points (see Figure 2).

Figure 2 - Text version Self-employed by incorporated status in the trucking occupation in the FRPS as a proportion of total workers in the sector, 1998 to 2017

| Year | Self-employed incorporated with employees | Self-employed incorporated without employees | Self-employed unincorporated with employees | Self-employed unincorporated without employees |

|---|---|---|---|---|

| 1998-2002 | 1,0% | 7,0% | 1,0% | 19,0% |

| 2003-2007 | 1,0% | 10,0% | 1,0% | 17,0% |

| 2008-2012 | 2,0% | 13,0% | 1,0% | 16,0% |

| 2013-2017 | 0,3% | 16,0% | 0,4% | 14,0% |

| 1998-2002 | 1,0% | 7,0% | 1,0% | 19,0% |

Source: LFS 1998 to 2018.

Notes: Any difference from 100% due to rounding error. The statistics, while zeroing in on 4-digit NAICS codes with a high preponderance of FRPS coverage, do partially capture trucking occupations in provincial jurisdiction.

Collective agreements

A September 2018 review by the Labour Program of a representative sample of 231 collective agreements in the FRPS found that it is common for bargaining parties to negotiate certain limits on an employer’s use of non-standard work. For example, many of the collective agreements examined have provisions stating that employers will not call in or schedule temporary, casual, seasonal and part-time employees to work unless a full-time, permanent employee cannot fill the vacancy. Many of the collective agreements also set limits on the number of contractors and part-time employees or their share as a percentage of the workforce, generally to protect the job stability of permanent employees.

Many agreements in the sample specifically exempt workers in non-standard work from certain employer-provided benefits available to those in standard work. These include notice periods for layoff, group insurance, pension plans, right to severance pay, hours of work and overtime pay, paid vacation, holiday with pay for statutory holidays and various leaves (for example, parental, sickness and disability).

On the other hand, some agreements do provide certain protections to workers in some types of non-standard work, especially temporary employees. For example, the analysis found that:

- temporary employees are usually provided with a specified term not exceeding a certain time limit (for example, 18 months), which means that an employer cannot hire an employee on a temporary basis for an extended period of time and avoid transitioning the employee into a permanent position or a position with entitlements to more protections and benefits

- there are agreements where temporary employees must be granted indeterminate employment status if their service exceeds a certain number of years, with the number varying depending on the employer (for example, three years for the Calgary Airport Authority; 18 months for CBC)

- under one agreement, temporary employees hired for fewer than 13 weeks must be paid a premium of 12.5% in recognition of the fact that they are not entitled to many benefits (for example, vacation or pension)

The sample included just one collective agreement, in the broadcasting sector, providing protections for freelancers. The agreement requires that a contract be signed by the employer and a freelancer before any assignment begins and that freelancers be paid fairly for their work based on fiscal realities. The agreement also sets out rates of pay for freelancers and contains a clause stating that freelancers shall not be required to work on a speculative basis.

What the research says

Scope of the issue

While there is limited data on how many workers are in non-standard work in the FRPS, there is some information available on the issue in Canada more generally. A 2016 C.D. Howe Institute report by Busby and Muthukumaran, for example, found that non-standard work accounts for just over a third of total employment in Canada. A study by the staffing firm Randstad Canada in 2017 concluded that non-traditional workers (meaning contingent, consultant, contractual, part-time, freelance and/or virtual workers for the purposes of the study) make up 20% to 30% of the Canadian workforce. The latter also identified information technology (IT), engineering, administrative support, sales and business development, finance and accounting, and human resources as the industries with the highest proportions of these workers.

Research has shown quite clearly that, overall, the share of non-standard work has stabilized in Canada in recent years. Busby and Muthukumaran (2016) demonstrate that the share has been “remarkably stable” at slightly more than one-third of total employment since the early 1990s and that the majority of jobs are full-time. A 2018 Chartered Professional Accountants Canada report by Fong similarly notes that “the aggregate statistics do not show that non-standard work arrangements are a growing issue”. Fong underlines that though part-time work rose as a share of total employment from the 1970s until the early 1990s, it has consistently accounted for about 20% of workers since then. In addition, while temporary work has risen as a proportion of total employment, it still only accounts for about 13% of the Canadian workforce (Fong, 2018).

However, while the use of part-time work has declined in many sectors, it has significantly increased in information, culture and recreation services, accommodation and food services, and educational services—and these are the same sectors where the largest increases in temporary employment have also been seen (Fong, 2018). Busby and Muthukumaran (2016) note that the absolute numbers of people in non-standard work are increasing and that full-time temporary work as a share of total employment is also increasing, especially for contract and term positions. There are also some who see the potential for continued growth. According to a 2016 report by Becker and Rajwani on the sharing economy, over half of all new jobs in Canada are non-standard work arrangements (for example, defined as part-time, temporary, on contract, freelance, self-employed or unpaid).

Impacts

According to the literature, there can be negative personal and family impacts for workers in non-standard work, particularly those who earn less. Poverty and Employment Precarity in Southern Ontario (PEPSO) (2015) found that low-income is associated with poorer general and mental health and that, for those in less secure employment in low- and middle-income households, anxiety about employment interferes with personal and family life.

The literature also suggests that workers in non-standard work may have difficulty accessing social programs and benefits. In a Mowat Centre report, Johal and Thirgood (2016) argue that because Canada’s social programs operate under the assumption that standard work is the norm, eligibility for programs such as EI and the CPP will decline as non-standard work increases.

There is research pointing to broader societal impacts of non-standard work. A recent ILO report (2016) identifies a number of societal impacts driven by two aspects of non-standard work: job insecurity and lower pay. The report points to lower home ownership and lower fertility rates as potential outcomes of non-standard work that could have negative consequences for societies. PEPSO (2015) found that precarious work has both negative and positive impacts on community and democratic participation. They found that moving from precarious to secure employment increases the likelihood of voting by over 20%. They also found that workers in less secure employment are more likely to volunteer than workers in standard work, and that they are more likely than workers in secure employment to do so to improve job opportunities.

There is also research examining the economic impacts of non-standard work. In its 2016 report on non-standard work around the world, for example, the ILO (2016) identifies labour market segmentationFootnote 6 as a potential outcome with economic consequences. According to the report, in situations of labour market segmentation, workers in standard and non-standard work share unemployment and income security risks unequally, which can cause labour market instability. The report also notes that labour market segmentation can also contribute to increased inequality because workers in non-standard work earn lower wages, have less access to training and are more likely to rotate between employment and unemployment compared to those in standard work (ILO, 2016).

A 2015 report by the Organisation for Economic Cooperation and Development also points to increased inequality as a potential economic impact of non-standard work. The report recognizes that not all non-standard jobs are “bad” and that they can be used by employers to build flexible workforces. However, it also concludes that an increase in non-standard work “tends to lower wages at the bottom of the earnings distribution, while the effect is often neutral at the top, thereby contributing to increased individual earnings inequality” and that addressing this inequality can promote economic growth.

Policy responses

There are conflicting views on how best to address the issues faced by workers in non-standard work. Some of the literature points to labour standards as a solution. Johal and Thirgood (2016), for instance, note that Ontario’s Employment Standards Act (ESA) was designed to protect the average Ontarian in a standard work arrangement but that, as fewer workers are engaged in this type of work arrangement, a growing number may not be entitled to ESA protections. As such, they recommend that governments explore whether independent contractors in the gig economy merit additional protections that they have not traditionally been afforded, such as minimum wage. Johal and Thirgood (2016) add that extending partial or full labour standards protections to gig workers who are dependent contractors could help prevent a race to the bottom.

Similarly, Becker and Rajwani (2016) identify a number of possible policy responses through labour standards, including creating provisions for independent contractors and dependent contractors in regulations that would leave the option open for further regulations to exempt or create different standards for particular groups, and using the broadest possible definitions for “employer” and “employee” when interpreting legislation.

There are also different views on the role of definitions in clarifying to whom federal labour standards apply. The 2006 Commission for the Review of Part III of the Canada Labour Code led by Harry Arthurs recommended in Fairness at Work that Part III be amended to permit the Minister to enact regulations defining “employees”, “employers” and “employment”. The report argued that “if coverage under Part III is not properly defined, the whole statutory scheme for federal labour standards is likely to be destabilized”. The 2017 Ontario Changing Workplaces Review report similarly recommended that Ontario’s ESA be amended to cover dependent contractors. The recommendation was based on the idea that the ESA should communicate with as much clarity as is reasonable the scope of coverage of the Act, and on the argument that failing to include dependent contractors within the definition of employee would prevent any interpretation of “employee” that tries to extend the ESA’s protections to that group (Mitchell and Murray, 2017). While Bill 148, which was passed by the Ontario legislature in fall 2017, included changes to the ESA to address misclassification of employees as independent contractors, it did not change the definition of “employee”. A report by Faraday (2017) for the Canadian Centre for Policy Alternatives argues that Bill 148 did not go far enough and recommends that, at a minimum, the definition be extended to cover dependent contractors.

In its rationale for not accepting the Changing Workplaces Review’s recommendation to revise the ESA definition of “employee” to include dependent contractors, the Ontario Ministry of Labour indicated that “changes to the definition [of employee] are likely to have unintended consequences” (Ministry of Labour, 2017). The Law Commission of Ontario advised the Government of Ontario that it would be difficult to define the scope of any dependent contractor provisions without inadvertently capturing true "independent contractors" within the definition (Ministry of Labour, 2017). A report by De Stefano (2016) for the ILO argues that, “proposing a new legal bucket for grey-zone cases may complicate matters, rather than simplifying the issues surrounding classification.” De Stefano notes that legal definitions are always difficult to apply in practice and that there is a risk of just shifting the grey zone while still leaving employers vulnerable to legal challenges.

Others maintain that this issue is best addressed outside of labour standards completely. Busby and Muthukumaran (2016), for example, advise against focusing on labour standards in response to the evolution of work arrangements, as it could result in less job creation or impact workers who choose non-standard work. Instead, they support focusing on policies and programs that would help mitigate risks faced by non-standard workers, such as income unpredictability, a lack of health or pension benefits and poor access to further education, while accommodating the need for labour market flexibility.

Stakeholder perspectives

The Modernizing Federal Labour Standards consultations run by the Labour Program from May 2017 to March 2018 generated divergent views on various aspects of this issue. For example, while many respondents to the January 2018 online public surveyFootnote 7 indicated that there is a shift towards more insecure and precarious jobs, one employer organization noted that the available evidence does not suggest a crisis in the number of workers in precarious work in the FRPS.

In terms of policy responses, many survey respondents said that Canada needs better labour standards and regulations in the context of the changing nature of work. In particular, a number noted that better labour standards are necessary to address the growth in non-standard, precarious and poorly paying work and create better quality jobs.

Several unions, labour organizations, advocacy groups and experts recommended during the consultations that a definition of “employee” be added to Part III and that it be broad enough to cover workers in non-standard work. Some recommended applying the definition of “employee” in Part I of the Code, which includes dependent contractors, to Part III. Others suggested that the definition be broadened even further to include workers who are not dependent on any single employer for their income but on a series of employers within the FRPS as a whole.

Other stakeholders argued against changes that would extend labour standards protections to workers in non-standard work. Several employers and employer organizations emphasized that many workers choose non-standard work. Some added that most of those classified as independent contractors are highly specialized professionals, for example, in information technology, and not vulnerable workers requiring special labour standards protections. One employer organization in the trucking industry said it is unnecessary to specify who is considered an employee or an independent contractor in Part III, arguing that independent contractors are common in the industry and should be able to set out their business relationship in a written contract and that employers and independent contractors across the industry agree on this point.

Non-standard work and labour standards in other jurisdictions

Provinces and territories

Similar to the federal regime, provincial and territorial labour standards legislation tends to apply broadly to employees with some occupational and sectoral exclusions.

Quebec and Yukon are the only two jurisdictions where labour standards legislation applies to categories of workers who are neither employees nor independent contractors. In both cases, the features of these types of workers are included in the statutory definition of “employee”.

Definitions in labour standards legislation of Quebec and YukonFootnote 8

Quebec Legislation - Act respecting labour standards

Definition

“Employee” means a person who works for an employer and who is entitled to a wage and also includes a worker who is party to a contract, under which he or she:

- undertakes to perform specified work for a person within the scope and in accordance with the methods and means determined by that person

- undertakes to furnish, for the carrying out of the contract, the material, equipment, raw materials or merchandise chosen by that person and to use them in the manner indicated by him or her

- keeps, as remuneration, the amount remaining to him or her from the sum he has received in conformity with the contract, after deducting the expenses entailed in the performance of that contract

Yukon Legislation - Employment Standards Act

Definition

“Contract worker” means a worker, whether or not employed under a contract of employment, and whether or not furnishing tools, vehicles, equipment, machinery, material, or any other thing owned by the worker, who performs work or services for another person for compensation or reward on such terms and conditions that:

- the worker is in a position of economic dependence on, and under an obligation to perform duties for, that person

- the relationship between the worker and that person more closely resembles the relationship of employee to employer than the relationship of an independent contractor to a principal or of one independent contractor to another independent contractor

United Kingdom

A non-binary “three tier” approach exists in the United Kingdom (UK). The UK’s Employment Rights Act (ERA) covers both “employees” and “workers”, but not “self-employed”. “Employees” are traditional employees; “workers” do work or services under a contract with certain limitations (for example, limited right to subcontract) for money or a benefit-in-kind; and “self-employed” people are those who run a business and take responsibility for its success or failure (Government of the United Kingdom, 2018). The “worker” category covers a wider range of work arrangements than the employee category, and could apply to workers in casual, freelance and zero hours contract work.Footnote 9 Only specific labour standards, including minimum wage, rest breaks and general holiday provisions, apply to “workers”.

The 2017 Taylor Review of Modern Working Practices (Taylor Review) report recommended keeping the three-tier system of employee vs. worker vs. self-employed. The report argued that the opportunities of platform-based working (including two-way flexibility and opportunities to work for those unable to work in conventional ways) need to be protected while ensuring fairness for people who work through those platforms and those who compete with them. The report also recommended renaming the “worker” category to “dependent contractor”. The report stated that “‘Dependent contractors are the group most likely to suffer from unfair one-sided flexibility and therefore we need to provide additional protections for this group and stronger incentives for firms to treat them fairly”.

The Association of Independent Professionals and the Self-Employed (IPSE), the Institute of Employment Rights (IER) and multiple UK unions criticized the Taylor Review’s recommendations for not getting to the root of the issue of protections for workers in non-standard work. The IPSE, for example, said the report “falls short of solving the most pressing issue facing the UK’s flexible labour market—clarifying what self-employment is” (Chamberlain, 2017). The IER called the recommendations a “gift to ‘gig economy’ companies that hope to avoid the minimum wage” (IER, 2017).

In February 2018, the UK government launched consultations to seek views on whether the Taylor Review’s recommendations related to employment status would work, as well as feedback on alternative approaches. In the discussion paper released during the consultations, the government notes that employment status is central to employment and tax law, but recognizes that it is a complex issue that requires careful consideration (Government of the United Kingdom, 2018).

Non-standard work and other federal programs in Canada

Similar to labour standards, a number of Canada’s other social and economic programs are generally based on standard work being the norm. For example, employers must pay CPP and EI premiums for all of their employees, but not for any self-employed workers they hire. The Canada Revenue Agency (CRA) can make rulings on whether an individual is an employee or self-employed for the purpose of the payment of these types of premiums. The CRA considers many of the same factors used by labour inspectors, officials, adjudicators and the courts when making these rulings.

However, there are some ways in which access to these programs has been extended to workers in non-standard work. For example, in 2010, the federal government introduced the EI Special Benefits for Self-employed Workers (SBSE) program as a way to allow self-employed workers in Canada to access maternity, parental, sickness, compassionate care and family caregiver EI benefits for which they would normally not be eligible. Self-employed workers can opt-in to the program and pay the same premiums paid by employees ($1.66 per $100 earned up to a maximum) in order to become eligible for the benefits. They must wait 12 months after they have opted in before using any benefits.

Take-up for the program has been lower than expected. Though it was estimated in 2012 that 318,900 self-employed workers would opt in, only 13,000 were registered as of May 2013 (4% of expected participation) (ESDC, 2016). By 2017, that number had increased to 19,400 which, while still only 6% of expected participation, was 10% higher than the previous year (ESDC, 2018). According to a 2016 evaluation of the SBSE, there are several explanations for the low take-up (ESDC, 2016):

- income: In 2012, about one-third of self-employed workers in Canada did not earn enough income from self-employment to access SBSE

- awareness: In 2012, only about one-quarter of self-employed workers had heard about the SBSE

- disincentives: Based on a 2012 Survey of Self-employed People, disincentives included: no longer being self-employed or other unspecified reason (29.6%); not needing the insurance or already having access to insurance (22.1%); not having enough information to decide (22.1%); and premiums too high, benefits too low or participation looked like too much of a hassle (17.5%)

The evaluation also identified a number of differences in the gender, age and income profiles of those who opted in to the SBSE compared to those who did not. Though self-employed workers were more likely to be male, take-up was higher among female, younger and lower-income workers. Those who made claims were also: mostly women (95%); between the ages of 25 and 44 (91.3%); and living in an urban area (88.2%) (ESDC, 2016). Most claims were made for maternity or parental benefits.

CPP can also apply to self-employed workers if they earn more than $3,500 in a year. Self-employed workers must pay a full 9.9% contribution rate up to an annual maximum contribution ($5,187.60 in 2018). Employees, meanwhile, split the 9.9% contribution rate between themselves and their employer, making their rate only 4.95% and their annual maximum contribution half that of self-employed workers.

Issues for the panel’s consideration

Who should be covered by federal labour standards?

- Should workers in non-standard work be covered by all labour standards?

- Should workers in non-standard work be covered by only a selection of core federal labour standards? If so, what standards should apply?

- Should other federal programs be examined to better protect workers in non-standard work?

Selected bibliography

Arthurs, H.W. Fairness at work: Federal labour standards for the 21st century, Federal Labour Standards Review, 2006. (PDF, 1.58 Mb)

Busby, C., & Muthukumaran, R. Precarious positions: Policy options to mitigate risks in non-standard employment, C.D. Howe Institute, 2016. (PDF, 883.47 Kb)

Chamberlain, A. The Taylor review overlooks the big issue—clarifying what self-employment is, The Guardian, 2017.

De Stefano, V. The rise of the ‘just-in-time workforce’: On-demand work, crowdwork and labour protection in the gig-economy, International Labour Organization, 2016.

Department for Business, Energy and Industrial Strategy. Employment status consultation, Government of the United Kingdom, 2018. (PDF, 761.01 Kb)

Employment and Social Development Canada (ESDC). Employment Insurance monitoring and assessment report for the fiscal year beginning April 1, 2016 and ending March 31, 2017, Government of Canada, 2018.

Employment and Social Development Canada (ESDC). Evaluation of the employment insurance special benefits for self-employed workers, Government of Canada, 2016.

Faraday, F. Demanding a fair share, Canadian Centre for Policy Alternatives, 2017. (PDF, 576.77 Kb)

Fong, F. Navigating precarious employment in Canada: Who is really at risk?, Chartered Professional Accountants Canada, 2018.

Gellatly, M. Still working on the edge: Building decent jobs from the ground up, Workers’ Action Centre, 2015. (PDF, 954.48 Kb)

Institute of Employment Rights. Our guide to the Taylor Review, 2017. (PDF, 331.04 Kb)

International Labour Organization (ILO). Non-standard employment around the world, ILO, 2016.

Johal, S., & Thirgood, J. Working without a net, Mowat Centre, 2016. (PDF, 7.24 Mb)

Kaardal, R.J., & Bjornson, A.C. The gig economy: Dependent contractors, workers’ rights, and the Canadian approach, 2018. (PDF, 308.29 Kb)

Katz, L., & Krueger, A. The rise and nature of alternative work arrangements in the United States, 1995 to 2015, 2019. (PDF, 576.66 Kb)

Ministry of Labour. Proposed changes to Ontario's employment and labour laws, Government of Ontario, 2017.

Mitchell, C.M., & Murray, J. C. The changing workplaces review: An agenda for workplace rights, 2017. (PDF, 3.50 Mb)

Organization for Economic Co-operation and Development (OECD). In it together: Why less inequality benefits all, OECD, 2015.

Poverty and Employment Precarity in Southern Ontario (PEPSO). The precarity penalty: The impact of precarious employment on individuals, households and communities—and what to do about it, PEPSO, McMaster University and United Way Toronto, 2015. (PDF, 7.08 Mb)

Randstad. Workforce 2025, 2017. (PDF, 2.20 Mb)

Statistics Canada. Self-employment, historical summary, CANSIM, table 282-0012 and Catalogue no.89F0133XIE, Government of Canada, 2016.

Taylor, M. Good work: The Taylor review of modern working practices, Government of the United Kingdom, 2017. (PDF, 3.75 Mb)