Evaluation of the Immigration Loan Program

Appendix D: Detailed Survey Results Related to Settlement Impacts

Figure 5: Impacts of Loan Repayment on Recipients Related to Settlement

Figure 5: Impacts of Loan Repayment on Recipients Related to Settlement - Table

| Percentage of survey respondents who agreed | Strongly agree/ agree |

Strongly disagree/ disagree |

|---|---|---|

| Paying back the loan makes/made it difficult to pay for basic things like food, clothing and housing (n=722) | 53.9% | 46.1% |

| After paying for food, clothing and housing, paying your loan back takes/took a large portion of what they had left (n=716) | 55.0% | 45.0% |

| Paying back the loan makes/made it difficult to afford to participate in school, community, or recreational activities (n=702) | 47.0% | 53.0% |

| As a result of the loan, they better understand the Canadian financial system (n=689) | 88.7% | 11.3% |

| As a result of working to pay back the loan, it was/is more difficult to find the time to use services available to help with adapting to living in Canada (n=661) | 47.8% | 52.2% |

| Having to pay back the loan made them get a job quickly (n=624) | 49.8% | 50.2% |

| Having to pay back the loan made your spouse or children get a job (n=536) | 31.0% | 69.0% |

| They feel proud that they are/have been able to pay back the loan (n=725) | 95.3% | 4.7% |

| Paying back the loan is/was stressful for them (n=722) | 51.1% | 48.9% |

Source: Loan Recipient Survey.

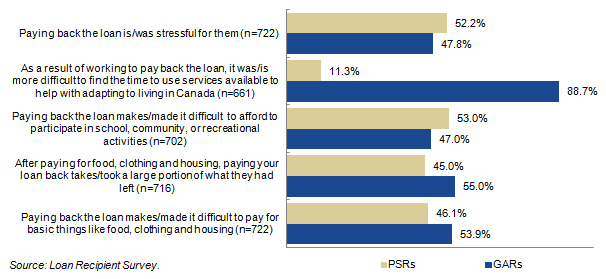

Figure 6: Impacts of Loan Repayment on Recipients Related to Settlement by Immigration Category

Figure 6: Impacts of Loan Repayment on Recipients Related to Settlement by Immigration Category - Table

| Percentage of survey respondents who agreed | GARs | PSRs |

|---|---|---|

| Paying back the loan makes/made it difficult to pay for basic things like food, clothing and housing (n=722) | 53.9% | 46.1% |

| After paying for food, clothing and housing, paying your loan back takes/took a large portion of what they had left (n=716) | 55.0% | 45.0% |

| Paying back the loan makes/made it difficult to afford to participate in school, community, or recreational activities (n=702) | 47.0% | 53.0% |

| As a result of working to pay back the loan, it was/is more difficult to find the time to use services available to help with adapting to living in Canada (n=661) | 88.7% | 11.3% |

| Paying back the loan is/was stressful for them (n=722) | 47.8% | 52.2% |

Source: Loan Recipient Survey.

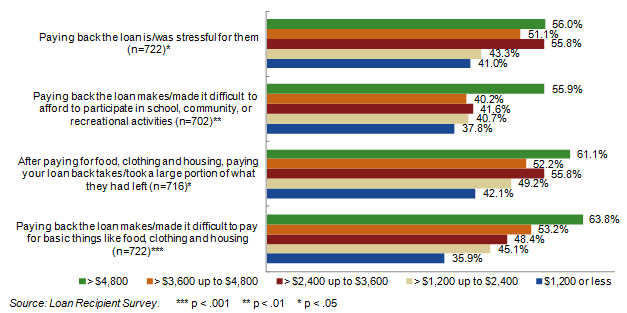

Figure 7: Impacts of Loan Repayment on Recipients Related to Settlement by Loan Size

Figure 7: Impacts of Loan Repayment on Recipients Related to Settlement by Loan Size - Table

| Percentage of survey respondents who agreed | $1,200 or less | > $1,200 up to $2,400 | > $2,400 up to $3,600 | > $3,600 up to $4,800 | > $4,800 |

|---|---|---|---|---|---|

| Paying back the loan makes/made it difficult to pay for basic things like food, clothing and housing (n=722)Footnote *** | 35.9% | 45.1% | 48.4% | 53.2% | 63.8% |

| After paying for food, clothing and housing, paying your loan back takes/took a large portion of what they had left (n=716)Footnote * | 42.1% | 49.2% | 55.8% | 52.2% | 61.1% |

| Paying back the loan makes/made it difficult to afford to participate in school, community, or recreational activities (n=702)Footnote ** | 37.8% | 40.7% | 41.6% | 40.2% | 55.9% |

| Paying back the loan is/was stressful for them (n=722)Footnote * | 41.0% | 43.3% | 55.8% | 51.1% | 56.0% |

Source: Loan Recipient Survey.

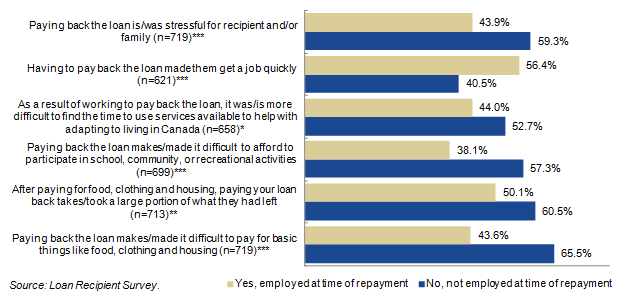

Figure 8: Impacts of Loan Repayment on Recipients Related to Settlement by Employment Status at Time of Repayment

Figure 8: Impacts of Loan Repayment on Recipients Related to Settlement by Employment Status at Time of Repayment - Table

| Percentage of survey respondents who agreed | No, not employed at time of repayment | Yes, employed at time of repayment |

|---|---|---|

| Paying back the loan makes/made it difficult to pay for basic things like food, clothing and housing (n=719)Footnote ***†| 65.6% | 43.6% |

| After paying for food, clothing and housing, paying your loan back takes/took a large portion of what they had left (n=713)Footnote **†| 60.5% | 50.1% |

| Paying back the loan makes/made it difficult to afford to participate in school, community, or recreational activities (n=699)Footnote ***†| 57.3% | 38.1% |

| As a result of working to pay back the loan, it was/is more difficult to find the time to use services available to help with adapting to living in Canada (n=658)Footnote *†| 52.7% | 44.0% |

| Having to pay back the loan made them get a job quickly (n=621)Footnote ***†| 40.5% | 56.4% |

| Paying back the loan is/was stressful for recipient and/or family (n=719)Footnote ***†| 59.3% | 43.9% |

Source: Loan Recipient Survey.

Figure 9: Impacts of Loan Repayment on Recipients Related to Settlement by Estimated Household Income (before taxes)

Figure 9: Impacts of Loan Repayment on Recipients Related to Settlement by Estimated Household Income (before taxes) - Table

| Percentage of survey respondents who agreed | $0 to $20,000 | $20,001 to $30,000 | Over $30,000 |

|---|---|---|---|

| Paying back the loan makes/made it difficult to pay for basic things like food, clothing and housing (n=633)Footnote ***††| 65.6% | 50.3% | 38.9% |

| After paying for food, clothing and housing, paying your loan back takes/took a large portion of what they had left (n=628)Footnote *††| 61.5% | 51.0% | 50.2% |

| Paying back the loan makes/made it difficult to afford to participate in school, community, or recreational activities (n=613)Footnote ***††| 54.6% | 47.2% | 36.2% |

| Having to pay back the loan made them get a job quickly (n=550)Footnote *††| 43.3% | 57.8% | 53.2% |

| Paying back the loan is/was stressful for them (n=631)Footnote ***††| 58.9% | 49.0% | 39.2% |

Source: Loan Recipient Survey.

| Impacts of the loan related to settlement | Number of RAP SPO respondents who agreed (n=19) | Number of SAH respondents who agreed (n=17) |

|---|---|---|

| Paying back the loan makes it difficult to pay for basic necessities, like food, clothing and housing | 19 | 14 |

| After taking into account the basic necessities (like food, clothing and housing), paying back the loan takes a large portion of loan recipients' monthly income | 18 | 15 |

| Loan recipients are conscientious about paying back their loan | 19 | 17 |

| Loan recipients are appreciative of the financial assistance to help them come to Canada that is provided by the loan | 16 | 13 |

| Paying back the loan makes it difficult for loan recipients or their families to afford to participate in school/community/recreational activities | 18 | 14 |

| As a result of their loan, loan recipients have learned how to better manage their finances | 8 | 3 |

| During their first year in Canada, loan recipients are focused too much on paying back their loan, rather than on their settlement needs. | 14 | 8 |

| Loan recipients feel proud that they have been able to repay their loan | 12 | 13 |

| Having to repay the loan makes loan recipients feel the need to get into the labour market more quickly | 16 | 13 |

| The loan is a significant source of stress or anxiety for loan recipients and/or their families | 18 | 14 |

| Typically, in the absence of a loan, GARs/PSRs would not be able to afford to pay upfront for the costs of their admissibility (e.g. medical exam) and transportation to Canada (prior to arrival) | 19 | 17 |