Help guide for the Regional Tariff Response Initiative (RTRI) expression of interest form

View the print-friendly version: PDF (481 kB)

This help guide is a companion for the Prairies Economic Development Canada (PrairiesCan) Regional Tariff Response Initiative .

Preparation

- Before beginning your expression of interest (EOI), carefully review the guidelines on the website for this initiative, to ensure your organization is eligible to apply for funding and your proposed activities meet the objective and criteria of the initiative.

- Review this help guide carefully as it contains details on how to answer specific fields exclusively for this initiative.

- This expression of interest will be used to determine whether you will be invited by PrairiesCan to submit a full Regional Tariff Response Initiative (RTRI) application.

- Applicants will normally be limited to 1 successful application for this initiative.

- Fields marked with an asterisk (*) are mandatory and you will be unable to submit your EOI if such fields are left incomplete.

- Incomplete EOIs cannot be assessed and may be deemed ineligible.

- Contact PrairiesCan should you have any questions or wish to discuss your proposed project or other relevant government programs that may be applicable your project.

- For program information about the program, application and assessment process, please see: Regional Tariff Response Initiative (RTRI)

Completing the form

Refer to the guidance below for explanations of how to complete the expression of interest form.

Organization information

- Legal name of applicant organization *

- The legal name as shown on the certificate of incorporation or registration.

- Operating name (if different than legal name)

- Provide the name you are operating under if different from the full legal name.

- Mailing address (Including suite, unit, apt #)

- The mailing address of the applicant organization.

- Email address

- Include the general email address of your organization.

- Website

- Your organization’s website address (if available).

- Corporate Status *

- Indicate if your organization is a for-profit or not-for-profit.

- Organization Type (select best fit) *

- Select from the drop down menu what most accurately reflects your organization type.

- Provide your Canada Revenue Agency (CRA) Business number or Goods and Services Tax (GST) number (first 9 digits only)

- The unique business number or GST number assigned to the applicant organization by the CRA. A business number or GST number must be obtained through the CRA. For information on obtaining a business number visit the CRA’s Business Number Registration page.

- Jurisdiction of Incorporation *

- Select from the drop down menu your organization’s jurisdiction of incorporation.

- Incorporation Number

- As shown on your Certification of Incorporation.

- In the province of

- Indicate in which province the organization was incorporated.

- Date of incorporation

- Indicate the date the organization was incorporated.

- Alternative number type

- Please enter if you do not have a CRA Business Number or Incorporation Number, so your organization can be identified (e.g. band number, education number).

- Number of employees working for your organization (full time equivalents)

- Indicate the number of Full-Time Equivalent employees (FTEs) working for your organization (and if applicable, any affiliated companies). Part-time employees should be calculated based on their equivalent to a FTE (i.e., 1 part time employee working approx. 20 hrs/week should be represented as 0.5 FTE).

- Provide a brief summary of your organization and mandate (Maximum of 500 characters)

-

Provide an overview of your organization. Include:

- the date it was established in Canada

- mandate and key priorities

- how it meets the eligibility criteria, including the impact of tariffs

- whether it is Canadian-owned

- whether it is a subsidiary of another company

Eligible for-profit businesses:

To be eligible for this program, for-profit businesses must meet all of the following criteria:

- have been viable prior to newly imposed tariffs by the U.S., China, and/or Canadian counter-tariffs and prior to March 21, 2025

- employ between 1 and 499 full-time employees

- be incorporated to conduct business in the Prairies

- have been in operation for at least 2 years

- have staffed operating facilities in the Prairie provinces

- have at least 25% of your sales in the markets targeted by tariffs, OR can demonstrate being directly negatively affected by the tariffs or the uncertainty they create. This could be demonstrated by:

- higher cost of materials

- higher cost from suppliers

- higher retail cost of finished product

- fewer purchase orders or sales

- addition of an import or export tax

- loss of access to markets

- other proof of negative impact

- have confirmed, at the time of application submission, funding from all other sources, including government and non-government

- are capable of entering into legally binding agreements

If you are a for-profit business applying for non-repayable contribution funding, you must also:

- generate economic benefits for the local economy or region

- play an important role in supporting the local supply chain

Preference may be given to:

- majority Canadian-owned businesses

- applicants with higher proportions of Canadian inputs

- applicants demonstrating higher leverage of funding from non-PrairiesCan sources

- applicants or industries experiencing a higher severity of tariff impact

Eligible not-for-profit organizations:

To be eligible for this program, not-for-profit* organizations must meet all of the following criteria:

- support businesses, innovators, or entrepreneurs in the Prairie provinces negatively impacted by the new tariffs by the U.S., China and/or Canadian counter-tariffs

- are capable of entering into legally binding agreements

- have an operating presence in the Prairies

*Not-for-profit organizations include post-secondary educational institutions, business accelerator and incubators, angel networks, social enterprises, groups of eligible recipients such as an industry association or consortium, municipalities and other levels of government.

Project primary contact

This person will be contacted for any follow-up on this application.

- Title *

- Provide the contact person’s job title (e.g., President, Executive Director).

- Email address *

- The email at which the primary contact may be reached.

Project secondary contact

- Title

- Provide the contact person’s job title (e.g., President, Executive Director).

- Email address

- The email at which the secondary contact may be reached.

Project information

- Project title (maximum of 90 characters) *

-

Provide a project title beginning with “RTRI-” that accurately reflects the activities and results of the project. The project title:

- must start with the acronym “RTRI-” to be identified as an application to the Regional Tariff Response Initiative

- if you are a business operating in the steel industry applying for non-repayable contribution funding, start your project title with “RTRI steel-”

- can be a maximum of 90 characters including spaces

- will be disclosed on the Open Government Portal website as part of its proactive disclosure guidelines if your project is approved

- Project address is the same as Mailing address on the account?

-

Select “Yes” if the address at which the project will be undertaken is the same as the organization’s mailing address. If checked, the mailing address will be automatically entered.

- Project address / location (Including suite, unit, apt #): *

- If the project address is different from the mailing address, enter the location at which the project will take place.

- Describe your project activities in plain language. The description should include the objectives of the project, as well as, key activities of the project and how these activities will achieve the intended objectives of the project. (Maximum of 1,000 characters including spaces) *

-

Briefly describe your project in plain language. This is important as this section will be used in summary documents to describe your project at various review stages.

The description should:

- provide a high-level overview of the project and its objective

- outline the main elements of the proposed project, including how your project addresses market demand and what the funds will be spent on

- if you are a for-profit business, describe how the project will mitigate the impact of tariffs on your organization

- if you are a not-for-profit organization, describe how the project will assist SMEs impacted by the tariffs

- explain how the project aligns with one or more of the eligible program activities

Eligible activities

- Productivity improvement

- investing in digitization, automation, or technology to enhance business productivity and competitiveness

- reshoring production, research and development operations, recruiting highly qualified personnel and expertise

- Market expansion and diversification

- developing and diversifying markets to help businesses find new customers

- business support, market development in all markets, and guidance services, e.g., advice for businesses from a sectoral intermediary organization

- Strengthening supply chains and trade resilience

- optimizing global supply chain logistics and ensuring compliance with standards to gain market access and/or enhance sales

- strengthening domestic supply chains and facilitating internal trade to increase the resilience of businesses and the reliability of domestic markets.

RTRI funding does not support projects that move company operations outside of Canada.

- Briefly describe the economic benefits associated with this project. (1,000 characters including spaces) *

-

Provide an explanation on what economic outcomes your project will achieve. Identify and detail all assumptions to support the reasonableness of your economic outcomes. All projects will be screened for significance of outcomes and the likelihood of achieving them.

Describe the economic benefits associated with your project and provide numerical values measured year over year from the project start date typically to 1 year following the project completion date. Anticipated outcomes include:

- number of highly qualified personnel (HQP), including science, technology, engineering, and mathematics (STEM), jobs created in Canada

- number of non-HQP jobs created in Canada

- revenue growth ($)

- export sales growth ($)

- incremental private sector investment attracted ($)

- number of technologies to market – where applicable

- number of Prairie businesses with new domestic sales

- number of new technologies or processes implemented to decrease the cost of production – where applicable

- value of business expenditures in research and development ($) – where applicable

- number of SMEs assisted (for not-for-profit projects only)

If your project supports the Government of Canada’s commitment to inclusive growth (under-represented groups) you may include this in your explanation. Note: recipients will be encouraged to track inclusiveness indicators (i.e., women, Indigenous Peoples, and youth).

You will be provided another opportunity to explain in the Benefits section. Refer to the expected results for more details.

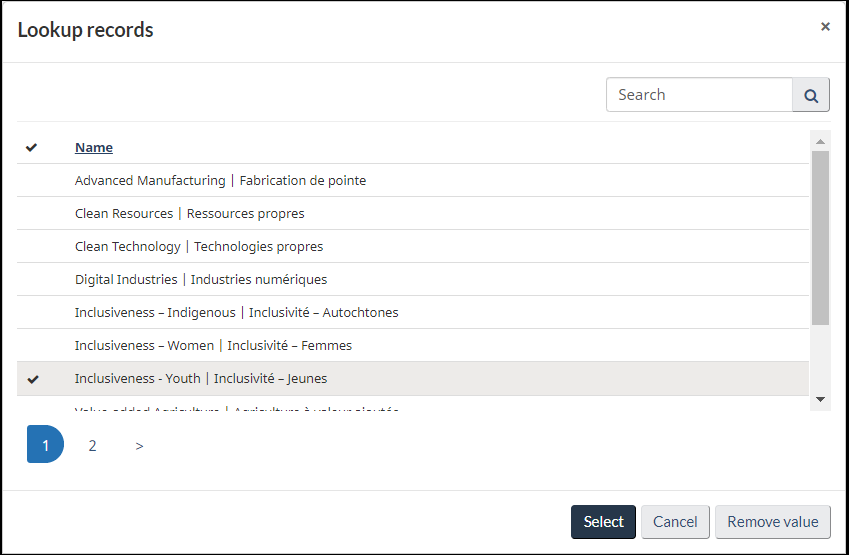

- Which regional development agency (RDA) Priority does this project best support?

-

The RTRI is open to all sectors of the economy impacted by the newly imposed tariffs.

If you are a business operating in the steel industry, choose “Other”.

Otherwise, select 1 of the following priorities that best aligns with your project’s objectives, activities, and outcomes.

To select 1 of the RDA’s priorities, click on the magnifying glass icon and the “Lookup records” window will appear where you can then select a priority.

- Advanced Manufacturing – Developing and adopting innovative technologies to:

- Create new products

- Enhance processes

- Establish more cost-effective ways of working

- Clean Resources – Transitioning from the old resource economy into a new resource economy. It’s where innovation drives economic and environmental competitiveness in the energy, mining and forestry sectors. It leverages Canada’s natural resources advantage to transition to a low-carbon economy.

- Clean Technology – This refers to any process, product or service that reduces environmental harm to:

- Control costs

- Meet new regulations

- Improve global competitiveness

- Reduce harm, to climate, water, land, and air

- Digital Industries – Includes companies operating in information and communications technologies, digital and interactive media, and content industries.

- Health/Bio-sciences – Includes pharmaceutical development, medical device and biomedical innovations, digital health solutions, precision health, and disruptive technologies including AI, big-data analytics, 3-D printing, robotics, and nanotechnologies.

- Natural Resources Value-added Processing – Includes processing natural resources in the energy, mineral, or forestry sectors to add value to raw materials.

- Value-added Agriculture – A complex and interdependent sector that includes agriculture, fisheries, and aquaculture, and food and beverage processing.

- Inclusiveness – Supporting under-represented groups such as Indigenous peoples, women, youth (between ages 15 and 34) and other under-represented groups

- Other – refers to an area that does not fall under one of the priority areas listed above. If you are a business operating in the steel industry, use this area

- Advanced Manufacturing – Developing and adopting innovative technologies to:

- Explain how this project supports the indicated priority. (Maximum of 2,000 characters).

- If you are a business operating in the steel industry, indicate that you are a steel applicant. Explain in detail how the project’s objectives, activities, and outcomes align with the selected RDA priority as well as other PrairiesCan key priorities where applicable.

Project timelines

- Proposed project start date *

-

This is the proposed date the agreement between the Recipient and PrairiesCan could come into effect.

- The start date must be on or after March 21, 2025.

- Costs may be eligible on a retroactive basis for a 12-month period prior to receipt of a funding request, but no earlier than March 21, 2025.

- If the application is approved, eligible project costs incurred on or after this date may be reimbursed with proper documentation.

- Any costs incurred prior to the project start date would not be eligible for reimbursement under the terms of the agreement and are outside of the scope of the project.

- The start date must be on or after March 21, 2025.

- Proposed project end date *

-

This is the anticipated date the project activity will cease.

- Project end date must be on or before the program end date of March 31, 2028

- This does not include the repayment period when applicable.

- Any costs incurred after this date are not eligible for reimbursement under RTRI.

- Project end date must be on or before the program end date of March 31, 2028

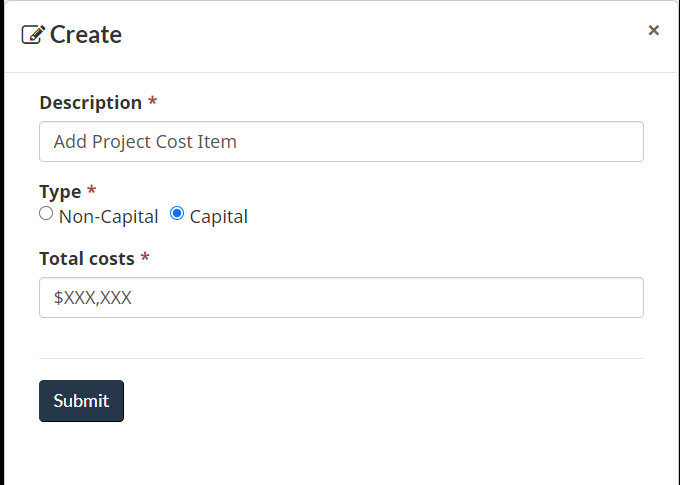

Project costs

RTRI funding for businesses normally ranges from $500,000 to $5 million per project. Eligible businesses may apply for up to $1 million of non-repayable funding.

- Description *

-

List the various cost items you anticipate incurring in the implementation of the project. Each cost item should have its own line (see instructions below).

Recipients must ensure all project cost items are clearly verifiable.

Project costs incurred by the applicant in the absence of a signed funding agreement with PrairiesCan are incurred at the sole risk of the applicant.

Eligible costs

Eligible costs under the program are incremental, reasonable and essential to carrying out the eligible project activities. Eligible costs can include the following:

- labour costs (e.g. wages and benefits) and material costs

- capital costs (e.g. purchase of machinery or equipment)

- management fees

- consultancy fees (e.g. professional, advisory and technical services)

- advisory expenses (e.g., planning, business information, counselling advisory services; coaching, mentoring or networking events; workshops or conference fees; fees associated with participation in business training through a business service organization)

- costs related to expanding or maintaining markets

Costs may be eligible on a retroactive basis up to a 12-month period prior to the receipt of a signed funding request, but no earlier than March 21, 2025.

Ineligible costs

Costs that are deemed not reasonable, non-incremental, and/or not directly related to the project are ineligible for funding. These can include, but are not limited to:

- basic and applied R&D (technology readiness levels 1-6)

- land acquisition and goodwill

- salary bonuses and dividend payments

- entertainment and hospitality expenses

- refinancing of existing debts

- amortization or depreciation of assets

- purchase of any assets for more than their fair market value

- lobbying activities

- donations, dues, and membership fees

Generally, the following costs/activities will not be supported:

- business plan preparation

- hospitality and other related costs

- sole sourced consultant fees

- fees related to advocacy work

- Type *

- Indicate if the cost is capital (e.g. purchase of equipment and associated costs such as installation) or non-capital (e.g. salaries, professional fees).

- Amount *

- The anticipated amount of the cost item.

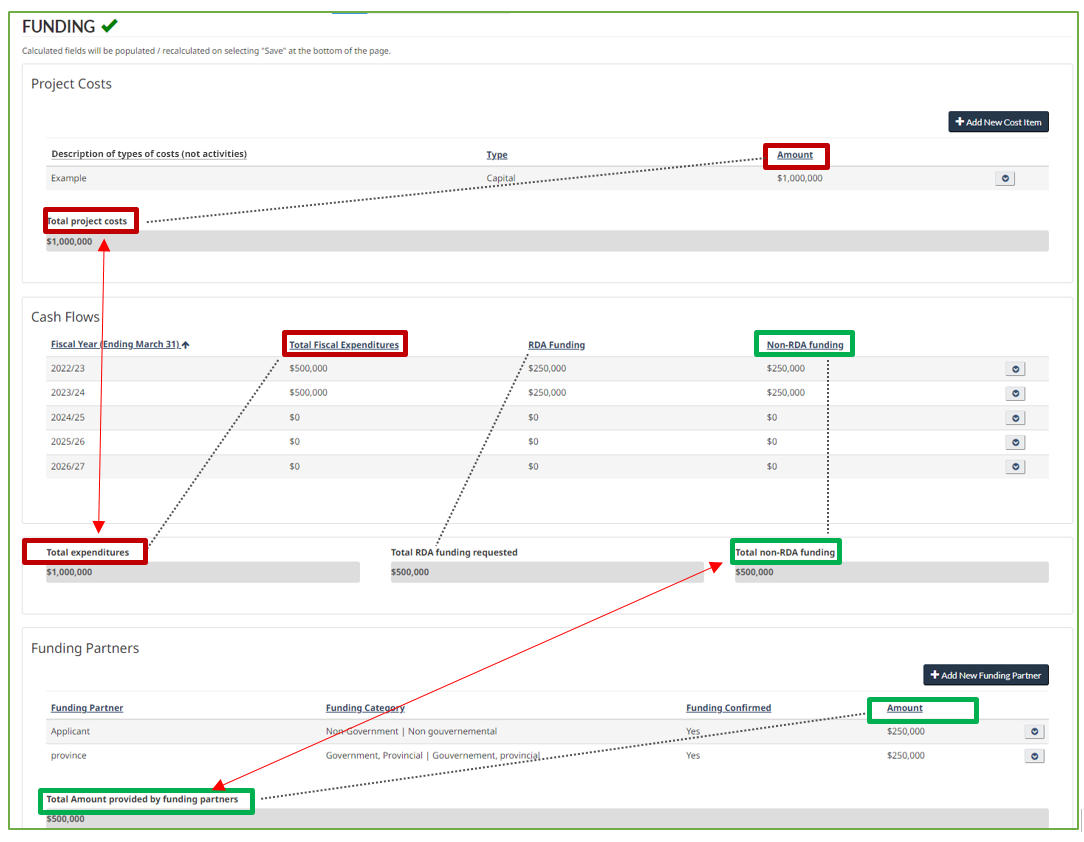

- Total Project Costs

-

Automatically sums the cost items listed above.

Note: This total must equal the Total expenditures from the Cash Flows section below.

To add a project cost item, click on the ![]() button and the following window will appear for you to provide the information. Click the Submit button once complete. You will still have the ability to edit the project cost item after hitting this Submit button.

button and the following window will appear for you to provide the information. Click the Submit button once complete. You will still have the ability to edit the project cost item after hitting this Submit button.

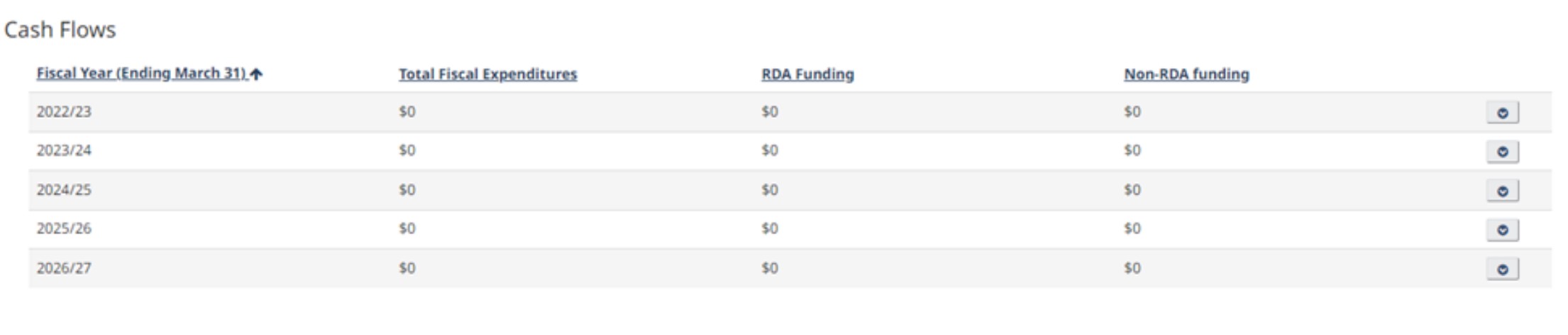

Cash flows

Financial assistance information

- Applicants are normally limited to one RTRI project approval.

- Minimum funding request of $500,000 and maximum of $5 million per project

- PrairiesCan will take into consideration all other sources of funding available to the applicant and may give preference to projects that demonstrate greater leverage of funding from non-PrairiesCan sources

- Government funding (federal, provincial, and municipal) can cover up to:

- 90% of project costs for businesses or commercial (revenue-generating) projects

- 100% of project costs for non-commercial projects

- Eligible business applicants can apply for up to $1 million in non-repayable contribution funding, otherwise funding is normally repayable. Funding can cover up to 50% of eligible project costs

- The remaining 50% of eligible costs must be supported from a non-PrairiesCan source and must be confirmed at time of application and again prior to project approval

- Not-for-profit applicants can apply for non-repayable contribution funding of up to 90% of eligible

- The remaining 10% of eligible costs must be supported from a non-PrairiesCan source and must be confirmed at time of application and again prior to project approval

- For commercial (revenue-generating) projects, funding will normally be repayable contribution funding for up to 75% of eligible project costs

- Indigenous applicants may receive funding for up to 80% of eligible project costs for commercial (revenue-generating) project or up to 100% of eligible project costs for non-commercial projects.

Fiscal Year (Ending March 31): Year 1

- Total Fiscal Expenditures

- Anticipated total project costs incurred in Year 1.

- RDA Funding

- The amount of PrairiesCan funding being requested to support Year 1 expenses.

- Non-RDA Funding

- Automatically generated: the expenditures not covered by PrairiesCan funding.

Fiscal Year (Ending March 31): Year 2

- Total Fiscal Expenditures

- Anticipated total project costs incurred in Year 2.

- RDA Funding

- The amount of PrairiesCan funding being requested to support Year 2 expenses.

- Non-RDA Funding

- Automatically generated: the expenditures not covered by PrairiesCan funding.

Fiscal Year (Ending March 31): Year 3

- Total Fiscal Expenditures

- Anticipated total project costs incurred in Year 3.

- RDA Funding

- The amount of PrairiesCan funding being requested to support Year 3 expenses.

- Non-RDA Funding

- Automatically generated: the expenditures not covered by PrairiesCan funding.

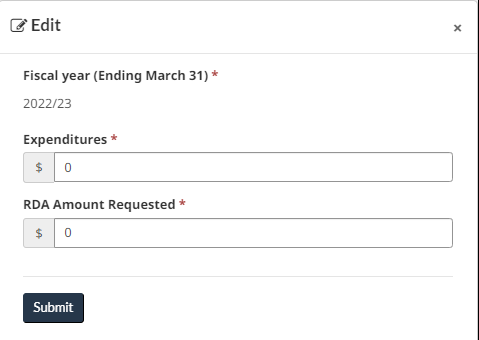

- To enter cash flow information, click the down arrow on the far right for the fiscal year you are interested in. Click the Edit option that appears. Note: the fiscal years shown below are for illustrative purposes only.

- Enter the “Expenditures” and “RDA Amount Requested” information and then hit Submit. You will still have the ability to edit the project cost item after hitting this Submit button. Note: the fiscal year shown below is for illustrative purposes only.

- RDA funding requested *

- This is the sum of the RDA Funding column in the Cash Flows section. It is automatically calculated.

- Total expenditures *

- This is the sum of the Total Fiscal Expenditures column in the Cash Flows section. It is automatically calculated.

Note: This total must equal the Total project costs from the Project Costs section above. - Total non-RDA funding *

- This is the sum of the Non-RDA Funding column in the Cash Flows section. It is automatically calculated.

Note: This total must equal the Amount provided by funding partners from the Funding Partners section below.

The solid arrows point to the fields that must balance and the dotted lines indicate what column is being summed to produce those totals. Note: the fiscal years shown above are for illustrative purposes only.

Funding partners *

- Funding Partner

The first entry in the list of funding partners is reserved for your own organization (the “Applicant”). Add other funding partners or contributors, if any, in subsequent rows.

Identify all potential project partners that will provide monetary or in-kind contributions.

Guidelines for in-kind costs/contributions

Only project costs incurred and directly paid by the applicant can be reimbursed by PrairiesCan.

An in-kind contribution is a project cost that does not involve an expense incurred and paid for by the project applicant. Typically, these expenses are borne by third parties for items or services that are in turn provided to the applicant at no cost or at a reduced cost (e.g., a deep discount not typically offered to others).

In-kind costs:

- are used to demonstrate a more accurate picture of the project scope, including:

- project funding

- project leveraging

- demonstration of participant and/or private sector contributions to a project.

- must be for an item considered by PrairiesCan to be essential to a project ’s success, eligible under the programming, and would otherwise be purchased and paid for by the applicant.

- may only be included in the project when there is a clear plan and commitment from the applicant on how the costs can be verified.

Example: An industry partner will provide trucks to a college for use in a project to train truck drivers.

- The college did not incur or pay any incremental costs but the project could not reasonably go forward without the trucks, so this would be an in-kind contribution to project costs.

- The value of the trucks to the project can be quantified via sales records.

Note: applicants must ensure all contributions (including in-kind contributions) are clearly verifiable.Other government assistance, SR&ED and other tax credits

PrairiesCan considers tax credits received for activities undertaken between the project start and end date as a source of government assistance. Such credits are included when calculating the total amount of government funding that has been provided to a project.

Successful applicants who are in receipt of Scientific Research & Experimental Development (SR&ED) tax credits and other similar federal or provincial tax credits for activities defined in the project are required to inform PrairiesCan. PrairiesCan may be required to reduce its overall level of project funding to ensure the total amount of government assistance does not exceed 90% of project costs.

The Canada Revenue Agency (CRA) may consider funding received from RTRI to be government assistance, even though it will eventually be repaid.

Applicants are strongly advised to seek independent professional advice to determine the potential effect of RTRI funding on project activities for which SR&ED tax credits, or other federal and provincial tax credits or funding, are likely to be sought.

- are used to demonstrate a more accurate picture of the project scope, including:

- Funding Category

-

Select from the drop down menu the description that best reflects the funding source.

- Funding Confirmed

- Indicate if the funding has been confirmed.

In the case where your organization (Applicant) is a source of funding, indicate yes if you have cash on hand. - Amount

- The anticipated amount of funding this partner will provide.

- Amount provided by funding partners

- Automatically sums the funding amounts listed above.

Note: This total must equal the Total non-RDA funding from the Cash Flows section above.

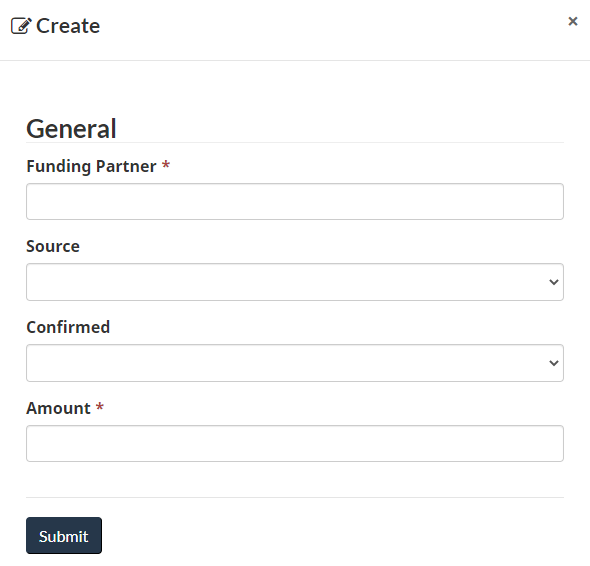

- To add a funding partner, click on the

button and the following window will appear for you to input the information. Click the Submit button once complete. You will still have the ability to edit the project cost item after hitting this Submit button.

button and the following window will appear for you to input the information. Click the Submit button once complete. You will still have the ability to edit the project cost item after hitting this Submit button.

- To edit what your organization will be contributing towards this project, click the down arrow on the far right for the fiscal year you are interested in. Click the Edit option that appears and a similar pop-up window as shown above will appear.

- Briefly describe any partnerships (non-financial and financial) for this project (maximum of 1200 characters including spaces): *

- Describe your management team (including board or directors, advisors) and/or partnerships that would be important to the success of the proposed project.

Documents

Upload the following required documents to be provided with your EOI:

- supporting documents

- incorporation documents for your organization and proof of signing authority (e.g. bylaws, articles of incorporation, board minutes or record of decision)

- a business plan or pitch deck providing details about your organization (including management team, board of directors) and details about the proposed project

- a signed Regional Tariff Response Initiative attestation and supplemental form must be completed, signed, and submitted with your EOI; download the fillable PDF form here

- other supporting documentation

- financial statements

- for the past 2 years

- interim financial statements for at least the last 6 months

- confirmed funding

- confirmation of non-PrairiesCan project funding* (e.g. bank statements, unused portion of lines of credit, official letters of intent, funding agreements, signed term sheets)

Signing authority

Indicate here the individual within your organization who has signing power / the authority to enter into an agreement. This person may be different from the contact person.

- Title *

- Provide the contact person’s job title (e.g., President, Executive Director).

- Email address *

- The email at which the primary contact may be reached.

Diversity and inclusion

The Government of Canada is committed to diversity and inclusion so that all Canadians have the opportunity to participate in and contribute to the growth of the economy. Gender and diversity data collected may be used for research, statistics, program and policy evaluation, risk management, strategy development, reporting, and gender-based analysis (including GBA+). This information can help the Government of Canada monitor progress on inclusive access to federal support programs and services; to identify and remove barriers; and, to make changes to improve inclusive access. The Government of Canada understands that participation of underrepresented groups is an integral part of building strong and inclusive communities and economy.

No personal identifying information will be shared. Aggregate and anonymous data may be shared with other federal organizations and/or published for reporting and monitoring purposes.

Unless otherwise directed by the program, the following gender and diversity data will not be used to assess the application. It is being collected for statistical purposes and may feed into future programming.

- Is your organization majority (i.e. over 50%) owned or led by individuals who self identify as:

- Definition: majority owned or led is defined as individuals with long-term control and management of the organization and an active role in both strategic and day-to-day decision making.

If applicable, please indicate whether your organization is led or majority-owned by one or more of the listed groups. Note that this information may be used in the assessment process. Aggregate and anonymous data may be shared with other federal organizations, and/or published for reporting and monitoring purposes. If you do not know if a particular group is involved in the management team, or prefer not to answer, please select ‘prefer not to answer/do not know’ from the drop down box. - Will your project directly support any of the following diverse groups?

- This question is regarding the people that will benefit from this project. Will your project directly support any of the groups listed? If so, please answer ‘yes’. If you do not know if your project will directly support a particular group, or prefer not to answer, just leave the field blank.

- If yes, please specify (maximum of 1,500 characters, including spaces)

- Provide an explanation.

Validation

For this step, any errors or omissions in the form will be brought to your attention, and you will be given the opportunity to review them, and make necessary corrections.

Attestation

Before you can complete and submit your expression of interest, it is necessary in this final step for you to affirm that you are aware of certain statutory obligations, and that your organization meets the eligibility requirements for the Regional Tariff Response Initiative. The attestation must be completed by a member of your organization with signing power/authority to enter into a legal agreement. For your reference, the complete text of this attestation is given below.

Please select “I agree” to affirm, and then submit using the “Submit” button.

On behalf of the Applicant Organization, I hereby acknowledge and agree that:

- This expression of interest does not constitute a commitment from Prairies Economic Development Canada (PrairiesCan) for financial assistance.

- Any person who has been lobbying on behalf of the Applicant Organization to obtain a contribution as a result of this expression of interest is registered pursuant to the Lobbying Act and was registered pursuant to that Act at the time the lobbying occurred.

- The Applicant Organization is under no obligation or prohibition, nor is it subject to, or threatened by any actions, suits or proceedings, which could or would affect its ability to implement this proposed project.

- The Applicant Organization has not, nor has any other person, corporation or organization, directly or indirectly paid or agreed to pay any person to solicit a contribution arising as a result of this expression of interest for a commission, contingency fee or any other consideration dependent on the execution of an Agreement or the payment of any contribution arising as a result of this expression of interest.

- Prairies Economic Development Canada (PrairiesCan) and Pacific Economic Development Canada (PacifiCan) are government institutions as defined under the Access to Information (ATI) Act. Records in the custody and care of the institution are subject to disclosures under Part 1 and Part 2 of the ATI Act with limited exceptions and exclusions.

- Personal information collected by PrairiesCan is collected in accordance with section 4 of the Privacy Act (R.S.C., 1985, c. P-21). This information will be used to determine eligibility, administer grants and contributions, and evaluate program effectiveness. Personal information collected is described in the Personal Information Bank entitled “Grants and Contributions”, number PrairiesCan-PPU-055. Questions regarding the collection and use of your personal information may be directed to the ATIP Coordinator, PrairiesCan, Canada Place, 1500-9700 Jasper Avenue NW, Edmonton, Alberta T5J 4H7, by telephone at 780-495-4164, or by email to atip-aiprp@prairiescan.gc.ca.

If you choose not to provide the personal information, your application may not be processed.

You have a right under section 12 of the Privacy Act to access to your personal information under the control of PrairiesCan as well as a right to request correction of personal information where there is an error or omission. You have the right to make a complaint to the Office of the Privacy Commissioner under section 29(1) of the Privacy Act regarding PrairiesCan’s collection, use, and disclosure of your personal information, processing of your request for correction of personal information or processing of your access to personal information request.

I authorize PrairiesCan, its officials, employees, agents and contractors to make credit checks and enquiries of such persons, firms, corporations, federal, provincial and municipal government departments/ agencies, and non-profit, economic development or other organizations as may be appropriate, and to collect and share information with them, as PrairiesCan deems necessary in order to assess this expression of interest, to administer and monitor the implementation of the subject project, and to evaluate the results of the project and related programs.