Regional Tariff Response Initiative (RTRI) applicant guide

Table of contents

- Purpose of this guide

- RTRI objectives

- Preparation

- Elements of a strong application

- Access to Information Act and Privacy Act Statement

- Frequently asked questions (FAQs)

- How to complete the application

- After you apply

- Assessment process

- Funding disbursement

- Repayment terms for repayable funding

- Environmental assessment compliance

- Reporting requirements

- Glossary

- All elements marked with an asterisk (*) are mandatory.

- Prairies Economic Development Canada (PrairiesCan) reserves the right to modify these guidelines at any time without notice.

Purpose of this guide

The purpose of this Applicant Guide is to provide information to assist you with the completion of your full application for funding under the Regional Tariff Response Initiative (RTRI).

RTRI objectives

The RTRI helps businesses and sectors negatively impacted by the new tariffs from the U.S., China and/or Canadian counter-tariffs. The goal is to boost productivity, catalyze growth, and diversify markets by:

- raising productivity, enhancing competitiveness and reducing costs, thereby mitigating tariff impacts within the firms; and

- improving resiliency among Canadian businesses through more robust domestic supply chains, enhanced internal trade, market diversification and future-proofing their operations.

Preparation

- Before beginning your application, carefully review the guidelines on the website for this initiative, to ensure your organization is eligible to apply for funding and your proposed activities meet the objective and criteria of the initiative.

- Review this help guide carefully as it contains details on how to answer specific fields exclusively for this initiative.

- This application will be used to determine whether your project will be funded by PrairiesCan under RTRI.

- Applicants will normally be limited to one (1) successful application for this initiative.

- Fields marked with an asterisk (*) are mandatory, and you will be unable to submit your application if such fields are left incomplete.

- Incomplete applications cannot be assessed and may be deemed ineligible.

- PrairiesCan will not assess saved applications that have not been submitted.

- Signing and submitting the application form does not constitute a commitment from PrairiesCan for financial assistance.

- Contact PrairiesCan should you have any questions or wish to discuss your proposed project or other relevant government programs that may be applicable to your project.

- For program specific guidelines, please see:

Elements of a strong application

A strong application is complete, clearly shows you’re eligible, and includes enough detail for PrairiesCan to thoroughly review and confirm the information.

All applications must demonstrate clear alignment with RTRI objectives.

Strong application for commercial (revenue-generating) projects

Will also include the following:

- a clear description of how the applicant has been directly impacted by tariffs and/or trade uncertainty, including numbers (dollars, percentages, etc.) where possible and supported by documentation

- an independent market assessment and/or proof of unmet market demand

- identification and assessment of direct competitors

- detailed information about the applicant and the project management team

- credible financial statements with logical and reasonable financial projections

- demonstrated financial capacity to carry out the project and the ability to repay the funding (if applicable)

- significant expected economic benefits for the Prairie provinces and/or local economy supported by reasonable assumptions and rationale

Strong application for non-commercial projects

Will also include the following:

- strong market/industry demand (such as the project supports SMEs directly or indirectly impacted by the ongoing trade uncertainty, including the recently imposed tariffs by the U.S., China and/or Canadian counter-tariffs)

- measurable economic benefits for the prairie provinces

- effective governance measures and management team in place to carry out the project

- strong, evidence-based rationale for the project

- financial statements that demonstrate the organization is financially self-sustaining well leveraged (more than 10%) by non-PrairiesCan sources of funding with written proof.*

*Written proof, confirmed or conditional upon PrairiesCan’s funding, will be considered acceptable confirmation of non-PrairiesCan funding.

- Examples of written proof include current bank statements detailing existing cash balances or the unused portion of lines of credit.

- If third parties are included in project funding, letters of intent or funding agreements from third parties, may be acceptable.

Access to Information Act and Privacy Act Statement

Prairies Economic Development Canada (PrairiesCan) is a government institution subject to the Access to Information Act and the Privacy Act. Applicants should be aware that information provided during the application process and throughout program participation is under the care and control of PrairiesCan and may be subject to Access to Information Act or Privacy Act requests. Please review the application attestation form and contribution agreement for statements regarding how PrairiesCan manages collection, use and disclosure of information.

Frequently asked questions (FAQs)

Please refer to our website for more information on the RTRI and other PrairiesCan programs.

How to complete the application

Tips

- Fields marked with an asterisk (*) are mandatory and you will be unable to submit your application if these fields are incomplete.

- Character count includes spaces.

- Remember to click save after each section.

- A glossary of terms used in the guide/application can be found at the end of this document.

Organization information

- Legal name of applicant organization: *

-

The legal name as shown on the certificate of incorporation or registration.

- Operating name (if different than legal name):

-

Provide the name you are operating under if different from the full legal name.

- Mailing address (Including suite, unit, apt #): *

-

The mailing address of your organization.

- Mailing address line 2:

-

Additional mailing address information.

- City: *

-

The city in which your organization resides.

- Province/Territory:

-

The province in which your organization resides.

- Country: *

-

The country in which your organization resides.

- Mailing postal code: *

-

The mailing postal code of your organization.

- Telephone country code: *

-

The telephone country code of your organization.

- Telephone: *

-

The telephone number of your organization.

- Facsimile country code:

-

The facsimile country code of your organization.

- Facsimile:

-

The facsimile number of your organization.

- Website:

-

Your applicant organization’s website address (if available).

- Email address:

-

Include the general email address of your organization.

- Are you an Indigenous (First Nation, Métis or Inuit) organization or government? *

-

Select yes or no.

- Corporate Status: *

-

Indicate if your organization is a for-profit or not-for-profit.

- Organization Type (select best fit): *

-

Select from the drop down menu that most accurately reflects your organization type.

- I have a Canada Revenue Agency (CRA) Business Number:*

-

Select yes or no.

- Provide your CRA Business number or GST number (first 9 digits only):

-

The unique business number or GST number assigned to your organization by the CRA. A business number or GST number must be obtained through the CRA. For information on obtaining a business number visit the website of the CRA.

- Jurisdiction of Incorporation: *

-

Select from the drop down menu your organization’s jurisdiction of incorporation.

- Incorporation number:

-

As shown on your certification of incorporation.

- In the province of:

-

Indicate in which province your organization was incorporated.

- Date of incorporation:

-

Indicate the date your organization was incorporated.

- Alternative number and Alternative number type:

-

Enter if you do not have a CRA Business Number or Incorporation Number, so your organization can be identified (such as band number, education number).

- Number of employees working for your organization (full time equivalents): *

-

Indicate the number of full-time equivalent employees (FTEs) working for your organization (and any affiliated companies if applicable). Part-time employees should be calculated based on their equivalent to an FTE (in other words, 1 part time employee working approximately 20 hours per week should be represented as 0.5 FTE).

- Provide a brief summary of your organization (Maximum of 500 characters). *

-

Provide an overview of your organization. Include:

- the date it was established in Canada

- mandate and key priorities

- how it meets the eligibility criteria, including the impact of tariffs

- whether it is Canadian-owned

- whether it is a subsidiary of another company

Eligible incorporated businesses

To be eligible for this program, for-profit businesses must meet all of the following criteria:

- have been viable prior to newly imposed tariffs by the U.S., China, and/or Canadian counter-tariffs and prior to March 21, 2025

- employ between 1 and 499 full-time employees

- be incorporated to conduct business in the Prairies

- have been in operation for at least 2 years

- have staffed operating facilities in the Prairie provinces

- have at least 25% of your sales in the markets targeted by tariffs, OR can demonstrate being directly negatively affected by the tariffs or the uncertainty they create. This could be demonstrated by:

- higher cost of materials

- higher cost from suppliers

- higher retail cost of finished product

- fewer purchase orders or sales

- addition of an import or export tax

- loss of access to markets

- other proof of negative impact

- have confirmed, at the time of application submission, funding from all other sources, including government and non-government

- are capable of entering into legally binding agreements

If you are a for-profit business applying for non-repayable contribution funding, you must also:

- generate economic benefits for the local economy or region

- play an important role in supporting the local supply chain

Preference may be given to:

- majority Canadian-owned businesses

- applicants with higher proportions of Canadian inputs

- applicants demonstrating higher leverage of funding from non-PrairiesCan sources

- applicants or industries experiencing a higher severity of tariff impact

Eligible not-for-profit organizations

- To be eligible for this program, not-for-profit* organizations must meet all of the following criteria:

- support businesses, innovators, or entrepreneurs in the Prairie provinces negatively impacted by the new tariffs by the U.S., China and/or Canadian counter-tariffs

- are capable of entering into legally binding agreements

- have an operating presence in the Prairies

*Not-for-profit organizations include post-secondary educational institutions, business accelerator and incubators, angel networks, social enterprises, groups of eligible recipients such as an industry association or consortium, municipalities and other levels of government.

Click Save.

Project primary and secondary contacts

If you have an existing portal account, the project contact may be selected and sub-sections will be pre-filled.

- Project Primary Contact *

-

This person will be contacted for any follow-up on this application. Enter primary contact person information in the sub-sections (first name, last name, title, email address, cellular phone country code, cellular phone, telephone country code, telephone).

- Project Secondary Contact

-

This person will be contacted if the primary contact is unavailable. Enter secondary contact person information in the sub-sections (first name, last name, title, email address, secondary cellular phone country code, secondary cellular phone, secondary telephone country code, secondary telephone).

Project information

- Project title (maximum of 90 characters): *

-

Provide a project title beginning with “RTRI-” that accurately reflects the activities and results of the project. The project title:

- must start with the acronym “RTRI-” to be identified as an application to the Regional Tariff Response Initiative

- if you are a business operating in the steel industry applying for non-repayable contribution funding, start your project title with “RTRI steel-”

- can be a maximum of 90 characters including spaces

- will be disclosed on the Open Government Portal website as part of its proactive disclosure guidelines if your project is approved

- Project address is the same as mailing address? *

-

Select “Yes” if the address at which the project will be undertaken is the same as the organization’s mailing address. If checked, the mailing address will be automatically entered.

- Project address / location (Including suite, unit, apt #): *

-

If the project address is different from the mailing address, enter the location at which the project will take place.

- Project address line 2:

-

If you would like to provide additional project address information, please fill out this section.

- Project city, province/territory, and postal code. *

-

The project location address.

- Briefly describe your project activities in plain language. This is an important section as it will be used in summary documents to describe your project at various review stages (maximum of 1,000 characters including spaces).*

-

Briefly describe your project in plain language. This is important as this section will be used in summary documents to describe your project at various review stages.

The description should:

- provide a high-level overview of the project and its objective

- outline the main elements of the proposed project, including how your project addresses market demand and what the funds will be spent on

- if you are a for-profit business, describe how the project will mitigate the impact of tariffs on your organization

- if you are a not-for-profit organization, describe how the project will assist SMEs impacted by the tariffs

- explain how the project aligns with one or more of the eligible program activities

A suggested opening sentence could be: ABC Company will identify export opportunities in Europe and hire an expert that will enable … etc. ABC Company will demonstrate xyz prototype, or adopt technology abs that will enable … etc.

You will have an opportunity to provide a Full Project Description in the Timelines section.

Eligible activities

- Productivity improvement

- investing in digitization, automation, or technology to enhance business productivity and competitiveness

- reshoring production, research and development operations, recruiting highly qualified personnel and expertise

- Market expansion and diversification

- developing and diversifying markets to help businesses find new customers

- business support, market development in all markets, and guidance services, e.g., advice for businesses from a sectoral intermediary organization

- Strengthening supply chains and trade resilience

- optimizing global supply chain logistics and ensuring compliance with standards to gain market access and/or enhance sales

- strengthening domestic supply chains and facilitating internal trade to increase the resilience of businesses and the reliability of domestic markets

RTRI funding does not support projects that move company operations outside of Canada.

- Briefly describe the economic benefits associated with this project. (1,000 characters including spaces) *

-

Provide an explanation on what economic outcomes (such as job creation, revenue growth, etc.) your project will achieve. Identify and detail all assumptions to support the reasonableness of your economic outcomes. All projects will be screened for significance of outcomes and the likelihood of achieving them.

Describe the economic benefits associated with your project and provide numerical values measured year over year from the project start date typically to 1 year following the project completion date. Anticipated outcomes include:

- number of highly qualified personnel (HQP), including science, technology, engineering, and mathematics (STEM), jobs created in Canada

- number of non-HQP jobs created in Canada

- revenue growth ($)

- export sales growth ($)

- incremental private sector investment attracted ($)

- number of technologies to market – where applicable

- number of Prairie businesses with new domestic sales

- number of new technologies or processes implemented to decrease the cost of production – where applicable

- value of business expenditures in research and development ($) – where applicable

- number of SMEs assisted (for not-for-profit projects only)

If your project supports the Government of Canada’s commitment to inclusive growth (under-represented groups) you may include this in your explanation. Note: recipients will be encouraged to track inclusiveness indicators.

You will be provided another opportunity to explain in the Benefits section. Refer to the expected results for more details.

- Which RDA priority does this project best support? *

-

- Explain how this project supports the indicated priority. (Maximum of 2,000 characters) *

-

If you are a business operating in the steel industry, indicate that you are a steel applicant. Explain in detail how the project’s objectives, activities and outcomes align with the selected priority as well as other PrairiesCan key priorities where applicable.

The RTRI is open to all sectors of the economy impacted by the newly imposed tariffs.

If you are a business operating in the steel industry, choose “Other”.

Otherwise, select 1 of the following priorities that best aligns with your project’s objectives, activities, and outcomes.

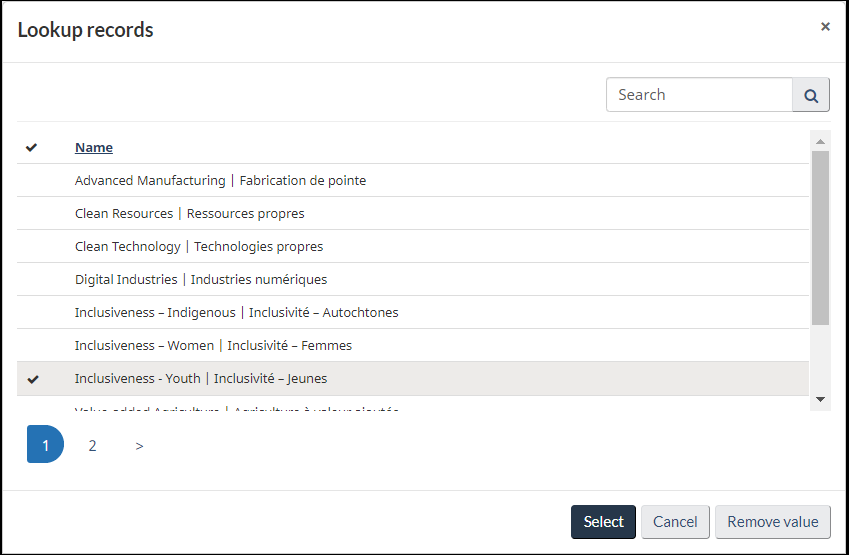

To select 1 of the priorities, click on the magnifying glass icon, and the “Lookup records” window will appear where you can then select a priority from. Scroll down for “Other.” For example:

Project timelines

- Proposed start date: *

-

This is the proposed date the agreement between the Recipient and PrairiesCan could come into effect.

- The start date must be on or after March 21, 2025.

- Costs may be eligible on a retroactive basis for a 12-month period prior to receipt of a signed funding request, but no earlier than March 21, 2025.

- If the application is approved, eligible project costs incurred on or after the project start date may be reimbursed with proper documentation.

- Any costs incurred prior to the project start date are not eligible for reimbursement under the terms of the agreement and are outside of the scope of the project.

- Proposed end date: *

-

This is the anticipated date the project activity will cease.

- Project end date must be on or before the program end date of March 31, 2028.

- This does not include a repayment period when applicable.

- Any costs incurred after this date are not eligible for reimbursement under RTRI.

- Project end date must be on or before the program end date of March 31, 2028.

Click Save.

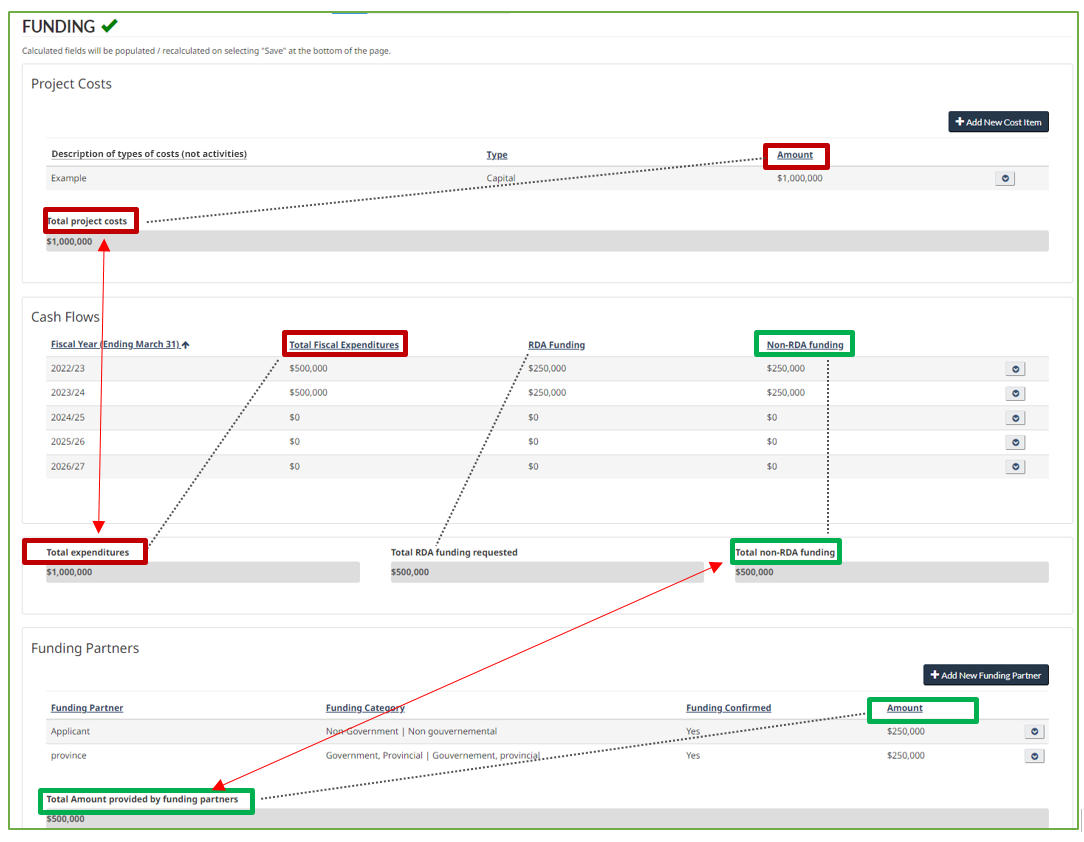

Funding

- Project costs *

-

RTRI repayable contribution funding for businesses normally ranges from $500,000 to $5 million per project. Eligible businesses may apply for up to $1 million of non-repayable contribution funding.

- Description

-

List the various cost items you anticipate incurring in the implementation of the project. Each cost item should have its own line (see instructions below).

Recipients must ensure all project cost items are clearly verifiable.

Project costs incurred by the applicant in the absence of a signed contribution agreement with PrairiesCan are incurred at the sole risk of the applicant.

Eligible costs

Eligible project costs under the program are incremental, reasonable and essential to carrying out the eligible activities. Eligible costs can include, but are not limited to:

- labour costs (e.g. wages and benefits) and material costs

- capital costs (e.g. purchase of machinery or equipment)

- management fees

- consultancy fees (e.g. professional, advisory and technical services)

- advisory expenses (e.g., planning, business information, counselling advisory services; coaching, mentoring or networking events; workshops or conference fees; fees associated with participation in business training through a business service organization)

- costs related to expanding or maintaining markets

Costs may be eligible on a retroactive basis up to a 12-month period prior to the receipt of a signed funding request, but no earlier than March 21, 2025.

Ineligible costs

Costs and activities that are deemed not reasonable, non-incremental, and/or not directly related to the project are ineligible for funding. These can include, but are not limited to:

- basic and applied R&D (technology readiness levels 1-6)

- land acquisition and goodwill

- salary bonuses and dividend payments

- entertainment and hospitality expenses

- refinancing of existing debts

- amortization or depreciation of assets

- purchase of any assets for more than their fair market value

- lobbying activities

- donations, dues, and membership fees

Generally, the following costs/activities will not be supported:

- business plan preparation

- hospitality and other related costs

- sole sourced consultant fees

- fees related to advocacy work

- Type

-

Indicate if the cost is capital (such as purchase of equipment and associated costs such as installation) or non-capital (such as salaries, professional fees).

- Amount

-

The anticipated amount of the cost item.

- Total project costs

-

Automatically sums the cost items listed above. Note: This total must equal the total expenditures from the Cash Flows section below.

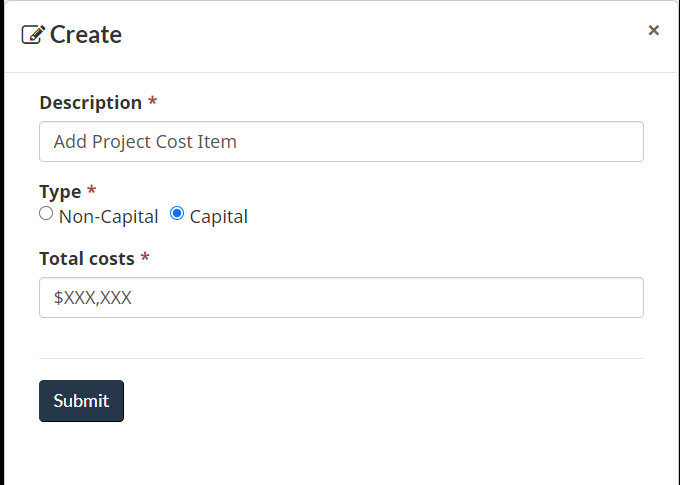

To add a project cost item, click on the

Add New Cost Item button and the following window will appear for you to provide the information. Click the Submit button once complete. You will still have the ability to edit the project cost item after hitting this Submit button.

Add New Cost Item button and the following window will appear for you to provide the information. Click the Submit button once complete. You will still have the ability to edit the project cost item after hitting this Submit button.

Cash flows *

Financial assistance information

- Applicants are normally limited to one RTRI project approval.

- Minimum funding request of $500,000 and maximum of $5 million per project

- PrairiesCan will take into consideration all other sources of funding available to the applicant and may give preference to projects that demonstrate greater leverage of funding from non-PrairiesCan sources

- Government funding (federal, provincial, and municipal) can cover up to:

- 90% of project costs for businesses or commercial (revenue-generating) projects

- 100% of project costs for non-commercial projects

- Eligible business applicants can apply for up to $1 million in non-repayable contribution funding, otherwise funding is normally repayable. Funding can cover up to 50% of eligible project costs

- The remaining 50% of eligible costs must be supported from a non-PrairiesCan source and must be confirmed at time of application and again prior to project approval

- Not-for-profit applicants can apply for non-repayable contribution funding of up to 90% of eligible

- The remaining 10% of eligible costs must be supported from a non-PrairiesCan source and must be confirmed at time of application and again prior to project approval

- For commercial (revenue-generating) projects, funding will normally be repayable contribution funding for up to 75% of eligible project costs

- Indigenous applicants may receive funding for up to 80% of eligible project costs for commercial (revenue-generating) project or up to 100% of eligible project costs for non-commercial projects.

- Fiscal year (ending March 31)

-

Select appropriate fiscal year for cash flows.

- Total fiscal expenditures

-

Anticipated total project costs incurred from each fiscal year.

- RDA funding

-

The amount of PrairiesCan funding being requested to support each fiscal year’s expenses.

- Non-RDA funding

-

Automatically generated: the portion of project expenditures not covered by PrairiesCan funding.

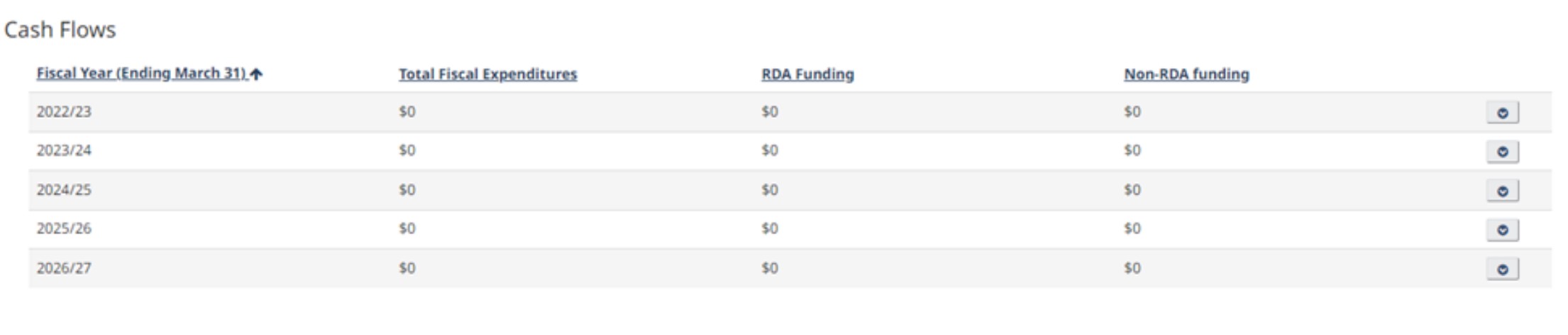

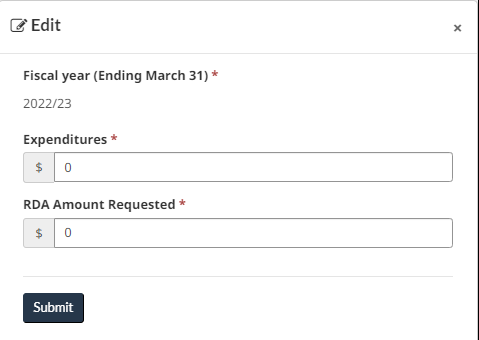

- To enter cash flow information, click the down arrow on the far right for the fiscal year you are interested in (e.g. 2022-2023). Click the Edit option that appears. Note: the fiscal years shown below are for illustrative purposes only.

- Enter the Expenditures and RDA Amount Requested information and then hit Submit. You will still have the ability to edit the project cost item after hitting the Submit button. Note: the fiscal years shown below are for illustrative purposes only.

- Total expenditures, total RDA funding requested and total non-RDA funding

-

The system will automatically calculate total PrairiesCan funding requested, as well as Total Fiscal Expenditures. Note that this total must equal total projects costs from the project cost section.

- Total expenditures: *

-

This is the sum of the Total Fiscal Expenditures column in the Cash Flows section. It is automatically calculated.

Note: This total must equal the Total project costs from the Project Costs section above.

- RDA funding requested: *

-

This is the sum of the PrairiesCan Funding column in the Cash Flows section. It is automatically calculated.

- Total non-RDA funding: *

-

This is the sum of the Non-PrairiesCan funding column in the Cash Flows section. It is automatically calculated.

Note: This total must equal the Amount provided by funding partners from the Funding Partners section below.

The solid arrows point to the fields that must balance and the dotted lines indicate what column is being summed to produce those totals. Note: the fiscal years shown above are for illustrative purposes only.

- Funding Partners *

-

The first line in the list of funding partners is reserved for the applicant organization. Please add other funding partners or contributors, if any, in subsequent rows. Identify all potential contributors that will provide a monetary contribution to the project. In-kind contributions are not eligible and, therefore, should not be listed in this section.

In-kind contributions, such as goods and services, toward project costs that do not involve a cost incurred or paid for by the applicant. These types of contributions should be demonstrated in the application at fair market value.

Guidelines for in-kind costs/contributions

Only project costs incurred and directly paid by the applicant can be reimbursed by PrairiesCan.

An in-kind contribution is a project cost that does not involve an expense incurred and paid for by the project applicant. Typically, these expenses are borne by third parties for items or services that are in turn provided to the applicant at no cost or at a reduced cost (e.g., a deep discount not typically offered to others).

In-kind costs:

- are used to demonstrate a more accurate picture of the project scope, including:

- project funding

- project leveraging

- demonstration of participant and/or private sector contributions to a project.

- must be for an item considered by PrairiesCan to be essential to a project ’s success, eligible under the programming, and would otherwise be purchased and paid for by the applicant.

- may only be included in the project when there is a clear plan and commitment from the applicant on how the costs can be verified.

Example: An industry partner will provide trucks to a college for use in a project to train truck drivers.

- The college did not incur or pay any incremental costs but the project could not reasonably go forward without the trucks, so this would be an in-kind contribution to project costs.

- The value of the trucks forto the project can be quantified via sales records.

Identify all potential project partners including the applicant organization that will provide a monetary or in-kind contribution. Note: applicants must ensure all contributions are clearly verifiable.

Other government assistance, SR&ED and other tax credits

PrairiesCan considers tax credits received for activities undertaken between the project start and end date as a source of government assistance. Such credits are included when calculating the total amount of government funding that has been provided to a project.

Successful applicants who are in receipt of Scientific Research & Experimental Development (SR&ED) tax credits and other similar federal or provincial tax credits for activities defined in the project are required to inform PrairiesCan. PrairiesCan may be required to reduce its overall level of project funding to ensure the total amount of government assistance does not exceed 90% of project costs.

The Canada Revenue Agency (CRA) may consider funding received from RTRI to be government assistance, even though it will eventually be repaid.

Applicants are strongly advised to seek independent professional advice to determine the potential effect of RTRI funding on project activities for which SR&ED tax credits, or other federal and provincial tax credits or funding, are likely to be sought.

- are used to demonstrate a more accurate picture of the project scope, including:

- Funding Category

-

Select from the drop down menu the description that best reflects the funding source.

- Funding Confirmed

-

In the case where your organization (Applicant) is a source of funding, indicate yes if you have cash on hand. In the case of other funding sources, indicate yes if there is written documentation supporting the funding.

- Amount

-

The anticipated amount of funding this partner (Applicant or funding partner) will provide.

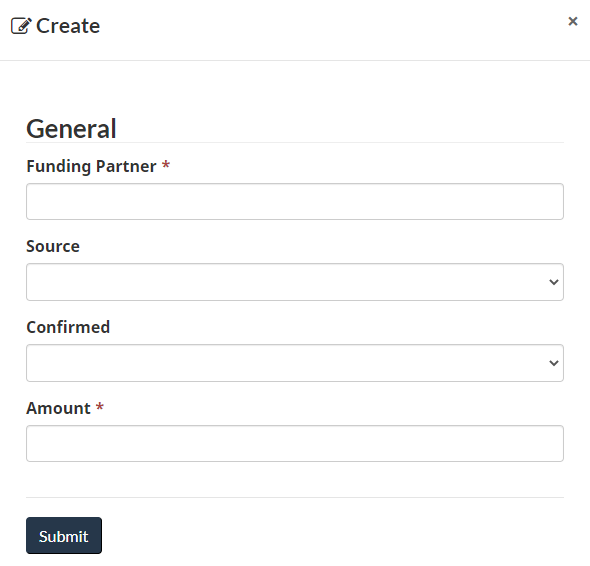

- To add a funding partner, click on the

button and the following window will appear for you to input the information. Click the Submit button once complete. You will still have the ability to edit the project cost item after hitting this Submit button.

button and the following window will appear for you to input the information. Click the Submit button once complete. You will still have the ability to edit the project cost item after hitting this Submit button.

- To edit what your organization will be contributing towards this project, click the down arrow on the far right for the fiscal year you are interested in. Click the Edit option that appears and a similar pop-up window as shown above will appear.

- To add a funding partner, click on the

- Total amount provided by funding partners

-

Automatically sums the funding amounts listed above.

Note: This total must equal the Total non-PrairiesCan funding from the Cash Flows section above.

- Briefly describe any partnerships (non-financial and financial), including any costs covered (maximum of 1,200 characters, including spaces) *

-

Describe partnerships that would be important to the success of the proposed project.

Click Save.

Benefits

- Primary activity: *

-

Choose 1 primary activity that best aligns with your project’s objectives, activities, and outcomes. Your project may be compared to similar projects of a chosen primary activity. Refer to Who can apply for more details.

- Indicator: *

-

Note that these should be measured from the proposed start date until typically 1 year following the project completion. The most common indicators are below, although additional indicators pertaining to your project can be added. If your project does not have a value to report for a listed indicator, input a value of “0” (zero) and enter a target date.

Mandatory and optional indicators

PrairiesCan supports RTRI projects that have a viable plan to produce strong economic outcomes. Applicants must quantify, substantiate, and later report on the following mandatory expected results:

- number of highly qualified personnel (HQP) including science, technology, engineering and mathematics (STEM) jobs created in Canada

- number of non-HQP jobs created in Canada

- revenue growth ($)

- export sales growth ($)

- incremental private sector investment attracted ($)

- number of technologies to market – where applicable

- number of new technologies or processes implemented to decrease the cost of production – where applicable

- value of business expenditures in research and development ($) – where applicable

- number of SMEs assisted (not-for-profit projects only)

If any of the mandatory indicators are not selected, then please explain why the indicator in question cannot be selected for your project.

Additional performance indicators available to measure the success for your project include:

- number of Prairie businesses with new domestic sales

PrairiesCan is working to improve the economic participation (e.g. job creation) of Indigenous Peoples, women and youth.

Note: recipients will be encouraged to establish and track inclusiveness indicators.

- Number of jobs created (highly qualified personnel including STEM) in Canada: *

-

Provide the number of jobs created as a result of this project that are professional, science, and technology-related jobs – based on an OECD (Organization for Economic Co-operation and Development) definition of ‘science and technology-related jobs’. See definition of this in the glossary. Number of jobs created includes the number of HQP (highly qualified personnel, including STEM) jobs expanded as a result of project supported through PrairiesCan funding. Expanded refers to transitioning a seasonal or part-time employee to a year-round or full-time position, or similar increase in hours.

- One FTE job = 12 person months of employment. (In the case of seasonal or part time employment, person months of employment should be converted to FTE job).

- Inclusiveness sub-types include women, Indigenous Peoples and youth.

- Number of jobs created (non-highly qualified personnel) in Canada: *

-

Provide the number of jobs created as a result of this project that are not considered highly qualified personnel (HQP) as per the definition above. Number of jobs created includes the number of non-HQP jobs expanded as a result of projects supported through PrairiesCan funding. Expanded refers to transitioning a seasonal or part-time employee to a year-round or full-time position, or similar increase in hours.

- One FTE job = 12 person months of employment. (In the case of seasonal or part time employment, person months of employment should be converted to FTE job).

- Inclusiveness sub-types include women, Indigenous Peoples and youth.

- Revenue Growth: *

-

Provide a numerical value that totals the anticipated entire firm sales year over year from the project proposed start date up to 1 year following the proposed end date.

The example below illustrates how to calculate the revenue growth.

- For example, a firm has $1 million in revenue at the time of application. They plan to grow to $2 million next year, $3 million the year after and $4 million the year after (which is the last year of the project), and finally $5 million for the year after the project. To calculate the total, add up the incremental amount (that years’ forecasted revenue minus the original level they were at when they applied) from each year. In this example, the revenue growth measurable would be $1 million + $2 million + $3 million + $4 million = $10 million.

Revenue at time of application Year 1 Year 2 Year 3 Year 4 Total $1 million Actual Revenue $2M $3M $4M $5M $14M Revenue Growth $1M $2M $3M $4M $10M - Export Sales Growth: *

-

Provide a numerical value that totals the anticipated sales growth related to entire firm exports the year over year from the project proposed start date up to 1 year following the proposed end date.

The example below illustrates how to calculate export sales growth.

- For example, a firm has $500,000 in export sales revenue at the time of application. They plan to grow to $1 million next year, $1.5 million the year after and $2 million the year after (which is the last year of the project), and finally $2.5 million for the year after the project. To calculate the total, add up the incremental amount (that years’ forecasted revenue minus the original level they were at when they applied) from each year. In this example, the export sales growth measurable would be $500,000 + $1 million + $1.5 million + $2 million = $5 million.

Export sales at time of application Year 1 Year 2 Year 3 Year 4 Total $500,000 Actual Export Sales $1M $1.5M $2M $2.5M $7M Export Sales Growth $500,000 $1M $1.5M $2M $5M - Incremental private sector investment attracted *

-

Provide a numerical value that totals the anticipated private sector capital invested through the project. Does not include private sources of project funding outlined at the start of the project.

Examples of incremental private sector investment include new venture capital financing, investment from a new partner, etc.

The example below illustrates how to calculate incremental private sector investment attracted:

- For example, a firm has identified $1 million in private sector investment at the start of the project. They plan to attract an additional $1.5 million next year, and an additional $2 million the year after. To calculate the total, add up the incremental amounts (excluding any funding outlined at the start of project) from each year. In this example, the total incremental private sector investment attracted would be $1,500,000 + $2,000,000 = $3,500,000.

- Number of technologies to market (where applicable)*

-

Provide a numerical value of the number of technologies anticipated to be developed which would meet legal and regulatory requirement in order to be sold to consumer or industrial clients. A technology could also include knowledge-based products, processes, services.

Examples of technologies to market could include the sale or commercialization of: a new pharmaceutical or pharmaceutical ingredients; new industrial machinery/tools, new hardware or software products, new waste treatment processes.

The example below illustrates how to calculate number of technologies to market:

- For example, a firm is developing three new products which they plan to bring to the market in the second year of project. In addition, they also plan to deliver a new service to their clients in the third and final year of the project. In this example, the total number of technologies to market would be 3 + 1 = 4.

- Number of Prairie businesses with new domestic sales

-

Provide a numerical value of the number of Prairie businesses anticipated. “New” refers to exports that a client has realized for the first time, or in a new international market. The client’s progression in terms of exports is from “opportunity” to “business lead” to “sales”.

- Number of new technologies or processes implemented to decrease the cost of production: *

- Provide a numerical value of the number of new products, processes, or services that a client has employed to reduce the amount of expenditures incurred to produce/manufacture a good or service.

- Value of expenditures in research and development ($) (mandatory if doing research and development activities): *

-

Provide a numerical value that totals the anticipated increase of business expenditures in research and development year over year from the project funding start date up to one year following the proposed end date.

- Number of SMEs assisted (businesses or organizations): *

- For organizations that support businesses, provide a numerical value of the number of SMEs that will be supported by this project.

- Please provide information on any other significant economic benefits that your project could achieve (maximum 2,000 characters including spaces). *

-

Provide a detailed explanation as to how the economic outcomes listed above will be tracked and achieved as well as any other economic outcomes that may be achieved. Identify the numbers of jobs requiring highly qualified personnel, which is defined as individuals with university degrees at the bachelor’s level and above. Identify and detail all assumptions to support the reasonableness of your economic outcomes. All projects will be screened for significance of outcomes and their likelihood of achievement.

If your project supports the Government of Canada’s commitment to inclusive growth (under-represented groups) you may include this in your explanation. Note: recipients will be encouraged to track inclusiveness indicators (in other words, women, Indigenous Peoples and youth) throughout the project from the project proposed start date to 1 year following the project completion date.

- Does your project have activities that will benefit Francophones? If your project includes activities that will directly benefit the Francophone community in the Prairie Provinces or if you are willing to modify your project to extend its benefits to the Francophone community, choose yes.*

-

Select Yes or No.

- If yes, describe how the project activities will benefit Francophones (maximum of 1,500 characters including spaces). *

-

Explain how this project will or could benefit the Francophone community in the Prairie Provinces and what specific activity(ies) will or could include. If Francophones will not benefit from the project, simply write ‘not applicable’.

For example:- The project will hire bilingual staff.

- The project will ensure that any communication tools are produced in French (final report, exhibit, video, etc.)

- Clearly outline if the project aligns with other Government of Canada priorities, provincial government priorities, industry needs, and your organization’s long-term research, capital, and/or strategic plans (maximum of 1,500 characters including spaces).

-

Clearly outline if the project aligns with other Government of Canada priorities; provincial government priorities; industry needs; and your organization’s long-term research, capital, and/or strategic plans. This is not a mandatory field. If none apply, simply write ‘not applicable’.

For example:

- The project will advance the Government of Canada’s priority of … by …

Official languages

Under the Official Languages Act, the Government of Canada is committed to supporting the development of official language minority communities (English-speaking communities in Quebec and French-speaking communities in the rest of Canada). More than 2 million Canadians belong to an official language minority community. The intention is to enable these communities to thrive and to enjoy the same benefits as the rest of the population.

Applicants seeking funding under not-for-profit programming may assist PrairiesCan in fulfilling its obligations under the Official Languages Act by identifying aspects of the proposed project that may benefit Francophone communities in Western Canada or by being willing to modify the proposed project to extend its benefits to the Francophone community. This may be as simple as including a French-speaking service provider who is able to offer business services in French as part of the project or offering the final product resulting from the project in French.

Please follow up with your PrairiesCan project officer to explore how you might modify your proposed project to assist the department in extending benefits to the Francophone community.

Click Save.

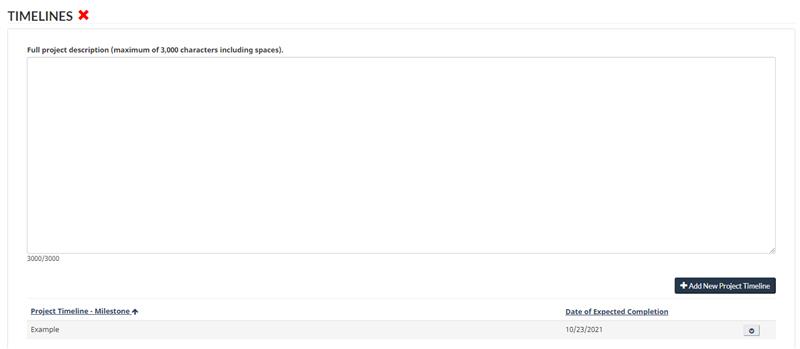

Project timelines

- Full project description (maximum of 3,000 characters, including spaces).

-

This description should provide clear understanding of the following:

- objectives of the project

- key activities of the project and how these activities will achieve the intended objectives of the project

- outline the plan to achieve the objectives and key activities;

- describe the engagement and/or commitment from other partners (such as industry, other levels of government)

- clearly address any project risks and mitigation measures to address these risks (such as project delays, staff turnover, other challenges) to secure confirmed funding

- Project timeline – milestone *

-

A milestone is a project activity that can be clearly defined and measured. Provide a list of significant activities or project milestones that can be measured and tracked to ensure the project is proceeding as planned. These should be significant milestones that will be used to ensure your project’s performance over the course of the project, up to the stated completion date of the project.

Select ‘+Add New Project Timeline’ to enter information.

- Date of Expected Completion *

-

This is the date that the milestone should be completed by.

- Timeline Comments (maximum of 1,000 characters including spaces). *

-

Add any information necessary to provide additional clarity regarding the milestones.

Click Save.

Market

- Are other organizations currently providing a similar activity, service, or product?

-

Select Yes or No.

- Describe how your activity, service, or product is different or unique compared to others (maximum of 1,000 characters including spaces).

-

Commercial project applicants: How many years has your organization been doing business in the indicated target market/sector? List your major competitors. Describe how your project could affect your competitive position and/or market share within Canada and internationally, if applicable. Identify if your project will adversely impact other businesses in Canada.

Non-commercial project applicants: Identify any similar or complementary initiatives in Canada or internationally. Does your project build upon or duplicate other initiatives or clearly illustrate that your project is not duplicating existing activities/services/products? Outline how your activity, service or product is different or unique.

- Provide the rationale for the project and for the Regional Development Agency’s involvement in the project (maximum of 2,000 characters including spaces).

-

Fully explain how the project will fill a market gap or an industry need.

- Describe the opportunity or challenge and how your project is a solution.

- Provide a rationale for government’s role in the project.

- Provide details on how this project is incremental to the organization’s current operations or activities.

- Clearly outline if the project aligns with other Government of Canada priorities; provincial government priorities; industry needs; and your organization’s long-term research, capital and/or strategic plans.

- Which western Canadian province(s) will directly benefit from this project? Select all that apply.

-

Select all provinces that will directly benefit.

- Will the project result in the generation of revenues?

-

Select Yes or No.

- If yes, please explain (maximum of 1,000 characters, including spaces).

-

Explain how much and what the revenues will be used for in the comment box.

Click Save.

Management

- Clearly demonstrate that your organization has effective governance measures in place to execute this project. Indicate how oversight will be provided to the project. (Maximum of 2,000 characters including spaces)*

-

Provide an explanation of how your organization is governed (such as board of directors, advisory board) and its structure along with a brief explanation of key executives’ credentials (such as indicate the level of experience of the board members, such as the number of years of experience each member has on the board of directors). Clearly demonstrate that your organization has effective governance measures in place to provide appropriate oversight of this project. Indicate how these individuals will specifically be involved in providing oversight on the project.

- Describe the qualifications and related experience of the key individuals that will be responsible for managing and implementing the project. (Maximum of 2,000 characters including spaces) *

-

Provide a list of the members of your organization who will be directly managing and implementing the project including their relevant prior experience, education, professional designation(s), and other achievements. Clearly demonstrate that your organization has the management skills and leadership to carry out the project.

Additional details

Complete the Additional Details if you are an incorporated business. This section is not applicable to not-for-profit applicants.

- Date your organization established business in Canada.*

-

Enter the month-day-year your organization established business in Canada.

- Is your organization a subsidiary of another company? *

-

Select Yes or No.

- If yes, what is the legal name of the parent company? (Maximum 200 characters including spaces)

-

Enter name.

- What is your fiscal year end date? *

-

Enter the month-day-year of your organization’s fiscal year end.

- Total revenues from your most recent fiscal year end. *

-

Enter amount ($).

- Total revenues from your previous fiscal year end. *

-

Enter amount ($).

- Previously received funding from a regional development agency (RDA)? *

-

Select Yes or No.

- Do you have an independent market assessment or evidence of unmet market demand? *

-

Select Yes or No.

- Competitors are operating within:

-

Select the applicable geographic locations.

- Describe your competition. * (Maximum 1,000 characters including spaces)

-

Provide a description of your primary competitors and how your organization differentiates itself. Please make specific note of any western Canadian or Canadian competition.

- Operating facilities existing in Western Canada? *

-

Select Yes or No.

- Describe the most significant risk to your project and the steps you have in place to mitigate this risk. (maximum 1,000 characters including spaces) *

-

Provide a description.

Documents

- Upload here the supporting documents to be provided with your application.

-

Upload the following mandatory documents marked with an asterisk (*) and other supporting documents:

- supporting documents

- incorporation documents for your organization and proof of signing authority (e.g. bylaws, articles of incorporation, board minutes or record of decision)*

- a business plan or pitch deck which must address each area outlined below* and should include clear rationale/assumptions where necessary:

- description of your business/organization

- description of each major product/service your business currently provides, and the value proposition to your customer base

- detailed operating/execution plan for implementing the proposed project

- description of how your project will affect the value proposition to your current key customer segments and/or how your customer base will grow or change; how it will strengthen revenue or reduce costs

- description of your businesses’ competitive advantage and how your project will affect your competitive position (where applicable)

- analysis of the marketplace (including industry factors, competition, and customers)

- detailed sales, pricing, and marketing strategy

- third party market assessment or evidence of unmet market demand (if available)

- description of the management team and corporate governance structure. This should include both the ability to manage day-to-day operations as well as to manage the project. If the management team is not yet complete, please comment as to the reasoning, and if applicable, future intentions

- signed Regional Tariff Response Initiative attestation and supplemental form* (the form provided with the Expression of Interest will be retained in the portal account)

- completed cost clarification form, included with the email invitation to complete a full application*

- completed financial disbursement disclosure form, included with the email invitation to complete a full application*

- other supporting documentation (e.g. project plan, letters of support, regulatory approvals and resolutions)

- Financial statements

- financial statements for the past 2 years*

- interim financial statement for the past 6 months*

- forecasted income statements and cash flows complete with rationale and assumptions (3 to 5 years)*

- confirmed funding (the proof of confirmed funding provided with the Expression of Interest will be retained in the portal account)

- evidence of confirmation of all other (non-PrairiesCan) sources of project funding*

- for funding to be provided by the applicant organization – current bank statements detailing existing cash balances or unused portion of lines of credit

- for third-party funding sources – official letters of intent (on letterhead, signed) and/or funding agreements, signed term sheet

- PrairiesCan does not consider the following as proof of confirmed funding:

- forecasted revenues from future activities

- accounts receivables

- commitments to raise equity

- commitments to obtain future bank financing

- scientific Research & Experimental Development (SR&ED) credit

- evidence of confirmation of all other (non-PrairiesCan) sources of project funding*

Click Save.

Signing authority

The application form must be submitted by a member of your organization with signing power/authority to enter into a legal agreement with PrairiesCan.

Note: the fields marked with an asterisk (*) need to be completed in order to submit this form.

- First name: *

-

Provide the first name of the member of the organization with signing power/the authority to enter into an agreement. This person should be either the primary or the secondary contact.

- Last name:

-

Provide the family name of the contact.

- Title:

-

Provide the contact person’s job title (such as president, executive director).

- Email address:

-

Provide a valid e-mail address.

- Telephone country code:

-

The telephone country code of where the contact person can be reached.

- Telephone:

-

Provide a phone number where the contact person can be reached.

- Cellular country code:

-

The cellular country code of your organization.

- Cellular phone:

-

The cellular number of your organization.

Click Save.

Diversity and inclusion

The Government of Canada is committed to diversity and inclusion so that all Canadians have the opportunity to participate in and contribute to the growth of the economy. Gender and diversity data collected may be used for research, statistics, program and policy evaluation, risk management, strategy development, reporting, and gender-based analysis (including GBA+). This information can help the Government of Canada monitor progress on inclusive access to federal support programs and services; to identify and remove barriers; and, to make changes to improve inclusive access. The Government of Canada understands that participation of underrepresented groups is an integral part of building strong and inclusive communities and economy.

No personal identifying information will be shared. Aggregate and anonymous data may be shared with other federal organizations and/or published for reporting and monitoring purposes.

Unless otherwise directed by the program, the following gender and diversity data will not be used to assess the application. It is being collected for statistical purposes and may feed into future programming.

- Is your organization majority (in other words, over 50%) owned or led by individuals who self identify as:

-

The purpose of this question is to gather information related to the ownership/leadership of the organization to see which diverse groups PrairiesCan funds. Answer related sub-questions below. Please refer to the glossary for definition on “majority-owned” and any of the diverse groups.

- Will your project directly support any of the following diverse groups?

-

This question is regarding the people that will benefit from this project. Will your project directly support any of the groups listed? If so, please answer ‘yes’. If you do not know if your project will directly support a particular group, or prefer not to answer, just leave the field blank. This information may be considered in assessing your project. Refer to the glossary for definition on “majority-owned” and any of the diverse groups.

- If yes is selected for any of the following diverse groups, please specify (maximum of 1,500 characters).

-

Provide an explanation on how your project will directly support the diverse group selected.

Click Save.

Validation

For this step, any errors or omissions in the form will be brought to your attention, and you will be given the opportunity to review them, and make any necessary corrections.

Attestation

Before you can complete and submit your application, it is necessary in this final step for you to affirm that you are aware of certain statutory obligations, that your organization meets the eligibility requirements for the program, and that the collected information may also be used for consideration under other government programs.

Please ensure the attestation is completed by the primary contact, who is also the member of your organization with signing power/authority to enter into a legal agreement with PrairiesCan.

Click off the check box to indicate you have read and agree with the acknowledgements.

Authorized official of the applicant organization acknowledgements

The application form must be submitted by a member of your organization with signing power/authority to enter into a legal agreement.

On behalf of the Applicant Organization, I hereby acknowledge and agree that:

- This application does not constitute a commitment from Prairies Economic Development Canada (PrairiesCan) for financial assistance.

- I have read and understand the application process, including the mandatory eligibility criteria located on PrairiesCan’s public website.

- Project costs incurred by the Applicant Organization in the absence of a signed funding agreement with PrairiesCan are incurred at the sole risk of the Applicant Organization and that any such costs may not be considered eligible for PrairiesCan assistance.

- Any person who has been lobbying on behalf of the Applicant Organization to obtain a contribution as a result of this application is registered pursuant to the Lobbying Act and was registered pursuant to that Act at the time the lobbying occurred.

- The Applicant Organization is under no obligation or prohibition, nor is it subject to, or threatened by any actions, suits or proceedings, which could or would affect its ability to implement this proposed project.

- The Applicant Organization has not, nor has any other person, corporation or organization, directly or indirectly paid or agreed to pay any person to solicit a contribution arising as a result of this application for a commission, contingency fee or any other consideration dependent on the execution of an Agreement or the payment of any contribution arising as a result of this application.

- Prairies Economic Development Canada (PrairiesCan) and Pacific Economic Development Canada (PacifiCan) are government institutions as defined under the Access to Information (ATI) Act. Records in the custody and care of the institution are subject to disclosures under Part 1 and Part 2 of the ATI Act with limited exceptions and exclusions.

- Personal information collected by PrairiesCan is collected in accordance with section 4 of the Privacy Act (R.S.C., 1985, c. P-21). This information will be used to determine eligibility, administer grants and contributions, and evaluate program effectiveness. Personal information collected is described in the Personal Information Bank entitled “Grants and Contributions”, number PrairiesCan-PPU-055. Questions regarding the collection and use of your personal information may be directed to the ATIP Coordinator, PrairiesCan, Canada Place, 1500-9700 Jasper Avenue NW, Edmonton, Alberta T5J 4H7, by telephone at 780-495-4164, or by email to atip-aiprp@prairiescan.gc.ca.

If you choose not to provide the personal information, your application may not be processed.

You have a right under section 12 of the Privacy Act to access to your personal information under the control of PrairiesCan as well as a right to request correction of personal information where there is an error or omission. You have the right to make a complaint to the Office of the Privacy Commissioner under section 29(1) of the Privacy Act regarding PrairiesCan’s collection, use, and disclosure of your personal information, processing of your request for correction of personal information or processing of your access to personal information request.

I authorize PrairiesCan, its officials, employees, agents and contractors to make credit checks and enquiries of such persons, firms, corporations, federal, provincial and municipal government departments/agencies, and non-profit, economic development or other organizations as may be appropriate, and to collect and share information with them, as PrairiesCan deems necessary in order to assess this application, to administer and monitor the implementation of the subject project, and to evaluate the results of the project and related Programs.

I have read and agree with the above acknowledgements and certify that all statements and information furnished in this application are true, complete and correct to the best of my knowledge. *

After you apply

Assessment process

Intake for RTRI is a competitive process.

All applications will be evaluated based on:

- ability to achieve RTRI objectives

- economic impact

- project viability

- relative strengths in:

- market potential

- management capability

- financial capacity

- economic benefits

- degree of alignment with governmental priorities

To fully assess your project, PrairiesCan may request (as applicable):

- business plan (if not already submitted)

- forecasted income statements and cash flow including relevant assumptions for the duration of the project

- detailed breakdown of project costs

- information to substantiate the negative impact of tariffs on your business

- information to substantiate the proportion of Canadian inputs in your project

- disclosure of pre-existing disbursements to third parties or senior executives

- other detailed information on the project or your organization

- a credit check (e.g. Equifax)

Although PrairiesCan may engage companies directly on outstanding questions or issues, applicants are advised to submit a complete and thorough application. Not all applications undergoing a detailed assessment will receive an offer of funding.

PrairiesCan anticipates funding decisions within approximately 90 business days from receiving a complete funding application.

If your application is approved

Funding disbursement

PrairiesCan provides contributions under RTRI, not grants.

RTRI funding for successful projects is provided as periodic reimbursements based on claims you submit. PrairiesCan will reimburse you for the approved portion (such as 50%) of eligible project costs that have been incurred and paid.

There will be a delay between the time costs are incurred and when claimed costs are partly reimbursed. Successful applicants will need to plan their project cash flow accordingly. PrairiesCan will provide an orientation to this process for successful applicants.

Claims for incurred costs can be submitted quarterly,between one and four times per year and are processed within 15 business days of PrairiesCan receiving a complete claim package.

Repayment terms for repayable funding

A RTRI contribution agreement for commercial project activities will normally require recipients to repay the entire principal within 6 years of project completion. Following a 1-year grace period after project completion, recipients will be required to make 60 equal monthly payments. Although funding is provided interest-free, interest equal to the average bank rate plus 3% will be charged for any late principal payments.

There is no penalty for early repayment.

Environmental assessment compliance

Projects involving physical works may be subject to the Impact Assessment Act (2019). Recipients of PrairiesCan funding will be responsible for obtaining all certificates, consents, permits and approvals required for compliance with applicable legislation and for complying with the requirements of such legislation. Should an environmental assessment be required, it will be necessary to plan several months before the project Proposed Start Date to allow sufficient time for the completion of the assessment.

Reporting requirements

All contribution agreements issued under the RTRI include performance indicators to measure the individual project performance and the program’s effectiveness relative to objectives.

If you are a successful applicant, you must:

- provide periodic progress reports at least twice per year (frequency requirements will be outlined in your funding agreement)

- progress reports should demonstrate project progress and achievement of results

- reports should accompany claims for project cost reimbursement

- provide annual financial statements from project start date to the end of the repayment period (if applicable)

- ensure project activities are completed by March 31, 2028

- track and report on key project activities and deliverables up to the final reporting date.

Glossary

Below is a short glossary of terms used in this guide:

- Assessment

-

Thorough review and analysis of all aspects of an application prior to entering into a contribution agreement. This includes scoping of the project to meet program and department objectives as well as Government of Canada guidelines for funding contributions.

- Black community(ies)

-

This term is a designation used for people of full or partial descent from over 200 ethnic or cultural origins, including sub-Saharan African descent, who are citizens or permanent residents of Canada. The majority of “Black” Canadians are of Caribbean origin, though the population also consists of African-American immigrants and their descendants (including Black Nova Scotians), as well as many native African immigrants.

- Contribution

-

A monetary payment to a successful Recipient that does not result in the acquisition by the Government of Canada of any goods, services, or assets. The payment(s) will be for assisted costs as identified in the Contribution Agreement with PrairiesCan. The successful Recipient must first pay the cost of the service or good and then submit a claim, which provides proof that the cost has been incurred and paid for by the Recipient. PrairiesCan then reimburses such costs on the percentage basis specified in the Contribution Agreement.

Contributions are subject to performance conditions specified in a Contribution Agreement and therefore a Recipient is required to report to PrairiesCan on results achieved. A contribution is to be accounted for, is subject to audit and, where profit is generated by the project, it may be subject to repayment conditions also specified in the contribution agreement.

- Diverse groups

-

Includes, but is not limited to people living with disabilities, Indigenous persons, youth, immigrants, persons from racialized communities and people from official language minority communities (OLMCs).

- Export sales growth

-

A numerical value that totals the anticipated entire firm sales growth related to exports year over year from the project proposed start date up to 1 year following the proposed end date.

- Full-time equivalent

-

The number of full-time employees working for the organization.

- Gender

-

This refers to the socially constructed roles, behaviours, expressions and identities of girls, women, boys, men, and gender diverse people. It influences how people perceive themselves and each other, how they act and interact and the distribution of power and resources in society. Gender is usually conceptualized as a binary (girl/women and boy/man), yet there is considerable diversity in how individuals and groups understand, experience, and express it. Self-identifying gender is an expression of what a person internally feels and/or the gender a person publicly expresses in their daily life. A person’s current gender may differ from the sex a person was assigned at birth (male, female, or intersex) and may differ from what is indicated on their current legal documents. A person’s gender may change over time.

- Government assistance

-

Funding from any level of government (federal, provincial or municipal). Also includes funding from any organization that is fully funded by government, and does not make investment decisions independent from government or on a commercial basis.

- Highly qualified personnel (HQP)

-

Canada’s Highly Qualified personnel (HQP) are defined as individuals with university degrees at the bachelor’s level and above.

- Incremental

-

Activities to be undertaken that are additional to the applicant’s current operations or activities.

- Indigenous Peoples

-

Refers to those persons who identify with at least 1 Indigenous group, that is First Nations, Métis or Inuit. Aboriginal peoples of Canada (referred to here as Indigenous peoples) are defined in the Constitution Act, 1982, Section 35 (2) as including the Indian, Inuit and Métis peoples of Canada.

- In-kind costs/contributions

-

Contributions toward project costs that do not involve a cost incurred or paid for by the recipient. These types of contributions should be demonstrated in the application at fair market value.

- 2SLGBTQI+

-

Refers to those persons who identify as lesbian, gay, bisexual, transgender, intersex, queer, 2-spirit, non-binary or gender queer, questioning, asexual, pansexual, agender, bigender, gender variant, and pangender.

- Majority-owned/led

-

Majority owned or led is defined as an enterprise where 1 or more of the diverse groups has long-term control and management of the organization and an active role in both strategic and day to day decision making. In for-profit enterprises, this may include an equity stake.

- Long-term control and management of the organization – have been engaged in the operation, management and ownership of the organization for at least 2 years

- Active role in strategic decision making – involved in elements related to the establishment of priorities, objective and goals for the organization; overall operations of the organization

- Day to day decision making – involved in elements related to the financial management, human resources, supply management, logistics or customer services (for example)

- Equity stake – demonstrates an ownership in the company

Majority-owned is where an individual(s) owns more than 50% of the company.

- Newcomer to Canada or immigrant

-

Person(s) who have landed in Canada within in the last 10 years.

- Official language minority communities (OLMCs)

-

English-speaking communities in Quebec and French-speaking communities in provinces and territories other than Quebec.

- Person with a disability

-

A person with long-term or recurring disabilities related to hearing, vision, mobility, flexibility, dexterity, pain, learning, mental health, memory, and developmental impairment or functional limitation and who consider themselves to be disadvantaged by reason of that impairment.

- Project

-

The group of activities and actions, which are cost-shared, that occurs in the period between the RDA Project Start Date and the Project End Date.

- Proposed start date

-

This is the date an agreement between a Recipient and the department comes into effect. Any costs incurred prior to this date are not eligible for reimbursement under the terms of the agreement and are outside of the scope of the project. It can be thought of as the start date for the project as defined by the contribution agreement.

- Proposed end date

-

The date it is anticipated that project activity will cease. (This does not include a repayment period when applicable.)

- Racialized communities

-

Groups that have been socially constructed as races, other than Indigenous peoples, persons from Black communities, or persons who are Caucasian in race or white in colour, based on characteristics such as ethnicity, language, economics, religion, culture, and/or politics. For example, Chinese, Japanese, Korean, South Asian/East Indian, Southern Asian, non-white West Asian, North African or Arab, non-white Latin American, persons of mixed origin (with 1 parent in 1 of the visible minority or racialized groups in this list), or other racialized or visible minority group.

- Regional Development Agency (RDA)

-

Canada’s regional development agencies (RDA) work closely with businesses and innovators in their regions to fuel economic growth that creates more well-paying middle-class jobs for Canadians.

They are a key part of the Government of Canada’s Innovation and Skills Plan, advancing and diversifying our regional economies and helping communities thrive. There are 7 RDAs across Canada including Prairies Economic Development Canada (PrairiesCan) and Pacific Economic Development Canada (PacifiCan).

- Repayable contribution

-

A repayable contribution is a contribution that will be repaid to the RDA according to repayment conditions specified in the contribution agreement.

- Revenue growth

-

A numerical value that totals the anticipated entire firm sales year over year from the project proposed start date up to 1 year following the proposed end date.

- Steel industry

-

The steel industry includes the production, processing, and fabrication of products made with steel and iron, from raw materials to finished components used in machinery, vehicles, and infrastructure.

- Supply chain

-

The supply chain includes suppliers of goods and services that contribute to the activities of another business, that involve sourcing, producing, and delivering a product or service to the customer. It includes direct and indirect suppliers and service providers, both in Canada and outside Canada. An entity's supply chain does not include the end users or customers who purchase its products or services.

- Women

-

The use of the word “women” is inclusive of cisgender and trans individuals.

- Youth

-

Person(s) who are between the ages of 15 and 34.