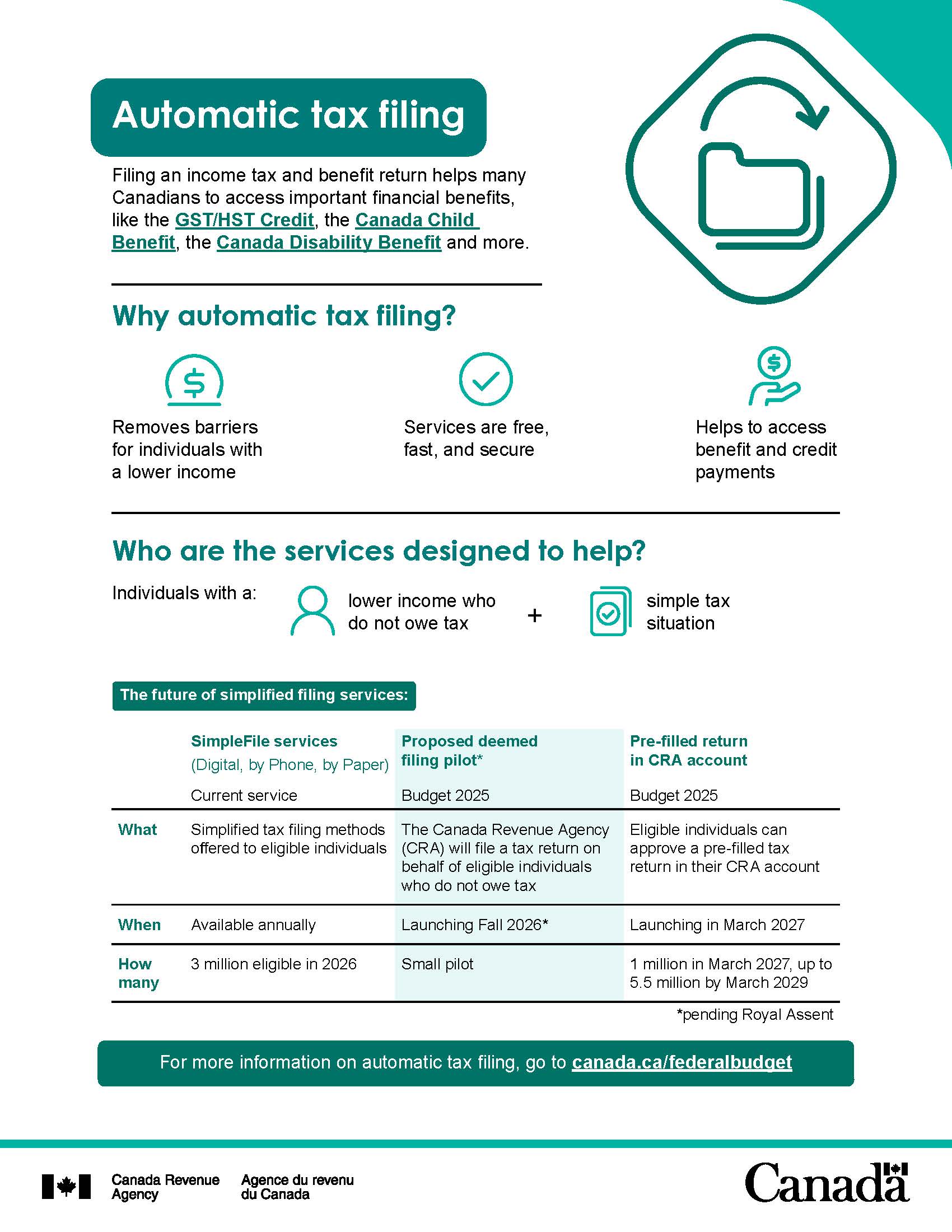

Infographic: Automatic tax filing

Filing an income tax and benefit return helps many Canadians access important financial benefits, like the GST/HST credit, the Canada child benefit, and the Canada Disability Benefit and more.

Infographic description

Making it easier to file a tax return

Automatic tax filing:

- removes barriers for individuals with a lower income

- services are free, fast, and secure

- helps individuals access benefit and credit payments they are entitled to

Eligibility for automatic tax filing

Automatic tax filing services are designed to help individuals with a lower income who do not owe tax and have a simple tax situation.

The future of simplified filing services

The Canada Revenue Agency (CRA) is working to make it easier for Canadians to file a tax return and access key benefits.

SimpleFile Services (Digital, by Phone, and by Paper)

- Current service

- Simplified tax filing methods for eligible individuals

- Available annually

- 3 million individuals eligible in 2026

Proposed deemed filing pilot (pending Royal Assent)

- Announced in Budget 2025

- The CRA will file a tax return on behalf of eligible individuals who do not owe tax

- Launching Fall 2026 (pending royal Assent)

- Will be made available to eligible individuals in a small pilot

Pre-filled returns in CRA account

- Announced in Budget 2025

- Eligible individuals can review and approve a pre-filled tax return in their CRA account

- Launching March 2027

- 1 million eligible individuals in March 2027, expanding to up to 5.5 million eligible individuals by March 2029

Related links