Automatic tax filing

File a return using SimpleFile starting in March

SimpleFile services will open on March 9, 2026. The digital option will be available to eligible individuals with or without an invitation. Refer to: SimpleFile services

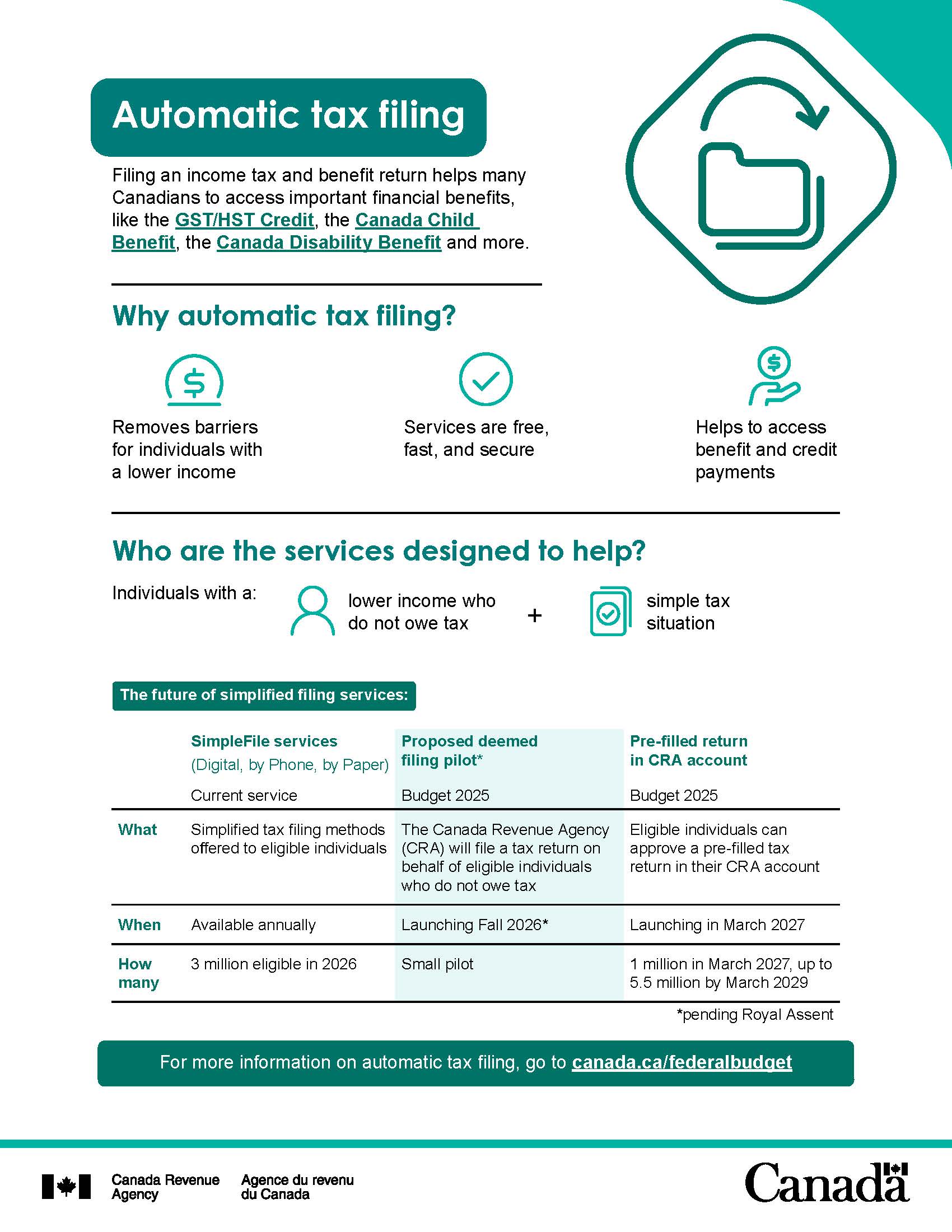

Curious about what we’ve got planned for the automatic tax filing services announced in Budget 2025? Check out our new infographic.

Many vulnerable individuals with lower income are missing out on valuable benefit and credit payments because they are not filing their annual income tax and benefit return.

Benefit and credit payments, such as the Canada child benefit and the GST/HST credit, help make life more affordable. In order to receive, or continue to receive, benefit and credit payments, individuals have to update their information with the CRA each year by doing their taxes. Filing a tax return can also confirm an individual’s eligibility for provincial and territorial programs.

The CRA continues to introduce initiatives to reduce barriers to filing an income tax and benefit return.

Budget 2025: Making it easier for Canadians to file a tax return

The Government of Canada has announced the CRA will make it easier for Canadians to file a tax return and access key benefits starting for the 2026 tax year. For more information, refer to Canada’s new government is lowering costs to help Canadians get ahead.

Budget 2025 also proposes to amend the Income Tax Act (ITA) to grant the CRA the discretionary authority to file a tax return for a taxation year on behalf of an individual (other than a trust) who meets certain criteria (generally, that they do not owe tax), also known as deemed filing.

Making tax filing easier

The CRA offers several tools and services, some of which are automated, to reduce filing barriers for individuals with lower income.

These include:

- SimpleFile

SimpleFile services are free, fast and secure tax filing methods (digital, phone, paper) offered by the CRA to eligible individuals with a lower income and a simple tax situation. Individuals answer a series of quick questions and the CRA processes the return with the information on file.

- Let us help you get your benefits!" Indigenous credit and benefit short return

A paper-based filing option available to Indigenous Peoples (First Nations, Inuit, and Metis) with a simple tax situation, including no income or tax-exempt income.

- Free tax clinics

Through the Community Volunteer Income Tax Program (CVITP), and the Income Tax Assistance – Volunteer Program (ITAVP) in Quebec, community organizations host free tax clinics where volunteers complete tax returns for people with a modest income and a simple tax situation.

- Auto-fill My Return (AFR)

A secure CRA service that allows individuals and authorized representatives using certified software, to automatically fill in parts of an income tax and benefit return. The AFR service can only use information the CRA has available at the time of the request.

Next steps

To help shape the future of automatic tax filing in Canada, the CRA has consulted individuals, community organizations, academia, and the tax filing industry. A summary of the consultation will be available in the Spring of 2026.

SimpleFile impact results will be available in the Spring of 2026.