Section 4 – Supplementary information

Corporate information

Organizational profile

Appropriate minister: The Honourable Diane Lebouthillier, P.C., M.P.

Institutional head: Bob Hamilton

Ministerial Portfolio: National Revenue

Enabling instrument: Canada Revenue Agency Actvii

Year of commencement: 1999

Raison d'être, mandate, role, operating context and key risks

The information is available on the CRA's websitevi.

Reporting framework

The CRA's Departmental Results Framework and Program Inventory of record for 2018-19 are shown below:

Departmental results framework

| Core responsibility | Departmental result | Indicator | Program | |

|---|---|---|---|---|

| Tax | Canadians comply with tax obligations, noncompliance is addressed, and Canadians have access to appropriate mechanisms for resolving disputes |

|

|

Internal Services |

| Benefits | Canadians receive their rightful benefits in a timely manner |

|

|

|

| Taxpayers' Ombudsman | Canadians have access to trusted and independent review of service complaints about the CRA |

|

|

Supporting information on the Program Inventory

Supporting information on planned expenditures, human resources, and results related to the CRA's Program Inventory is available in the GC InfoBase.

Supplementary information tables

The following supplementary information tables are available on the CRA's websiteiii.

- CRA Sustainable Development Strategy

- Details on transfer payment programs of $5 million or more

- Future Oriented Statement of Operations

- Gender-Based Analysis Plus

- Operating context and key risks

- Planned evaluation coverage over the next five fiscal years

- Planned Spending and Full-Time Equivalents

- Raison d'être, mandate and role

- Service standards

- Upcoming internal audits for the coming fiscal year

Federal tax expenditures

The tax system can be used to achieve public policy objectives through the application of special measures such as low tax rates, exemptions, deductions, deferrals, and credits. The Department of Finance Canada publishes cost estimates and projections for these measures each year in the Report on Federal Tax Expendituresviii. This report also provides detailed background information on tax expenditures, including descriptions, objectives, historical information and references to related federal spending programs. The tax measures presented in this report are the responsibility of the Minister of Finance.

Organizational contact information

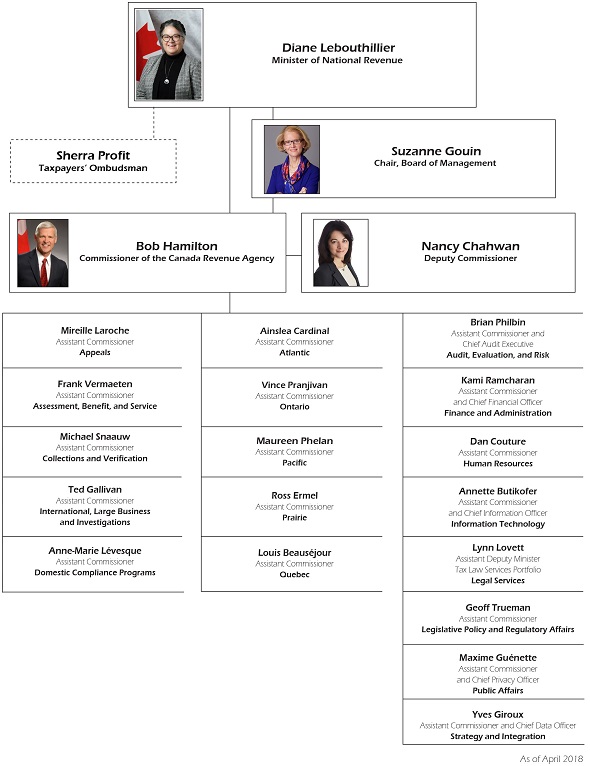

Image description

This is a representation of the organizational structure of the Canada Revenue Agency from the Minister down to the Assistant Commissioners.

At the top of the page is a rectangle with the name of the Minister, Diane Lebouthillier, and below her name is the title Minister of National Revenue. A photo of the Minister's face also appears in the rectangle.

At the bottom of the left-hand side of the rectangle a dotted line leads down to another rectangle which contains the name of Sherra Profit and below her name the title Taxpayers' Ombudsman. The rectangle's frame consists of dotted lines to illustrate the arm's length relationship between the Minister and the Taxpayers' Ombudsman.

A second line, which is solid, at the bottom of the right-hand side of the Minister's rectangle leads to a box containing the name Suzanne Gouin and below her name the title Chair, Board of Management. A photo of Suzanne Gouin's face also appears in the box.

A third line, which is solid, at the bottom of the middle of the Minister's rectangle, leads to a rectangle containing the name Bob Hamilton and below his name the title Commissioner of the Canada Revenue Agency. A photo of the Commissioner's face also appears in the rectangle.

There is also a solid line leading from the rectangle for Suzanne Gouin to the rectangle for Bob Hamilton to illustrate that the Commissioner has a reporting relationship to both the Minister of National Revenue and the Chair of the Agency's Board of Management.

On the left-hand side of the rectangle for Bob Hamilton there is a solid line leading to a rectangle containing the name Nancy Chahwan and below her name the title Deputy Commissioner. A photo of Nancy Chahwan also appears in the rectangle.

A solid line leads from the bottom of the rectangle for the Commissioner to a series of boxes in three columns containing the names and titles of the Agency's Assistant Commissioners.

The column on the left contains the names of the Assistant Commissioners of each program branch at Headquarters and, reading from top to bottom, this is the information that appears:

Mireille Laroche

Assistant Commissioner

Appeals

Frank Vermaeten

Assistant Commissioner

Assessment, Benefit, and Service

Michael Snaauw

Assistant Commissioner

Collections and Verification

Ted Gallivan

Assistant Commissioner

International, Large Business and Investigations

Anne-Marie Lévesque

Assistant Commissioner

Domestic Compliance Programs

The column in the middle contains the names of the Assistant Commissioners for the Regions and, reading from top to bottom, this is the information that appears:

Ainslea Cardinal

Assistant Commissioner

Atlantic

Vince Pranjivan

Assistant Commissioner

Ontario

Maureen Phelan

Assistant Commissioner

Pacific

Ross Ermel

Assistant Commissioner

Prairie

Louis Beauséjour

Assistant Commissioner

Quebec

The column on the right contains the names of the Assistant Commissioners of each corporate branch at Headquarters and, reading from top to bottom, this is the information that appears:

Brian Philbin

Assistant Commissioner and Chief Audit Executive

Audit, Evaluation, and Risk

Roch Huppé

Assistant Commissioner and Chief Financial Officer

Finance and Administration

Dan Couture

Assistant Commissioner

Human Resources

Annette Butikofer

Assistant Commissioner and Chief Information Officer

Information Technology

Lynn Lovett

Assistant Deputy Minister

Tax Law Services Portfolio

Legal Services

Geoff Trueman

Assistant Commissioner

Legislative Policy and Regulatory Affairs

Maxime Guénette

Assistant Commissioner and Chief Privacy Officer

Public Affairs

Yves Giroux

Assistant Commissioner

Strategy and Integration

As of April 2018

Head office

Connaught building

555 MacKenzie Avenue, 7th floor

Ottawa ON K1A 0L5

Telephone: 613-957-3688

Fax: 613-952-1547

Website: www.canada.ca/en/revenue-agency.htmlvi