Group work into SR&ED projects

On this page

What is an SR&ED project

An SR&ED project is a set of interrelated activities that together achieve or attempt to achieve scientific or technological advancement. All the activities within an SR&ED project must be related to the same advancement.

To claim SR&ED tax incentives, you need to separate your eligible work from other work you do that is not eligible. After you have identified your eligible work, you can then group it into one or more SR&ED projects.

Example of an SR&ED project

For example, your business is developing a vaccine for a new virus. Some parts of that development work are directly related to resolving an uncertainty, such as not knowing how the virus reacts.

But other parts of the work do not directly relate to resolving the uncertainty, such as marketing the final product.

Only the activities directly related to resolving the uncertainty, that is, discovering how the virus reacts, would be considered part of the SR&ED project.

Lifecycle of an SR&ED project

An SR&ED project starts when you identify the need for a scientific or technological advancement that overcomes a scientific or technological uncertainty. If you find that you have several uncertainties, you may actually have several SR&ED projects.

An SR&ED project ends when new scientific or technological knowledge is gained, whether you were successful in reaching your goal or not. Your work may still be eligible even if the results you sought were not achieved.

After you have grouped your work into SR&ED projects, you can then determine the related expenditures that you may claim for the year.

While some SR&ED projects can last several years, you may only claim the expenditures incurred during the tax year for which you are claiming.

How to group eligible work into SR&ED projects

Different ways to group work

The first step in grouping eligible work into an SR&ED project is to separate work that is done to achieve the scientific or technological advancement from other work you may have done that is not SR&ED.

Depending on how your business projects are organized, there are different ways you can group your SR&ED work.

What is a business project

The purpose of a business project is to achieve commercial success. The lifecycle of a business project may include many activities, often grouped into different projects, phases, and milestones.

The purpose of an SR&ED project is to advance scientific knowledge or to achieve a technological advancement.

SR&ED project scenarios

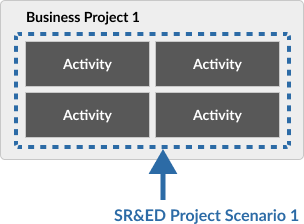

Scenario 1: All activities in your business project are eligible

All work in a given business project is eligible and can form one SR&ED project.

For example, if your business project contains 4 activities, these activities can be grouped to form one SR&ED project.

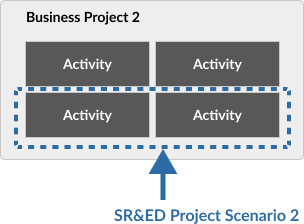

Scenario 2: Some activities within a business project are eligible

Your business project may have a mix of eligible and ineligible work. Only the eligible work can be part of your SR&ED project.

For example, your business project contains 4 activities but only 2 are eligible. You can group the 2 eligible activities to form one SR&ED project.

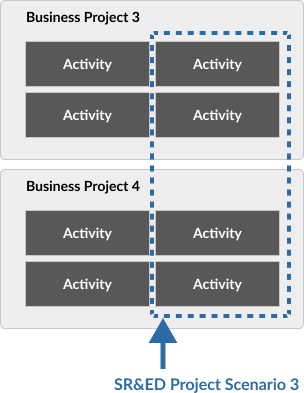

Scenario 3: Some activities over several business projects are eligible

You may have several business projects where eligible work is happening. You can group eligible work across your business projects into one SR&ED project as long as they relate to the same advancement.

For example, you have 2 business projects that contain 4 activities each. But only 2 activities in each project are eligible. Since these 2 eligible activities relate to the same advancement, you can group them to form one SR&ED project.

Basic steps to grouping your work into a project

Identify the activities

Identify all the tasks you carried out that were directly related to achieving or attempting to achieve the advancement.

For more information about eligible work, refer to the page What work is eligible.

Include SR&ED support work

You may include all support work that matches the needs of and directly supports your basic research, applied research, or experimental development.

Review eligible support work

Eligible support work must be in one of the following categories:

- Engineering

- Design

- Operations research

- Mathematical analysis

- Computer programming

- Data collection

- Testing

- Psychological research

Exclude activities that are not eligible

After you have listed your work that is eligible, remove any work that you cannot claim.

Work you cannot claim

Excluded work

- Market research or sales promotion

- Quality control or routine testing of materials, devices, products or processes

- Research in the social sciences or the humanities

- Prospecting, exploring or drilling for, or producing, minerals, petroleum or natural gas

- The commercial production of a new or improved material, device or product, or the commercial use of a new or improved process

- Style changes

- Routine data collection

Other activities you cannot claim

Some activities related to acquiring knowledge do not meet the SR&ED requirement of achieving an advancement. The following activities are not eligible:

- Training

- On-the-job learning

- Hiring expert employees or consultants with know-how

- Purchasing proprietary knowledge

Name the project

Create a name for your project and note down its start date and expected completion date. You will need to include this information in your SR&ED expenditures claim.

Get support grouping SR&ED work

How to write your project description for Form T661

Find industry specific examples of project descriptions.

Contact us

Call us if you have any questions about the SR&ED program or grouping work into SR&ED projects.