Statement of account for current source deductions – Regular and quarterly remitters – PD7A

On this page

How often is a PD7A sent

The PD7A is sent as soon as a payment for current source deductions is received or after a PD7A reply is processed in the CRA system. A PD7A will not be issued when a NIL remittance reply is received via TeleReply or over MyBA.

What to do if you received a PD7A

If you received a PD7A, you must use the PD7A to remit (pay) current source deductions.

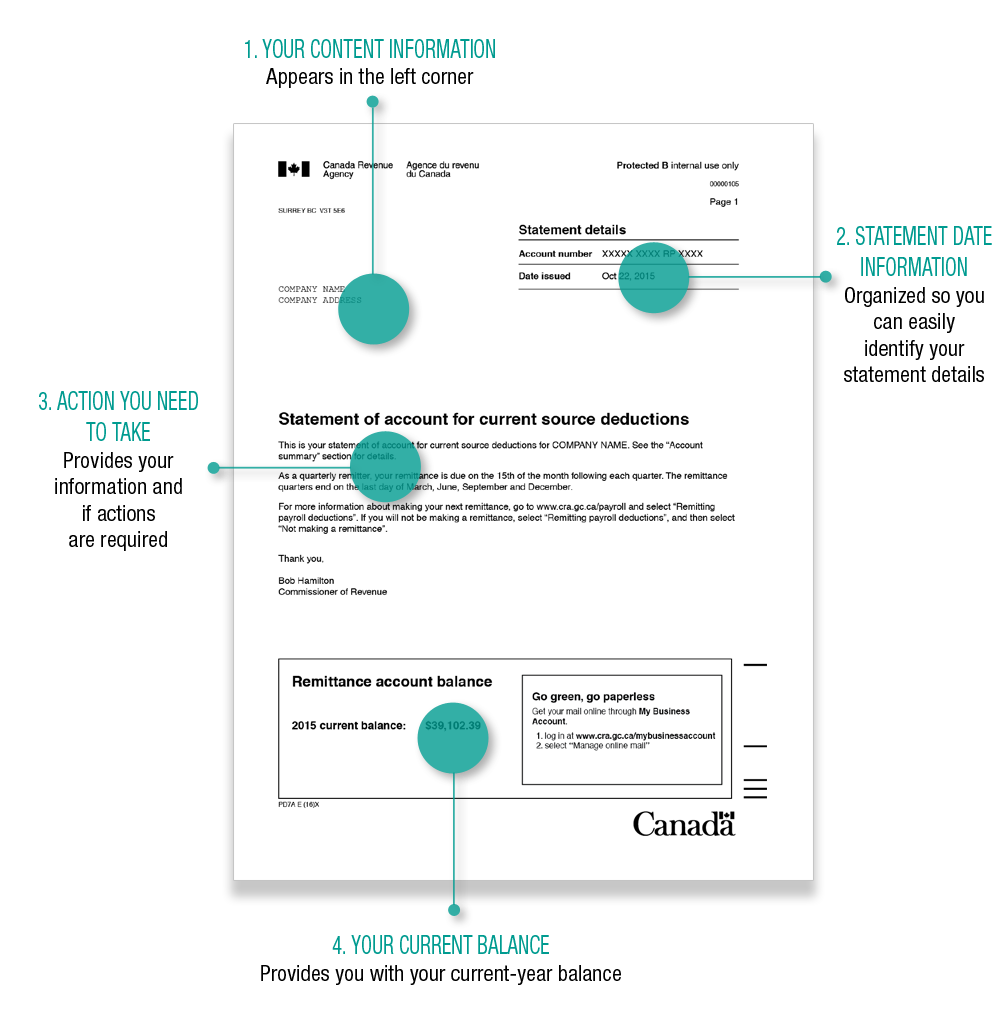

Learn more and view the sample: PD7A – Statement of account for current source deductions.