Determine your work space use

On this page

Detailed method

If you are claiming the employment portion of the actual amounts you paid, use the Detailed method. You will need to determine the size and use (employment and personal) of your work space to calculate your claim for work-space-in-the-home expenses.

To determine if you are eligible, refer to: Eligibility criteria – Detailed method.

Size of your home and work space

- Size of your home

All finished areas within the home count towards the size of the home. This includes:

- hallways

- bathrooms

- kitchen

You can measure this in square metres or square feet.

- Size of your work space

The size of the space you work in must be reasonable.

You can measure this in square metres or square feet.

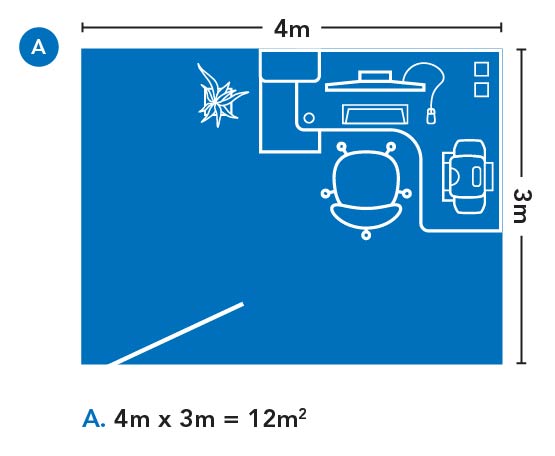

The formula to calculate a rectangle or square is:

Length times WidthFor example:

- 4 m (length of room)

- times 3 m (width of room)

- equals 12 m2 (total size of room)

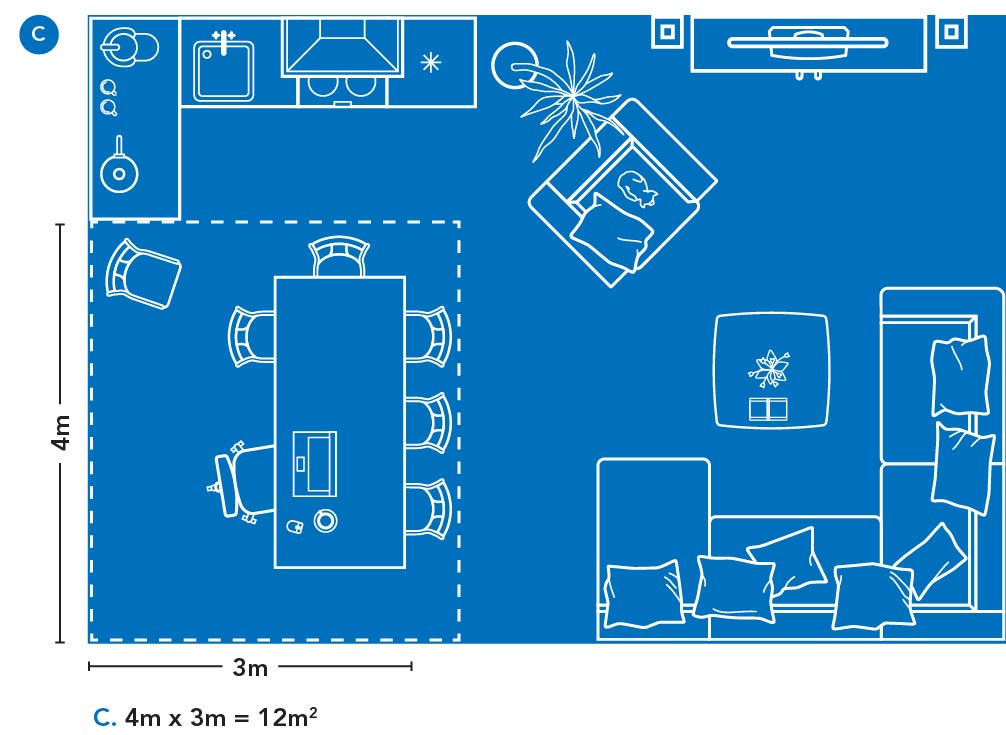

To calculate the size of an irregular-shaped room, break down the dimensions into rectangles and add them up.

For example:

- 4 m (length of 1st area)

- times 1.5 m (width of 1st area)

- equals 6 m2 (size of 1st area)

- 2 m (length of 2nd area)

- times 1.5 m (width of 2nd area)

- equals 3 m2 (size of 2nd area)

- 6 m2 (size of 1st area)

- plus 3 m2 (size of 2nd area)

- equals 9 m2 (total size of room)

Determine the percentage of your home that you use as a work space

To determine the percentage of your home that you use as a work space, use this formula:

Size of your work space divided by Size of your home times 100 equals your work space as a % of your home

Example: Basic calculation

- 40 m2 (size of work space)

- divided by 400 m2 (size of home)

- times 100 (to convert it into a percentage)

- equals 10% (percentage of home used as a work space)

The calculator will perform this calculation for you.

Types of work spaces

There are two types of work spaces:

- common (shared) area

- designated room

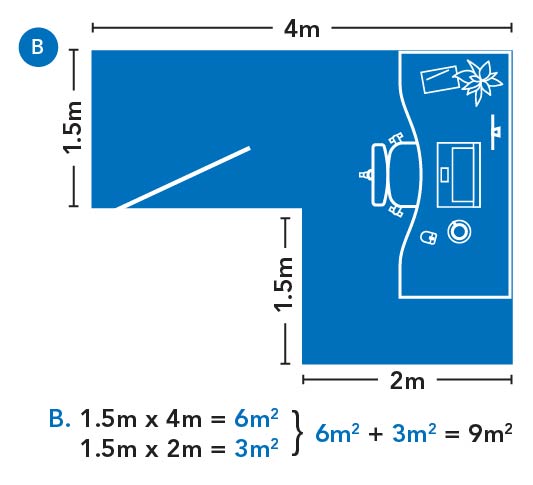

Common (shared) area: Option 1 of 2

A common area is a space that has other purposes besides your work (for example, working at a kitchen table or using the family computer room).

Designated room: Option 2 of 2

A designated room is used only for your work (for example, a spare room).

Hours per week you use the space for work

The number of hours you use the space for work can affect the amount of expenses you can claim, and depends on the type of your work space: a common (shared) area or designated room.

Common (shared) area: Option 1 of 2

Your claim is based on your employment use of the space and is determined using the number of hours the space is used for work. For example, if you work 40 hours a week at the kitchen table:

- 40 hours (hours worked)

- divided by 168 hours (total hours in a week)

- times 100 (to convert into a percentage)

- equals 23.8% (percentage of time you can claim for the work space)

Designated room: Option 2 of 2

Your claim is not affected by the number of hours you use the space for work. For example, if you work 40 hours a week in your dedicated room:

- 40 hours (hours worked)

- equals 100% (percentage of time you can claim for the work space)

Example: Dining room table is the work space

Sam has been working from home using her dining room table. The dining room is 12% of the total square footage of her house and she uses it for work for 40 hours out of a total 168 hours in the week.

Since the dining room is not used only for work, Sam will need to calculate the employment use of that work space.

- 12% (size of work space compared to the entire finished area of the home)

- times 23.8% (40 hours worked per week divided by 168 hours in a week)

- times 100 (to convert into a percentage)

- equals 2.8% (percentage of home that is used as a work space)

If Sam paid $1,200 for rent, electricity, heat, and water for the period she worked at home, the employment use portion is $1,200 x 2.8% = $33.60.

Example: Spare room is the work space

Charlie lives alone in a 5-room house and has a designated area (spare room) where Charlie only performs employment duties.

- 20 m2 (area of Charlie's work space in his home)

- divided by 200 m2 (total finished area)

- times 100 (to convert into a percentage)

- equals 10% (percentage of home Charlie uses for his work space)

If Charlie paid $1,200 for electricity, heat, and water for the period they worked at home, the employment use portion is $1,200 x 10% = $120.

The calculator will perform this calculation for you.

Number of workers in the home

One employee working in the home

If only one person in your home uses a work space, that person will claim the whole employment use of that work space.

Multiple employees working in the same home

Different work spaces

Each employee will calculate their employment use of the work space they are using.

Sharing the same common area work space

Each employee will calculate their employment use of the work space they are sharing.

Example: Multiple employees sharing a common area (shared) work space

Sam and Terry rent an 8-room house. They have been working from home using their dining room table and they each use half of the space. They both meet all the eligibility criteria.

- 12 m2 (dining room area)

- times by 50% (portion of the space they each used)

- equals 6 m2 each

- divided by 100 m2 (total finished area of the house)

- times 100 (to convert into a percentage)

- equals 6% (percentage of home used for their work space)

Sam worked 40 hours a week and Terry worked 25 hours per week, both at the dining table.

For Sam

- 6% (percentage of home used for his work space)

- times 23.8% (40 hours worked divided by 168 total hours in a week)

- times 100 (to convert into a percentage)

- equals 1.4%

For Terry

- 6% (percentage of home used for her work space)

- times 14.9% (25 hours worked divided by 168 total hours in a week)

- times 100 (to convert into a percentage)

- equals 0.9%

Sharing a designated work space

Each employee will calculate their employment use of the work space they are sharing.

Example: Multiple employees sharing a designated work space

Nneka and Sergio both worked from home and they shared a designated office in their home (office used only for work). The designated office space makes up 12% of the total finished area of their home and they each use half of space to do their work. They both meet all the eligibility criteria

- 12 m2 (office area)

- times by 50% (portion of the space they each used)

- equals 6 m2 each

- divided by 100 m2 (total finished area of the house)

- times 100 (to convert into a percentage)

- equals 6% (percentage of home used for their work space)

Nneka and Sergio have a designated work space so the number of hours they work does not affect the calculation.

Change of work space

If you use different work spaces in your home, or you move to a new property, you will need to claim the expenses you paid for each work space separately. This is due to changes in the size and type of the work space, or finished area of the home.

Example: Moving between two homes

Jean-François worked from home full-time from April 1 to July 15, 2024, and then returned to work full-time at the office. During these 15 weeks, he met all the eligibility criteria.

Jean-François lived in property A until June 30, 2024, and moved to property B on July 1, 2024.

- Calculation 1: April 1 to June 30, 2024 (Consider the deductible expenses paid during that period, the type of work space, its size, and the size of the total finished space that relates to property A)

- plus Calculation 2: July 1 to July 15, 2024 (Consider the deductible expenses paid during that period, the type of work space, its size, and the size of the total finished space that relates to property B)

- equals Total expenses Jean-François can claim in 2024

Temporary flat rate method for 2020, 2021 and 2022

If you are using the Temporary flat rate method, you do not need to determine the size of your work space to calculate your claim for home office expenses.

To determine if you are eligible, refer to: Eligibility criteria – Temporary flat rate method.

Multiple employees working in the same home

Each employee working from home who meets the eligibility criteria can use the temporary flat rate method to calculate their deduction for home office expenses.