Treasury Board of Canada Secretariat 2019–20 Departmental Plan

Erratum

In the table “Planned results: administrative leadership” of the original version of the Departmental Plan, September 2019 was given as the date for achieving the target for the indicator “Percentage of Government of Canada websites that deliver digital services to citizens securely.” That date has been changed to December 31, 2019, to align with subsection 6.2.3 of the Information Technology Policy Implementation Notice “Implementing HTTPS for Secure Web Connections.”

On this page

- President’s message

- Plans at a glance and operating context

- Planned results: what we want to achieve this year and beyond

- Spending and human resources

- Additional information

- Appendix: definitions

Complete a survey on your experience using this Departmental Plan.

President’s message

President of the Treasury Board and Minister of Digital Government

As the President of Treasury Board and Minister of Digital Government, I am pleased to present the Departmental Plan of the Treasury Board of Canada Secretariat (TBS) for the 2019 to 2020 fiscal year.

In leading the government’s management agenda, I am fortunate to be supported by the dedicated employees of TBS. Their past achievements have set the foundation for further progress this coming year.

TBS has embraced regulatory modernization, setting the table for critically important domestic and international trade opportunities and making it easier for Canadian businesses to grow and create jobs. We have also made changes to the Estimates process so that Parliamentarians can better track the spending of taxpayers’ dollars.

As my title now makes clear, we have, as well, made a strong commitment to the digital revolution that is transforming how Canadians will receive Government of Canada programs and services in the future.

In the 2019 to 2020 fiscal year, we will continue to deliver meaningful results for Canadians by focusing on the following key priorities:

- increasing the openness, transparency and accountability of government, leading the implementation of Canada’s 2018–2020 National Action Plan on Open Government, providing leadership to the Open Government Partnership and hosting the 2019 Open Government Partnership Global Summit in May 2019

- improving government operations and service delivery, including developing a new digital policy to make government more service oriented, open, collaborative, accessible, and digitally enabled

- implementing regulatory modernization, including conducting targeted reviews of regulatory irritants, and establishing a Centre for regulatory innovation to help grow competitiveness for Canadian businesses.

I look forward to leading the ground breaking work done by TBS and helping make a difference in the lives of Canadians.

Original copy signed by

The Honourable Joyce Murray, P.C., M.P.

President of the Treasury Board and Minister of Digital Government

Plans at a glance and operating context

As the administrative arm of the Treasury Board, the Treasury Board of Canada Secretariat (TBS) provides leadership to help departments effectively implement government priorities and meet citizens’ evolving expectations of government.

In 2019–20, TBS will continue to work toward its performance targets in relation to its 4 Core Responsibilities:Footnote 1

- spending oversight

- administrative leadership

- employer

- regulatory oversight

1. Spending Oversight

Context

TBS oversees how the federal government spends taxpayers’ dollars. It does this by reviewing government programs, spending proposals and spending authorities, and by reporting to Parliament and Canadians on government spending.

Highlights of recent progress in this area include:

- piloting a change to the timing and content of the Main Estimates, making them easier for parliamentarians and Canadians to understand

- better reporting to Canadians on government spending through the GC InfoBase, an interactive online tool for finding the latest information on government finances, people, and results

Plans

In 2019–20, performance targets reflect plans to further improve spending oversight by:

- increasing departments’ success rates in meeting their targets in relation to their departmental results indicators

- disclosing financial risk more clearly in Treasury Board submissions

- making reports on government spending more useful for parliamentarians and Canadians

2. Administrative Leadership

Context

TBS develops policies and sets the strategic direction for government administration. It also supports the President of the Treasury Board in her additional role as Minister of Digital Government.

Highlights of recent progress in this area include:

- a significant reduction in the government’s greenhouse gas emissions

- an increase in the number of government datasets accessible to Canadians

Plans

In 2019–20, performance targets in this area reflect plans to further improve administrative leadership by:

- giving Canadians access to even more federal government datasets

- reducing the time it takes for federal government institutions to answer access to information and personal information requests

- increasing the percentage of federal government services that meet service standards

- delivering more federal government services digitally and securely

- better managing federal government assets

- further reducing the federal government’s greenhouse gas emissions

3. Employer

Context

TBS develops policy and provides strategic direction for managing people in the public service, including in areas such as talent and performance management, wellness and diversity. It also represents the government in labour relations matters.

Highlights of recent progress in this area include:

- the completion of the 2014 round of collective bargaining

- an increase in bilingual service provision in designated bilingual offices

- an increase in job satisfaction among federal employees

- the representation of women, visible minorities and persons with disabilities in the executive ranks of the public service exceeds workforce availability for those groups

- the 2018 round of collective bargaining continues to advance in good faith

- the creation of a new Centre on Wellness, Inclusion and Diversity to share tools and resources with employees in order to support a healthy, harassment-free workplace

- the modernization of the people management and executive policy suites to align with the public service of the future

Plans

In 2019–20, performance targets in this area reflect plans to further improve TBS’s support to the Treasury Board in its role as employer of the public service by:

- increasing diversity in the executive levels of the federal public service

- improving wellness in the public service

- reducing harassment in the workplace

- pursuing the 2018 round of collective bargaining

4. Regulatory Oversight

Context

TBS develops and oversees policies to promote good regulatory practices, reviews proposed regulations, and promotes regulatory cooperation across jurisdictions.

Highlights of recent progress in this area include:

- updating policy direction for regulatory practices in the federal government

- putting in place new regulatory cooperation forums

Plans

In 2019–20, performance targets in this area reflect plans to further improve regulatory oversight by:

- increasing the number of federal regulatory programs that have a regulatory cooperation work plan

- implementing new regulatory modernization initiatives that support innovation and economic growth

For more information on TBS’s plans, priorities and planned results, see the “Planned results” section of this report.

Planned results: what we want to achieve this year and beyond

This section contains the following for each of TBS’s Core Responsibilities:

- a description of the responsibility

- the results that TBS will work toward in 2019–20Footnote 2 in relation to the responsibility

- links between these results and the commitments in the Prime Minister’s November 2015 mandate letter to the President of the Treasury Board for 2015 to 2019

- highlights of what TBS plans to do in 2019–20 to work toward achieving these results

- a brief description of a key risk to TBS’s ability to achieve the resultsFootnote 3

- tables that show:

- the indicators TBS will use to measure its performance against each planned result

- TBS’s targets and when it is aiming to meet them

- the financial and human resources that TBS will allocate to achieving these results

This section also contains information about internal servicesFootnote 4 at TBS:

- highlights of TBS’s plans for 2019–20

- tables that show the financial and human resources that TBS will allocate to internal services

Core Responsibilities

1. Spending Oversight

Description

- Review spending proposals and authorities

- Review existing and proposed government programs for efficiency, effectiveness, and relevance

- Provide information to Parliament and Canadians on government spending

Planning highlights

TBS’s planned departmental results in relation to spending oversight are as follows:

- Departments achieve measurable results

- Treasury Board proposals contain information that helps Cabinet ministers make decisions

- Budget initiatives are approved for implementation quickly

- Reporting on government spending is clear

The following provides details on those results.

Departmental result 1 for Spending Oversight: departments achieve measurable results

TBS works with departments to:

- set ambitious but achievable targets in relation to performance indicators for their core responsibilities, programs, and spending proposals

- review departmental spending

This work supports the fulfillment of the Treasury Board President’s mandate letter commitments to:

- strengthen the oversight of taxpayers’ dollars

- improve the use of evidence and data in evaluating programs

- reduce poorly targeted and inefficient measures

The Treasury Board Policy on Results came into effect in 2016–17 and aimed at improving how departments measure, evaluate, and report results in order to:

- improve the achievement of results across government

- more clearly communicate the results of government spending

In the first 2 years of implementation of the policy, government-wide, the percentage of departmental results indicators for which targets were achieved decreased, from 69% in 2016–17 to 65% in 2017–18. This decrease stemmed from TBS’s encouraging departments to set more ambitious results and targets when developing their new Departmental Results Frameworks.

TBS wants to see this result improve to between 70% and 80% in 2019–20. A result in this range would suggest that departments are setting targets that are ambitious but achievable.

In pursuit of this target, TBS will provide advice to departments on refining their departmental results, results indicators, and targets.

In addition, to help departments achieve measurable results more broadly, TBS will continue to advise departments on:

- applying experimental approaches to policies and programs to address persistent problems that traditional approaches have failed to solve

- using performance measurement information when designing programs and developing spending proposals

- incorporating gender-based analysis plus into their performance measurement information to explain how they are helping achieve the government-wide priorities of gender equality, diversity, and inclusiveness

- measuring the performance and impact of federal innovation programs as part of a joint initiative between TBS and Statistics Canada that began in 2018

Departmental result 2 for Spending Oversight: Treasury Board proposals contain information that helps Cabinet ministers make decisions

TBS works with federal organizations when they are preparing spending proposals for the Treasury Board’s consideration. Before these proposals are submitted to the Treasury Board, TBS works with departmental staff, primarily during the Treasury Board submission process but also when the memorandum to Cabinet is being drafted, to ensure that the proposals:

- align with Treasury Board policies and government priorities

- support value for money

- clearly explain the results that will be achieved and how those results will be measured

- contain clear assessments of risk, including financial risk

Once proposals have been submitted to the Treasury Board, TBS advises Treasury Board ministers accordingly.

TBS also has an ongoing support, oversight, and advisory role with respect to broader departmental and whole-of-government management matters, including departmental reviewsFootnote 5 and complex, long-term priorities.

This work supports the fulfillment of the Treasury Board President’s mandate letter commitments to:

- strengthen the oversight of taxpayer dollars

- exercise due diligence regarding costing analysis prepared by departments

- accelerate and expand open data initiatives and make government data available digitally

- take a leadership role to review policies to improve the use of evidence and data in program innovation and evaluation

- ensure that all federal services are delivered in full compliance with the Official Languages Act

TBS reviewed the degree to which Treasury Board submissions transparently disclosed financial risk in 2017–18 and found that 13% did so.Footnote 6 The target is to improve this result in the medium-term so that 75% transparently disclose by 2023.

In pursuit of this target, in 2019–20, TBS will update guidance to departments on presenting cost information. The new guidance will focus on how to build comprehensive, well-documented cost estimates. It will, for example, explain how to identify and document costing assumptions, which will help departments identify and communicate financial risks.

TBS is also considering changing its approach to working with departments, in an effort to provide better support to departments when they are developing cost estimates and to address a capacity risk in this area. See the “Key risk to spending oversight” section of this report for more information on this risk.

Departmental result 3 for Spending Oversight: Budget initiatives are approved for implementation quickly

TBS aligns the Estimates process with the annual Budget so that financial reporting is clear and consistent, and timely funding is available to departments.

This work supports the fulfillment of the Treasury Board President’s mandate letter commitments to:

- strengthen the oversight of taxpayers’ dollars

- improve the clarity and consistency of financial reporting

In 2017, following Budget 2017, 40% of initiatives were included in the next available (supplementary) Estimates. However, in June 2017, the House of Commons adopted changes to the Standing Orders of the House of Commons to allow the Main Estimates to be tabled after the Budget and to incorporate Budget initiatives. As a result of these changes, which took effect in 2018 as a 2-year pilot initiative, 100% of Budget 2018 initiatives were included in the 2018–19 Main Estimates.

In 2019–20, TBS aims to again have 100% of Budget 2019 initiatives included in the next available Estimates.

In pursuit of this target, TBS will:

- incorporate funding for Budget 2019 initiatives into the Main Estimates

- review the results of the pilot and make recommendations for the next (2020) Budget cycle

- continue to update its Budget Tracker, which is available on a public website (GC InfoBase), so that Canadians can track Budget items as funding is distributed to departments and allocated to programs

Departmental result 4 for Spending Oversight: reporting on government spending is clear

TBS is always working to improve reporting to Canadians. This work supports the fulfillment of the Treasury Board President’s mandate letter commitment to improve reporting to Parliament.

TBS’s work in this area includes:

- continuing to improve the GC InfoBase, an interactive publically accessible tool for finding the latest information on all government finances, people and results

- simplifying Departmental Plans and Departmental Results Reports

In 2017–18, TBS surveyed GC InfoBase users for the first time. The survey showed that 71% found the information useful. The aim is to reach 80% in 2019–20. TBS will continue to update the GC InfoBase to meet users’ needs, including by adding links between datasets to make it easier to find information.

As part of its efforts to improve Departmental Plans and Departmental Results Reports, in 2018–19, TBS began surveying online readers about the usefulness of these documents. As of December 2018, the preliminary result was an average rating of 3.4 out of 5. TBS will work with departments to help them communicate their plans and results in an effort to achieve at least an average rating of 4 out of 5 in 2019–20.

Key risk to spending oversight

The federal government’s capacity to estimate the cost of projects is limited. The public service has fewer than 50 certified cost estimators,Footnote 7 and not all departments have the data and tools they need to perform robust cost estimates. This level of capacity creates a risk that not all major program and project proposals will have robust cost estimates.

In response, TBS’s Costing Centre of Expertise is looking at ways to improve how it provides oversight. The centre reviews and oversees cost estimates when major proposals come to the Treasury Board for approval. The centre is considering changing the way it works with departments, by engaging with them earlier in the process, when they are developing program and project proposals, to help them:

- identify and mitigate financial risks

- provide better information to decision-makers

| Departmental Results | Departmental Result Indicators | Target | Date to achieve target | 2015–16 Actual results | 2016–17 Actual results | 2017–18 Actual results |

|---|---|---|---|---|---|---|

Table 1 Notes

|

||||||

| 1. Departments achieve measurable results | Percentage of departmental results indicators for which targets are achieved | 70% to 80% | Annually | Not available | 69.2% | 65%table 1 note 1 |

| 2. Treasury Board proposals contain information that helps Cabinet ministers make decisions | Degree to which Treasury Board submissions transparently disclose financial risk | At least 75% | March 2023 | Not available | Not available (new indicator) | 13%table 1 note 2 |

| 3. Budget initiatives are approved for implementation quickly | Percentage of Budget initiatives included in the next available Estimates | 100% of Budget 2019 initiatives included in the next available Estimates | April 2019 | Not available | 66% of Budget 2016 initiatives were included in the next available Estimates | 40% of Budget 2017 initiatives were included in the next available Estimatestable 1 note 3 |

| 4. Reporting on government spending is clear | Degree to which GC InfoBase users found the spending information useful (on a scale of 1 to 5) | At least 80% | Annually | Not available | Not available (new indicator) | 71%table 1 note 4 |

| Degree to which visitors to online departmental planning and reporting documents found the information useful (on a scale of 1 to 5) | Average of at least 4 out of 5table 1 note 5 | Annually | Not available | Not available (new indicator) | Not available. User survey implemented with tabling of 2018–19 Departmental Plans. | |

|

2019–20 Main Estimates |

2019–20 Planned spending |

2020–21 Planned spending |

2021–22 Planned spending |

|---|---|---|---|

| 4,116,924,204 | 4,116,924,204 | 3,628,008,445 | 3,593,057,175 |

Planned spending of $4.1 billion for TBS’s Core Responsibility of Spending Oversight relates largely to Government-Wide Funds.

TBS transfers funding from Government-Wide Funds to supplement the appropriations of other federal organizations, once approved by the Treasury Board, for items such as government contingencies, government-wide initiatives, compensation requirements, operating and capital budget carry forward, and paylist expenditures.

Planned spending in 2019–20 also includes $40.1 million in program expenditures for TBS to deliver on this Core Responsibility.

|

2019–20 Planned full-time equivalents |

2020–21 Planned full-time equivalents |

2021–22 Planned full-time equivalents |

|---|---|---|

| 295 | 296 | 296 |

Financial, human resources and performance information for the TBS’s Program Inventory is available in the GC InfoBase

2. Administrative leadership

Description

- Lead government-wide initiatives

- Develop policies and set the strategic direction for government administration related to:

- service delivery

- access to government information

- the management of assets, finances, information, and technology

Planning highlights

TBS’s planned departmental results in relation to administrative oversight are as follows:

- Canadians have timely access to government information

- Government service delivery is digitally enabled and meets the needs of Canadians

- Government has good asset and financial management practices

- Government demonstrates leadership in making its operations low-carbon

The following provides details on those results.

Departmental result 1 for Administrative Leadership: Canadians have timely access to government information

TBS works with departments to provide Canadians with timely access to government information. This work supports the fulfillment of the Treasury Board President’s mandate letter commitments to:

- make government more open

- make government data available digitally

TBS has worked steadily with federal government organizations to add datasets to open.canada.ca, the open government portal. In 2018, Canada ranked number 1 in the world on the Open Data Barometer (tied with the United Kingdom) and, in recognition of its leadership on open government, was co-chair of the Open Government Partnership in 2018–19.

In 2017–18, federal government organizations made 1,807 new datasets available to the public. The target for 2019–20 is at least 2,000.

In pursuit of this target, TBS will continue to provide guidance and technical support to federal government organizations to help them add content to open.canada.ca.

Also in 2019–20, in support of open government, TBS will:

- lead the implementation of Canada’s 2018–20 National Action Plan on Open Government

- share best practices with other jurisdictions by:

- supporting the President of the Treasury Board as she represents Canada in its role as co-chair of the Open Government Partnership

- hosting the 2019 Open Government Partnership Global Summit in May 2019

In support of government institutions’ efforts to provide Canadians with information that they specifically request, TBS tracks the degree to which institutions respond to Canadians’ access to information requests and personal information requests within legislated timelines.

Performance in these areas has been declining. The percentage of access to information requests responded to within legislated timelines dropped from 86% in 2015–16 to 76% in 2017–18. The percentage of personal information requests responded to within legislated timelines also dropped in that period, from 80% in 2015–16 to 75% in 2017–18. This downward trend reflects the continuing increase in the number of requests the government receives each year.

In 2018–19, TBS set the following targets, to be achieved by the end of the 2019–20 fiscal year:

- 90% of access to information requests are responded to within legislated timelines

- 85% of personal information requests are responded to within legislated timelines

In pursuit of these targets, in 2019–20, TBS will explore ways to increase support to the offices that respond to access to information and personal information requests by, for example, coordinating staffing and training. In addition, the new Access to Information and Privacy Online Request Service, launched in 2018, is expected to contribute to better results in this area. The new service is helping reduce misdirected requests for government information by helping requesters choose the institution that is most likely to have the information they want. As well, the service collects the $5 fee for access to information requests submitted electronically. As a result, institutions have a lighter administrative burden and can focus on responding to requests. By 2021, all government institutions subject to the Access to Information Act and the Privacy Act will receive requests through this service.

The “Key risk to administrative leadership” section provides more information on the risk to the government’s ability to achieve these targets.

To further support improved access to government information, TBS will help government institutions implement proposed amendments to the Access to Information Act, including by providing guidance and tools to help them implement new requirements to proactively publish key government information.

The amendments would also require the President of the Treasury Board and Minister for Digital Government to begin a full review of the act within 1 year of the amendments coming into force. TBS would support the President in fulfilling these requirements.

Departmental result 2 for Administrative Leadership: government service delivery is digitally enabled and meets the needs of Canadians

TBS sets outs the requirements and expectations for government services, with the aim of:

- making services across all channels (for example, in person, phone, online) easy to use and responsive to the needs of Canadians

- making more services available online

- making these services secure and accessible to all Canadians

These efforts support the fulfillment of the Treasury Board President’s mandate letter commitment to improve government service delivery.

In 2017–18, targets in this area were not met. In 2018–19, TBS worked with departments to help them improve service delivery, including through direct, hands-on delivery partnerships offered by the Canadian Digital Service.

TBS has also been working to increase the secure delivery of digital services; in June 2018, it issued new requirements and supporting guidance for secure web communications.

The aim is to improve the following results in the area of service delivery:

- In 2017–18, 62% of Government of Canada priority services were available online; the aim is to increase this to at least 70% by March 2020.

- In 2017–18, the degree to which clients were satisfied with how the Government of Canada delivered services, expressed as a score from 1 to 100, was 58; the aim is to increase this to at least 60 in the next survey, the results of which are expected by March 2022.

- In 2017–18, 70% of priority services met the service standard; the aim is to increase this to at least 80% by March 2020.

- When tracking began in August 2018, 19% of all publicly accessible Government of Canada websites and web services communicated with citizens securely; the aim is to reach 100% by December 31, 2019.

In pursuit of these targets, in 2019–20, TBS plans to introduce a new digital policy that streamlines, integrates, and replaces existing policies on information technology, information management, and service. The policy will aim to:

- make the design and improvement of government services more informed by user input, the need to safeguard personal information, and the need to protect against cybersecurity threats

- improve the management of government information, including data

TBS will also:

- help departments comply with the new requirements for secure web communications by:

- offering information sessions

- advising them on resolving specific compliance issues

- work with departments, provinces, and territories to develop a pan-Canadian approach to digital identityFootnote 8 so that the public has seamless access to government services

- continue to help departments design and deliver services that meet their users’ needs, by providing policy guidance and training, as well as hands-on help through the Canadian Digital Service

- through the Office of Public Service Accessibility, develop and monitor the implementation of a new Public Service Accessibility Strategy, which will promote full accessibility for government websites and online services

Departmental result 3 for Administrative Leadership: government has good asset and financial management practices

TBS works with departments to improve their asset and financial management practices. This work supports the fulfillment of the Treasury Board President’s mandate letter commitment to take a more modern approach to comptrollership.

In 2017–18, 97% of departments had assessed all internal controls over financial reporting in high-risk areas and had shown that they annually realign, implement and monitor systems on internal control. The aim is to maintain this result in 2019–20.

A new indicator was added for 2017–18 to measure whether assets are well-managed. Based on a small sample of 10 departments, 80% of departments were effectively maintaining and managing their assets over their life cycleFootnote 9 during that year. The aim is to increase this to 90% of departments in 2019–20.

In pursuit of these targets, in 2019–20, TBS will:

- issue new guidance to departments on how to maintain their systems of internal control over financial management

- continue to implement a modern, integrated financial management system for the federal government so that decision-makers will have easy access to key financial information

- develop guidance and tools to help departments implement a new policy that sets direction for the planning and management of federal assets, investments, procurement, and projects

- implement a project management strategy to help strengthen the capacity of the government to deliver projects

Also in 2019–20, in further support of good asset and financial management practices, TBS will advise departments on accessible procurement, through the Office of Public Service Accessibility.

Departmental result 4 for Administrative Leadership: government demonstrates leadership in making its operations low-carbon

TBS works with departments to make the transition to low-carbon, climate-resilient, and green operations; and to reduce greenhouse gas emissions. This work aligns with the Federal Sustainability Development Strategy goal of greening government.

The federal government has been steadily reducing its greenhouse gas emissions. Relative to 2005 levels, it reduced its emissions by 24% by 2015–16, by 28% by 2016–17, and by 32% by 2017–18.

TBS has set targets for long-term emission reductions. Specifically, it wants to see a reduction in the federal government’s overall greenhouse gas emissions by 40% below 2005 levels by 2030 (with an aspiration to achieve this target by 2025), and by 80% by 2050.

In pursuit of these targets, in 2019–20, TBS will work with departments to implement the government’s Greening Government Strategy. It will, for example, coordinate federal efforts to reduce emissions from real property and fleet. Under the strategy, departments must meet new requirements for 100% of executive vehicle purchases, and 75% of administrative vehicles purchases, to be zero-emission or hybrid vehicles.

TBS will also fund the first group of projects under the Greening Government Fund, an initiative that will:

- promote and share innovative approaches to reducing greenhouse gas emissions

- provide funding for innovative projects in departments to reduce greenhouse gases in their operations

Key risk to administrative leadership

The number of access to information and personal information requests continues to increase.

Although the number of requests that were closed within legislated timelines, including extensions, increased from 70,128 in 2016–17 to 74,453 in 2017–18, there is a risk that institutions will find it increasingly difficult to keep pace with this demand and to answer requests within the legislated timelines.

To mitigate the risk that the 2019–20 targets will not be met, as mentioned above, TBS will explore ways to increase support to offices that respond to access to information and personal information requests. It will also continue to phase in the Access to Information and Privacy Online Request Service until all institutions that are subject to the Access to Information Act and the Privacy Act are receiving requests through this service.

| Departmental Results | Departmental Result Indicators | Target | Date to achieve target | 2015–16 Actual results |

2016–17 Actual results |

2017–18 Actual results |

|---|---|---|---|---|---|---|

Table 2 Notes

|

||||||

| 1. Canadians have timely access to government information | Number of new datasets available to the public | At least 2,000 new non-geospatial datasets | Annually | 192 new datasets published | 2,079 new datasets published | 1,807 new datasets publishedtable 2 note 1 |

| Percentage of access to information requests responded to within legislated timelines | At least 90% | March 2020 | 86% | 80.7% | 76%table 2 note 2 | |

| Percentage of personal information requests responded to within legislated timelines | At least 85% | March 2020 | 80% | 80.4% | 75%table 2 note 3 | |

| 2. Government service delivery is digitally enabled and meets the needs of Canadians | Percentage of Government of Canada priority services available online | At least 70% | March 2020 | Not available | Not available (new indicator) | 62% |

| Degree to which clients are satisfied with the delivery of Government of Canada services, expressed as a score from 1 to 100 | At least 60 | March 2022 | Canadians were not asked this question in 2015–16 | Canadians were not asked this question in 2016–17 |

58 | |

| Percentage of priority services that meet service standards | At least 80% | March 2020 | Not available | 85% | 70%table 2 note 4 | |

| Percentage of Government of Canada websites that deliver digital services to citizens securely | 100%table 2 note 5 | December 31, 2019 | Not available | Not available | Not available | |

| 3. Government has good asset and financial management practices | Percentage of departments that have assessed all internal controls over financial reporting in high-risk areas and annually realign, implement and monitor systems on internal control | At least 97% | March 2020 | 77% of the 35 departments assessed had reached the ongoing monitoring stage (had looked at their key controls at least once) | 94% | 97%table 2 note 6 |

| Percentage of departments that effectively maintain and manage their assets over their life cycle | At least 90% | March 2020 | Not available | Not available | 80% | |

| 4. Government demonstrates leadership in making its operations low-carbon | Level of overall government greenhouse gas emissions | Reduce greenhouse gas emissions by 40% below 2005 levels by December 2030, with an aspiration to achieve this target by December 2025, and by 80% by December 2050 | December 2030 (stretch target 2025) and December 2050 |

24% | 28% | 32% |

| 2019–20 Main Estimates |

2019–20 Planned spending |

2020–21 Planned spending |

2021–22 Planned spending |

|---|---|---|---|

| 100,107,686 | 100,107,686 | 76,812,232 | 76,794,229 |

| 2019–20 Planned full-time equivalents |

2020–21 Planned full-time equivalents |

2021–22 Planned full-time equivalents |

|---|---|---|

| 587 | 474 | 477 |

Financial, human resources and performance information for TBS’s Program Inventory is available in the GC InfoBase.

3. Employer

Description

- Develop policies and set the strategic direction for people management in the public service

- Manage total compensation (including pensions and benefits) and labour relations

- Undertake initiatives to improve performance in support of recruitment and retention

Planning highlights

TBS’s planned departmental results in relation to employer are as follows:

- Public service attracts and retains a skilled and diverse workforce

- Employee wellness is improved

- Modernized employment conditions

The following provides details on those results.

Departmental result 1 for Employer: public service attracts and retains a skilled and diverse workforce

Effective people management is a cornerstone of a high-performing public service and helps build Canadians’ trust in government. TBS works with key stakeholders, including the Public Service Commission of Canada and the Canada School of Public Service, to lead excellence in effective people management. Although departments manage their own human resources, TBS ensures an appropriate degree of consistency in people management across the public service in order to achieve a public service that:

- attracts and retains talented and skilled individuals, and maximizes the potential of its workforce to meet both current and future organizational needs

- is healthy, diverse and inclusive, and that is representative of the population it serves

- fosters leadership that sets clear direction, engages employees, and embodies the public service values and ethics

- innovates and invests in human resources systems and processes that enable high-quality people management services

TBS will continue to set the strategic direction for departments on government-wide people management needs, including innovation, performance, and inclusion.

TBS will also continue to support the fulfillment of the Treasury Board President’s mandate letter commitment to work with departments to deliver services in full compliance with the Official Languages Act, and the commitment to create a workplace free from harassment and sexual violence.

There are several facets to Departmental result 1 for Employer.

- Recruitment

The federal public service is trying to attract younger talent. The percentage of new indeterminate hires under the age of 35 has been fairly stable in the last 3 years, at a little over 50% each year. The target is to keep this rate at least 55% annually.

- Retention

One way the federal government gauges employee retention is by looking at their sense of satisfaction from their work. From 2014 to 2017, this increased from 74% to 77%. The target is to at least maintain this result.

- Skills

A key skill is bilingualism, and one way the public service measures this is by tracking the percentage of federal organizations where “communications in designated bilingual offices ‘nearly always’ occur in the official language chosen by the public.” This percentage increased from 84.5% in 2015–16 to 92.6% in 2017–18. The target is to maintain a result of at least 90%.

- Diversity

With respect to attracting and retaining a diverse public service, the federal government has set specific targets for the percentage of executive employees who are members of employment equity groups. These targets are, at minimum, consistent with the current availability of these groups in the Canadian executive workforce.

The percentages of executives who are members of a visible minority group, women, or persons with disabilities, are above current workforce availability. The target is to at least maintain workforce availability rates, annually, for visible minorities and women.Footnote 10 For persons with disabilities, given TBS’s work to improve accessibility in the public service, the target is to reach 5% annually, compared with the workforce availability rate of 2.3%.

The percentage of executive employees who are Aboriginal persons, however, is below workforce availability. This percentage decreased between 2016–17 and 2017–18, indicating that the rate of attrition for this group at the executive level exceeds recruitment. The target is to at least match workforce availability for this group at the executive level by March 2022.

In pursuit of these targets, TBS will strengthen its research capacity by using business intelligence tools and analytics in order to provide a holistic picture of the state of people management across the public service. Research and innovation in the area of people management will put the public service at the leading edge of workplace wellness, employee engagement, and the future of work.

In 2019–20, TBS will:

- provide departments and agencies with a framework, tools, and guidance on wellness, diversity and inclusion

- advise departments on accessibility issues related to recruitment, retention, and career progression (for example, on how to acquire and fund assistive devices) and discuss accommodation needs with departments’ staff, through the Office of Public Service Accessibility

- work with departments to continue to implement the recommendations in the report The Next Level: Normalizing a Culture of Inclusive Linguistic Duality in the Federal Public Service Workplace, such as improving language training and accommodating the second-language learning needs of Indigenous public servants

As well, in support of expanding bilingual services, TBS will work toward implementing new official languages regulations, which will result in more bilingual federal services by 2023.

Departmental result 2 for Employer: employee wellness is improved

To improve employee wellness across the public service, TBS provides resources, tools, and guidance on creating safe and healthy workplaces. These efforts support the fulfillment of the Treasury Board President’s mandate letter commitment to take action in support of a public service workplace that is free from harassment and sexual violence.

Results in these areas have been mixed. The percentage of employees who believe that their workplace is psychologically healthy decreased between 2016–17 (60%) and 2017–18 (56%). The target is year-over-year increase.

The percentage of employees who indicate that they have been harassed on the job in the past 2 years decreased between 2016–17 (22%) and 2017–18 (18%). The 2018–19 survey results indicate that 15% of employees believe that they have been harassed on the job in the past 12 months. The target is to have a year-over-year reduction in this percentage.

In pursuit of these targets, in 2019–20, TBS will:

- expand resources for departments in the areas of mental health and preventing harassment and violence in the workplace, including profiles of initiatives that are considered best practices

- provide guidance to departments on how to address incidents of harassment and violence

- develop updated Treasury Board policy requirements related to harassment and violence to align with changes to the Canada Labour Code

Departmental result 3 for Employer: modernized employment conditions

TBS works with bargaining agents to modernize employment conditions in the federal public service, in fulfillment of the Treasury Board President’s commitment to bargain in good faith with Canada’s public sector unions.

Labour relations issues are sometimes brought to the Federal Public Sector Labour Relations and Employment Board, a quasi-judicial tribunal that resolves such issues through adjudication or mediation. In the past 3 years, all decisions by this board have found that the Treasury Board, as employer, bargained in good faith. TBS seeks to maintain this result and to maintain the trust of employees and their representatives.

In 2019–20, TBS will:

- advance a partnership between bargaining agents and the employer to better reintegrate employees into the workplace after long periods of leave due to illness or injury

- advance planning on proactive pay equity reform

In addition, to support the stabilization of the pay system, TBS will continue to work with:

- departments to implement standard timelines and performance measures for key transactions that lead to a pay action

- bargaining agents to develop an approach for addressing damages for employees who have experienced hardships

- industry and stakeholders, including employees, through a staged procurement process, to identify options for a new human resources and pay solution, as part of the government’s plans to move away from the Phoenix pay system

Key risk to the Treasury Board’s role as employer

Problems with the Phoenix pay system continue to affect employees and the government’s ability to pay them accurately and on time. They also continue to impact labour relations, talent management, and employee wellness.

Concerted efforts continue to identify options for a new human resources and pay solution, and at the same time stabilize the Phoenix system. In parallel, TBS will need to help departments prepare to transition to a new human resources and pay solution, by redesigning processes, managing change, and training the human resources community to successfully test and implement a new platform.

| Departmental Results | Departmental Result Indicators | Target | Date to achieve target | 2015–16 Actual results | 2016–17 Actual results | 2017–18 Actual results |

|---|---|---|---|---|---|---|

Table 1 Notes

|

||||||

| 1. Public service attracts and retains a skilled and diverse workforce | Percentage of indeterminate hires under the age of 35 | At least 55% | Annually | 52% | 55% | 54% |

| Percentage of all employees who receive a sense of satisfaction from their work | At least 77% | Annually | Employees were not asked this question in 2015–16 | Employees were not asked this question in 2016–17 |

77%table 3 note 1 | |

| Percentage of executive employees (compared with workforce availability) who are members of a visible minority group | At least 9.5%table 3 note 2 | Annually | 9.4% | 10.2% | 10.1% | |

| Percentage of executive employees (compared with workforce availability) who are women | At least 47.8%table 3 note 3 | Annually | 47.3% | 48.0% | 49.1% | |

| Percentage of executive employees (compared with workforce availability) who are Aboriginal persons | At least 5.2%table 3 note 4 | March 2022 | 3.7% | 3.9% | 3.7% | |

| Percentage of executive employees (compared with workforce availability) who are persons with a disability | At least 5% | Annually | 5.1% | 5.2% | 4.8% | |

| Percentage of institutions where communications in designated bilingual offices “nearly always” occur in the official language chosen by the public | At least 90% | March 2020 | 84.5% | 90.5% | 92.6% | |

| 2. Employee wellness is improved | Percentage of employees who believe their workplace is psychologically healthy | Year-over-year increase | Annually | Employees were not asked this question in 2015–16 | 60% | 56%table 3 note 5 |

| Percentage of employees who indicate that they have been the victim of harassment on the job in the past 12 monthstable 3 note 6 | Year-over-year decrease | Annually | Employees were not surveyed on harassment in 2015–16 | 22% of employees indicated that they had been the victim of harassment on the job in the previous 2 years | 18% of employees indicated that they had been the victim of harassment on the job in the previous 2 yearstable 3 note 7 | |

| Percentage of employees who indicate that the nature of harassment experienced is a sexual comment or gesture | Year-over-year decrease | Annually | Employees were not surveyed on sexual harassment in 2015–16 | Employees were not surveyed on sexual harassment in 2016–17 | 1.8% of employees indicated that they had been the victim of sexual harassment on the job in the previous 2 years | |

| 3. Modernized employment conditions | Percentage of Federal Public Sector Labour Relations and Employment Board outcomes that confirm that the Government of Canada is bargaining in good faith | 100% | Annually | 100% | 100% | 100% |

| 2019–20 Main Estimates |

2019–20 Planned spending |

2020–21 Planned spending |

2021–22 Planned spending |

|---|---|---|---|

| 2,713,952,385 | 2,713,952,385 | 2,205,315,597 | 2,204,182,409 |

|

2019–20 Planned full-time equivalents |

2020–21 Planned full-time equivalents |

2021–22 Planned full-time equivalents |

|---|---|---|

| 432 | 387 | 347 |

Planned spending for TBS’s Core Responsibility of Employer covers the following:

- payments under the public service pension, benefit and insurance plans, including the employer’s share of health, income maintenance, and life insurance premiums

- payments to or in respect of provincial health insurance plans

- payments of provincial payroll taxes and Quebec sales tax on insurance premiums

Planned spending in 2019–20 includes $57.0 million in program expenditures for TBS to deliver on this Core Responsibility.

Financial, human resources and performance information for TBS’s Program Inventory is available in the GC InfoBase.

4. Regulatory oversight

Description

- Develop and oversee policies to promote good regulatory practices

- Review proposed regulations to ensure they adhere to the requirements of government policy

- Advance regulatory cooperation across jurisdictions

Planning highlights

TBS’s planned departmental results in relation to regulatory oversight are as follows:

- Government regulatory practices and processes are open, transparent, and informed by evidence

- Regulatory cooperation among jurisdictions is advanced

The following provides details on those results.

Departmental result 1 for Regulatory oversight: government regulatory practices and processes are open, transparent, and informed by evidence

TBS promotes open, transparent, and evidence-based regulatory practices and processes to protect and advance Canadians’ health, safety, and environment, and to help create the conditions for an innovative and prosperous economy. This includes setting out, in the Cabinet Directive on Regulation, requirements and expectations for the development, management, and review of federal regulations. It also includes modernizing Canada’s regulatory policy framework to be more efficient and agile, and less burdensome for business.

In 2017–18, performance in this area was strong. For 97% of regulatory initiatives,Footnote 11 departments reported that they consulted the public before publishing the proposed regulations. In addition, 99% of regulatory proposalsFootnote 12 had an appropriate impact assessment (for example, including cost-benefit analysis). The target for 2019–20 is at least 95% for each result.

In 2018, Canada’s regulatory system maintained its high international rankings, as reported in the OECD Regulatory Policy Outlook 2018. This publication considers factors such as stakeholder engagement, regulatory impact analysis, and ex-post evaluation. The target is to keep Canada in the top 5 in the next issue of the report, in 2021.

In pursuit of these targets, in 2019–20, TBS will:

- pursue a regulatory modernization agenda focused on supporting innovation, business competitiveness, and economic growth, including:

- introducing an annual regulatory modernization bill to remove outdated or duplicative legislative requirements

- establishing an external advisory committee on regulatory competitiveness

- launching a new Centre for Regulatory Innovation to develop and conduct regulatory experimentation

- coordinating additional regulatory reviews of targeted sectors to examine regulatory bottlenecks to economic growth and innovation

- developing a new online regulatory consultation system

- launching a full review of the Red Tape Reduction Act and Red Tape Reduction Regulations

- continue helping departments implement the Cabinet Directive on Regulation,Footnote 13, by:

- providing them with updated regulatory guidance and advice

- monitoring and assessing their progress

- continue to support Treasury Board ministers by providing advice on regulatory and order-in-council matters

- continue to represent Canada in international and domestic regulatory policy and trade forums

Departmental result 2 for Regulatory oversight: regulatory cooperation among jurisdictions is advanced

TBS promotes regulatory cooperation among jurisdictions to support the interests of industry, consumers, and regulators, both domestically and internationally.

In 2017–18, 100% of significant federal regulatory proposals took regulatory cooperation considerations into account, where appropriate. The target is a result of at least 95%.

Although regulatory cooperation considerations are being taken into account in all regulatory proposals, the number of federal regulatory programs that had a regulatory cooperation work plan remained the same from 2015–16 to 2017–18, at 23.

In 2017–18, TBS established 2 new regulatory cooperation forums:

- the Regulatory Cooperation Forum established under the Canada-European Union Comprehensive Economic Trade Agreement

- the Regulatory Reconciliation and Cooperation Table established under the Canadian Free Trade Agreement to address regulatory barriers to trade, investment, and labour mobility within Canada

Since the inception of these forums, 28 additional work plans were started, resulting in a total of 51 active regulatory cooperation work plans. Taking into account the progress made through these forums, as well as the expected completion of some existing work plans, the aim is for 35 federal regulatory programs to have regulatory cooperation work plans by March 2020.

In 2019–20, TBS will:

- continue to pursue new areas for regulatory cooperation work plans under the Canada-United States Regulatory Cooperation Council, the Canada-European Union Regulatory Cooperation Forum, and the Canadian Free Trade Agreement Regulatory Reconciliation and Cooperation Table to achieve greater regulatory alignment domestically and internationally

- continue to support and coordinate efforts to foster regulatory alignment between Canada and key trading partners in select sectors

- continue to support the negotiation of good regulatory practices and regulatory cooperation provisions in new trade agreements

- implement changes to the Red Tape Reduction Act and Red Tape Reduction Regulations to increase flexibility so that regulators can consider the benefits of regulatory cooperation initiatives under the “One-for-One” Rule

- promote good regulatory practices, including international cooperation, through initiatives to share information and build capacity, such as the Memorandum of Understanding between Canada and Mexico for the Advancement of Good Regulatory Practices

Key risk to regulatory oversight

New regulatory modernization initiatives were announced in the government’s Fall Economic Statement 2018. These initiatives were in addition to a number of reform activities and regulatory cooperation efforts that were already underway at TBS. The added pressure on existing human resources to deliver the new initiatives in a short timeframe is being addressed through staffing, and additional hires are planned to add resource capacity where needed.

Successful implementation of these regulatory initiatives also relies heavily on regulators to participate in review and cooperation activities and on external stakeholders to participate in consultations. An emphasis on strategic coordination across TBS and the stakeholder community will mitigate the coordination and communication risks that result from the added complexity.

| Departmental Results | Departmental Result Indicators | Target | Date to achieve target | 2015–16 Actual results |

2016–17 Actual results |

2017–18 Actual results |

|---|---|---|---|---|---|---|

Table 4 Notes

|

||||||

| 1. Government regulatory practices and processes are open, transparent, and informed by evidence | Ranking of Canada’s regulatory system by the Organisation for Economic Co-operation and Development (OECD) | Maintain Canada’s ranking in the top 5 of participating OECD countries | December 2021 | In the 2015 report, out of 35 countries, Canada ranked:

|

Not available The OECD ranking is on a 3-year cycle. No ranking done this year. |

In the 2018 report, out of 38 OECD jurisdictions, and the European Union, Canada ranked:

|

| Percentage of regulatory initiativestable 4 note 1 that report on early public consultation undertaken prior to first publication | At least 95% | Annually | Not available | Not available (new indicator as of 2016–17) |

97% | |

| Percentage of regulatory proposalstable 4 note 2 that have an appropriate impact assessment (for example, cost-benefit analysis) | At least 95% | Annually | Not available | Not available (new indicator as of 2016–17) |

99% | |

| 2. Regulatory cooperation among jurisdictions is advanced | Number of federal regulatory programs that have a regulatory cooperation work plan | At least 35 | March 2020 | 23 | 23 | 23 |

| Percentage of significant regulatory proposals (for example, high and medium impact) that promote regulatory cooperation considerations, when relevant | At least 95% | Annually | Not available | Not available (new indicator as of 2016–17) |

100% | |

| 2019–20 Main Estimate |

2019–20 Planned spending |

2020–21 Planned spending |

2021–22 Planned spending |

|---|---|---|---|

| 9,076,639 | 9,076,639 | 6,672,687 | 4,605,266 |

| 2019–20 Planned full-time equivalents |

2020–21 Planned full-time equivalents |

2021–22 Planned full-time equivalents |

|---|---|---|

| 63 | 47 | 32 |

Financial, human resources and performance information for TBS’s Program Inventory is available in the GC InfoBase.

Internal services

Description

Internal Services are those groups of related activities and resources that the federal government considers to be services in support of Programs and/or required to meet corporate obligations of an organization. Internal Services refers to the activities and resources of the 10 distinct services that support Program delivery in the organization, regardless of the Internal Services delivery model in a department. These services are:

- Management and Oversight Services

- Communications Services

- Legal Services

- Human Resources Management Services

- Financial Management Services

- Information Management Services

- Information Technology Services

- Real Property Management Services

- Materiel Management Services

- Acquisition Management Services

Planning highlights

TBS allocates 28.65% of its planned operating spending and 30.98% of its planned full-time equivalents to Internal Services, to support its 4 Core Responsibilities.

In 2019–20, TBS will focus on maximizing the effectiveness of 3 internal services that are key to TBS’s business:

- human resources management

- information technology

- financial management

It will:

- implement a new 3-year departmental People Management Plan to:

- cultivate and maximize leadership capacity and effectiveness

- attract, develop, and retain an agile, skilled, and diverse workforce

- develop a culture of civility and inclusion

- foster a healthy and respectful workplace

- make its human resources infrastructure (for example, human resources processes and tools, and workforce planning) more responsive and innovative

- optimize the use of its open-concept office space, including by experimenting with activity-based space, which provides the flexibility to work anywhere with anyone, in order to encourage collaboration

- modernize its information technology, including by using more cloud computing, in order to improve access to documents, and provide better collaborative tools

- modernize its financial management practices, including by improving the timeliness and quality of financial information and analysis, in order to support program delivery and decision making

Federal departments use standardized indicators for internal services. TBS will continue to collect and analyse its own internal services data to support the monitoring and improvement of these services.

| 2019–20 Main Estimates |

2019–20 Planned spending |

2020–21 Planned spending |

2021–22 Planned spending |

|---|---|---|---|

| 82,864,572 | 82,864,572 | 83,418,819 | 82,777,488 |

| 2019–20 Planned full-time equivalents |

2020–21 Planned full-time equivalents |

2021–22 Planned full-time equivalents |

|---|---|---|

| 618 | 616 | 615 |

Spending and human resources

Planned spending

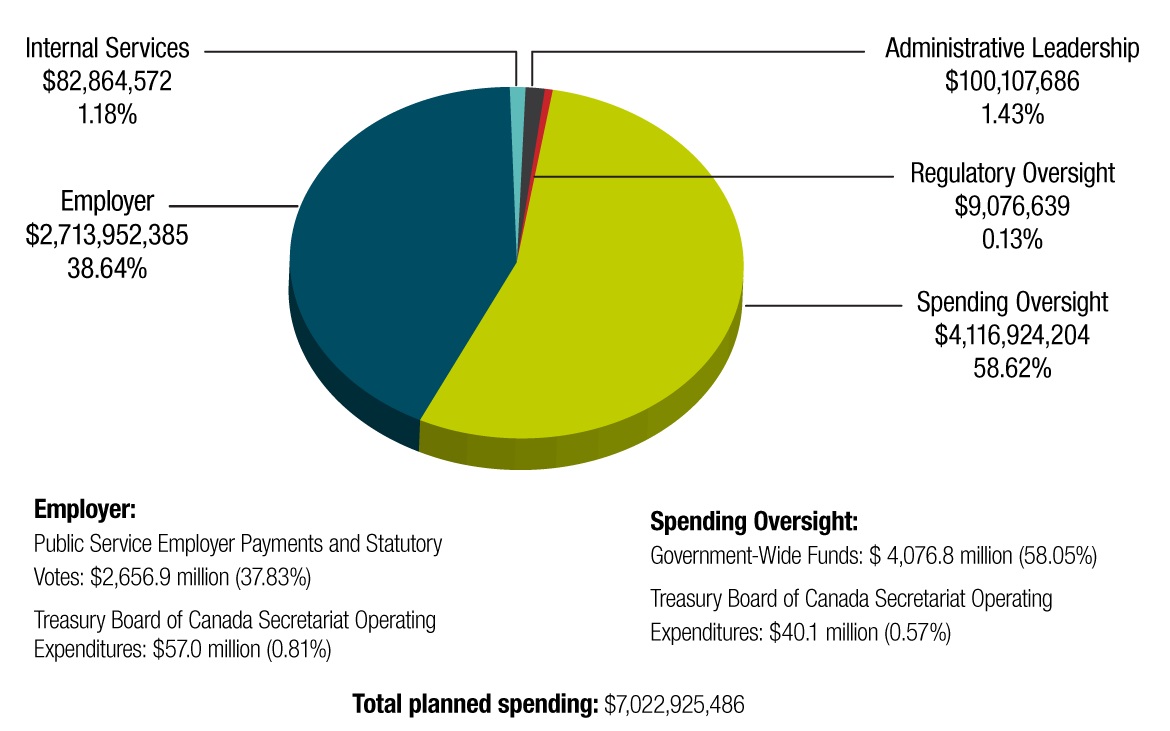

Figure 1 shows the breakdown of TBS’s planned spending of $7.0 billion for 2019–20.

Figure 1 - Text version

| Core Responsability | $ | % |

|---|---|---|

| Spending Oversight | $4,116,924,204 | 58.62% |

| Employer | $2,713,952,385 | 38.64% |

| Internal Services | $82,864,572 | 1.18% |

| Administrative Leadership | $100,107,686 | 1.43% |

| Regulatory Oversight | $9,076,639 | 0.13% |

| Grand Total | $7,022,925,486 | 100.00% |

| Vote | $ | % |

|---|---|---|

| Public Service Employer Payments and Statutory Votes | 2,656.9 million | 37.83% |

| TBS Operating Expenditures | 57.0 million | 0.81% |

| Vote | $ | % |

|---|---|---|

| Budget Implementation Vote (vote 40) | - | 0.00% |

| TBS Operating Expenditures | 40.1 million | 0.57% |

| Government-Wide Funds | 4,076.8 million | 58.05% |

TBS’s total planned spending consists of its operating budget (4%) and Government-Wide Funds and Public Service Employer Payments (96%).

TBS’s planned spending for 2019–20 consists of the following allocations:

- $4.1 billion for the Core Responsibility of Spending Oversight to top up the Government-Wide Funds central vote funding held in TBS’s reference levels. This funding is approved by Parliament, and TBS transfers it to individual departments and agencies once specific criteria are met.

- Vote 5, Government contingencies: Provides federal departments and agencies with temporary advances for urgent or unforeseen departmental expenditures between Parliamentary supply periods

- Vote 10, Government-wide initiatives: Supports the implementation of strategic management initiatives across the federal public service

- Vote 15, Compensation adjustments: Provides funding for adjustments made to terms and conditions of service or employment of the federal public administration as a result of collective bargaining

- Vote 25, Operating budget carry forward: Used to carry forward unused operating funds from the previous fiscal year, up to 5% of the gross operating budget in an organization’s Main Estimates

- Vote 30, Paylist requirements: Covers the cost of meeting legal requirements for the government as employer for items such as parental benefits and severance payments

- Vote 35, Capital budget carry forward: Used to carry forward unused capital funds from the previous fiscal year, up to 20% of an organization’s capital vote

- $2.6 billion for the Core Responsibility of Employer, which relates to TBS’s role in supporting the Treasury Board as employer of the core public administration. These funds are used for:

- payments under the public service pension, benefits, and insurance plans, including payment of the employer’s share of health, income maintenance, and life insurance premiums

- payments in respect of provincial health insurance

- payments of provincial payroll taxes and Quebec sales tax on insurance premiums

- addressing actuarial deficits in the Public Service Pension Fund

- $0.3 billion for program expenditures (Vote 1), which will be used to run TBS and to deliver on the President’s mandate commitments related to TBS’s Core Responsibilities and to Internal Services

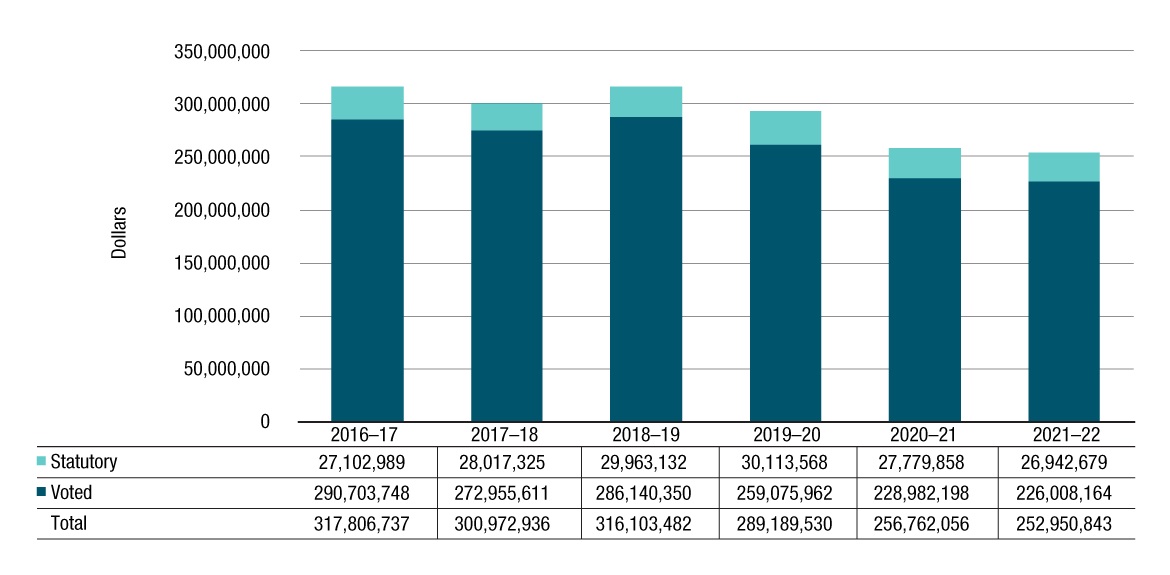

Figure 2 - Text version

| Fiscal year | Total | Voted | Statutory |

|---|---|---|---|

| 2016-17 | $317,806,737 | $290,703,748 | $27,102,989 |

| 2017-18 | $300,972,936 | $272,955,611 | $28,017,325 |

| 2018-19 | $316,103,482 | $286,140,350 | $29,963,132 |

| 2019-20 | $289,189,530 | $259,075,962 | $30,113,568 |

| 2020-21 | $256,762,056 | $228,982,198 | $27,779,858 |

| 2021-22 | $252,950,843 | $226,008,164 | $26,942,679 |

TBS’s program expenditures include salaries, non-salary costs to deliver programs, and statutory items related to the employer’s contributions to TBS’s employee benefit plans.

The one-time Budget 2016 funding received in 2016–17 to accelerate the Back Office Transformation Initiative sunsetted in 2017–18, which resulted in a decrease of $16.8 million.

As shown in Figure 2, forecast spending for TBS’s program expenditures is expected to increase by $15.1 million in 2018–19 as the implementation of Budget 2017 and Budget 2018 initiatives continues. These initiatives include:

- Web Renewal

- Canadian Digital Service

- Regulatory Cooperation Council

- Next Generation Human Resources Solution

- Stabilization of the Federal Government’s Pay System (Phoenix)

- Supporting Federal Leadership at the Canadian Free Trade Agreement

- Regulatory and Horizontal Skills Review

For 2019–20 to 2020–21, total planned spending for TBS’s Core Responsibilities is projected to decrease as the following programs will sunset. Funding for after 2020–21 is subject to the renewal process.

Sunsetting in 2019–20:

- Regulatory Cooperation Council

- Classification Program

- Federal Contaminated Sites

- Canadian Digital Service

- Next Generation Human Resources Solution

- Open Government Partnership Global Summit in Canada

- Supporting Federal Leadership at the Canadian Free Trade Agreement

Sunsetting in 2020–21:

- Regulatory Review

- Joint Learning Program

| Core Responsibilities and Internal Services | 2016–17 Expenditures |

2017–18 Expenditures |

2018–19 Forecast spending |

2019–20 Main Estimates |

2019–20 Planned spending |

2020–21 Planned spending |

2021–22 Planned spending |

|---|---|---|---|---|---|---|---|

| Spending Oversight | 40,721,685 | 42,055,064 | 10,305,828,794 | 4,116,924,204 | 4,116,924,204 | 3,628,008,445 | 3,593,057,175 |

| Administrative Leadership | 121,470,940 | 103,822,405 | 100,985,338 | 100,107,686 | 100,107,686 | 76,812,232 | 76,794,229 |

| Employer | 2,823,956,155 | 3,568,437,380 | 6,131,403,388 | 2,713,952,385 | 2,713,952,385 | 2,205,315,597 | 2,204,182,409 |

| Regulatory Oversight | 4,704,732 | 5,983,551 | 9,381,820 | 9,076,639 | 9,076,639 | 6,672,687 | 4,605,266 |

| Subtotal | 2,990,853,512 | 3,720,298,400 | 16,547,599,340 | 6,940,060,914 | 6,940,060,914 | 5,916,808,961 | 5,878,639,079 |

| Internal Services | 73,355,122 | 86,603,603 | 88,147,403 | 82,864,572 | 82,864,572 | 83,418,819 | 82,777,488 |

| Total | 3,064,208,634 | 3,806,902,003 | 16,635,746,743 | 7,022,925,486 | 7,022,925,486 | 6,000,227,780 | 5,961,416,567 |

The Budgetary planning summary for Core Responsibilities and Internal Services table outlines:

- actual spending for 2016–17 and 2017–18, as reported in the Public Accounts of Canada

- forecast spending for 2018–19, which reflects the authorities received to date, including Government-Wide Funds and Public Service Employer Payments, as well as authorities for Budget 2017 initiatives (such as the Canadian Digital Service, the Regulatory Cooperation Council, the Executive Leadership Development Program, and Access to Information Reform), and authorities for Budget 2018 initiatives (such as Next Generation Human Resources Solution and the Stabilization of the Federal Government’s Pay System (Phoenix), Supporting Federal Leadership at the Canadian Free Trade Agreement, and the Regulatory and Horizontal Skills Review)

- planned spending for 2019–20, 2020–21 and 2021–22, which aligns with government commitments as set out in ministerial mandate letters

Expenditures increased by $742.7 million from 2016–17 to 2017–18. Most of the increase relates to a top-up payment to the Service Income Security Insurance Plan in 2017–18 and higher employer costs following the implementation of collective agreements that were ratified in 2017.

Forecast spending for 2018–19 will increase by $12.8 billion compared with 2017–18 actual spending. Of that increase, $10.2 billion relates to Government-Wide Funds allocated to the Core Responsibility of Spending Oversight, much of which will be allocated to departments. The remainder of the increase ($2.6 million) relates to a net increase in the Employer Core Responsibility, which is mostly due to the one-time payment required in 2018–19 to eliminate the shortfall in the superannuation account.

Planned human resources

| Core Responsibilities and Internal Services | 2016–17 Actual full-time equivalents |

2017–18 Actual full-time equivalents |

2018–19 Forecast full-time equivalents |

2019–20 Planned full-time equivalents |

20–21 Planned full-time equivalents |

2021–22 Planned full-time equivalents |

|---|---|---|---|---|---|---|

| Spending Oversight | 314 | 302 | 323 | 295 | 296 | 296 |

| Administrative Leadership | 538 | 589 | 547 | 587 | 474 | 477 |

| Employer | 456 | 435 | 462 | 432 | 387 | 347 |

| Regulatory Oversight | 33 | 40 | 61 | 63 | 47 | 32 |

| Subtotal | 1,341 | 1,366 | 1,393 | 1,377 | 1,204 | 1,152 |

| Internal Services | 581 | 605 | 601 | 618 | 616 | 615 |

| Total | 1,922 | 1,971 | 1,994 | 1,995 | 1,820 | 1,767 |

Full-time equivalents increased by 49 from 2016–17 to 2017–18 as a result of the hiring of additional resources for the following initiatives and for the Internal Services to support them:

- Stabilization of the Federal Government’s Pay System (under the Employer Core Responsibility)

- Regulatory Cooperation Council (under the Regulatory Oversight Core Responsibility)

- Web Renewal (under the Administrative Leadership Core Responsibility)

- Canadian Digital Service (under the Administrative Leadership Core Responsibility)

Full-time equivalents are expected to increase by 23 from 2017–18 to 2018–19 in order to implement Budget 2018 initiatives such as:

- Next Generation Human Resources Solution

- Stabilization of the Federal Government’s Pay System (Phoenix)

- Supporting Federal Leadership at the Canadian Free Trade Agreement

- Regulatory and Horizontal Skills Review

Full-time equivalents are expected to decline by 228 from 2019–20 to 2020–21 because the mandates of the Canadian Digital Service, the Regulatory Cooperation Council, the Next Generation Human Resources Solution, the Joint Learning Program and the Regulatory Review will be sunsetting, as will the Classification Program and the Employee Wellness Support.

Estimates by vote

Information on TBS’s organizational appropriations is available in the 2019–20 Main Estimates.

Future-Oriented Condensed Statement of Operations

The Future-Oriented Condensed Statement of Operations provides a general overview of TBS’s operations. The forecast of financial information on expenses and revenues is prepared on an accrual accounting basis to strengthen accountability and to improve transparency and financial management. The forecast and planned spending amounts presented in other sections of the Departmental Plan are prepared on an expenditure basis; as a result, amounts may differ.

A more detailed Future-Oriented Statement of Operations and associated notes, including a reconciliation of the net cost of operations to the requested authorities, are available on TBS’s website.

| Financial information | 2018–19 Forecast results |

2019–20 Planned results |

Difference (2019–20 Planned results minus 2018–19 Forecast results) |

|---|---|---|---|

| Total expenses | 6,399,854,960 | 2,975,111,729 | (3,424,743,231) |

| Total net revenues | 13,446,208 | 13,285,559 | (160,649) |

| Net cost of operations before government funding and transfers | 6,386,408,752 | 2,961,826,170 | (3,424,582,582) |

Total expenses comprise public service employer payments ($6.1 billion in 2018–19 and $2.7 billion in 2019–20) and departmental program expenses ($0.3 billion in both 2018–19 and 2019–20). Public service employer payments are used to fund the employer’s share of the Public Service Health Care Plan, the Public Service Dental Care Plan and other insurance and benefit programs provided to federal public service employees. In 2018–19, public service employer payments included a one-time $3.1 billion lump-sum contribution to the Public Service Pension Plan made to address an actuarial shortfall that was reported in the triennial actuarial report on the plan, tabled in Parliament in November 2018.

Total planned expenses are expected to decrease by $3,425 million (53.5%) from 2018–19 to 2019–20 due to:

- a one-time $3,107 million lump-sum contribution made in 2018–19 to cover the actuarial shortfall in the Public Service Pension Plan mentioned above

- a $298 million decrease in employer contributions to public service insurance plans, mostly due to the transfer of the Service Income Security Insurance Plan to the Department of National Defence

- a $20 million decrease in TBS’s program expenses, mostly due to the sunsetting of funding received in 2018–19 for various initiatives, such as the Stabilization of the Federal Government’s Pay System, Web Renewal, Fixed Assets Review, Access to Information Reform, and Back Office Transformation

Total net revenues include recoveries from other government departments for costs associated with the provision of internal support services related to financial and human resources management systems, as well as the information technology infrastructure that supports these systems. Other internal support services for which TBS recovers costs include accounting services (part of financial management) and mail services (part of information management). Net revenues also include the recovery of costs incurred by TBS for the administration of the Public Service Pension Plan. A slight decrease of $0.2 million (1.2%) in total net revenues is expected from 2018–19 to 2019–20.

Additional information

Corporate information

Organizational profile

Appropriate minister: The Honourable Joyce Murray, President of the Treasury Board and Minister of Digital Government

Institutional head: Peter Wallace, Secretary of the Treasury Board

Ministerial portfolio: The minister’s portfolio consists of the Treasury Board of Canada Secretariat and the Canada School of Public Service, as well as the following organizations, which operate at arm’s length and report to Parliament through the President of the Treasury Board: the Public Sector Pension Investment Board, the Office of the Commissioner of Lobbying of Canada, and the Office of the Public Sector Integrity Commissioner of Canada.

Enabling instrument: The Financial Administration Act is the act that establishes the Treasury Board itself and gives it powers with respect to the financial, personnel and administrative management of the public service, and the financial requirements of Crown corporations.

Year of incorporation / commencement: 1966

Raison d’être, mandate and role: who we are and what we do

“Raison d’être, mandate and role: who we are and what we do” is available on TBS’s website.

Reporting framework

TBS’s Departmental Results Framework and Program Inventory of record for 2019–20 are shown below. TBS made some improvements to its Departmental Results Framework for 2019–20. The changes better reflect an increased focus on digitally enabled government. They also streamline indicators relating to its role as employer of the public service to better reflect TBS’s priorities in this area.

Core Responsibility 1: Spending Oversight

Departmental Results Framework

Departmental Result: Departments achieve measurable results

- Indicator: Percentage of departmental results indicators for which targets are achieved

Departmental Result: Treasury Board proposals contain information that helps Cabinet ministers make decisions

- Indicator: Degree to which Treasury Board submissions transparently disclose financial risk

Departmental Result: Budget initiatives are approved for implementation quickly

- Indicator: Percentage of Budget initiatives included in the next available Estimates

Departmental Result: Reporting on government spending is clear

- Indicator: Degree to which GC InfoBase users found the spending information useful (on a scale of 1 to 5)

- Indicator: Degree to which visitors to online departmental planning and reporting documents found the information useful (on a scale of 1 to 5)

Program Inventory

- Oversight and Treasury Board Support

- Expenditure Data, Analysis, Results and Reviews

- Government-Wide Funds

Core Responsibility 2: Administrative Leadership

Departmental Results Framework

Departmental Result: Canadians have timely access to government information

- Indicator: Number of new datasets available to the public

- Indicator: Percentage of access to information requests responded to within legislated timelines

- Indicator: Percentage of personal information requests responded to within legislated timelines