Secretary of the Treasury Board - Transition 2024: Briefing Book 1

On this page

- Role of the Secretary of the Treasury Board

- The roles and powers of the Treasury Board and the President

- Treasury Board of Canada at a glance

- Treasury Board of Canada Secretariat at a glance

- People management in the federal public service

- Primer: people management in the federal public service

- Office of the Chief Information Officer at a glance

- Primer: digital government

- Office of the Comptroller General at a glance

- Office of Public Service Accessibility at a glance

- Centre for Greening Government at a glance

- The business of supply: voted appropriations

- Primer: the business of supply

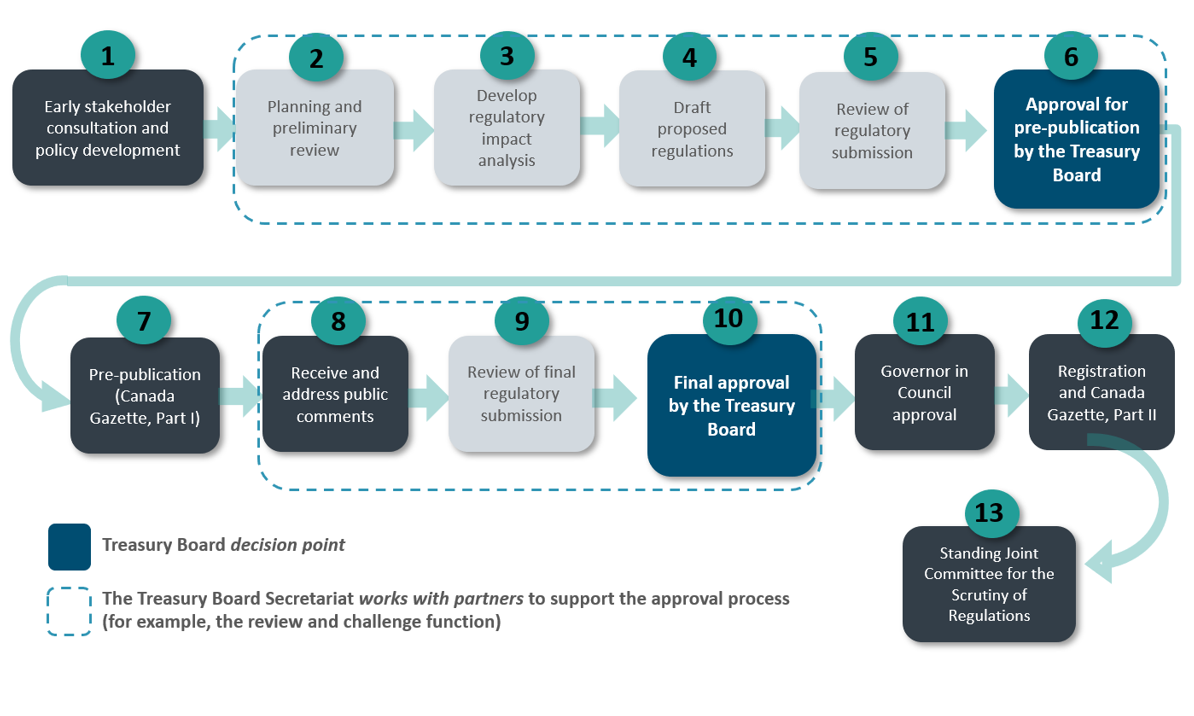

- Federal regulations

- Primer: The Government of Canada’s regulatory system and regulatory policy initiatives

- The Treasury Board policy suite

Role of the Secretary of the Treasury Board

Outline

- The President of the Treasury Board

- Supporting the President of the Treasury Board

- Treasury Board and its Secretariat

- Treasury Board of Canada Secretariat (TBS) deputy head legislative authorities

- TBS

- Ministerial portfolio

The President of the Treasury Board

- The Treasury Board was established in 1867 as the first Cabinet committee and is the only one enshrined in legislation. It takes the final decision on expenditures and regulations.

- The Treasury Board President is the Chair of the Treasury Board and oversees TBS, setting the management agenda for the Government of Canada in the areas of people, money and technology.

- The President serves as the gatekeeper to the Board and sets its agenda, supporting the management and implementation of initiatives across government.

- The President is supported by TBS, which provides integrated advice from across the department.

Supporting the President of the Treasury Board

Treasury Board

The President of the Treasury Board chairs Treasury Board meetings, and:

- acts as gatekeeper, deciding what is brought to the Treasury Board

- guides discussions to maintain focus on due diligence and impact

- plays a central role in Cabinet, bringing the Board’s focus on implementation and impact to Cabinet meetings

Treasury Board of Canada Secretariat

The Secretary supports the President in their mandate to:

- establish the management practices that dictate how finances, human resources and information technology operate across government

- approve the form and approach to tabling the Estimates in Parliament

Treasury Board of Canada Secretariat Portfolio

The President of the Treasury Board is the Minister responsible for a portfolio of four organizations:

- Canada School of Public Service

- Commissioner of Lobbying of Canada

- Public Sector Integrity Commissioner

- Public Sector Pension Investment Board

The Treasury Board and its Secretariat

Treasury Board

- Authority is derived from the Financial Administration Act

- Treasury Board ministers make the final decision on expenditures and regulations

- Sets the rules for the management of people, finances, information technology and administration

- The Treasury Board is the Cabinet committee designated by the Prime Minister to make recommendations to the Governor General

- This means it functions as the Governor in Council for regulations and most orders-in-council (the Privy Council Office is responsible for orders-in-council for senior appointments)

- Typically meets weekly while Parliament is in session

Treasury Board of Canada Secretariat

- Key responsibilities are to provide integrated advice to Treasury Board ministers in the management and administration of government, and to fulfill the statutory responsibilities of a central government agency

- To fulfill its mandate, TBS organizes its business and resources around four core responsibilities:

- spending oversight

- administrative leadership

- employer

- regulatory oversight

The Treasury Board of Canada Secretariat

Key facts

- 2,693 employees and 254 executivesFootnote 1

- $4.2 billion in expendituresFootnote 2

- Senior officials:

- Secretary: Catherine Blewett

- Associate Secretary: Dominique Blanchard

- Chief Human Resources Officer: Jacqueline Bogden

- Associate Chief Human Resources Officer: Francis Trudel

- Comptroller General: Roch Huppé

- Chief Information Officer: Dominic RochonFootnote 3

Core responsibilities

As the administrative arm of the Treasury Board, TBS provides leadership to help departments effectively implement government priorities and meet citizens’ evolving expectations of government.

TBS’s four core responsibilities mirror those of the Treasury Board, which are:

- spending oversight

- administrative leadership

- employer

- regulatory oversight

President’s responsibilities

- Provides policy direction to TBS

- Brings forward Treasury Board submissions related to TBS’s mandate

- Approves and presents proposals to Cabinet related to TBS’s mandate

- Establishes the form and tabling of the Estimates

- Establishes the form and tabling of the Public Accounts

- Receives and tables a wide range of reports under legislation or Treasury Board policies

TBS deputy head legislative authorities

- Section 6 of the Financial Administration Act provides authority for the appointment of the Secretary, Comptroller General, Chief Human Resources Officer and the Chief Information Officer of Canada each of whom ranks as and has the powers of a deputy head.

- Subsection 6(4) and 6(5) of the Financial Administration Act also provides that the Treasury Board may delegate any of its powers or functions authorized under any Act of Parliament to the President, the Secretary or the Comptroller General of Canada except its power to delegate or make regulations.

- Furthermore, the Treasury Board may delegate any of its powers or functions related to employment that the Treasury Board is authorized to exercise under the Public Service Employment Act as well as any powers or functions related to human resources management, official languages, employment equity, and values and ethics to the Chief Human Resources Officer. The Treasury Board may also delegate any of its powers or functions to the Chief Information Officer of Canada including powers or functions in relation to information technology.

Ministerial portfolio

The President has oversight responsibilities for four portfolio agencies. This includes responsibility for the legislation governing these bodies and tabling any amendments in Parliament.

Canada School of Public Service: departmental corporation

Taki Sarantakis, President

- Reappointed July 2023

- Provides training and learning for the federal public administration

- Reports to Parliament through the President of the Treasury Board

Commissioner of Lobbying of Canada: Agent of Parliament (arm’s length)

Nancy Bélanger, Commissioner

- Appointed December 2017

- Establishes and maintains the Registry of Lobbyists, the Lobbyists’ Code of Conduct, and conducts investigations

- Reports directly to Parliament on matters under the mandate

- Reports to Parliament through the President on accountability and budgetary matters

Public Sector Integrity Commissioner: Agent of Parliament (arm’s length)

Harriet Solloway, Commissioner

- Appointed June 2023

- Provides an independent mechanism for public servants to disclose potential wrongdoing in the workplace

- Reports directly to Parliament on matters under the mandate

- Reports to Parliament through the President on accountability and budgetary matters

Public Sector Pension Investment Board: Crown corporation (arm’s length)

Deborah K. Orida, President and Chief Executive Officer

- Appointed September 2022

- Manages employer and employee contributions to public service pension plans

- Reports to Parliament through the President of the Treasury Board

The roles and powers of the Treasury Board and the President

Treasury Board

The Treasury Board was first established as a committee of the King’s Privy Council for Canada on July 2, 1867, and was made a statutory committee in 1869. It is the only Cabinet committee recognized in legislation.

The Treasury Board consists of the President of the Treasury Board (the President), the Minister of Finance and four other members of the King’s Privy Council for Canada that are designated as members by an order-in-council. The composition of the Treasury Board is provided for in the Financial Administration Act, which also provides for the appointment of alternates who can serve in the place of members. The Treasury Board’s quorum is three members (including alternates)., which also provides for the appointment of alternates who can serve in the place of members. The Treasury Board’s quorum is three members (including alternates).

The Treasury Board exercises authority over a range of issues, and its role can generally be classified into powers of supervision, recommendation, decision, approval, reporting and regulation-making. While the primary statute setting out the role of the Treasury Board is the Financial Administration Act, there are over 20 other statutes that also establish its roles and authorities. The Treasury Board’s powers and responsibilities are also set out in regulations, orders-in-council, policies, guidelines and practices.

The Treasury Board has three principal roles:

- It acts as the government’s “Expenditure Manager”:

- preparing the government’s expenditure plans (the Estimates) and monitoring program spending by government departments

- approving the use of new money that has been set aside in the Budget, including for major procurements, assets, new programs, and grants and contributions

- It acts as the government’s “Management Board”:

- setting the rules that establish how people, public funds and government assets are managed

- reviewing departmental investment plans in support of accountability of government operations

- It acts as the “Employer” of the core public administration (including the Royal Canadian Mounted Police):

- approving collective bargaining for the core public administration

- determining terms and conditions of employment

- setting rules on human resources management

Treasury Board (Governor in Council)

Since December 2003, the members of the Treasury Board have also been asked to serve as members of the Committee of the Privy Council advising the Governor in Council. This role is often referred to as “Treasury Board, Part B.” The principal role of Treasury Board, Part B, is to:

- Provide “Regulatory Oversight”: reviewing and approving most regulations and orders-in-council

When advising the Governor in Council, Treasury Board, Part B’s quorum is four members. The composition of the Treasury Board, Part B, is not governed by the Financial Administration Act. In the absence of a sufficient number of Treasury Board members, other Cabinet ministers may be invited to participate.

President of the Treasury Board

Responsibilities and key accountabilities

The responsibilities assigned to the President as Chair of the Treasury Board are implicitly inseparable from the Treasury Board’s mandate: the management, expenditure and employer responsibilities that fall to the Treasury Board are also the President’s own responsibilities and form the basis for their key accountabilities. Appendix A provides further information about the legislative mandate and responsibilities of the Treasury Board and the President.

Specific responsibilities assigned directly to the President include:

- coordinating the activities of the Secretary of the Treasury Board, Comptroller General of Canada, Chief Human Resources Officer and the Chief Information Officer of Canada and delegating responsibility to the Secretary or other officials accordingly

- recommending external members of Departmental Audit Committees

- establishing the form and tabling of the Public Accounts

- publishing a consolidated quarterly report on Crown corporations

- receiving and tabling a wide range of reports under legislation or Treasury Board policies

The Treasury Board may delegate to the President (in addition to other officials) any of the powers or functions it is authorized to exercise under any Act of Parliament or by any order made by the Governor in Council. The Treasury Board may make the delegation subject to terms and conditions it considers appropriate. In turn, the Financial Administration Act provides that such delegated powers can be further delegated. Any sub-delegation is subject to the terms and conditions of the original delegation.

Other statutes assign specific authorities to either the President or the Treasury Board. For example, the President has the authority to:

- establish policies and forms with respect to the administration of the Access to Information Act and the Privacy Act

- coordinate the implementation of the Official Languages Act

- administer components of the Public Servants Disclosure Protection Act

The Treasury Board’s authority to act as the Employer for the core public administration is established under various statutes. As the Chair of the Treasury Board, the President supports the Treasury Board’s employer responsibilities. Legislation gives the Treasury Board the authority to:

- engage in collective bargaining under the Federal Public Sector Labour Relations Act

- make rules respecting deployments, probation and promotion under the Public Service Employment Act

- set pay levels for Canadian Armed Forces members under the National Defence Act

Legislative portfolio

The President maintains overall responsibility for the statutes within their legislative portfolio. Should the government decide to amend these statutes, the President would be responsible for sponsoring any bills introduced in the House of Commons and tabling any required Government Response. Appendix B contains a list of statutes that fall under the President’s legislative portfolio.

Ministerial portfolio

The President is the minister responsible for the Treasury Board of Canada Secretariat and the Canada School of Public Service. The Canada School of Public Service provides a common, standardized curriculum to support the learning and development of public servants.

Operating at arm’s length and reporting to Parliament through the President of the Treasury Board are the Public Sector Pension Investment Board, the Office of the Commissioner of Lobbying of Canada and the Office of the Public Sector Integrity Commissioner of Canada.

The President’s ministerial portfolio is subject to change based on ministerial or machinery decisions by a new government.

Treasury Board of Canada Secretariat (TBS)

TBS was established as a department in 1966 as the administrative arm of the Treasury Board. It supports the Treasury Board by making recommendations and providing advice on program spending, regulations, and management policies and directives, while respecting the primary responsibility of deputy heads in managing their organizations and in their roles as accounting officers before Parliament. In this way, TBS helps to strengthen government performance, results and reporting and supports good governance and sound stewardship.

The business lines of TBS are expressed through its Departmental Results Framework. The Departmental Results Framework sets out the core responsibilities for the organization, which are:

- spending oversight

- administrative leadership

- employer

- regulatory oversight

- internal services

The Departmental Results Framework also focuses on the results the department is aiming to achieve in these core areas as well as how progress will be assessed. This information helps support TBS’s reporting to Parliament through its Departmental Plan and Departmental Results Report. The Departmental Plan, tabled in the spring, describes what TBS will do over the next three years to achieve results for Canadians and the resources that are required to do so. The Departmental Results Report, tabled in the fall, describes TBS’s actual performance and the resources it used during the previous fiscal year.

The Secretary of the Treasury Board

The Secretary of the Treasury Board is the deputy head of TBS. The Secretary is appointed by the Governor in Council.

Subsection 12(1) of the Financial Administration Act sets out the powers assigned to deputy heads in the core public administration, which include, among others:

- determining the learning, training and development requirements of public service employees

- establishing standards of discipline and setting penalties (including termination of employment, suspension, demotion or financial penalties)

- providing for the termination of employment or demotion of public service employees for disciplinary reasons, unsatisfactory performance or other non-disciplinary reasons

The Secretary, as are all other deputy heads and chief executive officers, is an accounting officer pursuant to sections 16.1 through 16.4 of the Financial Administration Act. Accounting officers are senior officials that can be called to testify before a parliamentary committee regarding the management of their department and the performance of their duties.

Under section 16.5 of the Financial Administration Act, the Secretary has a role in providing guidance on the interpretation of policies, directives or standards issued by the Treasury Board in disputes between deputy heads (as accounting officers) and ministers.

Although the Secretary oversees TBS, three other senior officials within TBS, established under the Financial Administration Act and appointed by order-in-council, have specific government-wide leadership responsibilities:

- the Comptroller General of Canada provides leadership, direction and oversight of financial management, internal audit, and the management of assets and acquired services

- the Chief Human Resources Officer:

- provides leadership on people management through policies, programs and strategic engagements

- centrally manages labour relations, compensation, pensions and benefits

- contributes to the management of executives

- the Chief Information Officer of Canada provides leadership, direction and oversight of information management, information technology, government security, access to information, privacy and internal and external service delivery

The Treasury Board may delegate to the Secretary any of the powers or functions it is authorized to exercise under any Act of Parliament or by any order made by the Governor in Council (section 6(4) of the Financial Administration Act). The Treasury Board may also delegate some of its powers to the three other senior officials listed above, in addition to other officials (sections 6(4), (4.1) and (4.11) of the Financial Administration Act). Such delegated powers can be further delegated. Any sub-delegation is subject to the terms and conditions of the original delegation (section 6(6) of the Financial Administration Act).

Appendix A: overview of the legislative mandate of the Treasury Board and the President

The Financial Administration Act is the primary statute that outlines the role of the Treasury Board and the President. Other federal laws also contain provisions that implicate the Treasury Board and the President.

Financial management and administrative policy

1. General

The Financial Administration Act provides that the Treasury Board may act for the King’s Privy Council for Canada in specified areas, including general administrative policy in the federal public administration, the organization of the federal public administration, financial management, and the review of departmental spending plans and programs. The Act also provides for various powers of delegation.

The Financial Administration Act also provides important rules for the financial administration of the Government of Canada, the establishment and maintenance of the accounts of Canada and the control of Crown corporations. A variety of other statutes also grant authorities to the Treasury Board on financial matters such as presenting financial statements to the Auditor General for audit and approving rates of remuneration, travel expenses and other allowances.

The appropriation acts implement the Main Estimates and Supplementary Estimates. They are approved by the Treasury Board and tabled in the House of Commons by the President.

2. Management of assets

The Federal Real Property and Federal Immovables Act provides for the authorization and regulation of the acquisition, administration, and disposition of real property by or on behalf of the Crown. Under that Act, the Treasury Board is given authority to establish financial or other limits, restrictions or requirements respecting any real property transaction or class of transactions. Policies have been adopted ensuring proper stewardship of Crown property and maximization of value for any property acquired or disposed. Although the Act has delegated full authority to ministers to complete most transactions, certain transactions are subject to Cabinet approval (Governor in Council) on the recommendation of the Treasury Board. The President acts as the minister responsible for this Act.

3. Access to information and privacy

The Access to Information Act provides a right of access to records under the control of government institutions, requires a range of institutions to proactively publish specified information, and establishes the Office of the Information Commissioner. The President is one of the ministers designated by the Governor in Council for the purposes of the Act. As such, the President is responsible for:

- initiating a review of the Act every five years

- providing direction and guidance (for example, through administrative policies) to government institutions regarding the operation of the Act and for reviewing the management of records under the control of government institutions to ensure compliance with the Act

- publishing the following annually:

- a list containing the names of government institutions, their responsibilities and the classes of records kept by them

- a summary report of statistics on institutional compliance with the Act

The Privacy Act establishes rules to protect personal information held by government institutions, provides individuals with a right to access and correct their personal information that is held by government institutions, and establishes the Office of the Privacy Commissioner. The President is the minister designated by the Governor in Council for the purposes of certain provisions of the Act. As such, the President is responsible for:

- providing direction and guidance (for example, through administrative policies) to government institutions regarding the operation of the Act

- reviewing the use of personal information banks and for reviewing the management of such banks to ensure compliance with the Act

- publishing annually an index of:

- personal information banks, including the names of government institutions controlling the banks and the purposes for which the personal information was collected

- classes of personal information that are not contained in personal information banks

4. Official languages

The President is responsible for exercising leadership within the Government of Canada in relation to the implementation of the Official Languages Act and, in consultation with the other ministers of the Crown, for coordinating the implementation of the Act and ensuring good governance of the Act.

The Treasury Board is responsible for the general direction and coordination of the policies and programs relating to the implementation of Part IV (Communications with and Services to the Public), Part V (Language of Work) and Part VI (Participation of English-Speaking and French-Speaking Canadians), subsection 41(5) (Positive Measures) and paragraph 41(7)(a.1) (Inclusion of linguistic clauses in agreements with provincial or territorial governments) of the Official Languages Act within all federal institutions except:

- the Senate

- the House of Commons

- the Library of Parliament

- the Office of the Senate Ethics Officer

- the Office of the Conflict of Interest and Ethics Commissioner

- the Parliamentary Protective Service

- the Office of the Parliamentary Budget Officer

The President must submit an annual report to Parliament concerning the implementation of these programs. The President may also be designated by the Governor in Council to undertake public consultations on proposed regulations.

5. Auditor General

The Auditor General Act establishes the position of Auditor General, who is responsible for verifying the accuracy of the government’s financial statements and providing Parliament with independent information, assurance and advice regarding the stewardship of public funds. With respect to the Auditor General, the President:

- Tables the Public Accounts of Canada in the fall, which contain the Auditor General’s opinion on the government’s financial statements. The Auditor General also issues a Commentary on the Financial Audits, which includes the observations from the financial statement audit.

- Leads the Government of Canada’s public response to performance audits conducted by the Auditor General, which determine whether the government is appropriately managing its activities and resources. The findings of performance audits are summarized in the Auditor General’s reports, which are generally tabled in Parliament twice per year (spring and fall). Prior to tabling, the Auditor General typically offers to meet with the President to provide an overview of the audits implicating TBS. The President briefs Cabinet on the findings of the Auditor General’s performance audits and discusses communications strategies. If an audit implicates TBS, the President will also issue a specific response relating to its findings.

- Receives copies of the Auditor General’s special examinations, which determine whether Crown corporations are managed efficiently and effectively, and whether their assets are reasonably safeguarded. Special examinations must be conducted at least once every 10 years for each Crown corporation, and the results are generally tabled in Parliament annually as part of the Auditor General’s spring reports.

6. Red tape reduction

The Red Tape Reduction Act provides that the President may establish policies or issue directives respecting the way the One-for-One Rule is applied. The One-for-One Rule requires federal government regulators to offset the cost increases of administrative burdens on businesses and remove one regulation for every new regulation added that imposes an administrative burden. The President is also responsible for publishing a report each year and causing a review of the Act to be conducted five years after its coming into force. A review of the Act is currently underway. The Regulations provide that the Treasury Board may exempt a regulation from the One-for-One Rule in certain circumstances.

7. Service Fees Act

The Service Fees Act requires responsible authorities, before certain fees are fixed, to develop fee proposals for consultation and to table them in Parliament. It also requires that performance standards and procedures for refunding certain fees be established in accordance with Treasury Board policies or directives. It adjusts certain fees on an annual basis in accordance with the Consumer Price Index. Furthermore, it requires responsible authorities to table a report on their fees in Parliament in accordance with Treasury Board policies and directives. Finally, the President is required to publish a report that consolidates the information set out in the reports tabled in Parliament.

Human resources management

1. General

The Treasury Board acts as the Employer for the core public administration and, as such, the Financial Administration Act gives it general responsibility for the organization of the public service and personnel management within the public administration, including the determination of the terms and conditions of employment of persons employed in it. It further allows the Treasury Board to delegate to the Chief Human Resource Officer any of its powers and functions – other than its power to make regulations – in relation to human resources management, official languages, employment equity, values and ethics and its authorities under the Public Service Employment Act.

The Financial Administration Act also provides direct authority for certain aspects of personnel management in the hands of deputy heads, subject to policies and directives of the Treasury Board. Deputy head responsibilities include determining learning and developmental requirements, providing for awards and setting standards of discipline and imposing penalties (up to and including termination) and the termination or demotion of employees for unsatisfactory performance or other non-disciplinary reasons.

2. Staffing

The Public Service Employment Act provides for the appointment of public servants in the public service and other related matters.

Under the Act, staffing in the public service is based on the core values of merit, excellence, non-partisanship, representativeness and the ability to serve members of the public with integrity in the official language of their choice. The Act defines merit, assigns certain functions directly to the employer and creates arrangements for staffing recourse. The Public Service Commission of Canada has the authority to make appointments, and this authority can be delegated to deputy heads. The Commission can also conduct investigations and audits on matters within its jurisdiction.

The Federal Public Sector Labour Relations and Employment Board is responsible for the resolution of staffing complaints related to internal appointments and layoffs in the federal public service.

3. Labour relations

The Federal Public Sector Labour Relations Act establishes a labour relations regime within the public service, provides for the negotiation of collective agreements with unions representing public servants and establishes a grievance process for public servants. The Act provides for a labour relations regime based on cooperation and consultation between the employer and bargaining agents, notably by requiring labour-management consultation committees, enabling co-development of workplace improvements and enhancing collaboration. The Act also establishes an essential services regime whereby, although the employer determines the level at which services are to be provided during a strike, an essential services agreement must be entered between the employer and the bargaining agent prior to the bargaining agent being in a strike position. The Act provides for the establishment of informal conflict resolution system within departments and for comprehensive grievance resolution provisions.

The Federal Public Sector Labour Relations Act was amended in 2017 to include a new collective bargaining and labour relations regime for the Royal Canadian Mounted Police.

The Federal Public Sector Labour Relations and Employment Board is responsible for administering the collective bargaining and grievance adjudication systems in the federal public service.

4. Employment equity

The Employment Equity Act aims to ensure that members of designated groups (women, Aboriginal peoples, persons with disabilities, and members of visible minorities) are equitably represented in both the federal public service and the federally regulated private sector (which includes airlines, interprovincial rail, ship or ferry operations, radio broadcasting stations and banks). While the Minister of Labour is the responsible minister, the Act specifies that the Treasury Board and the Public Service Commission of Canada are responsible for carrying out obligations in the Act, as employer. Moreover, the Treasury Board plays an important role in the implementation of the Act for the Canadian Armed Forces, the Royal Canadian Mounted Police and the Canadian Security Intelligence Service. The President is responsible for tabling in Parliament an annual report on the state of employment equity in the public service.

5. Disclosure of wrongdoing and reprisal protection

The Public Servants Disclosure Protection Act establishes a regime to enable public servants to make disclosures of information that they believe could show that a wrongdoing has occurred in relation to the public sector. The regime includes access to the Public Sector Integrity Commissioner. The Act also provides protection from reprisal to public servants who have made a protected disclosure or have cooperated in an investigation into a disclosure under the Act.

The Treasury Board, as required by the Act, has created a code of conduct for the public sector. The Treasury Board is also responsible for approving the procedures for handling disclosures that must be set up by certain public sector organizations that are excluded from the Act (the Canadian Armed Forces, the Canadian Security Intelligence Service and the Communications Security Establishment).

Under the Act, the President is responsible for:

- promoting ethical practices in the public sector, fostering a positive environment for making disclosures of wrongdoing by disseminating information about the Act, its purposes and its processes

- tabling annually in each House of Parliament a report prepared by the Chief Human Resources Officer that provides an overview of activities regarding certain disclosures made under the Act

6. Health and safety

Part II of the Canada Labour Code creates a regime of requirements and recourse to prevent work-related accidents and illness that is applicable to employers and employees subject to federal jurisdiction. The Treasury Board is currently the largest employer subject to Part II of the Code. The Treasury Board is also subject to Part IV of the Code, which establishes an administrative monetary penalty regime for violations of Part II of the Code.

7. Pensions

The Treasury Board and the President have responsibilities in relation to a number of legislated pension plans.

The President is the responsible minister for:

- the Public Service Superannuation Act, which provides pension benefits to public service employees and their survivors; it is compulsory for all members of the public service (including some Crown agencies and Crown corporations) and provides a defined benefit plan based on years of pensionable service and salary

- the Members of Parliament Retiring Allowances Act, which provides pension benefits to Senators and Members of the House of Commons and their survivors

- the Diplomatic Service (Special) Superannuation Act, an Act to provide superannuation benefits for senior appointees of the Department of Foreign Affairs, Trade and Development serving outside of Canada

- certain sections of the Public Pensions Reporting Act, which require the Chief Actuary to conduct actuarial reviews and issue valuation reports in respect of prescribed pension plans

- the Public Service Pension Adjustment Act, which provides a framework to adjust for persons in receipt of more than one public service pension

- the Special Retirement Arrangements Act, which authorizes the establishment of retirement compensation arrangements

- the Supplementary Retirement Benefits Act, which provides for pension indexing

- the Public Sector Pension Investment Board Act, which establishes the Public Sector Pension Investment Board; since March 31, 2000, contributions made by the government and employees are invested in securities markets under the Public Service Superannuation Act, the Royal Canadian Mounted Police Superannuation Act and the Canadian Forces Superannuation Act plans

The Canadian Forces Superannuation Act, Defence Services Pension Continuation Act, Royal Canadian Mounted Police Superannuation Act and the Royal Canadian Mounted Police Pension Continuation Act provide pension benefits to all Canadian Armed Forces personnel, to members of the Royal Canadian Mounted Police and their survivors, and to retired officers of the military or Royal Canadian Mounted Police who were part of the old Defence Services Pension Act and Royal Canadian Mounted Police Act and their survivors. The Minister of National Defence and the Minister of Public Safety and Emergency Preparedness are responsible for each of their respective plans. However, the President is accountable to Parliament for funding and financial policies for these plans and thus has a shared responsibility.

8. Pay equity

The Pay Equity Actcame into force on August 31, 2021. The Act creates a proactive pay equity regime that applies to the federal public service as well as to federally regulated businesses in Canada. The Act requires employers to establish and maintain a pay equity plan and to identify and correct differences in compensation between predominantly male and predominantly female job classes where the work performed is of equal value. Under the Act, the Treasury Board of Canada is the employer for the core public administration, the Canadian Forces and the Royal Canadian Mounted Police and will be responsible for developing and maintaining the pay equity plans for these workplaces. TBS may be called on to provide guidance to separate agencies in the establishment of their plans.

Government ethics and lobbying

1. Conflict of Interest Act

The Conflict of Interest Act establishes ethical rules for public office holders to protect the integrity of government decision-making. The Conflict of Interest and Ethics Commissioner administers the Act by reviewing confidential reports submitted to their Office, investigating possible contraventions of the Act and tabling reports to Parliament. Although the Act does not assign any specific legislative responsibilities to the President, the Act falls under the President’s legislative portfolio.

2. Lobbying Act

The Lobbying Act establishes the Office of the Commissioner of Lobbying and provides for the appointment of the Commissioner of Lobbying. The Commissioner of Lobbying is mandated to establish and maintain the registry of lobbyists, which includes information about all registered lobbyists as well as their activities. Although the Act does not assign any specific legislative responsibilities to the President, the Act falls under the President’s legislative portfolio

Appendix B: legislative portfolio of the President

Statutes for which the President is named as responsible minister:

- Access to Information Act(note: the President’s responsibility is shared with the Minister of Justice)

- Alternative Fuels Act

- Auditor General Act

- Canada School of Public Service Act

- Conflict of Interest Act

- Diplomatic Service (Special) Superannuation Act

- Federal Real Property and Federal Immovables Act

- Government Services Act, 1999

- Government Services Resumption Act

- Lieutenant Governors Superannuation Act

- Lobbying Act

- Members of Parliament Retiring Allowances Act

- Privacy Act (note: the President’s responsibility is shared with the Minister of Justice)

- Public Pensions Reporting Act(note: the President’s responsibility is shared with the Minister of Employment and Social Development)

- Public Sector Compensation Act

- Public Sector Pension Investment Board Act

- Public Servants Disclosure Protection Act

- Public Service Employment Act(note: the President’s responsibility is shared with the President of the King’s Privy Council for Canada and the Minister of Canadian Heritage)

- Public Service Pension Adjustment Act

- Public Service Superannuation Act

- Red Tape Reduction Act

- Special Retirement Arrangements Act

- Supplementary Retirement Benefits Act

Treasury Board of Canada at a glance

About the Treasury Board

Established in 1867, the Treasury Board is the only statutory Cabinet committee.

It has two distinct functions:

Part A: Management Board

Makes decisions about:

- funds (expenditure manager)

- authorities, rules and compliance (management board)

- people (employer)

Treasury Board responsibilities are delegated by the Financial Administration Act, which creates the Board’s public service support: Secretary, Comptroller General, Chief Human Resources Officer and Chief Information Officer

Part B: Governor in Council

Since 2003, the Treasury Board has been designated as the Cabinet Committee responsible for considering Governor in Council matters.

Makes recommendations to the Governor General about:

- regulations

- most orders-in-council (that is, non-appointment orders-in-council)

In addition to the Financial Administration Act, over 20 other statutes establish the Treasury Board’s roles and authorities. Powers and responsibilities are also set out in regulations, orders-in-council, policies, guidelines and practices.

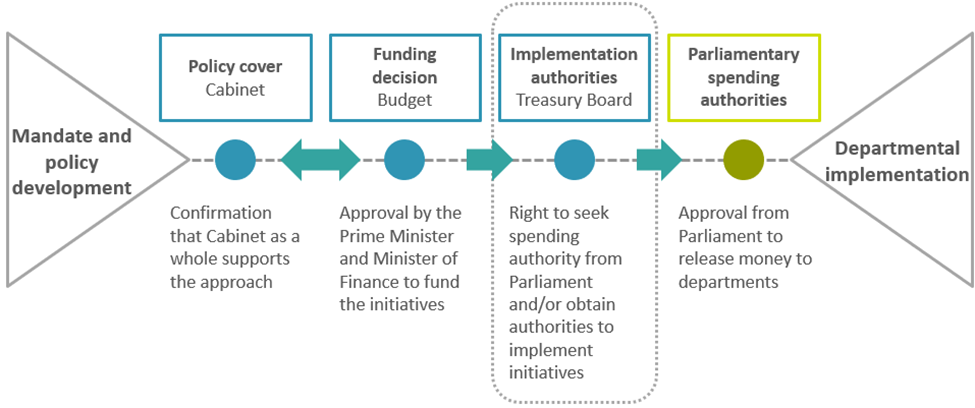

Where the Treasury Board fits

Between the genesis of a policy idea and its implementation by a department, ministers must secure certain approvals to ensure policy alignment, affordability and feasibility.

Text version

Graphic showing the process from policy idea to implementation by a department.

- The first step is mandate and policy development.

- The second step is policy cover by Cabinet, which includes confirmation that Cabinet as a whole supports the approach.

- The third step is a funding decision through the Budget, which includes approval by the Prime Minister and the Minister of Finance to fund the measures.

- The fourth step is implementation authorities by Treasury Board, which includes the right to seek spending authority from Parliament and/or to carry out certain operational steps.

- The fifth step is parliamentary spending authorities, which includes approval from Parliament to release money to departments.

- The final step is departmental implementation.

The fourth step (implementation authorities by Treasury Board) is circled to indicate where Treasury Board fits within the process.

Combined, these key decisions help ensure the government can implement its agenda.

How Treasury Board helps implement the government’s agenda

Cabinet focuses on the what

For example:

- helps formulate government agenda and set priorities and strategy (for example, parliamentary, communications)

- approves policy and legislative proposals

- manages government-wide issues and communications

- approves most Governor in Council appointments (judicial and non-judicial)

- reviews progress against certain major commitments

Treasury Board focuses on the how

For example:

- ensures all initiatives respect the Financial Administration Act and Government of Canada policies

- ensures departmental implementation plans and resource requests are reasonable and likely to achieve identified results

- approves changes to departmental budgets via the Estimates process

Treasury Board lenses

Alignment

Does the proposal align with the government’s policy goals?

Design

How is the program or regulation designed?

Value

Does the proposal represent good value?

Risk

Are solid risk mitigation plans in place for the overall risks of the proposal?

Implementation capacity

Does the proposal work within the department’s existing administrative capacity?

Impact

Will it achieve outcomes? How will these be measured?

The roles of the Treasury Board

Part A

Expenditure manager

- Oversees government expenditure plans and the stewardship of public funds (2023–24 Main Estimates presented $432.9 billion in planned budgetary spending)

- Ensures that government decisions with financial implications are included in Estimates and supply bills for parliamentary approval

- Sets policies and rules for departments on how they spend money

Management board

- Sets rules on how government is managed (the Treasury Board is responsible for 28 policies)

- Provides authorities for new programs, projects, transfer payments, and contracts

- Sets policies to support prudent and effective management and comptrollership

Employer

- Sets rules for employee management, oversees collective bargaining and labour relations (total of about 271,000 employees)

- Sets policies to support the public service (for example, performance management, learning and training)

- Sets terms and conditions of employment (which are the basis of collective agreements)

Part B

Regulatory oversight

- Oversees most orders-in-council and regulations, and promotes regulatory cooperation within Canada and (increasingly) with the United States

- Regulations in areas such as food and drug safety, environmental protection, and transportation safety

- Orders-in-council can include authority to enter into an international agreement and bring legislation into force

Treasury Board takes a wide range of decisions

- Implementation of new initiatives (approval of funding, project authorities, contracting authorities, terms and conditions for new programs)

- Ongoing implementation of major projects (shipbuilding, information technology systems supporting Old Age Security and Employment Insurance)

- Real property transactions (new buildings, major renovations, major leases)

- Major procurements (competitive service contracts above $3.75 million for most departments and $37.5 million for Public Services and Procurement Canada)

- Collective agreements with public service unions

- Corporate plans for Crown corporations

- Access to funding litigation settlements

- New and significant changes to Departmental Results Framework

- Debt write-off, remission orders

- Certain transactions to be included in the Estimates

Key features of the Treasury Board

Ministers play a corporate role as opposed to representing their own departmental priorities.

Highest-volume Cabinet committee with a wide scope of decision-making authority:

- the Treasury Board takes more than 1,000 decisions per year

TBS officials present proposals, unlike at Cabinet, where Ministers present their proposals:

- officials’ advice is provided to all Treasury Board ministers, not just the Chair

- Treasury Board material is not shared or reviewed by Treasury Board ministers’ departments

Quorum for Part A is three ministers and for Part B is four ministers.

Annex A: how the Treasury Board works

Due diligence

Submissions reviewed for:

- clarity, completeness and quality

- business case and value for money

- compliance with existing legal and policy requirements

- program operations and viability

- risk and mitigation

- design and implementation

- international alignment

- regulatory quality and adherence to the Cabinet Directive on Regulation

TBS provides advice

Treasury Board ministers receive materials in advance of the meeting that contain:

- sponsoring ministers’ signed submissions

- TBS’s advice

- regulatory proposals and order-in-council submissions

Cases are presented at the Treasury Board

Process:

- not all cases are formally presented or discussed

- TBS officials present the cases flagged for discussion

- members can ask for any case to be presented

TBS officials answer questions on any item.

Treasury Board ministers challenge and decide

For Part A, members either:

- approve as proposed

- approve with conditions

- defer the decision

- do not approve

For Part B, members:

- consider draft regulations for public comment (beginning of process)

- consider regulations for final approval (end of process)

Part B decisions are only to approve or not approve.

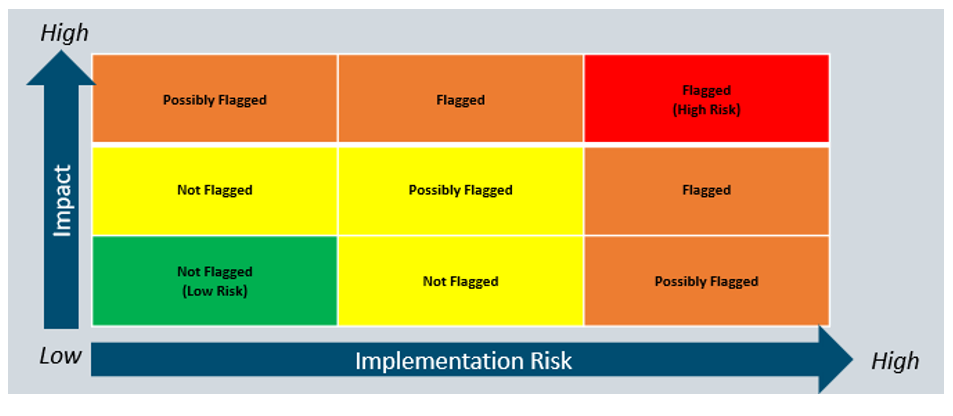

Annex B: assessment of impact and implementation risks

High impact

Submission is considered to have a high impact when it has one or more of the following:

- has a significant impact on a large number of Canadians/stakeholders or a specific group of stakeholders or regions

- high level of public interest

- high level of involvement/ dependencies on other levels of government

- sets a precedent

- has a large service component

- significant financial investment

High implementation risk

Submission is considered to have a high implementation risk when it includes one or more of the following elements:

- highly complex plan

- novel or untested approach to delivery

- transformational or requiring significant change management

- department has limited capability to deliver or enforce

- department has poor past performance

- cyber or security concerns

- high legal risk: high likelihood of successful challenge

- results are not well articulated or there is concern that the plan will not achieve the results

- challenges with costing certainty: not clear that results can be achieved with the available funding

For Part A only: In circumstances where risks haven’t been appropriately mitigated by the department, the Assistant Secretaries may recommend conditions or adjustments to the authorities to be provided (for example, less money, requirement to return to the Board, and so on)

Text version

Three-by-three grid showing implementation risk on the horizontal axis and impact on the vertical axis. Impact increases from bottom to top and implementation risk increases from left to right.

This grid demonstrates when a Treasury Board submission can be flagged for presentation and discussion to the Treasury Board:

- Low implementation risk, low-impact items are not flagged

- Low implementation risk, medium-impact items are not flagged

- Low implementation risk, high-impact items are possibly flagged

- Medium implementation risk, low-impact items are not flagged

- Medium implementation risk, medium-impact items are possibly flagged

- Medium implementation risk, high-impact items are flagged

- High implementation risk, low-impact items are possibly flagged

- High implementation risk, medium-impact items are flagged

- High implementation risk, high-impact items are flagged

Treasury Board of Canada Secretariat at a glance

Outline

- Overview of TBS

- Central agency and departmental functions

- Senior management team

- The Secretary and Associate Secretary

- Office of the Chief Human Resources Officer

- Office of the Comptroller General

- Office of the Chief Information Officer

- Office for Public Service Accessibility

- Centre for Greening Government

- Supporting the Treasury Board directly

- Enabling functions

Overview of the Treasury Board of Canada Secretariat

TBS plays a central coordinating function for the Government of Canada, promoting coherence across programs and services.

| Central agency | Department |

|---|---|

Sets the government-wide management agenda and provides guidance to departments on a wide range of management issues |

As a department, it is subject to this agenda and guidance |

Performs a challenge function and advises Ministers on proposals brought forward by departments (for example, on Memoranda to Cabinet, Budget items, and Treasury Board submissions) |

Submits proposals to Cabinet for the President’s own initiatives |

Central agency and departmental functions

Central agency

The central agency function supports the Treasury Board’s mandate. This role is generally carried out by the following groups:

- Office of the Comptroller General

- Office of the Chief Human Resources Officer

- Office of the Chief Information Officer

- Expenditure Management Sector

- Regulatory Affairs

- Program Sectors

- Centre for Greening Government

- Canadian Digital Service

Department

Enabling functions support the smooth operation of the Treasury Board Secretariat. These functions are carried out mainly by the following groups:

- Priorities and Planning Sector

- Strategic Communications and Ministerial Affairs

- Legal Services

- Human Resources Division

- Corporate Services Sector

- Internal Audit and Evaluation Bureau

TBS organizational chart

The Honourable Anita Anand

President of the Treasury Board

Anthony Housefather

Parliamentary Secretary

Dominique Blanchard

Associate Secretary

Catherine Blewett

Secretary of the Treasury Board

Matthew Partridge

Acting Chief of Staff to the Secretary

Program sectors

Jen O’Donoughue

International Affairs, Security and Justice

David Peckham

Social and Cultural

Heather Sheehy

Government Operations

Anuradha Marisetti

Economic

Policy sectors

Annie Boudreau

Expenditure Management

Tina Green

Regulatory Affairs

Nick Xenos

Centre for Greening Government

Enabling functions

Mallika Nanduri Bhatt

Priorities and Planning

James Stott

Strategic Communications and Ministerial Affairs

Karen Cahill

Corporate Services

Marie-Pierre Jackson

Human Resources

Manon LeBrun

Internal Audit and Evaluation

Office of the Chief Human Resources Officer

Jacqueline Bogden

Chief Human Resources Officer

Francis Trudel

Associate Chief Human Resources Officer

People and Culture

Mireille Laroche

Assistant Deputy Minister

Heidi Kutz

Associate Assistant Deputy Minister

Strategic Directions and Digital Solutions

Jean-François Fleury

Assistant Deputy Minister

Pankaj Sehgal

Associate Assistant Deputy Minister

Employee Relations and Total Compensation

Carole Bidal

Acting Assistant Deputy Minister

Carole Bidal

Associate Assistant Deputy Minister

Office of the Comptroller General

Roch Huppé

Comptroller General

Monia Lahaie

Financial Management

Sheri Ostridge

Internal Audit

Samantha Tattersall

Acquired Services and Assets

Christine Walker

Financial Management Transformation

Office of the Chief Information Office

Dominic Rochon

Chief Information Officer of Canada

Po Tea-Duncan

Chief Information Security Officer

Minh Doan

Chief Technology Officer

Stephen Burt

Chief Data Officer, Digital Policy and Performance

Mike MacDonald

Security Policy Modernization

Len Bastien

Special Advisor to the Chief Information Officer / Digital Community Development

Office of Public Service Accessibility

Alfred MacLeod

Assistant Deputy Minister

Department of Justice Canada

Carol McLean

Legal Services

The Secretary and Associate Secretary

Catherine Blewett, Secretary of the Treasury Board

Deputy head of TBS supported by an Associate Secretary and four other deputy ministers

Dominique Blanchard, Associate Secretary

Works with the Secretary, providing leadership on the management of the Treasury Board Cabinet committee

The Secretary and Associate Secretary lead TBS, which is divided into seven thematic areas:

- human resources

- comptrollership

- information (including digital)

- accessibility

- greening government

- direct support to the Treasury Board

- enabling functions

Office of the Chief Human Resources Officer

Jacqueline Bogden, Chief Human Resources Officer

Francis Trudel, Associate Chief Human Resources Officer

The Chief Human Resources Officer is responsible for government-wide direction and leadership on people management to recruit and retain talent, support a work environment in which employees can thrive, and manage human resources using the best possible tools and evidence.

The Office of the Chief Human Resources Officer supports the Treasury Board’s mandate by:

- developing policies and providing strategic direction, and its enabling systems and processes, for people and workplace management in the public service

- leading negotiations with bargaining agents and managing total compensation to ensure fair and sustainable terms for collective agreements, pensions and benefits

- establishing terms and conditions of employment, including the management of talent and performance for the executive cadre

- monitoring the conditions of the workplace and workforce through data acquisition and analysis

- leading the heads of the human resources community to foster collaboration, innovation and coherence across the Government of Canada

Key policies

- The Policy on People Management sets expectations for deputy heads and managers in the core public administration to create a high-performing workforce and a modern, healthy and respectful work environment

- The Policy on the Management of Executives sets the expectations specific to the management of the executive cadre in the core public administration

- Policies for Ministers’ Offices provides coherence and transparency for financial, personnel and administrative management

Office of the Comptroller General

Roch Huppé, Comptroller General

The Comptroller General is responsible for government-wide direction and leadership on comptrollership, in the areas of financial management, management of assets, and internal audit.

The Office of the Comptroller General supports the Treasury Board’s mandate by:

- developing policies and providing government-wide coordination and strategic direction for comptrollership in the public service, including internal audit, financial management, project management and the management of procurement and real property

- providing strategic direction and oversight for chief financial officers and chief audit executives across the Government of Canada

- providing proactive analysis and recommendations on management and policy issues such as departmental management and spending authorities and contributing to government-wide oversight by providing assurance and advice

- providing analysis and advice on Treasury Board submissions, including on cost estimates and financial risks

Key policies

- The Policy on Financial Management provides key responsibilities for deputy heads, chief financial officers, and other senior managers in exercising effective financial management

- The Policy on Transfer Payments explains the roles and responsibilities for the delivery and management of transfer payment programs

- The Policy on the Planning and Management of Investments sets the direction for the planning and management of assets and acquired services to ensure that these activities provide value for money and demonstrate sound stewardship in program delivery

- The Policy on Internal Audit sets out the responsibilities for deputy heads, chief audit executives and departmental audit committees, in demonstrating responsible stewardship through sound risk management, control and governance processes

Office of the Chief Information Officer

Dominic Rochon,Footnote 4 Chief Information Officer

The Chief Information Officer is responsible for the planning and management of technology and the stewardship of information and data for the Government of Canada.

The Office of the Chief Information Officer of Canada supports the Treasury Board’s mandate by:

- developing policies and strategic direction on digital transformation, service delivery, security, information management and information technology in the public service

- providing analysis and advice on Treasury Board submissions, including on the use of digital technology and issues related to privacy

- working with departments and agencies to improve their digital service capacity, support the use of digital approaches in government operations and develop tools and resources to meet users’ needs

- leading the Government of Canada chief information officers’ community to advance the adoption of best practices for information management and digital and service delivery

Key policies

- The Policy on Service and Digital serves as an integrated set of rules on how the Government of Canada manages service delivery, information and data, information technology and cyber security.

- The Policy on Government Security, which provides direction to manage government security in support of the trusted delivery of Government of Canada programs and services and the protection of information.

Office for Public Service Accessibility

Alfred MacLeod, Assistant Deputy Minister

The Assistant Deputy Minister of Public Service Accessibility is responsible for supporting the Canadian public service in meeting the requirements of the Accessible Canada Act.

The Office for Public Service Accessibility supports TBS’s mandate by providing strategic advice to government departments and agencies regarding issues related to accessibility and inclusion through:

- equipping public servants with knowledge on how to better design and deliver accessible programs and services

- providing practical guidance and tools for removing barriers through initiatives such as the Centralized Enabling Workplace Fund and online via an Accessibility Hub

- providing strategic advice, informed by engagement with persons with disabilities, to government departments and agencies

- improving recruitment, retention and promotion of persons with disabilities

- enhancing the accessibility of the physical workspace

- making technology usable by all

Centre for Greening Government

Nick Xenos, Executive Director

The Centre for Greening Government works to ensure the Government of Canada is a global leader in government operations that are net-zero emissions, climate-resilient, and green.

The Centre for Greening Government supports TBS’s mandate by:

- providing strategic advice to other federal departments and agencies regarding net-zero, resilient and green operations through:

- providing practical guidance and tools for net-zero, resilient and green real property, fleet, and procurement

- convening interdepartmental working groups and external stakeholder communities of practice to share expertise, successes, and best practices among departments

- tracking and publicly disclosing government environmental performance information, including greenhouse gas emissions reductions for federal operations

- administering the Greening Government Fund to reduce emissions and support projects that can be replicated within and across departments, including the new Low-Carbon Fuel Procurement Program

- working with Public Services and Procurement Canada on common procurement tools that incorporate greening criteria

Supporting the Treasury Board directly

Expenditure Management Sector

The Expenditure Management Sector (EMS) plays a central role in the planning and coordination of federal spending.

EMS supports the Treasury Board by:

- ensuring that Parliament has oversight and approval of how money is spent following the funding decision

- providing transparency in expenditures to Parliament and Canadians

EMS is also responsible for refining and strengthening the Quality of Life Framework and advancing its implementation across government.

Program sectors

Program sectors are the interface with departments preparing proposals for the Treasury Board.

There are four program sectors:

- Government Operations

- Social and Cultural

- Economic

- International Affairs, Security and Justice

Program sectors support the Treasury Board by:

- reviewing Memoranda to Cabinet and Treasury Board submissions from federal organizations

- providing advice, guidance and support to federal organizations in their implementation and application of policies

- providing advice on and presenting proposals to Treasury Board Ministers

Regulatory Affairs Sector

The Regulatory Affairs Sector (RAS) establishes policies and strategies to support the federal regulatory system by:

- supporting and coordinating efforts to foster regulatory cooperation with key domestic and international partners

- leading horizontal regulatory modernization efforts

- undertaking targeted regulatory reviews

RAS supports the Treasury Board in its role as a Committee of the Privy Council by:

- providing advice on and presenting regulatory submissions and non-appointment orders-in-council to Treasury Board Ministers

Enabling functions

Enabling functions support the internal operations of TBS. In some cases, they may also work with other organizations to advance the department’s mandate for good management.

Strategic Communications and Ministerial Affairs

Responsible for departmental communications and government-wide communications policy direction, secretariat support for meetings of the Treasury Board, Cabinet and Parliamentary Affairs, departmental Access to Information and Privacy, and correspondence.

Human Resources

The Human Resources Division is responsible for providing strategic human resources advice, guidance and services to TBS’s senior leaders, managers and supervisors, and employees.

Corporate Services and Chief Financial Officer

Provides support to the Secretary of the Treasury Board in financial management, security, information management and technology, facilities and materiel management, and Phoenix-related damages claims processing.

Internal Audit and Evaluation

Provides independent, neutral and objective assurance and evaluation services to support the departmental mandate and priorities.

Priorities and Planning

Provides an integrated lens to TBS policy and planning activities that underpin both government-wide management excellence, as well as corporate governance within the Secretariat. Priorities and Planning also provides leadership on management priorities of strategic importance to the President and the Secretary of the Treasury Board, as well as provide support to the rest of TBS to ensure coherence in priorities, aligned progress on key files, clear accountabilities, and continuous improvement.

Departmental Legal Services

Provides legal advice to the Treasury Board and TBS.

People management in the federal public service

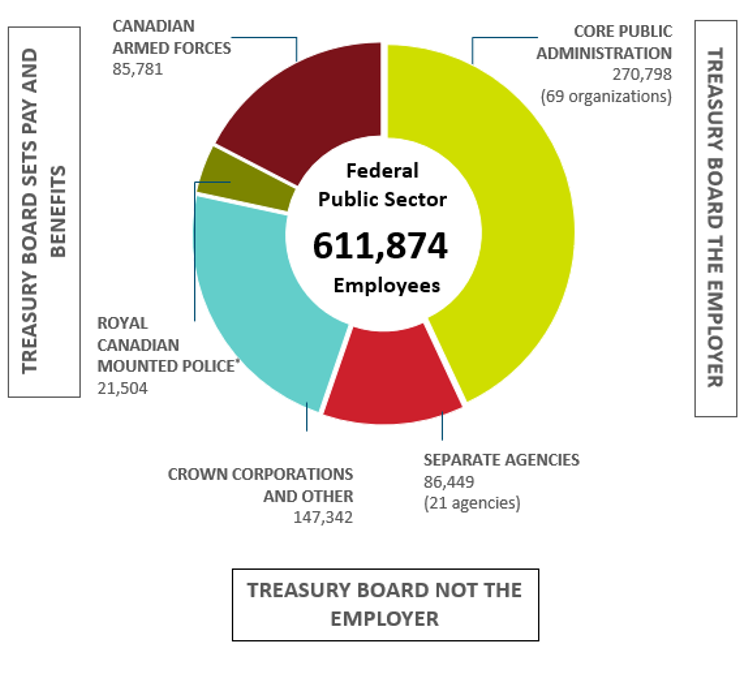

Overview of the federal public sector

Public service employees impact the lives of Canadians every day through an array of services and programs. The federal government is the largest employer in Canada with total compensation cost of $84.9 billion (2022–23).

| Federal public sector: 611,874 employees | |||||

|---|---|---|---|---|---|

| Federal government | |||||

| Federal public service | |||||

| Federal public sector organizations | Core public administration | Royal Canadian Mounted PoliceFootnote * | Separate agencies | Canadian Armed Forces | Crown corporations & other |

| Number of employees (as of March 2023) | 270,798 | 21,504 | 86,449 | 85,781 | 147,342 |

| Human resource authorities | The Treasury Board has overarching responsibility for human and financial resources management within the core public administration (CPA) (69 departments) |

Uniform and Civilian Members are employees of the Treasury Board. The Treasury Board has authority under the Royal Canadian Mounted Police Act to set members’ pay and benefits |

Employers in their own right, are responsible for classification, staffing, and amending changes to terms and conditions of employment for their employees. Separate Agencies must have their collective bargaining mandates approved by the President of the Treasury Board (21 separate agencies) |

Canadian Armed Forces members serve at the pleasure of the Crown and are not employees of the Treasury Board. Treasury Board’s authority to establish Canadian Armed Forces members’ pay and benefits is provided by the National Defence Act |

As separate legal entities, Crown corporations have authority over internal human resources. The Governor in Council may require a Crown Corporation to obtain Treasury Board approval of their collective bargaining mandates in advance of bargaining |

Federal public sector profile

Quick facts

The size of the federal public sector is unmatched by any other public or private institution in the country

The federal public service contains two distinct populations within the federal public sector:

- the core public administration

- separate agencies

Treasury Board as the employer oversees and approves the human resources (HR) policies, providing guidance to deputy heads in managing the core public administration population.

*RCMP (Royal Canadian Mounted Police) public service employees are included in core public administration.

Figure 3 - Text version

Pie chart describing the population of the federal public service and its relationship with the Treasury Board as the employer.

- The Treasury Board is the employer of the core public administration, which has 270,798 employees from 69 organizations.

- The Treasury Board sets the pay and benefits for uniformed members of the Royal Canadian Mounted Police. The Treasury Board is the employer of civilian members. In total, the Royal Canadian Mounted Police has 21,504 employees.

- The Treasury Board is not the employer for the Canadian Armed Forces but does set pay and benefits. The Canadian Armed Forces have 85,781 employees.

- The Treasury Board is not the employer for Crown corporations and others, which have 147,342 employees.

- The Treasury Board is not the employer for separate agencies, which have 86,449 employees from 21 agencies. Separate agencies are employers in their own right.

In total, there are 611,874 employees in the federal public sector.

RCMP (Royal Canadian Mounted Police) public service employees are included in core public administration.

The core public administration by the numbers

Figure 4 - Text version

Line graph showing population growth in the core public administration from 2000 to 2023. There are three groups observed: knowledge workers, executives and non-executives.

The graph is based on the index year of 2000, which was set to 100. The graph shows the growth of the three observed groups since the index year of 2000.

In 2023, the growth index values observed were as follows:

- 261 for knowledge workers, which indicates growth of 161% since 2000

- 222 for executives, which indicates growth of 122% since 2000

- 177 for non-executives, which indicates growth of 77% since 2000

Knowledge workers include Actuarial Science (AC), Auditing (AU), Commerce Officers (CO), Economics and Social Science Services (EC), Financial Management (FI), Information Technology (IT), Law (LP, LA, LC), Mathematics (MA) and Personnel Administration (PE).

The number of knowledge workers within the core public administration has more than doubled in the past twenty years.

2022–23 Public Service Employee Survey

Employee engagement

- Satisfied with job: 80%

- Satisfied with organization: 71%

- Feel valued: 71%

Diversity and inclusion

- Treated with respect: 82%

- Everyone accepted as equal: 80%

- Organization supports diversity: 70%

- Organization respects differences: 74%

- Organization supports anti-racism: 67%

Subject of harassment: 12%

Subject of discrimination: 8%

Note: The information provided is for the core public administration, a subset of the federal public service. It includes all employment tenures and active employees only (employees on leave without pay are excluded), and it is based on effective employment classification (acting appointments are included).

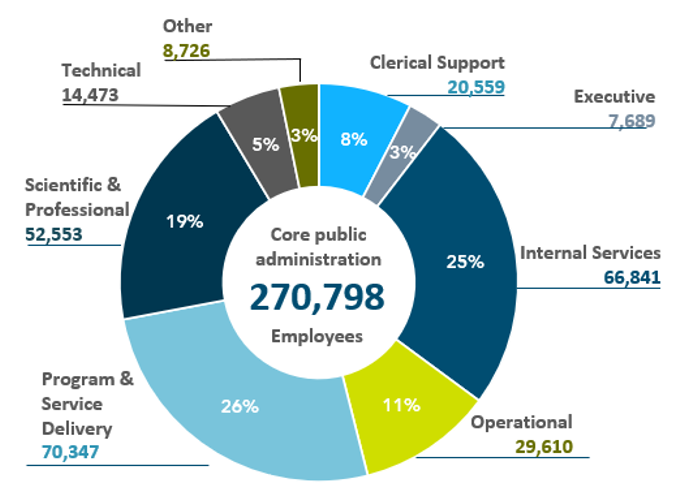

Snapshot: core public administration

There are 72 classifications of employees ranging from air traffic control to engineering and scientific support, program and service providers, and policy analysts.

Figure 5 - Text version

Pie chart showing the number and percentage of employees by occupational category in the core public administration as of March 31, 2023.

| Occupational category | Number of employees | Percentage of the core public administration |

|---|---|---|

| Program and service delivery | 70,347 | 26 |

| Internal services | 66,841 | 25 |

| Scientific and professional | 52,553 | 19 |

| Operational | 29,610 | 11 |

| Clerical support | 20,559 | 8 |

| Technical | 14,473 | 5 |

| Other | 8,726 | 3 |

| Executive | 7,689 | 3 |

The total number of employees in the core public administration is 270,798.

Between 2017 and March 31, 2023, the core public administration has grown consistently and has increased by 71,107 employees.

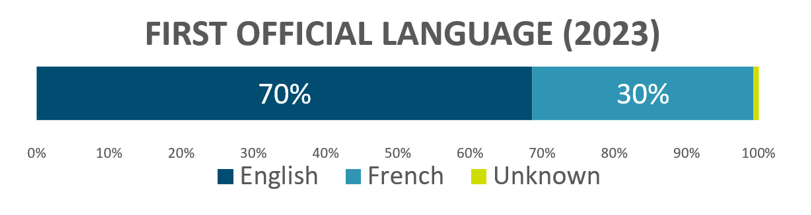

Figure 6.1 - Text version

Graph showing the percentage of employees in the core public administration by first official language as of 2023:

- English: 70%

- French: 30%

- Unknown: less than 1%

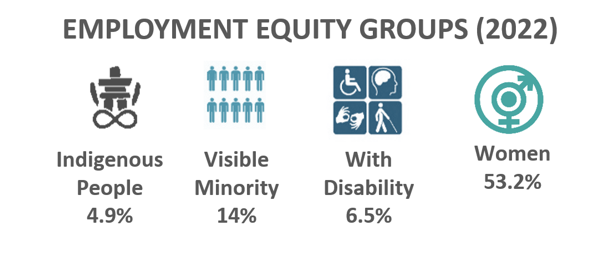

Figure 6.2 - Text version

Graphic showing the representation of employment equity groups in the core public administration as of 2022:

- Indigenous people: 4.9%

- visible minority: 14%

- with disability: 6.5%

- women: 53.2%

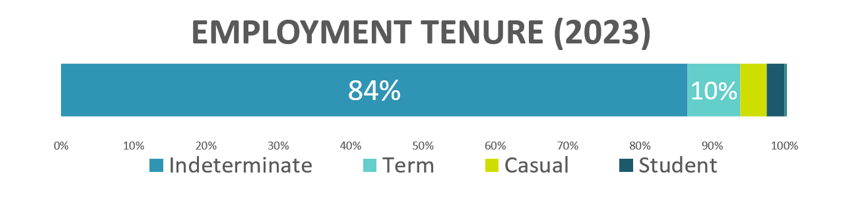

Figure 6.3 - Text version

Graph showing the number of employees in the core public administration by employment tenure as of 2023:

- indeterminate: 84%

- term: 10%

- casual: 4%

- student: 2%

Figure 6.4 - Text version

Graph showing the percentage of employees in the core public administration by age group as of 2023:

- under 25: 5%

- 25 to 29: 11%

- 30 to 34: 12%

- 35 to 39: 13%

- 40 to 44: 15%

- 45 to 49: 14%

- 50 to 54: 13%

- 55 to 59: 10%

- 60 to 64: 5%

- 65 and older: 2%

Source: Treasury Board of Canada Secretariat Human Resources Statistics

Treasury Board as the employer

Established in 1867, Treasury Board is the only statutory Cabinet Committee. It has several responsibilities including being the Employer for the core public administration; these responsibilities are delegated to the Chief Human Resources Officer (CHRO) through the Financial Administration Act.

As the employer, Treasury Board has three primary duties:

1. Establishing compensation and terms and conditions of employment for represented employees:

- collective agreements govern key aspects between the relationship between employer and employee

- the National Joint Council is the forum through which participating employers and bargaining agents take joint ownership of broad labour relations issues and develop collaborative solutions to workplace problems

- pension plans that are set in legislation and not subject to bargaining

- benefit plans (health, dental, and disability insurance) are negotiated outside the bargaining process. Plans are for both employees and retirees

2. Setting policy direction for people management. Two primaryFootnote 5 policies supported by 22 directives guide people management in the core public administration:

- Policy on People Managementprovides deputy heads with support in developing and sustaining a high-performing workforce

- Policy on the Management of Executives establishes the authorities and responsibilities of deputy heads and the CHRO for executive management

3. Maintaining a healthy, diverse, inclusive, accessible, bilingual and safe workplace. This is achieved through:

- developing innovative solutions for recruitment and talent management

- providing guidance on how to develop and implement measures to support the Federal Public Service Mental Health Strategy

- supporting government implementation of the Official Languages Act in federal institutions

- providing clear expectations for behaviour and shared values and ethics

People management roles and responsibilities

There are distributed accountabilities and roles across the Government of Canada for people management:

Office of the Chief Human Resources Officer

The Office of the Chief Human Resources Officer (OCHRO) supports Treasury Board in its role as the employer by driving excellence in people management and providing guidance to support consistency across the public service.

Deputy heads

Hold primary responsibility for human resources management within their organizations. This includes directing the administration of financial and human resources.

Privy Council Office

The Privy Council Office (PCO) supports the Clerk as Head of the Public Service, including directing public service–wide people management priorities.

Collective agreements

As of March 2023, in the core public administration:

- 232,000 unionized members represented by 16 bargaining agents

- covered by 28 group collective agreements

Collective agreements cover issues such as pay and other allowances, leave, labour relations, career development, hours of work and job security.

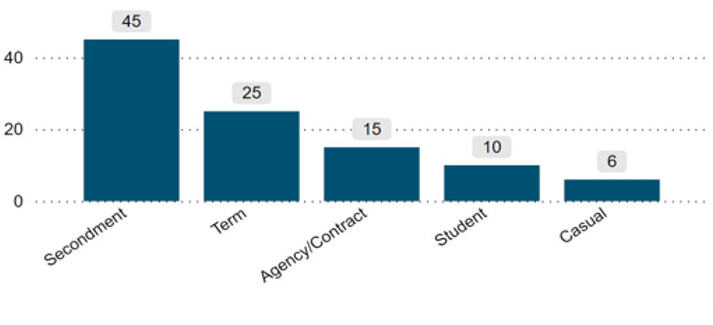

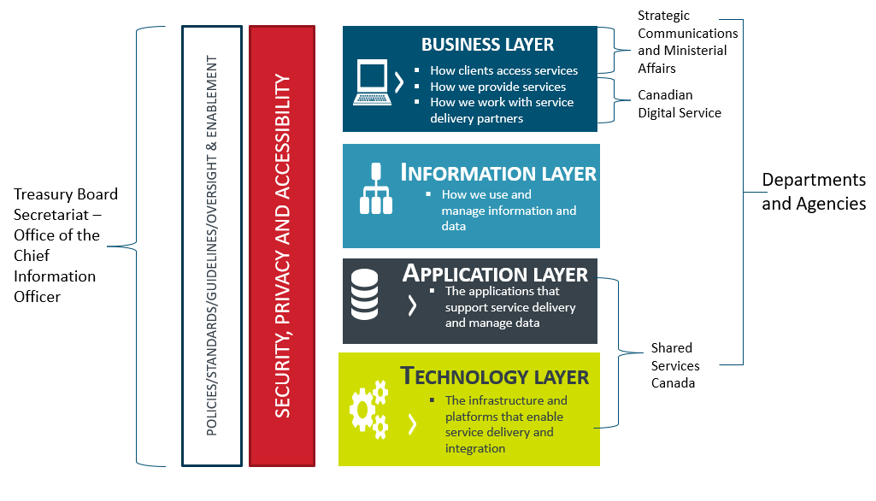

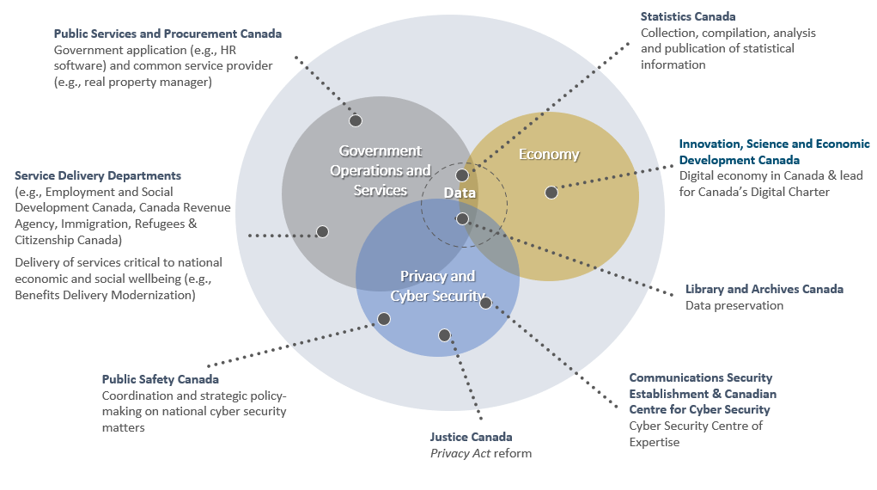

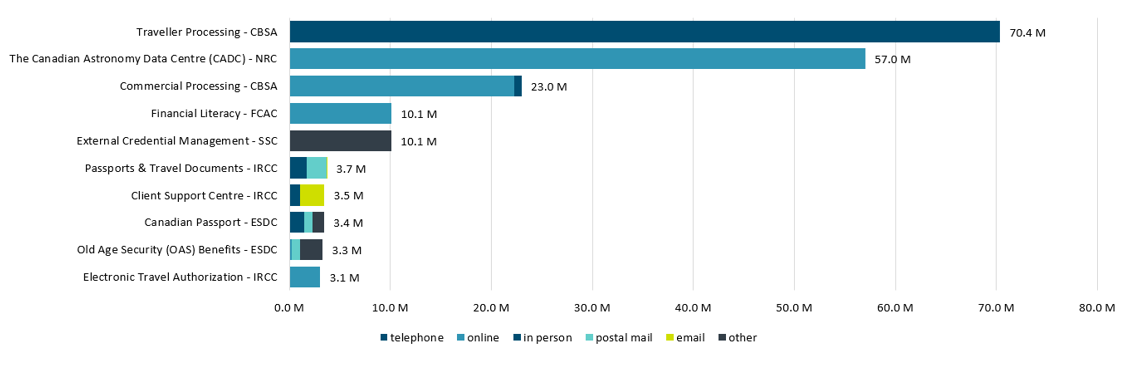

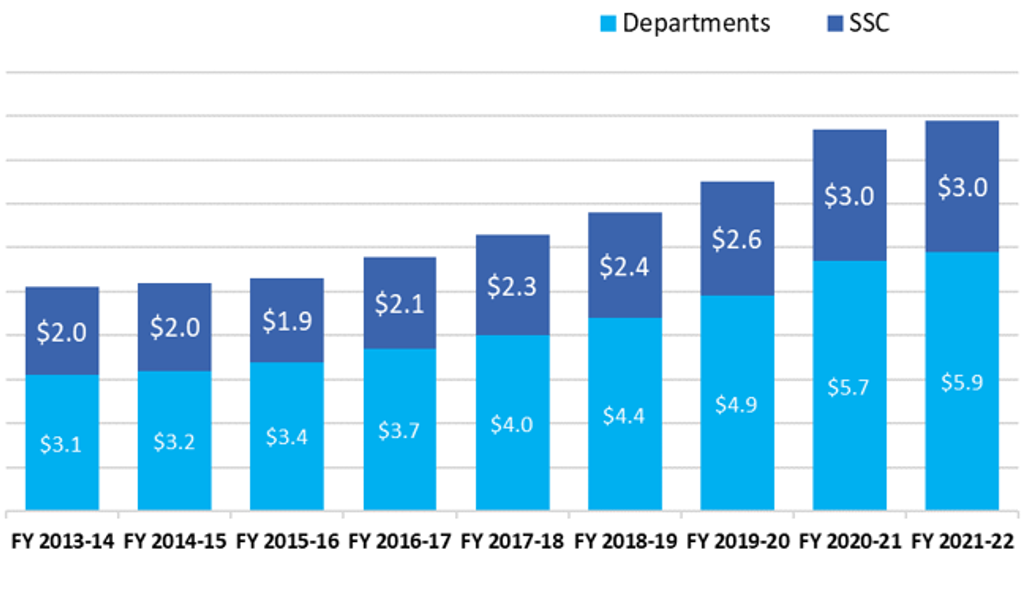

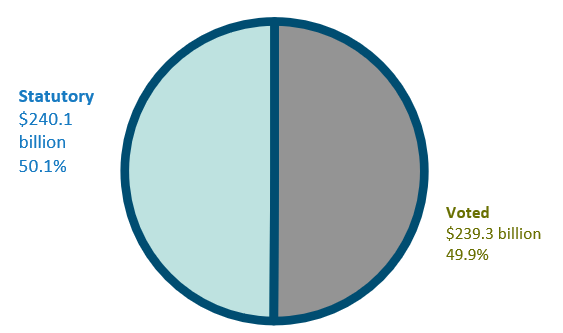

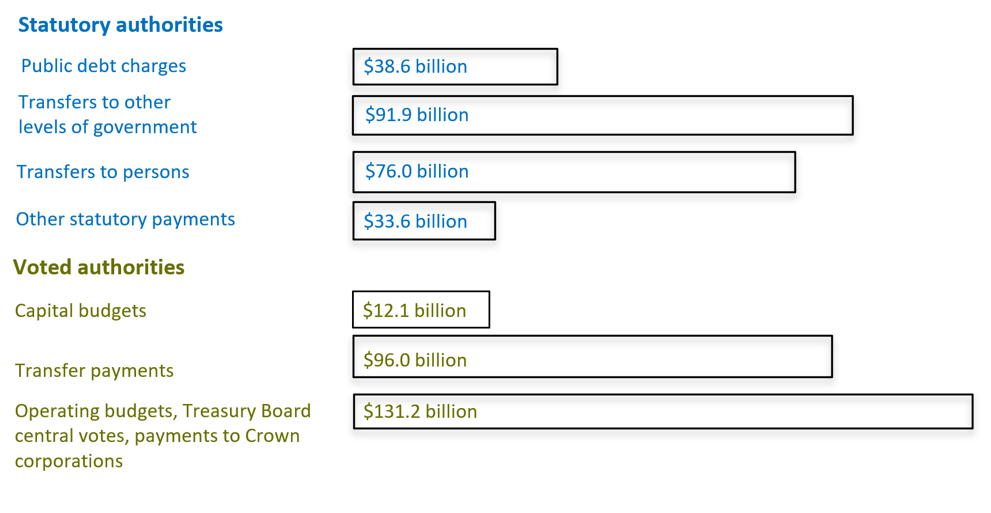

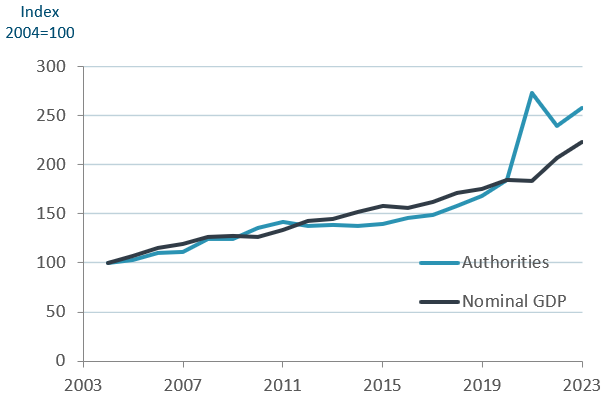

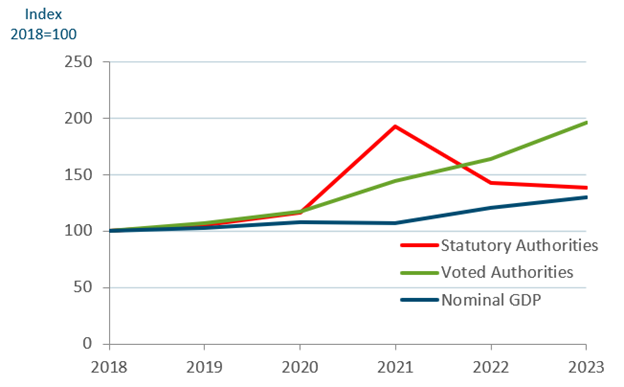

These terms and conditions of employment are negotiated with bargaining agents through the collective bargaining process.