Your Pension and Benefits Liaison: Information for Retired Members of the Federal Public Service Pension Plan, Issue 10

Issue 10 : 2016

- Travelling soon?

- Re-employment and your health care plan

- Year at a glance

- Your dental benefits: a reason to smile

- Direct deposit and epost: the smart way to go!

- Documenting your common-law relationship

- The bridge benefit

- It is your responsibility to keep your health and dental coverage up to date

- Keep us informed

- Government of Canada Pension Centre: contact information

Travelling soon?

If you are a member of the Public Service Health Care Plan (PSHCP) with Supplementary Coverage, you are covered for the Emergency Travel Benefit. This benefit provides coverage for up to 40 days following your departure from your province or territory of residence. It includes the reimbursement of up to CAN$500,000 per person in eligible emergency medical expenses incurred by you or your covered dependants while travelling. This amount is in addition to the expenses covered by your provincial or territorial health insurance.

Eligible expenses include the cost of physician services and hospital accommodation. Charges for medical evacuation, including air ambulance services, may also be authorized if suitable care is not available in the area. For a list of benefits available and restrictions, consult the PSHCP Directive from the National Joint Council.

Before travelling, note that the PSHCP has set a 100-day supply limit on prescription drugs. However, arrangements can be made with Sun Life to dispense up to another 100-day supply by calling 1-888-757-7427 two weeks prior to your departure.

Re-employment and your health care plan

If you retired prior to , and are re-employed as a contributor to the public service pension plan, you will need a minimum of six years of cumulative pensionable service when you retire again in order to be eligible for Public Service Health Care Plan (PSHCP) coverage as a retired member. For a list of exceptions, refer to the PSHCP Special Bulletin on Plan Changes.

Year at a glance

Did you know that the Government of Canada publishes the annual Report on the Public Service Pension Plan? The report provides an overview of the plan’s key achievements and an update on its financial performance. It also highlights the government’s commitment to provide information about the pension plan. For more interesting facts, you can read the full report.

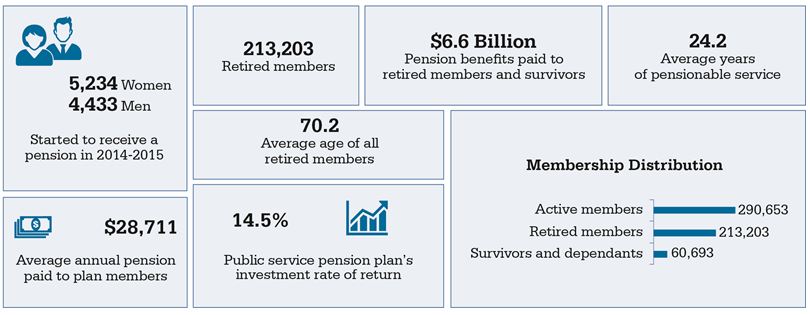

Figure 1: text version

This infographic shows the following information for the 2014-2015 fiscal year:

- 5,234 women and 4,433 men started to receive a pension in 2014-2015

- There were 213,203 retired members.

- $6.6 billion in pension benefits were paid to retired members and survivors.

- The average age of all retired members was 70.2.

- The public service pension plan had an investment rate of return of 14.5%.

- The average number of years of pensionable service was 24.2.

- The average annual pension paid to plan members was $28,711.

- The membership distribution was as follows:

- active members: 290,653

- retired members: 213,203

- survivors and dependants: 60,693

Your dental benefits: a reason to smile

The Pensioners’ Dental Services Plan provides reimbursement towards the cost of specific dental services, to a maximum of $1,500 per calendar year. If the eligibility requirements are met, basic dental procedures such as fillings, cleaning, scaling and recall examinations are reimbursed at 90%. In addition, major services such as crowns, dentures and bridges are reimbursed at 50%. The Plan reimburses the reasonable and customary cost of services based on the previous year Fee Guide for the province or territory where the service was provided. For example, if the fee for a filling in the relevant Fee Guide is $280 and your dentist charges $300, assuming your annual deductible is satisfied, the Plan will reimburse you $252 (90% of $280).

There are limitations on how often certain services and treatments are covered. For example, recall examinations are covered every nine months. Visit Sun Life to find information on the Plan Rules.

For any dental work that will cost more than $300, it is recommended that you or your dentist request an estimate of eligible expenses from Sun Life. You will be provided with a predetermination of benefits statement to let you know if the work will be covered and how much of the estimated cost will be reimbursed.

Direct deposit and epost: the smart way to go!

If you have not already enroled in direct deposit, we encourage you to do so by calling or sending a written request along with a void cheque to the Government of Canada Pension Centre (Pension Centre). As well, if you have not registered for epost, visit the website to see what it is all about and to register.

Documenting your common-law relationship

To make it easier to determine your partner’s eligibility for survivor benefits, you can gather documents now such as mortgage or bank statements, bills or other documents that demonstrate your cohabitation. You may also complete the Statutory Declaration (PWGSC-TPSGC 2016) and send it to the Pension Centre.

For your common-law partner to be eligible for survivor benefits, your relationship must:

- have started before you retired

- last at least one year

- continue without interruption until your death

Note: Eligibility for survivor benefits can only be determined upon your death.

The bridge benefit

The bridge benefit is a temporary benefit payable until age 65, and is intended to supplement your retirement income until you are entitled to receive an unreduced benefit under the Canada Pension Plan (CPP) or Quebec Pension Plan (QPP). If you become entitled to a CPP or QPP disability benefit before age 65, you are no longer entitled to the bridge benefit and you must notify the Pension Centre immediately to avoid an overpayment.

It is your responsibility to keep your health and dental coverage up to date

Your coverage may be affected by certain life events such as:

- marriage or common-law relationship

- divorce or separation

- death of a spouse or dependant

- change in eligibility of a dependant (e.g., a dependant child reaching age 21, or a full-time student reaching age 25)

To make changes to your Public Service Health Care Plan coverage, you must first advise the Pension Centre. You must also update your positive enrolment with Sun Life or by calling 1-888-757-7427.

To change your category of coverage under the Pensioners’ Dental Services Plan, you must complete and submit a new application form available from the Pension Centre.

Waiting periods may apply before changes in your health and dental coverage take effect. Once your coverage has been updated, your monthly deductions will be amended, if applicable.

Note: Update your information as soon as possible since retroactive changes and refunds are only approved in exceptional circumstances.

Keep us informed

It is important to notify the Pension Centre if there are changes to the following:

- mailing address (even if you are enroled in direct deposit)

- banking information

- marital status (married, common law, widowed, separated, divorced or single)

- mailing address of your designated beneficiary

- name and mailing address of a person to contact in the event of incapacity

Government of Canada Pension Centre: contact information

We encourage you to visit Pension and Benefits for more information.

When communicating with the Pension Centre, it is very important that you always provide your:

- pension number

- surname, first name and initials

- address (with postal code)

- telephone number (with area code)

Call Monday to Friday

1-800-561-7930 (toll-free)

8:00 a.m. to 4:00 p.m. (your local time)

Outside Canada and the United States

506-533-5800 (collect calls accepted)

8:00 a.m. to 5:00 p.m. (Atlantic time)

Telephone teletype (TTY)

506-533-5990 (collect calls accepted)

8:00 a.m. to 5:00 p.m. (Atlantic time)

Facsimile

418-566-6298

In writing

Government of Canada Pension Centre

Mail Facility

PO Box 8000

Matane QC G4W 4T6

If you have comments or questions about our communication products, email us.

Note: For security reasons, please do not provide personal information by email.

Note: Some federal agencies, Crown corporations and territorial governments do not participate in the public service group benefit plans. Even if your former employer did not participate in all public service group benefit plans, you as a retired member may be eligible to join these plans. To find out if you are eligible, please call the Pension Centre.

Disclaimer: Your Pension and Benefits Liaison newsletter is provided for information purposes only and is not a legal document on your rights and obligations. Should there be any discrepancy between the information in this document and that contained in the Public Service Superannuation Act (PSSA) and related regulations or other applicable laws, the legislative provisions will apply. Similarly, should there be any discrepancy between information in this document and that contained in the group insurance benefits plan provisions or insurance contracts, the plan provisions or insurance contracts will apply.