Annual Allowance

An annual allowance is a benefit available to plan members who have more than two years of pensionable service, who retire and want to draw a pension benefit but they are not yet entitled to an immediate annuity. This benefit is a reduced pension that takes into account the early payment of a retirement pension.

Under normal circumstances, choosing the reduced pension option cannot be reversed.

You would also receive an unreduced bridge benefit payable until age 65, calculated according to the formula described in Pension Formula: Lifetime Pension and Bridge Benefit.

- Protection from inflation:

- An annual allowance is fully indexed as of the most recent date you leave the public service. Your total pension amount is indexed according to the Consumer Price Index (CPI) as described in Protection from Inflation.

- Protection in case of disability:

- If you opt for an annual allowance and suffer from a disability after your departure from the public service, you must inform the Pension Centre. Your annual allowance could be suspended and you could become eligible for an immediate annuity on grounds of disability. In such cases, though, the immediate annuity would be adjusted to take into account any amount you had already received as an annual allowance. If you are entitled to a disability pension under the CPP/QPP before you reach age 65, your public service bridge benefit will end immediately. The lifetime pension amount continues to be indexed annually. It is your responsibility to inform the Pension Centre if you start to receive a disability benefit under the CPP/QPP, otherwise you will be required to repay any overpayments.

- How your annual allowance may be affected in case of divorce or separation:

- The pension benefits you have acquired during the course of your marriage or during the period of cohabitation in a conjugal relationship may be divided in the event of a separation or divorce.

- Protection for your survivor and children:

- Your eligible survivor and children may be entitled to survivor benefits as described in Survivor Benefits.

- Retirement Compensation Arrangement:

- The income tax rules limit the pension amount payable under a registered pension plan. Therefore, if your salary exceeds a certain amount ($157,700 in 2015), a portion of your pension will be paid by the Retirement Compensation Arrangement.

- Re-employment:

- It is important to note that re-employment in the federal public service after retirement can have an impact on your public service pension benefits.

Visit Public service group insurance benefit plans for information on benefits.

If you become a member on or before :

Your annual allowance becomes payable at age 50 at the earliest.

- How your annual allowance is calculated:

- Your annual allowance is calculated according to the Pension Formula: Lifetime Pension and Bridge Benefit.

A reduction is applied to the pension according to your years of service, as follows:

| If you have completed the following years of service | And have reached age | Your annual allowance is reduced by the following amount |

|---|---|---|

| 25 or more | 50 but are under age 55 | The greater of:

|

| 55 but are under age 60 | The lesser of:

|

|

| Less than 25 | 50 but are under age 60 | 5% for each year you are under age 60 (rounded to the nearest one tenth of a year) |

Example of Annual Allowance Reduction if you became a member on or before :

Age at departure or when option was made: Age 55

Years of pensionable service: 25 years

Pension amount that would have been payable at age 60: $30,000

You are under age 60 by 5 years and your pensionable service is less than 30 years by 5 years. Your annual allowance would be $30,000 - $7,500 = $22,500.

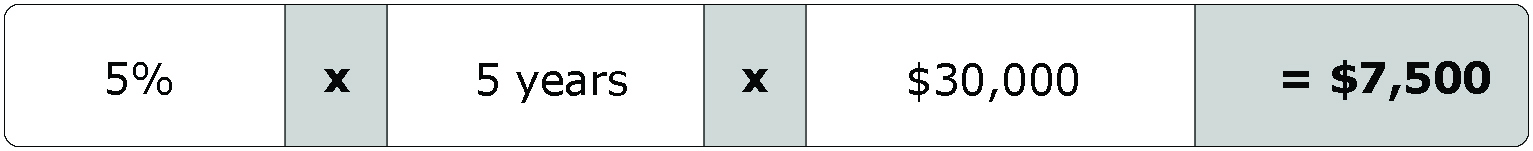

Step 1: Your annual allowance reduction would be $7,500, calculated as follows:

Figure 2 - Text version

5 percent multiplied by 5 years multiplied by 30,000 dollars equals 7,500 dollars.

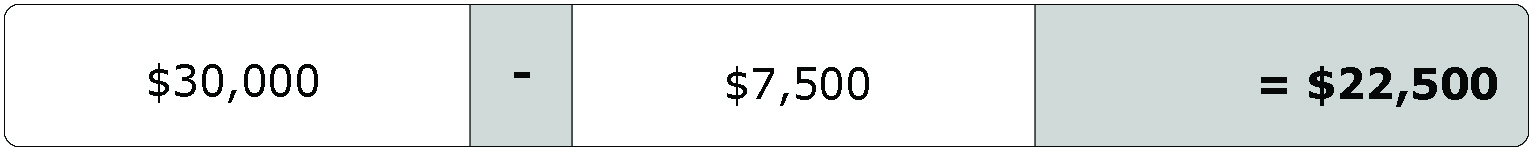

Step 2: Your annual allowance would be $22,500, calculated as follows:

Figure 3 - Text version

30,000 dollars minus 7,500 dollars equals 22,500 dollars.

If you become a member on or after :

Your annual allowance becomes payable at age 55 at the earliest.

- How your annual allowance is calculated:

- Your annual allowance is calculated according to the Pension Formula: Lifetime Pension and Bridge Benefit.

A reduction is applied to the pension according to your years of service, as follows:

| If you have completed the following years of service | And have reached age | Your annual allowance is reduced by the following amount |

|---|---|---|

| 25 or more | 55 but are under age 60 | The greater of:

|

| 60 but are under age 65 | The lesser of:

|

|

| Less than 25 | 55 but are under age 65 | 5% for each year you are under age 65 (rounded to the nearest one tenth of a year) |

Example of Annual Allowance Reduction if you became a member on or after :

Age at departure or when option was made: Age 60.

Years of pensionable service: 25 years.

Pension amount that would have been payable at age 65: $30,000

You are under age 65 by 5 years and your pensionable service is less than 30 years by 5 years. Your annual allowance would be $30,000 - $7,500 = $22,500.

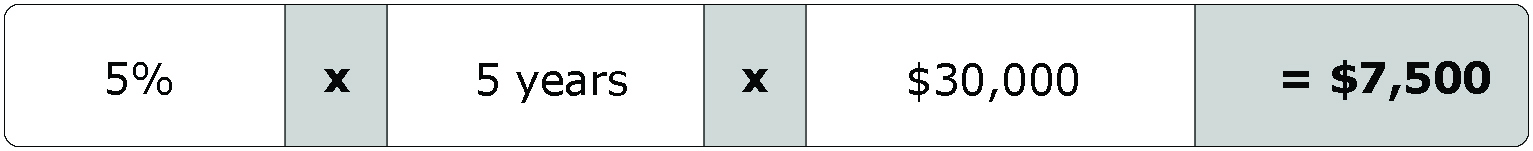

Step 1: Your annual allowance reduction would be $7,500, calculated as follows:

Figure 5 - Text version

5 percent multiplied by 5 years multiplied by 30,000 dollars equals 7,500 dollars.

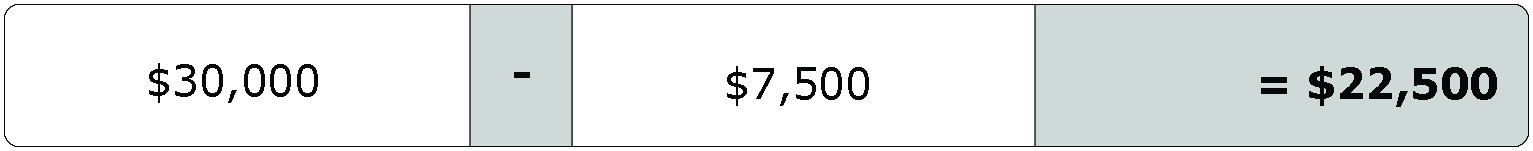

Step 2: Your annual allowance would be $22,500, calculated as follows:

Figure 6 - Text version

30,000 dollars minus 7,500 dollars equals 22,500 dollars.