Evaluation of ACOA's Economic Development Programming (2018 - 2022)

About this publication

© His Majesty the King in Right of Canada, as represented by

the Minister of Rural Economic Development and Minister responsible

for the Atlantic Canada Opportunities Agency, 2023.

Catalogue No. AC5-52/2023E

ISBN 978-0-660-48410-5

The evaluation team is grateful to ACOA’s clients and staff, as well as external key informants for their generous contributions of time and knowledge to this study. Thank you!

What is an evaluation?

An evaluation provides Canadians with an evidence-based, neutral assessment of the relevance, effectiveness and efficiency of government policies and programs.

It also provides senior management with recommendations aimed at continuously improving policies, programs and operations.

The team

ACOA’s Evaluation and Advisory Services team conducted the evaluation between January 2022 and February 2023.

Director: Anouk Utzschneider

Senior Analyst: Laura Kastronic

Analysts: Lise Gallant & Nidhi Patel

Coordinator: Gaétanne Kerry

Project Lead: Deanna Slattery-Doiron

Questions or comments about this report: evaluation-evaluation@acoa-apeca.gc.ca

Table of Contents

Executive summary

This report presents the results of an evaluation of the Atlantic Canada Opportunities Agency’s (ACOA) economic development programs, namely the Business Development Program (BDP), the Innovative Communities Fund (ICF) and the Atlantic Innovation Fund (AIF). The study covered broad evaluation themes related to relevance and performance. The programs were not evaluated in isolation, but rather were examined through the lens of their relative value and ongoing contribution to Agency outcomes in the context of the Regional Economic Growth through Innovation (REGI) program. It also took into consideration the rapidly-evolving and inter-connected nature of current economic barriers as well as the impacts of the COVID-19 pandemic on the ability of the Agency to deliver its core programming.

Conclusions

Innovative Communities Fund: Budget 2023 reaffirmed that rural communities are “a driver of economic growth, and home to a wide range of industries including agriculture, mining and tourism”.Footnote 1 With a large percentage of Atlantic Canada’s population residing in small rural communities, the evaluation found that there continues to be a need for dedicated programming focused on supporting their growth. ICF offers unique place-based programming that responds to the specific needs of Atlantic Canadian communities. There is an opportunity to increase focus on investments that build the capacity of communities, especially in those areas that drive population growth and retention.

Business Development Program: Compounded by the COVID-19 pandemic, the greatest barriers to economic growth are evolving rapidly and becoming increasingly inter-connected. BDP’s relative value lies in its flexibility which allows the Agency to provide regionally-relevant programming that is responsive to emerging opportunities and barriers. It has also proven to be an effective vehicle through which to rapidly flow relief and recovery funding critical to the survival of Atlantic Canadian businesses. There is, however, an opportunity to clarify program expected results.

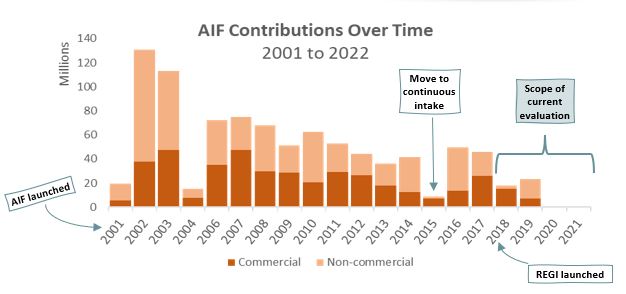

Atlantic Innovation Fund: With dwindling investments in recent years, along with the introduction of REGI as the Agency’s primary innovation program and recently announced changes to the federal government’s approach to supporting innovation, the evaluation found that AIF is no longer relevant or contributing to the achievement of Agency outcomes.

Recommendations

- Ensure the continued alignment of key Agency priorities and resources with current drivers of economic growth and the barriers that constrain it:

- Building upon work done pre-pandemic, clarify the Agency’s path forward for addressing the skills and labour shortage

- Streamline the Agency’s suite of programming and reduce redundancies by eliminating AIF

- Develop and implement a comprehensive, proactive path forward for the Agency’s approach to inclusive growth

- Develop a coordinated approach to supporting small and medium-sized businesses (SMEs) address barriers related to supply chain disruptions

- Implement an integrated change agenda that supports excellence in program delivery and accurate tracking and reporting of investments:

- Ensure availability of high-quality data related to the nature of projects and their impacts on the Atlantic Canadian economy

- Ensure reliable data is available on the profile of the Agency’s client base in terms of representation of diverse groups

- Remove barriers and streamline processes to help program delivery staff continue to provide excellent service to clients and do their jobs more efficiently

- Increase support for crucial role staff play in convening, pathfinding and coordinating ecosystem partners and advocating for needs of businesses and communities

- Update internal program governance documentation to clarify expected results and eligible activities of each program

Why it matters: As the federal government department responsible for economic development in Atlantic Canada, it is important for ACOA to be able to rapidly pivot in response to evolving economic conditions and Government priorities (e.g., Green Economy) and ensure its programs, policies and processes remain aligned with the factors that drive economic growth and address the barriers that constrain it. To do this, senior management needs access to real-time, reliable data on the nature of the projects in which the Agency invests and the impacts they are having on the economy. Reliable project data also supports the Agency’s ability to ensure its programs are aligned with Government of Canada priorities and are meeting the needs of diverse groups. Lack of reliable data also limits the ability of evaluations to accurately assess the relevance and performance of the programs.

The introduction of REGI fundamentally changed the way the Agency uses its flagship program, BDP. With the large majority of commercial investments now being funded through this new program, it is timely for the Agency to re-think its suite of programming with a view to ensuring that programs are optimized and are being put to their highest and best use. This means eliminating programs such as AIF that are no longer contributing to outcomes and in the case of BDP, it means leveraging its flexibilities to offer regionally-relevant solutions to local economic challenges. For ICF this means increasing investments in projects that improve the capacity of communities to seize opportunities that drive population growth. To do so will require a common understanding of the broad results each program is expected to achieve, and the types of projects it is intended to support.

Context

The Agency

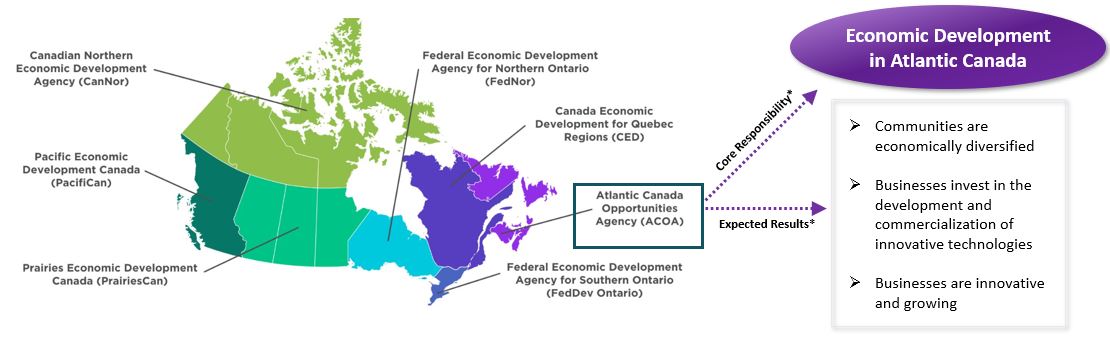

ACOA is one of seven federal regional development agencies (RDAs) in Canada that provide regionally-tailored programs, services, knowledge and expertise with aims to address economic challenges and opportunities.Footnote 2 ACOA’s mandate is “to increase opportunity for economic development in Atlantic Canada and, more particularly, to enhance the growth of earned incomes and employment opportunities in that region”.Footnote 3

ACOA works with SMEs, communities, organizations and regional stakeholders to strengthen the Atlantic economy through programs that focus on economic development, community development as well as policy, advocacy and coordination.Footnote 4

*For more information see the Agency’s Departmental Results Framework.

Long description

This figure shows a map of Canada, indicating the geographic locations covered by each regional development agency. The Canadian Northern Economic Development Agency (CanNor) covers Yukon, Northwest Territories and Nunavut; the Federal Economic Development Agency for Northern Ontario (FedNor) covers Northern Ontario; the Canada Economic Development for Quebec Regions (CED) covers Quebec; the Federal Economic Development Agency for Southern Ontario (FedDev) covers Southern Ontario; Prairies Economic Development Canada (PrairiesCan) covers Alberta, Saskatchewan and Manitoba; Pacific Economic Development Canada (PacifiCan) covers British Columbia; and the Atlantic Canada Opportunities Agency (ACOA) covers New Brunswick, Nova Scotia, Prince Edward Island, and Newfoundland and Labrador.

ACOA’s core responsibility is economic development in Atlantic Canada, and its expected results are ensuring that communities are economically diversified, businesses are investing in the development and commercialization of innovative technologies, and businesses are innovative and growing. For more information on ACOA’s core responsibility and expected results, see the Agency’s Departmental Results Framework.

The evaluation

Purpose

This evaluation responds to accountability requirements under the Policy on Results (2016) and the Financial Administration Act (1985) by assessing the relevance, effectiveness and efficiency of the Agency’s economic development programs.

The evaluation also provides recommendations to ACOA’s senior management on proposed actions that would contribute to the continuous improvement of the Agency’s policies, programs and operations.

Scope

The evaluation examines grants and contributions made under the following transfer payment programsFootnote 5 between April 1, 2018 and March 31, 2022:

Methodology

To answer the evaluation questions, the team:

- Reviewed internal documents and recent literature

- Analyzed internal project data

- Surveyed clients and staff

- Interviewed internal and external key informants

Note: See Appendix A for more information on methodology.

Evaluation questions

- Relevance

- To what extent do ICF and BDP address current and emerging needs of Atlantic Canadian SMEs and communities?

- To what extent does AIF address a demonstrable need?

- To what extent are programs are aligned with current Government of Canada and ACOA priorities?

- To what extent are programs unique or complementary to other program offerings internally and externally? Do any areas of overlap or duplication exist?

- What would be the impact of the absence of the programs?

- Effectiveness

- To what extent do BDP, AIF and ICF contribute to:

- Sustainable economic development of communities;

- Increased SME productivity and capacity for growth and innovation along the growth continuum (including export development) and leveraging of investments; and

- Strengthened regional ecosystem that supports high growth, innovative and competitive firms?

- To what extent did the introduction of new programs (i.e., REGI, COVID-19 relief) impact the achievement of program outcomes?

- To what extent do ACOA’s non-financial supports contribute to the achievement of outcomes?

- To what extent do BDP, AIF and ICF contribute to:

- Efficiency

- What factors facilitate or impede efficient program delivery?

- How has the introduction of REGI impacted the efficiency and effectiveness of program delivery?

Note: Details on methods employed for each evaluation question can be found in Appendix E.

The programs

| Business Development Program | Atlantic Innovation Fund | Innovative Communities Fund | Regional Growth through Innovation | |

|---|---|---|---|---|

| Year introduced: | 1995 | 2001 | 2005 | 2018 |

| Purpose | Create opportunities for economic growth in Atlantic Canada by helping SMEs become more competitive, innovative and productive. Work with communities to develop and diversify local economies and champion the strengths of the region. |

Strategic investments in research and development (R&D) initiatives in the area of natural and applied sciences, as well as social sciences, humanities, and arts and culture. Projects are expected to result in the successful adaptation or development as well as the commercialization of technology-based products, processes or services. |

Support strategic initiatives that respond to the economic development needs of communities. The ICF focuses on investments that lead to long-term employment and economic capacity building in rural communities. |

In 2018, REGI was launched as a result of the Government of Canada’s Horizontal Business Innovation and Clean Technology Review. The program aims to strengthen RDAs’ focus on business scale up, export development, technology adoption and regional innovation ecosystems. Although beyond the scope of this evaluation, the introduction of REGI changed the Agency’s approach to supporting innovation and is included for context throughout this report. |

| Clients | Commercial and non-commercial (e.g., SMEs, crown corporations, provincial/municipal governments, post-secondary educational institutions, Indigenous organizations) | Commercial and non-commercial (e.g., SMEs, post-secondary educational institutions, industry associations, research institutions, crown corporations) | Non-commercial (e.g., municipal governments, industry associations, economic development organizations, local co-operatives, post-secondary educational institutions, Indigenous organizations) | |

| Type | Non-repayable, conditionally repayable and fully repayable contributions. | Non-repayable contributions | ||

Delivery approach

In addition to financial contributions, ACOA clients have access to non-financial supports throughout the project life-cycle. Program officers provide tailored advice and guidance, convene stakeholders and help with pathfinding and leveraging additional sources of funding from ACOA offices located in communities across all 4 Atlantic provinces.

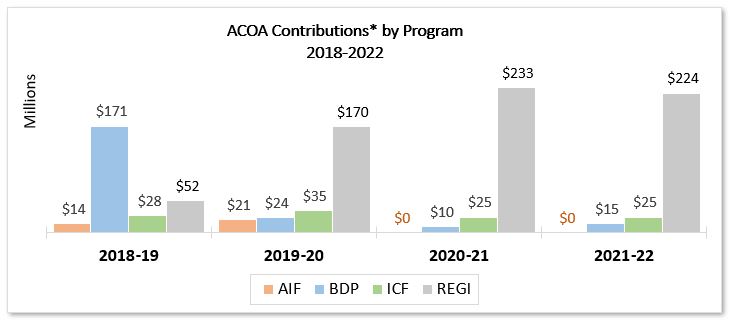

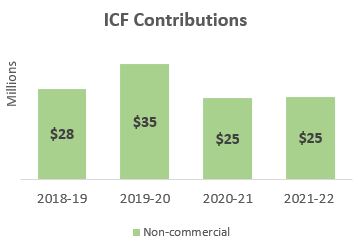

Since the introduction of REGI in 2018, overall BDP and AIF contributions have declined steeply, while ICF contributions have remained relatively stable. REGI now accounts for the largest proportion of funds and projects across ACOA’s suite of programming.Footnote 6

Long description

A bar chart of ACOA’s AIF, BDP, ICF and REGI contributions from 2018 to 2022 illustrates that the BDP was the top contributor in 2018-2019 with $171 million and then it drastically decreased over the evaluation period to $15 million in 2021-2022. REGI held the highest contributions after the first year of its launch ($170 million in 2019-2020, $233 million in 2020-2021 and $224 million in 2021-2022). There were no AIF contributions between 2020 and 2022. ICF contributions remained relatively stable through the evaluation period with $28 million in 2018 and $25 million in 2022. Note: The term “contributions” is used throughout the report and refers to ACOA’s approved project funding amounts.

| Totals: 2018 to 2022 | ||

|---|---|---|

| Number of projects | Contributions (millions) | |

| AIF | 10 | $35 |

| BDP | 1,129 | $220 |

| ICF | 412 | $113 |

| Total | 1,551 | $368 |

| Totals: 2018 to 2022 | ||

|---|---|---|

| Number of projects | Contributions (millions) | |

| REGI | 2,663 | $679 |

Key factors that impacted delivery over the 5-year period include the introduction of REGI as well as the economic impacts of the COVID-19 pandemic. Although not within scope of this evaluation, some clients who received funding from AIF, BDP or ICF during the period covered by the evaluation may have also received support through COVID-19 support programs delivered by the Agency.

The Atlantic Canadian economy 2018-2022

PopulationFootnote 7, Footnote 8, Footnote 9

The population of Atlantic Canada has grown in the last 5 years. This is largely due to an increase in net migration. More people are moving to the east coast from other parts of the country than leaving, and more people are migrating from other countries. While almost half of the population resides in rural areas, the urban population continues to grow at a faster pace.

EmploymentFootnote 10, Footnote 11, Footnote 12, Footnote 13

Even with the turbulence created by the COVID-19 pandemic, more people were employed in March 2022 compared to April 2018. The unemployment rate also dropped in all 4 Atlantic provinces during this period although rural areas continue to have the highest proportion of the labour force without a job. They also tend to have lower salaries compared to urban areas. Compared with 2018, more employers were seeking workers to fill job vacancies in the Atlantic region by the end of the period (2022).

InflationFootnote 14, Footnote 15, Footnote 16

The cost of goods and services has increased in Atlantic Canada since 2018, reaching record highs above the national average following the onset of the COVID-19 pandemic, which constrained consumer spending and impacted businesses and communities.

HousingFootnote 16, Footnote 17, Footnote 18, Footnote 19

The number of housing units in construction is up from 2018 in Atlantic Canada while vacancy rates have decreased in all provinces except PEI. Housing prices have also increased since 2018 due to inflation and overheated markets following the COVID-19 pandemic. The availability of rental units in rural areas remains low.

Trade and exportFootnote 20, Footnote 21

Despite the COVID-19 pandemic, wholesale trade and domestic exports are up from 2018 in all 4 Atlantic provinces.

Relevance

Summary of findings

Relevance questions are designed to assess the extent to which the programs are aligned with current needs and priorities, as well as their relative value compared with other available programs.

What we found:

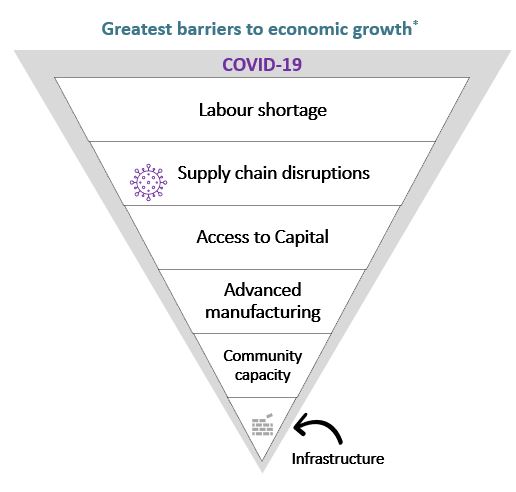

Compounded by the COVID-19 pandemic, the greatest barriers to economic growth are evolving rapidly and becoming increasingly complex and interconnected. There is an opportunity to clarify expected outcomes of programs and ensure Agency priorities and resources are aligned with current needs and barriers. There is also an opportunity to improve the availability of reliable data on the nature and impacts of funded projects.

Long Description

The diagram illustrates the greatest barriers to economic growth reported by ACOA clients, program officers, external stakeholders and recent literature.

The six barriers to economic growth are presented along with Covid-19 in an inverted pyramid shape, representing their relative impact on the economy and their interconnectedness with each other. The barriers are presented in descending order of impact:

1. Labour shortage

2. Supply chain disruptions

3. Access to capital

4. Advanced manufacturing

5. Community capacity

6. Infrastructure

*As reported by ACOA clients, program officers, external stakeholders and recent literature

With the bulk of innovation-focused projects now being funded through REGI, and no AIF contributions in the last 2 years of the study, AIF is no longer meeting a demonstrable need.

The ongoing relevance of BDP has become less apparent, especially with respect to commercial projects, with the large majority of contributions shifting to REGI. However, BDP’s flexibility remains a key strength of the program that allows the Agency to adapt to these rapidly evolving needs especially with respect to types of projects and contribution limits.

There continues to be a need for dedicated programming aimed at supporting community development. ICF remains relevant as it offers unique programming that responds to the specific needs of Atlantic Canadian communities related to infrastructure and capacity-building.

Labour shortage

Finding:

Difficulty recruiting and retaining labour remains the greatest barrier to economic growth in Atlantic Canada and is exacerbating many other barriers. Progress has been made; however, opportunities remain to clarify the Agency’s approach to supporting the workforce of the future.

The barrier:

Despite an increase in employment in the region in 2021, many sectors did not recover the jobs lost in 2020 due to the COVID-19 pandemic.Footnote 22 The problem also continues to be aggravated by the region’s ageing populationFootnote 23, low birth ratesFootnote 24, and high rural concentration.Footnote 25

Rural communities continue to face unique challenges: Rural communities have an even greater disadvantage as they traditionally have higher rates of unemployment, lower levels of education, lower wages, more seasonal industries and limited access to broadband internet.

Indigenous populations living in rural areas, also continue to face disproportionate barriers to employment.Footnote 26

Lack of affordable housing is having a negative impact on retention of workers, including immigrants.Footnote 27

One third (n=206) of clients indicated that a lack of affordable housing impacted growth, the large majority (75%) of whom were in communities with less than 30,000 people. ACOA program officers agree, ranking housing among the top 3 greatest barriers to growth.

How the programs respond:

Over the period of the evaluation, the Agency undertook several studies with the goal of developing a path forward for prioritizing and responding to the region’s skills and labour shortage. One study, which concluded shortly after the start of the COVID-19 pandemic, consisted of an extensive categorization and recoding of approved contributions over a 32-month period from 2017 to 2019. It found that 16% of Agency funding (32% of projects) had a skills and labour component, and the large majority of these projects focused on developing entrepreneurial skills. There is an opportunity to leverage these studies to help inform the Agency’s path forward for supporting the workforce of the future.

Opportunities exist to improve documentation and data:

The Agency does not currently have reliable mechanisms in place to track its contributions towards addressing Atlantic Canada’s labour shortage. As such, we are unable to assess the extent to which ACOA responded to this barrier over the period.

Immigration

Immigration plays an important role in supporting labour force growth, and ACOA continues to participate in the Atlantic Immigration Program. Overall Agency contributions to immigration-related projects decreased over the period, however. Historically funded through BDP, contributions have largely shifted to ICF and REGI, and by the final year of this study (2021-22), the Agency invested $2M in 8 projects related to immigration. In a survey, ACOA program officers suggest that newcomers' needs are being met to a lesser extent compared with other diverse groups.

Supply chain disruptions

Finding:

Disruptions to global supply chains, largely resulting from the COVID-19 pandemic, are having a significant impact on economic growth. There is an opportunity to develop a coordinated approach to supporting SMEs address barriers related to supply chain disruptions.

The barrier:

Global supply chains are facing the worst shortages in 50 years due to the pandemic and the war in Ukraine.Footnote 28 These challenges stem primarily from COVID-19 stay-at-home orders, worker shortages, transportation issues (e.g., increased freight prices due to significant growth in e-commerce sales) and increasing gas prices.Footnote 29

A review of recent literature suggests that smaller companies were impacted faster and harder than larger firms:

“SMEs generally have smaller inventories and supplier networks making them more vulnerable to supply chain disruptions and price increases. Similarly, they have less bargaining power to enforce attractive payment conditions.” OECD (2021) Footnote 30

ACOA clients and staff agree: Just over half (51%; n=495) of ACOA clients reported that supply chain issues are having an impact on growth, and ACOA program officers ranked supply chain issues among the top 3 greatest barriers to growth.

Impact of labour shortage: “The pandemic also highlighted the need for better data in the supply chain. The main barrier to more adoption of the required advanced analytics for supply-chain management is the talent required to implement the technologies.”Footnote 31

How the programs respond:

Opportunities exist to improve the availability or reliability of project data or program information:

- Given the relatively recent emergence of supply chain disruptions as a key barrier, data on Agency contributions are limited. There is an opportunity to ensure Agency priorities and resources are aligned with and addressing rapidly emerging barriers such as this.

- Improved reliability of data on the nature of funded projects would enable the Agency to demonstrate how it is responding to emerging barriers and the extent to which resources are allocated to addressing those issues that are limiting economic growth in Atlantic Canada.

Access to capital

Finding:

The cost of doing business is rising rapidly, making access to capital more important than ever. The majority of Agency contributions have shifted to REGI, with BDP and ICF now primarily supporting non-commercial projects related to tourism and regional priorities.

The barrier:

In response to rapidly increasing costs of inputs such as energy, materials, capital and fuel due to rising inflation and interest rates, SMEs need greater access to capital in order to remain competitive. ACOA clients were over-represented in some of the hardest hit sectors of the COVID-19 pandemic (e.g., tourism, manufacturing).Footnote 32

Nearly half of ACOA clients (46%; n=281) said that obtaining financing was a key challenge and this response was greatest among smaller, non-commercial firms, those in high-tech sectors and those located in small population centers (<30,000 people).

Input from internal and external key informants, as well as a review of available literature reveals a need for additional early-stage R&D funding in the ecosystem, especially smaller amounts (less than $1M) to support early collaborations and small-scale studies.

Labour shortage

Access to capital is also needed to help offset the relatively high cost of adoption of advanced manufacturing and digitalization, which helps mitigate the effects of the labour shortage.

In addition, increased wage pressures and competition (largely brought on by the move towards remote-work arising from COVID-19) are driving up the cost of labour, which makes it more difficult for Atlantic Canadian businesses to remain competitive.

How the programs respond:

AIF contributions decreased drastically, with no projects approved in the final 2 years of the period, and only 10 projects totaling just $35M in the first 2 years.

BDP contributions also decreased considerably over the period, mostly due to a drastic drop in commercial projects, with only 6 commercial projects funded by the final year of the study (2021-22). In fact, 92% of Agency commercial contributions were funded by REGI that year. The majority of BDP projects (66%) supported tourism and regional priorities. The average BDP project size was $195K and the majority of clients were not-for-profit organizations.

ICF contributions remained relatively stable over the period, and the majority of projects (78%) were also in support of tourism and regional priorities. All ICF projects were non-commercial, and the average size was $275K. The program supported mostly not-for-profit organizations or charities, Indigenous communities, educational institutions and other levels of government.

Long description

Line graph illustrating the trend of contributions made by ACOA through AIF, BDP and ICF from 2018 to 2022.

AIF contributions were approximately $14 million in 2018, climbed to $21 million in 2020 and dropped to zero in subsequent years.

BDP contributions were highest in 2018-2019, over $150 million, and then dropped sharply and remained flat for the subsequent years.

ICF contributions remained consistent over time, ranging between $25 and $35 million.

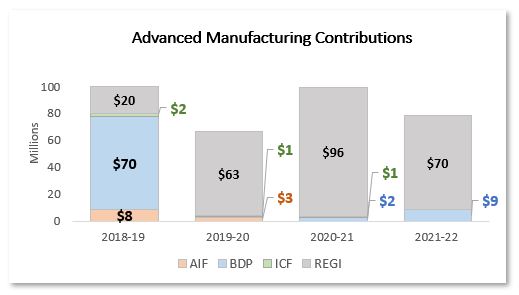

Advanced manufacturing

Finding:

Advanced manufacturing is a crucial ingredient for increasing productivity and competitiveness and is considered part of the solution to the labour shortage. High costs and a lack of skilled labour pose barriers to adoption, however. The Agency continues to prioritize and promote advanced manufacturing primarily through REGI.

The barrier:

Advanced manufacturing is the use of innovative technology to improve products or processes. It can improve productivity, however the high costs typically associated with adoption of new technology and processes can be a barrier for SMEs. The smaller nature of firms in Atlantic Canada also acts as a barrier to the adoption of new technologies.33 Atlantic Canadian companies (especially SMEs) lag other provinces in terms of digitalization, which hinders competitiveness, productivity and resiliency.Footnote 33, Footnote 34, Footnote 35 While the COVID-19 pandemic accelerated the adoption of online sales models, the move to virtual work models further compounded challenges related to labour.

Long description

Two arrows with text pointing toward each other, illustrating the relationship between labour shortage and advanced manufacturing

Adoption of advanced manufacturing is considered a necessary step in response to the labour shortage. The labour shortage in turn, hinders adoption of advanced manufacturing, as clients report challenges with recruiting and retaining skilled labour in the fields of digitalization and automation (e.g., IT, robotics).

“The difficulties many of our clients were facing in recruiting and retaining skilled labour to support the adoption of digitalization have only grown with the expansion of virtual work across the globe.”

- ACOA Program Officer

How the programs respond:

Over the period, the Agency invested in advanced manufacturing projects more than any other priority area, representing 22% of overall Agency contributions.

With the large majority of funding transitioning to REGI, overall Agency support for advanced manufacturing remained relatively stable.

Long description

The chart illustrates trends in ACOA’s contributions to projects in support of advanced manufacturing through AIF, BDP, ICF and REGI programs from 2018 to 2022. AIF contributions dropped from $8 million to $3 million in first two years, and dropped to zero in subsequent years. BDP dropped from a high of $70 million in 2018-2019 to just $9 million in the final year. ICF contributions were lowest throughout the evaluation period, averaging less than $2 million across all years. REGI contributions increased significantly over the period, and provided the majority of funding in comparison to other programs by the end of evaluation period.

Community capacity and infrastructure

Finding:

Communities face barriers related to their capacity to respond to opportunities and challenges and invest in infrastructure. ICF is generally aligned with these barriers, however there is an opportunity to increase support for capacity-building.

The barrier:

Each of the 4 provinces within Atlantic Canada varies widely in terms of key industries, strengths and challenges. Key informants pointed to the importance of supporting the capacity of communities through place-based approaches to economic development that are aligned with the unique opportunities and threats that exist in individual communities.

ACOA clients also pointed to the importance of funding for infrastructure in helping their community to be more attractive and productive, factors that contribute to recruiting and retaining labour. The need is greatest for not-for-profit organizations and municipal governments in small or rural communities with less than 30,000 people. Limited access to broadband internet also remains a challenge in remote locations.

COVID-19 impacts:

Clients reported particular barriers for the construction sector related to rapidly rising costs arising from the pandemic, and closely linked to supply chain disruptions. At the same time, the pandemic presents an opportunity to advance new place-based approaches to community development and entrepreneurship.Footnote 36 “Many rural communities are experiencing ‘newcomers’ who can be immigrants, former residents retiring or moving ‘home’, and migrants seeking experience of rural life. This cosmopolitanizing is bringing new diversity in expectations of and ideas about rural life.”Footnote 37

How the programs respond:

Over the period, ICF mainly supported projects related to tourism and regional priorities, which aim to address the unique needs and strengths of each region and support place-based economic development. The majority of ICF contributions (75%; $79M) were for projects related to infrastructure, and the remaining 25% ($27M) supported capacity building of communities. In 2021-22, an additional $37M of COVID community infrastructure recovery funding was also delivered through the Canada Community Revitalization Fund (CCRF).

A majority (60%; n=30) of surveyed ACOA program officers agreed that the outcomes of the ICF program are aligned with the needs of communities.

Opportunities exist to improve documentation and data:

We are unable to assess BDP’s contributions to building capacity of communities or improving community infrastructure due to a lack of reliable internal project data.

The Atlantic Innovation Fund

When AIF was launched over 2 decades ago, it represented a relatively new model for supporting innovation. Initially focused on large-scale non-commercial R&D projects, over time the program gradually evolved towards greater support for commercialization, and responsibility for R&D largely transitioned to other federal departments.

2001: AIF is launched

The Atlantic Innovation Fund was launched in 2001 as part of the Atlantic Innovation Partnership. The $300 million fund was originally a 5-year initiative, to be delivered via 2 large competitive rounds (approximately $150M per round).

AIF was originally created with the broad goal of helping close the Atlantic region’s innovation and productivity gap and to help institutions and firms compete in the knowledge economy. Through AIF, the Agency would invest in large-scale, cutting-edge R&D projects with amounts ranging from $500K to $3M.

The fund was initially focused on capacity building and earlier-stage R&D projects with academic and research institutions, with more than 70% of Round 1 funding awarded to non-commercial proponents. Subsequent rounds saw a greater balance between commercial and non-commercial projects and a transition from early-stage R&D towards commercialization.

2004: Evaluation #1

The first evaluation of AIF found that it was a good model and addressed an actual need. It recommended that the Agency monitor its niche within Atlantic Canada with respect to other programs to ensure that it continues to be relevant and to address an actual gap. It also recommended that ACOA look for ways to streamline the review and approval process to ensure it was moving at the speed of business.

2005: AIF is renewed

Budget 2005 renewed AIF for an additional $300M over 4 years. From 2006 to 2009, funding was awarded through 4 smaller rounds (approximately $60M per round).

2010: AIF becomes ongoing program; Evaluation #2

Budget 2010 announced that AIF would become an ongoing program. That same year, ACOA completed its second evaluation of AIF, which covered the first 4 rounds from 2001 to 2007.

While the evaluation findings were generally positive, it recommended the Agency expand its innovation strategy to increase its focus on commercialization and implement more streamlined application, approval and reporting processes.

The evaluation also noted that while there had been a significant increase in R&D investment by Atlantic Canadian firms over the period, spending on R&D in the region was still well below the national average.

2014: AIF is refocused

In 2014, the federal government’s Economic Action Plan confirmed $450M over 5 years for ACOA to support innovation and commercialization under its current suite of programs and suggested that ACOA’s innovation programs be refocused to better suit the needs of business of all sizes.

Also in 2014, changes were made to AIF following an internal review of ACOA’s innovation programming. In an effort to ensure a more “robust, streamlined and accessible approach”, the application process was changed from an annual competitive process to a continuous intake model. Also included was a shift toward greater commercial applicant uptake and a stronger emphasis on projects closer to commercialization (improving access for smaller-scale projects). The funding threshold was lowered from $1M to $500K for commercial projects, and there was an enhanced focus on improving competitiveness through technology adaptation.

2015: Evaluation #3

The following year, a third evaluation of the Agency’s innovation programming confirmed the program was shifting away from R&D capacity-building toward a greater emphasis on commercialization and observed that other federal programs appeared to be focusing more heavily on earlier-stage R&D.

2018: REGI is launched across RDAs

Following the national Horizontal Business Innovation and Clean Technology Review, Budget 2018 saw the creation of REGI, solidifying RDAs as one of 4 national flagship platforms for innovation*. REGI was designed to allow RDAs to move away from R&D towards commercial innovation that focuses on technology demonstration, adoption and adaptation, commercialization and market expansion as well as productivity and scale up. It would also allow RDAs to continue to focus on non-commercial innovation that supports the regional innovation ecosystem. It was also expected that the program would be used to fill gaps in earlier R&D stages on an as-needed basis to support regional clusters.

At the time, it was decided that AIF would be maintained in parallel to REGI to maximize benefits from national R&D programs and build on the momentum of rising business expenditures in R&D in the Atlantic region, which remain below national levels. It would keep its $40M yearly budget with no changes to application, assessment or approval processes.

* For more information on the platforms, see Appendix C.

2020: Evaluation #4

In 2020, an evaluation of ACOA’s Innovation programming recommended that the Agency examine AIF in relation to the current needs of SMEs and the priorities of the Government of Canada to confirm the strategic direction for the program. It went on to suggest that eliminating AIF would allow ACOA to streamline its suite of programming while at the same time doubling down on ongoing efforts, mainly via REGI, to support various type of business innovation (e.g., product, service, process, marketing), depending on firms’ unique strategies, markets and customers.

AIF current situation

Finding:

Given the program’s evolution towards commercial innovation over time, and with minimal investments since the introduction of REGI, AIF is no longer meeting a demonstrable need and is no longer aligned with federal government priorities.

Long description

The chart illustrates AIF contributions for commercial and non-commercial projects from 2001 to 2022. The AIF contributions were highest in the initial years (2002-2003) for both commercial and non-commercial projects after which they fluctuated but generally declined steeply. AIF contributions dropped significantly in 2015 when the program transitioned to a continuous intake model. The scope of the current evaluation (2018 – 2022) is depicted in the chart, with contributions dropping to zero in the final two years of the study. There were no AIF contributions after 2019 which coincides with the launch of REGI program.

And now, with only 10 projects totaling just $35M in the first 2 years of the period covered by the evaluation, and no projects approved in the final 2 years, AIF is no longer responding to needs related to innovation and commercialization.

Over the period of the evaluation, the average project size was $3.6M, and while the $35M was split fairly evenly between commercial and non-commercial projects, commercial projects were on average, much smaller in size ($2M) compared with non-commercial projects which averaged $6M. The majority (7 of 10) were related to R&D, and half of them contributed to Advanced Manufacturing.

Internal perspective on AIF:

When asked about the impacts of the lack of investments under AIF, many internal key informants suggested that the transition away from early-stage R&D towards commercialization, the need for programs to move at the speed of business and the inherent flexibilities afforded by REGI and BDP, effectively render AIF redundant. Furthermore, the impact of the absence of AIF in its current form would be negligible as it is no longer being used to fund projects.

The future of innovation programming

Originally announced as part of Budget 2022, on February 16, 2023, the federal government released a blueprint for the new Canada Innovation Corporation (CIC). The new agency is expected to begin operations in 2023 with a mandate “to increase Canadian business expenditure on R&D across all sectors and regions of Canada and help to generate new and improved products and processes that will support the productivity and growth of Canadian firms”.

CIC will operate with an initial budget of $2.6 billion over 4 years, and investments are expected to range from roughly $50K to $5M per project. The CIC will also have the flexibility to support a select number of larger-scale R&D projects, up to a maximum of $20M per project.Footnote 38 In comparison, AIF projects have typically ranged between $100K to $15M, with an average project amount of $2.6M since its launch in 2001.

Alignment with priorities

Finding:

The programs are generally aligned with Government of Canada priorities36 related to economic development; however, opportunities exist for greater alignment and clearer direction related to inclusive growth.

COVID-19 relief and recovery

Between April 2020 and March 2022, BDP and ICF contributed to the recovery and growth of key sectors (e.g., $34M in support of tourism and $11M for the food sector) and supported investments in advanced manufacturing ($6.4M). In addition to providing regular funding, the inherent flexibility of the programs also made them effective instruments through which to rapidly deliver targeted pandemic relief and recovering funding (e.g., CCRF).

Clean growth

In support of the federal government’s commitment to “reduce emissions, create clean jobs and address the climate-related challenges communities are already facing”Footnote 39, the programs collectively contributed $23M to projects in support of clean growth over the period of the evaluation.

Oceans

Oceans have long been a strategic sector for ACOA and is currently one of the Agency’s key priority files. Over the period of the evaluation, a combined $13M was invested through AIF, BDP and ICF in projects that support the ocean economy and contribute to the Government of Canada’s Ocean Supercluster and Blue Economy Strategy.

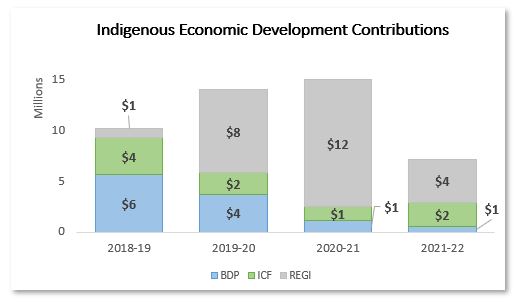

Indigenous economic development

Overall support for Indigenous Economic Development remained relatively stable over the period, however much of the funding shifted to REGI. The proportion of funds allocated to projects with a key focus on Indigenous economic development increased from 2% to 6% of overall Agency funding. This is proportional to the percentage of Indigenous people living in Atlantic Canada, which accounts for 5.7% of overall population according to the 2021 census.Footnote 40

Long description

The chart illustrates contributions in support of indigenous economic development projects through BDP, ICF and REGI programs. In the first year (2018-2019), BDP was the top contributor, with $6 million, followed by ICF ($4 million) and then REGI ($1 million). The proportion of contributions funded through REGI increased over time, and by the end of the period (2022) the majority of projects were funded by REGI ($4 million) followed by ICF ($2 million) and BDP ($1 million).

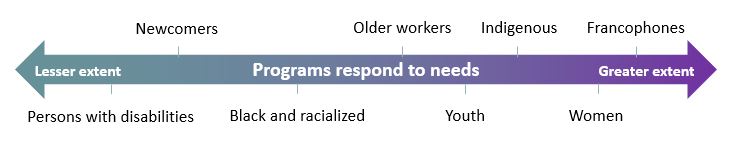

Inclusive growth

Opportunities exist to improve documentation and data:

Inclusion remains a top priority for ACOA, and the Agency continues to take positive steps towards integrating Inclusive Growth into its programs and practices. Opportunities remain, however, to create a more comprehensive and proactive strategy, and to better define, track and report on outcomes related to under-represented groups. With the exception of Indigenous Economic Development which has been identified as a key priority file, the Agency currently collects limited data on its contributions in support of diverse groups.

Clients report minimal representation of diverse groups

Fewer than 10% of ACOA clients indicated that their company or organization was either led by or employed members of under-represented groups (i.e., Francophones, Indigenous, persons with disabilities, newcomers, black, 2SLGBTQI+). Clients reported that women, older workers and youth were only slightly more likely to be leading or employed by their companies or organizations.

ACOA program officer perspectives:

When asked about the extent to which the programs respond to the diverse needs of under-represented groups, ACOA program officers indicated that the needs of Francophone communities and women are being met to a greater extent compared with other groups. Furthermore, nearly a third (32%) indicated that they don’t have the information and resources they need to effectively support to these diverse groups.

Long description

A two-way horizontal arrow illustrates the extent to which ACOA programs are responsive to the needs of diverse groups. The right-pointing arrow indicates ACOA programs are more responsive to francophones, women, Indigenous peoples and youth. The left-pointing arrow indicates ACOA programs are less responsive to the needs of newcomers, persons with disabilities, Black and racialized people, and older workers.

Complementarity

Finding:

The programs generally complement other available economic development supports in Atlantic Canada. A strong regional presence, flexible funding mechanisms and non-financial supports continue to set the programming apart. Strong collaboration with ecosystem stakeholders helps to mitigate any areas of overlap or duplication. Internally, some overlap exists with REGI.

Internally, the large majority of ACOA program officers (86%; n=36) agree that overlap exists between the programs, and based on a review of program expected resultsFootnote 5, there appears to be overlap between BDP, AIF and REGI in terms of capacity for innovation and commercialization and between REGI and AIF in terms of support for the innovation ecosystem. Areas of overlap also exist between BDP and ICF in supporting communities’ capacity to identify and respond to economic opportunities and challenges, and availability of capital, business information and counselling.

Externally, BDP and ICF are set apart from other available federal economic development programs* in the region through:

- a focus on Atlantic Canada including rural and community projects led by not-for-profit organizations, post-secondary educational institutions as well as governmental entities

- interest-free, non-dilutive funding with both repayable and non-repayable options

- non-financial supports such as strategic advice, pathfinding and convening delivered by program delivery staff located in the communities they serve

Note: See Appendix B for environmental scan of similar federal programs.

Long description

A honeycomb diagram depicts the overlap between REGI, AIF, BDP and ICF with the following eight areas of expected results:

- Ecosystem supports

- R&D

- Productivity & Growth of SMEs

- Innovation and Commercialization

- Export Capacity & Foreign Direct Investment

- Policy

- Community Capacity

- Business Development Needs

BDP, AIF and REGI overlap with each other in their support for innovation and commercialization. REGI and AIF overlap in their support for innovation ecosystem. BDP and ICF overlap in their support for community capacity.

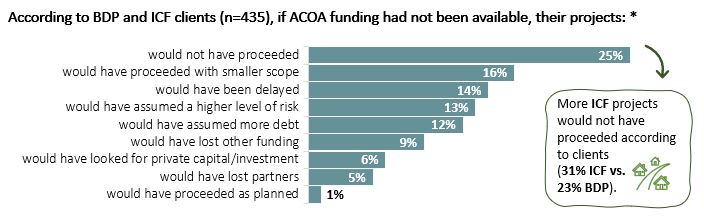

Absence of programs

Finding:

There would be major negative impacts on the economic growth of communities in the absence of ICF. The relevance of BDP is less clear in the context of REGI, however its flexibility is considered a key strength.

Long description

The graph illustrates clients’ ratings* of the following possible outcomes of BDP and ICF projects if ACOA funding had not been available:

- 25% would not have proceeded

- 16% would have proceeded with smaller scope

- 14% would have been delayed

- 13% would have assumed a higher risk

- 12% would have assumed more debt

- 9% would have lost other funding

- 6% would have looked for private capital/investment

- 5% would have lost partners

- 1% would have proceeded as planned

According to clients, more ICF projects (31%) than BDP (23%) would not have proceeded without ACOA funding.

* Percentages represent the proportion of the total number of responses (n=1,006). Respondents could select multiple options.

ACOA program officers agree: According to a large majority of BDP (83%) and ICF (90%) program officers it is unlikely that community outcomes would have been achieved without ACOA support.

According to clients, beyond ACOA’s support, other factors that contributed to the success of projects funded under the ICF and BDP programs included financial and non-financial support from other partners as well as experience and qualifications of project leaders, staff and volunteers.

Given the distinctive, targeted supports offered through ICF that aim to address the specific circumstances of rural, IndigenousFootnote 41 and Official Language Minority Communities, these communities would be further disadvantaged in its absence.

Although opinions are split on what impact the absence of BDP would have on achievement of Agency outcomes, internal key informants highlighted the program’s flexibility as being necessary in supporting projects that would otherwise not be possible under other programs.

Effectiveness

Summary of findings

Effectiveness questions are designed to assess the extent to which the programs are contributing to the achievement of expected results.

BDP contributes to the achievement of the Agency’s broad economic development outcomes and is an effective mechanism for providing regionally relevant programming that is responsive to the evolving needs and barriers that exist in the region.

ICF continues to contribute to the long-term sustainability and communities through dedicated programming primarily focused on infrastructure.

Non-financial supports provided by ACOA program officers are key to the success of SMEs and communities, and assist with leveraging additional funds.

Opportunities exist to improve documentation and data.

The following factors limit our ability to determine the extent to which the programs are achieving outcomes:

- Outdated definitions of expected results in program governance documentation (i.e., terms and conditions)

- Lack of reliable data on the nature of projects funded and results achieved

Business Development Program

Finding:

BDP contributes to the achievement of the Agency’s broad economic development outcomes and is an effective mechanism for providing regionally relevant programming that is responsive to the evolving needs and barriers that exist in the region. There is, however, an opportunity to clarify expected results and the availability of data related to outcomes of funded projects.

Project outcomes:

BDP clients (n=418) reported that their projects contributed most often to:

- Recruiting or retaining employees

- Growth or scale-up

- Strengthened innovation or commercialization capacity

- Increased sales or revenue

Opportunities exist to improve documentation and data:

By the end of the evaluation period, however, only 6 commercial projects totaling $9.4M were funded under BDP, (and one of the 6 was for $8M). This, along with outdated program governance documentation and a lack of reliable data on project outcomes limits our ability to fully assess the effectiveness of the program.

Community outcomes:

When asked about how their projects impacted broader community outcomes, BDP clients (n=418) pointed most often to:

- Increased business revenue or activity

- Improvements to infrastructure

- Economic sustainability of rural communities

- Attraction or retention of employees

As previously noted, economic needs and barriers are evolving rapidly, and becoming increasingly inter-connected. Internal key informants highlighted BDP’s flexibilities as being a key strength in allowing the Agency to effectively respond to the region’s unique economic challenges. The inherent flexibilities afforded by the program allows a focus on regional priorities and supports a place-based approach to economic development.

BDP also proved to be an effective vehicle for rapidly delivering regional response and recovery funds (e.g., COVID-19 and more recently Hurricane Fiona).

Long description

The stacked bar graph illustrates BDP contributions to commercial and non-commercial projects from 2018-2019 to 2021-2022. It shows a significant decrease in both commercial and non-commercial contributions after the first year, from a total contribution of $171 million in 2018-2019 to $14 million in 2021-2022.

Innovative Communities Fund

Finding:

ICF continues to contribute to the long-term sustainability of communities through dedicated programming primarily focused on infrastructure. There is an opportunity to ensure that investments are aligned with activities that drive growth at the local level.

Project outcomes:

ICF clients (n=194) reported that their projects, which were all non-commercial in nature, contributed most often to outcomes related to:

- Growth or scale-up

- Marketing activities

- Recruiting or retaining employees

- Growth strategies or plans

Community outcomes:

When asked specifically how their projects impacted broader community outcomes, ICF clients pointed to:

- Increased tourism

- Infrastructure

- Long-term sustainability of rural communities

- Capacity to identify and address challenges and opportunities

Top 3 tourism outcomes:

- Increased satisfaction of visitors

- New tourist attractions/offerings

- Increased visitation from new locations

Opportunity for increased focus on capacity-building

ICF contributions remained fairly stable over the period, and the majority of projects were related to tourism and regional priorities that support place-based economic development priorities. Investments supported infrastructure (75%) and community capacity building (25%). Use of ICF for community capacity-building is inconsistent across the 4 provinces however, with one region accounting for over half (52%) of all contributions.

Internal key informants reported that while the focus of ICF has traditionally been on infrastructure investments, community development needs are evolving towards a greater emphasis on capacity-building activities that will help drive population growth (e.g., immigration, settlement, planning, housing, industrial development).

There is an opportunity for further study of these drivers to ensure resources are aligned with activities that drive growth in communities.

ICF capacity-building projects focused primarily on:

- Strategic planning

- Skills development

- Events

- Marketing

- Operational support

Long descriptions

The bar graph illustrates ICF contributions to non-commercial projects between 2018-2022. The amount of contributions remained fairly stable over the five-year period, ranging from $28 million in 2018-2019 to $25 million in 2021-2022.

Value of non-financial assistance

Finding:

Non-financial supports provided by ACOA program officers are important to the success of SMEs and communities, and assist with leveraging additional funds. Accurately accounting for these non-financial contributions remains a challenge, however.

ACOA officers spend half their time providing non-financial support

ACOA program officers (n=43) estimate that they spend, on average 50% of their time providing advice and guidance, convening partners and pathfinding additional sources of funding. When asked how this has changed over the past 5 years, 44% indicated they are spending more or a lot more time providing these types of supports, however there is currently no mechanism to accurately capture or measure these efforts.

While some program officers pointed out that this type of work can be time consuming and challenging, many indicated that these non-financial supports are a valuable and essential part of their role and help to maximize benefits from national programs by providing information and making connections. Key informants also pointed to the value of having local program officers who know the economic landscape and the benefits of a ‘warm handoff’ for clients attempting to access other federal programs.

A recent study of rural communities in Atlantic Canada confirms that “communities need the support of local development officers who know local settings and small places and are linked into resources, industry opportunities, new initiatives and can coordinate.Footnote 37

“The time is critical for maintaining supportive client relationship and in helping client efforts to align in a greater community context.”

- ACOA program officer

Clients report high degree of satisfaction (A+)

When asked about their degree of satisfaction with any non-financial supports they received, the overwhelming majority of ACOA clients (95%; n=415) indicated that they were satisfied with the business knowledge, advice or other expertise, and 93% indicated that they were satisfied with the suggestions or referrals for other sources of funding or services.

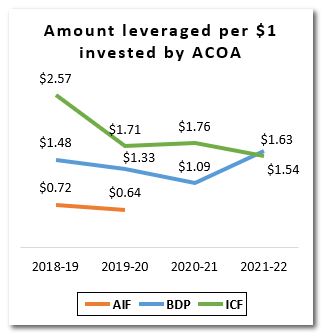

Leveraging has remained relatively stable

Over the period, each dollar invested across all 3 programs leveraged an additional $1.51 from other sources, on average. Leveraging decreased considerably for ICF and remained relatively unchanged for BDP.

Long description

The line graph illustrates amount leveraged per $1 invested by ACOA from 2018-2019 to 2021-2022 for three programs: AIF, BDP and ICF.

- AIF leveraged $0.72 in 2018-2019, which decreased to $0.64 in 2019-2020.

- BDP leveraged $1.48 in 2018-2019, which decreased to $1.33 in 2019-2020 and then $1.09 in 2020-2021, but increased again to $1.63 in 2021-2022.

- ICF leveraged a high of $2.57 in 2018-2019 and reached a low of $1.54 by 2021-2022.

Efficiency

Summary of findings

Efficiency questions are designed to assesses the extent to which programs are being delivered in an economical manner.

Client satisfaction with service features remains high; however, complicated application and claims processes and long waits for approvals continue to negatively impact clients.

The introduction of REGI and delivery of COVID-19 relief and recovery programs had an impact on the efficient delivery of pre-existing programs. Lack of clear guidance and direction has led to some confusion and inconsistent application across the Agency, especially with respect to tourism projects.

Client satisfaction

Finding:

Client satisfaction with ACOA’s service features remains extremely high, however long delays for application approvals and complicated processes continue to negatively impact clients.

Clients remain extremely satisfied with personal service

Consistent with previous evaluations, overall client satisfaction is once again highest (>95%) for services provided by ACOA’s program staff, including their courteousness and professionalism, ongoing business relationship, availability, and sensitivity with regards to the needs of under-represented groups.

Approval times have improved somewhat

While clients once again expressed concerns with the time it takes for their projects to be approved, overall satisfaction is very high (91%), and has increased from 82% in 2020.Footnote 42

Opportunities remain to modernize processes

Client satisfaction with ease of application process and paperwork has also increased slightly from 83% in 2020Footnote 42 to 86% in current evaluation.

Client perspectives

“ACOA personnel are ever so helpful. I have worked with 3 or 4 different people across the years. Their professionalism has been outstanding.”

“The length of time it takes to get a project approved is problematic for small communities trying to secure other funding to do a major project. Amendments take just as long (4 months) and can impact timelines for completing work.”

ACOA program officer perspectives

“Many of our processes for reporting are complicated and arduous for our clients. Our forms are not client centric, making them difficult for clients to understand.”

“I could connect with more clients, more often, if I wasn't bogged down in our processes.”

Some ACOA program officers mentioned that long delays for application approval is a barrier to efficient service delivery.

Impact of REGI

Finding:

The introduction of REGI has had a major impact on BDP, with the majority of commercial funding transitioning to the new program. Tourism projects now account for a considerable proportion of BDP and ICF contributions, and there is an opportunity to further clarify direction on program selection, especially in terms of defining innovation.

Overall, 39% of ACOA program officers indicated that there is a lack of clear and consistent direction on which program should be used to fund which types of projects. The majority of whom were officers who had been in their current role for more than 10 years. The greatest area of uncertainty exists between BDP and REGI, and the large majority of ACOA program officers (82%) reported that REGI had little to no impact on their use of ICF.

Wide variation exists among regions in use of programs for tourism-related projects

A review of project data reveals wide variations among the Agency’s 4 regions in terms of which programs are used to fund tourism projects. The variations are even more pronounced for non-commercial tourism projects with some regions primarily using ICF, and others split more equally between BDP, ICF and REGI; still others use almost no REGI for non-commercial tourism projects. What is consistent across all regions, however, is a marked downward trend in the use of BDP for non-commercial tourism projects.

When asked which program they use most for tourism projects, nearly half of ACOA program officers reported using REGI (49%), 38% said ICF and only 14% reported using BDP. This varies greatly by region, however. The factors cited most often by program officers in making decisions about which program to use for tourism projects was whether the project was commercial or non-commercial, and level of innovation involved. Internal key informants’ definition of what constitutes “innovation” varies greatly across regions, however.

Internal key informants also reiterated the beneficial nature of the flexibilities afforded by BDP and ICF, as they allow regions to take a place-based approach to tourism development. Furthermore, program flexibility and adaptability is a key component in the Agency’s ability to address the evolving needs of clients.

Nearly $10M of COVID-19 tourism recovery support was delivered through BDP in 2021-22. The large majority of which (80%) supported commercial tourism projects.

Long description

The stacked bar graph illustrates tourism contributions made by REGI, the ICF and the BDP from 2018-19 to 2021-22.

- In 2018-2019, the BDP was the top contributor for tourism projects with $20 million, followed by the ICF with $13 million and REGI with $2 million.

- In 2019-2020, the ICF was the top contributor with $21 million, followed by REGI with $11 million and the BDP with $8 million.

- In 2020-2021, REGI was the top contributor with $13 million, followed by the ICF with $12 million and the BDP with $3 million.

- In 2021-2022, REGI was the top contributor with $26 million, followed by thhe ICF $17 million and the BDP with $2 million.

Recommendations

- Ensure the continued alignment of key Agency priorities and resources with current drivers of economic growth and the barriers that constrain it:

- Building upon work done pre-pandemic, clarify the Agency’s path forward for addressing the skills and labour shortage

- Streamline the Agency’s suite of programming and reduce redundancies by eliminating AIF

- Develop and implement a comprehensive, proactive path forward for the Agency’s approach to inclusive growth

- Develop a coordinated approach to supporting SMEs address barriers related to supply chain disruptions

- Implement an integrated change agenda that supports excellence in program delivery and accurate tracking and reporting of investments:

- Ensure availability of high-quality data related to the nature of projects and their impacts

- Ensure reliable data is available on the characteristics of the Agency’s clients in terms of representation of diverse groups

- Remove barriers and streamline processes to help program delivery staff continue to provide excellent service to clients and do their jobs more efficiently

- Increase support for crucial role staff play in convening, pathfinding and coordinating ecosystem partners and advocating for needs of businesses and communities

- Update internal program governance documentation and clarify expected results and eligible activities of each program

- 20+ internal documents, including program Terms and Conditions, policy reports and performance measurement information

- 70+ external documents, including academic literature and Statistics Canada reports

- Speeches from the Throne, federal budgets, mandate letters

- ACOA project performance data (QAccess)

- ACOA financial expenditure data (GX)

- Clients: Online delivery with a response rate of 58% (n= 418 BDP; 194 ICF)

- Administered to all clients who received funding from BDP and ICF programs.

- ACOA Program Officers: Online delivery with a response rate of 55% (n=63/114).

- 37 internal key informants as well as external stakeholders from other government departments and not-for-profit organizations

- This evaluation offers several strengths that helped mitigate common limitations. It was designed and implemented by an experienced evaluation team that focused efforts on questions of most importance to senior management. The study used a mixed-methods approach to identify useful findings and recommendations while meeting Treasury Board Secretariat timelines and requirements. There was high stakeholder engagement throughout the project. The online surveys had high response rates of above 50%.

- The evaluation considered Gender-based analysis Plus43 in its design and implementation of data collection methods and synthesis of findings.

- The RDAs using a new horizontal innovation program, REGI, would support firms in their efforts to scale-up and grow their businesses in all markets

- The National Research Council-Industrial Research Assistance Program (NRC-IRAP) would provide technical and scientific support during the early R&D phases and will broaden its support for R&D to higher value projects with funding of up to $10M, including the ability to support commercialization elements of large R&D projects

- ͏͏͏͏͏͏Trade Commissioner Service would provide firms with advice, connections, and funding to take advantage of new export/market development opportunities

- ͏͏Innovation, Science and Economic Development’s (ISED) Strategic Innovation Fund (SIF) would maintain its broad eligibility and will focus on larger-scale projects needing support in excess of $10M

- Performing a comparison of similar projects in REGI

- Exploring options to eliminate AIF

- Update program guidance in the Programs Policies and Guidelines Manual to provide clear instruction.

- Organize information sessions/training to staff responsible for data entry to improve input accuracy.

- Leverage future technology advancements to better capture data related to underrepresented groups and projects.

- AAFC

- Agriculture and Agri-Food Canada

- ACOA

- Atlantic Canada Opportunities Agency

- AIF

- Atlantic Innovation Fund

- BDC

- Business Development Bank of Canada

- BDP

- Business Development Program

- COVID-19

- Coronavirus Disease of 2019

- DFO

- Fisheries and Oceans Canada

- EDC

- Export Development Canada

- GAC

- Global Affairs Canada

- ICF

- Innovative Communities Fund

- ISED

- Innovation, Science and Economic Development

- INFC

- Infrastructure Canada

- NRC

- National Research Council

- NRC-IRAP

- National Research Council - Industrial Research Assistance Program

- R&D

- Research and Development

- RDA

- Regional development agency

- REGI

- Regional Growth through Innovation

- SIF

- Strategic Innovation Fund

- SME

- Small and medium-sized enterprise

| Evaluation of ACOA’s Economic Development Programs (BDP, ICF, AIF 2018-19 to 2021-22) MANAGEMENT ACTION PLAN |

|||

|---|---|---|---|

| RECOMMENDATION | RESPONSIBILITY | Management Response and Planned Actions | DUE DATE |

| 1. Ensure the continued alignment of key Agency priorities and resources with current drivers of economic growth and the barriers that constrain it: | |||

| a) Building upon work done pre-pandemic, clarify the Agency’s path forward for addressing the skills and labour shortage | DG of Programs, Head Office | Launch an internal workforce of the future Community of Practice to identify and develop strategic opportunities to build, attract and retain a skilled, diversified, and inclusive workforce that meets current and future local labour market needs. | 2024/03/31 |

| Develop focused programming (such as Strategic Growth Initiative (SGI)) to better support businesses in skills and labour shortage. | 2024/03/31 | ||

| Deliver the Digital Acceleration Pilot (DAP) to help SMEs digitize and automate, therefore help addressing the labor shortage for companies. | 2023/12/31 | ||

| b) Streamline the Agency’s suite of programming and reduce redundancies by eliminating AIF | DG of Programs, Head Office | Streamline programming with REGI as the main tool to support AIF-like projects by: |

2025/03/31 |

| c) Develop and implement a comprehensive, proactive path forward for the Agency’s approach to inclusive growth | DG of Programs, Head Office | Work with non-commercial clients and partners to increase access to and improve services for underrepresented groups. | 2024/12/31 |

| Establish a collaborative approach to develop strategies and activities targeted at underrepresented groups. That would include engaging key stakeholders to understand the current landscape and to identify gaps in the ecosystem (i.e., Skilled Workforce and Immigration approach, the Indigenous Economic Development, and Indigenous guidelines). | 2024/03/31 | ||

| d) Develop an approach to addressing supply chain disruptions | DG of Programs, Head Office | Work with sector associations (e.g., regional bio alliances, fish farmers associations, ocean technology industry associations) to build awareness and knowledge about changes and requirements in global markets linked to decarbonization and green trade to support increased exports for Atlantic SMEs and how to prepare and adapt in the supply chain and remain competitive. Some examples are: targeted missions in renewable energy such as International Partnering Forum for offshore wind (March 2023, Baltimore, MD USA), special workshops and sessions on Green Standards in trade and investment such as ESG (May 2023), establishing and inventory of clean tech companies in Atlantic Canada (September 2023), working with ATIGS partners on developing a clean technology cohort of Atlantic Canadian companies to leverage the Canadian Technology Accelerator (CTA, Global Affairs) (March 2024). | 2024/09/30 |

| Include international supply chain optimization for Atlantic Canadian companies as an objective in Programs planning. | 2024/03/31 | ||

| 2. Implement an integrated change agenda that supports excellence in program delivery and accurate tracking and reporting of investments: | |||

| a) Ensure availability of high-quality data related to the nature of projects and their impacts on the Atlantic Canadian economy | DG of Programs, Head Office | Adapt information and data systems to better capture nature of projects and how we deliver on priorities. | 2025/03/31 |

| Improve identification of expected outcomes and documentation of actual results for projects in CAPRI to better reflect the real impacts on the Atlantic Canadian economy. | 2024/03/31 | ||

| b) Ensure reliable data is available on the profile of the Agency’s client base in terms of representation of diverse groups | DG of Programs, Head Office | Undertake specific actions to improve the quality and reliability of the data collected: | |

| 2024/03/31 | |||

| 2025/03/31 | |||

| 2025/03/31 | |||

| c) Remove barriers and streamline processes to help program delivery staff continue to provide excellent service to clients and do their jobs more efficiently | DG of Programs, Head Office | Implement an integrated program delivery change and modernization approach that will improve client service while increasing flexibility and efficiency. | 2024/03/31 |

| d) Increase support for crucial role program delivery staff play in convening, pathfinding and coordinating ecosystem partners and advocating for needs of businesses and communities | DG of Programs, Head Office | Build internal capacity, knowledge and tools on priorities. | 2024/03/31 |

| Improve support and increase collaboration with front line staff such as Business Information Services as they are renewing their mandate. | 2024/12/31 | ||

| Provide support and training to enhance digital literacy to staff to better serve communities and businesses. | 2024/12/31 | ||

| e) Update internal program governance documentation to clarify expected results and eligible activities of each program | DG of Programs, Head Office | Improve clarity in the Programs Policies and Guidelines Manual on expected results | 2024/03/31 |

| Align eligible activities in the Programs Policies and Guidelines Manual for each program in accordance with the terms and conditions. | 2024/03/31 | ||

Appendix A: Methodology

Document and literature review

Validate economic development needs, alignment with government priorities and broad outcomes.

Internal administrative data review

Document program design, implementation, nature of projects, client types and performance.

Client and staff surveys

Assess relevance and performance from the perspective of ACOA clients and staff.

Key informant interviews

Assess relevance and performance from the perspective of various stakeholders.

Evaluation strengths and limitations:

Appendix B: Environmental Scan

| Organization | Program | Funding | Client Type | Focus Area | |||||

|---|---|---|---|---|---|---|---|---|---|

| Non-repayable | Repayable | $* | SMEs | NFPs | Education | Government | |||

| ACOA | AIF | Yes | Yes | $$ | Yes | Yes | Yes | Innovation, R&D | |

| BDP | Yes | Yes | $$ | Yes | Yes | Yes | Yes | Launch/Modernize/Grow Business | |

| ICF | Yes | $$ | Yes | Yes | Yes | Community development | |||

| REGI | Yes | Yes | $$ | Yes | Yes | Yes | Yes | Business Scale-up, Innovation | |

| ISED | Sustainable Development Technology Fund | Yes | $ | Yes | Green Tech | ||||

| Strategic Innovation Fund | Yes | Yes | $$$$$ | Yes | Yes | R&D Ecosystem | |||

| Boost your Business Technology (Canada Digital Adoption Program) |

Yes | $ | Yes | Digital Tech | |||||

| Challenge Stream (Innovative Solutions Canada) |

Yes | $ | Yes | R&D, Prototype | |||||

| NRC | Industrial Research Assistance Program | Yes | $$$ | Yes | Yes | Yes | R&D, Tech Adoption/Adaptation | ||

| BDC | Small Business Loan | Yes | $ | Yes | Retail, Real Estate | ||||

| EDC | Investment Matching Program | Yes | $ | Yes | Trade | ||||

| DFO | Atlantic Fisheries Fund | Yes | $ | Yes | Yes | Yes | Yes | Fish and Seafood | |

| GAC | CanExport | Yes | $ | Yes | Yes | Trade | |||

| INFC | Green and Inclusive Community Buildings | Yes | $$$$$ | Yes | Yes | Infrastructure | |||

| AAFC | Agri-Marketing Program | Yes | $$$ | Yes | Trade | ||||

* Amounts converted to ranges for display purposes. Variations may not be completely reflected. $= ≤5M $$ = ≤10M (≤20M) $$$$$= ≥10M

Appendix C: 2018 Innovation Review: National Innovation Platforms

In 2018, the national Regional Growth through Innovation program was created following the Government of Canada’s Horizontal Business Innovation and Clean Technology Review and 4 national innovation platforms were identified:

Appendix D: Acronyms

2SLGBTQI+ – Two spirited (and bispirited), lesbian, gay, bisexual, transgender, queer and intersex persons and well as people who are part of the sexual diversity community

Appendix E: Methodology

Relevance

Relevance questions are designed to assess the extent to which the programs are aligned with current needs and priorities, as well as their relative value compared with other available programs.

| Questions | Methods | ||||