Finances

On This Page:

Financial status is widely recognized as a key factor in well-being. Sufficient and stable finances are associated with greater independence, health, access to health services,

quality of housing, family stability, and greater control and choice in managing life challenges in general. Essentially, greater financial security can enable you to enjoy life more fully.

Transitioning to civilian life, CAF members experience changes in sources of income and can have temporary or long-term reduction in income levels. You may face many challenges in this domain, such as finding steady and sufficient employment income or requiring extra funds for relocations, housing, vehicles, health care expenses and costs of living in a new community. These challenges may be more significant if living expenses like housing and leisure activities were subsidized during service.

All members should develop a budget based on their current financial obligations (for example living expenses and indebtedness). Post-transition expenses should also be considered to determine if the expected income will adequately address anticipated financial obligations (such as housing, medical, food, insurance, transportation, costs of establishing a home, utility security deposits, etc.).

The most important aspect of this domain of well-being is to be financially secure.

Some things to consider:

- Do you have a good understanding of your current financial situation?

- Do you have a financial plan for the future?

- Do you understand the differences in benefits based on retiring or joining the reserves and what will be available in either case?

Note: Release related benefits cannot be paid out until after the release date – therefore members need to plan for financial security to cover at least 30-45 days from the release date. Completing all benefit administration before the release date will ensure that you receive your payments in a timely manner.

- Are you confident that you can secure civilian employment that will provide for the same quality of life that you now enjoy in the CAF (considering salary, benefits, and support services)?

- Do you understand that your living costs will increase once you leave the military and how that will impact your plans and decisions related to housing, retirement savings and health care?

- Did you investigate the cost of living in the locations that you would consider moving to in your transition?

- Did you investigate how your tax payments might change after military life (federal, provincial, municipal)?

- Did you develop a realistic budget (income and expenses) or financial plans that demonstrates that you will be able to maintain a good civilian quality of life?

- Did you take steps to ensure timely payment of your CAF pension?

- Did you receive or develop a pension estimate?

- Are you aware of and have you made arrangements for all relevant release benefits?

Assessing and Planning Your Financial Situation

Your financial situation is a key factor in determining how you will plan your transition to civilian life. We encourage you to plan ahead with your SISIP Planning and Investment services offered by CAF, financial advisor or banks. These could influence where you wish to live, and the lifestyle you can afford, among other decisions. Assessing the state of your finances after release requires, you and your spouse/partner to conduct an in-depth evaluation of all benefits, savings, sources of revenues, and expenses. In initiating such an exercise, answering the following questions is an important part of the financial assessment and planning process:

- Do I qualify for a pension plan? For additional information related to pension plans as an active member, visit the Veterans Emergency Funds webpage.

- If yes, how much would I receive on a monthly basis?

- Do I qualify for income replacement under CAF LTD?

- If yes, how much would be my monthly allotment?

- Am I entitled to a VAC benefit?

- If yes, how much would be my monthly allotment?

- How much can I expect in the way of benefits on release?

- How can I invest my return of contributions (if applicable)?

- What is my partner/spouse’s monthly income of (if applicable)?

- How much savings do I/we have?

- How much income do I/we have to generate to have the quality of life we wish to enjoy after release?

- Is my/our will updated?

- Would I/one of us need to secure employment after release to enjoy a comfortable lifestyle?

Having sound money management skills can help reduce stress and uncertainty. This is especially true during the transition period. The forms below have been created to help families estimate their overall income and expenses after release:

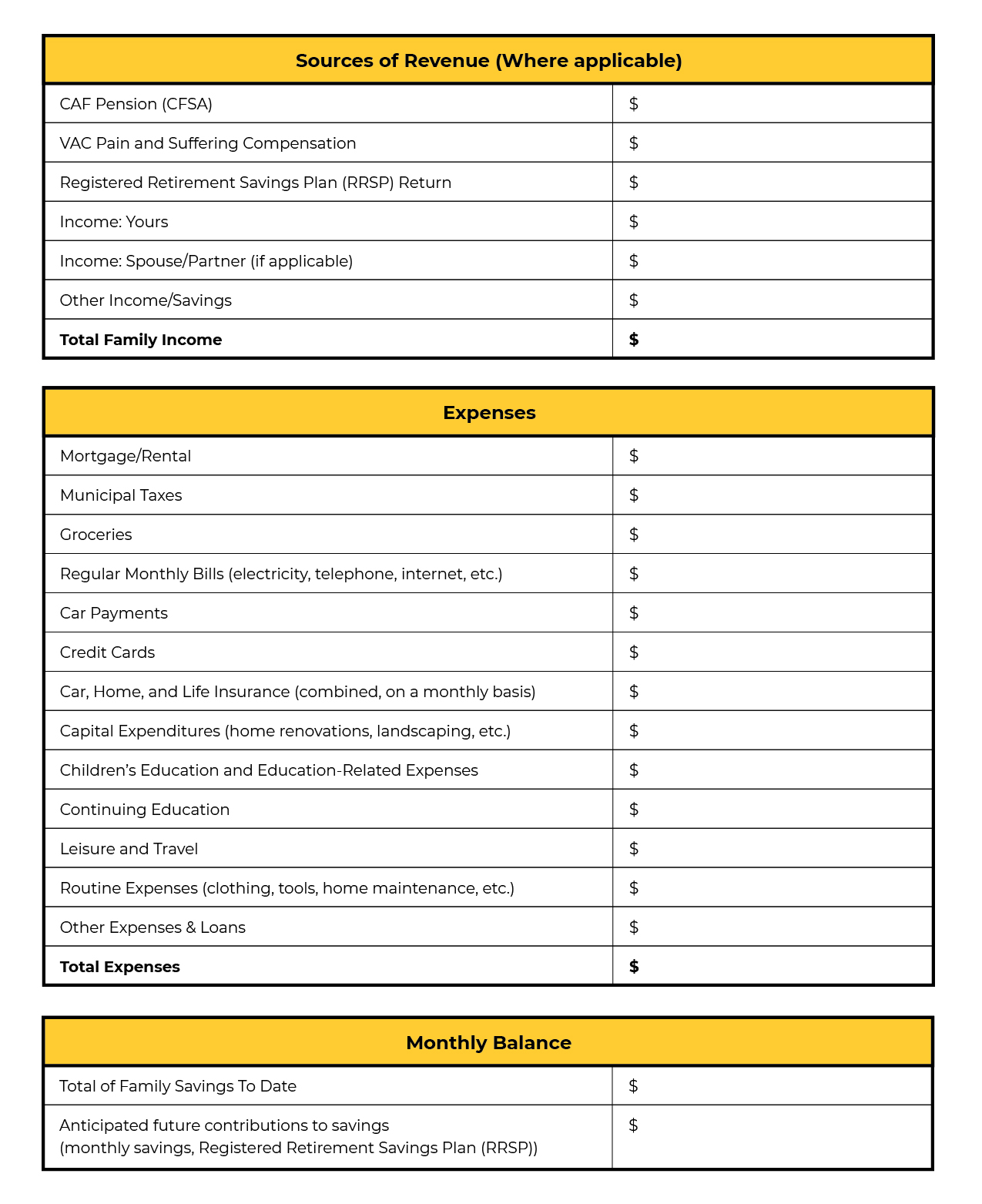

Description of figure

This form has been created to help families estimate their overall income and expenses after release. Using the form, you will be able to determine your total family income/savings as well as the total cost for monthly expenses.

Sources of Revenue (Where Applicable)

| CAF Pension (CFSA) | $ |

| VAC Pain and Suffering Compensation | $ |

| Registered Retirement Savings Plan (RRSP) Return | $ |

| Income: Yours | $ |

| Income: Spouse/Partner (if applicable) | $ |

| Other Income/Savings | $ |

| Total Family Income | $ |

Expenses

| Mortgage/Rental | $ |

| Municipal Taxes | $ |

| Groceries | $ |

| Regular Monthly Bills (electricity, telephone, internet, etc.) | $ |

| Car Payments | $ |

| Credit Cards | $ |

| Car, Home, and Life Insurance (combined, on a monthly basis) | $ |

| Capital Expenditures (home renovations, landscaping, etc.) | $ |

| Children’s Education and Education-Related Expenses | $ |

| Continuing Education | $ |

| Leisure and Travel | $ |

| Routine Expenses (clothing, tools, home maintenance, etc.) | $ |

| Other Expenses & Loans | $ |

| Total Expenses | $ |

Monthly Balance

| Total of Family Savings To Date | $ |

| Anticipated future contributions to savings (monthly savings, Registered Retirement Savings Plan (RRSP)) | $ |

Note: This form is available in the My Transition Services application and is transferable in PDF format.

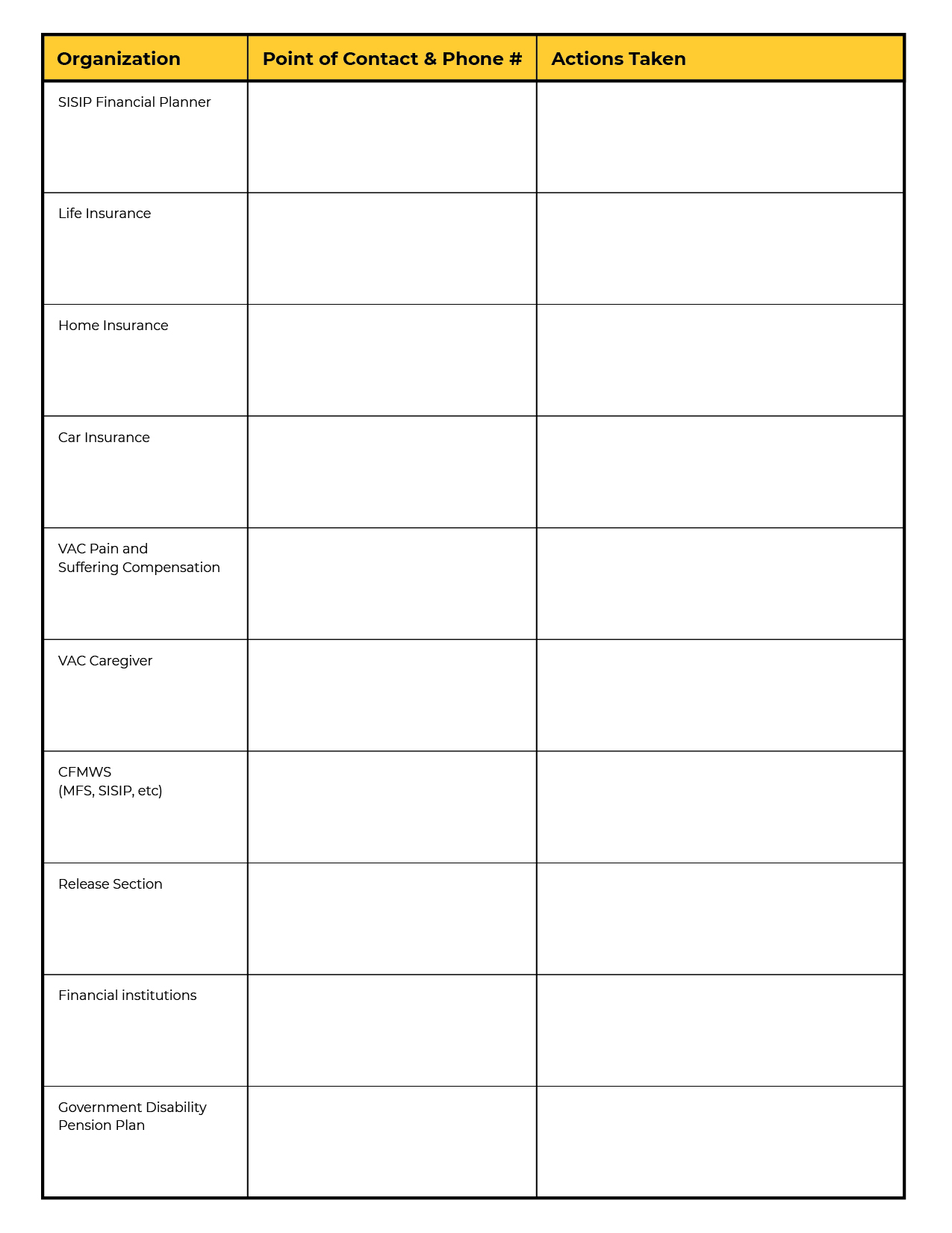

Description of the figure

This form is created to help families manage their finances after release. The form has a list of organisations, next to which you will list the appropriate phone number and actions taken with regards to each organization.

Financial Planning: Contact Form

| Organization | Point of Contact & Phone # | Actions Taken |

| SISIP Financial Planner | - | - |

| Life Insurance | - | - |

| Home Insurance | - | - |

| Car Insurance | - | - |

| VAC Pain and Suffering Compensation | - | - |

| VAC Caregiver | - | - |

| CFMWS (MFS, SISIP, etc | - | - |

| Release Section | - | - |

| Financial institutions | - | - |

| Government Disability Pension Plan | - | - |

Canadian Armed Forces Pensions

To learn about the Canadian Armed Forces Pension plans that are specific to you as an active or retired member and to your survivors/child (ren). Learn about participating in the pension plan, retirement income sources and pension options.

Visit the Canadian Armed Forces Pension plan web page for more information.

Canadian Retirement Income Calculator

The Canadian Retirement Income Calculator provides retirement income information, including the Old Age Security (OAS) pension and Canada Pension Plan (CPP) retirement benefits. Understanding how each pillar of the retirement income system will contribute to your future financial security and is beneficial to your financial health and future. It is important to note that the calculator's results are estimates for information purposes only, and should not be considered financial planning advice.

The Canadian Retirement Income Calculator does not collect personal information or identifiers. Visit the Retirement Income Calculator web page for more information.

SISIP Financial – Planning and Investment Services

Seeking the assistance of a professional advisor early in your career is recommended. SISIP Financial advisors are qualified to provide general financial advice and investment advice, suited to specific requirements, at every career stage and beyond.

SISIP Financial advisors offer unbiased financial and investment advice, and assist preparing financially for the change in circumstances. Providing guidance and solutions, they can help you avoid potentially costly mistakes regarding release benefits, tax planning, budgeting, and other considerations.

They can also provide investment options that will enable you to fulfill your financial goals. Locate your nearest SISIP Financial advisor by calling SISIP Financial customer service at

1-800-267-6681 or visit the SISIP website.

SISIP Financial – Life Insurance Services

Whether or not you have optional term life insurance coverage with SISIP Financial while serving in the CAF, it is recommended that you contact a SISIP Financial advisor who can explain the coverage available.

If you have coverage in effect, review your post-release insurance needs and transfer options. A completed application form must be received at a SISIP Financial or SISIP Life Insurance Services – Manulife office no later than 60 days after the final date of release in order to transfer it. After 60 days following your date of release, your current coverage will expire.

You are encouraged to contact a SISIP Financial advisor at least 3 months prior to your date of release to review the following:

- Insurance needs post-release;

- Discuss any other coverage(s) available to released members; and

- Complete the applicable transfer request.

SISIP Financial office locations, Manulife contact information and application forms can be obtained by calling SISIP Financial customer service at 1-800-267-6681, SISIP Life Insurance Services - Manulife at 1-800-565-0701 or visit the SISIP website.

Veterans Affairs Canada’s Pain and Suffering Compensation

Do you have an illness or injury from your service? Disability benefits are financial recognition for the impact this service-related injury or disease can have on your life.

A disability benefit is a tax-free, financial payment to support your well-being.

The amount you receive depends on the degree to which your condition is related to your service (entitlement) and the severity of your condition, including its impact on your quality of life (assessment).

To qualify for a disability benefit you must be a CAF member or Veteran. You should apply for a disability benefit if you:

- Have a diagnosed medical condition or disability; and

- Are able to show that the condition is related to your service.

If you qualify for a disability benefit, you may receive a Pain and Suffering Compensation – a life-time monthly benefit or lump sum benefit – the choice is yours.

You can find out more information on VAC’s Pain and Suffering Compensation web page.

Veterans Emergency Fund (VEF)

The Veterans Emergency Fund (VEF) provides prompt, non-taxable financial assistance to Veterans, their families, and survivors who are facing an emergency that threatens their health and well-being. Applicants will also be referred to additional resources for longer-term support.

VEF qualifications are intentionally broad to assist as many people as possible who require urgent financial help. An applicant does not need to be in receipt of other VAC benefits in order to qualify for the fund.

The following groups can qualify for VEF if they are a Canadian resident and a(n):

- Veteran of the Canadian Armed Forces (CAF);

- Current spouse/common-law partner of a Veteran;

- Survivor of a deceased Veteran or deceased CAF member; or

- Orphan of a deceased Veteran or deceased CAF member (or the legal guardian if the orphan is under the age of 18).

VEF applications are assessed on a case-by-case basis and can cover essentials such as :

- food;

- rent/mortgage;

- clothing;

- medical care/expenses; and

- expenses required to maintain safety and shelter.

For more information on the VEF, please visit the Active Member Services and Information webpage.