What we heard: Developing greater labour protections for gig workers

On this page

Alternate formats

List of acronyms and abbreviations

- AMPs

- Administrative Monetary Penalties

- ACTRA

- Alliance of Canadian Cinema, Television and Radio Artists

- AB 5

- Assembly Bill 5

- CBA

- Canadian Banker Association

- CBC

- Canadian Broadcasting Corporation

- CCC

- Canadian Chamber of Commerce

- CFIB

- Canadian Federation of Independent Business

- Code

- Canada Labour Code

- CLC

- Canada Labour Congress

- CPA

- Canadian Payroll Association

- CRA

- Canada Revenue Agency

- CTA

- Canadian Trucking Alliance

- CUPE

- Canadian Union of Public Employees

- CUPW

- Canadian Union of Postal Workers

- DSA

- Direct Sellers Association of Canada

- EHQ

- Engagement Headquarters

- ESDC

- Employment and Social Development Canada

- FTQ

- Fédération des Travailleurs et Travailleuses du Québec

- FETCO

- Federally Regulated Employers – Transportation and Communications

- HEA

- Halifax Employers Association

- IAMAW

- International Association of Machinists and Aerospace Workers

- ILWU

- International Longshore and Warehouse Union

- NACC

- National Airlines Council of Canada

- NBC

- National Building Code

- NIOs

- National Indigenous Organizations

- NWAC

- Native Women's Association of Canada

- PSAC

- Public Service Alliance of Canada

- ToS

- Terms of Service

- TIAC

- Tourism Industry Association of Canada

- UFCW

- United Food and Commercial Workers

- LFMO

- Women of the Métis Nation – Les Femmes Michif Otipemisiwak

1. Introduction

A growing share of Canada's workforce are gig workers. The term "gig worker" describes workers who enter more casual work arrangements such as short-term contracts with firms or individuals to complete specific and often one-off tasks. Gig work is often facilitated by new technologies such as digital labour platforms. Digital platform workers are a subset of gig workers. They complete tasks through:

- location-based platforms (for example, Uber, Lyft, and SkipTheDishes), or

- web-based freelancing platforms (for example, Upwork, Freelancer, and Amazon Mechanical Turk).

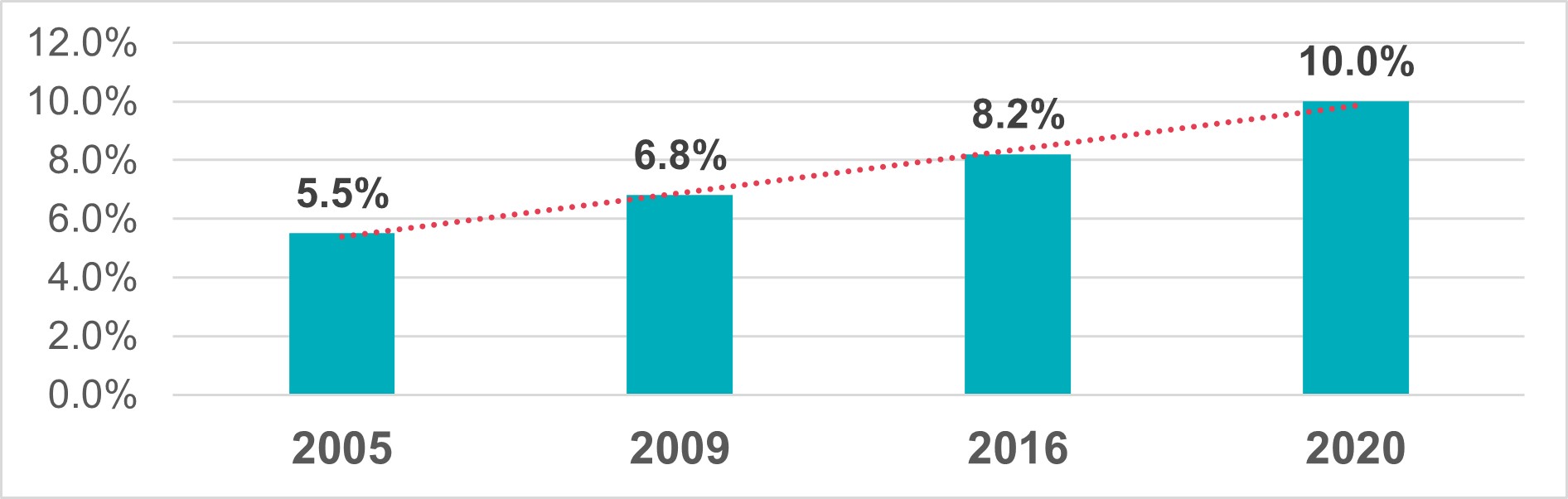

In recent years, changing labour demands (in particular, the 2008 financial crisis and the COVID-19 pandemic) and the emergence of new work technologies have contributed to the rise in the share of Canadian workers who perform gig work. Indeed, this share has nearly doubled over the past 15 years, growing from 5.5% in 2005 to roughly 10% in 2020 (Figure 1). A recent study by Statistics Canada revealed that in 2022, approximately 250,000 Canadians performed gig work through digital platfoms, with rideshare and delivery services as the most common type of work.Footnote 1 As the federal labour jurisdiction covers a limited number of industries, most gig workers are expected to fall under provincial jurisdictional authority.Footnote 2 That said, it is estimated that roughly 41,000 gig workers currently operate in federally regulated industries.Footnote 3

Text description of figure 1

| Year | Share of gig workers in % |

|---|---|

| 2005 | 5.5% |

| 2009 | 6.8% |

| 2016 | 8.2% |

| 2020 | 10.0% |

Source: Jeon, Liu and Ostrovsky (2019); Jeon and Ostrovsky (2020).

The growth of the gig economy presents a number of opportunities for workers, with a potential for added flexibility and freedom in how, where, and when they choose to work. However, gig workers can also face a number of challenges, putting many of them in difficult working conditions and precarious economic positions.

Recognizing these challenges, the Prime Minister mandated the Minister of Labour to improve labour protections for gig workers, including those who work through digital platforms.

In order to gather information and perspectives on the gig economy in Canada, Labour Program officials engaged, through various consultation activities, with:

- gig work experts

- academics

- the Canadian public

- Indigenous organizations, and

- labour groups, including groups representing gig workers, and employer stakeholders

Consultations highlightsFootnote 4

- 530 visits to the online discussion forum

- 215 contributions to the quick poll questions in English and French

- 6 personal stories

- 511 employers responded to a survey

- 3 roundtables with provincial and territorial partners

- 29 written submissionsFootnote 5

- 5 roundtables with stakeholdersFootnote 6

- 4 meetings with digital platform companies, and

- 3 meetings with National Indigenous Organizations (NIOs)

Officials conducted extensive background research and numerous expert interviews in the months leading up to public and stakeholder consultations, which took place in 3 phases in February 2021, July 2021 and December 2022.

The first phase of consultations focused on better understanding the challenges and opportunities of work in the gig economy. The second phase focused on obtaining stakeholder feedback on a set of preliminary policy options for improving labour protections for gig workers. The third phase of consultations focused on obtaining more feedback on policy options that were positively received in the second phase. The main objectives of this report is to summarize what we heard during the consultations (Section 2) and outline next steps (Section 3).

2. What we heard

This section summarizes key takeaways from expert outreach and consultations with the public and stakeholders. The feedback received through engagement activities is organized under 4 themes:

- the challenges and opportunities of gig work

- improving access to labour protections for gig workers

- ensuring more transparency and fairness in the gig economy, and

- improving information quality for better policymaking

Recognizing the challenges and opportunities of gig work

The different points of view collected during consultations have led to a better understanding of the key challenges and opportunities related to work in the gig economy. This section of the report summarizes what we heard on these challenges and opportunities.

2.1 Challenges

Interviews with experts and consultations with the public and stakeholders revealed a number of key challenges faced by gig workers in Canada, including:

- misclassification: gig workers often share many of the characteristics of employees, but are classified as independent contractors and therefore do not benefit from key protections such as labour standards coverage

- low pay: gig workers have no minimum wage protections and complete many hours of unpaid work looking for gigs or waiting for task assignment on online platforms or applications

- risk of late- or non-payment: particularly for gig workers working exclusively online, work can be taken or refused without pay

- unpredictable schedules and earnings: many gig workers are unable to predict how many hours they will work in a given day or week, making income stability difficult to achieve

- risk of unsafe working conditions: many gig workers have sole responsibility over ensuring their own health and safety at work, and

- limited access to dispute resolution: when faced with adverse decisions by employers or digital labour platforms (for example, non-payment, inaccurate online reviews, deactivation from platforms), gig workers have little access to effective dispute mechanisms, aside from the costly remedies offered by courts or private arbitration. They may also be unaware of their rights and how to file a complaint through the Labour Program.

Gig workers facing 1 or more of these challenges can find themselves in precarious and vulnerable economic positions. In the feedback we received from gig workers through the online public consultations, there was a theme of frustration towards working conditions on digital platforms in the gig economy. Some workers referred to platform work as exploitation, explaining that companies profit heavily off the work of their contracted staff, yet provide them with few benefits or labour protection.

Although all the challenges identified are significant and deserve individual attention, labour representatives (unions, labour advocacy groups, and gig workers) identified issues related to employment classifications, misclassification in particular, as being at the root of many of the problems faced by gig workers. Misclassification and other challenges will be explored in the next sections of this report, including stakeholders' proposed solutions to these challenges.

"Gig employers are disrupting Canada's existing labour standards; taking advantage of the ability to classify workers as independent contractors for financial profit, and distancing themselves from all responsibilities to workers. This exploitation is prevalent in every aspect of the day-to-day experience of gig workers."

While recognizing that some gig workers face difficult work situations, employer representatives expressed concerns over describing all forms of gig work as being precarious. Through written submissions and roundtable discussions, they provided examples of workers that may fall under conventional definitions of gig worker, but who more closely resemble established entrepreneurs, with little need for greater labour protections. Such is the case, they argue, of most:

- owner-operators in the trucking industry

- information technology specialists in the banking sector, and

- on-call port workers in the maritime transportation sector

"In the case of owner-operators, these individuals have made substantial investments in their business, with many tractor-trailers costing between $125,000 and over $200,000."

"Gig workers [in the maritime transportation sector] are not unlike our union represented workforce which have no employment guarantees or set hours of work but still command annual average earnings in the $100,000 range and have a very long history of collectively bargained protections."

Employers and employer representatives also stressed that precarious forms of gig work are found largely in provincially regulated sectors, rather than under federal jurisdiction. By contrast, labour groups shared numerous accounts of gig workers facing many of the challenges previously identified in providing services to federally regulated businesses. Combining what we heard from both perspectives, a key takeaway is that gig work is diverse. Some workers face severe challenges while others are able to benefit from gig work to achieve positive outcomes.

"For some groups - this has been a very positive change. White-collar professionals in particular have benefitted by being able to develop valuable skill specializations and get paid top dollar for short-term or on-demand work. For others though, it has not been positive - this is particularly true for work where there is no need for valuable specialization."

Opportunities

2.2 More flexibility and freedom at work

Increased flexibility and freedom from traditional schedules and workplaces were the more frequently cited benefits of work in the gig economy. Many gig workers enjoy the opportunity of having additional control over how, when, and where to work, including choosing to whom they provide services. With these benefits in mind, many participants in the consultation process warned that any new legislation or other intervention aimed at developing greater protections for gig workers should be careful to conserve the flexibility that attracts many people to gig work in the first place.

However, while increased flexibility and control over work may be a real benefit for some gig workers, others have described freedom in the gig economy as somewhat of an illusion. Many platform workers feel heavily managed by their gig employers. For example, they reported being highly encouraged to work at specific times of the day when demand for services surges. Many participants in the online public consultations referred to flexibility in the gig economy as a "scam", especially when they spend most of their unpaid work time looking or waiting for the next task or job.

"Gig workers agree that 'flexible work' is what draws us to this work, it's the primary language of the gig economy. What we learn after beginning to work is that 'flexible work' within the gig economy means workers being flexible to accommodate the needs of apps. The 'flexibility' that gig employers advertise isn't what gig workers get."

We can choose the days we work, but not the times when work is available, if we want to earn an income we must work when the apps are busy which is not necessarily when it is beneficial for us to go to work."

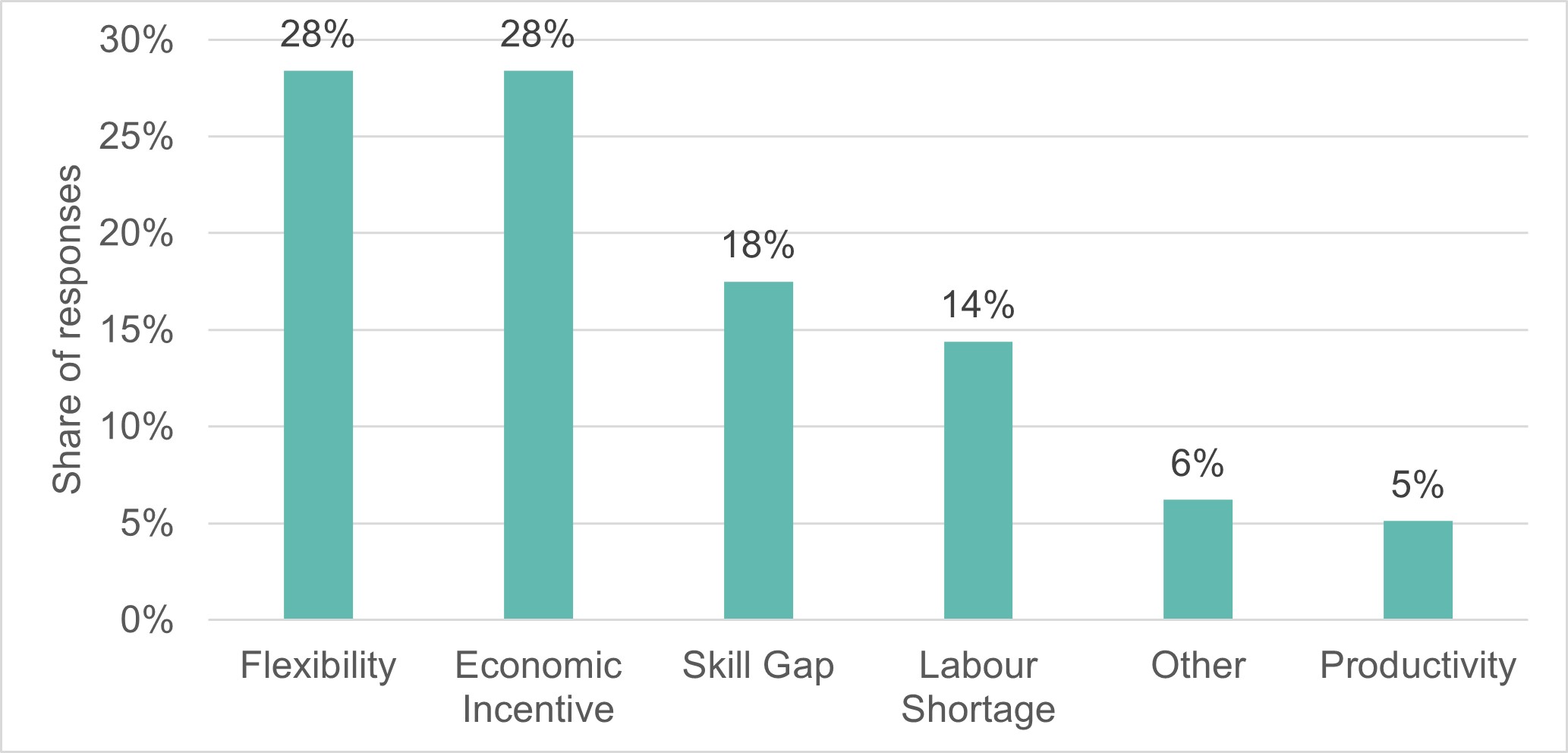

A flexible gig workforce allows employers to adapt their workforce to changing demand from clients and to undertake specific one-off tasks or projects without the rigidity and often higher costs of establishing and managing a traditional employer-employee relationship. In an online survey administered by the Labour Program, federally regulated employers who reported hiring self-employed contractors, including gig workers, cited flexibility and economic incentive (lower costs) as being the main advantages of a self-employed workforce (Figure 2).

Text description of figure 2

| Main advantage | Share of responses in % |

|---|---|

| Flexibility | 28% |

| Economic Incentive | 28% |

| Skill Gap | 18% |

| Labour Shortage | 14% |

| Other | 6% |

| Productivity | 5% |

Source: Online employer survey, gig work mandate commitment consultations.

Note: 257 valid responses

On the flexibility advantage (28% of responses), employers said that hiring gig workers allows them to rapidly adapt the size of their workforce to changing demand from customers. As for the economic incentive (also 28% of responses), they said that hiring gig workers allows employers to acquire very specialized skills for specific short-term projects, without having to keep people with those skills on payroll.

"On occasion we require specific tasks to be completed for customers that is outside the scope of our regular duties. During these times, we will contract a specialist to complete the work required. The main benefit is simple: we can complete the work without having a specialist on staff 5 days a week. Although we would love to hire people who specialize in all areas, this would be too expensive for our small business."

"[Our] company is not required to pay employee benefits or employer portions of the Canada Pension Plan and Employment Insurance for self-employed workers."

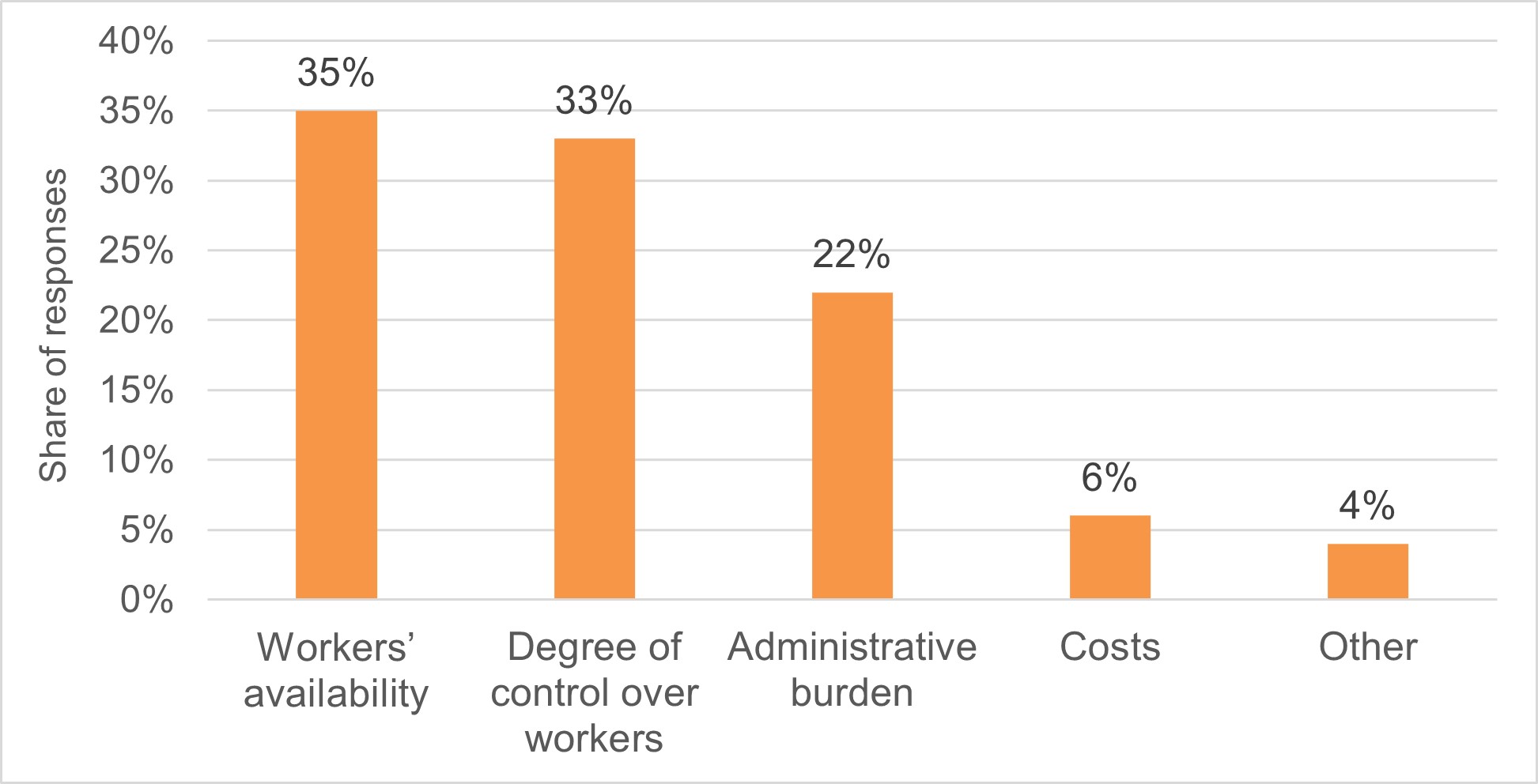

However, what we also heard from many employers is that hiring contractors and gig workers presents a number of challenges. The most common issues faced by businesses who hire this type of workforce is the lack of availability of workers and the lack of control employers have over their work and schedule (Figure 3).

Text description of figure 3

| Main challenges | Share of responses in % |

|---|---|

| Workers' availability | 35% |

| Degree of control over workers | 33% |

| Administrative burden | 22% |

| Costs | 6% |

| Other | 4% |

Source: Online employer survey, gig work mandate commitment consultations

Note: 165 valid responses

Being able to temporally hire self-employed gig workers on short notice is advantageous to employers, but many businesses struggle to find available workers when they need them (35% of employers reported that worker availability is the main challenge they face in working with self-employed persons). Even when employers manage to hire gig workers, many employers (33%) report that the main challenge in contracting with this type of workforce is a lack of control over when, where and how gig workers provide services.

"At times the work distributed to an external independent contractor can be at a much higher cost than if we had an internal employee conducting the work, also at times schedules may not align as we do not have control over when precisely the external independent contractor is available as they are operating on a completely different schedule than our regular internal staff."

Considering both worker and employer perspectives, it is clear that greater flexibility and freedom in the gig economy may be beneficial to some workers and businesses, while presenting a challenge to others.

2.3 Greater work opportunities

Many labour and employer stakeholders and experts told us that the gig economy provides an opportunity for many workers to enter the labour market and accumulate meaningful work experiences. This is the case, for example, of young workers beginning their professional lives. It is also the case for many other groups that may find themselves marginalized from the traditional labour market, such as:

- Indigenous peoples

- racialized persons

- persons with disabilities

- women

- newcomers, and

- persons who belong to linguistic minorities

Many marginalized workers may face labour market barriers that may be less prominent in the gig economy, such as language and geographical requirements, and rigid scheduling for persons with care responsibilities.

While greater access to work opportunities was often cited as a key benefit of the gig economy, stakeholders also stressed that gig work is not accessible to all interested workers. This is because work in the gig economy relies heavily on new information technologies (for example, smartphone applications and web-based digital platforms), which requires a certain level of technical knowledge. We also heard that many workers, particularly marginalized individuals, do not enter the gig economy by choice, but do so in response to a lack of more standard work opportunities or to supplement low wages earned in more traditional forms of employment.

"Gigs may provide opportunities to enter an otherwise inaccessible labour market, earn a livelihood and meet immediate economic needs that could be attractive for Inuit women who feel pushed out of Inuit Nunangat or who are struggling to adapt and prosper in urban centres."

"[…] the fact that many gig jobs can be done remotely means that Indigenous women face less pressure to move away from their families and communities. However, gig work may not be accessible to everyone, especially people that don't have access to, or a working knowledge of, the technologies needed to engage in gig work."

"The choice of entering into gig work is often a constrained choice since many workers – particularly those who are marginalized, including racialized workers, women, youths, and newcomers – have few options to earn a living wage and will take any income-generating opportunity that comes their way."

Stock-take on challenges and opportunities

Taken together, the feedback received from consultations shows that the world of gig work is complex and filled with both challenges and opportunities for workers and employers. What can be a challenge for some workers or employers (for example, flexible work arrangements and scheduling), can be a benefit for others. While gig work can open up meaningful opportunities for some workers, others feel condemned to the gig economy, due to limited prospects in the traditional labour market.

In terms of policy feedback, the consultation process identified a need for careful intervention in the area of gig work. The objective is for government to develop greater labour protections that will address the main challenges faced by gig workers without limiting the opportunities the gig economy presents.

Improving access to labour standards protections

Part III of the Canada Labour Code (Code) sets out minimum labour standards for employers and employees in the federally regulated private sector, including:

- minimum wage

- job-protected leaves

- vacations, and

- hours of work

All of the protections in Part III are afforded exclusively to employees, while workers who are not deemed to be employees are excluded. In the absence of clear definitions of employment categories, a worker's status as either an employee (entitled to protections) or an independent contractor (not entitled to protections). This is handled by enforcement personnel and courts on a case by case basis using criteria established in provincial private law (civil law and common law). In general, gig workers are classified as independent contractors by employers and hiring entities. As independent contractors, they are not covered by labour protections under Part III of the Code. However, some gig workers are in work situations that resemble an employer-employee relationship.

This part of the report discusses what we heard during the consultation process on the need for clearer employment definitions in Part III, the extent to which misclassification is occurring in the federal jurisdiction, approaches to extend labour protections to gig workers, and the question of jurisdiction as it relates to the gig economy.

More clarity over employment classifications

We heard from several stakeholders that employment classifications needed to be made clearer so that workers and employers can apply them. Several suggested that new statutory definitions should be introduced under Part III of the Code for each of the following employment classifications:

- employee

- dependent contractor (intermediate category that exists under Part I of the Code), and

- independent contractor

Participants also pointed out that the difference between employees (with full protections under the Code) and independent contractors (with next to no protections under the Code) is not clearly defined in Part III, creating ambiguity for workers and employers.

Unions and labour groups supported a recommendation made by the Expert Panel on Modern Federal Labour Standards to introduce the following in Part III of the Code:

- a presumption of employee status,

- simplified employment definitions, and

- an employment classification test

They argued that such a change would improve gig workers’ access to employment rights to which they should be entitled. One labour representative pointed out that the determination of employment status by Labour Program enforcement personnel and courts in Canada involves complicated, multi-factorial tests which place the burden on workers themselves to challenge their status when most gig workers do not have the knowledge or resources to undertake this task.

"The test for determining an employer-employee relationship should be clarified and simplified to match modern working conditions and the law should be enforced."

Adding to the complexity of employment classifications, some employer organizations and labour groups noted that gig workers may fall under different employment classifications depending on which federal department or agency they are dealing with (such as Canada Revenue Agency, Employment and Social Development Canada). They suggested harmonizing employment definitions across federal laws could provide clarity and consistency for workers and businesses.

"There needs to be a whole of government approach on putting forward a solid definition on what (independent contractors) are because small businesses don't even know where to go for that information."

While there was no major opposition to increased clarity over employment classification, employer organizations warned against introducing a blanket approach to employment definitions that could result in true self-employed independent contractors being reclassified as employees. They argued this could negatively affect the livelihood of workers who benefit from being classified as independent contractors. As mentioned in the previous section, they pointed out that federally regulated gig workers often earn high incomes, enjoy flexible work schedules, receive tax benefits, and have skills that are in demand (for example, informational technology professionals, truck drivers), giving them strong bargaining power.

"If we are going to design any protection, we can't see a one-size-fits-all approach working in this space. It is so broad and there are people across the spectrum who could be impacted by unintended consequences. We don't want to impact flexibility with which some workers choose to receive."

Stakeholders from the trucking sector were particularly concerned that the introduction of employment definitions might create more confusion than clarity for truck drivers. They explained that owner-operator truck drivers (for example, drivers who own or lease their vehicle and operate as incorporated businesses) could fit the definition of "gig worker" given they work on a contract-to-contract basis and have autonomy over their own schedule. However, they stressed that owner-operators are in true business-to-business relationships where they reap economic and social benefits (for example, high earnings, flexibility). They suggested that owner-operators should be exempt from any new federal policies related to employment definitions.

"When we think about ‘gig workers' we think about short-term, no security, no resolution about when and how they get paid [but] owner-operators […] see how it works and they see it as positive and it doesn't define employment. Longevity is what defines employment. The complaints from gig workers are legitimate, but it doesn't happen in our industry. Long-term relationships work in our industry. Longevity is a testimony of something that works."

Misclassification

We heard from several experts that misclassification is an ongoing problem in the gig economy. Misclassification happens when gig workers are treated as independent contractors by their employers, despite the fact that their relationship with the employer is more akin to an employment relationship than a contracting or business-to-business relationship. Misclassification can be intentional or unintentional, but the result is the same: it denies labour protections for workers and allows employers to avoid fiscal responsibilities (such as contributions to Employment Insurance and Canada Pension Plan). That said, many gig workers are appropriately classified as independent contractors and enjoy the freedoms and fiscal benefits associated with this status.

Seven labour unions provided written submissions suggesting misclassification allows employers to gain a competitive advantage by evading labour protections and employer responsibilities. One union suggested that digital platforms intentionally misclassify workers to offset costs, arguing that workers should not have to trade their labour protections for flexibility. One union and one law firm pointed out that misclassification is a problem for both gig workers (who are denied protections to which they should be entitled) and the public (which bears the cost of misclassification through tax loss). Unions and labour groups also pointed out that marginalized communities are more likely to be engaged in precarious work, including gig work, meaning that addressing misclassification would better protect some of the most vulnerable workers. While the extent of misclassification in the federal jurisdiction is unclear, experts expect that as the gig economy continue to grow, so too will issues of misclassification.

"Women, newcomers to Canada, and people of colour are particularly likely to work in the gig economy; this means that combatting employee misclassification and ensuring misclassified gig workers have access to the rights and protections enjoyed by all employees are fundamental issues of gender and racial equity."

In 2018, significant legislative amendments were made to Part III of the Code, including the introduction of a prohibition on misclassification that came into force in January 2021. This provision states that employers are prohibited from treating an employee as if they were an independent contractor in order to avoid their rights and obligations under Part III. Any employer who was found to have deliberately misclassified an employee could be subject to an Administrative Monetary Penalty for doing so. The burden of proof is also placed on the employer to demonstrate that a person is not their employee if that person makes a complaint under Part III.

Some labour stakeholders criticized these new provisions as they argued they put the onus on vulnerable workers to file complaints. One gig worker pointed out that putting the onus on workers is problematic because "gig workers don't have the resources or energy to address misclassification on their own." Labour groups told us that workers, and especially marginalized workers, are not likely to complain about employment classification as they may not be well informed of administrative processes available to them, and may fear reprisal from their employer. As such, labour groups and gig workers argued for a broader presumption of employee status, which would apply even when a worker does not file a complaint. In addition, 1 Inuit group pointed out that a complaint-based process does not reflect their community's values and would not be particularly helpful for Inuit gig workers.

"Understanding economic dependence within the dynamics of colonial institutions and power structures may not be straightforward, and Inuit may lack the knowledge, resources and desire to pursue such classification, particularly to the detriment of a vital source of income. To pursue such a course of action may be seen to be at odds with Inuit Societal Values, particularly Aajiiqatigiinniq (decision making through discussion and consensus) and Piliriqatigiinniq/Ikajuqtigiinniq (working together for a common cause)."

Some employer organizations questioned the extent to which misclassification is taking place in the federally regulated private sector, suggesting that there are significant data limitations on Canada's gig economy. One employer organization submitted that misclassification was not a widespread issue and that it is already addressed by the misclassification prohibition that came into force in January 2021. In addition, several employer representatives argued that further regulations may negatively affect gig workers by decreasing employment opportunities should firms choose to hire workers from other jurisdictions to maintain existing business models.

"There are hours of work and overtime protections already in the Code […] and protections against mischaracterization [misclassification] already exist. Individuals should have the ability to decide how they want to work and be able to choose the nature of the relationship they choose to enter into."

That said, some employer stakeholders agreed that one clear example of misclassification in the federal jurisdiction occurs in the trucking sector through the "Driver Inc." model. This is a model whereby workers who do not own or lease their own vehicles, self-incorporate as personal service businesses. While the Labour Program’s approach to misclassification is multifaceted and considers several dynamics of an employer-employee relationship on a case-by-case basis, many from the sector relayed during the consultations that this model is used so that employers can claim that their workers are self-employed and avoid any obligations under the Code and other federal laws, like the Employment Insurance Act.

Industry stakeholders stressed that this situation is complex and represents only a fragment of the trucking industry. They cautioned against new measures that attempt to address misclassification in the trucking sector as they may have unintended negative consequences on true owner-operators. They also advised against the federal government complicating the situation by using the "Driver Inc." model as evidence that misclassification is widespread in the federal jurisdiction. Finally, they also advised against creating an additional employment category under Part III of the Code. For example, the dependent contractor category that exists under Part I, as a third employment status could contribute to further misclassification by making the existing classification system even more complex.

"CTA (Canadian Trucking Alliance) fears that in ESDC's attempts to find a federally regulated population to fit this initiative, trucking will be caught up in a conversation that is largely non applicable to the industry. In doing so, ESDC will be complicating an already complicated issue in the trucking sector."

2.4 Better coverage for gig workers

Throughout our consultations, stakeholders and experts told us that a major issue facing gig workers is their lack of access to labour and social protections. However, views differed significantly as to the reason why gig workers are lacking access. As discussed, some believed that the problem lies entirely with misclassification and that the law and enforcement practices should be strengthened and clarified to catch and correct misclassification. On the other hand, several experts, academics and labour stakeholders felt that labour laws are too narrow to apply to gig workers and should be broadened to extend protections to workers who do not fit the traditional conception of an "employee". Several stakeholders emphasized the importance of having more proactive enforcement to crack down on employers who are likely misclassifying their workers.

California's passage of Assembly Bill 5 (AB 5) and the adoption of the "ABC" test was a focal point amongst unions, experts, and law firms. One expert called it "the most important legislative action toward the goal of increasing worker protection."

AB 5 came into force on January 1, 2020 and codified an employment test known as the ABC test. Under this test, a worker is presumed to be an employee and not an independent contractor, unless the hiring entity can demonstrate that the hired worker satisfies all 3 of the following conditions:

- the worker is free from the control and direction of the hiring entity in connection with the performance of the work, both under the contract for the performance of the work and in fact

- the worker performs work that is outside the usual course of the hiring entity's business, and

- the worker is customarily engaged in an independently established trade, occupation, or business of the same nature as that involved in the work performed

If the worker's relationship with the employer does not meet any of these criteria, the worker is deemed to be an employee and is entitled to the protections of California's labour legislation.

Nine unions and 1 law firm suggested the government adopt a similar approach by following the Expert Panel on Modern Federal Labour Standards' recommendation to introduce an employment test and define "employee", "dependent contractor" and "independent contractor" in Part III of the Code. Most unions suggested that dependent contractors should be entitled to the same protections as employees (like in Part I) and cautioned against a standalone category of dependent contractor, as it may allow employers to downgrade workers into a less protected classification and cause more ambiguity.

One law firm went further, suggesting that a harmonized employment test should apply to the Employment Insurance Act, the Canada Pension Plan, and to all parts of the Code in order to simplify and clarify employment statuses under these acts.

"Gig workers should be classified as any other employee and have the same rights and entitlements as employees under the labour code. Good policy would also give app-based workers access to Employment Insurance, statutory holidays, maternity leave, wage theft protections, protection from unjust discipline and dismissal, protection from harassment and abuse, and other provisions that are considered minimum standards for employees."

By contrast, employers made several arguments against extending the application of the Code. First, some suggested there was not enough evidence that gig work is widespread enough in federally regulated sectors to justify making path-breaking changes such as modifying the application of federal statutes. Indeed, 1 employer said they were "having difficulty seeing what the problem was in relation to gig work in the federally-regulated private sector." Second, employer organizations argued that gig work should not be framed as "always precarious or necessarily negative." Particularly in the federal jurisdiction, employers noted that wages are relatively high and workers prefer the flexibility that gig work offers. Other employers suggested that problems stem more from the fact that employers do not understand how to apply the law, rather than the law itself, and suggested that the Labour Program should provide more educational opportunities to employers.

2.5 Jurisdictional issues

It was unclear to some participants in the consultations what types of gig work would be affected by potential changes to the Code, given that most gig workers fall under provincial jurisdiction because of the nature of the work they do. For example:

- local delivery

- ridesharing, and

- professional services

That said, many labour representatives argued that the federal government should show leadership in developing protections for gig workers to promote similar actions in other jurisdictions. Recognizing that provincial and territorial governments have greater authority over gig work, 1 union representative submitted that the federal government should be "viewed as setting the bar for labour standards in Canada."

Indigenous organizations explained that gig workers are generally unaware of which jurisdiction their work falls under and, subsequently, which legislation is applicable. One organization suggested the government should find a way to ensure that protections for gig workers apply to all sectors, in all provinces and territories, so that Indigenous workers can actually benefit from protections for gig workers.

They pointed to the National Building Code (NBC) as an example of where the federal government set a national model and provinces and territories adopted it, or supplemented their own labour regulations based on the NBC. Another Indigenous organization suggested a guaranteed livable income would represent a universally accessible and substantively equal socioeconomic wellness system. This could help to address many of the challenges faced by gig workers, especially those who belong to multiple intersecting marginalized groups.

"When the province, the feds, and the municipalities are not working together, we Indigenous get stuck in the middle."

2.6 Stock-take: labour standards for gig workers

Stakeholders, experts, and gig workers themselves had diverse views on how to ensure labour standards protections for gig workers. Unions and labour groups were generally in favour of introducing employment definitions and tests in the Code that would extend labour protections to many workers currently classified as independent contractors. The gig workers we talked to and surveyed confirmed they needed such protections and expressed the urgency of the situation, particularly in the context of the COVID-19 pandemic.

Employers and employer organizations, on the other hand, did not see an obvious need to amend the Code at this time given the small footprint of the gig economy in the federal jurisdiction and that introducing employment definitions could negatively impact gig workers who are well paid and who benefit from independent contractor status. They also indicated that Canadian businesses are still reeling from the economic impacts of the COVID-19 pandemic and that the Government should allow firms to recover before making any significant changes to labour legislation.

Ensuring more fairness and transparency in the gig economy

Several experts, gig workers, union and labour groups told us that gig workers' lack of bargaining power manifests itself in 2 key ways. First, gig workers often feel they are unable to speak up and engage with their employers on issues which affect their working conditions out of fear that their employer will take action against them, such as refusing to assign them more work. As a result, stakeholders argued that protecting gig workers if they decide to exert collective voice to improve their working situation is key to improving the quality of work in the gig economy. The second way gig workers' lack of bargaining power manifests itself is in the business practices of the digital labour platforms through which they work. Often, digital platforms lack transparency in the way they operate (with respect to deactivating accounts, paying workers, or handling complaints or disputes), creating confusing and sometimes unfair outcomes for the people who use them.

2.7 Broadening opportunities for collective voice and dispute resolution in the gig economy

Many experts argued that a lack of established and protected channels for gig workers to voice concerns, grievances, or engage in discussions with their employers was a significant challenge in the gig economy. They suggested that part of the problem is that gig workers are often classified as independent contractors (sometimes correctly, sometimes incorrectly) and therefore do not benefit from the right to unionize that is afforded to employees or dependent contractors. Another part of the problem is that even if gig workers were to be found to be dependent contractors and allowed to unionize, there is no guarantee that they would be able to form a union and access basic labour protections through this channel of collective representation. This is because gig work does not lend itself well to union organizing, as these workers are:

- mostly unknown to each other

- geographically dispersed, and

- may engage in gig work only occasionally

"[The 2020 decision of the Ontario Labour Relations Board finding that app-based couriers for Foodora are dependent contractors and therefore entitled to unionize] does not fix the problem, which is the inability (for gig workers) to access worker protections."

The gap in protected channels of collective voice for non-unionized workers was also recognized by the 2019 Report of the Expert Panel on Modern Federal Labour Standards, which made the recommendation to introduce protections for "concerted activities." Concerted activity is a form of freedom of association which exists in the United States, and provides protection from reprisal when 2 or more workers engage in acts of concerted activities in good faithFootnote 7 with their employers to address issues and attempt to improve their working conditions.

In their written submissions, unions, worker advocacy groups, labour lawyers, and 1 employer association recommended ensuring there are appropriate and protected channels of collective voice for gig workers and non-union workers more generally, for example concerted activity protections and new forms of sector-specific collective bargaining.

"[Without protected channels of collective voice,] gig workers and all workers are unlikely to speak about dangerous and substandard workplace conditions if they fear employer reprisal."

"Providing such (gig) workers rights of representation and bargaining across an entire sector or platform of gig work would help to establish industry-wide labour standards, which are responsive to the unique challenges of gig work in that area."

When consulted on the possibility of introducing concerted activity protections for non-unionized employees and dependent contractors (a status that many gig workers are likely to fall under), unions, labour groups, and gig workers were supportive of the idea. However, some felt that such new protections would likely not be sufficient, and indicated that the Government should move to make unionization more accessible for workers that do not currently have formal union representation. Employer representatives were not necessarily opposed to new mechanisms that would provide protected channels for workers to voice concerns in the workplace. However, they did warn that any change that would impact productivity and business continuity should be carefully considered, particularly as many of them are still rebounding from the COVID-19 pandemic and associated lockdowns.

"Changes to the Canada Labour Code aimed at gig workers would create changes for the entire federally regulated workforce, and reimagine the collective voice channels which are already in place for many non-unionized workers."

"Introducing this [concerted activity protections] could have the unintended consequence of impacting workers who want to run their own businesses, be independent, and receive the benefits associated with that classification, including avoiding the rigidity of formal work and unions."

Along with a need for protected channels of collective voice, many consultation participants identified a lack of access to effective mechanisms of dispute resolution as a key issue facing gig workers. Gig workers can face circumstances where they find themselves in need of impartial dispute resolution such as situations of late- or non-payment of sums due, rejection of work without justification, and deactivation from and inaccurate reviews on digital platforms.

Given that they are generally classified as independent contractors, experts told us gig workers lack coverage from established dispute mechanisms such as the complaint mechanisms that exist under Part III of the Code. This means that these workers must rely on private dispute resolution (for example, small claims court) to address unjust treatment, which can be long and costly for both parties.

"[If gig workers had the same rights as employees,] we wouldn't fear arbitrary deactivation (from digital platforms) because we'd have the right to file a grievance for wrongful dismissal."

"The ability to appeal and protect one's rights through administrative agencies or tribunals are far better and much more easily accessible than resolving private disputes. The Ministry of Labour provides a safer space for workers to protect their rights and interests."

Experts, gig workers and labour groups also highlighted that many gig workers face the added challenge of finding themselves in indirect relationships with a hiring entity or employer. This is the case, for example, of gig workers who provide web-based services through digital platforms, such as freelancers working through platforms like Upwork or people performing microtasks through platforms like Amazon Mechanical Turk.

Workers in these types of arrangements typically do not have direct access to the hiring entity or employer that is requesting the work. This means they have no ability to discuss or address any issues, such as inaccurate worker reviews or rejection of work produced. In other words, interactions with the employer are mediated through digital platform infrastructures, which often do not have effective dispute resolution mechanisms in place.

"Government should require platform companies to provide gig workers with access to transparent and accountable mechanisms for resolving disputes with users/clients and with other workers within a reasonable time period."

While recognizing that a lack of dispute resolution mechanisms is an issue for some gig workers, employer representatives indicated that many self-employed contractors who could be considered gig workers have established methods of resolving conflicts, and that the process for solving disputes and providing remedies is often included in the contractual agreements. As such, many employer representatives did not see a pressing need for the federal government to introduce new mechanisms to resolve disputes, whether to address issues with the prompt payment of earnings or other problems arising within the contractual relationship.

2.8 Improving fairness and transparency on digital platforms

Many experts we interviewed explained that some people who work through digital platforms do not understand the policies and practices of digital platforms, as the terms of service (ToS) agreements that workers must accept are often opaque and subject to frequent changes. Experts told us that these ToS agreements can include a variety of clauses that are unfair to workers. For instance, some might undermine the worker's ability to work outside of the platform (for example, by imposing penalties for establishing off-platform relationships with clients) while others might require the worker and client to submit to costly arbitration in the event that there is a dispute between them. Such clauses, they argued, harm workers' ability to earn a decent living, and do not sufficiently protect them in the event they are not paid.

Experts also told us that to address fairness and transparency on digital platforms policymakers should look beyond the formal ToS agreements and examine the algorithms that are used by digital platforms. These algorithms, they argued, often have as much impact on a worker's experience of using a platform as the formal ToS agreements. For instance, they pointed out that workers do not know how platforms determine workers' ratings and rankings (in other words, whether someone is listed first for a particular type of work, or thirty-first). As ratings and rankings often determine how much work is offered to platform workers, experts argue that workers should be given the information necessary to understand the factors that influence these decisions.

Stakeholders discussed algorithmic management in detail, citing the issue of transparency among digital platforms as a particular problem with this business model that can create challenges for workers. Relying on technology to manage workers, assign tasks, and track progress is necessary for the operational requirements of most digital platforms, but can create certain barriers for the workers which are unique to platform work. Indeed, stakeholders from worker advocacy organizations told us they were concerned that there are significant barriers to direct communication between workers and platform representatives, challenges accessing dispute resolution, and difficulty acquiring personal information, records of work, and invoices if needed. Some stakeholders suggested this type of algorithmic management can have an adverse impact on the mental health of platform workers.

"With respect to virtual work, there is a real risk of a lack of privacy, increased capacity for discrimination, and unpaid wages. New technology can also increase the ability of employers to conduct surveillance of their employees which could have important psychological impacts."

In its written submission, one digital platform acknowledged the need to facilitate communication between the platform and its workers, and stressed that progress has been made in attempting to resolve these issues and improve the ability of workers to directly engage with digital platforms. Some platforms have begun to utilize forms of community outreach and offer opportunities to join working groups, fill out surveys, or use other methods to get feedback on user experiences.

"We believe strongly in working closely with Dashers and take their feedback into account when considering how we can best support them on issues of concern. We maintain a regular dialogue with Dashers across the country and are constantly learning from them regarding ways we can improve the Dasher experience."

Several countries, including the United Kingdom and South Africa have worked with academics and experts to gather information on digital platforms' policies, practices and the experiences of their users. With this information in hand, the platforms are evaluated and rated based on principles of fairness developed in consultation with stakeholders and gig workers. Following this, the results are made publically available online. These tools have allowed gig workers more information to choose work that suits their preferences. They can also highlight any steps that platforms have taken to address common challenges and improve their worker/user experiences.

Stakeholders were broadly supportive of exploring such an approach in the Canadian context. However, they were divided on how effective such an initiative would be in improving working conditions in the gig economy. In particular, labour representatives indicated that such an initiative needs to be combined with other efforts, as a transparency initiative may only address symptoms of the problem, and do little to address the real issues faced by gig workers, which they argued stem from inadequate protection under existing labour legislation and a lack of worker power.

"We are not opposed to transparency, but this option without other elements will not be sufficient. What workers need is proper [employment] classification. This won't change much."

"There should be basic access to information requirements in the gig economy. For example, what the name of the company is, how much workers are getting paid."

2.9 Stock-take: ensuring fairness and transparency in gig work

Stakeholders generally indicated that the main areas where policy responses could serve to improve outcomes for gig workers include:

- collective voice

- fairness, and

- transparency in the gig economy

While stakeholders generally agreed on the importance of collective voice, differences exist between unions, workers advocacy organizations, and employers in terms of whether they see concerted activity protections as a potential solution to the lack of protected channels of worker voice in the gig economy. Many stakeholders also recognized that there are issues with fairness and transparency that are unique to digital platform work, but many agreed that these issues are symptoms of larger problems such as misclassification and low bargaining power. Labour stakeholders agreed that any transparency initiative aimed at digital platforms should be part of a broader strategy to improve protections for gig workers.

Improving information quality on the gig economy

All participants in the consultation process voiced concerns over the quality of statistical information and data on the gig economy, and on gig workers more specifically. While data on the gig economy is improving over time as Statistics Canada supplements and develops statistical products and data strategies that better capture gig work, there remain significant information gaps. These gaps contribute to an imprecise understanding of the breadth of the gig economy, the people who engage in it, and the challenges that they face.

Representatives of provincial and territorial governments also expressed a need for better data on the gig economy to support them as they explore policy interventions of their own to better protect gig workers operating in provincially regulated sectors. In particular, these representatives advocated for developing a standard definition of gig work, so that vulnerable gig workers can be better distinguished from successful self-employed entrepreneurs. This would help target policy interventions towards more vulnerable forms of work in the gig economy.

Some stakeholders also suggested that existing statistical sources may underestimate the extent of gig work, especially in more marginalized communities. An Indigenous organisation noted that the data presented by the Labour Program during the consultation process may not capture the total number of Indigenous peoples who engage in gig work, particularly Inuit women's participation in the gig economy.

"While Pauktuutit does not maintain any independent data with respect to Inuit women in the gig economy, anecdotally we would suggest that the available data sources do not adequately capture the breadth and scope of their participation. For example, there are many Inuit women working as performers, seamstresses, and other artists who fit the definition of gig workers."

One union representative noted that better quality data on the gig economy would also allow for a better understanding of specific challenges faced by equity-seeking groups in the gig economy, for example:

- women

- persons with disabilities

- Indigenous persons, and

- racialized persons

All participants in the consultations process supported proposals to develop better statistical products, which would help inform ongoing policy work on the gig economy.

3. Next steps

We are grateful to the individuals and organizations who took the time to share their experiences with the gig economy, and to provide feedback and ideas on how we can best protect gig workers in the changing world of work. The Government is committed to making changes to the Code and to pursuing other non-legislative initiatives to ensure that workers in the gig economy have the labour protections they need. As we move forward, we will carefully consider what we heard during these consultations.

Annex A: Consultations overview

Public and stakeholder consultations on the Minister's mandate commitment to develop greater labour protections for gig workers were held from February 2021 to July 2021, and December 2022. In the months leading up to the consultations, Labour Program officials conducted over 30 interviews with subject matter experts and academics to better understand the challenges and opportunities in Canada's gig economy.

Between February 4, 2021 and April 30, 2021, Labour Program officials undertook the first phase of consultations with the public and key stakeholders. The first phase focused on better understanding issues faced by gig workers and gathering recommendations for improving labour protections. It included:

- roundtable discussions with stakeholders hosted by the Labour Program

- an online public consultation through Engagement Headquarters (EHQ) activities such as quick polls, discussion forums and shared stories

- written submissions from stakeholders and the public, and

- consultations with employers through an online survey aimed at better understanding ways and reasons for contracting gig workers

More specifically:

- online EHQ consultations: Between March 18, 2021 and April 30, 2021, Canadians were invited to share their views on gig work, and a "right to disconnect" and its potential benefits for federally regulated workers. During the time the EHQ platform was online, there were 530 visits to the discussion questions on gig work. Among the visitors:

- 55 individuals answered questions related to working for digital platforms operating in Canada

- 67 provided ideas for potential changes that could be made to the Canada Labour Code to improve labour protections for gig workers, and

- 41 offered feedback on what kind of impact greater labour protections would have on gig workers and employers

- written submissions: During the first phase of consultations, Labour Program officials received 23 written submissions from stakeholders. Of these, 8 were submitted by employers, 6 by unions, 2 by worker advocacy groups, 3 by Indigenous organizations, and 4 by other groups (2 law firms, a public policy forum, and a research institute)

- employer survey: Between April 2021 and May 2021, Labour Programs officials surveyed employers to better understand ways and reasons for hiring self-employed contractors, including gig workers. In total, 511 employers responded to the survey

- a clear majority of respondents (91%) indicated belonging to the federal sector. Half of the federally regulated employers self-identified as being part of the road transportation sector, with other sizeable groups of respondents in the air transportation sector (16%) and telecommunications (12%)

- eighty-four percent (84%) of respondents indicated having a total workforce of under 100 employees and/or contractors, 40% reported having less than 20 workers, and 44% reported having between 21 and 99 workers

- just under half (45%) of all employers indicated hiring self-employed contractors, including gig workers. Among employers who hire self-employed contractors, roughly a quarter (27%) do so only occasionally to meet changing seasonal demand or to complete tasks or projects for which required skills are not available internally. For most employers who hire self-employed contractors (58%), such workers represent only a small fraction (less than 10%) of their total workforce.

In the second phase of consultations, between June and July 2021, Labour Program officials hosted 3 roundtables with stakeholders (one with unions and labour organisations; 2 with employer representatives from different industries) and 3 bilateral meetings with Indigenous organisations to obtain feedback on a discussion paper outlining a set of preliminary policy options. Following these roundtable discussions, Labour Program officials received 6 additional written submissions from stakeholders (4 from unions, 1 from a legal clinic, and 1 from an employer representative) offering more detailed input on the preliminary options.

In the third and final phase of consultations in December 2022, Labour program officials hosted one roundtable discussion and several bilateral engagements with some individual stakeholders. Participants in the roundtable discussion included federally regulated stakeholders, including some groups that had not participated in the previous rounds of consultations. Labour Program officials also held bilateral meetings with the Canadian Trucking Alliance, Uber/Uber Freight, SkipTheDishes, Doordash and Lyft.

Annex B: Written submissions

The following 25 organizations made written submissions (4 organizations submitted 2 submissions) as part of the consultations on the minister of labour mandate letter commitment:

- employer organizations:

- Canadian Bankers Association (CBA)

- Canadian Chamber of Commerce (CCC)

- Canadian Federation of Independent Business (CFIB)

- Canadian Trucking Alliance (CTA)

- Direct Sellers Association of Canada (DSA)

- DoorDash

- Halifax Employers Association (HEA)

- Tourism Industry Association of Canada (TIAC)

- workers advocacy groups:

- Ridefair Toronto

- Parkdale Community Legal Services

- Worker's Health and Safety Legal Clinic

- unions:

- Canada Labour Congress (CLC)

- Canadian Union of Postal Workers (CUPW)

- Gig Workers United (supported by CUPW)

- International Association of Machinists and Aerospace Workers (IAMAW)

- International Longshore and Warehouse Union (ILWU)

- Public Service Alliance of Canada (PSAC)

- United Food and Commercial Workers (UFCW)

- National Indigenous Organizations (NIO'S)

- Native Women's Association of Canada (NWAC)

- Pauktuutit Inuit Women of Canada

- Women of the Métis Nation – Les Femmes Michif Otipemisiwak (LFMO)

- others:

- Action Canada

- Canadian Bar Association

- Canadian Poverty Institute

- Goldblatt Partners

Annex C: Roundtable discussions and bilateral meetings

A total of 49 stakeholders participated in roundtable meetings and bilateral meetings held as part of consultations on developing greater labour protections for workers. They represented the following organizations:

- unions and labour organizations:

- Alliance of Canadian Cinema, Television and Radio Artists(ACTRA)

- Canadian Association of Journalists

- Canadian Labour Congress (CLC)

- Canadian Union of Public Employees (CUPE)

- Canadian Union of Postal Workers (CUPW)

- Fédération des Travailleurs et Travailleuses du Québec (FTQ)

- Gig Workers United (supported by CUPW)

- International Association of Machinist and Aerospace Workers(IAMAW)

- International Longshore and Warehouse Union (ILWU)

- Parkdale Community Legal Clinic

- Public Service Alliance of Canada (PSAC)

- Seafarers International Union

- Teamsters

- Unifor

- United Food & Commercial Workers (UFCW)

- Women's Trucking Federation of Canada

- employers and employer organizations:

- Armour Transportation Systems

- Atlantic Provinces Trucking Association

- Bank of Montréal

- BC Maritime Employers Association

- Bison Transport

- C.A.T.

- Canadian Association of Broadcasters

- Canadian Bankers Association

- Canadian Broadcasting Corporation (CBC)

- Canadian Federation of Independent Businesses (CFIB)

- Canadian Payroll Association (CPA)

- Canadian Trucking Alliance (CTA)

- Challenger Motor Freight

- Direct Sellers Association (DSA)

- ERB Transport

- Fedex

- Federally Regulated Employers – Transportation and Communications (FETCO)

- Manitoulin Transport

- National Airlines Council of Canada (NACC)

- National Bank

- Tandel

- Trucking HR Canada

- UPS

- Western Transportation Advisory Council

- digital Platforms:

- Uber/Uber Freight

- SkipTheDishes

- Doordash

- Lyft

- National Indigenous Organizations (NIOs):

- Native Women's Association of Canada (NWAC)

- Pauktuutit Inuit Women of Canada

- Women of the Métis Nation – Les Femmes Michif Otipemisiwak (LFMO)

- others:

- Canadian Poverty Institute

- Goldblatt Partners