Employment Insurance Monitoring and Assessment Report for the fiscal year beginning April 1, 2017 and ending March 31, 2018

Annex 2: Employment Insurance benefits data tables

-

Annex 2.1 Employment Insurance benefits - Concepts and definitions

Chapter II and Annex 2 provide information on the numbers of new claims established, the average actual duration, the average weekly benefit rate, the amount paid in benefits, employment insurance claimant categories (long-tenured workers, occasional claimants, frequent claimants), seasonal regular claimants and claim status (active, open, completed, terminated, dormant and combined). These concepts are defined below.

Concept Definition New claims established New claims established refer to new Employment Insurance claims that have been received, processed and approved by Employment and Social Development Canada (via Service Canada) for which at least $1 in benefits was paid to an Employment Insurance claimant.

To avoid double counting, each claim established is counted only once. Thus, a claim that was established, for example, in November 2016 (i.e. in FY1617) and for which benefits paid to an Employment Insurance claimant began in December 2016 (i.e. in FY1617) and ended in June 2017 (i.e. in FY1718) is included in the FY1617 statistics, but is not counted in the FY1718 statistics.

New claims established designate a different concept from new applications submitted to Employment and Social Development Canada (and received by the organization). An application may be submitted, but not necessarily established. This is the case, for example, when the application is rejected because not all of the eligibility requirements are met.

It should be noted that the number of new claims established during a fiscal year does not necessarily correspond to the number of new Employment Insurance claimants because a claimant can have more than one Employment Insurance claim established annually.

New claims established are also referred to under other names such as: new claims established, benefits, claims and claims established. The terms "new," "benefits" and "established" are sometimes omitted so as not to complicate the text. In all cases, these terms refer to the same concept.Average actual duration The average actual duration of Employment Insurance claims refers, in regard to these claims, to the average number of weeks of benefits per claim during which at least one dollar in benefits was paid to an Employment Insurance claimant. For claims associated with most benefits types, the average actual duration is calculated by dividing the sum of the number of weeks of benefits during which at least one dollar was paid per claim by the number of claims that were completed based on the variable assessed (that is, the average actual duration for Ontario is equal to the sum of the number of weeks of benefits paid in Ontario for all claims completed during a fiscal year divided by the number of claims that were completed in Ontario during the same period.

Average actual duration for claims for Employment Insurance fishing benefits, Work-Sharing benefits and family caregiver benefits for children are calculated using claims established during the reference period rather than claims completed during the reference period.

The average actual duration is a different concept than the average maximum duration: the latter is the maximum number of weeks during which benefits may be paid (under sections 12 and 152.14 of the Employment Insurance Act, and Section 8 of the Employment Insurance (Fishing) Regulations), while the former is the number of weeks for which benefits are actually paid.Average weekly benefit rate The average weekly benefit rate, or level of EI benefits, refers to the rate of weekly benefits payable on average for an Employment Insurance claim.

The average weekly benefit rate is calculated by dividing the sum of the weekly benefit rate of each claim by the number of claims that were established.

The Family Supplement is always included in the calculation of the average weekly benefit rate, unless otherwise specified.

The average weekly benefit rate is not necessarily equal to the amount of benefits actually paid on average per claim established. The amount paid may be less than the benefit rate, especially if the weekly benefits are reduced because the claimant worked while on claim (for more information, see subsection 2.2.8 of Chapter II relating to the Working While on Claim provision).Amount paid The amount paid refers to the sum of benefit payments that claimants who have established an Employment Insurance claim have received. In other words, it is the value of Employment Insurance benefits that were paid to Employment Insurance claimants. The amount paid is always reported on a cash basis, meaning that they are reported in the year in which they were paid regardless of when the claim was established. Thus, the amount paid in benefits to an Employment Insurance claimant who, for example, had a claim established in November 2016 (i.e. in FY1617) and received payment starting in December 2016 (i.e. in FY1617) and ending in June 2017 (i.e. in FY1718) are included in the fiscal year statistics for FY1617 and FY1718. If this claimant received $200 per week for 17 weeks between December 2016 and March 2017, and $200 per week for 12 weeks between April and June 2017, an amount of $3,400 will be allocated to FY1617 and $2,400 will be allocated to FY1718. Long-Tenured workers Long-Tenured workers are Employment Insurance (EI) claimants who have paid at least 30% of the maximum annual EI premiums in 7 of the past 10 years and who, over the last five years, have collected EI regular or fishing benefits for 35 weeks or less. Frequent claimants Frequent claimants are EI claimants who have had three or more EI regular or fishing claims and have collected benefits for a total of more than 60 weeks in the past five years. Occasional claimants Occasional claimants are EI claimants who do not meet the requirements for either long-tenured workers or frequent claimants. Seasonal claimants Seasonal claimants are individuals who established three or more regular or fishing claims in the five fiscal years preceding the reference year, of which at least two were established at the same time of year as their claim in the reference year.

A claim is considered to have been established at the same time of year if it was established between eight weeks before and eight weeks after the week in which the reference year claim was established.Active claims Active claims are claims for which benefits are still being paid during the reference period.

With regards to the subsection 2.2.4 Extension of Employment Insurance regular benefits for workers in regions affected by the downturn in commodity prices, active claims represent those that were established after January 4, 2015 in the 15 EI economic regions targeted by the Budget Implementation Act, 2016, No.1 and that were still open by the time the implementation act came into effect on July 3, 2016.Open claims Open claims are those for which the claimants are still receiving or still can receive EI benefits. Completed claims Completed claims refer to claims that are terminated and those that are dormant. Terminated claims Terminated claims are those that have ended and for which claimants are no longer eligible to receive Employment Insurance benefits. The main reasons associated with the termination of claims is either that all weeks of benefits the claimant was entitled to be paid or that the claim reached the last week of the benefit period, that is the last week for which Employment Insurance benefits could be paid. Dormant claims Dormant claims are those that, as of August of the reference year following the reporting fiscal year, are open but are not active. Combined or mixed claims A combined or mixed claim refers to an Employment Insurance claim for which the claimant receives more than one type of benefit during the claimant’s benefit period. The eight types of benefits available under the Employment Insurance program as stipulated in Chapter II and Annex 2 are: regular benefits, fishing benefits, maternity benefits, parental benefits, sickness benefits, compassionate care benefits, family caregiver benefit for adults, family caregiver benefit for children and Work-Sharing benefits. Regular and fishing benefits can never be combined in the same claim.

A claim for which a claimant receives both regular benefits and maternity benefits during its benefit period is treated as two separate claims in cases where information on regular benefits or maternity benefits is reported separately (as in the case of Annexes 2.5 and 2.14, which report data on the two types of benefits separately; in this example, each of the two annexes would add one claim to its totals). Conversely, if aggregated information is presented, the claim is considered a single claim (as in the case of Annex 2.3, which presents data on all Employment Insurance benefits). -

Annex 2.2 Employment Insurance maximum number of benefit weeks entitlement

Employment Insurance maximum number of benefit weeks entitlement Number of hours of insurable employment in qualifying period Regional rate of unemployment 6% and under More than 6% but not more than 7% More than 7% but not more than 8% More than 8% but not more than 9% More than 9% but not more than 10% More than 10% but not more than 11% More than 11% but not more than 12% More than 12% but not more than 13% More than 13% but not more than 14% More than 14% but not more than 15% More than 15% but not more than 16% More than 16% 420-454 0 0 0 0 0 0 0 0 26 28 30 32 455-489 0 0 0 0 0 0 0 24 26 28 30 32 490-524 0 0 0 0 0 0 23 25 27 29 31 33 525-559 0 0 0 0 0 21 23 25 27 29 31 33 560-594 0 0 0 0 20 22 24 26 28 30 32 34 595-629 0 0 0 18 20 22 24 26 28 30 32 34 630-664 0 0 17 19 21 23 25 27 29 31 33 35 665-699 0 15 17 19 21 23 25 27 29 31 33 35 700-734 14 16 18 20 22 24 26 28 30 32 34 36 735-769 14 16 18 20 22 24 26 28 30 32 34 36 770-804 15 17 19 21 23 25 27 29 31 33 35 37 805-839 15 17 19 21 23 25 27 29 31 33 35 37 840-874 16 18 20 22 24 26 28 30 32 34 36 38 875-909 16 18 20 22 24 26 28 30 32 34 36 38 910-944 17 19 21 23 25 27 29 31 33 35 37 39 945-979 17 19 21 23 25 27 29 31 33 35 37 39 980-1,014 18 20 22 24 26 28 30 32 34 36 38 40 1,015-1,049 18 20 22 24 26 28 30 32 34 36 38 40 1,050-1,084 19 21 23 25 27 29 31 33 35 37 39 41 1,085-1,119 19 21 23 25 27 29 31 33 35 37 39 41 1,120-1,154 20 22 24 26 28 30 32 34 36 38 40 42 1,155-1,189 20 22 24 26 28 30 32 34 36 38 40 42 1,190-1,224 21 23 25 27 29 31 33 35 37 39 41 43 1,225-1,259 21 23 25 27 29 31 33 35 37 39 41 43 1,260-1,294 22 24 26 28 30 32 34 36 38 40 42 44 1,295-1,329 22 24 26 28 30 32 34 36 38 40 42 44 1,330-1,364 23 25 27 29 31 33 35 37 39 41 43 45 1,365-1,399 23 25 27 29 31 33 35 37 39 41 43 45 1,400-1,434 24 26 28 30 32 34 36 38 40 42 44 45 1,435-1,469 25 27 29 31 33 35 37 39 41 43 45 45 1,470-1,504 26 28 30 32 34 36 38 40 42 44 45 45 1,505-1,539 27 29 31 33 35 37 39 41 43 45 45 45 1,540-1,574 28 30 32 34 36 38 40 42 44 45 45 45 1,575-1,609 29 31 33 35 37 39 41 43 45 45 45 45 1,610-1,644 30 32 34 36 38 40 42 44 45 45 45 45 1,645-1,679 31 33 35 37 39 41 43 45 45 45 45 45 1,680-1,714 32 34 36 38 40 42 44 45 45 45 45 45 1,715-1,749 33 35 37 39 41 43 45 45 45 45 45 45 1,750-1,784 34 36 38 40 42 44 45 45 45 45 45 45 1,785-1,819 35 37 39 41 43 45 45 45 45 45 45 45 1,820+ 36 38 40 42 44 45 45 45 45 45 45 45 Source: Employment Insurance Act, Schedule I.

-

Annex 2.3 Employment Insurance benefits

Annex 2.3.1 Employment Insurance benefits: New claims established1 Province or territory FY1314 FY1415 FY1516 FY1617 FY1718 Change (%) FY1617 to FY1718 Newfoundland and Labrador 82,040 81,230 85,910 74,000 81,090 +9.6 Prince Edward Island 21,330 21,950 22,140 22,540 22,720 +0.8 Nova Scotia 78,610 79,550 82,410 82,710 85,300 +3.1 New Brunswick 85,620 85,020 88,670 88,910 91,130 +2.5 Quebec 492,840 491,160 496,680 483,700 482,990 -0.1 Ontario 572,990 561,200 569,620 552,030 562,570 +1.9 Manitoba 56,620 57,000 64,660 59,250 61,440 +3.7 Saskatchewan 44,400 47,840 57,110 49,850 51,250 +2.8 Alberta 146,070 169,840 235,470 201,610 170,270 -15.5 British Columbia 205,300 208,320 216,790 197,770 200,820 +1.5 Yukon 2,560 2,450 2,410 2,300 2,200 -4.3 Northwest Territories 2,310 2,250 2,320 2,380 2,420 +1.7 Nunavut 1,260 990 1,230 1,290 1,340 +3.9 Gender Men 976,920 994,200 1,075,810 984,150 974,660 -1.0 Women 815,030 814,600 849,610 834,190 840,880 +0.8 Age 24 years old and under 182,350 181,910 194,270 178,010 172,810 -2.9 25 to 44 years old 860,520 871,570 933,430 883,950 876,270 -0.9 45 to 54 years old 399,020 391,140 402,020 370,360 363,410 -1.9 55 years old and over 350,060 364,180 395,700 386,020 403,050 +4.4 EI claimant category2 Long-tenured workers 461,460 412,320 600,900 543,960 525,560 -3.4 Occasional claimants 991,310 1,063,380 988,250 960,300 970,360 +1.0 Frequent claimants 339,180 333,100 336,270 314,080 319,620 +1.8 Canada 1,791,950 1,808,800 1,925,420 1,818,340 1,815,540 -0.2 - Note: Includes claims for which at least $1 of EI benefits was paid.

- 1 Excludes Parents of Critically Ill Children/Caregiver benefits due to the incompatibility of administrative data sources.

- 2 See Annex 2.1 for definitions related to EI claimant categories.

- Source: Employment and Social Development Canada, Employment Insurance (EI) administrative data. Data are based on a 10% sample of EI administrative data.

Annex 2.3.2 – Employment Insurance benefits: Average weekly benefit rate1,2 ($) Province or territory FY1314 FY1415 FY1516 FY1617 FY1718 Change (%) FY1617 to FY1718 Newfoundland and Labrador 422 435 448 445 456 +2.5 Prince Edward Island 403 416 428 432 436 +1.0 Nova Scotia 404 419 425 426 431 +1.0 New Brunswick 402 412 424 426 431 +1.3 Quebec 409 420 428 433 443 +2.2 Ontario 419 431 441 451 458 +1.7 Manitoba 408 422 435 440 444 +0.9 Saskatchewan 432 452 466 465 467 +0.5 Alberta 453 472 486 485 487 +0.4 British Columbia 416 429 442 447 454 +1.7 Yukon 472 474 490 498 502 +0.9 Northwest Territories 489 495 505 510 519 +1.9 Nunavut 464 469 472 485 501 +3.2 Gender Men 443 457 469 473 480 +1.5 Women 387 398 409 416 422 +1.5 Age 24 years old and under 380 394 407 400 403 +0.8 25 to 44 years old 429 442 455 460 467 +1.4 45 to 54 years old 420 434 446 452 460 +1.7 55 years old and over 405 417 428 433 440 +1.6 EI claimant category3 Long-tenured workers 453 468 477 485 490 +1.0 Occasional claimants 397 414 419 422 429 +1.7 Frequent claimants 428 439 449 457 467 +2.2 Canada 417 431 443 447 453 +1.5 - Note: Percentage change is based on unrounded numbers. Includes claims for which at least $1 of EI benefits was paid.

- 1 Excludes Parents of Critically Ill Children/Caregiver benefits due to the incompatibility of administrative data sources.

- 2 Takes into account Family Supplement top-ups paid to Employment Insurance claimants.

- 3 See Annex 2.1 for definitions related to EI claimant categories.

- Source: Employment and Social Development Canada, Employment Insurance (EI) administrative data. Data are based on a 10% sample of EI administrative data.

Annex 2.3.3 – Employment Insurance benefits: Amount paid1 ($ million) Province or territory FY1314 FY1415 FY1516 FY1617 FY1718 Change (%) FY1617 to FY1718 Newfoundland and Labrador 837.8 862.8 958.6 1,040.2 1,185.2 +13.9 Prince Edward Island 200.0 211.4 228.1 230.7 248.1 +7.5 Nova Scotia 738.7 748.1 833.0 841.3 892.2 +6.0 New Brunswick 828.0 824.0 904.0 919.0 954.0 +3.8 Quebec 3,374.2 3,507.1 3,649.7 3,430.7 3,558.2 +3.7 Ontario 5,241.9 5,270.5 5,478.3 5,443.2 5,657.7 +3.9 Manitoba 482.8 498.2 573.4 587.3 631.3 +7.5 Saskatchewan 413.9 437.4 572.7 671.5 700.9 +4.4 Alberta 1,383.6 1,507.0 2,362.3 3,158.3 2,655.3 -15.9 British Columbia 1,798.0 1,862.8 2,031.1 2,064.2 2,089.5 +1.2 Yukon 29.5 30.4 25.9 27.3 27.8 +1.6 Northwest Territories 31.4 29.3 28.8 29.9 30.9 +3.2 Nunavut 18.1 15.1 16.2 17.6 23.6 +33.9 Gender Men 7,872.5 8,088.4 9,411.7 9,868.8 9,678.0 -1.9 Women 7,505.4 7,715.7 8,250.3 8,592.2 8,976.6 +4.5 Age 24 years old and under 1,319.7 1,316.1 1,523.7 1,522.2 1,443.0 -5.2 25 to 44 years old 8,281.6 8,525.3 9,497.1 9,869.4 9,908.0 +0.4 45 to 54 years old 3,050.6 3,069.2 3,341.4 3,450.0 3,431.5 -0.5 55 years old and over 2,726.1 2,893.5 3,299.8 3,619.4 3,872.1 +7.0 EI claimant category2 Long-tenured workers 4,424.0 3,919.7 5,516.7 6,220.4 5,890.2 -5.3 Occasional claimants 7,860.5 8,774.0 8,877.8 9,048.8 9,288.2 +2.6 Frequent claimants 3,093.3 3,110.4 3,267.6 3,191.8 3,476.3 +8.9 Canada 15,377.9 15,804.1 17,662.0 18,461.0 18,654.7 +1.0 - Note: Data may not add up to the total due to rounding. Percentage change is based on unrounded numbers. Includes claims for which at least $1 of EI benefits was paid.

- 1 Excludes Parents of Critically Ill Children/Caregiver benefits due to the incompatibility of administrative data sources.

- 2 See Annex 2.1 for definitions related to EI claimant categories.

- Source: Employment and Social Development Canada, Employment Insurance (EI) administrative data. Data are based on a 10% sample of EI administrative data.

-

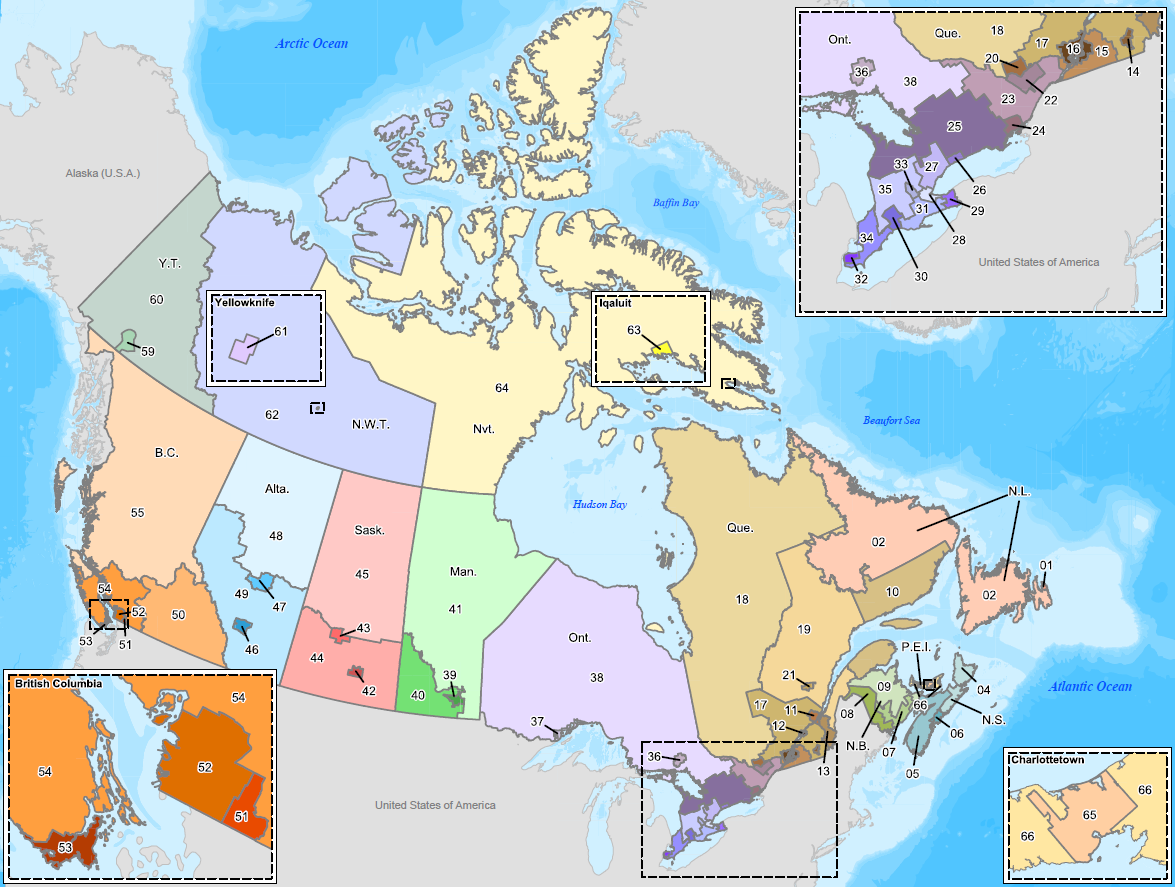

Annex 2.4 Employment Insurance benefits (by Employment Insurance economic region)

Annex 2.4.1 – Employment Insurance benefits by EI economic region1: New claims established EI economic region FY1314 FY1415 FY1516 FY1617 FY1718 Change (%) FY1617 to FY1718 Newfoundland and Labrador St. John's 13,990 14,810 16,190 16,210 16,620 +2.5 Newfoundland - Labrador 68,050 66,420 69,720 57,790 64,470 +11.6 Prince Edward Island Prince Edward Island2 21,330 9,530 n/a n/a n/a n/a Charlottetown2 n/a 2,960 5,470 5,860 5,570 -4.9 Prince Edward Island2 n/a 9,460 16,670 16,680 17,150 +2.8 Nova Scotia Eastern Nova Scotia 27,010 27,660 28,370 28,580 30,060 +5.2 Western Nova Scotia 34,090 33,860 35,120 34,740 35,660 +2.6 Halifax 17,510 18,030 18,920 19,390 19,580 +1.0 New Brunswick Fredericton-Moncton-Saint-John 26,370 26,280 28,070 27,670 28,250 +2.1 Madawaska-Charlotte 14,520 14,250 14,270 13,880 14,380 +3.6 Restigouche-Albert 44,730 44,490 46,330 47,360 48,500 +2.4 Quebec Gaspésie-Îles-de-la-Madeleine 27,240 26,520 27,320 27,780 27,900 +0.4 Quebec 39,040 40,290 40,400 38,730 40,490 +4.5 Trois-Rivières 10,700 9,900 10,060 9,550 9,650 +1.0 South Central Quebec 10,590 9,760 9,190 9,950 8,780 -11.8 Sherbrooke 9,690 10,850 10,060 9,870 10,150 +2.8 Montérégie 31,260 30,970 33,220 32,400 31,710 -2.1 Montréal 176,260 176,270 179,760 174,100 174,490 +0.2 Central Quebec 87,370 87,010 87,800 86,170 86,950 +0.9 North Western Quebec 22,690 23,260 22,520 21,010 21,210 +1.0 Bas-Saint-Laurent-Côte-Nord 52,600 49,550 50,290 49,020 47,100 -3.9 Hull 12,860 13,420 13,320 12,980 12,630 -2.7 Chicoutimi-Jonquière 12,540 13,360 12,740 12,140 11,930 -1.7 Ontario Ottawa 33,380 33,180 34,370 33,210 32,610 -1.8 Eastern Ontario 26,590 26,590 27,780 26,630 26,410 -0.8 Kingston 5,790 5,730 5,110 5,520 5,140 -6.9 Central Ontario 60,790 58,200 61,340 60,350 59,150 -2.0 Oshawa 17,820 17,890 17,760 17,770 18,760 +5.6 Toronto 213,260 207,290 211,410 205,510 204,230 -0.6 Hamilton 29,520 29,230 29,400 29,650 29,240 -1.4 St. Catharines 22,220 19,580 20,760 20,330 20,380 +0.2 London 20,550 19,400 18,920 19,270 20,780 +7.8 Niagara 17,410 17,520 18,080 17,240 17,280 +0.2 Windsor 14,420 19,480 13,630 12,200 19,440 +59.3 Kitchener 22,420 20,450 20,340 20,980 21,820 +4.0 Huron 17,680 17,570 17,710 20,100 19,450 -3.2 South Central Ontario 19,740 18,560 19,210 19,310 21,680 +12.3 Sudbury 8,150 7,870 8,760 7,290 7,430 +1.9 Thunder Bay 6,440 6,510 6,540 6,000 6,370 +6.2 Northern Ontario 36,810 36,150 38,500 30,670 32,400 +5.6 Manitoba Winnipeg 31,920 31,990 36,060 32,910 34,580 +5.1 Southern Manitoba 15,060 15,120 18,200 17,150 17,180 +0.2 Northern Manitoba 9,640 9,890 10,400 9,190 9,680 +5.3 Saskatchewan Regina 7,800 8,510 9,830 10,260 10,470 +2.0 Saskatoon 11,360 12,220 14,780 13,940 13,430 -3.7 Southern Saskatchewan 11,660 13,080 15,310 12,210 12,750 +4.4 Northern Saskatchewan 13,580 14,030 17,190 13,440 14,600 +8.6 Alberta Calgary 46,710 54,040 74,310 63,390 55,710 -12.1 Edmonton 50,510 57,710 81,150 67,740 61,260 -9.6 Northern Alberta 12,180 14,890 20,620 22,770 13,900 -39.0 Southern Alberta 36,670 43,200 59,390 47,710 39,400 -17.4 British Columbia Southern Interior British Columbia 38,040 38,600 43,030 36,590 36,700 +0.3 Abbotsford 11,120 10,690 10,790 11,090 10,750 -3.1 Vancouver 91,040 90,310 90,370 84,900 87,510 +3.1 Victoria 12,560 12,660 12,990 12,090 12,870 +6.5 Southern Coastal British Columbia 30,310 30,380 32,410 31,280 30,000 -4.1 Northern British Columbia 22,230 25,680 27,200 21,820 22,990 +5.4 Territories Yukon2 2,560 1,120 n/a n/a n/a n/a Whitehorse2 n/a 740 1,560 1,420 1,340 -5.6 Yukon (excluding Whitehorse)2 n/a 590 850 880 860 -2.3 Northwest Territories2 2,310 1,330 n/a n/a n/a n/a Yellowknife2 n/a 310 810 870 840 -3.4 Northwest Territories (excluding Yellowknife)2 n/a 610 1,510 1,510 1,580 +4.6 Nunavut2 1,260 510 n/a n/a n/a n/a Iqualuit2 n/a 100 300 230 320 +39.1 Nunavut (excluding Iqaluit)2 n/a 380 930 1,060 1,020 -3.8 Canada 1,791,950 1,808,800 1,925,420 1,818,340 1,815,540 -0.2 - Note: Includes claims for which at least $1 of EI benefits was paid.

- 1 Excludes Parents of Critically Ill children/Caregiver benefits due to incompatibility of administrative data sources

- 2 As of October 12, 2014, there is a total of 62 EI economic regions, instead of 58 regions. The EI economic regions of Prince Edward Island, Yukon, the Northwest Territories and Nunavut were each divided into two EI economic regions, one consisting of the capital area and the remaining consisting of the non-capital area.

- Source: Employment and Social Development Canada, Employment Insurance (EI) administrative data. Data are based on a 10% sample of EI administrative data.

Annex 2.4.2 – Employment Insurance benefits by EI economic region: Average weekly benefit rate1,2 ($) EI economic region FY1314 FY1415 FY1516 FY1617 FY1718 Change (%) FY1617 to FY1718 Newfoundland and Labrador St. John's 430 441 456 464 463 -0.3 Newfoundland - Labrador 421 434 447 440 454 +3.3 Prince Edward Island Prince Edward Island3 403 409 n/a n/a n/a n/a Charlottetown3 n/a 402 413 406 405 -0.2 Prince Edward Island3 n/a 428 433 441 446 +1.3 Nova Scotia Eastern Nova Scotia 419 435 439 440 446 +1.3 Western Nova Scotia 392 407 413 416 418 +0.6 Halifax 405 415 426 425 431 +1.4 New Brunswick Fredericton-Moncton-Saint-John 392 403 414 416 424 +1.9 Madawaska-Charlotte 391 398 411 411 420 +2.2 Restigouche-Albert 413 421 434 436 439 +0.6 Quebec Gaspésie-Îles-de-la-Madeleine 421 432 437 443 451 +1.8 Quebec 417 427 435 441 454 +3.1 Trois-Rivières 400 409 415 419 436 +3.8 South Central Quebec 406 419 429 437 443 +1.4 Sherbrooke 403 412 418 430 435 +1.0 Montérégie 403 415 424 432 439 +1.7 Montréal 407 419 427 433 442 +2.2 Central Quebec 401 412 420 426 436 +2.5 North Western Quebec 417 428 433 438 446 +1.7 Bas-Saint-Laurent-Côte-Nord 417 425 433 435 445 +2.4 Hull 422 431 439 452 458 +1.3 Chicoutimi-Jonquière 408 422 423 427 437 +2.1 Ontario Ottawa 435 448 455 465 468 +1.0 Eastern Ontario 409 424 431 441 440 -0.1 Kingston 409 425 421 437 441 +1.1 Central Ontario 407 419 432 444 448 +0.9 Oshawa 429 449 452 466 475 +2.1 Toronto 422 433 445 455 464 +2.1 Hamilton 425 433 444 455 464 +2.1 St. Catharines 399 409 413 428 434 +1.4 London 414 426 427 439 450 +2.6 Niagara 411 425 438 444 455 +2.7 Windsor 404 448 437 433 467 +8.1 Kitchener 427 438 444 458 459 +0.4 Huron 414 421 435 441 449 +1.9 South Central Ontario 418 429 440 455 461 +1.2 Sudbury 426 434 453 453 455 +0.7 Thunder Bay 438 439 459 467 474 +1.6 Northern Ontario 424 432 445 442 451 +2.1 Manitoba Winnipeg 411 425 436 448 447 0.0 Southern Manitoba 401 416 434 432 441 +2.1 Northern Manitoba 410 417 435 428 438 +2.6 Saskatchewan Regina 448 457 466 480 476 -0.7 Saskatoon 434 459 466 469 471 +0.5 Southern Saskatchewan 421 444 464 459 468 +1.8 Northern Saskatchewan 429 450 467 455 457 +0.7 Alberta Calgary 456 473 485 484 485 +0.4 Edmonton 458 474 489 492 495 +0.9 Northern Alberta 462 484 494 498 494 -0.5 Southern Alberta 440 465 479 472 475 +0.7 British Columbia Southern Interior British Columbia 422 434 450 443 455 +2.9 Abbotsford 366 383 391 407 409 +0.6 Vancouver 413 424 435 451 456 +1.2 Victoria 426 436 450 453 463 +2.2 Southern Coastal British Columbia 419 433 444 443 451 +1.9 Northern British Columbia 438 454 467 459 467 +1.8 Territories Yukon3 472 471 n/a n/a n/a n/a Whitehorse3 n/a 478 485 504 503 -0.1 Yukon (excluding Whitehorse)3 n/a 474 498 487 501 +2.7 Northwest Territories3 489 488 n/a n/a n/a n/a Yellowknife3 n/a 499 505 511 523 +2.4 Northwest Territories (excluding Yellowknife)3 n/a 507 506 509 517 +1.6 Nunavut3 464 464 n/a n/a n/a n/a Iqualuit3 n/a 497 499 524 517 -1.4 Nunavut (excluding Iqaluit)3 n/a 470 463 477 496 +5.3 Canada 417 431 443 447 453 +1.5 - Note: Percentage change is based on unrounded numbers. Includes claims for which at least $1 of EI benefits was paid.

- 1 Excludes Parents of Critically Ill children/Caregiver benefits due to incompatibility of administrative data sources

- 2 Takes into account Family Supplement top-ups paid to Employment Insurance claimants.

- 3 As of October 12, 2014, there is a total of 62 EI economic regions, instead of 58 regions. The EI economic regions of Prince Edward Island, Yukon, the Northwest Territories and Nunavut were each divided into two EI economic regions, one consisting of the capital area and the remaining consisting of the non-capital area.

- Source: Employment and Social Development Canada, Employment Insurance (EI) administrative data. Data are based on a 10% sample of EI administrative data.

Annex 2.4.3 – Employment Insurance benefits by EI economic region: Amount paid1 ($ million) EI economic region FY1314 FY1415 FY1516 FY1617 FY1718 Change (%) FY1617 to FY1718 Newfoundland and Labrador St. John's 120.1 130.5 146.2 167.4 191.6 +14.4 Newfoundland - Labrador 717.7 732.4 812.4 872.7 993.6 +13.8 Prince Edward Island Prince Edward Island2 200.0 153.1 13.1 n/a n/a n/a Charlottetown2 n/a 11.1 46.9 52.3 50.1 -4.3 Prince Edward Island2 n/a 47.1 168.1 178.4 198.0 +11.0 Nova Scotia Eastern Nova Scotia 286.6 286.4 328.9 335.5 362.0 +7.9 Western Nova Scotia 300.1 298.5 321.4 322.3 337.6 +4.8 Halifax 151.9 163.1 182.6 183.5 192.5 +4.9 New Brunswick Fredericton-Moncton-Saint-John 222.1 225.5 257.6 263.4 259.3 -1.5 Madawaska-Charlotte 132.3 120.5 125.2 117.1 124.6 +6.4 Restigouche-Albert 473.7 478.0 521.2 538.5 570.1 +5.9 Quebec Gaspésie-Îles-de-la-Madeleine 271.7 273.8 291.4 290.4 322.5 +11.1 Quebec 221.6 240.7 259.0 237.7 254.8 +7.2 Trois-Rivières 69.3 65.3 66.6 58.2 63.4 +9.0 South Central Quebec 53.1 57.6 57.0 53.5 51.9 -2.9 Sherbrooke 54.2 67.2 66.7 61.9 62.1 +0.2 Montérégie 188.1 195.7 218.8 207.6 210.1 +1.2 Montréal 1,211.3 1,289.1 1,331.2 1,273.9 1,288.5 +1.1 Central Quebec 566.1 569.7 585.3 533.1 596.1 +11.8 North Western Quebec 178.1 176.4 180.1 164.2 163.6 -0.3 Bas-Saint-Laurent-Côte-Nord 398.0 390.9 397.4 372.8 370.3 -0.7 Hull 80.0 89.7 95.1 91.9 91.4 -0.5 Chicoutimi-Jonquière 82.7 91.0 101.0 85.6 83.6 -2.4 Ontario Ottawa 322.4 333.4 352.9 341.9 344.7 +0.8 Eastern Ontario 207.6 217.3 238.4 229.5 231.2 +0.7 Kingston 48.4 51.4 46.0 48.1 47.7 -0.9 Central Ontario 485.5 487.6 503.2 505.7 541.4 +7.1 Oshawa 159.0 162.7 167.4 167.5 181.8 +8.5 Toronto 2,149.4 2,161.6 2,224.3 2,178.7 2,244.7 +3.0 Hamilton 251.7 258.6 275.6 275.9 289.9 +5.1 St. Catharines 171.9 164.1 163.1 168.8 174.3 +3.2 London 182.2 179.3 174.5 169.7 193.3 +13.9 Niagara 158.4 142.2 166.7 154.9 159.5 +3.0 Windsor 133.7 129.6 147.5 108.2 125.7 +16.2 Kitchener 197.0 202.2 194.7 199.1 210.4 +5.6 Huron 133.9 142.4 148.1 162.2 166.0 +2.4 South Central Ontario 169.8 165.2 169.4 177.3 189.2 +6.7 Sudbury 68.5 69.2 75.4 94.2 84.0 -10.8 Thunder Bay 48.5 54.5 55.9 55.3 57.3 +3.6 Northern Ontario 354.1 349.1 375.2 406.2 416.7 +2.6 Manitoba Winnipeg 271.3 272.4 321.0 312.1 332.4 +6.5 Southern Manitoba 112.5 122.1 143.0 152.5 155.0 +1.6 Northern Manitoba 99.0 103.6 109.3 122.6 144.0 +17.4 Saskatchewan Regina 71.1 76.8 93.7 106.6 118.0 +10.6 Saskatoon 99.8 111.3 144.1 177.0 187.0 +5.6 Southern Saskatchewan 99.0 106.2 142.8 169.9 170.9 +0.6 Northern Saskatchewan 144.0 143.0 192.2 217.9 225.0 +3.3 Alberta Calgary 474.1 510.1 786.2 1,057.4 917.0 -13.3 Edmonton 466.9 515.4 781.3 1,037.9 922.1 -11.2 Northern Alberta 122.6 139.3 225.5 323.4 236.9 -26.8 Southern Alberta 320.0 342.3 569.3 739.5 579.3 -21.7 British Columbia Southern Interior British Columbia 302.7 321.9 386.2 439.6 433.6 -1.4 Abbotsford 86.9 86.7 88.6 93.0 93.3 +0.4 Vancouver 834.7 852.0 866.0 830.6 867.7 +4.5 Victoria 113.4 115.5 124.0 119.8 119.5 -0.2 Southern Coastal British Columbia 250.2 258.9 297.7 279.6 281.9 +0.8 Northern British Columbia 210.0 227.9 268.6 301.6 293.4 -2.7 Territories Yukon2 29.5r 24.0r 2.7r n/a r n/a n/a Whitehorse2 n/a 3.2 14.3r 18.4r 19.0 +3.1 Yukon (excluding Whitehorse)2 n/a r 3.2r 9.0r 8.9r 8.8 -1.5 Northwest Territories2 31.4r 24.8r 3.6r n/a r n/a n/a Yellowknife2 n/a 1.2r 7.7r 10.1r 9.3 -7.3 Northwest Territories (excluding Yellowknife)2 n/a 3.3 17.5 19.8 21.5 +8.5 Nunavut2 18.1 12.8 1.3 n/a n/a n/a Iqualuit2 n/a 0.6 2.7 3.0 4.1 +36.4 Nunavut (excluding Iqaluit)2 n/a 1.7 12.1 14.6 19.5 +33.4 Canada 15,377.9 15,804.1 17,662.0 18,461.0 18,654.7 +1.0 - Note: Data may not add up to the total due to rounding. Percentage change is based on unrounded numbers. Includes claims for which at least $1 of EI benefits was paid.

- 1 Excludes Parents of Critically Ill Children/Caregiver benefits due to incompatibility of administrative data sources

- 2 As of October 12, 2014, there is a total of 62 Employment Insurance (EI) economic regions, instead of 58 regions. The EI economic regions of Prince Edward Island, Yukon, the Northwest Territories and Nunavut were each divided into two EI economic regions, one consisting of the capital area and the remaining consisting of the non-capital area. Amounts paid were registered in FY1516 in the four former EI economic regions in spite of the change in EI economic region boundaries because some claims established just prior to that change had continued to be paid in FY1516.

- r Revised.

- Source: Employment and Social Development Canada, Employment Insurance (EI) administrative data. Data are based on a 10% sample of EI administrative data.

-

Annex 2.5 Regular benefits

Annex 2.5.1 – Regular benefits: New claims established Province or territory FY1314 FY1415 FY1516 FY1617 FY1718 Change (%) FY1617 to FY1718 Newfoundland and Labrador 63,290 63,410 67,880 55,590 62,170 +11.8 Prince Edward Island 16,040 16,560 16,790 16,910 16,430 -2.8 Nova Scotia 59,530 60,730 62,020 62,610 63,880 +2.0 New Brunswick 69,450 68,930 72,030 70,120 70,610 +0.7 Quebec 424,230 423,840 422,200 405,460 399,080 -1.6 Ontario 401,030 391,380 390,830 366,810 373,130 +1.7 Manitoba 35,640 37,280 41,810 39,310 40,230 +2.3 Saskatchewan 27,390 31,500 39,580 34,090 35,190 +3.2 Alberta 84,000 105,780 167,800 141,140 112,400 -20.4 British Columbia 140,810 139,040 146,080 124,830 122,410 -1.9 Yukon 2,020 1,880 1,840 1,750 1,610 -8.0 Northwest Territories 1,530 1,680 1,550 1,740 1,760 +1.1 Nunavut 850 600 680 770 810 +5.2 Gender Men 808,040 826,410 896,610 806,660 788,880 -2.2 Women 517,770 516,200 534,480 514,470 510,830 -0.7 Age 24 years old and under 129,400 129,700 140,640 126,880 118,750 -6.4 25 to 44 years old 580,650 592,390 639,540 588,420 571,930 -2.8 45 to 54 years old 330,230 323,840 329,800 298,500 289,420 -3.0 55 years old and over 285,530 296,680 321,110 307,330 319,610 +4.0 EI claimant category1 Long-tenured workers 285,000 261,760 380,460 329,290 310,270 -5.8 Occasional claimants 731,030 776,150 742,840 706,150 699,370 -1.0 Frequent claimants 309,780 304,700 307,790 285,690 290,070 +1.5 Canada 1,325,810 1,342,610 1,431,090 1,321,130 1,299,710 -1.6 - Note: Includes claims for which at least $1 of EI regular benefits was paid.

- 1 See Annex-2.1 for definitions related to EI claimant categories.

- Source: Employment and Social Development Canada, Employment Insurance (EI) administrative data. Data are based on a 10% sample of EI administrative data.

Annex 2.5.2 – Regular benefits: Average actual duration (number of weeks) Province or territory FY1314 FY1415 FY1516 FY1617 FY1718p Change (%)

FY1617 to FY1718Newfoundland and Labrador 26.2 25.8 26.0 31.8r 32.4 +1.8 Prince Edward Island 23.5 22.8 23.3 23.3r 22.9 -1.5 Nova Scotia 23.9 23.1 23.7 23.3r 22.5 -3.2 New Brunswick 23.7 23.8 24.0 23.6r 22.3 -5.6 Quebec 18.5 18.7 18.6 18.2r 16.7 -8.4 Ontario 19.7 19.0 18.3 18.9r 17.4 -7.5 Manitoba 17.8 17.2 17.9 19.3r 19.1 -1.2 Saskatchewan 18.3 18.2 18.3 24.8r 25.9 +4.2 Alberta 15.9 16.4 17.4 24.5 28.4 +15.8 British Columbia 19.0 18.5 18.4 20.3r 19.7 -2.8 Yukon 23.2 24.2 21.6 21.0r 21.4 +2.0 Northwest Territories 26.2 24.2 26.6 21.6r 22.3 +3.3 Nunavut 27.2 31.4 27.0 31.2r 32.6 +4.6 Gender Men 19.7 19.6 19.6 20.9r 20.3 -3.0 Women 19.7 19.2 18.9 20.3r 19.7 -2.6 Age 24 years old and under 17.8 17.6 17.6 18.7r 17.5 -6.3 25 to 44 years old 18.9 18.6 18.5 19.6r 19.1 -2.9 45 to 54 years old 20.2 19.9 19.8 21.4r 20.8 -2.9 55 years old and over 21.5 21.3 21.1 22.9r 22.3 -2.7 EI claimant category1 Long-tenured workers 18.7 18.0 17.4 20.0 21.0 +4.8 Occasional claimants 19.0 18.9 19.0 20.1r 18.9 -5.7 Frequent claimants 22.2 22.0 22.1 23.1r 21.9 -5.1 Canada 19.7 19.4 19.3 20.7r 20.1 -2.9 - Note: Percentage change is based on unrounded numbers. Includes claims for which at least $1 of EI regular benefits was paid. Based on completed claims which include those that are terminated and those that are dormant and remained inactive as of August the following fiscal year.

- 1 See Annex-2.1 for definitions related to EI claimant categories.

- r Revised.

- p Preliminary.

- Source: Employment and Social Development Canada, Employment Insurance (EI) administrative data. Data are based on a 10% sample of EI administrative data.

Annex 2.5.3 – Regular benefits: Average weekly benefit rate1 ($) Province or territory FY1314 FY1415 FY1516 FY1617 FY1718 Change (%)

FY1617 to FY1718Newfoundland and Labrador 417 430 444 434 447 +3.1 Prince Edward Island 395 407 419 419 426 +1.8 Nova Scotia 400 417 423 422 427 +1.1 New Brunswick 403 413 426 430 437 +1.7 Quebec 414 426 434 440 450 +2.4 Ontario 421 435 445 454 462 +1.9 Manitoba 412 424 438 441 449 +1.7 Saskatchewan 435 458 472 468 471 +0.7 Alberta 462 484 495 493 496 +0.6 British Columbia 419 434 449 451 459 +1.8 Yukon 477 478 494 501 500 -0.2 Northwest Territories 487 498 507 511 527 +3.1 Nunavut 460 472 469 486 514 +5.8 Gender Men 443 458 470 474 481 +1.6 Women 382 395 406 412 419 +1.8 Age 24 years old and under 389 405 419 412 416 +1.0 25 to 44 years old 430 445 458 462 470 +1.7 45 to 54 years old 423 437 449 454 r 463 +1.8 55 years old and over 407 420 431 435 442 +1.6 EI claimant category2 Long-tenured workers 454 472 482 489 495 +1.1 Occasional claimants 403 420 428 429 437 +1.8 Frequent claimants 425 436 446 453 464 +2.3 Canada 419 433r 446 449 457 +1.6 - Note: Percentage change is based on unrounded numbers. Includes claims for which at least $1 of EI regular benefits was paid.

- 1 Takes into account Family Supplement top-ups paid to claimants with regular benefits. Includes benefits paid for training purposes under section 25 of the Employment Insurance Act.

- 2 See Annex-2.1 for definitions related to EI claimant categories.

- r Revised.

- Source: Employment and Social Development Canada, Employment Insurance (EI) administrative data. Data are based on a 10% sample of EI administrative data.

Annex 2.5.4 – Regular benefits: Amount paid1 ($ million) Province or territory FY1314 FY1415 FY1516 FY1617 FY1718 Change (%)

FY1617 to FY1718Newfoundland and Labrador 644.3 666.5 749.5 822.2 953.6 +16.0 Prince Edward Island 144.3 147.5r 162.6 161.2 175.5 +8.9 Nova Scotia 535.3 534.1 603.0 595.5 642.5 +7.9 New Brunswick 643.7 640.9 712.5 703.0 729.6 +3.8 Quebec 2,986.9 3,115.2 3,227.0 2,974.1 3,043.3 +2.3 Ontario 3,128.9 3,093.1r 3,200.8 3,069.9 3,183.3 +3.7 Manitoba 267.7 277.2 338.3 352.1 386.2 +9.7 Saskatchewan 225.4 246.3 361.3 450.8 473.3 +5.0 Alberta 670.5 746.9 r 1,499.9 2,274.7 1,804.8 -20.7 British Columbia 1,067.1 1,081.5 1,219.0 1,217.0 1,193.0 -2.0 Yukon 21.3 22.7 18.7 18.8 18.9 +0.9 Northwest Territories 20.3 20.5 20.2 19.3 20.8 +7.6 Nunavut 11.9 9.5 9.4 11.5 15.8 +37.5 Gender Men 6,851.0 7,032.7r 8,253.4 8,612.3 8,359.3 -2.9 Women 3,516.6 3,569.3 3,868.8 4,057.8 4,281.2 +5.5 Age 24 years old and under 973.2 966.1 1,153.7 1,158.1 1,076.1 -7.1 25 to 44 years old 4,510.3 4,603.5 5,345.2 5,548.9 5,449.7 -1.8 45 to 54 years old 2,586.6 2,604.6 2,844.6 2,921.7 2,876.7 -1.5 55 years old and over 2,297.5 2,427.9 2,778.8 3,041.3 3,238.0 +6.5 EI claimant category2 Long-tenured workers 2,377.2 2,136.9 3,141.1 3,681.5 3,343.6 -9.2 Occasional claimants 5,278.5 5,735.6 6,118.7 6,220.2 6,272.5 +0.8 Frequent claimants 2,712.0 2,729.5 2,862.3 2,768.4 3,024.4 +9.2 Canada 10,367.6 10,602.0 12,122.2 12670.1 12,640.5 -0.2 - Note: Data may not add up to the totals due to rounding. Percentage change is based on unrounded numbers. Includes claims for which at least $1 of EI regular benefits was paid.

- 1 Takes into account Family Supplement top-ups paid to claimants with regular benefits. Includes benefits paid for training purposes under section 25 of the Employment Insurance Act.

- 2 See Annex-2.1 for definitions related to EI claimant categories.

- r Revised.

- Source: Employment and Social Development Canada, Employment Insurance (EI) administrative data. Data are based on a 10% sample of EI administrative data.

-

Annex 2.6 Regular benefits (by industry)

Annex 2.6.1 – Regular benefits (by industry): New claims established Industry FY1314 FY1415 FY1516 FY1617 FY1718 Change (%)

FY1617 to FY1718Goods-producing industries 512,200 511,030 565,610 484,720 502,080 +3.6 Agriculture, forestry, fishing and hunting 57,140 56,880 57,360 51,910 53,760 +3.6 Mining and oil and gas extraction 24,380 28,900 38,250 24,430 21,340 -12.6 Utilities 4,680 4,420 4,230 3,980 4,150 +4.3 Construction 274,730 274,140 316,290 273,380 288,870 +5.7 Manufacturing 151,270 146,690 149,480 131,020 133,960 +2.2 Service-producing industries 769,260 748,370 821,740 762,630 764,150 +0.2 Wholesale trade 43,940 44,050 48,240 43,600 39,790 -8.7 Retail trade 79,210 72,850 83,500 76,300 79,090 +3.7 Transportation and warehousing 56,690 56,270 67,950 59,470 60,190 +1.2 Finance and insurance 14,750 13,820 15,500 14,080 15,020 +6.7 Real estate and rental and leasing 18,050 18,030 20,220 18,640 17,720 -4.9 Professional, scientific and technical services 53,800 54,690 61,630 54,190 52,690 -2.8 Business, building and support services1 96,850 93,310 100,250 88,740 86,380 -2.7 Educational services 145,810 146,040 156,100 153,460 157,110 +2.4 Health care and social assistance 48,840 47,160 47,610 45,740 46,590 +1.9 Information, culture and recreation2 41,960 39,470 41,320 38,030 39,080 +2.8 Accommodation and food services 63,360 58,550 63,840 60,630 63,840 +5.3 Other services (except public administration) 40,700 40,730 45,900 42,020 40,340 -4.0 Public administration 65,300 63,400 69,680 67,730 66,310 -2.1 Unclassified 44,350 83,210 43,740 73,780 33,480 -54.6 Canada 1,325,810 1,342,610 1,431,090 1,321,130 1,299,710 -1.6 - Note: Includes claims for which at least $1 of EI regular benefits was paid.

- 1 This industry sector comprises the industries with codes 55 (Management of companies and enterprises) and 56 (Administrative and support, waste management and remediation services) from the North American Industry Classification System.

- 2 This industry sector comprises the industries with codes 51 (Information and cultural industries) and 71 (Arts, entertainment and recreation) from the North American Industry Classification System.

- Source: Employment and Social Development Canada, Employment Insurance (EI) administrative data. Data are based on a 10% sample of EI administrative data.

Annex 2.6.2 – Regular benefits (by industry): Average actual duration (number of weeks) Industry FY1314 FY1415 FY1516 FY1617 FY1718p Change (%)

FY1617 to FY1718Goods-producing industries 19.3 19.1 19.3 20.7r 19.9 -4.1 Agriculture, forestry, fishing and hunting 21.5 21.4 21.6 22.0r 21.8 -0.9 Mining and oil and gas extraction 20.3 20.7 20.8 23.9r 27.0 +13.1 Utilities 17.0 18.5 17.6 18.4r 18.8 +2.4 Construction 18.1 18.1 18.4 19.6r 19.1 -2.7 Manufacturing 20.6 20.0 20.0 21.9r 19.6 -10.4 Service-producing industries 19.9 19.5 19.3 20.5r 20.1 -1.9 Wholesale trade 23.5 23.1 22.7 23.7r 23.7 -0.3 Retail trade 22.7 22.2 21.9 22.8r 22.5 -1.1 Transportation and warehousing 19.3 19.1 18.9 20.9r 20.0 -4.1 Finance and insurance 25.1 24.4 23.3 24.3r 24.2 -0.4 Real estate and rental and leasing 21.9 22.3 22.0 22.9r 23.9 +4.5 Professional, scientific and technical services 21.2 21.2 20.9 22.7r 22.3 -2.0 Business, building and support services1 21.6 21.3 21.2 22.0r 21.2 -3.5 Educational services 11.9 11.7 11.9 12.4r 12.6 +1.3 Health care and social assistance 21.3 21.2 21.0 22.3 21.3 -4.2 Information, culture and recreation2 20.7 20.4 20.0 20.7r 20.6 -0.3 Accommodation and food services 22.6 22.0 22.1 22.7r 22.5 -1.3 Other services (except public administration) 21.5 21.1 20.9 22.4r 22.3 -0.4 Public administration 20.4 20.4 20.1 21.7r 21.9 +0.6 Unclassified 20.8 22.4 19.7 22.8r 22.0 -3.7 Canada 19.7 19.4 19.3 20.7r 20.1 -2.9 - Note: Percentage change is based on unrounded numbers. Includes claims for which at least $1 of EI regular benefits was paid. Based on completed claims which include those that are terminated and those that are dormant and remained inactive as of August the following fiscal year.

- 1 This industry sector comprises the industries with codes 55 (Management of companies and enterprises) and 56 (Administrative and support, waste management and remediation services) from the North American Industry Classification System.

- 2 This industry sector comprises the industries with codes 51 (Information and cultural industries) and 71 (Arts, entertainment and recreation) from the North American Industry Classification System.

- r Revised.

- p Preliminary.

- Source: Employment and Social Development Canada, Employment Insurance (EI) administrative data. Data are based on a 10% sample of EI administrative data.

Annex 2.6.3 – Regular benefits (by industry): Average weekly benefit rate1 ($) Industry FY1314 FY1415 FY1516 FY1617 FY1718 Change (%)

FY1617 to FY1718Goods-producing industries 451 467 480 485 493 +1.7 Agriculture, forestry, fishing and hunting 403 416 429 431 441 +2.5 Mining and oil and gas extraction 495 510 522 528 531 +0.7 Utilities 494 501 516 524 532 +1.5 Construction 473 487 498 505 512 +1.4 Manufacturing 423 439 448 453 464 +2.4 Service-producing industries 399 413r 425r 430r 434 +1.1 Wholesale trade 412 424 440 447 449 +0.3 Retail trade 352 368 374 386 386 +0.1 Transportation and warehousing 390 403 425 417 420 +0.6 Finance and insurance 436 445 462 463 481 +3.8 Real estate and rental and leasing 407 421 432 440 449 +2.0 Professional, scientific and technical services 448 463 479 482 488 +1.3 Business, building and support services2 394 409 419 422 429 +1.7 Educational services 438 449 457 466 473 +1.3 Health care and social assistance 384 394 402 408 414 +1.6 Information, culture and recreation3 388 401 413 414 418 +1.0 Accommodation and food services 330 341 352 355 359 +1.1 Other services (except public administration) 380 394 416 418 422 +1.0 Public administration 426 437 446 451 460 +2.1 Unclassified 392 412 419 423 427 +0.8 Canada 419 433r 446 449 457 +1.6 - Note: Percentage change is based on unrounded numbers. Includes claims for which at least $1 of EI regular benefits was paid.

- 1 Takes into account Family Supplement top-ups paid to claimants with regular benefits.

- 2 This industry sector comprises the industries with codes 55 (Management of companies and enterprises) and 56 (Administrative and support, waste management and remediation services) from the North American Industry Classification System.

- 3 This industry sector comprises the industries with codes 51 (Information and cultural industries) and 71 (Arts, entertainment and recreation) from the North American Industry Classification System.

- r Revised.

- Source: Employment and Social Development Canada, Employment Insurance (EI) administrative data. Data are based on a 10% sample of EI administrative data.

Annex 2.6.4 – Regular benefits (by industry): Amount paid1 ($ million) Industry FY1314 FY1415 FY1516 FY1617 FY1718 Change (%)

FY1617 to FY1718Goods-producing industries 4,349.4 4,379.8 5,337.1 5,397.7 5,343.6 -1.0 Agriculture, forestry, fishing and hunting 503.6 500.7 520.4 515.6 578.2 +12.2 Mining and oil and gas extraction 253.1 238.9 445.0 448.8 310.0 -30.9 Utilities 40.0 41.1 39.1 42.2 48.2 +14.3 Construction 2,324.7 2,376.7r 2,934.7 3,001.5 3,113.4 +3.7 Manufacturing 1,228.0 1,222.4 1,397.9 1,389.6 1,293.7 -6.9 Service-producing industries 5,734.4r 5,656.9 6,487.5 6,687.7 6,998.6 +4.6 Wholesale trade 435.7 421.0 497.1 515.1 492.3 -4.4 Retail trade 630.3 607.0 685.4 712.3 763.4 +7.2 Transportation and warehousing 412.9 400.3 520.5 556.8 533.3 -4.2 Finance and insurance 167.0 155.9 166.5 177.9 193.9 +8.9 Real estate and rental and leasing 155.3 163.7 191.8 208.1 207.3 -0.4 Professional, scientific and technical services 510.6 505.4 630.5 666.4 601.1 -9.8 Business, building and support services2 784.5 787.0 881.9 876.9 871.4 -0.6 Educational services 605.8 634.6 711.6 695.1 850.0 +22.3 Health care and social assistance 360.2 362.2 371.2 389.6 424.0 +8.8 Information, culture and recreation3 332.8 318.3 336.2 337.1 377.7 +12.0 Accommodation and food services 460.3 427.2 498.2 496.3 559.9 +12.8 Other services (except public administration) 336.6 334.4 399.4 424.4 421.5 -0.7 Public administration 542.3 539.9 597.3 631.5 702.7 +11.3 Unclassified 283.9 565.3 297.6 584.7 298.4 -49.0 Canada 10,367.6 10,602.0 12,122.2 12,670.1 12,640.5 -0.2 - Note: Data may not add up to the totals due to rounding. Percentage change is based on unrounded numbers. Includes claims for which at least $1 of EI regular benefits was paid.

- 1 Takes into account Family Supplement top-ups paid to claimants with regular benefits. Includes benefits paid for training purposes under section 25 of the Employment Insurance Act.

- 2 This industry sector comprises the industries with codes 55 (Management of companies and enterprises) and 56 (Administrative and support, waste management and remediation services) from the North American Industry Classification System.

- 3 This industry sector comprises the industries with codes 51 (Information and cultural industries) and 71 (Arts, entertainment and recreation) from the North American Industry Classification System.

- r Revised.

- Source: Employment and Social Development Canada, Employment Insurance (EI) administrative data. Data are based on a 10% sample of EI administrative data.

-

Annex 2.7 Regular benefits (by regional unemployment rate and hours of insurable employment from previous employment)

Annex 2.7.1 – Regular benefits (by regional unemployment rate and hours of insurable employment from previous employment): New claims established Regional unemployment rate1 FY1314 FY1415 FY1516 FY1617 FY1718 Change (%)

FY1617 to FY17186.0% and under 187,910 273,380 218,020 171,350 384,230 +124.2 6.1% ~ 7.0% 196,410 158,060 363,660 363,170 425,580 +17.2 7.1% ~ 8.0% 259,710 329,870 279,030 299,000 134,750 -54.9 8.1% ~ 9.0% 327,910 236,460 216,290 169,290 110,860 -34.5 9.1% ~ 10.0% 45,870 78,450 75,660 65,480 31,660 -51.6 10.1% ~ 11.0% 84,810 55,950 50,430 35,420 7,990 -77.4 11.1% ~ 12.0% 52,390 44,380 16,740 21,420 60,140 +180.8 12.1% ~ 13.0% 10,030 7,660 43,880 35,300 13,420 -62.0 13.1% ~ 14.0% 6,620 470 16,910 11,350 28,240 +148.8 14.1% ~ 15.0% 20,030 25,870 23,650 38,190 24,020 -37.1 15.1% ~ 16.0% 57,470 25,100 31,980 25,370 10,270 -59.5 16.1% or greater 76,650 106,960 94,840 85,790 68,550 -20.1 Hours of insurable employment from previous employment 420 to 559 16,200 15,540 16,070 20,010 18,660 -6.7 560 to 699 52,690 48,850 51,100 56,330 47,490 -15.7 700 to 839 88,590 88,530 91,000 102,770 104,810 +2.0 840 to 979 112,690 115,160 116,610 113,880 110,790 -2.7 980 to 1,119 125,430 127,920 132,800 119,850 114,140 -4.8 1,120 to 1,259 127,170 128,290 131,700 122,760 120,710 -1.7 1,260 to 1,399 116,850 117,920 126,290 113,860 114,510 +0.6 1,400 to 1,539 127,380 127,610 134,580 125,170 125,090 -0.1 1,540 to 1,679 109,630 109,360 115,230 103,540 105,730 +2.1 1,680 to 1,819 110,030 109,480 119,890 103,900 106,150 +2.2 1,820 or more 339,150 353,950 395,820 339,060 331,630 -2.2 Canada 1,325,810 1,342,610 1,431,090 1,321,130 1,299,710 -1.6 - Note: Includes claims for which at least $1 of EI regular benefits was paid.

- 1 Unemployment rates used for the Employment Insurance program are a moving average of seasonally adjusted monthly rates of unemployment produced by Statistics Canada, as per section 17 of the Employment Insurance Regulations.

- Source: Employment and Social Development Canada, Employment Insurance (EI) administrative data. Data are based on a 10% sample of EI administrative data.

Annex 2.7.2 – Regular benefits (by regional unemployment rate and hours of insurable employment from previous employment): Average actual duration (number of weeks) Regional unemployment rate1 FY1314 FY1415 FY1516 FY1617r FY1718p Change (%)

FY1617 to FY17186.0% and under 15.9 15.7 17.2 19.0 14.5 -23.7 6.1% ~ 7.0% 17.5 18.0 15.9 18.9 17.3 -8.2 7.1% ~ 8.0% 17.7 18.2 19.2 18.9 19.8 5.0 8.1% ~ 9.0% 19.9 19.5 19.4 19.7 23.4 +18.5 9.1% ~ 10.0% 21.1 19.7 19.2 21.0 22.5 +7.6 10.1% ~ 11.0% 20.6 21.4 21.3 22.9 22.5 -1.9 11.1% ~ 12.0% 22.0 21.2 23.8 24.9 25.4 +2.3 12.1% ~ 13.0% 26.0 23.6 19.8 24.2 30.4 +25.8 13.1% ~ 14.0% 24.3 25.1 19.7 24.0 22.3 -6.9 14.1% ~ 15.0% 26.5 26.7 27.9 26.1 25.8 -1.1 15.1% ~ 16.0% 26.0 28.0 26.6 28.6 26.7 -6.4 16.1% or greater 26.3 25.2 26.4 32.0 33.0 +3.1 Hours of insurable employment from previous employment 420 to 559 26.6 25.9 26.6 28.3 28.6 +1.1 560 to 699 21.3 20.6 20.8 21.6 22.1 +2.5 700 to 839 19.3 18.8 18.5 19.2 18.6 -3.4 840 to 979 19.8 19.4 19.2 20.4 19.6 -4.3 980 to 1,119 19.5 19.4 19.0 20.2 19.6 -3.0 1,120 to 1,259 18.9 18.5 18.4 19.6 19.1 -2.5 1,260 to 1,399 18.4 18.2 17.8 19.2 18.3 -4.4 1,400 to 1,539 17.0 16.7 16.8 17.8 17.0 -4.3 1,540 to 1,679 18.4 18.4 18.3 19.4 18.7 -3.6 1,680 to 1,819 19.8 19.8 19.6 21.2 20.1 -5.3 1,820 or more 21.4 21.2 21.1 22.8 22.4 -1.6 Canada 19.7 19.4 19.3 20.7 20.1 -2.9 - Note: Percentage change is based on unrounded numbers. Includes claims for which at least $1 of EI regular benefits was paid. Based on completed claims which include those that are terminated and those that are dormant and remained inactive as of August the following fiscal year.

- 1 Unemployment rates used for the Employment Insurance program are a moving average of seasonally adjusted monthly rates of unemployment produced by Statistics Canada, as per section 17 of the Employment Insurance Regulations.

- r Revised.

- p Preliminary.

- Source: Employment and Social Development Canada, Employment Insurance (EI) administrative data. Data are based on a 10% sample of EI administrative data.

Annex 2.7.3 – Regular benefits (by regional unemployment rate and hours of insurable employment from previous employment): Average weekly benefit rate1 ($) Regional unemployment rate2 FY1314 FY1415 FY1516 FY1617 FY1718 Change (%)

FY1617 to FY17186.0% and under 442 452 452 454 459 +1.1 6.1% ~ 7.0% 416 433 456 453 454 +0.3 7.1% ~ 8.0% 417 428 439 446 468 +4.8 8.1% ~ 9.0% 415 426 443 451 460 +2.1 9.1% ~ 10.0% 412 436 427 443 462 +4.3 10.1% ~ 11.0% 413 430 447 466 462 -0.8 11.1% ~ 12.0% 411 419 481 449 456 +1.4 12.1% ~ 13.0% 429 434 448 478 461 -3.5 13.1% ~ 14.0% 429 506 442 432 448 +3.6 14.1% ~ 15.0% 413 422 431 429 436 +1.8 15.1% ~ 16.0% 413 431 433 443 442 -0.2 16.1% or greater 420 429 444 433 445 +2.7 Hours of insurable employment from previous employment 420 to 559 309 328 340 334 333 -0.3 560 to 699 342r 353 369 365 370 +1.5 700 to 839 356 367 379 380 377 -0.8 840 to 979 374 387 397 402 405 +0.8 980 to 1,119 388 402 411 417 424 +1.8 1,120 to 1,259 403 417 427 436 445 +2.1 1,260 to 1,399 422 434 446 451 462 +2.4 1,400 to 1,539 438 452 462 472 481 +1.9 1,540 to 1,679 439 452 463 472 482 +2.0 1,680 to 1,819 445 457 471 478 488 +2.0 1,820 or more 463 478 491 499 505 +1.3 Canada 419 433r 446 449 457 +1.6 - Note: Percentage change is based on unrounded numbers. Includes claims for which at least $1 of EI regular benefits was paid.

- 1 Takes into account Family Supplement top-ups paid to claimants with regular benefits.

- 2 Unemployment rates used for the Employment Insurance program are a moving average of seasonally adjusted monthly rates of unemployment produced by Statistics Canada, as per section 17 of the Employment Insurance Regulations.

- r Revised.

- Source: Employment and Social Development Canada, Employment Insurance (EI) administrative data. Data are based on a 10% sample of EI administrative data.

Annex 2.7.4 – Regular benefits (by regional unemployment rate and hours of insurable employment from previous employment): Amount paid1 ($ million) Regional unemployment rate2 FY1314 FY1415 FY1516 FY1617 FY1718 Change (%)

FY1617 to FY17186.0% and under 2,512.0 2,848.1 4,089.6 1,381.8 2,329.3 +68.6 6.1% ~ 7.0% 1,583.2 1,855.8 2,836.0 3,092.1 3,453.9 +11.7 7.1% ~ 8.0% 2,957.8 2,661.5 1,572.8 2,511.9 1,751.9 -30.3 8.1% ~ 9.0% 406.5 461.9 727.7 2,022.7 1,367.9 -32.4 9.1% ~ 10.0% 573.1 534.0 526.8 539.5 527.8 -2.2 10.1% ~ 11.0% 455.0 444.9 194.9 337.2 275.9 -18.2 11.1% ~ 12.0% 108.1 112.5 294.4 282.4 522.9 +85.1 12.1% ~ 13.0% 164.0 24.8 60.8 460.1 350.0 -23.9 13.1% ~ 14.0% 150.0 227.4 235.3 165.6 275.9 +66.6 14.1% ~ 15.0% 424.0 379.2 378.3 345.7 364.1 +5.3 15.1% ~ 16.0% 503.0 604.6 459.2 295.1 205.9 -30.2 16.1% or greater 530.9 447.4 746.2 1,235.9 1,215.2 -1.7 Hours of insurable employment from previous employment 420 to 559 133.8 127.2 144.0 175.8r 207.5 +18.0 560 to 699 380.0 361.1 380.7 437.8 460.8 +5.2 700 to 839 592.4r 592.5r 625.3 720.0 812.3 +12.8 840 to 979 795.4 829.4 879.3 917.6 946.5 +3.1 980 to 1,119 891.1 931.0 1,001.5 1,002.1 1,015.7 +1.3 1,120 to 1,259 871.5 903.0 985.0 1,001.8 1,065.4 +6.4 1,260 to 1,399 814.0 851.0 931.2 950.8 999.5 +5.1 1,400 to 1,539 853.0 872.5 976.4 996.0 1,037.2 +4.1 1,540 to 1,679 803.8 836.3 932.8 958.5 973.3 +1.5 1,680 to 1,819 923.5 924.4 1,075.4 1,107.4 1,076.9 -2.8 1,820 or more 3,309.1 3,373.4 4,190.5 4,401.8 4,045.4 -8.1 Canada 10,367.6 10,602.0 12,122.2 12,670.1 12,640.5 -0.2 - Note: Data may not add up to the totals due to rounding. Totals include amounts paid for claims where data on hours of insurable employment are missing. Percentage change is based on unrounded numbers. Includes claims for which at least $1 of EI regular benefits was paid.

- 1 Takes into account Family Supplement top-ups paid to claimants with regular benefits. Includes benefits paid for training purposes under section 25 of the Employment Insurance Act.

- 2 Unemployment rates used for the Employment Insurance program are a moving average of seasonally adjusted monthly rates of unemployment produced by Statistics Canada, as per section 17 of the Employment Insurance Regulations.

- r Revised.

- Source: Employment and Social Development Canada, Employment Insurance (EI) administrative data. Data are based on a 10% sample of EI administrative data.

-

Annex 2.8 Regular benefits (by Employment Insurance economic region)

Annex 2.8.1 – Regular benefits (by Employment Insurance economic region): New claims established EI economic region FY1314 FY1415 FY1516 FY1617 FY1718 Change (%)

FY1617 to FY1718Newfoundland and Labrador St. John’s 9,740 10,550 12,290 12,510 12,900 +3.1 Newfoundland – Labrador 53,550 52,860 55,590 43,080 49,270 +14.4 Prince Edward Island Prince Edward Island1 16,040 6,940 n/a n/a n/a n/a Charlottetown1 n/a 2,320 4,070 4,420 3,820 -13.6 Prince Edward Island (excluding Charlottetown)1 n/a 7,300 12,720 12,490 12,610 +1.0 Nova Scotia Eastern Nova Scotia 21,600 22,110 22,420 22,580 23,760 +5.2 Western Nova Scotia 26,340 26,450 27,000 26,950 27,020 +0.3 Halifax 11,590 12,170 12,600 13,080 13,100 +0.2 New Brunswick Fredericton-Moncton-Saint-John 19,040 19,230 20,920 19,800 20,180 +1.9 Madawaska-Charlotte 11,830 11,370 11,240 10,700 10,940 +2.2 Restigouche- Albert 38,580 38,330 39,870 39,620 39,490 -0.3 Quebec Gaspésie-Île-de-la Madeleine 24,670 23,830 24,740 24,990 25,180 +0.8 Québec 32,840 34,200 33,750 31,470 32,950 +4.7 Trois-Rivières 8,870 8,620 8,430 7,930 7,820 -1.4 South Central Quebec 8,930 8,160 7,480 7,900 6,820 -13.7 Sherbrooke 8,070 9,210 8,230 7,990 8,000 +0.1 Montérégie 26,190 25,750 27,030 26,160 24,880 -4.9 Montreal 152,130 152,310 152,860 146,390 144,110 -1.6 Central Quebec 74,410 74,540 73,830 70,970 71,440 +0.7 North Western Quebec 19,970 20,300 19,850 17,960 17,730 -1.3 Lower Saint Lawrence and North Shore 47,280 44,590 44,610 43,010 40,660 -5.5 Hull 10,340 10,750 10,660 10,430 9,890 -5.2 Chicoutimi-Jonquière 10,530 11,580 10,730 10,260 9,600 -6.4 Ontario Ottawa 19,950 20,180 21,210 19,470 19,340 -0.7 Eastern Ontario 19,820 19,820 20,220 18,910 18,670 -1.3 Kingston 3,820 3,770 3,120 3,530 3,110 -11.9 Central Ontario 44,080 42,610 44,200 42,800 41,030 -4.1 Oshawa 12,700 12,350 12,280 12,270 12,690 +3.4 Toronto 145,690 141,040 141,370 132,690 131,950 -0.6 Hamilton 20,220 19,540 19,400 19,210 18,630 -3.0 St. Catharines 16,770 14,660 15,240 14,710 14,310 -2.7 London 14,210 13,430 12,300 12,710 13,770 +8.3 Niagara 12,610 12,330 12,760 12,160 11,600 -4.6 Windsor 10,230 15,520 9,340 8,360 14,490 +73.3 Kitchener 15,050 13,340 13,340 13,360 13,570 +1.6 Huron 13,750 13,040 12,940 13,970 13,360 -4.4 South Central Ontario 13,040 11,590 11,890 11,480 13,110 +14.2 Sudbury 5,780 5,540 6,550 4,560 4,990 +9.4 Thunder Bay 4,520 4,580 4,990 4,250 4,460 +4.9 Northern Ontario 28,790 28,040 29,680 22,370 24,050 +7.5 Manitoba Winnipeg 19,370 20,080 22,270 21,380 21,920 +2.5 Southern Manitoba 9,260 9,750 11,550 10,960 11,180 +2.0 Northern Manitoba 7,010 7,450 7,990 6,970 7,130 +2.3 Saskatchewan Regina 3,970 4,470 5,700 6,270 6,330 +1.0 Saskatoon 6,100 7,510 9,730 9,210 8,640 -6.2 Southern Saskatchewan 7,500 8,550 10,590 8,320 8,710 +4.7 Northern Saskatchewan 9,820 10,970 13,560 10,290 11,510 +11.9 Alberta Calgary 26,580 32,730 52,480 43,150 35,620 -17.5 Edmonton 29,770 36,310 57,060 47,150 42,230 -10.4 Northern Alberta 7,320 10,290 16,090 18,750 9,880 -47.3 Southern Alberta 20,330 26,450 42,170 32,090 24,670 -23.1 British Columbia Southern Interior British Columbia 29,140 28,630 32,740 25,790 25,520 -1.0 Abbotsford 7,980 7,380 7,390 7,160 6,690 -6.6 Vancouver 58,780 55,620 54,580 49,110 47,730 -2.8 Victoria 7,790 7,520 7,920 6,650 6,710 +0.9 Southern Coastal British Columbia 21,280 20,740 22,350 20,390 19,220 -5.7 Northern British Columbia 15,840 19,150 21,100 15,730 16,540 +5.1 Territories Yukon1 2,020 780 n/a n/a n/a n/a Whitehorse1 n/a 560 1,070 950 820 -13.7 Yukon (excluding Whitehorse)1 n/a 540 770 800 790 -1.3 Northwest Territories1 1,530 990 n/a n/a n/a n/a Yellowknife1 n/a 170 410 510 520 +2.0 Northwest Territories (excluding Yellowknife)1 n/a 520 1,140 1,230 1,240 +0.8 Nunavut1 850 280 n/a n/a n/a n/a Iqualuit1 n/a 40 110 110 170 +54.5 Nunavut (excluding Iqaluit)1 n/a 280 570 660 640 -3.0 Canada 1,325,810 1,342,610 1,431,090 1,321,130 1,299,710 -1.6 - Note: Includes claims for which at least $1 of EI regular benefits was paid.

- 1 As of October 12, 2014, there is a total of 62 Employment Insurance (EI) economic regions, instead of 58 regions. The EI economic regions of Prince Edward Island, Yukon, the Northwest Territories and Nunavut were each divided into two EI economic regions, one consisting of the capital area and the remaining consisting of the non-capital area.

- Source: Employment and Social Development Canada, Employment Insurance (EI) administrative data. Data are based on a 10% sample of EI administrative data.

Annex 2.8.2 – Regular benefits (by Employment Insurance economic region): Average actual duration (number of weeks)

EI economic regionFY1314 FY1415 FY1516 FY1617 FY1718p Change (%)

FY1617 to FY1718Newfoundland and Labrador St. John’s 17.3 17.6 18.7 19.2r 20.7 +7.9 Newfoundland – Labrador 27.7 27.3 27.6 35.4 r 35.5 +0.3 Prince Edward Island Prince Edward Island1 23.5 23.2 25.3 n/a n/a n/a Charlottetown1 n/a n/a 19.6 19.4 18.8 -2.7 Prince Edward Island (excluding Charlottetown)1 n/a n/a 23.9 24.7 r 24.3 -1.6 Nova Scotia Eastern Nova Scotia 27.4 26.0 27.4 26.8 r 26.2 -2.1 Western Nova Scotia 23.4 22.6 23.0 22.0 r 21.3 -3.1 Halifax 18.8 19.4 18.9 19.8 r 18.8 -5.0 New Brunswick Fredericton-Moncton-Saint-John 19.6 19.5 20.4 19.9 r 18.6 -6.6 Madawaska-Charlotte 23.2 21.6 21.4 20.6 r 19.0 -8.0 Restigouche- Albert 26.0 26.6 26.5 26.4 r 25.0 -5.4 Quebec Gaspésie-Île-de-la Madeleine 24.6 26.2 26.0 25.4 r 25.0 -1.5 Québec 15.1 15.3 15.9 15.3 r 14.1 -8.4 Trois-Rivières 18.3 18.0 17.4 16.2 r 15.2 -6.2 South Central Quebec 13.9 14.3 14.8 13.8 r 12.9 -6.3 Sherbrooke 16.3 17.2 17.1 16.2 r 14.3 -12.1 Montérégie 16.5 16.9 16.9 16.4 r 15.1 -7.8 Montreal 18.9 19.2 19.0 18.9 r 16.9 -10.9 Central Quebec 18.0 17.7 17.4 16.5 r 15.5 -6.3 North Western Quebec 19.8 19.3 20.1 18.8 r 17.3 -8.0 Lower Saint Lawrence and North Shore 19.0 19.6 19.3 19.1 r 17.1 -10.4 Hull 16.9 17.3 18.0 17.4 r 16.1 -7.5 Chicoutimi-Jonquière 17.3 18.0 19.2 18.1 r 16.7 -7.7 Ontario Ottawa 17.6 17.4 17.1 17.4 r 16.2 -6.9 Eastern Ontario 18.0 18.1 17.8 18.4 r 16.7 -9.7 Kingston 17.3 17.9 18.1 17.2 r 15.7 -8.6 Central Ontario 18.6 17.5 16.9 17.5 r 16.6 -5.1 Oshawa 19.5 16.7 15.5 17.6 r 15.5 -11.7 Toronto 21.0 20.3 19.6 19.1 r 17.9 -6.4 Hamilton 18.1 16.5 16.9 16.4 r 16.1 -1.8 St. Catharines 18.9 19.0 17.5 17.4 r 16.4 -5.7 London 19.3 19.3 18.2 16.5 r 16.3 -1.4 Niagara 19.9 18.4 18.2 18.3 r 16.7 -8.7 Windsor 20.4 19.0 16.6 19.2 r 10.9 -43.3 Kitchener 18.1 18.4 17.0 16.7 r 15.6 -6.5 Huron 18.4 18.3 17.1 17.1 r 15.5 -9.8 South Central Ontario 16.9 16.7 16.2 16.4 r 14.0 -14.8 Sudbury 18.3 18.2 17.3 25.0 24.4 -2.3 Thunder Bay 16.5 17.4 16.0 15.9 r 15.5 -2.9 Northern Ontario 22.4 22.4 21.7 28.7 r 27.9 -2.9 Manitoba Winnipeg 16.0 15.7 16.9 17.0 r 16.4 -3.6 Southern Manitoba 15.7 14.8 15.8 16.7 r 16.2 -3.0 Northern Manitoba 25.2 24.5 24.4 30.5 r 31.6 +3.4 Saskatchewan Regina 15.4 14.0 14.9 16.4 r 16.6 +1.0 Saskatoon 14.9 15.6 16.0 22.6 r 24.4 +7.7 Southern Saskatchewan 15.9 16.7 16.4 24.0 r 25.8 +7.5 Northern Saskatchewan 23.3 22.7 23.2 31.6 r 33.0 +4.2 Alberta Calgary 16.8 16.8 17.5 26.4 r 29.8 +13.1 Edmonton 15.1 15.7 16.8 24.0 r 26.1 +8.5 Northern Alberta 17.0 18.3 19.8 21.7 r 31.6 +45.7 Southern Alberta 15.5 16.1 17.3 24.4 r 28.6 +17.5 British Columbia Southern Interior British Columbia 17.8 18.3 18.4 24.2 r 24.5 +1.4 Abbotsford 18.7 18.4 17.3 16.9 r 16.7 -0.8 Vancouver 19.3 18.3 17.7 17.4 r 16.7 -4.0 Victoria 18.4 17.2 17.3 18.1 r 15.8 -12.6 Southern Coastal British Columbia 18.8 18.9 19.1 18.9 r 17.3 -8.3 Northern British Columbia 20.9 19.7 20.6 26.3 r 24.6 -6.5 Territories Yukon1 23.2 26.5 29.6 n/a n/a n/a Whitehorse1 n/a 11.9 16.7 21.9 r 22.8 +3.8 Yukon (excluding Whitehorse)1 n/a n/a 20.4 19.9 r 19.5 -2.0 Northwest Territories1 26.2 25.4 35.0 n/a n/a n/a Yellowknife1 n/a n/a 17.6 14.7 r 16.5 +12.1 Northwest Territories (excluding Yellowknife)1 n/a n/a 25.0 24.6 r 24.4 -0.5 Nunavut1 27.2 32.0 34.7 n/a n/a n/a Iqualuit1 n/a n/a 17.6 16.8 r 22.6 +34.0 Nunavut (excluding Iqaluit)1 n/a n/a 25.5 34.3 34.6 +1.0 Canada 19.7 19.4 19.3 20.7 r 20.1 -2.9 - Note: Percentage change is based on unrounded numbers. Includes claims for which at least $1 of EI regular benefits was paid. Based on completed claims which include those that are terminated and those that are dormant and remained inactive as of August the following fiscal year.

- 1 As of October 12, 2014, there is a total of 62 Employment Insurance (EI) economic regions, instead of 58 regions. The EI economic regions of Prince Edward Island, Yukon, the Northwest Territories and Nunavut were each divided into two EI economic regions, one consisting of the capital area and the remaining consisting of the non-capital area.

- r Revised.

- p Preliminary.

- Source: Employment and Social Development Canada, Employment Insurance (EI) administrative data. Data are based on a 10% sample of EI administrative data.

Annex 2.8.3 – Regular benefits (by Employment Insurance economic region): Average weekly benefit rate1 ($) EI economic region FY1314 FY1415 FY1516 FY1617 FY1718 Change (%)

FY1617 to FY1718Newfoundland and Labrador St. John’s 434 447 460 468 466 -0.5 Newfoundland – Labrador 414 426 440 424 442 +4.4 Prince Edward Island Prince Edward Island2 395 399 n/a n/a n/a n/a Charlottetown2 n/a 401 416 399 406 +1.8 Prince Edward Island (excluding Charlottetown)2 n/a 417 421 426 432 +1.6 Nova Scotia Eastern Nova Scotia 413 432 434 433 440 +1.5 Western Nova Scotia 388 404 411 411 414 +0.5 Halifax 405 417 428 424 429 +1.1 New Brunswick Fredericton-Moncton-Saint-John 393 406r 418 422 432 +2.3 Madawaska-Charlotte 391 399 413 413 424 +2.5 Restigouche- Albert 411 421 433 438 443 +1.3 Quebec Gaspésie-Île-de-la Madeleine 421 430 437 442 451 +2.0 Québec 428 438 445 452 467 +3.2 Trois-Rivières 409 418 424 429 446 +3.9 South Central Quebec 414r 425r 441 444 458 +3.1 Sherbrooke 411 419 426r 440 447 +1.7 Montérégie 408 420 430 439 448 +1.9 Montreal 412 424 432 438 448 +2.2 Central Quebec 407 418 427 434 445 +2.6 North Western Quebec 422 437 440 447 453 +1.5 Lower Saint Lawrence and North Shore 422 429 439 441 452 +2.6 Hull 424 436 445 457 463 +1.2 Chicoutimi-Jonquière 413 427 432 434 446 +2.7 Ontario Ottawa 429 443 453 460 464 +1.0 Eastern Ontario 410 428 435 443r 440 -0.6 Kingston 411 429 429 438 443 +1.1 Central Ontario 412 425 437 449 452 +0.8 Oshawa 432 453 456 472 483 +2.2 Toronto 424 435 447 458 467 +2.0 Hamilton 431 437 452 460 468 +1.7 St. Catharines 405 412 417 434 440 +1.5 London 416 423 427 441 455 +3.0 Niagara 415 433 439 447 457 +2.3 Windsor 408 456 440 440 481 +9.2 Kitchener 429 443 452 463 464 +0.1 Huron 419 431 445 451 458 +1.5 South Central Ontario 419 431 445 460 468 +1.6 Sudbury 430 444 457 458 466 +1.6 Thunder Bay 446 455r 463 476 485 +1.9 Northern Ontario 429 439 452 444 455 +2.4 Manitoba Winnipeg 417 429 441 451 456 +1.1 Southern Manitoba 404 419 438 435 443 +1.8 Northern Manitoba 409 417 431 421 435 +3.4 Saskatchewan Regina 455 468 473 490 487 -0.6 Saskatoon 437 469 474 476 478 +0.2 Southern Saskatchewan 426 450 469 461 472 +2.4 Northern Saskatchewan 432 453 472 453 457 +1.0 Alberta Calgary 462 484 493 490 493 +0.6 Edmonton 470 487 499 500 505 +0.9 Northern Alberta 465 489r 499 500 498 -0.3 Southern Alberta 450 477 490 481 485 +0.7 British Columbia Southern Interior British Columbia 428 442 459 448 463 +3.4 Abbotsford 359 373r 383 398 395 -0.9 Vancouver 412 424 438 453 460 +1.5 Victoria 428 438r 454 459 461 +0.6 Southern Coastal British Columbia 426r 443 457 456 459 +0.6 Northern British Columbia 444 462 474 461 474 +3.0 Territories Yukon2 477 476 n/a n/a n/a n/a Whitehorse2 n/a 485 491 510 496 -2.7 Yukon (excluding Whitehorse)2 n/a 473 499 491 504 +2.6 Northwest Territories2 487 492 n/a n/a n/a n/a Yellowknife2 n/a 511 506 508 533 +4.9 Northwest Territories (excluding Yellowknife)2 n/a 507 507 513 525 +2.4 Nunavut2 460 464 n/a n/a n/a n/a Iqualuit2 n/a 494 496 526 523 -0.5 Nunavut (excluding Iqaluit)2 n/a 477 464 480 512 +6.7 Canada 419 433r 446 449 457 +1.6 - Note: Percentage change is based on unrounded numbers. Includes claims for which at least $1 of EI regular benefits was paid.

- 1 Takes into account Family Supplement top-ups paid to claimants with regular benefits.

- 2 As of October 12, 2014, there is a total of 62 Employment Insurance (EI) economic regions, instead of 58 regions. The EI economic regions of Prince Edward Island, Yukon, the Northwest Territories and Nunavut were each divided into two EI economic regions, one consisting of the capital area and the remaining consisting of the non-capital area.

- r Revised.

- Source: Employment and Social Development Canada, Employment Insurance (EI) administrative data. Data are based on a 10% sample of EI administrative data.

Annex 2.8.4 – Regular benefits (by Employment Insurance economic region): Amount paid1 ($ million) EI economic region FY1314 FY14152 FY15162 FY1617 FY1718 Change (%)

FY1617 to FY1718Newfoundland and Labrador St. John’s 71.0 82.0 98.6 116.3 139.1 +19.6 Newfoundland – Labrador 573.4 584.5 650.9 705.9 814.5 +15.4 Prince Edward Island Prince Edward Island2 144.3 105.7 8.5 n/a n/a n/a Charlottetown2 n/a 8.3 33.4 34.1 32.3 -5.3 Prince Edward Island (excluding Charlottetown)2 n/a 33.5 120.6 127.1 143.2 +12.7 Nova Scotia Eastern Nova Scotia 225.8 222.4 256.1 257.9 283.4 +9.9 Western Nova Scotia 224.1 219.8 241.1 231.8 244.9 +5.7 Halifax 85.3 91.9 105.8 105.8 114.2 +7.9 New Brunswick Fredericton-Moncton-Saint-John 142.0 146.2 176.3 170.1 172.9 +1.7 Madawaska-Charlotte 104.2 92.1 96.5 87.9 93.0 +5.8 Restigouche- Albert 397.6 402.7 439.7 445.0 463.6 +4.2 Quebec Gaspésie-Île-de-la Madeleine 248.2 249.1 266.8 264.2 295.6 +11.9 Québec 188.5 209.8 222.0 198.3 211.6 +6.7 Trois-Rivières 59.6 57.1 57.5 48.6 53.3 +9.6 South Central Quebec 44.1 47.5 47.0 42.7 40.7 -4.6 Sherbrooke 45.6 58.5 57.4 50.6 50.5 -0.3 Montérégie 161.5 168.6 186.3 174.3 173.2 -0.6 Montreal 1,090.8 1,166.0 1,195.6 1,124.4 1,116.9 -0.7 Central Quebec 495.5 496.5 508.2 449.4 499.2 +11.1 North Western Quebec 160.5 159.5 164.2 146.7 141.6 -3.5 Lower Saint Lawrence and North Shore 354.6 349.5 354.2 327.0 318.4 -2.6 Hull 67.4 74.9 81.2 76.5 74.7 -2.4 Chicoutimi-Jonquière 70.5 78.1 86.5 71.4 67.6 -5.3 Ontario Ottawa 147.4 151.3 165.8 151.8 152.4 +0.4 Eastern Ontario 137.1 144.8 160.2 146.6 145.7 -0.7 Kingston 26.1 27.9 24.1 23.9 24.2 +1.2 Central Ontario 316.3 310.7 320.9 313.5 333.7 +6.4 Oshawa 89.9 89.9 93.6 91.1 101.9 +11.8 Toronto 1,218.5 1,215.2 1,230.7 1,148.5 1,177.8 +2.6 Hamilton 141.1 137.5 145.9 143.5 150.2 +4.7 St. Catharines 117.2 109.2 106.7 106.7 108.2 +1.3 London 109.1 104.9 92.6 88.3 107.3 +21.6 Niagara 100.1 88.9 103.8 93.9 94.4 +0.5 Windsor 85.3 83.8 98.6 62.5 77.6 +24.1 Kitchener 111.9 108.9 104.5 101.6 108.2 +6.5 Huron 94.1 95.3 98.6 101.2 99.3 -1.9 South Central Ontario 90.6 82.8 86.7 84.1 91.6 +8.9 Sudbury 45.5 43.0 50.9 64.6 55.2 -14.6 Thunder Bay 31.4 33.9 36.0 33.4 35.1 +5.2 Northern Ontario 267.2 265.1 281.4 314.4 320.6 +1.9 Manitoba Winnipeg 134.8 138.4 171.9 169.3 182.0 +7.5 Southern Manitoba 60.9 64.1 82.9 88.6 91.2 +2.9 Northern Manitoba 72.0 74.7 83.6 94.2 113.0 +19.9 Saskatchewan Regina 28.7 31.3 43.8 52.3 61.8 +18.2 Saskatoon 43.4 52.1 82.1 109.4 117.1 +7.0 Southern Saskatchewan 52.6 60.3 87.9 115.4 115.4 0.0 Northern Saskatchewan 100.6 102.6 147.5 173.7 179.1 +3.1 Alberta Calgary 217.0 237.3 486.3 747.9 613.1 -18.0 Edmonton 227.7 260.7 489.2 730.6 632.7 -13.4 Northern Alberta 65.1 79.3 157.5 253.3 176.4 -30.4 Southern Alberta 160.8 169.6 366.9 542.9 382.6 -29.5 British Columbia Southern Interior British Columbia 207.9 221.2 273.0 318.5 310.0 -2.6 Abbotsford 51.8 48.9 49.3 48.7 48.9 +0.4 Vancouver 449.4 435.8 436.5 391.0 403.4 +3.2 Victoria 57.1 57.4 64.6 56.4 53.8 -4.6 Southern Coastal British Columbia 158.4 161.5 193.8 173.2 165.0 -4.8 Northern British Columbia 142.5 156.8 201.8 229.2 211.9 -7.5 Territories Yukon2 21.3 17.0 1.8 n/a n/a n/a Whitehorse2 n/a 2.6 9.2 10.8 10.9 +1.2 Yukon (excluding Whitehorse)2 n/a 3.1 7.7 8.0 8.0 +0.5 Northwest Territories2 20.3 17.2 2.6 n/a n/a n/a Yellowknife2 n/a 0.7 3.8 4.3 4.3 +0.2 Northwest Territories (excluding Yellowknife)2 n/a 2.7 13.8 15.0 16.4 +9.8 Nunavut2 11.9 7.9 0.7 n/a n/a n/a Iqualuit2 n/a 0.2 0.7 1.3 2.0 +54.3 Nunavut (excluding Iqaluit)2 n/a 1.4 8.0 10.2 13.8 +35.3 Canada 10,367.6 10,602.0 12,122.2 12,670.1 12,640.5 -0.2 - Note: Data may not add up to the totals due to rounding. Percentage change is based on unrounded numbers. Includes claims for which at least $1 of EI regular benefits was paid.

- 1 Takes into account Family Supplement top-ups paid to claimants with regular benefits. Includes benefits paid for training purposes under section 25 of the Employment Insurance Act.

- 2 As of October 12, 2014, there is a total of 62 Employment Insurance (EI) economic regions, instead of 58 regions. The EI economic regions of Prince Edward Island, Yukon, the Northwest Territories and Nunavut were each divided into two EI economic regions, one consisting of the capital area and the remaining consisting of the non-capital area. Amounts paid were registered in FY1516 in the four former EI economic regions in spite of the change in EI economic region boundaries because some claims established just prior to that change had continued to be paid in FY1516.

- Source: Employment and Social Development Canada, Employment Insurance (EI) administrative data. Data are based on a 10% sample of EI administrative data.

-

Annex 2.9 Seasonal regular claimants

Annex 2.9.1 – Seasonal regular claimants1: New claims established2 Province or territory FY1314 FY1415 FY1516 FY1617 FY1718 Change (%) FY1617 to FY1718 Newfoundland and Labrador 32,100 30,720 32,470 17,130 14,630 -14.6 Prince Edward Island 8,750 8,580 8,590 8,430 8,340 -1.1 Nova Scotia 26,060 25,560 24,970 24,630 25,340 +2.9 New Brunswick 34,470 34,090 34,910 33,620 33,890 +0.8 Quebec 160,890 159,240 159,380 156,020 157,360 +0.9 Ontario 95,870 97,110 98,420 92,340 96,070 +4.0 Manitoba 10,520 10,820 11,090 9,970 10,320 +3.5 Saskatchewan 7,770 7,770 8,240 4,800 3,790 -21.0 Alberta 13,000 13,700 15,280 8,650 7,690 -11.1 British Columbia 32,100 31,370 31,500 24,410 22,960 -5.9 Yukon 550 520 560 420 430 +2.4 Northwest Territories 280 210 230 220 260 +18.2 Nunavut 50 30 50 40 30 -25.0 Gender Men 262,030 261,810 266,130 232,770 235,580 +1.2 Women 160,380 157,910 159,560 147,910 145,530 -1.6 Age 24 years old and under 10,940 10,540 10,470 8,130 7,930 -2.5 25 to 44 years old 155,330 154,680 156,900 142,730 144,000 +0.9 45 to 54 years old 126,060 120,920 119,340 103,330 98,730 -4.5 55 years old and over 130,080 133,580 138,980 126,490 130,450 +3.1 Canada 422,410 419,720 425,690 380,680 381,110 +0.1 - Note: Includes claims for which at least $1 of EI regular benefits was paid.

- 1 Seasonal regular claimants are individuals who established three or more regular or fishing claims in the five fiscal years preceding the reference year, of which at least two were established at the same time of year as their claim in the reference year. For the purposes of this annex, a 17-week window is used to determine whether a claim was established at the same time of year as their claim in the reference year. Specifically, a claim is considered to have been established at the same time of year if was established between eight weeks before and eight weeks after the week in which the reference year claim was established.

- 2 In previous Employment Insurance Monitoring and Assessment Reports, this annex dealt with all seasonal claimants, not only seasonal regular claimants. By definition, all those receiving fishing benefits were considered seasonal claimants, and their statistics were therefore included in this annex. For the FY1718 Employment Insurance Monitoring and Assessment Report, for consistency and simplicity, this annex deals only with seasonal regular claimants, and data on individuals receiving fishing benefits are shown separately in Annex 2.10.

- Source: Employment and Social Development Canada, Employment Insurance (EI) administrative data. Data are based on a 10% sample of EI administrative data.

Annex 2.9.2 – Seasonal regular claimants1: Average actual duration (number of weeks) Province or territory FY1314 FY1415 FY1516 FY1617 FY1718p Change (%) FY1617 to FY1718 Newfoundland and Labrador 26.9 26.6 26.7 34.5r 32.8 -5.0 Prince Edward Island 23.8 23.1 23.6 23.9r 23.7 -1.0 Nova Scotia 23.7 22.7 23.6 22.9r 22.4 -2.0 New Brunswick 24.6 24.6 24.6 24.2r 23.2 -3.8 Quebec 16.8 17.1 17.1 16.7r 15.5 -6.9 Ontario 14.6 14.6 14.0 14.8r 13.8 -6.6 Manitoba 14.7 13.8 15.3 16.1r 15.7 -2.2 Saskatchewan 16.3 16.2 16.6 24.7r 22.7 -8.3 Alberta 13.2 12.9 14.2 21.8r 22.4 +2.6 British Columbia 15.8 15.0 15.0 17.4r 16.9 -2.5 Yukon 22.4 21.3 19.9 19.4r 20.2 +4.2 Northwest Territories 27.0 23.7 24.1 24.5r 21.3 -13.1 Nunavut 27.8 37.3 26.7 38.0 31.0 -18.4 Gender Men 19.0 18.9 19.0 19.9r 18.4 -7.4 Women 16.8 16.3 16.1 17.2r 16.5 -4.2 Age 24 years old and under 18.1 17.7 18.2 18.7r 17.6 -5.7 25 to 44 years old 17.1 16.9 17.0 17.5r 16.5 -6.0 45 to 54 years old 18.0 17.7 17.7 18.7r 17.6 -5.9 55 years old and over 19.5 19.2 19.1 20.7r 19.0 -7.8 Canada 18.2 17.9 17.9 18.9r 17.7 -6.5 - Note: Percentage change is based on unrounded numbers. Includes claims for which at least $1 of EI regular benefits was paid. Based on completed claims which include those that are terminated and those that are dormant and remained inactive as of August the following fiscal year.

- 1 Seasonal regular claimants are individuals who established three or more regular or fishing claims in the five fiscal years preceding the reference year, of which at least two were established at the same time of year as their claim in the reference year. For the purposes of this annex, a 17-week window is used to determine whether a claim was established at the same time of year as their claim in the reference year. Specifically, a claim is considered to have been established at the same time of year if was established between eight weeks before and eight weeks after the week in which the reference year claim was established.

- p Preliminary.

- r Revised.

- Source: Employment and Social Development Canada, Employment Insurance (EI) administrative data. Data are based on a 10% sample of EI administrative data.

Annex 2.9.3 – Seasonal regular claimants1: Average weekly benefit rate2,3 ($) Province or territory FY1314 FY1415 FY1516 FY1617 FY1718 Change (%) FY1617 to FY1718 Newfoundland and Labrador 426 439 452 428 439 +2.4 Prince Edward Island 404 413 431 443 452 +2.1 Nova Scotia 411 427 433 440 450 +2.2 New Brunswick 417 426 440 453 465 +2.7 Quebec 436 447 456 466 475 +2.0 Ontario 443 456 466 478 486 +1.7 Manitoba 425 435 442 452 465 +2.9 Saskatchewan 441 451 465 457 487 +6.5 Alberta 468 478 488 485 505 +4.1 British Columbia 422 431 445 444 451 +1.6 Yukon 489 497 514 517 524 +1.3 Northwest Territories 498 513 517 515 536 +4.2 Nunavut 501 431 507 484 466 -3.7 Gender Men 458 470 481 487 495 +1.6 Women 392 403 413 423 436 +3.0 Age 24 years old and under 444 462 478 479 490 +2.2 25 to 44 years old 451 464 475 484 495 +2.1 45 to 54 years old 431 443 454 462 473 +2.5 55 years old and over 412 423 432 437 447 +2.3 Canada 433 445 455 462 473 +2.2 - Note: Percentage change is based on unrounded numbers. Includes claims for which at least $1 of EI regular benefits was paid.