Employment Insurance Monitoring and Assessment Report for the fiscal year beginning April 1, 2017 and ending March 31, 2018

Chapter 2 - 2 Employment Insurance regular benefits

From: Employment and Social Development Canada

On this page

- 2.2 Employment Insurance regular benefits

- 2.2.1 Employment Insurance regular claims and amount paid

- 2.2.2 Employment Insurance regular benefits: coverage, eligibility and access

- 2.2.3 Level of Employment Insurance regular benefits

- 2.2.4 Extension of Employment Insurance regular benefits for workers in regions affected by the downturn in commodity prices

- 2.2.5 Employment Insurance regular benefit entitlement

- 2.2.6 Employment Insurance regular benefits and seasonal claimants

- 2.2.7 Exhaustion of Employment Insurance regular benefits

- 2.2.8 Working While on Claim

2.2 Employment Insurance regular benefits

Employment Insurance (EI) regular benefits are designed to provide temporary income support to partially replace lost employment income for eligible claimants while they search for work or upgrade their skills. In order to qualify for EI regular benefits, unemployed individuals have to meet certain requirements; these include: the individuals must have paid EI premiums during their qualifying period (defined as either the 52 weeks prior to the establishment of the new claim or since the establishment of a previous claim, whichever is shorter), they must have been unemployed and without pay for at least 7 consecutive days, and they must have accumulated between 420 and 700 hours of insurable employment during the qualifying period (depending on the unemployment rate of the EI economic region in which they reside at the time of making their claim). Claimants must also be available for and actively seeking suitable employment while claiming benefits.Footnote 15

For the purpose of this section, EI regular claims refer to the ones for which at least one dollar of regular benefits was paid.

2.2.1 Employment Insurance regular claims and amount paid

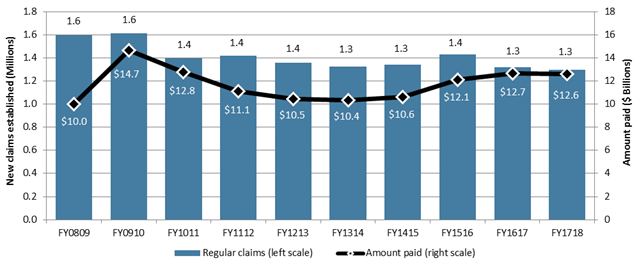

The number of new EI regular claims established decreased by 1.6% from 1.32 million in FY1617 to 1.30 million in FY1718. This decline was largely attributable to the notable decline in new claims established in Alberta (-20.4%), reflecting the slight recovery in employment observed in that province.

The total amount of EI regular benefits paid in FY1718 decreased by 0.2% from $12.7 billion in FY1617 to $12.6 billion in FY1718. As illustrated in Chart 5, the decline in the total amount paid in FY1718 is observed after it had increased for the previous three consecutive years.

Chart 5 – Text version

| Fiscal year | Regular claims (millions) (left scale) | Amount paid ($ billions) (right scale) |

|---|---|---|

| FY0809 | 1.6 | $10.0 |

| FY0910 | 1.6 | $14.7 |

| FY1011 | 1.4 | $12.8 |

| FY1112 | 1.4 | $11.1 |

| FY1213 | 1.4 | $10.5 |

| FY1314 | 1.3 | $10.4 |

| FY1415 | 1.3 | $10.6 |

| FY1516 | 1.4 | $12.1 |

| FY1617 | 1.3 | $12.7 |

| FY1718 | 1.3 | $12.6 |

- Note: Includes claims for which at least $1 of EI regular benefits was paid.

- Source: Employment and Social Development Canada, Employment Insurance (EI) administrative data. Data are based on a 10% sample of EI administrative data.

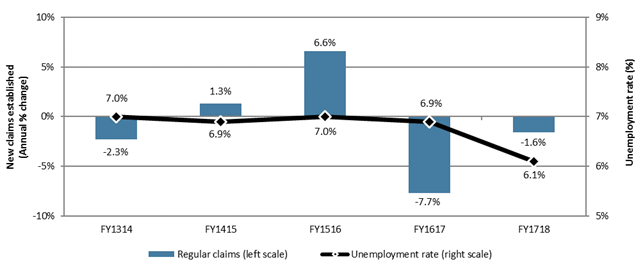

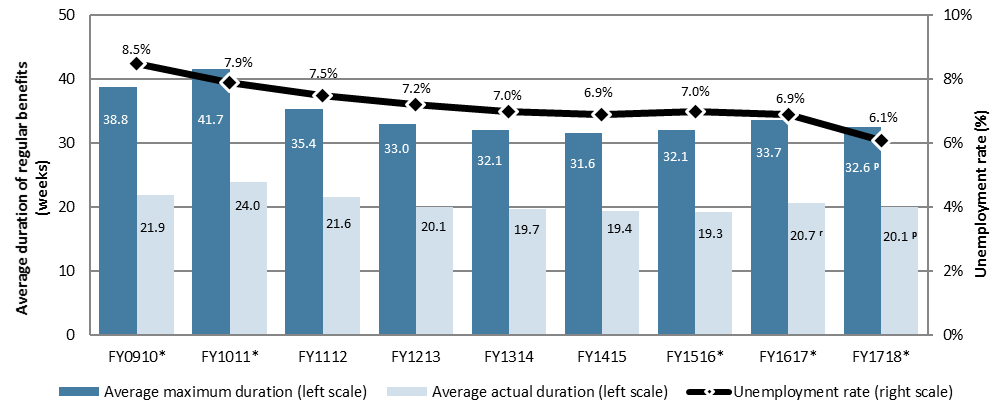

The number of new claims established tends to be responsive to labour market conditions and overall economic conditions, as EI regular benefits are designed to provide temporary income support for eligible claimants during periods of unemployment. During periods of economic growth and robust labour market conditions, fewer claims for EI regular benefits are established, while the opposite is true during periods of economic stagnation and unfavourable labour market conditions. This is evident in Chart 5—the number of new claims established reached the peak of 1.6 million in FY0910 following the recession in FY0809. As discussed in Chapter I, the Canadian economy experienced strong growth in FY1718 as GDP increased by 3.0% compared to the previous year, while the labour force increased by 1.0% during the same time period. The national unemployment rate decreased from 6.9% in FY1617 to 6.1% in FY1718 as the number of unemployed individuals declined by 10.0% during the same time period, leading to the corresponding decrease in the volume of new claims established for EI regular benefits (-1.6%) (see Chart 6).

Chart 6 – Text version

| Fiscal year | Regular claims (left scale) | Unemployment rate (right scale) |

|---|---|---|

| FY1314 | -2.3% | 7.0% |

| FY1415 | 1.3% | 6.9% |

| FY1516 | 6.6% | 7.0% |

| FY1617 | -7.7% | 6.9% |

| FY1718 | -1.6% | 6.1% |

- Note: Includes claims for which at least $1 of EI regular benefits was paid.

- Source: Employment and Social Development Canada, Employment Insurance (EI) administrative data. Data are based on a 10% sample of EI administrative data.

On average, there were 511,800 beneficiaries receiving EI regular benefits each month in FY1718, compared to 566,000 beneficiaries each month in the previous year,Footnote 16 representing a decrease of 9.6%. Because the number of beneficiaries is based on previously established claims, these two measures tend to move in similar directions, with the count of beneficiaries usually lagging behind the number of new claims established. To illustrate this, suppose there is an increase in the number of claims established for EI regular benefits after an economic shock. The number of beneficiaries will increase following the increase in claims. However, the count of beneficiaries can still remain elevated even after the volume of new claims have subsided once the labour market conditions improve, as payments continue to be made on previously established claims until benefits are exhausted or the claimants have found employment.

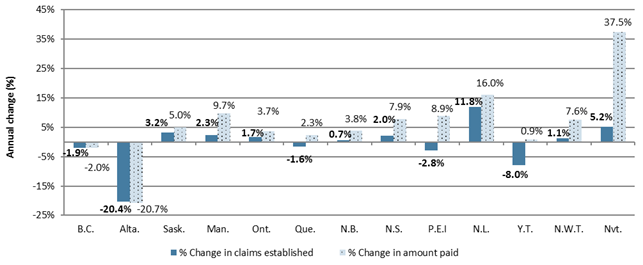

Employment Insurance regular claims and amount paid by province or territory, gender and age

As illustrated in Chart 7, the number of claims established for EI regular benefits increased in six of the ten provinces, and in two of the three territories. Among the provinces, the number of claims increased significantly in magnitude in Newfoundland and Labrador (+6,580 claims or +11.8%). The most significant decrease in the number of claims was observed in Alberta (-28,740 claims or -20.4%).

Chart 7 – Text version

| Province or territory | % Change claims established | % Change amount paid |

|---|---|---|

| British Columbia | -1.9% | -2.0% |

| Alberta | -20.4% | -20.7% |

| Saskatchewan | 3.2% | 5.0% |

| Manitoba | 2.3% | 9.7% |

| Ontario | 1.7% | 3.7% |

| Quebec | -1.6% | 2.3% |

| New Brunswick | 0.7% | 3.8% |

| Nova Scotia | 2.0% | 7.9% |

| Prince Edward Island | -2.8% | 8.9% |

| Newfoundland and Labrador | 11.8% | 16.0% |

| Yukon | -8.0% | 0.9% |

| Northwestern Territories | 1.1% | 7.6% |

| Nunavut | 5.2% | 37.5% |

- Note: Includes claims for which at least $1 of EI regular benefits was paid.

- Source: Employment and Social Development Canada, Employment Insurance (EI) administrative data. Data are based on a 10% sample of EI administrative data.

In terms of the total EI regular benefits paid in FY1718, it increased in all provinces and territories (see Chart 7) except Alberta (-20.7%) and British Columbia (-2.0%) compared to the previous year. On the other hand, the largest percentage increase in amount paid was observed in Nunavut (+37.5%), followed by Newfoundland and Labrador (+16.0%). Although the percentage increase in benefits payments was moderate in Ontario and Quebec, these two provinces continued to account for half (49.3%) of all EI regular benefits paid in FY1718.

Table 7 outlines the number of EI regular claims established and amount paid by gender and age groups. The number of claims established by both men and women decreased in the reporting period compared to the previous year (-2.2% and -0.7%, respectively). The share of claims established by gender remained stable year-over-year.

In terms of the total amount paid in EI regular benefits, men accounted for 66.1% of the total benefits paid in FY1718, down from 68.0% in the previous year. Consequently, the share of benefits paid to women increased from 32.0% in FY1617 to 33.9% in FY1718.

| Number of claims | Amount paid | |||||

|---|---|---|---|---|---|---|

| FY1617 | FY1718 | Change (%) | FY1617 | FY1718 | Change (%) | |

| Gender | ||||||

| Men | 806,660 | 788,880 | -2.2% | $8,612.3 | $8,359.3 | -2.9% |

| Women | 514,470 | 510,830 | -0.7% | $4,057.8 | $4,281.2 | +5.5% |

| Age category | ||||||

| 24 years old and under | 126,880 | 118,750 | -6.4% | $1,158.1 | $1,076.1 | -7.1% |

| 25 to 44 years old | 588,420 | 571,930 | -2.8% | $5,548.9 | $5,449.7 | -1.8% |

| 45 to 54 years old | 298,500 | 289,420 | -3.0% | $2,921.7 | $2,876.7 | -1.5% |

| 55 years old and over | 307,330 | 319,610 | +4.0% | $3,041.3 | $3,238.0 | +6.5% |

| Canada | 1,321,130 | 1,299,710 | -1.6% | $12,670.1 | $12,640.5 | -0.2% |

- Note: Data may not add up to the total due to rounding. Percentage change is based on unrounded numbers. Includes claims for which at least $1 of EI regular benefits was paid.

- Source: Employment and Social Development Canada, Employment Insurance (EI) administrative data. Data are based on a 10% sample of EI administrative data.

The number of claims established and amount paid for EI regular benefits decreased for all age groups in the reporting period compared to the previous year, except for the older claimants (aged 55 years and over). Claimants who were between 25 and 44 years old continued to account for the largest share of regular claims in FY1718, while the smallest share was for younger claimants aged less than 25 years.

One notable trend that has been observed over the past few years is that, while the shares of new claims established by different age groups has been relatively stable, the share of new claims established by older claimants aged 55 years and over has increased slowly but steadily over the past several years. The trends observed for older claimants are likely attributable in part to Canada’s aging population and the labour force composition. Individuals in this age category accounted for 21.1% of the labour force in FY1718, up from 14.9% in FY0708 (+6.2 percentage points).Footnote 17

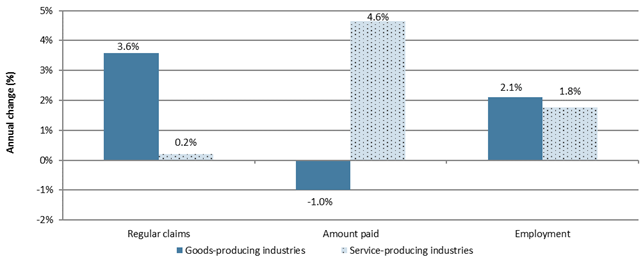

Employment Insurance regular claims and amount paid by industry

As outlined in Table 8, the number of new claims established for EI regular benefits increased slightly in FY1718 compared to the previous year for the goods-producing industries (+17,360 claims or +3.6%), while for the service producing industries it remained stable. Among the goods-producing industries, the Construction industry accounted for more than half (57.5%) of all claims established, and exhibited the largest increase in FY1718 compared to the previous year. On the other hand, the largest decrease was in the Mining and oil and gas extraction industry where the number of claims declined by 12.6%. Among the services-producing industries, the Educational services industry accounted for the largest share of claims in FY1718 (20.6%). On a year-over-year basis, the largest percentage increase in the number of claims established in the services-producing sector was observed for the Finance and insurance industry (+6.7%), while the largest decrease was for the Wholesale trade industry (-8.7%).

The amount of benefits paid to claimants in the goods-producing sector decreased by $54.1 million (-1.0%) in the reporting period compared to the previous year, while it increased for claimants in the services-producing sector by $310.9 million (+4.6%). The decline in amount paid in the goods-producing industries was mainly attributable to the large decrease (-138.8 million or -30.9%) in the Mining and oil and gas extraction industry. The decrease was offset by increases in the Utilities industry (+14.3%) and the Agriculture, forestry, fishing and hunting industry (+12.2%).

The total amount of EI regular benefits paid to claimants in the services-producing industries increased by $310.9 million (+4.6%) in FY1718 compared to the previous year. This increase is mostly attributed to the Educational services industry where the claimants received $154.9 million (+22.3%) more in FY1718 than the previous year. The Accommodation and food services industry and the Information, culture and recreation industry also had significant increases in the amount paid for EI regular benefits (+12.8% and +12.0%, respectively). On the other hand, the largest percentage decrease in amount paid in the reporting year was observed in the Professional, scientific and technical services industry (-9.8% or -$65.4 million).

| Industry | Number of claims (% share of all claims) |

Amount paid - $ Million (% share of total amount paid) |

||||

|---|---|---|---|---|---|---|

| FY1617 | FY1718 | Change (%) | FY1617 | FY1718 | Change (%) | |

| Goods-producing Industries | 484,720 (36.7%) |

502,080 (38.6%) |

+3.6% | $5,397.7 (42.6%) |

$5,343.6 (42.3%) |

-1.0% |

| Agriculture, forestry, fishing and hunting | 51,910 (3.9%) |

53,760 (4.1%) |

+3.6% | $515.6 (4.1%) |

$578.2 (4.6%) |

+12.2% |

| Mining and oil and gas extraction | 24,430 (1.8%) |

21,340 (1.6%) |

-12.6% | $448.8 (3.5%) |

$310.0 (2.5%) |

-30.9% |

| Utilities | 3,980 (0.3%) |

4,150 (0.3%) |

+4.3% | $42.2 (0.3%) |

$48.2 (0.4%) |

+14.3% |

| Construction | 273,380 (20.7%) |

288,870 (22.2%) |

+5.7% | $3,001.5 (23.7%) |

$3,113.4 (24.6%) |

+3.7% |

| Manufacturing | 131,020 (9.9%) |

133,960 (10.3%) |

+2.2% | $1,389.6 (11.0%) |

$1,293.7 (10.2%) |

-6.9% |

| Services-producing Industries | 762,630 (57.7%) |

764,150 (58.8%) |

+0.2% | $6,687.7 (52.8%) |

$6,998.6 (55.4%) |

+4.6% |

| Wholesale trade | 43,600 (3.3%) |

39,790

(3.1%) |

-8.7% | $515.1 (4.1%) |

$492.3 (3.9%) |

-4.4% |

| Retail trade | 76,300 (5.8%) |

79,090 (6.1%) |

+3.7% | $712.3 (5.6%) |

$763.4 (6.0%) |

+7.2% |

| Transportation and warehousing | 59,470 (4.5%) |

60,190 (4.6%) |

+1.2% | $556.8 (4.4%) |

$533.3 (4.2%) |

-4.2% |

| Finance and insurance | 14,080 (1.1%) |

15,020 (1.2%) |

+6.7% | $177.9 (1.4%) |

$193.9 (1.5%) |

+8.9% |

| Real estate, rental and leasing | 18,640 (1.4%) |

17,720 (1.4%) |

-4.9% | $208.1 (1.6%) |

$207.3 (1.6%) |

-0.4% |

| Professional, scientific and technical services | 54,190 (4.1%) |

52,690 (4.1%) |

-2.8% | $666.4 (5.3%) |

$601.1 (4.8%) |

-9.8% |

| Business, building and other support services* | 88,740 (6.7%) |

86,380 (6.6%) |

-2.7% | $876.9 (6.9%) |

$871.4 (6.9%) |

-0.6% |

| Educational services | 153,460 (11.6%) |

157,110 (12.1%) |

+2.4% | $695.1 (5.5%) |

$850.0 (6.7%) |

+22.3% |

| Health care and social assistance | 45,740 (3.5%) |

46,590 (3.6%) |

+1.9% | $389.6 (3.1%) |

$424.0 (3.4%) |

+8.8% |

| Information, culture and recreation** | 38,030 (2.9%) |

39,080 (3.0%) |

+2.8% | $337.1 (2.7%) |

$377.7 (3.0%) |

+12.0% |

| Accommodation and food services | 60,630 (4.6%) |

63,840 (4.9%) |

+5.3% | $496.3 (3.9%) |

$559.9 (4.4%) |

+12.8% |

| Other services (excluding Public administration) | 42,020 (3.2%) |

40,340 (3.1%) |

-4.0% | $424.4 (3.3%) |

$421.5 (3.3%) |

-0.7% |

| Public administration | 67,730 (5.1%) |

66,310 (5.1%) |

-2.1% | $631.5 (5.0%) |

$702.7 (5.6%) |

+11.3% |

| Unclassified | 73,780 (5.6%) |

33,480 (2.6%) |

-54.6% | $584.7 (4.6%) |

$298.4 (2.4%) |

-49.0% |

| Canada | 1,321,130 (100.0%) |

1,299,710 (100.0%) |

-1.6% | $12,670.1 (100.0%) |

$12,640.5 (100.0%) |

-0.2% |

- Note: Data may not add up to the total due to rounding. Percentage change is based on unrounded numbers. Includes claims for which at least $1 of EI regular benefits was paid.

- * This industry sector comprises the industries with codes 55 (Management of companies and enterprises) and 56 (Administration and support, waste management and remediation services).

- ** This industry sector comprises the industries with codes 51 (Information and cultural industries) and 71 (Arts, entertainment and recreation).

- Source: Employment and Social Development Canada, Employment Insurance (EI) administrative data. Data are based on a 10% sample of EI administrative data.

Chart 8 illustrates the percentage changes in the number of new regular claims, amount paid and employment by industry grouping in FY1718 compared to the previous year. The employment gain in the goods-producing industries was slightly higher than that in the services-producing industries, whereas the increase in claims in the goods-producing industries was more significant than that in the services-producing industries. Changes in the amount paid in goods-producing and services-producing industries were in opposite direction—claimants in the goods-producing industries received 1.0% less in EI regular benefit payments in FY1718 compared to the previous year while those in the services-producing industries received 4.6% more in benefit payments.

Chart 8 – Text version

| Industry | Regular claims | Amount paid | Employment |

|---|---|---|---|

| Goods-producing industries | 3.6% | -1.0% | 2.1% |

| Services-producing industries | 0.2% | 4.6% | 1.8% |

- Note: Includes claims for which at least $1 of EI regular benefits was paid.

- Source: Employment and Social Development Canada, Employment Insurance (EI) administrative data. Data are based on a 10% sample of EI administrative data. Statistics Canada, Labour Force Survey, Table 14-10-0022-01.

Employment Insurance regular benefits and firms

According to the 2016 tax dataFootnote 18 available from Canada Revenue Agency (CRA), the number of firms operating in Canada remained stable (0.4% increase) compared to 2015. Among the 1.2 million firms, 311,600 (representing 26.0% of all firms) employed at least one employee who had received EI regular benefits.

Table 9 outlines the number of firms, employment and EI regular claimants by sizeFootnote 19 of firms. The proportion of firms which employed at least one employee receiving EI regular benefits varied widely by firm size, with smaller firms being less likely to be the last employer of a claimant. For example, 20.5% of small-sized firms in 2016 had at least one former employee who received EI regular benefits, compared to 75.3% of small-to-medium sized firms, 95.2% of medium-to-large sized firms and 99.6% of large-sized firms.

However, when the number of claimants for EI regular benefits is compared with distribution of workforce by firm size, employees from smaller firms are found to be over-represented among EI regular claimants. As shown in Table 9, smaller firms accounted for 21.7% of the total workforce while they represented 26.3% of the total EI regular benefit claimants in 2016. Similarly, employees in the small-to-medium sized firms were also over-represented among EI regular claimants—these firms accounted for 19.7% of the total employees and 24.7% of the total EI regular claimants. This gap between the share of employment and the share of EI regular claimants narrows for the medium-to-large sized firms. For the large-sized firms, however, the opposite was observed—these firms represented 42.6% of the total workforce in Canada in 2016 but accounted for only 31.3% of the total EI regular claimants. The higher proportion of usage of EI regular benefits among employees in the smaller-sized firms suggest that smaller firms are more vulnerable to difficult business or economic conditions than larger firms, and need to make broader adjustments to their workforces, resulting in a larger share of their employees claiming EI regular benefits as a result of layoffs. Moreover, this trend can also be influenced by industry-related characteristics such as the greater prevalence of seasonal jobs in small-sized firms that are generally more likely to rely on EI, relative to the national average in some industries.Footnote 20

| Firm size | Number of firms | Employment distribution** (% share) | EI claimant distribution*** (% share) | |

|---|---|---|---|---|

| All firms | Firms with at least one employee receiving EI regular benefits | |||

| Small | 1,086,990 | 222,730 | 21.7% | 26.3% |

| Small-medium | 93,840 | 70,640 | 19.7% | 24.7% |

| Medium-large | 15,770 | 15,020 | 15.9% | 17.8% |

| Large | 3,210 | 3,190 | 42.6% | 31.3% |

| Canada | 1,199,800 | 311,590 | 100.0% | 100.0% |

- Note: Data may not add up due to rounding.

- * The categories of firm size reflect those found in Business Dynamics in Canada, a Statistics Canada publication. Small-sized firms are defined as those that employ 1 to 19 employees. Small-to-medium sized firms employ 20 to 99 employees. Medium-to-large sized firms employ 100 to 499 employees. Large-sized firms employ 500 employees or more.

- ** The number of workers in a firm is the number of individuals with employment income in that firm, as indicated on a T4 form. The number of workers is adjusted so that each individual in the labour force is only counted once and individuals who work for more than one firm are taken into account. For example, if an employee that earned $25,000 in firm 1 and $25,000 in firm 2, then he or she was recorded as 0.5 employees at the first firm and 0.5 employees at the second firm.

- *** These are based on the number of people receiving EI regular benefits in 2016.

- Source: Employment and Social Development Canada, Employment Insurance (EI) administrative data. Data are based on a 100% sample of EI administrative data. Canada Revenue Agency, CRA administrative data. CRA data are based on a 100% sample.

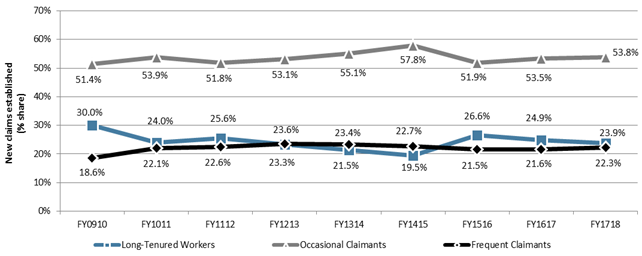

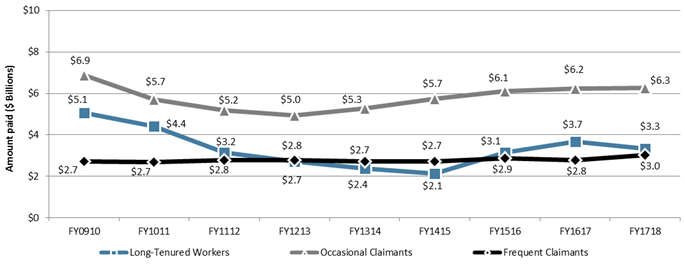

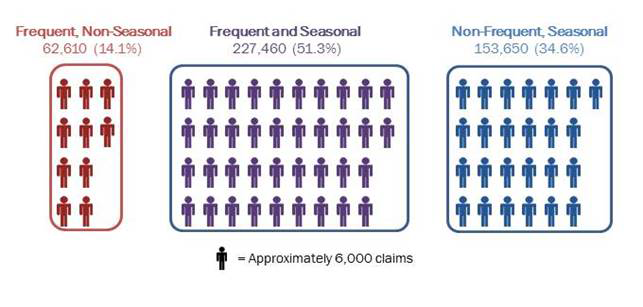

Employment Insurance regular claims and amount paid by EI claimant category

Table 10 outlines the number of claims established for EI regular benefits and amount paid by EI claimant category.Footnote 21 The number of claims established by long-tenured workers decreased by 5.8% in the reporting period compared to the previous year. During the same period, the total amount paid to long-tenured workers decreased by 9.2% to reach $3,343.6 million. On the other hand, both the number of claims established and amount paid for occasional claimants changed slightly in FY1718 compared to the previous year. Lastly, the number of claims established by frequent claimants had a slight increase in the reporting period; while the total amount paid to the claimants in this category increased more significantly (+$256.0 million or +9.2%).

It is also evident from Table 10 that long-tenured workers, who are more likely to have contributed substantially to the EI regime through premiums, continue to proportionally benefit more from EI regular benefits. In FY1718 they accounted for 23.9% of all new regular claims established while they received 26.5% of the total amount paid. Occasional claimants, on the other hand, proportionally benefited less—they accounted for 53.8% of all new claims established in FY1718 but received 49.6% of the total amount paid. Frequent claimants accounted for 22.3% of total new regular claims in the reporting year and received 23.9% of the total amount paid.

| Claimant category | Number of claims (% share of all EI regular claims) |

Amount paid (% share of total amount paid for EI regular benefits) |

||||

|---|---|---|---|---|---|---|

| FY1617 | FY1718 | Change (%) | FY1617 | FY1718 | Change (%) | |

| Long-tenured workers | 329,290 (24.9%) |

310,270 (23.9%) |

-5.8% | $3,681.5 (29.1%) |

$3,343.6 (26.5%) |

-9.2% |

| Occasional claimants | 706,150 (53.5%) |

699,370 (53.8%) |

-1.0% | $6,220.2 (49.1%) |

$6,272.5 (49.6%) |

+0.8% |

| Frequent claimants | 285,690 (21.6%) |

290,070 (22.3%) |

+1.5% | $2,768.4 (21.9%) |

$3,024.4 (23.9%) |

+9.2% |

| Canada | 1,321,130 (100.0%) |

1,299,710 (100.0%) |

-1.6% | $12,670.1 (100.0%) |

$12,640.5 (100.0%) |

-0.2% |

- Note: Data may not add up to the total due to rounding. Percentage change is based on unrounded numbers. Includes claims for which at least $1 of EI regular benefits was paid.

- * See Annex 2.1 for definitions of EI claimant categories referenced in this table.

- Source: Employment and Social Development Canada, Employment Insurance (EI) administrative data. Data are based on a 10% sample of EI administrative data.

Chart 9 and Chart 10 show the shares of EI regular claims established and the total amount paid by claimant categories from FY0910 to FY1718.

Chart 9 – Text version

| Fiscal year | Long-tenured workers | Occasional claimants | Frequent claimants |

|---|---|---|---|

| FY0910 | 30.0% | 51.4% | 18.6% |

| FY1011 | 24.0% | 53.9% | 22.1% |

| FY1112 | 25.6% | 51.8% | 22.6% |

| FY1213 | 23.3% | 53.1% | 23.6% |

| FY1314 | 21.5% | 55.1% | 23.4% |

| FY1415 | 19.5% | 57.8% | 22.7% |

| FY1516 | 26.6% | 51.9% | 21.5% |

| FY1617 | 24.9% | 53.5% | 21.6% |

| FY1718 | 23.9% | 53.8% | 22.3% |

- Note: Includes claims for which at least $1 of EI regular benefits was paid.

- * See Annex 2.1 for definitions of claimant categories referenced in this chart.

- Source: Employment and Social Development Canada, Employment Insurance (EI) administrative data. Data are based on a 10% sample of EI administrative data.

Chart 10 – Text version

| Fiscal year | Long-tenured workers | Occasional claimants | Frequent claimants |

|---|---|---|---|

| FY0910 | $5.1 | $6.9 | $2.7 |

| FY1011 | $4.4 | $5.7 | $2.7 |

| FY1112 | $3.2 | $5.2 | $2.8 |

| FY1213 | $2.7 | $5.0 | $2.8 |

| FY1314 | $2.4 | $5.3 | $2.7 |

| FY1415 | $2.1 | $5.7 | $2.7 |

| FY1516 | $3.1 | $6.1 | $2.9 |

| FY1617 | $3.7 | $6.2 | $2.8 |

| FY1718 | $3.3 | $6.3 | $3.0 |

- Note: Includes claims for which at least $1 of EI regular benefits was paid.

- * See Annex 2.1 for definitions of claimant categories referenced in this chart.

- Source: Employment and Social Development Canada, Employment Insurance (EI) administrative data. Data are based on a 10% sample of EI administrative data.

Employment Insurance regular claims by hours of insurable employment and unemployment rate in the Employment Insurance economic region of establishment

One of the eligibility conditions for EI regular benefits is the accumulation of enough hours of insurable employment during the qualifying period. The number of required hours depends on the unemployment rate in the EI economic region where the claim was established and known as the Variable Entrance Requirement (VER). The higher the unemployment rate in a given region, the lower the number of hours needed to qualify for EI regular benefits (see Annex 2.2 for the full breakdown of required number of hours of insurable employment with corresponding regional rate of unemployment). A detailed discussion is provided in subsection 2.2.2 on eligibility and access to EI regular benefits.

Variable entrance requirement

In order to establish a benefit period a worker must accumulate between 420 and 700 hours of insurable employment in the qualifying period depending on the applicable regional rate of unemployment. The higher the regional rate of unemployment, the lower the number of hours of insurable employment required.

| Unemployment rate | Entrance requirement |

|---|---|

| 6.0% and under | 700 hours |

| 6.1% to 7.0% | 665 hours |

| 7.1% to 8.0% | 630 hours |

| 8.1% to 9.0% | 595 hours |

| 9.1% to 10.0% | 560 hours |

| 10.1% to 11.0% | 525 hours |

| 11.1% to 12.0% | 490 hours |

| 12.1% to 13.0% | 455 hours |

| More than 13.0% | 420 hours |

Table 11 outlines the distribution of EI regular claims for the past 5 years by the number of hours of insurable employment during the qualifying period. Consistent with previous years, claimants who accumulated more than 1,820 hours of insurable employment accounted for the largest share (25.5%) of total new EI regular claims established in FY1718. This was relatively unchanged from the previous year. On the other hand, claimants with less than 700 hours of insurable employment represented the smallest share (5.1%), decreasing by 0.7 percentage points compared to the previous year. All of the categories shown in Table 11 experienced a change in their share in FY1718 that was less than 1.0 percentage point compared to the previous year.

| Number of hours of insurable employment in the qualifying period | FY1314 | FY1415 | FY1516 | FY1617 | FY1718 |

|---|---|---|---|---|---|

| Less than 700 hours | 68,880 (5.2%) |

64,390 (4.8%) |

67,170 (4.7%) |

76,340 (5.8%) |

66,150 (5.1%) |

| 700 to 979 hours | 201,280 (15.2%) |

203,690 (15.2%) |

207,610 (14.5%) |

216,650 (16.4%) |

215,600 (16.6%) |

| 980 to 1,259 hours | 252,600 (19.1%) |

256,210 (19.1%) |

264,500 (18.5%) |

242,610 (18.4%) |

234,850 (18.1%) |

| 1,260 to 1,539 hours | 244,230 (18.4%) |

245,530 (18.3%) |

260,870 (18.2%) |

239,030 (18.1%) |

239,600 (18.4%) |

| 1,540 to 1,819 hours | 219,660 (16.6%) |

218,840 (16.3%) |

235,120 (16.4%) |

207,440 (15.7%) |

211,880 (16.3%) |

| 1,820 hours and more | 339,150 (25.6%) |

353,950 (26.4%) |

395,820 (27.7%) |

339,060 (25.7%) |

331,630 (25.5%) |

| Canada | 1,325,810 (100.0%) |

1,342,610 (100.0%) |

1,431,090 (100.0%) |

1,321,130 (100.0%) |

1,299,710 (100.0%) |

- Note: Data may not add up to the total due to rounding. Includes claims for which at least $1 of EI regular benefits was paid.

- Source: Employment and Social Development Canada, Employment Insurance (EI) administrative data. Data are based on a 10% sample of EI administrative data.

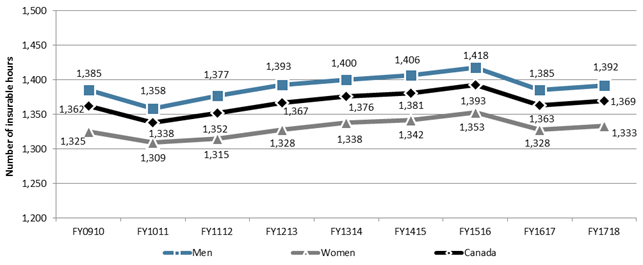

Chart 11 shows the average number of hours of insurable employment per claim receiving EI regular benefits from FY0910 to FY1718 by gender. In the reporting period, on average in Canada, claimants had accumulated 1,369 hours of insurable employment during their qualifying period, up from 1,363 hours in FY1617. The difference between the average number of hours of insurable employment for men and women has stayed around 60 hours over the years. In FY1718, men on average had 59 more hours of insurable employment than women. This can be attributable to the fact that a higher proportion of women work in part-time and/or temporary jobs than men, and thus accumulate fewer hours of insurable employment on average.

Chart 11 – Text version

| Fiscal year | Men | Women | Canada |

|---|---|---|---|

| FY0910 | 1,385 | 1,325 | 1,362 |

| FY1011 | 1,358 | 1,309 | 1,338 |

| FY1112 | 1,377 | 1,315 | 1,352 |

| FY1213 | 1,393 | 1,328 | 1,367 |

| FY1314 | 1,400 | 1,338 | 1,376 |

| FY1415 | 1,406 | 1,342 | 1,381 |

| FY1516 | 1,418 | 1,353 | 1,393 |

| FY1617 | 1,385 | 1,328 | 1,363 |

| FY1718 | 1,392 | 1,333 | 1,369 |

- Note: Includes claims for which at least $1 of EI regular benefits was paid.

- Source: Employment and Social Development Canada, Employment Insurance (EI) administrative data. Data are based on a 10% sample of EI administrative data.

In FY1718, claimants who were aged between 25 and 44 years accumulated the highest number of hours of insurable employment during their qualifying period (1,401 hours), followed by those who were 45 to 54 years old (1,397 hours). Younger claimants aged less than 25 years, on the other hand, accumulated the lowest number of hours of insurable employment (1,304 hours) in FY1718, closely followed by the older claimants above 55 years of age (1,309 hours).

Furthermore, the average number of hours of insurable employment per claim during the qualifying period in FY1718 varied by province and territory as well. Generally, the number of hours of insurable employment per claim in the Atlantic provinces and the Territories tend to be lower than other regions. This trend continued in the reporting period—the lowest average hours of insurable employment per claim among all provinces and territories was observed in Newfoundland and Labrador (1,165 hours), followed by Prince Edward Island (1,170 hours) and New Brunswick (1,226 hours). On the other hand, the highest average hours of insurable employment per claim in FY1718 was observed in Alberta (1,456 hours), followed by Ontario (1,441 hours) and British Columbia (1,400 hours).

Table 12 outlines the number and distribution of new claims established for EI regular benefits as well as the labour force and the unemployed population by regional unemployment rate. The share of new regular claims established in EI economic regions where the unemployment rate was between 0.1% and 7.0% was higher in FY1718 compared to previous fiscal years. This can be mainly attributable to the decrease, on average, in unemployment rates recorded in many regions in FY1718 compared to FY1617. Table 12 also shows that, in FY1718, EI regular claims established and the unemployed population were similarly spread across regional unemployment rate categories.

| Unemployment rate | Employment Insurance regular claims (% share of total claims) |

Labour force (% share of labour force) |

Number of unemployed (% share of unemployed) |

||||

|---|---|---|---|---|---|---|---|

| FY1314 | FY1415 | FY1516 | FY1617 | FY1718 | FY1718 | FY1718 | |

| 0.1% to 6.0% | 187,910 (14.2%) |

273,380 (20.4%) |

218,020 (15.2%) |

171,350 (13.0%) |

384,230 (29.6%) |

8,882,360 (44.6%) |

468,280 (35.0%) |

| 6.1% to 7.0% | 196,410 (14.8%) |

158,060 (11.8%) |

363,660 (25.4%) |

363,170 (27.5%) |

425,580 (32.7%) |

6,089,130 (30.6%) |

394,250 (29.5%) |

| 7.1% to 8.0% | 259,710 (19.6%) |

329,870 (24.6%) |

279,030 (19.5%) |

299,000 (22.6%) |

134,750 (10.4%) |

2,011,030 (10.1%) |

151,870 (11.4%) |

| 8.1% to 9.0% | 327,910 (24.7%) |

236,460 (17.6%) |

216,290 (15.1%) |

169,290 (12.8%) |

110,860 (8.5%) |

1,567,150 (7.9%) |

133,120 (10.0%) |

| 9.1% to 10.0% | 45,870 (3.5%) |

78,450 (5.8%) |

75,660 (5.3%) |

65,480 (5.0%) |

31,660 (2.4%) |

247,730 (1.2%) |

23,660 (1.8%) |

| 10.1% to 11.0% | 84,810 (6.4%) |

55,950 (4.2%) |

50,430 (3.5%) |

35,420 (2.7%) |

7,990 (0.6%) |

102,670 (0.5%) |

10,780 (0.8%) |

| 11.1% to 12.0% | 52,390 (4.0%) |

44,380 (3.3%) |

16,740 (1.2%) |

21,420 (1.6%) |

60,140 (4.6%) |

465,500 (2.3%) |

53,040 (4.0%) |

| 12.1% to 13.0% | 10,030 (0.8%) |

7,660 (0.6%) |

43,880 (3.1%) |

35,300 (2.7%) |

13,420 (1.0%) |

39,290 (0.2%) |

4,920 (0.4%) |

| 13.1% to 14.0% | 6,620 (0.5%) |

470 (0.0%) |

16,910 (1.2%) |

11,350 (0.9%) |

28,240 (2.2%) |

71,570 (0.4%) |

9,800 (0.7%) |

| 14.1% to 15.0% | 20,030 (1.5%) |

25,870 (1.9%) |

23,650 (1.7%) |

38,190 (2.9%) |

24,020 (1.8%) |

69,490 (0.3%) |

9,900 (0.7%) |

| 15.1% to 16.0% | 57,470 (4.3%) |

25,100 (1.9%) |

31,980 (2.2%) |

25,370 (1.9%) |

10,270 (0.8%) |

24,400 (0.1%) |

3,780 (0.3%) |

| 16.1% or higher | 76,650 (5.8%) |

106,960 (8.0%) |

94,870 (6.6%) |

85,790 (6.5%) |

68,550 (5.3%) |

340,380 (1.7%) |

73,230 (5.5%) |

| Canada | 1,325,810 (100.0%) |

1,342,610 (100.0%) |

1,431,090 (100.0%) |

1,321,130 (100.0%) |

1,299,710 (100.0%) |

19,910,700 (100.0%) |

1,336,630 (100.0%) |

- Note: Data may not add up to the total due to rounding. Includes claims for which at least $1 of EI regular benefits was paid.

- * Unemployment rates used for the Employment Insurance program are a moving average of seasonally adjusted rates of unemployment produced by Statistics Canada, as per section 17 of the Employment Insurance Regulations.

- Source: Employment and Social Development Canada, Employment Insurance (EI) administrative data and Statistics Canada, special tabulations from the Labour Force Survey. EI data are based on a 10% sample of EI administrative data.

Claimant obligations to search for and accept suitable employment

Under the Employment Insurance Act, claimants for EI regular benefits must generally be capable of and available for suitable employment and must demonstrate this by searching for and taking advantage of an opportunity for suitable employment in order to receive EI regular benefits.

As specified under section 27 of the Employment Insurance Act, a claimant is disqualified from receiving EI regular benefits in cases where he/she does not apply for suitable employment after becoming aware it is vacant, or fails to accept the employment after it being offered; has not taken advantage of an opportunity for suitable employment; or has not followed written direction by the Canada Employment Insurance Commission given to assist the claimant in finding suitable employment.

The Government made legislative and regulatory changes in July 2016 to simplify job search responsibilities for claimants of EI regular benefits. During the reporting period, the following criteria determine what constitutes suitable employment:

(a) the claimant’s health and physical capabilities allow them to commute to the place of work and to perform the work;

(b) the hours of work are not incompatible with the claimant’s family obligations or religious beliefs; and

(c) the nature of work is not contrary to the claimant’s moral convictions or religious beliefs.

While EI claimants are required to make reasonable and customary efforts to obtain suitable employment, they are not required to seek employment that is not suitable. Section 6(4) of the Employment Insurance Act also summarizes what constitutes employment that is considered not suitable:

(a) it arises in consequence of a work stoppage attributable to a labour dispute;

(b) it is in the claimant’s usual occupation and is either at a lower rate of earnings or on conditions less favourable than those observed by agreement between employers and employees or, in the absence of any such agreement, than those recognized by good employers; or

(c) it is not in the claimant’s usual occupation and is either at a lower rate of earnings or on conditions less favourable than those that the claimant might reasonably expect to obtain, having regard to the conditions that the claimant usually obtained in their usual occupation, or would have obtained if they had continued to be so employed.

Before the legislative change in July 2016, the Connecting Canadians with Available Jobs (CCAJ) initiative that started on January 6, 2013 was in effect. A recent departmental evaluation reportFootnote 22 found that the number of disqualifications or disentitlements due to inadequate job searches or failing to accept suitable jobs increased, but remained low relative to the total number of disqualifications and disentitlements during the period in which CCAJ was in effect (January 2013 to July 2016), indicating enhanced and more efficient monitoring of claimants by Service Canada.

Table 13 outlines the number of disqualifications and disentitlements related to refusal and failure to search for work in the past 5 years. In FY1718, there were a total of 1,730 disqualifications and disentitlements related to failure to search for work, compared to 1,340 incidents in the previous year. On the other hand, there were a total of 130 disqualifications and disentitlements related to refusal of suitable work in FY1718, compared to 170 incidents in the previous year. However, these two factors represent only a fraction (0.2%) of all disqualifications and disentitlements in FY1718, and do not take into consideration that benefits would generally have been reinstated in some situations once the claimants demonstrated that they were fulfilling their responsibilities.

| Type of disqualification or disentitlement | FY1314 | FY1415 | FY1516 | FY1617 | FY1718 | Change (%) FY1617 to FY1718 |

|---|---|---|---|---|---|---|

| Refusal of suitable work | 220 | 190 | 180 | 170 | 130 | -23.5% |

| Failure to search for work | 860 | 940 | 1,020 | 1,340 | 1,730 | +29.1% |

- Source: Statistics Canada, monthly Employment Insurance disqualifications and disentitlements, Table 14-10-0004-01.

2.2.2 Employment Insurance regular benefits: coverage, eligibility and access

As mentioned at the beginning of section 2.2, there are three eligibility criteria to qualify for EI regular benefits: the claimant must have had insurable employment and paid EI premiums within the previous 52 weeks; have a valid reason for job separation according to the Employment Insurance Act; and must have worked a minimum number of insurable hours (ranging from 420 to 700 hours, depending on the regional unemployment rate) within their qualifying period (defined as either the previous 52 weeks or since the establishment of their last claim, whichever is shorter). This subsection provides an overall picture of these three criteria in 2017 using results from the Employment Insurance Coverage Survey (EICS)Footnote 23 published annually by Statistics Canada. The survey provides statistics on the contributors and non-contributors to the EI program among the unemployed, as well as on the eligible recipients and those who did not qualify for EI regular benefits. The survey also provides information on the take-up of EI maternity and parental benefits in Canada (see sub-section 2.6.2).

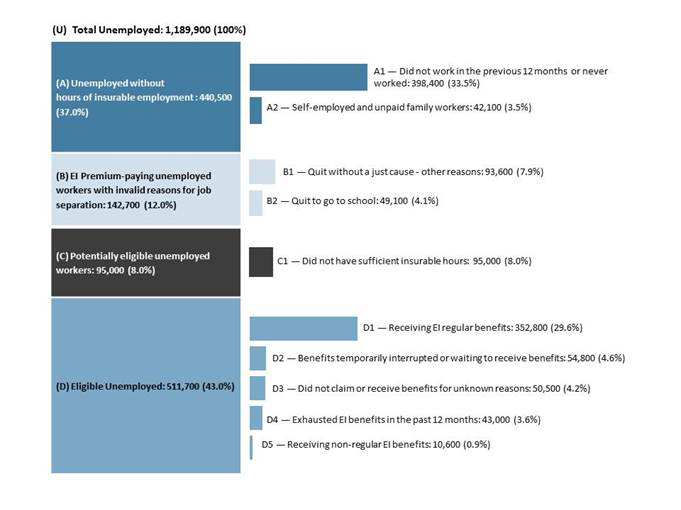

Chart 12 illustrates the characteristics of the unemployed population in Canada in 2017 with respect to their eligibility criteria for EI regular benefits using estimates from the EICS. The survey shows that on average there were 1,189,900 unemployed individuals per month in Canada in 2017. Among them, 440,500 did not contribute to the EI program—these include people who did not work in the previous 12 months or never worked (398,400 individuals representing 33.5% of the total unemployed) and self-employed and unpaid family workers (42,100 individuals representing 3.5% of the total unemployed). On the other hand, an estimated 749,400 individuals had paid EI premiums in the 52 weeks prior to becoming unemployed in 2017. These individuals represent 63.0% of all unemployed, down slightly from 2016 (65.3%). Of these premium-paying workers, 142,700 were ineligible to receive EI benefits because of an invalid job separation—a total of 93,600 had quit their jobs without a cause acceptable to the EI program, while the other 49,100 had quit to go to school. The number of workers who contributed to the EI program and had a valid job separation was 606,700, representing 51.0% of the total unemployed—down 2.4 percentage points from 2016 (53.4%). Of these, an estimated 511,700 individuals had enough hours of insurable employment within their qualifying period (43.0% of total unemployed), down from 593,500 individuals in 2016 (45.6% of total unemployed). These individuals were eligible to receive EI benefits as they met all three core requirements of the EI program.

Chart 12 – Text version

| (U) Total Unemployed: 1,189,900 (100%) | |

|---|---|

| (A) Unemployed without hours of insurable employment: 440,500 (37.0%) | A1—Did not work in the previous 12 months or never worked: 398,400 (33.5%) |

| A2—Self-employed and unpaid family workers: 42,100 (3.5%) | |

| (B) EI Premium-paying unemployed workers with invalid reasons for job separation: 142,700 (12.0%) | B1—Quit without a just cause - other reasons: 93,600 (7.9%) |

| B2—Quit to go to school: 49,100 (4.1%) | |

| (C) Potentially eligible unemployed workers: 95,000 (8.0%) | C1—Did not have sufficient insurable hours: 95,000 (8.0%) |

| (D) Eligible Unemployed: 511,700 (43.0%) | D1—Receiving EI regular benefits: 352,800 (29.6%) |

| D2—Benefits temporarily interrupted or waiting to receive benefits: 54,800 (4.6%) | |

| D3—Did not claim or receive benefits for unknown reasons: 50,500 (4.2%) | |

| D4—Exhausted EI benefits in the past 12 months: 43,000 (3.6%) | |

| D5—Receiving non-regular EI benefits: 10,600 (0.9%) |

- Note: Data may not add up to the total due to rounding.

- Source: Statistics Canada, Employment Insurance Coverage Survey, 2017.

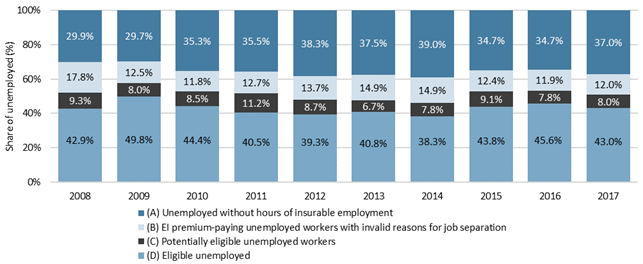

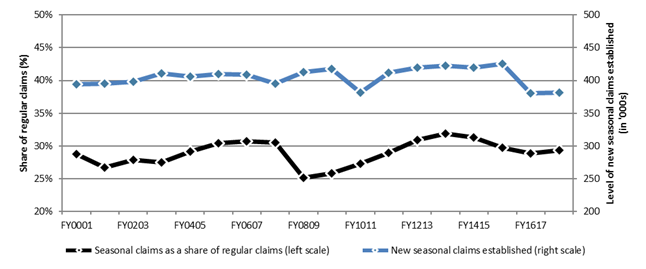

Chart 13 shows the distribution of the unemployed population by EI regular benefits eligiblity over the past 10 years. Following the recession in FY0809 and the downturn in commodity prices in 2015, the share of eligible unemployed increased. The share of unemployed individuals without hours of insurable employment trends upwards over time. The proportion of unemployed workers with invalid reasons for job separation who paid EI premiums decreased over time, whereas the proportion of potentially eligible unemployed workers with insufficient hours of insurable employment remained relatively stable.

Chart 13 – Text version

| 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | |

|---|---|---|---|---|---|---|---|---|---|---|

| (A) Unemployed without hours of insurable employment | 29.9% | 29.7% | 35.3% | 35.5% | 38.3% | 37.5% | 39.0% | 34.7% | 34.7% | 37.0% |

| (B) EI premium-paying unemployed workers with invalid reasons for job separation | 17.8% | 12.5% | 11.8% | 12.7% | 13.7% | 14.9% | 14.9% | 12.4% | 11.9% | 12.0% |

| (C) Potentially eligible unemployed workers | 9.3% | 8.0% | 8.5% | 11.2% | 8.7% | 6.7% | 7.8% | 9.1% | 7.8% | 8.0% |

| (D) Eligible unemployed | 42.9% | 49.8% | 44.4% | 40.5% | 39.3% | 40.8% | 38.3% | 43.8% | 45.6% | 43.0% |

- Source: Statistics Canada, Employment Insurance Coverage Survey, 2008 to 2017.

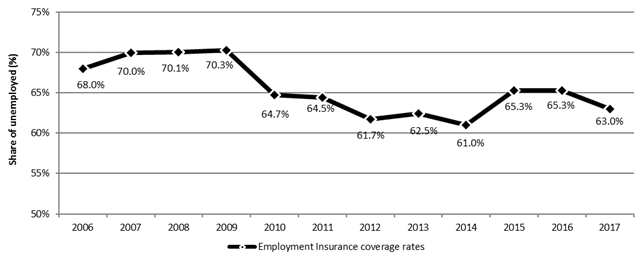

Coverage of Employment Insurance regular benefits

This section examines the coverage of EI regular benefits which is expressed as the share of EI unemployed contributors – unemployed who had insurable employment and contributed to the EI program by paying premiums within the previous 52 weeks - among total unemployed population in Canada. While the recipients of EI regular benefits are subject to three core eligibility requirements, as mentioned in the beginning of this section, the number of unemployed who had insurable employment and contributed to the EI program by paying premiums within the previous 52 weeks is an important factor in determining the program’s overall coverage of the unemployed population.

Chart 14 illustrates the coverage of EI regular benefits in Canada for the past 12 years. Higher EI coverage rates are usually observed during economic downturns, as slowing economic activities lead to layoffs that increase the share of unemployed EI contributors among all unemployed. The coverage rates within the past 12 years peaked in 2008 and 2009, corresponding with the FY0809 recession. After ranging between 61.0% in 2014 and 64.7% in 2010, the coverage rates increased to 65.3% in 2015 and remained unchanged in 2016, during the slowed down economic growth caused by the downturn in commodity prices in those two years. As the Canadian economy rebounded in 2017, the coverage rate returned to 63.0%.

Chart 14 – Text version

| 2006 | 2007 | 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Employment Insurance coverage rates | 68.0% | 70.0% | 70.1% | 70.3% | 64.7% | 64.5% | 61.7% | 62.5% | 61.0% | 65.3% | 65.3% | 63.0% |

- Source: Statistics Canada, Employment Insurance Coverage Survey, 2006 to 2017.

Table 14 shows the coverage rates for EI regular benefits by province, gender, age, and work pattern in 2017. Newfoundland and Labrador reported the highest share of unemployed (87.4%) who had paid EI premiums in the previous 52 weeks, while Alberta had the lowest share (55.8%). Historically, Atlantic provinces have higher coverage rates than the rest of the country—this can be explained by the prevalence of the seasonal employment pattern in that region.Footnote 24, Footnote 25, Footnote 26 On the basis of gender, 66.8% of unemployed men contributed EI premiums in 2017, compared to 58.1% of unemployed women. The lower contribution rate among women can be explained by the fact that women are more likely to experience frequent career interruptions than men, and also for longer total durations.Footnote 27

When the unemployed population is categorized by their previous work pattern, it can be seen that a lower share of unemployed who occupied permanent jobs contributed EI premiums (68.8%) than unemployed who were in non-permanent jobs (77.6%). This can be explained by the fact that the proportion of seasonal jobs among those unemployed who held non-permanent jobs is high. As these individuals work for few weeks or months on a cyclical pattern over a year, they are more likely to have paid EI premiums in the previous 52 weeks than other individuals who were in permanent jobs that might be unemployed for more than a year. Among the unemployed who held permanent jobs, those who had full-time jobs reported a higher coverage rate (70.6%) than those who had part-time jobs (65.9%). Among the unemployed who had non-permanent jobs, on the other hand, those who had seasonal employment had a much higher contribution rate (90.2%) than those who had another type of non-permanent paid jobs (69.0%).

| Coverage rate (unemployed contributors as a share of total unemployed) | |

|---|---|

| Province or territory | |

| Newfoundland and Labrador | 87.4% |

| Prince Edward Island | 78.8% |

| Nova Scotia | 69.3% |

| New Brunswick | 80.8% |

| Quebec | 65.0% |

| Ontario | 57.9% |

| Manitoba | 60.9% |

| Saskatchewan | 72.5% |

| Alberta | 55.8% |

| British Columbia | 69.8% |

| Gender | |

| Men | 66.8% |

| Women | 58.1% |

| Age category | |

| 24 years old and under | 50.9% |

| 25 to 44 years old | 65.7% |

| 45 years old and over | 67.1% |

| Work pattern | |

| Permanent | 68.8% |

| Full-time | 70.6% |

| Part-time | 65.9% |

| Non-permanent | 77.6% |

| Seasonal* | 90.2% |

| Other non-standard** | 69.0% |

| Canada | 63.0% |

- * Seasonal workers are those who are employed in temporary work that is expected to last only until the end of a ‘season’—the period for which services are in demand.

- ** Other non-standard refers to non-permanent paid jobs that were either temporary, term, contractual, casual or other non-permanent (but not seasonal) employment. These unemployed were not self-employed.

- Source: Statistics Canada, Employment Insurance Coverage Survey, 2017.

Eligibility for Employment Insurance regular benefits

Among the 749,400 unemployed EI contributors in 2017, an estimated 606,700 had valid job separations—making them potentially eligible to receive EI benefits. The number of unemployed contributors with valid job separations in 2017 represents a decrease of 88,100 compared to the previous year. Of these potentially eligible contributors, 511,700 had sufficient hours of insurable employment within their qualifying period, making them eligible to receive EI regular benefits.

The eligibility rate for EI regular benefits, expressed as the share of the potentially eligible unemployed population with enough hours of insurable employment to qualify for EI regular benefits (511,700 divided by 606,700), decreased from 85.4% in 2016 to 84.3% in 2017. As illustrated in Chart 15, the eligibility rate in Canada over the past 10 years has ranged from 86.2% to 78.4%.

Chart 15 – Text version

| 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | |

|---|---|---|---|---|---|---|---|---|---|---|

| Eligibility rates | 82.2% | 86.2% | 83.9% | 78.4% | 81.9% | 85.8% | 83.1% | 82.8% | 85.4% | 84.3% |

- Source: Statistics Canada, Employment Insurance Coverage Survey, 2008 to 2017.

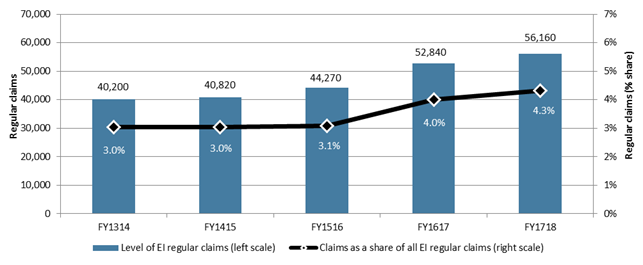

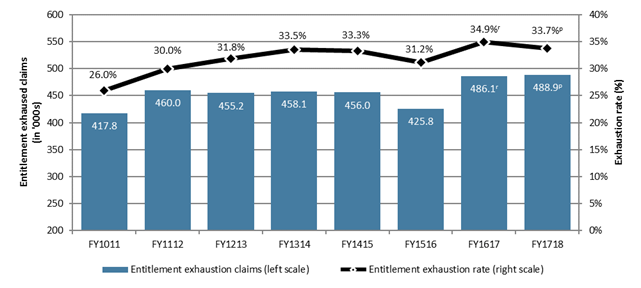

As mentioned, claimants who apply for EI regular benefits have to work a minimum number of hours of insurable employment (between 420 and 700 hours, depending on the regional unemployment rate) within their qualifying period in order to be eligible to receive benefits—this provision is known as the Variable Entrance Requirement (VER). Under the VER, EI claimants in higher unemployment regions need fewer hours of insurable employment than those in lower unemployment regions to qualify for EI benefits, as it is more difficult to accumulate hours of employment in regions with higher unemployment rates. An important consideration in this respect is that the eligible claimants who receive EI regular benefits accumulate varying hours of insurable employment. EI administrative data show that most of the claimants who receive EI regular benefits generally accumulate hours of insurable employment that are well beyond the minimum requirement under the VER in their respective regions. However, the share of claimants for EI regular benefits who qualified with hours of insurable employment near the minimum entrance requirement—defined as being within 70 hours of the VER—has been rising for the last two fiscal years.

Chart 16 illustrates the number and share of claims established for EI regular benefits that qualified within 70 hours of the minimum entrance requirement in the last five fiscal years. It can be seen that the number of such claims has been rising steadily, while the share of such claims to the total number of claims established for EI regular benefits has been increasing for the last 3 years. In FY1718, the number of regular claims that qualified within 70 hours of the minimum entrance requirement increased to 56,160 claims from 52,840 claims observed in FY1617. The share of these claims represented 4.3% of the total number of regular claims—up from 4.0% in FY1617. In general, claimants qualifying within 70 hours of their VER are disproportionately found in EI economic regions with higher unemployment rates (12.1% or greater).Footnote 28 This could be partly attributable to the importance of seasonal employment in those regions and the discrete period available to accumulate sufficient hours of insurable employment for workers to qualify for EI regular benefits.

Chart 16 – Text version

| FY1314 | FY1415 | FY1516 | FY1617 | FY1718 | |

|---|---|---|---|---|---|

| Level of EI regular claims (left scale) | 40,200 | 40,820 | 44,270 | 52,840 | 56,160 |

| Claims as a share of all EI regular claims (right scale) | 3.0% | 3.0% | 3.1% | 4.0% | 4.3% |

- Note: Includes claims for which at least $1 of EI regular benefits was paid.

- Source: Employment and Social Development Canada, Employment Insurance (EI) administrative data. Data are based on a 10% sample of EI administrative data.

An alternate method to measure eligibility

A recent departmental study* used the Record of Employment (ROE)** data from 2001 to 2017 to estimate the proportion of job separators who met the required number of hours of insurable employment to qualify for EI regular benefits. The share of laid-off job separators (the reason for separation was shortage of work) with enough hours in the previous 52 weeks to meet the VER declined over time(75.4% in 2001 to 68.2% in 2017)— to the lowest proportion observed over this time period. The probability of accumulating enough insurable hours increased with regional unemployment rates (70.4% to 85.2%). This may not fully reflect potential eligibility where previous employment did not result in a ROE. This point is supported by another departmental study*** that examined ROE issuance for an interruption of earnings. It found that nearly one-third (30.2%) of earnings interruptions in 2014 were not associated with a ROE.

- * ESDC, Record of Employment-based Measures of Employment Insurance Eligibility: Update 2001 to 2017. (Ottawa: ESDC, Evaluation Directorate, 2019)

- ** A Record of Employment is a form completed by the employer when an employee stops working. It contains information on employment history, and is the single most important document used by employees to apply for EI benefits.

- *** ESDC, Record of Employment and Interruption of Earnings: Firms. (Ottawa: ESDC, Evaluation Directorate, 2018)

Eligibility for Employment Insurance regular benefits by province, gender and age

The eligibility rates for EI regular benefits are sensitive to economic conditions and specific employment patterns during the qualifying period, such as the incidence of full-time versus part-time hours, permanent versus temporary employment, etc. Because of this, significant variations are found when EI claimants are classified based on demographic and regional labour force characteristics.

Table 15 outlines the eligibility rates for EI regular benefits by province, gender and age groups over the past 5 years. Among all provinces in 2017, the highest eligibility rate was observed in Newfoundland and Labrador (96.7%) while the lowest was in Saskatchewan (69.7%). Compared with the previous year, the eligibility rate declined in six provinces and increased in the other four provinces in 2017. Generally, Atlantic provinces have the highest eligibility rate among all provinces in Canada, whereas Ontario and the Western provinces have comparatively lower eligibility rates. This trend has continued in 2017.

Historically, men have higher eligibility rates than women, which may be attributable to the fact that a higher proportion of men hold full-time and/or permanent jobs while a higher proportion women work in part-time and/or temporary jobs. In 2017, the eligibility rate for men was 85.8% compared to 82.1% for women.

In terms of age groups, unemployed young workers aged 24 years and under had the lowest eligibility rateFootnote 29 (40.7%) in 2017, compared to those aged between 25 and 44 years (89.4%) and older workers aged 45 years and over (90.2%). The largest variation in eligibility rates in 2017 compared to the previous year was observed for the younger workers (-10.1 percentage points), while the eligibility rate of unemployed workers in the other two age groups showed little change. The large decline in the eligibility rate of unemployed younger workers can be explained in part by the strong economic growth observed in 2017 which caused the unemployment rate to go down,Footnote 30 resulting in EI claimants having to accumulate more hours of insurable employment in order to qualify for EI regular benefits. This was particularly difficult for younger workers as they are over-represented in part-time and seasonal employment.

Among workers who were aged between 25 and 44 years, the eligibility rate for men (92.5%) was higher than that for women (84.0%); however, this reversed among workers aged 45 years and over—the eligibility rate was 87.7% for men, whereas for women it was 94.2%.

| 2013 | 2014 | 2015 | 2016 | 2017 | |

|---|---|---|---|---|---|

| Province or territory | |||||

| Newfoundland and Labrador | 93.9% | 94.1% | 93.7% | 95.9% | 96.7% |

| Prince Edward Island | 94.4% | 93.4% | 92.7% | 98.5% | 94.3% |

| Nova Scotia | 94.8% | 81.2% | 82.3% | 93.3% | 86.0% |

| New Brunswick | 96.4% | 90.5% | 96.2% | 94.6% | 93.1% |

| Quebec | 86.1% | 84.3% | 81.5% | 86.7% | 85.1% |

| Ontario | 83.1% | 81.0% | 84.8% | 81.3% | 79.6% |

| Manitoba | 85.6% | 91.4% | 82.9% | 75.3% | 84.9% |

| Saskatchewan | 82.3% | 85.4% | 89.9% | 78.9% | 69.7% |

| Alberta | 87.9% | 80.4% | 78.6% | 84.9% | 85.2% |

| British Columbia | 81.5% | 77.3% | 75.2% | 87.3% | 90.0% |

| Gender | |||||

| Men | 89.8% | 84.0% | 82.0% | 87.2% | 85.8% |

| Women | 80.0% | 81.3% | 84.3% | 81.6% | 82.1% |

| Age category | |||||

| 24 years old and under | 54.5% | 44.0% | 54.0% | 50.8% | 40.7% |

| 25 to 44 years old | 89.7% | 86.9% | 82.1% | 88.4% | 89.4% |

| 45 years old and over | 90.8% | 88.8% | 90.7% | 94.0% | 90.2% |

| Canada | 85.8% | 83.1% | 82.8% | 85.4% | 84.3% |

- Source: Statistics Canada, Employment Insurance Coverage Survey, 2013 to 2017.

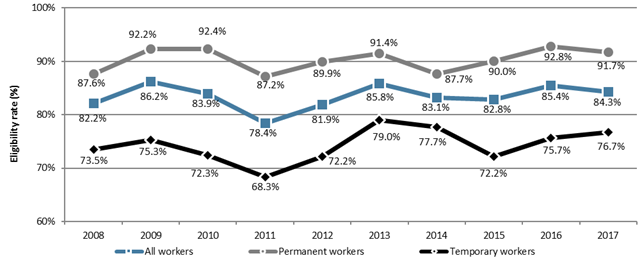

Eligibility for Employment Insurance regular benefits by type of employment

As discussed, applicants for EI regular benefits need to accumulate a minimum number of hours of insurable employment, depending on the regional unemployment rate in the previous 52 weeks or since the start of their last claim, whichever is shorter. Intuitively, workers who previously held full-time positions are more likely to have accumulated the required number of hours of insurable employment and have a higher eligibility rate than part-time workers. Similarly, applicants who previously had permanent jobs are more likely to report a higher eligibility rate than those who had temporary employment.

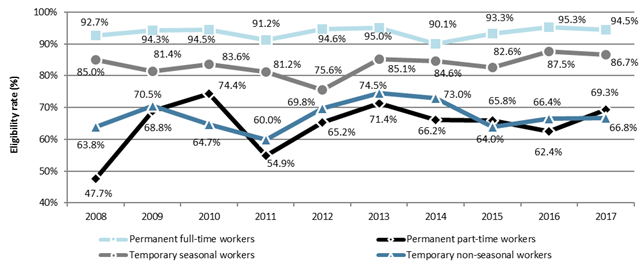

Chart 17 illustrates the eligibility rates for EI regular benefits by previous employment characteristics for the past 10 years. During this time, the eligibility rate for permanent workers ranged between 92.8% and 87.2%, while the eligibility rate for temporary workers ranged between 79.0% and 68.3%. Eligibility rates for temporary workers show comparatively more variability than that for permanent workers over this period.

Chart 17 – Text version

| 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | |

|---|---|---|---|---|---|---|---|---|---|---|

| All workers | 82.2% | 86.2% | 83.9% | 78.4% | 81.9% | 85.8% | 83.1% | 82.8% | 85.4% | 84.3% |

| Permanent workers | 87.6% | 92.2% | 92.4% | 87.2% | 89.9% | 91.4% | 87.7% | 90.0% | 92.8% | 91.7% |

| Temporary workers | 73.5% | 75.3% | 72.3% | 68.3% | 72.2% | 79.0% | 77.7% | 72.2% | 75.7% | 76.7% |

- Source: Statistics Canada, Employment Insurance Coverage Survey, 2008 to 2017.

In terms of previous work pattern, permanent workers can further be classified in two categories—those who had full-time employment and those who had part-time employment. Similarly, temporary workers can be classified in two categories as well—those who were seasonal workers and those whose previous employment was non-seasonal.Footnote 31 Chart 18 shows the eligibility rates for EI regular benefits by previous work pattern for the past 10 years. The eligibility rates for permanent full-time workers show little variability over this period, while the eligiblity rates for permanent part-time workers and temporary non-seasonal workers show much higher variability. The eligibilty rate for permanent full-time workers decreased slightly from 95.3% in 2016 to 94.5% in 2017, while the eligibility rate for permanent part-time workers notably increased from 62.4% in 2016 to 69.3% in 2017. Among temporary workers, the eligibility rate for temporary seasonal workers decreased slightly from 87.5% in 2016 to 86.7% in 2017 while the eligibility rate for temporary non-seasonal workers increased sligtly from 66.4% in 2016 to 66.8% in 2017.

Chart 18 – Text version

| 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | |

|---|---|---|---|---|---|---|---|---|---|---|

| Permanent full-time workers | 92.7% | 94.3% | 94.5% | 91.2% | 94.6% | 95.0% | 90.1% | 93.3% | 95.3% | 94.5% |

| Permanent part-time workers | 47.7% | 68.8% | 74.4% | 54.9% | 65.2% | 71.4% | 66.2% | 65.8% | 62.4% | 69.3% |

| Temporary seasonal workers | 85.0% | 81.4% | 83.6% | 81.2% | 75.6% | 85.1% | 84.6% | 82.6% | 87.5% | 86.7% |

| Temporary non-seasonal workers | 63.8% | 70.5% | 64.7% | 60.0% | 69.8% | 74.5% | 73.0% | 64.0% | 66.4% | 66.8% |

- Source: Statistics Canada, Employment Insurance Coverage Survey, 2008 to 2017.

Access to Employment Insurance regular benefits

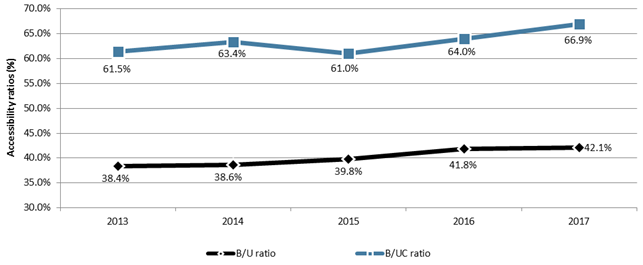

Access to EI regular benefits is another way to measure how well the EI program is functioning to meet the needs of Canada’s unemployed in helping them transition to new employment. For the purpose of the EI Monitoring and Assessment Report, access to EI regular benefits is measured as the share of the unemployed population receiving EI regular benefits. Chart 19 illustrates the two main ratios used to measure accessibility—the Beneficiary-to-Unemployed (B/U) ratio and the Beneficiary-to-Unemployed Contributor (B/UC) ratio from 2013 to 2017.

The B/U and B/UC ratios in 2017 were 42.1% and 66.9%, respectively. It can be seen that, while the B/U ratio changed very little in 2017 compared to the previous year (+0.3 percentage points), the increase in the B/UC ratio was more significant (+2.9 percentage points) during this time. This happened because the change in the number of unemployed (-112,100 people) from 2016 to 2017 was higher than the change in the number of unemployed contributors (-100,900 people) during the same time period.

Chart 19 – Text version

| 2013 | 2014 | 2015 | 2016 | 2017 | |

|---|---|---|---|---|---|

| Beneficiary-to-Unemployed (B/U) Ratio | 38.4% | 38.6% | 39.8% | 41.8% | 42.1% |

| Beneficiary-to-Unemployed Contributor (B/UC) Ratio | 61.5% | 63.4% | 61.0% | 64.0% | 66.9% |

- Sources: Statistics Canada, Employment Insurance Coverage Survey (for data on the number of unemployed (U) and the number of unemployed contributors (UC)); and Statistics Canada, monthly Employment Insurance statistics release, Table 14-10-0010-01 (for data on EI regular beneficiaries (B)).

The Beneficiary-to-Unemployed (B/U) ratio

The Beneficiary-to-Unemployed (B/U) ratio is calculated by expressing the average number of unemployed individuals who received EI regular benefits in the reference week of the EICS as a share of the corresponding unemployed population.Footnote 32 As such, it includes a significant segment of the unemployed population who are ineligible for EI regular benefits (such as those who did not work in the previous year or never worked, who did not have a valid job separation, and those who were self-employed). Because of this, the B/U ratio is sensitive to changes in the composition of the unemployed population and the proportion of the unemployed outside the scope of the EI program coverage. This makes the ratio less suited to measuring access to EI regular benefits.

The Beneficiary-to-Unemployed Contributor (B/UC) ratio

The Beneficiary-to-Unemployed Contributor (B/UC) ratio is calculated by expressing the average number of EI regular beneficiaries as a share of the corresponding unemployed population who contributed EI premiums in the previous 12 months. This ratio considers a narrower target population than the B/U ratio. Because the B/UC ratio measures accessibility among unemployed workers for whom the EI regular benefits are designed to provide coverage, and exclude those who did not contribute EI premiums during their last employment period or did not have any labour force attachments, this ratio may provide a better assessment of accessibility to EI regular benefits.

Unemployed individuals eligible for EI benefits who do not apply

A recent study* by ESDC examined the characteristics of unemployed individuals who were eligible to receive EI regular and special benefits but did not apply, and the reasons for not applying. The study found that the proportion of individuals who recalled being eligible but did not apply was higher for EI special benefits than EI regular benefits.

The most common reasons for not applying for regular benefits were having found another job right away (30% of respondents), assuming not being eligible (25% of respondents) and not needing benefits (21% of respondents). These estimates were generally consistent for men and women, except for the reason of not needing benefits (23% for women vs. 18% for men.

On the other hand, the most common reasons for not applying for EI special benefits among eligible respondents at the time of the survey, were not needing the benefits (33% of respondents), followed by having found another job right away (26% of respondents) and assuming not being eligible (18% of respondents).

Both the likelihood and reasons for not applying varied by several factors (age groups, educational attainment, geographic regions, prevalence of disability and/or health conditions, duration of unemployment, previous work pattern, industry of employment and net income of the respondents). For example, a higher non-application rate for EI regular benefits was found for eligible individuals who were younger (aged 24 years or less), had more than a high school education, resided in the Prairies, had been unemployed for one to two months, and had worked in the service-producing industries. On the other hand, eligible individuals who reported having a disability, identified as being a visible minority or reported having poor health at job separation were slightly more likely to apply for EI regular and special benefits in general.

- * ESDC, EI-Eligible Job Separators that Do Not Apply: Characteristics of Non-Application. (Ottawa: ESDC, Evaluation Directorate, 2019)

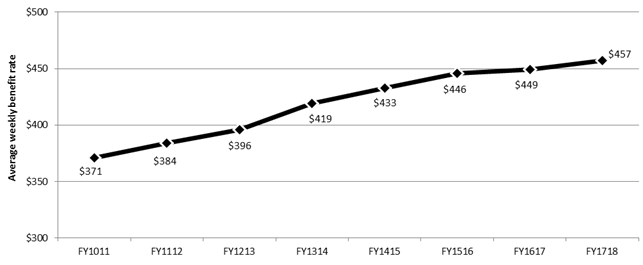

2.2.3 Level of Employment Insurance regular benefits

The level of EI regular benefits (that is, the weekly regular benefit rate) that eligible claimants are entitled to receive is calculated as 55% of their highest (best) weeks of earnings in insurable employment during the qualifying period under the Variable Best Weeks (VBW) provision. The number of weeks used to determine the weekly benefit rate ranges from 14 to 22, depending on the monthly regional unemployment rate of the claimant’s EI economic region. In addition to this, claimants with children (under the age of 18) and low annual family income may be eligible to receive additional benefits under the Family Supplement Provision which can increase their benefit rate from 55% to a maximum of 80%, subject to the maximum weekly benefit rate (see sub-section 2.1.1 for detailed discussion).

Chart 20 illustrates the average weekly benefit rate for EI regular benefits claimants over the past eight years. During the current reporting period, the average weekly EI regular benefit rate was $457. This represents an increase of approximately $8 (+1.6%) from the benefit rate in the previous year ($449). The average weekly regular benefit rate has been rising steadily on a year-over-year basis.

Chart 20 – Text version

| FY1011 | FY1112 | FY1213 | FY1314 | FY1415 | FY1516 | FY1617 | FY1718 | |

|---|---|---|---|---|---|---|---|---|

| Average weekly benefit rate | $371 | $384 | $396 | $419 | $433 | $446 | $449 | $457 |

- Note: Includes all claims for which at least $1 of EI regular benefits was paid.

- Source: Employment and Social Development Canada, Employment Insurance (EI) administrative data. Data are based on a 10% sample of EI administrative data.

Among all provinces and territories, the average weekly regular benefit rate increased in all regions except Yukon in FY1718 compared to the previous year. The highest growth rate was observed in Nunavut (+5.8%) followed by Newfoundland and Labrador and Northwest Territories (+3.1%). The level of average weekly regular benefit rate varied among regions—from a high of $527 in Northwest Territories to a low of $426 in Prince Edward Island in the current reporting period. On average, claimants in the Atlantic province, Quebec and Manitoba received less in weekly regular benefits than the national average weekly benefit rate.

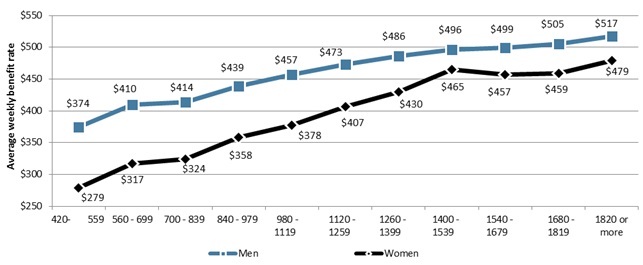

In FY1718, the average weekly regular benefit rate for men ($481) was well over that for women ($419)—a trend that has continued over the years (see Annex 2.5.3 for average weekly regular benefit rate by gender over the past 5 years). This gap is observable for all categories of hours of insurable employment worked during the qualifying period and is more apparent at lower levels of labour market attachment, as outlined in Chart 21. At the lowest level of labour market attachment (as indicated by the number of hours of insurable employment), the average weekly regular benefit rate for women ($279) in FY1718 was approximately 74.6% of men’s ($374), whereas for women with the highest level of labour market attachment the average weekly benefit rate ($479) was approximately 92.6% of men’s ($517). However, this gap was the narrowest for claimants who had between 1400-1539 hours of insurable employment during their qualifying period.

Chart 21 – Text version

| Insurable hours worked | Men's average weekly benefit rate | Women's average weekly benefit rate |

|---|---|---|

| 420 to 559 | $374 | $279 |

| 560 to 699 | $410 | $317 |

| 700 to 839 | $414 | $324 |

| 840 to 979 | $439 | $358 |

| 980 to 1119 | $457 | $378 |

| 1120 to 1259 | $473 | $407 |

| 1260 to 1399 | $486 | $430 |

| 1400 to 1539 | $496 | $465 |

| 1540 to 1679 | $499 | $457 |

| 1680 to 1819 | $505 | $459 |

| 1820 or more | $517 | $479 |

- Note: Includes all claims for which at least $1 of EI regular benefits was paid.

- Source: Employment and Social Development Canada, Employment Insurance (EI) administrative data. Data are based on a 10% sample of EI administrative data.

Table 16 outlines the level of average weekly regular benefits by age group for men and women for the current reporting period and the previous year. It can be seen that claimants who were between 25 and 44 years old had the highest average weekly regular benefit rate ($470) in FY1718, while younger claimants (aged 24 years and under) had the lowest ($416). Claimants who were between 45 and 54 years of age experienced the highest increase in the average weekly benefit rate in FY1718 compared to the previous year (+1.8% or +$9). When claimants are categorized by age group and gender, it can be seen that men who were between 45 and 54 years of age had the highest average weekly regular benefit rate ($496) in FY1718, whereas for women the highest rate was for claimants who were aged between 25 and 44 years ($436).

| Age group | Men | Women | Total | |||

|---|---|---|---|---|---|---|

| FY1617 | FY1718 | FY1617 | FY1718 | FY1617 | FY1718 | |

| 24 years old and under | $429 | $436 | $364 | $367 | $412 | $416 |

| 25 to 44 years old | $484 | $491 | $427 | $436 | $462 | $470 |

| 45 to 54 years old | $488 | $496 | $414 | $422 | $454 | $463 |

| 55 years old and over | $463 | $471 | $392 | $399 | $435 | $442 |

| Canada | $474 | $481 | $412 | $419 | $449 | $457 |

- Note: Includes all claims for which at least $1 in EI regular benefits was paid.

- Source: Employment and Social Development Canada, Employment Insurance (EI) administrative data. Data are based on a 10% sample of EI administrative data.

Table 17 shows the average weekly regular benefit rates by EI claimant categories. The average weekly regular benefit increased for all claimant categories in the current reporting period compared to the previous year, with the highest increase observed for frequent claimants (+2.3% or $11). In FY1718, long-tenured workers received the highest weekly regular benefit ($495), followed by the frequent claimants ($464). Occasional claimants received the lowest weekly regular benefit ($437), which was approximately $20 less than the national average.

| EI Claimant category | Average weekly regular benefit rate ($) | ||

|---|---|---|---|

| FY1617 | FY1718 | Change (%) | |

| Long-tenured workers | $489 | $495 | +1.1% |

| Occasional claimants | $429 | $437 | +1.8% |

| Frequent claimants | $453 | $464 | +2.3% |

| Canada | $449 | $457 | +1.6% |

- Note: Includes all claims for which at least $1 in EI regular benefits was paid.

- * See Annex 2.1 for definitions of claimant categories referenced in this table.

- Source: Employment and Social Development Canada, Employment Insurance (EI) administrative data. Data are based on a 10% sample of EI administrative data.

The weekly benefit rate for EI regular benefits is capped at a maximum that is based on the maximum insurable earnings (MIE). The MIE was $51,300 in 2017 and $51,700 in 2018. As the weekly regular benefit rate is calculated as 55% of average weekly earnings, the maximum weekly regular benefit rate was $543 in 2017 and $547 in 2018. Table 18 shows the proportion of claimants that received the maximum benefit rate.

| Share of claims that received the maximum weekly benefit rate | ||

|---|---|---|

| FY1617 | FY1718 | |

| Gender | ||

| Men | 56.9% | 58.4% |

| Women | 29.2% | 30.2% |

| Age group | ||

| 24 years old and under | 30.4% | 30.6% |

| 25 to 44 years old | 50.7% | 51.8% |

| 45 to 54 years old | 48.0% | 49.8% |

| 55 years old and over | 42.1% | 43.3% |

| EI claimant category | ||

| Long-tenured workers | 63.7% | 63.7% |

| Occasional claimants | 38.1% | 39.5% |

| Frequent claimants | 45.7% | 48.5% |

| Canada | 46.1% | 47.3% |

- Note: Includes all claims for which at least $1 in EI regular benefits was paid.

- * See Annex 2.1 for definitions of claimant categories referenced in this table.

- Source: Employment and Social Development Canada, Employment Insurance (EI) administrative data. Data are based on a 10% sample of EI administrative data.

Benefit repayments in the 2016 tax year*

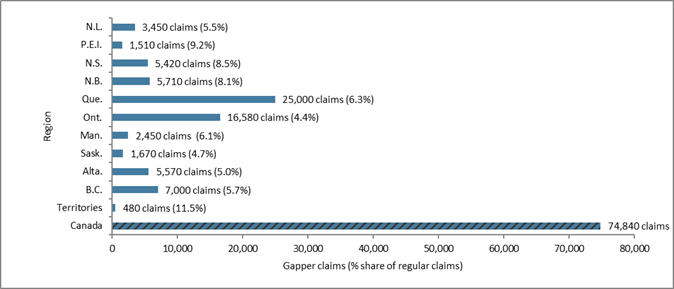

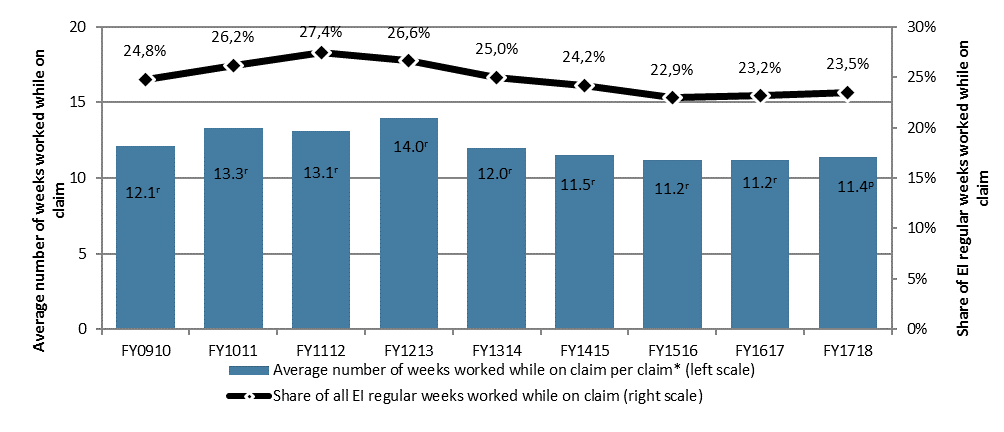

Pursuant to the Employment Insurance Act, EI claimants must repay a percentage of EI benefits they have received if their net income** exceeds 1.25 times the maximum yearly insurable earnings. In the 2016 taxation year, they were required to repay 30% of the lesser of their net income above $63,500 or 30% of regular or fishing benefits they received in that taxation year. However, claimants who received special benefits or less than 1 week of either regular or fishing benefits in the preceding 10 taxation years were exempt from the benefits repayment requirement.