Corporate documents

On this page

Planning and reporting

Corporate Business Plan

The Corporate Business Plan (CBP) is the primary planning document used by the CRA to communicate its strategic agenda over a three-year planning period.

- The Board of Management (Board) oversees the development of the CBP

- The Treasury Board of Canada (Treasury Board) approves the CBP through a Treasury Board submission, following internal approval by the Board and Minister of National Revenue

- Following Treasury Board's approval, the Minister of National Revenue is responsible for tabling the Summary of the CBP in Parliament within 15 sitting days of approving the Summary, as legislated by the Canada Revenue Agency Act

Currently, the CBP focuses on the following five strategic priorities:

- Providing a seamless, empathetic, and client‑centric service experience

- Enhancing the fairness of Canada's tax and benefit administration

- Strengthening trust through enhanced security, transparency, and accountability

- Fostering an innovative and data‑driven organization

- Promoting a thriving and inclusive workforce

The CBP and the Summary of the CBP are nearly identical. Producing a Summary of the CBP is a requirement of the Canada Revenue Agency Act and differs from the CBP due to the exclusion of the details of the CRA's Strategic Investment Plan.

The Summary of the Corporate Business Plan 2021-22 with perspectives to 2023-24 was published on April 29, 2021.

Departmental Plan

In addition to the CBP, the CRA has a Departmental Plan (DP) requirement like other departments, but from an efficiency perspective has made them essentially the same.

The Minister of National Revenue is responsible for approving the DP before it can be submitted to the Treasury Board of Canada Secretariat (TBS) to be tabled in Parliament by the President of the Treasury Board on behalf of departmental ministers.

Once tabled, on or before March 31, the DP is referred to Parliamentary committees, which may then report to the House of Commons.

The CRA's 2021-22 DP can be found on the CRA website.

Departmental Results Report

The CRA's Departmental Results Report (DRR) is the primary reporting document used by the CRA to communicate its results to Parliament and Canadians. All federal departments and agencies are required to annually present a DRR to the President of the Treasury Board for tabling in Parliament.

The Minister of National Revenue is responsible for approving the DRR before it can be submitted to TBS to be tabled in Parliament by the President of the Treasury Board on behalf of departmental ministers.

The DRR for the period ending March 31, 2020, can be found on the CRA website.

The DRR for 2020-21 is currently in development and is expected to be published in fall 2021.

CRA budget and financial reports

Introduction

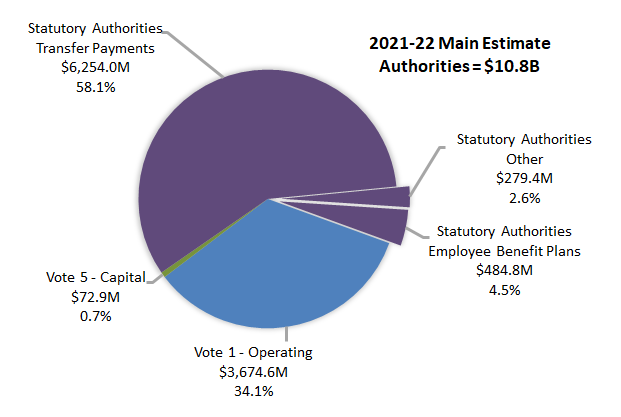

The Main Estimates present the spending plans for the coming fiscal year. They contain both statutory programs (included for information purposes) and appropriations which must be authorized annually by Parliament. The Main Estimates are tabled by March 1st. Supplementary Estimates are adjustments throughout the year (generally tabled in June, December, and March).

The process to seek funding for a new spending initiative included in the Main or Supplementary Estimates will generally include a Treasury Board submission, an official document submitted by the minister seeking approval or authority from the Treasury Board for an initiative that the organization would otherwise not be able to undertake or that is outside its delegated authorities.

The commissioner may be called on to defend the Canada Revenue Agency (CRA)'s Main or Supplementary Estimates before the Standing Committee on Public Accounts. The minister may be invited and choose to attend. Ministers cannot be summoned to appear, and cannot be forced to answer questions or reveal information that would threaten national security or breach Cabinet secrecy.

As an Agency, the CRA benefits from a two-year spending authority, meaning that funds voted in one year can be spent over two fiscal years. This two‐year spending authority enables the CRA to be more strategic in using public funds by taking a multi‐year view of plans and budgets.

Text version

| Vote 1 - Operating | $3,674.6 million |

|---|---|

| Vote 5 - Capital | $72.9 million |

| Statutory Authorities Transfer Payments | $6,254.0 million |

| Statutory Authorities Other | $279.4 million |

| Statutory Authorities Employee Benefit Plans | $484.8 million |

| Total | $10,765.8 million |

2021-22 Main Estimates

$10.8 billion budget, of which 65.2% (or $7.0 billion) is funded from statutory authorities and 34.8% (or $3.8 billion) from voted authorities.

Authorities

As well as its statutory authorities, the CRA has two annually voted appropriations (commonly referred to as "votes"):

Vote 1 – Operating covering the CRA's base operations, including salaries (79%) and operating expenditures such as accommodations, supplies, postage, training, travel, legal and IT services, etc.

Vote 5 – Capital covering the acquisition or creation of mainly IT assets expected to exceed $10,000.

In addition to the $10.8 billion, the 2021-22 Main Estimates include $429.5 million in revenues to cover costs associated with support the CRA provides to Employment and Social Development Canada (ESDC) in administering the Canada Pension Plan and Employment Insurance legislation.

The CRA's 2021-22 Main Estimates do not include amounts for the administration of measures associated with the government's response to COVID-19, with the exception of an increase in the forecasted statutory authorities for costs to be recovered from ESDC for measures administered on their behalf. Also not included are incremental resources for announcements made in April by the Minister of Finance with respect to Budget 2021. The funding required for the implementation and administration of these measures have been or will be presented to Treasury Board Ministers through formal submissions during the year and once approved, will be included in the Supplementary Estimates.

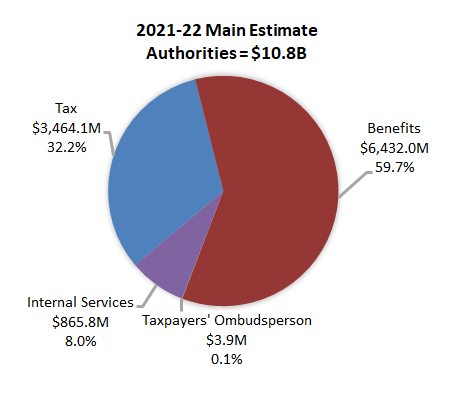

Core responsibilities and programs

The CRA's budget supports the delivery of three core responsibilities – tax, benefits, and the Taxpayers' Ombudsperson. These in turn are supported by internal services (finance, human resources, information technology, real property, etc.).

Budgets are allocated to functional branches who in turn allocate the funding to programs across headquarters and in the regions based on negotiated work plans. The CRA has twenty-two externally reported programs, of which ten are under tax, one under benefits, one under the Taxpayers' Ombudsperson, and ten under internal services.

Text version

| Main Estimates by Core Responsibility | 2021-2022 Main Estimates | % of Total |

|---|---|---|

| Tax | $3,464.1 million | 32.2% |

| Benefits | $6,432.0 million | 59.7% |

| Taxpayers' Ombudsperson | $3.9 million | 0.1% |

| Internal Services | $865.8 million | 8.0% |

| Total | $10,765.8 million | 100.0% |

| Core responsibility and program | $ millions | % of Total |

|---|---|---|

| Tax Tax Services and Processing |

944.5 |

8.8% |

| Tax - Charities | 40.8 | 0.4% |

| Tax - Registered Plans | 21.6 | 0.2% |

| Tax - Policy, Rulings, and Interpretations | 132.4 | 1.2% |

| Tax - Service Complaints | 11.8 | 0.1% |

| Tax - Objections and Appeals | 225.3 | 2.1% |

| Tax - Taxpayer Relief | 20.8 | 0.2% |

| Tax - Reporting Compliance | 1,270.2 | 11.8% |

| Tax - Returns Compliance | 363.3 | 3.4% |

| Tax - Collections | 433.5 | 4.0% |

| Benefits table note 1 | 6,432.0 | 59.7% |

| Taxpayers' Ombudsman | 3.9 | 0.1% |

| Internal Services Management & Oversight |

159.7 |

1.5% |

| Internal Services - Communications | 41.2 | 0.4% |

| Internal Services - Human Resources Management | 126.7 | 1.2% |

| Internal Services - Financial Management | 66.1 | 0.6% |

| Internal Services - Information Management | 32.8 | 0.3% |

| Internal Services - Information Technology Management | 341.7 | 3.2% |

| Internal Services - Real Property Management | 53.8 | 0.5% |

| Internal Services - Materiel Management | 30.2 | 0.3% |

| Internal Services - Acquisition Management | 10.6 | 0.1% |

| Internal Services - Legal | 2.9 | 0.0% |

| 2021-22 Main Estimates | 10,765.8 | 100.0% |

Table 1 Notes

|

||

Internal reallocation mechanisms

The CRA has a rigorous financial management regime and system of controls over planning and budgeting. This includes a number of internal reallocation mechanisms to ensure that the disbursement of resources is done prudently and effectively, and is aligned with the strategic direction and priorities of the CRA and the government.

Most notably, this consists of two to three annual Resource Management Strategy updates to evaluate and prioritize in-year operational and emerging pressures against available financial flexibility; an Annual Resource Alignment Process to review, on a more structured basis, how long-term allocations are aligned with CRA and government priorities; and the annual preparation of the Strategic Investment Plan to facilitate the alignment between major investment decisions and priorities, on a ten-year planning horizon.

Financial reporting

Compared to most departments, the CRA has greater responsibilities from a financial reporting perspective.

The CRA is responsible for establishing and maintaining an effective system of internal control over financial reporting to enable the preparation of financial statements that are free from material misstatement, whether due to fraud or error. In this regard, the CRA establishes policies and procedures to ensure that financial information is prepared in accordance with Canadian public sector accounting standards.

The CRA's activities have been divided into two sets of financial statements as follows:

- CRA Activities - include those operational revenues and expenses which are managed by the CRA and utilized in running the organization. This type of statement is similar to those produced by most government departments.

- Administered Activities - include those revenues and expenses that are administered on behalf of the federal, provincial, and territorial governments, First Nations, and other organizations.

The Auditor General of Canada provides an audit opinion on these two sets of financial statements. The CRA financial statements are reviewed by the Agency Audit Committee and approved by the Board, typically in the August/September timeframe.

The CRA's financial information is also reported to the Receiver General to be included in the Public Accounts of Canada which include the audited consolidated financial statements of the Government of Canada for the fiscal year, ending each March 31. The Public Accounts of Canada are typically tabled in November.

- Date modified: