Welcome to the CRA

This section presents a high-level introduction to the responsibilities of the Minister of National Revenue, how you are supported, the administration of taxes and benefits, and current issues.

On this page

- Purpose

- The role of the Minister of National Revenue

- Support

- What we do

- Being an Agency

- Organization

- Tax and benefit administration

- External experts and partners

- Key stakeholders

- Tax filing experience

- Delivery of benefits and credits

- COVID-19 emergency measures

- CRA revenue collections

- Compliance

- Protection of information

- Communications

- CRA transformation

- The near term

- Platform commitments

Purpose

- As the Minister of National Revenue, you are accountable to Parliament and the Prime Minister for the operation of the Canada Revenue Agency (CRA).

- The CRA plays a key role in helping the government achieve its objectives, through tax assessment, benefit delivery, revenue collection, and audit. The Agency administers revenue and pension contributions of over $482 billion and provides high-quality and empathetic services in processing 32 million individual and corporate returns.

- This content will provide you with an overview of the CRA and demonstrates the support we will offer you in achieving the government's priorities.

The role of the Minister of National Revenue

This is an image of the Connaught building, the headquarters of the CRA located in Ottawa, Ontario.

- Along with the Minister of Finance and other Cabinet members, you influence and shape government policy and legislation

- As Minister of National Revenue, you engage CRA management and key external stakeholders to discuss broad policy issues and direction, and you help guide our activities and shape our future

- You also appoint members to your ministerial advisory committees and recommend other appointments to the Governor-in-Council

You are supported by…

- The Commissioner and Chief Executive Officer of the CRA, who is responsible for the day-to-day management and direction of the CRA. The commissioner is supported by a deputy commissioner (currently vacant).

- The CRA's Board of Management (Board), which oversees the organization and administration of the CRA and the management of its resources, services, property, personnel, and contracts. The Board may advise the minister on matters relating to the general administration and enforcement of program legislation.

- The CRA's management and employees, to whom many of the CRA's millions of decisions, including those related to specific taxpayer cases, are delegated.

- The Taxpayers' Ombudsperson, who advises and informs the minister about any matter relating to CRA services provided to taxpayers, and upholds key elements of the Taxpayer Bill of Rights.

What we do

- The CRA administers tax, benefits, and related programs on behalf of governments across Canada, thereby contributing to the ongoing economic and social well-being of Canadians

- The Minister of Finance develops policy and legislation on tax matters

- Other ministers, such as the Minister of Employment and Social Development Canada, develop legislation for benefits such as Employment Insurance (EI) and the Canada Pension Plan (CPP)

- The CRA is also the de facto regulator of charities in Canada due to the tax benefits registered charities can receive

- The CRA engages a variety of stakeholder groups, such as industry associations, other regulatory bodies, and professional organizations, to advance our shared interests

- Internationally, the CRA collaborates with other tax jurisdictions and groups such as the Organisation for Economic Co-operation and Development to exchange knowledge and best practices

Being an Agency

- The CRA's governance structure is more complex than most departments given its status as an Agency with unique authorities

- The Canada Revenue Agency Act gives the Agency authority over all matters relating to:

- General administrative policy

- The organization of the Agency

- Real property and immovable (administered by Public Services and Procurement Canada)

- Human resources management, including the determination of the terms and conditions of employment of persons employed by the Agency

- Internal audit

- The CRA generally strives to maintain alignment with Treasury Board policies applicable to the core public service in these areas

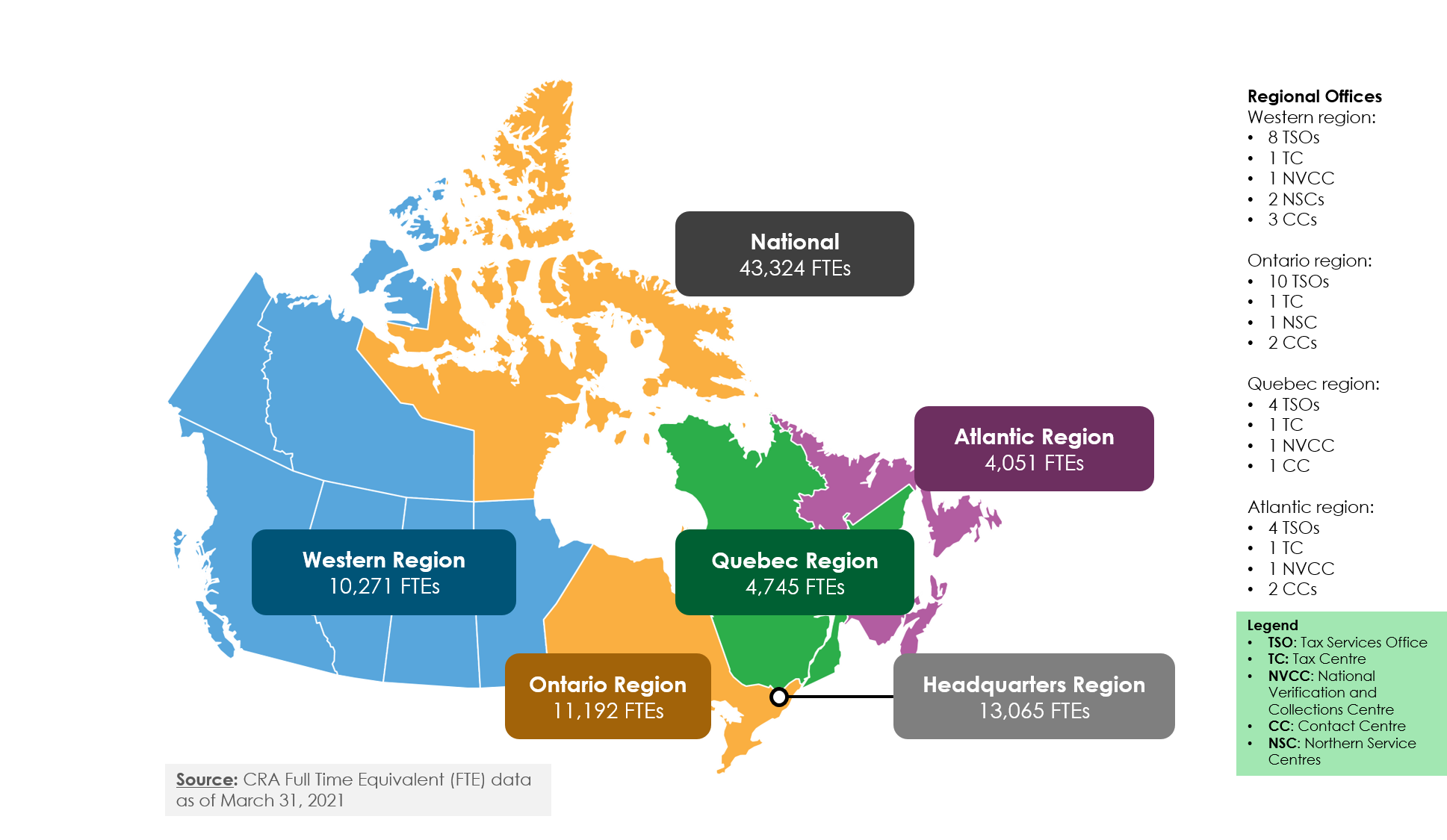

We are a large, national organization

Image description

This graphic, entitled “We are a large, national organization,” is a map of Canada showing the CRA's employee representation across the country, separated by region. Starting on the west coast, the CRA's Western region (including the provinces of British Columbia, Alberta, Saskatchewan, Manitoba, as well as the Yukon and Northwest Territories) is shown in blue and makes up 10,271 full time equivalent employees (FTEs). Moving east, the Ontario region (including Ontario and Nunavut) is shown in yellow and makes up 11,192 FTEs. The Headquarters region (located in Ottawa, Ontario) makes up 13,065 FTEs. Second-last on the east is the Quebec Region, which makes up 4,745 FTEs. On the furthest east, the Atlantic region (including New Brunswick, Nova Scotia, Prince Edward Island, and Newfoundland and Labrador) makes up 4,051 FTEs. Above the map, the national total of CRA employees is shown, making up 43,324 FTEs.

Below and to the left of the map is a note with the source of the map data: “CRA Full Time Equivalent (FTE) data as of March 31, 2021”.

To the right of the map, there is a chart with a breakdown of the four regional offices:

- In the Western region there are:

- 8 Tax Services Offices

- 1 Tax Centre

- 1 National Verification and Collections Centre

- 2 Northern Service Centres

- 3 Contact Centres

- In the Ontario region there are:

- 10 Tax Services Offices

- 1 Tax Centre

- 1 Northern Service Centre

- 2 Contact Centres

- In the Quebec region there are:

- 4 Tax Services Offices

- 1 Tax Centre

- 1 National Verification and Collections Centre

- 1 Contact Centre

- In the Atlantic region there are:

- 4 Tax Services Offices

- 1 Tax Centre

- 1 National Verification and Collections Centre

- 2 Contact Centres

Below the chart, there is a legend that spells out the acronyms used in the regional offices breakdown above.

- In the Western region there are:

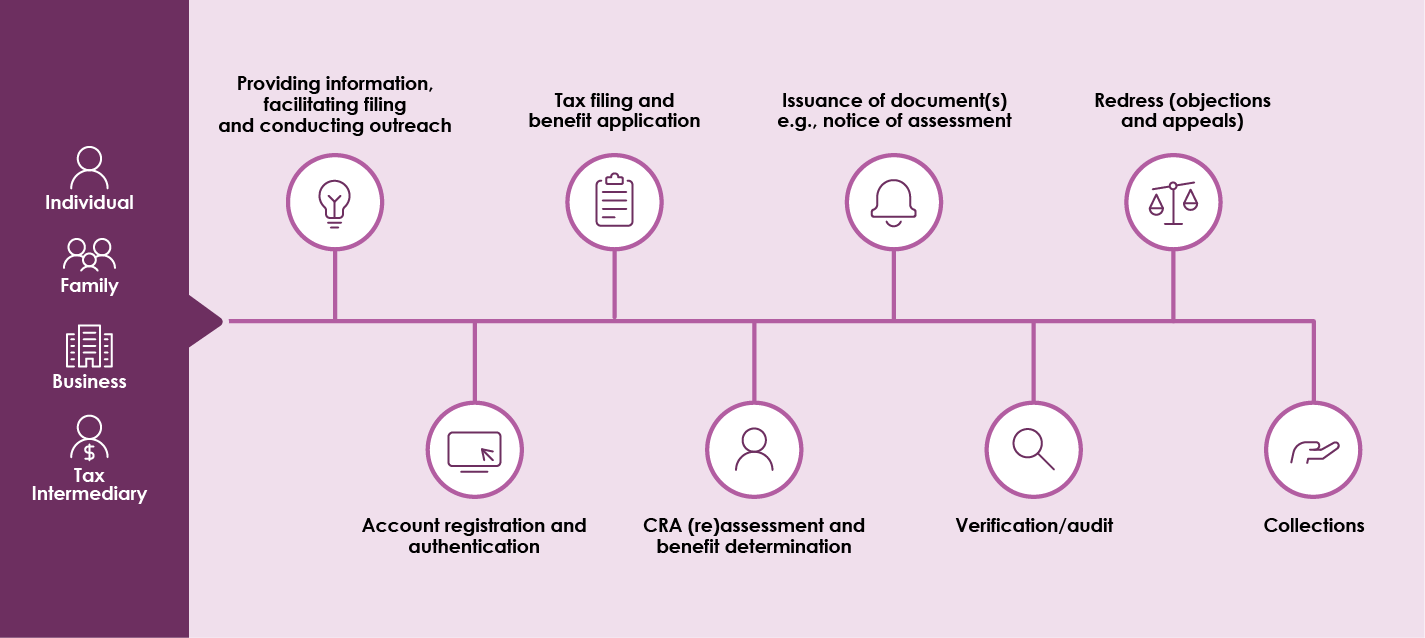

Tax and benefit administration has many functions

Image description

This graphic entitled “Tax and benefit administration has many functions,” depicts a process flow map diagram for CRA operations. In the top-left corner is the heading “Channels” and below are four purple icons placed horizontally depicting the four channels for Canadians to communicate with the CRA. The first icon on the left is an envelope with the text “mail” below. The second icon is a silhouette of a person with the text “in-person” below. The third icon is a computer monitor and smartphone with the text “online” below. The fourth icon is a phone with the text “contact centre” below.

A process flow map diagram appears below the four channels. Along the left side of the process flow map, there are four icons placed vertically to represent the four types of CRA clients:

- The icon at the top is the silhouette of a person; beneath the icon is the text "individual"

- The second icon is the silhouette of two adults and a child; beneath the icon is the text "family"

- The third icon is the outline of three buildings; beneath the icon is the text "business"

- The fourth icon is the silhouette of a person with a dollar-sign below; beneath the icon is the text "tax intermediary"

A purple line starts from the four client icons and leads across to the right of the graphic, connecting to images representing the different functions of tax and benefits administration:

- The first image is a lightbulb labeled "providing information, facilitating filing, and conducting outreach"

- The next image is a computer screen labeled "account registration and authentication"

- The next image is a clipboard labeled "tax filing and benefit application"

- The next image is a silhouette of a person labeled "CRA (re)assessment and benefit determination"

- The next image is a notification bell labeled "issuance of document(s) e.g., notice of assessment"

- The next image is a magnifying glass labeled "verification/audit"

- The next image is of the scales of justice labeled "redress (objections and appeals)"

- The last image at the end of the purple line on the right side of the graphic is an open hand labeled "collections"

The CRA engages with external experts and partners...

- The following external advisory committees provide advice on CRA operations and policies in their focus areas:

- Advisory Committee on the Charitable Sector

- Disability Advisory Committee

- Independent Advisory Board on Eligibility for Journalism Tax Measures

- Offshore Compliance Advisory CommitteeFootnote 1

- Underground Economy Advisory CommitteeFootnote 1

- The CRA engages with international organizations including other tax jurisdictions

- Key federal, provincial and territorial partners including:

- Provincial and territorial governments

- Revenu Québec

- Department of Finance

- Department of Justice

- Employment and Social Development Canada

- Service Canada

- Treasury Board of Canada Secretariat

- Shared Services Canada

… and other key stakeholders

- The CRA also engages with the industry associations and civil society organizations to obtain a better understanding of their perspective on key strategic issues which may have an impact on their organizations as well as on the CRA clients they serve

- Examples of organizations with which the CRA engages:

- National Payroll Institute

- Chartered Professional Accountants of Canada

- Canadian Federation of Independent Business

- Tax-Filer Empowerment Canada

- Canadian Bankers Association

- Canadian Tax Foundation

- Canadian Taxpayers Association

For many Canadians, the main interaction with the Government is their tax filing experience

- The CRA offers a variety of tools and services to support tax filing:

- Auto-fill my return, a certified tax software, automatically partially completes parts of a tax return with information the CRA has on file at the time of the request

- Secure online portals and mobile apps for individuals and small businesses allow clients to submit documents and receive email notifications

- The CRA is undertaking a digital transformation to enhance the services that are delivered to Canadians, as well as the mindsets, tools and business processes that support these services

Key facts and figures 2020-21 - tax filing experience

- More than 32 million individual and corporate returns filed

- 90% of individual income tax and benefit returns and 94% of corporation income tax returns were filed electronically

- Call volume has more than doubled due to our administration of COVID-19 relief measures, with over 49 million total calls received

- 46 million log-ins to My Account during this year's tax filing season

The economic and social well-being of Canadians is supported by the delivery of benefits and tax credits

- Our overarching goal is to ensure clients know how to access the benefits and tax credits for which they are eligible

- The CRA undertakes significant efforts to reach people, in particular vulnerable populations, to increase benefit uptake:

- The Community Volunteer Income Tax Program (CVITP)

- A 3-year, $10 million grants pilot, introduced in 2021, to help organizations cover the costs to run free tax clinics

- Benefit outreach, including to Indigenous populations and seniors

- “Nudge” campaigns

- The CRA works with provincial, territorial, and federal partners, the private sector, and non-governmental organizations to support our efforts

Key facts and figures 2020-21 - benefits and tax credits

- Over $44.4 billion in benefits issued

- Administered 195 federal, provincial and territorial benefit and credit programs and services

Emergency measures related to the COVID-19 pandemic

- In response to the pandemic, the CRA responded quickly by launching new emergency relief programs, while adapting our administration of tax and benefits to support individuals, businesses, and charities

- Verification and collection activities related to these measures continue and will increase as the economy recovers from the pandemic

- The response plan also provided an additional payment of the GST/HST quarterly tax credit for low income individuals and families ($5.4 billion), and an additional Canada Child Benefit payment ($2 billion)

| Program | Unique applicants | Total value |

|---|---|---|

| Canada Recovery Benefit | 2,195,220 | $27.0 billion |

| Canada Recovery Caregiving Benefit | 465,610 | $3.6 billion |

| Canada Recovery Sickness Benefit | 698,970 | $742.2 million |

| Canada Emergency Rent Subsidy | 211,830 | $6.8 billion |

| Canada Emergency Wage Subsidy | 454,910 | $95.2 billion |

| Canada Recovery Hiring Program | 8,600 | $104.8 million |

| Canada Emergency Response Benefit | 22,700,000 | $45.3 billion |

| Canada Emergency Student Benefit | 2,100,000 | $2.9 billion |

| Temporary Wage Subsidy | 263,000 | $988 million |

Source: CRA COVID-19 Dashboard, October 10, 2021

Recent announcement to the emergency measures related to the COVID-19 pandemic

The Government announced on October 21 its intention to extend, expand and introduce the following COVID-19 benefits and programs:

- Extend the Canada Recovery Hiring Program until May 7, 2022, for eligible employers

- Deliver targeted support to businesses that are still facing significant pandemic-related challenges through two streams as of October 24, 2021:

- Tourism and Hospitality Recovery Program, to provide support through the wage and rent subsidy programs, to hotels, tour operators, travel agencies, and restaurants

- Hardest-Hit Business Recovery Program,to provide support through the wage and rent subsidy programs, helping businesses that have faced deep losses

- Extend the Canada Recovery Caregiving Benefit and the Canada Recovery Sickness Benefit until May 7, 2022, and increase the maximum duration of benefits by 2 weeks

- Establish the Canada Worker Lockdown Benefit which would provide $300 a week in income support to eligible workers if they are unable to work due to a local lockdown anytime between October 24, 2021 and May 7, 2022

CRA revenue collections

- The CRA collects taxes on behalf of the Government of Canada, most provinces and territories, and some First Nations

- The CRA also undertakes a variety of activities to collect debts on behalf of other government programs (e.g., social program overpayments, Canada Student Loan)

- The revenues collected by the CRA are critical in supporting government programs, services, and investment priorities

Key facts and figures 2020-21CRA revenue collections

- Total administered revenue and pension contributions over $482 billion

- Resolved just under $74 billion in outstanding tax debt

Canadians' level of compliance is impacted by the CRA's reputation and perceived fairness

- Non-compliance ranges from accidental error (making honest mistakes) to intentional (wilfully seeking to mislead the CRA)

- Our responses are tailored to the type of non-compliance:

- Focus on education and facilitation to help those who want to comply

- Enforcement efforts target high-risk individuals and corporations, and the underground economy

- The CRA collaborates with our international partners to combat tax evasion

- Canadians have the right to a fair and impartial review through the redress process, including the court system, as outlined in the legislation administered by the CRA and confirmed in the Taxpayer Bill of Rights

- The CRA has a number of active court cases, including some with very high profiles, all of which are being litigated by the Department of Justice

Canadians expect their information to be protected

- The CRA has one of the largest holdings of personal information in Canada and Canadians expect us to protect it by:

- Managing information and data

- Ensuring appropriate safeguards are in place

- Governing the use of new and emerging technology

- Adhering to privacy and confidentiality obligations set out in the Privacy Act and other laws (e.g., section 241 of the Income Tax Act)

- Any impact on our reputation could reduce trust in the CRA, and ultimately compliance

- The CRA has rigorous controls to protect personal information and regularly monitors and enhances these controls

- The CRA is addressing an increase in the frequency and sophistication of security threats and raising the profile of security and privacy

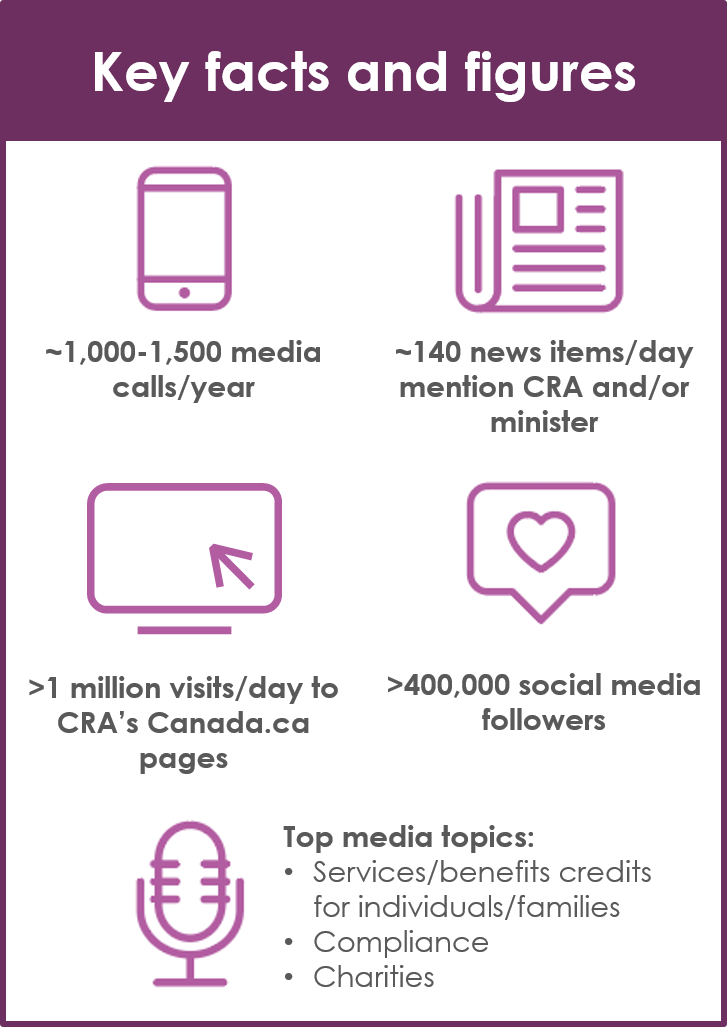

Communications is key to achieving results

Image description

This graphic, entitled “Key facts and figures” features five small purple icons. Each icon has text associated with it and provides information related to the CRA's communications and media presence.

The first icon is a cell phone. Beneath it is text that reads that the CRA responds to approximately 1,000 to 1,500 media calls a year.

To the right of the first icon is a second icon of a newspaper. Below it is text that reads that approximately 140 news items per day mention the CRA and/or the Minister.

Under the first icon, there is a third icon of a computer. Below it is text that reads that there are over one million visits a day to the CRA's Canada.ca pages.

Beside the third icon, on the right, there is a fourth icon which depicts a “like” on social media. The text below it reads that the CRA has over 400,000 social media followers.

Below the third and fourth icons, the fifth and last icon in the graphic is of a microphone. Beside it there is a list of the top media topics related to the CRA. These include: services, benefits and credits for individuals and families, compliance, and charities.

- A high national public interest in certain CRA stories creates challenges:

- Being open and transparent while protecting the confidentiality of taxpayer information

- Perception that the CRA is cracking down on the average Canadian more than wealthy Canadians and businesses

- The CRA is addressing these challenges by taking a proactive approach to media relations, providing accurate and timely information about our programs, services, and service improvements

- Our helpful, user-centric approach on social media has made CRA one of the most followed government agencies

- Canada.ca is one of our primary communications channels and the CRA relies on usability testing to make sure Canadians can quickly get the information they need

Image description

This graphic, entitled “Agency 2030,” has an inner white circle with the text "Trusted, fair, and helpful by putting people first" which is the CRA vision. It also has an outer circle with five sections representing the five Agency 2030 aspirations.

The first section of the outer circle is at the top in the centre and is purple. Within this section, there is the text "Seamless client experience" and a small graphic of a person with an arrow in the shape of circle around them.

The second section is at the upper right side of the outer circle and is blue. Within this section, there is the text “Data-driven and digital” and a small graphic of a bar chart.

The third section is at the bottom right side of the outer circle and is green. Within this section, there is the text “Tax and benefits just happen” and a small graphic of a gear.

The fourth section is at the bottom left side of the outer circle and is yellow. Within this section, there is the text “Connected and proactive” and a small graphic of the internet globe.

The fifth section is at the upper left side of the outer circle and is blue. Within this section, there is the text “Diverse workforce and high-performance culture” and a small graphic of a computer screen with four individuals participating in a virtual meeting.

To better serve Canadians, the CRA is transforming

- Over the last few years, the CRA has been on a journey to adopt a People-First Philosophy to better meet the needs and expectations of our clients, and advance the realization of our vision of being trusted, fair, and helpful by putting people first

- In 2021, the CRA articulated clear, directional aspirations to guide our transformation over the long-term:

- Tax and benefits just happen

- Seamless client experience

- Connected and proactive

- Data-driven and digital

- Diverse workforce and high-performance culture

In the near term, we have important work ahead of us

- Emerging stronger from the pandemic, guided by our Agency 2030 aspirations and sensitive to the well-being of our workforce, which has been called upon to deliver significant new programs throughout the pandemic

- Preparing for re-integrating into CRA worksites and for the workplace of the future, seizing the moment to innovate and accelerate our transformation into a more digital and data-driven organization

- Focusing on ensuring the inclusion of equity-deserving groups, and that diversity is reflected across the CRA and in positions of senior leadership

- Implementing measures identified in Budget 2021, including working towards collecting electronic payroll data directly from businesses (i.e., ePayroll)

- Continuing to address an increase in the frequency and sophistication of security threats

…including with respect to your platform commitments

Your platform contained a number of tax and benefit proposals that have implications for the CRA, many of which are straightforward to implement (e.g., simple tax credits) while others are more complex or relate to the public service broadly.

We look forward to discussing commitments, among others:

- Working with international partners to implement a global corporate minimum tax

- Increasing resources of the CRA to combat aggressive tax planning and tax avoidance, up to $1 billion per year

- Reforming the Scientific Research and Experimental Development Program to reduce red tape, the need for consultants, better align expenses, and make the program more generous for companies

- Establishing the Canada Financial Crimes Agency by combining resources of the Royal Canadian Mounted Police, the Financial Transactions and Reports Analysis Centre of Canada, and the CRA

- Extending the national tax of 1% on non-resident, non-Canadian owners of vacant housing (announced to begin January 2022) to include foreign-owned vacant land within large urban areas