Organization

This section provides an overview of the CRA's organization and structure, governance and oversight, key corporate documents, and the partners and stakeholders with whom the CRA interacts.

On this page

Governance

Organizational Structure

The CRA comprises 14 headquarter branches and 4 regions.

- 6 headquarter branches centrally organize and provide technical and policy support for the delivery of CRA programs

- 8 headquarter branches provide corporate services for the CRA

- 4 regions are responsible for program delivery via field offices in their respective areas of operation

Image description

Minister of National Revenue

- Marie-Claude Bibeau

Taxpayers' Ombudsperson

Commissioner and Chief Executive Officer

Board Management

Deputy Commissioner

Regions

Atlantic

Quebec

Ontario

Western

Headquaters

Program Branches

Appeals

Assessment, Benefit, and Services

Collections and Verifications

Compliance Programs

Legislative Policy and Regulatory Affairs

Digital Transformation Program

Corporate Branches

Audit, Evaluation, and Risk

Finance and Administration

Human resources

Information Technology

Legal Services

Public Affaires

Security

Service, Innovation and Integration

Legend

AC: Assistant Commissioner

ADM: Assistant Deputy Minister

DAC: Deputy Assistant Commissioner

ED/SGC: Executive Director/Senior General Counsel

RAC: Regional Assistant Commissioner

Agency Governance Overview

The Canada Revenue Agency's (CRA) governance structure is more complex than most departments given its status as an Agency with unique authorities. It includes a Minister, a Commissioner and Chief Executive Officer (i.e., Deputy Minister), and a Deputy Commissioner (i.e., Associate Deputy Minister), similar to other government departments. In addition, the CRA also has a Board of Management (Board) and a Taxpayers' Ombudsperson.

Minister of National Revenue

- Accountable to Parliament and the Prime Minister for the operations of the CRA, matters relating to the collection of taxes and duties (set out in the Income Tax Act, the Excise Tax Act, and the Excise Act) and elements of the Employment Insurance Act and the Canada Pension Plan

- Powers related to regulation-making and reporting to Parliament and the Governor in Council

- Does not direct officials on interpreting tax law

- Member of Cabinet and Privy Councillor

Board of Management

- Accountable to the Minister of National Revenue

- Consists of 15 Directors:

- A Chair and two directors who are nominated by the federal government and appointed by the Governor in Council

- Eleven directors in total, 10 of whom are nominated by each province, and one who is nominated by the territories (on a rotating basis), and appointed by the Governor in Council

- The Commissioner (ex-officio member)

- Oversees the organization, administration and management of the CRA

- Provides oversight to the CRA's internal audit and program evaluation planning and reporting

- Responsible for the development of the CRA's Corporate Business Plan

- Not involved in CRA operational activities

- Has no authority in the administration or enforcement of legislation, for which the CRA remains fully accountable to the Minister

Taxpayers' Ombudsperson

- Accountable directly to the Minister and operates at arm's length from the CRA

- Mandated to improve service to taxpayers via service complaint mechanisms, systemic reporting and outreach

- Upholds the 8 service-related rights outlined in the Taxpayer Bill of Rights

Commissioner and Chief Executive Officer

- Accountable to the Minister, the Board, and the Clerk of the Privy Council

- Responsible for the authorities assigned to them by a person (e.g., Minister or Prime Minister), a body (e.g., Treasury Board), or by law, regulation or policy (e.g., Financial Administration Act)

- Responsible for the day-to-day management and direction of the CRA

- Ex-officio member of the Board

- Advises the Minister on legislated authorities, duties, and functions

Deputy Commissioner

- Supports the Commissioner in all duties

- Responsible for exercising specific duties/functions assigned by the Commissioner

- Acts for the Commissioner in case of absence, incapacity, or vacancy

- Not a member of the Board but normally attends Board meetings

Commissioner of the CRA

Bob Hamilton, Commissioner and Chief Executive Officer

Bob was appointed Commissioner of the Canada Revenue Agency (CRA) effective August 1, 2016. He was reappointed to a second term of up to five years effective August 1, 2021.

Prior to joining the CRA, Bob served as Deputy Minister of Environment Canada (2012 to 2014), and Deputy Minister of Natural Resources Canada (2014 to 2016).

Bob was appointed Senior Associate Secretary of the Treasury Board in March 2011 and named by the Prime Minister as the lead Canadian on the Canada-United States Regulatory Cooperation Council.

Bob also held many senior positions in the Department of Finance, including Senior Assistant Deputy Minister, Tax Policy, and Assistant Deputy Minister of Financial Sector Policy.

He received his Honours BA and master's degrees in economics from the University of Western Ontario.

He was appointed the Chair of the Organisation for Economic Co-operation and Development's Forum on Tax Administration (FTA) in August 2020, for a three-year term. The FTA brings together commissioners from 53 advanced and emerging tax administrations from across the globe.

Deputy Commissioner of the CRA

Brigitte Diogo, Deputy Commissioner of the CRA

From July 2020 to April 8, 2022, Brigitte Diogo was the Vice President of the Health Public Health Agency of Canada (PHAC), at the Security and Regional Operations Branch where she was responsible for the administration of the Quarantine Act at Canada’s points of entry including compliance and enforcement, the biosecurity program through the regulation of human pathogens and toxins in Canada, and the implementation of the Agency’s regional operations across the country.

Previously, she was Director General, Rail Safety with the Department of Transport Canada. In the role, she was responsible for providing regulatory oversight for rail safety in Canada and overseeing the development and enforcement of regulations and standards related to the railway industry under the Railway Safety Act.

Prior to that, Brigitte held a variety of roles at the Privy Council Office. From 2011 through 2014, she was Director of Operations within the Security and Intelligence Secretariat, where she was responsible for matters related to national security, including border security. From 2008 to 2011, she was Director of Operations within the Economic and Regional Development Policy Secretariat, where her responsibilities included international trade, competition and copyright policies, innovation and research, major military procurement, transportation, and infrastructure programs.

Brigitte also worked for several years in the Department of Immigration, Refugees and Citizenship Canada where she held several positions including Director General, Admissibility.

She is a graduate of the University of Ottawa in Economics and Political Science.

Board of Management

Creation of the Board of Management

- In 1999, Parliament established the Canada Revenue Agency (CRA) (the Canada Customs and Revenue Agency at the time) and created the Board of Management (Board)

- The Canada Revenue Agency Act outlines the composition and the responsibilities of the Board, as detailed below

Board of Management role

- Oversees the organization and administration of the CRA and the management of its resources, services, property, personnel, and contracts

- Responsible for the development and approval of the Corporate Business Plan, as well as the approval of the CRA's Departmental Results Report and its audited financial statements

- May advise the Minister of National Revenue on matters that relate to the general administration and enforcement of program legislation

- Provides a challenge function, ensuring the CRA is properly managing and exercising its authorities by reviewing quarterly performance reports, financial statements, and dashboards

- Brings a forward-looking, strategic perspective to the CRA's operations

Responsibility for day-to-day management rests with the Commissioner and CRA officials:

- The Board may not direct the Commissioner or an employee in the exercise of statutory power, duty, function or in the administration or enforcement of program legislation

- The Board is not authorized to receive personal/business information or information obtained under program legislation

Chair

- Appointed by the Governor in Council (GIC) to serve "at pleasure" for a period of no more than five years that can only be renewed once

- Must preside at meetings of the Board. This includes quarterly meetings in June, September, January, and March (two in Ottawa, one at a regional office, and one held virtually). An annual Strategic Development Meeting, a meeting to approve the annual financial statements, and other ad hoc meetings are held throughout the year.

Suzanne Gouin, Chair

Suzanne was appointed Chair of the Canada Revenue Agency's (CRA) Board of Management (Board) effective August 2017 for a four-year term. She was re-appointed to a second, five-year term effective August 2021.

Suzanne has the following roles with the Board:

- Chair, Board

- Member, Audit Committee

- Member, Governance and Social Responsibility Committee

- Member, Human Resources Committee

- Member, Resources Committee

Suzanne has experience dealing with business transformation, digital implementation, and governance and human capital issues. In addition to being Chair of the CRA's Board, she is also a member of the Board of Directors of the Foundation of Greater Montreal, Hydro-Québec, Laurentian Bank of Canada, and sits on various advisory committees.

Suzanne is an experienced media executive, and was the Chief Executive Officer of TV5 Québec Canada for more than 13 years. She has held various management positions in both the private and public sectors. A graduate of Concordia University, she holds an MBA from the Richard Ivey School of Business (University of Western Ontario) and holds the IAS accreditation of the Institute of Corporate Directors. Suzanne is a recipient of the National Order of Merit of the French Republic.

Directors

- Appointed by the GIC to serve “at pleasure” for a period of no more than three years that can be renewed twice

- A short list of nominees is provided to the Minister of National Revenue, from the nominating province's Minister of Finance, who then recommends a nominee to the GIC

- Two federal positions are appointed by the GIC, on the recommendation of the Minister, based on an open and transparent selection process

- 15 directors: Chair, Commissioner (ex-officio), 10 provincial, 1 territorial (rotating), 2 federal

| Name | Nominated by |

|---|---|

| Kathryn A. Bouey | Ontario |

| Dawn S. Dalley | Newfoundland and Labrador |

| Mary Ference | Saskatchewan |

| Colin Younker | Prince Edward Island |

| Barbara Carra | Alberta |

| Thane Sherrington | Nova Scotia |

| Carole Imbeault | Quebec |

| David W. Reid | Manitoba |

| Mireille A. Saulnier | New Brunswick |

| Madhuri Parikh | British Columbia |

| D. Stanley Thompson | Yukon |

| Joyce Sumara | Federal- Outgoing, new appointment pending |

| 1 vacant position | Federal- new appointment pending |

| Bob Hamilton | Ex Officio |

Currently, there are appointment processes underway for two federal positions, Manitoba (re-appointment) and New Brunswick (re-appointment). Members are permitted to serve past the end of their term while new nominations or re-appointments are processed. As a result, there are currently no issues with quorum.

Board secretariat

The Board is supported by the Board of Management Secretariat. The team is led by the Corporate Secretary (Louise Ouellette-Bolduc), who reports directly to the Commissioner and Deputy Commissioner.

Taxpayers’ Ombudsperson

Mandate of the Taxpayers' Ombudsperson

The Taxpayers' Ombudsperson position was created in 2007 to serve as a special advisor to the Minister. The current Ombudsperson, François Boileau, was appointed by the Order in Council P.C. 2020-0703 for a non-renewable term of five years to enhance the Canada Revenue Agency's accountability in its service to, and treatment of, taxpayers and benefit recipients.

The mandate of the Ombudsperson is to assist, advise, and inform the Minister about any matter relating to services provided to taxpayers by the Canada Revenue Agency (CRA). The Taxpayers' Ombudsperson fulfills this mandate by:

- Upholding 8 of the 16 taxpayer service-related rights outlined in the Taxpayer Bill of Rights

- Providing an independent and impartial review of unresolved complaints from taxpayers about the service or treatment they have received from the CRA

- Reviewing any matter within the Ombudsperson's mandate at the request of the Minister

The Ombudsperson identifies and reviews systemic and emerging issues related to:

- Service matters that impact negatively on taxpayers

- Facilitating access by taxpayers to redress mechanisms within the Agency to address service matters

- Providing information to taxpayers about the mandate of the Ombudsperson

The Ombudsperson will generally review a complaint only after all CRA internal complaint resolution mechanisms have been exhausted. There are certain types of complaints that the Ombudsperson cannot review, such as:

- Complaints that are not service-related or have been addressed by the Minister's office

- Matters that are before the courts

Taxpayer Bill of Rights

- You have the right to receive entitlements and to pay no more and no less than what is required by law

- You have the right to service in both official languages

- You have the right to privacy and confidentiality

- You have the right to a formal review and a subsequent appeal

- You have the right to be treated professionally, courteously, and fairlyFootnote 1

- You have the right to complete, accurate, clear, and timely informationFootnote 1

- You have the right, unless otherwise provided by law, not to pay income tax amounts in dispute before you have had an impartial review

- You have the right to have the law applied consistently

- You have the right to lodge a service complaint and to be provided with an explanation of our findingsFootnote 1

- You have the right to have the costs of compliance taken into account when administering tax legislationFootnote 1

- You have the right to expect us to be accountableFootnote 1

- You have the right to relief from penalties and interest under tax legislation because of extraordinary circumstances

- You have the right to expect us to publish our service standards and report annuallyFootnote 1

- You have the right to expect us to warn you about questionable tax schemes in a timely mannerFootnote 1

- You have the right to be represented by a person of your choiceFootnote 1

- You have the right to lodge a service complaint and request a formal review without fear of reprisal

Commitment to small business

The CRA is committed to:

- Administering the tax system in a way that minimizes the costs of compliance for small businesses

- Working with all governments to streamline service, minimize cost, and reduce the compliance burden

- Providing service offerings that meet the needs of small businesses

- Conducting outreach activities that help small businesses comply with the legislation we administer

- Explaining how we conduct our business with small businesses

Ombudsperson Liaison Office

The Ombudsperson Liaison Office (OLO) is located in the Service, Innovation and Integration Branch, serving as the designated point of contact in the CRA for the Office of the Taxpayer Ombudsperson (OTO) for service-related issues. OLO facilitates the OTO's activities in the Agency and provides assistance to the Ombudsperson to fulfill the office's mandate in a timely manner.

Taxpayers' Ombudsperson publications

The Ombudsperson must submit to the Minister and to the Chair of the Board of Management an annual report on the activities of the Taxpayers' Ombudsperson, which must contain information regarding the carrying out of the Ombudsperson's mandate in the previous fiscal year and statistics related to those activities for that year. Annual reports may include recommendations from the OTO, in which case the CRA is required to develop a corresponding action plan. The Minister must cause a copy of the annual report to be tabled in each House of Parliament.

The OTO publishes systemic examination (SE) reports which present evidence and findings arising from the office's examination of a specific systemic issue and makes recommendations for corrective action to the Minister. When the OTO issues recommendations for the CRA, the CRA has an opportunity to review and approve these recommendations for technical accuracy and acceptance by the Commissioner prior to their publication. A systemic issue is one that negatively impacts large numbers of taxpayers or a segment of the population.

The OTO also publishes papers on issues of importance to taxpayers. Papers do not contain recommendations but still undergo a technical accuracy review and acceptance by the Commissioner prior to publication.

For more information on the Taxpayers' Ombudsperson, including all publication details, go to the Office of the Taxpayers’ Ombudsperson.

François Boileau, Taxpayers' Ombudsperson

François Boileau took office as Canada's Taxpayers’ Ombudsperson on October 5, 2020. Prior to this nomination, François was the French Language Services Commissioner as an independent Officer of the Ontario Legislative Assembly from 2007 to 2019. His role consisted mainly of receiving complaints from members of the public and making recommendations on matters pertaining to the implementation of the French Languages Services Act.

For nearly 30 years, as a senior executive, he has developed expertise as an ombudsperson, as well as in oversight, investigation, and governance.

Before his appointment as Commissioner, François served as legal counsel for the Office of the Commissioner of Official Languages with responsibility for landmark cases, which went before the Supreme Court of Canada. Before this, he held pivotal positions with the Fédération des communautés francophones et acadienne du Canada (FCFA), at its Québec City and Ottawa offices, including director, political and legal liaison officer, and legal counsel. One of his most important achievements during that time was representing the FCFA before the Ontario Court of Appeal in the Montfort case. For this case, he devised strategies and played a pivotal role in legal coordination of the interveners, which included the Commissioner of Official Languages of Canada and the Association canadienne-française de l’Ontario (ACFO), now the Assemblée de la francophonie de l’Ontario (AFO).

François became the first executive director of the Court Challenges Program of Canada in Winnipeg in 1995. During his tenure, he developed the organization’s strategic priorities and operational plans and headed the language rights component of the program.

In addition to a Law Degree (LL.L.) from the University of Ottawa (1991), François holds a Certificate in Alternate Dispute Resolution from York University (2020), a Bachelor’s Degree in Political Science (1988) and a Certificate in History (1985) from the Université Montréal.

He holds numerous distinctions including the prestigious Paulette-Gagnon Award, Assemblée de la Francophonie de l'Ontario, the title of Chevalier de l'Ordre de la Pléiade, Order of the Francophonie and Dialogue of Cultures, the Order of Merit, Civil Law Section, Faculty of Law, University of Ottawa, the Order of Merit, Association des juristes d'expression française de l'Ontario (AJEFO) and Communicator of the Year, Alliance des radios francophones du Canada (ARC).

Office of the Auditor General

The Office of the Auditor General of Canada (OAG) serves Parliament by providing objective, fact-based information and advice on government programs and activities. Parliament uses OAG reports to oversee government operations and hold the federal government to account for its handling of public funds. Karen Hogan was appointed Auditor General of Canada in June 2020.

The Standing Committee on Public Accounts is Parliament's standing audit committee, and it reviews the work of the Auditor General of Canada.

Recent Audits

Treasury Board of Canada Secretariat

The Treasury Board of Canada Secretariat (TBS) is the administrative agency that supports the Treasury Board of Canada (Treasury Board) which is a committee of the King’s Privy Council for Canada. TBS plays a central oversight role in government-wide management practices and ensuring value for money.

TBS submits recommendations and provides advice to the Treasury Board on all matters relating to:

- general administrative policy and organization in the Public Service of Canada,

- financial and asset management policies and procedures, review of annual and long-term expenditure plans and programs,

- determination of related priorities.

As an Agency, the CRA has certain statutory authorities over matters that are overseen by TBS for the core public service. The CRA does, however, seek to align its corporate policies with the core public service, and works closely with TBS to ensure effective government-wide operations.

The CRA makes a variety of submissions to Treasury Board throughout the year (e.g., to access funds for new programs, and seek approval of its Corporate Business Plan), and works with TBS to ensure their quality prior to their presentation to Ministers.

Branches

The Canada Revenue Agency (CRA) comprises 14 headquarters branches and 4 regions:

- Six headquarters branches centrally organize and provide technical and policy support for the delivery of CRA programs

- Eight headquarters branches provide corporate services for the CRA

- Four regions are responsible for program delivery via field offices in their respective areas of operation

Appeals Branch

Mandate

Delivers high-quality, timely, and impartial recourse services for disputes and relief requests, and promotes the prevention and earliest resolution of tax/benefit issues in the client experience.

Tammy Branch, Assistant Commissioner

Prior to her appointment as Assistant Commissioner, Appeals Branch at the Canada Revenue Agency (CRA), Tammy was Deputy Assistant Commissioner, Collections and Verification Branch, CRA, from April 2019 to October 12, 2021, and joined the CRA in August 2016 as the Director general of Collections Directorate.

Recruited into the Government of Canada through the Management Trainee Program, Tammy initially worked in the Department of National Defence where she held various positions in the areas of communications, policy, human resources and in the Deputy Minister's office. In 2005, she joined Public Safety Canada where she headed up the Cabinet Affairs group.

Tammy joined the Canada Border Services Agency (CBSA) in 2007 as the Strategic Advisor to the President. She was also Chief of Staff and Director, International Policy. In the fall of 2011, Tammy took on the role of Director General of the Recourse Directorate at the CBSA, where she led a significant Modernization of the Recourse Program, with an emphasis on improved client service.

She holds a Master of Arts Degree in Development Studies from the University of East Anglia in the United Kingdom and a Masters of Business Administration from Queen's University. She also studied Political Science at the University of Toronto.

Assessment, Benefit, and Service Branch

Mandate

Administer key tax processing services and contact centre operations, enable tax and revenue generation programs, and administer benefits on behalf of the federal government and most provinces.

Gillian Pranke, Assistant Commissioner

In 2022, Gillian was appointed to the position of Assistant Commissioner, Assessment, Benefit and Service Branch (ABSB) in the Canada Revenue Agency (CRA).

Gillian began her career in the federal public service as a summer student in the CRA. Her career has led her through both Headquarters and Field operations where she has worked in many of the Agency's business and program lines, holding positions of increased responsibility. Some of the positions she has held included, Director, International Tax Services Office, Director, Ottawa Tax Services Office, and Director, Ottawa Technology Centre, Ontario Region. In 2016, she returned to Headquarters and was appointed to the position of Director General, Call Centre Services Directorate, ABSB.

Gillian is a graduate of the Public Service Commission's Direxion Program, holds a Master's in Business Administration from the University of Ottawa and is a graduate of the University of Ottawa, Public Service Leadership and Governance Certificate Program. She also studied political science and public administration at Carleton University.

Gillian thrives on the challenges and opportunities around service delivery, derives great satisfaction in seeing tangible results and likes working to bring out the best in others. She is married, has twin sons, enjoys the outdoors and likes to be active.

Melanie Serjak, Deputy Assistant Commissioner

In April 2023, Melanie was appointed to the position of Deputy Assistant Commissioner, Assessment, Benefit, and Service Branch (ABSB) in the Canada Revenue Agency (CRA).

Prior to joining the CRA in July 2021 as the Director General of the Benefit Systems Directorate, Information Technology Branch, Melanie held the position of Director General, Digital Services Branch at Public Services and Procurement Canada (PSPC), where she worked to bridge business needs with technology solutions, leading the support and development of critical IT systems, such as Treasury, Procurement and Pension, in support of the Government of Canada (GC) and Canadians. Prior to this, Melanie held a series of increasingly senior positions at PSPC, where she worked on large GC Enterprise-wide priorities and initiatives as Director General, Change Management and Stakeholder Engagement for HR-to-Pay stabilization, and Senior Director, Stakeholder Consultations and Implementation for the GC's common HR platform.

Before joining the public service in 2009, Melanie worked for a number of private sector organizations in a variety of industries, such as supply chain management, media and communications, and human resources.

Melanie is a Commerce graduate of the Telfer School of Management at the University of Ottawa with specialization in International Management and Marketing.

She is an avid sports enthusiast who enjoys training for half marathons in the summer, and is a committed downhill ski racing parent on the slopes of Camp Fortune and Mont Tremblant in the winter.

Audit, Evaluation, and Risk Branch

Mandate

Enables the achievement of the Canada Revenue Agency (CRA) strategic goals by providing independent and objective information, advice and assurance on the soundness of the Canada Revenue Agency (CRA) management framework and on the effectiveness, efficiency and economy of its strategies, programs and practices. Ensures the CRA has successfully embedded a holistic approach to managing risk and fosters a working culture that values responsible risk taking and continuous improvement.

Nathalie Meilleur, Assistant Commissioner and Chief Audit Executive

Nathalie was appointed to the position of Assistant Commissioner and Chief Audit Executive in October 2021. She plays a key role in supporting major strategic and change management initiatives within the CRA. She is responsible for providing strategic advice and executive oversight with respect to horizontal and integrated enterprise risk management, and as such is an active member of the Forum on Tax Administration's Enterprise Risk Management Community of Interest Advisory Group. She also leads robust independent internal audit and program evaluation functions that are supported by strong Professional Practices and Data Science sections. Furthermore, Nathalie is the Senior Officer responsible for overseeing and managing the internal disclosure of wrongdoings within the CRA.

Prior to joining the CRA as Director General, of the Financial Management Advisory Services Directorate, at Financial Administration Branch (June 2018), Nathalie occupied the position of Executive Director of the Financial Policy and Community Development Division with the Office of the Comptroller General of Canada, of the Treasury Board of Canada Secretariat. Nathalie has more than 20 years of financial management and internal audit experience, including 10 years with the Natural Sciences and Engineering Research Council of Canada. Prior to joining the federal government, she worked for a private accounting firm providing financial management services to several departments.

Nathalie strives to establish strong partnerships and trust at all levels, as well as support employee and community development and work collaboratively to sustain a strong workforce.

Nathalie holds a Bachelor's degree in Commerce with a specialization in Accounting from the University of Ottawa and is a Chartered Professional Accountant (CPA, CA).

Collections and Verification Branch

Mandate

Protects the integrity and fairness of Canada's tax system for all Canadians by delivering national validation, compliance, and collections programs that:

- Foster taxpayer understanding of their tax obligations and promote voluntary registration, accurate and timely filing, and remittance;

- Validate tax returns and benefit entitlements and enforce compliance with Canada's tax laws for filing, declaring, withholding, registering, and remitting;

- Identify compliance risks and address non-compliance using advanced verification techniques and world class analytics; and

- Collect outstanding debts owed to the Crown through progressive and targeted enforcement approaches.

Cultivates a motivated, innovative, and highly skilled workforce that fosters its relationships with other Agency branches and tax administrations through excellence in developing and managing effective and innovative strategies, systems, tools, and processes.

Marc Lemieux, Assistant Commissioner

Marc was appointed to the position of Assistant Commissioner, Collections and Verification Branch in April 2020.

Over the years, Marc has held positions with increasing responsibilities and acquired a wealth of experience in various senior positions. He began his career in the public sector as a Senior Economist on Climate Change Policy before joining the internal functions in the regional development agencies in Atlantic Canada and Quebec. During these years in regions, Marc led the functions of evaluation, performance management, audit, finance, human resources and IM/IT.

In 2016, Marc joined Public Services and Procurement Canada (PSPC) to contribute to resolving the issues related to the implementation of the Phoenix pay system. During the following three years, he led the restructuring of the Pay Centre, grew the pay operations significantly, and reversed the trend in operations. His actions led to a significant reduction in the inventory of cases. Marc was a key player in building a coalition to align resources between PSPC and the client departments toward adopting an HR-to-Pay approach.

Marc also worked in the private sector for over 10 years at Gaz Metropolitan in the field of pricing, regulation, and environment.

Marc holds one Master's degree in Business Administration from HEC Montreal and one in Economy from the University of Laval, and he is also a Chartered Professional Accountant (CPA-CMA).

Compliance Programs Branch

Mandate

Protects the integrity and fairness of the Canadian tax system through education and proactive efforts aimed at helping those who want to comply, and making it harder for those who choose not to comply.

Depending on the level of risk identified, addresses and deters non-compliance through a graduated compliance approach including targeted education and communications, examinations, audits and, where warranted, penalties or criminal investigations.

Cathy Hawara, Assistant Commissioner

Cathy was named Assistant Commissioner of the Compliance Programs Branch on October 12, 2021.

Cathy joined the Canada Revenue Agency (CRA) in September 2009, when she became the Director General of the Charities Directorate. In that role, she was responsible for the overall management of the federal regulation of registered charities under the Income Tax Act. In June 2016, Cathy was appointed as the Deputy Assistant Commissioner of the Legislative Policy and Regulatory Affairs Branch (LPRAB). During that time, Cathy was active in the development and implementation of a number of priority files for the CRA, and coordinated the CRA's response to the tax implications resulting from the implementation of the Phoenix pay system. In September 2018, Cathy was named Assistant Commissioner of the Appeals Branch, where she was responsible for overseeing the delivery of the Agency's recourse programs and for leading the risk management function related to tax litigation. Also from 2018 to 2022, Cathy served as the National Champion of the Agency's Young Professionals Network.

From 2006 to 2009, prior to joining the CRA, Cathy served as the Director of Appointments with the Senior Personnel Secretariat at the Privy Council Office, where she was responsible for providing advice and support to the Clerk of the Privy Council, the Prime Minister and his Office on all matters related to selection processes and appointments to Governor in Council positions, including Deputy Ministers and heads of agencies. Previous to that, from 2004 to 2006, Cathy was Executive Assistant to the Deputy Minister of Social Development, where she supported and advised the Deputy on all issues related to the portfolio and acted as the principal liaison with the Minister's office. Cathy also worked as an officer in the Machinery of Government Secretariat at the Privy Council Office.

Cathy holds a Bachelor of Arts in Political Science and a Bachelor of Law, both from the University of Ottawa. Cathy clerked for Mr. Justice Ian Binnie at the Supreme Court of Canada and was called to the Ontario bar in 2000. Cathy carried on a general litigation practice with McCarthy Tetrault in Toronto, specializing primarily in medical malpractice, before joining the public service in 2002.

Digital Transformation Program Branch

Mandate

Builds a unified direction for enterprise-wide digital transformation and creates an environment without barriers that keeps pace with change.

Silvano Tocchi, Assistant Commissioner and Digital Transformation Officer

Silvano leads the CRA's Digital Transformation Program Branch (DTPB) as Assistant Commissioner.

He began his career at Employment and Social Development Canada and joined the CRA in 2014. He advanced a number of the CRA's digital service initiatives before assuming a role to accelerate the Agency's digital capabilities overall. DTPB is dedicated to supporting the Agency in its digital transformation ambitions. These ambitions go beyond introducing new technology; they are equally mindful of the evolution of our processes and the skills of our people to harvest the benefits of digital transformation.

Silvano embraces new ideas, thrives on the collaboration required to turn them into real change and enjoys bragging about the CRA's digital capabilities and where they might go next.

Silvano earned a diplôme d'études supérieures in international relations from the Institut universitaire de hautes études internationales in Geneva as well as a Bachelor of Arts from the University of Ottawa.

Finance and Administration Branch

Mandate

Facilitates the delivery of CRA programs and services by providing sound advice, products and services in diversified key functions: namely, financial and resource management, administration and real property.

Hugo Pagé, Assistant Commissioner and Chief Financial Officer

Hugo was appointed Chief Financial Officer and Assistant Commissioner of the Finance and Administration Branch on September 6, 2022.

Previously, he held the position of Assistant Deputy Minister and Chief Financial Officer at the Department of Fisheries and Oceans Canada where he provided leadership on major corporate financial and resource management strategies, including the implementation of the SAP financial system, the departments accrual budgeting initiative and the Canadian Coast Guard Fleet Renewal.

Prior to joining Fisheries and Oceans, Hugo held the position of Deputy Assistant Commissioner and Agency Comptroller at the Agency. He also formerly held the position of Director General of the Financial Administration Directorate, also at the Agency. Other past executive positions were held with the Treasury Board of Canada Secretariat and with Public Services and Procurement Canada.

Hugo is a Chartered Professional Accountant, a Certified Internal Auditor and holds a Bachelor in Accounting and a Master of Business Administration (Finance).

Claude Corbin, Deputy Assistant Commissioner and Agency Comptroller

Claude was appointed to the position of Deputy Assistant Commissioner and Agency Comptroller of the Finance and Administration Branch at the CRA effective June 29, 2020.

Claude joined the public service in 1993 at Transport Canada and, until 2011, occupied a variety of positions of increasing responsibility within the department's Programs Group, including Director General of Airport and Port Programs.

From 2011 to 2017, he worked for the Corporate Services Branch as the Director General of the Financial Planning and Resource Management Section.

In 2017, Claude joined Transport Canada's Oceans Protection Plan task team as the Director General, Engagement and Policy Development.

Finally, in late 2019, he joined Immigration, Refugees and Citizenship Canada in a corporate finance role as the Director General of the Financial Partnership Branch before starting yet again a new chapter of his career with the CRA.

Claude is a certified general accountant, chartered professional accountant since 1996.

Human Resources Branch

Mandate

Provides HR advice, services, and stewardship that support the Agency in achieving its business priorities.

Sonia Côté, Assistant Commissioner and Chief Human Resource Officer

On January 3, 2023, Sonia Côté was appointed to the position of Assistant Commissioner (AC), Human Resources Branch (HRB) and Chief Human Resources Officer (CHRO).

Sonia believes that more than ever, organizations need individual and collective strength of character to develop and maintain a culture built on trust, respect, integrity, and collaboration.

From talent architect to advocate of equity, diversity, and inclusion, and anti-racism, Sonia is a CHRO who focuses on people, data, technology, and workplace flexibilities to facilitate change, foster organizational resilience, and support employee growth.

Sonia has a broad range of experience as an executive in various roles in several Federal organizations over the past 28 years. She holds a Bachelor of Arts degree in Communications as well as a Master's of Science degree in Project Management.

Whether in the office, on MS Teams, or recharging on the yoga mat, Sonia is a leader who strives to bring creativity, compassion and kindness to everything that she does.

David Conabree, Deputy Assistant Commissioner

On June 26, 2023, David Conabree was appointed to the position of Deputy Assistant Commissioner (DAC), Human Resources Branch (HRB).

Prior to this appointment, David held the position of the Deputy Assistant Commissioner of the Collections and Verification Branch since January 2022.

David originally joined the Canada Revenue Agency (CRA) in Calgary as a collections contact officer in 2000. During the years that followed, he held various positions of increasing responsibilities in the Prairie and Ontario Regions. Through the Executive Development Program, he led Human Resources, Finance and Public Affairs files before his appointment as the Director of Resource Systems Integrity and Costing Division in 2011. In the next few years, David held the position of Director General of Corporate Services at Public Safety Canada until returning to the CRA in July 2017 as Director General, Employment Programs Directorate in the Human Resources Branch.

David holds a Master's degree in Public Administration Management from Dalhousie University and is a graduate of the Direxion Program, Next Generation CFO Program, and the Public Sector Leadership Program of the University of Ottawa.

At home, David is an avid guitar player, and enjoys family time at the cottage with his wife and two kids.

Information Technology Branch

Mandate

Develops, operates, maintains and evolves the CRA’s information technology (IT), with the goal of delivering world-class technology services and solutions that meet the expectations of employees and Canadians. Also provides client computing and corporate IT solutions to the Canada Border Services Agency.

Santo Scarfo, Assistant Commissioner and Chief Information Officer

Santo was appointed Assistant Commissioner of the Information Technology Branch (ITB) and Chief Information Officer on October 18, 2021. Prior to this appointment, Santo was Deputy Assistant Commissioner, Corporate Systems and Support, ITB, from November 2019 to October 18, 2021.

Santo began his career at the CRA as a Systems Analyst in 1994 and has held progressively challenging positions from management to executive level positions supporting numerous CRA systems including individual tax processing, business processing, business intelligence, IT security, architecture and information management. Santo has performed several senior executive roles including Director General of the Data and Business Intelligence Directorate, Director General of the Systems Integrity Directorate, and Director General for the Business and Enterprise Solutions Directorate.

He holds a Bachelor of Commerce (Honours) degree with a specialization in Management Information Systems from Lakehead University. Santo also graduated from the University of Ottawa Certificate Program in Public Sector Leadership and Governance.

Denis Skinner, Deputy Assistant Commissioner

Denis was appointed Deputy Assistant Commissioner on January 31, 2022.

An experienced digital systems professional and entrepreneur, Denis’s career has spanned a variety of key departments, including the Public Health Agency of Canada, Citizenship and Immigration Canada, and the Public Service Commission, where he was the Chief Information Officer. He has led a number of high-profile initiatives and major crown projects, and he brings that passion and commitment to ITB.

Prior to his appointment, Denis led the Digital Change Sector at Treasury Board of Canada Secretariat, and was also Director General of IT Strategy, Enterprise Architecture and Business Relations at Employment and Social Development Canada.

He has a Bachelor of Engineering and a Master's in Business Administration from the University of Ottawa.

Legal Services Branch

Mandate

Provide strategic advice and support to the CRA on legal and legal policy issues arising in the delivery of its programs and in its interactions with stakeholders and clients, as well as litigation services.

Jade Boucher, Acting Assistant Deputy Minister, Tax Law Services Portfolio, Department of Justice

Jade has been the Acting Assistant Deputy Minister since October 2022.

After being called to the Quebec Bar in 1999, Jade began her legal career with the Department of Justice as a tax litigator. She has appeared before the Tax Court of Canada, the Federal Court and the Federal Court of Appeal. Jade has also served as Special Advisor to the Associate Deputy Minister of Justice.

In 2010, Jade launched her management career. Between 2011 and 2017, she was the Director of the Ottawa Tax Litigation Section. Between 2017 and 2020, she held the position of Executive Director of the Legal Services Branch to the CRA. Prior to acting as Assistant Deputy Minister, she held the position of Deputy Assistant Deputy Minister of the Tax Law Services Portfolio since 2020.

Jade holds both a Licentiate in Civil Law (LL.L.) and a Bachelor of Common Law (LL.B.) from the University of Ottawa.

Catherine Letellier de St-Just, Executive Director and Senior General Counsel

Catherine has been the Executive Director and Senior General Counsel of the Legal Services Branch since February 2020.

Catherine began her career with the federal public service in 1996 as counsel for the Department of Justice, Tax Law Services Portfolio, Montreal, Toronto and Ottawa offices, and litigated tax cases before the Tax Court of Canada and the Federal Courts. She progressively held positions with increasing responsibilities within the Tax Law Services Portfolio, from counsel, senior counsel, to Deputy Director-Litigator and Acting Director. In January 2011, she joined the Canada Revenue Agency on an exchange program as Director of the GST, International and Financial Division, at the Tax and Charities Appeals Directorate of the Appeals Branch. From October 2012 to February 2020, she was the Director General of the Tax & Charities Appeals Directorate.

Catherine is a graduate of the Faculty of Law, Civil Law Section, and of the Faculty of Social Sciences, Political Science and Public Management of the University of Ottawa and is a member of the Quebec bar.

Legislative Policy and Regulatory Affairs Branch

Mandate

Acts as the ultimate authority for the interpretation of tax and benefits related legislation. Establishes and clarifies the interpretation of tax laws and is responsible for recommending legislative amendments to the Department of Finance on behalf of the CRA.

Holds responsibility for registering and regulating charities and the income tax treatment of registered plans, which involves the full range of services through application, registration, monitoring and compliance. In addition, the excise and specialty tax program provides the full range of services in its administration of the legislation that imposes excise duty, excise tax, fuel charge, luxury tax, and air travelers security charge.

Through the accurate and responsive delivery of its programs − whether relating to income tax or GST/HST rulings, legislative policy, charities, registered plans, or excise and specialty tax − LPRAB strengthens public confidence and facilitates greater understanding of the taxation framework, thereby contributing to greater voluntary compliance.

Soren Halverson, Assistant Commissioner

Soren was named Assistant Commissioner of the Legislative Policy and Regulatory Affairs Branch in May 2023.

Over the course of his career, Soren has worked on a wide range of economic and financial sector policy issues. Most recently, he served as Special Advisor to the Deputy Minister at Environment and Climate Change Canada, where he led the development of Canada’s Clean Electricity Regulations.

Prior to that, he served in senior roles at Finance Canada, including Associate Assistant Deputy Minister of the Financial Sector Policy Branch as well as Associate Assistant Deputy Minister of the Economic Development and Corporate Finance Branch.

In support of the federal government’s COVID response, he led on the development of business credit programs, including the $50 billion CEBA program.

Other areas of focus have included sustainable finance, environment and natural resources, innovation, infrastructure, transportation, defence, and management of the government’s corporate assets. Soren holds a Master’s of Arts (Economics) from Simon Fraser University and is a CFA Charterholder.

Public Affairs Branch

Mandate

Provides effective public affairs advice, products, and services to the CRA and its clients in a variety of functions including communications, issues management, brand management, ministerial services, parliamentary and Cabinet affairs, access to information and privacy, public opinion research, internet planning, and publishing.

Sophie Galarneau, Assistant Commissioner and Chief Privacy Officer

Sophie joined the CRA as Assistant Commissioner of the Public Affairs Branch and Chief Privacy Officer in February 2022.

Prior to joining the CRA, Sophie served as acting Assistant Deputy Minister (ADM) at Defence Research and Development Canada (DRDC) where she led the DRDC enterprise on publications, corporate services, technical and information services, financial management, and resource planning and management. From May 2018 to August 2021, she was the Chief of staff at DRDC. As Second in Command, she managed the organization’s corporate services and resources, while leading a broad-based change management initiative geared at increased strategic alignment, improved governance and employee morale.

Sophie has accumulated over 20 years of public affairs experience in government, political and not-for-profit settings. Within the Government of Canada, Sophie has held executive positions in communications as the Director General, Public Affairs, Strategic Planning at National Defence; Director, Strategic Communications, Media Relations and Regions at Health Canada and the Public Health Agency of Canada; and Director, Media Relations, Outreach and Electronic Communications at Global Affairs Canada. She also served as press secretary for the Prime Minister of Canada from 1997 to 2001.

Sophie holds a double Bachelor of Arts in communications and political science from the University of Ottawa.

Security Branch

Mandate

Enables the seamless delivery of Canada Revenue Agency (CRA) programs and services by ensuring the protection of the CRA's people, information, and assets. Ensures that security matters are considered at the beginning, middle, and end of every major program, strategy, or initiative at the CRA. Centralizes the management of all of the CRA's security functions to ensure that security matters benefit from:

- Increased coordination between branches at the Agency level

- Enhanced collaboration and information sharing with external partners

- More efficient incident and emergency management

- More integrated management of internal and external fraud risks

- More focused direction and investment of Agency resources

- A professional security workforce with deeper and more meaningful, modern career paths

Harry Gill, Assistant Commissioner and Agency Security Officer

Harry began his career in the Canada Revenue Agency (CRA) as an Income Tax and GST auditor in 1998 at the Ottawa Tax Services Office. Harry moved to CRA headquarters in 2004, and has since held various executive positions in the Compliance Programs Branch. Prior to his appointment as Assistant Commissioner and Agency Security Officer of the Security Branch in June 2021, Harry was the Director General of the Small and Medium Enterprises Directorate and then Director General for the External Fraud and Account Security Directorate.

In 2022, Harry laid the ground work for the consolidation of the CRA’s security functions into the new Security Branch, settings its vision and strategy as its first Assistant Commissioner. Harry has established and oversees Agency-wide security governance and as co-chair of the Incident Management Committee, he provides continuity to the response to security events at the CRA.

Harry holds a Bachelor of Commerce (Accounting) from the University of Ottawa and is a Chartered Professional Accountant (CPA). He is a graduate of the Institute on Governance Executive Leadership Program.

Service, Innovation, and Integration Branch

Mandate

Ensures rigour in the CRA reporting to Parliament and the provinces and territories, supports informed internal decision making on key questions facing the CRA in its operational and strategic agenda, and leads cross-cutting CRA projects in the interests of an integrated, enterprise approach and result.

Maximizes the CRA's ability to use its information assets, including both data and unstructured information, to the benefit of Canadians.

Maxime Guénette, Assistant Commissioner, Chief Data Officer, and Chief Service Officer

Prior to his appointment as Assistant Commissioner, Service, Innovation and Integration Branch, Chief Service Officer and Chief Data Officer at the CRA, Max was appointed Assistant Commissioner, Public Affairs Branch and Chief Privacy Officer for the CRA, a position he held for five years.

Max joined the CRA from Finance Canada, where he held the position of Director General, Communications and Consultations. Previously, he was Director General of Communications at Environment and Climate Change Canada, where he spent three years. From 2005 to 2013, Max was at the Treasury Board Secretariat, where he was Chief of Strategic Communications before being appointed Director of Corporate Communications, a position he held for six years.

Max holds a Bachelors of Social Sciences, with a specialization in Political Science, from the University of Ottawa. He is a graduate of the Canada School of Public Service's Assistant Deputy Minister Executive Leadership Development Program.

Ann Marie Hume, Deputy Assistant Commissioner

Prior to her appointment as Deputy Assistant Commissioner, Service, Innovation and Integration Branch, Ann Marie was Deputy Assistant Commissioner, Human Resources Branch (HRB), from January 2017 to October 12, 2021.

Ann Marie began her career in the federal public service in 1994. She has held positions of increasing responsibilities in various departments covering policy, program and corporate areas. In 2011, Ann Marie joined the CRA as Director General, Strategic Business Integration Directorate, HRB. In 2015, she moved to the Strategy and Integration Branch and held the position of Director General, Agency Strategy and Reporting Directorate.

Ann Marie holds Honours Bachelor degrees in Journalism and Science from Carleton University as well as a Master of Arts degree, Geography and Environmental Studies, from the University of Toronto. She is a graduate of the Management Trainee Program and the Accelerated Executive Development Program.

Regions

Four regional operations support the CRA's delivery of operational programs:

- Atlantic

- Quebec

- Ontario

- Western

Similar to the program and corporate branches at headquarters, each region is led by a Regional Assistant Commissioner. Regional operations take place in:

Tax Services Offices (TSOs)

TSOs handle more complex audit, collection and related files, which generally involve more direct interactions with taxpayers or their representatives.

Tax Centres (TCs)

TCs are tax return processing centres.

National Verification and Collections Centres (NVCCs)

NVCCs handle non-complex, non-face-to-face files in the areas of collections, validation, and verification.

Contact Centres (CC)

CCs respond to either individual enquiries or business enquiries related to tax and benefits programs.

Northern Service Centres (NSC)

Three NSCs support individuals, community organizations and businesses in the Yukon, Northwest Territories and Nunavut.

Centres of Expertise (COEs)

COEs provide leadership, best practices, research, support and training for a focus area.

Atlantic Region

The Atlantic Region covers the provinces of:

- New Brunswick

- Nova Scotia

- Prince Edward Island

- Newfoundland and Labrador

Tanya Cameron, Acting Regional Assistant Commissioner

On July 24, 2023, Tanya took on the role of acting Regional Assistant Commissioner until a replacement is found. Tanya is acting Director of the Newfoundland and Labrador Tax Services Office/National Verification and Collections Centre.

Tanya began her career with the Canada Revenue Agency in 1993. She progressed into management in 2001 and became the Assistant Director of the Business Returns Division in 2011. Tanya completed the Leadership Development Program and is a graduate of the University of Prince Edward Island.

In 2016, as the lead for Service Renewal, Tanya helped oversee PEI's transition from a tax processing centre to a business processing centre. In June 2019 she was appointed to the position of Director of the PEI Tax Centre/Tax Services Office. Prior to her role as Director, she was one of two Atlantic Region representatives on the Agency's Service Council where she had input into the Agency's Service Transformation Initiative. She is currently leading the Modernization Review for the Atlantic Region. Her focus is on improving service to Canadians through innovation and optimization of our business processes.

Quebec Region

The Quebec Region covers the province of Quebec. It is the only region in Canada where taxpayers must deal with two tax authorities.

Mark Quinlan, Regional Assistant Commissioner

Mark was appointed to the position of Regional Assistant Commissioner, Quebec Region, on May 18, 2020.

Mark was previously Vice-President of Operations at Canada Economic Development for Quebec Regions (CED-Q). Prior to his appointment at CED-Q, he held several executive positions in both the Quebec Region and the National Capital Region within the Government of Canada, including Regional Director General for the Quebec Region at Public Services and Procurement Canada (PSPC), Director General of Real Property and Service Integration for the CRA at PSPC, Executive Director for Strategic Reviews reporting to the Associate Deputy Minister of PSPC, as well as Senior Director, Internal Services within the Administrative Services Review Sector at the Privy Council Office.

Mark holds Bachelor degrees in Commerce (John Molson School of Business - Concordia University) and in Law (Université du Québec à Montréal), as well as a degree in notarial law (Université de Sherbrooke) and an Executive Certificate in Public Leadership (Harvard Kennedy School - Harvard University).

Ontario Region

The Ontario Region covers the province of Ontario.

Maria Mavroyannis, Regional Assistant Commissioner

Maria was appointed as Regional Assistant Commissioner of the Ontario Region in August 2018. Previously, she was Assistant Deputy Minister of Strategy Stewardship and Program Policy with the Ontario Ministry of Finance. Maria has extensive executive leadership experience gained from a diverse background in the public, private and not-for-profit sectors.

With a track record for delivery and a reputation for integrity combined with a commitment to accountability, Maria brings a long-term perspective to decision-making to ensure continuous organizational improvement, by attracting talent, and leading high-performance teams to deliver exceptional results. She is a respected leader appreciated for her collaborative approach.

Maria holds Bachelor degrees in Social Sciences and Arts in Economics and Psychology (University of Ottawa); a Juris Doctor (University of Ottawa Law School); a Master of Laws in Tax (Osgoode Hall Law School); and the Institute of Corporate Directors, Director (ICD.D) designation (Rotman School of Management).

Western Region

The Western Region covers the provinces of British Columbia, Alberta, Saskatchewan, and Manitoba, as well the Yukon, Nunavut and the Northwest Territories.

Sylvie Bérubé, Regional Assistant Commissioner

Sylvie Bérubé was appointed to the position of Assistant Commissioner of the Western Region on April 25, 2022.

Sylvie held various positions across the Federal Public Service prior to joining the Canada Revenue Agency (CRA). She served as the Assistant Deputy Minister of Employment and Social Development for the Western Canada and Territories Region, the Regional Director General for Public Services and Procurement Canada's Pacific Region, and the Associate Regional Director General for Fisheries and Oceans Canada's Pacific Region. Sylvie was also previously the Regional Director for the British Columbia/Yukon Region and Acting Director General of the Centre for Emergency Preparedness and Response at the Public Health Agency of Canada. Sylvie held the role of Executive Director of the Pacific Federal Council and continues to be a member of the Executive Committee. Sylvie is the Agency’s Official Languages champion and is passionate about promoting the inclusion of official languages at the CRA. She continues to be a strong supporter of the Agency’s Employment Equity, Diversity and Inclusion initiatives, including the national Black Employee Network (BEN), which builds on the significant grassroots contributions of the BEN in the Western Region.

Sylvie holds a Master of Business Administration from Simon Fraser University and a Bachelor of Arts with distinction in Sociology from Carleton University. She earned both degrees as an adult learner while working full-time.

Sylvie is an avid cyclist and enjoys exploring British Columbia's Lower Mainland and Vancouver Island by bike with her partner, Ben.

CRA budget and financial reports

Introduction

The Main Estimates present the spending plans for the coming fiscal year. They contain both statutory programs (included for information purposes) and appropriations which must be authorized annually by Parliament. The Main Estimates are tabled by March 1st. Supplementary Estimates are adjustments throughout the year (generally tabled in June, December, and March).

The process to seek funding for a new spending initiative included in the Main or Supplementary Estimates will generally include a Treasury Board submission, an official document submitted by the Minister seeking approval or authority from the Treasury Board for an initiative that the organization would otherwise not be able to undertake or that is outside its delegated authorities.

The Commissioner and Deputy Commissioner may be called on to defend the CRA's Main or Supplementary Estimates before the Standing Committee on Finance. The Minister may be invited and choose to attend.

As an Agency, the CRA benefits from a two-year spending authority, meaning that funds voted in one year can be spent over two fiscal years. This two-year spending authority enables the CRA to be more strategic in using public funds by taking a multi-year view of plans and budget.

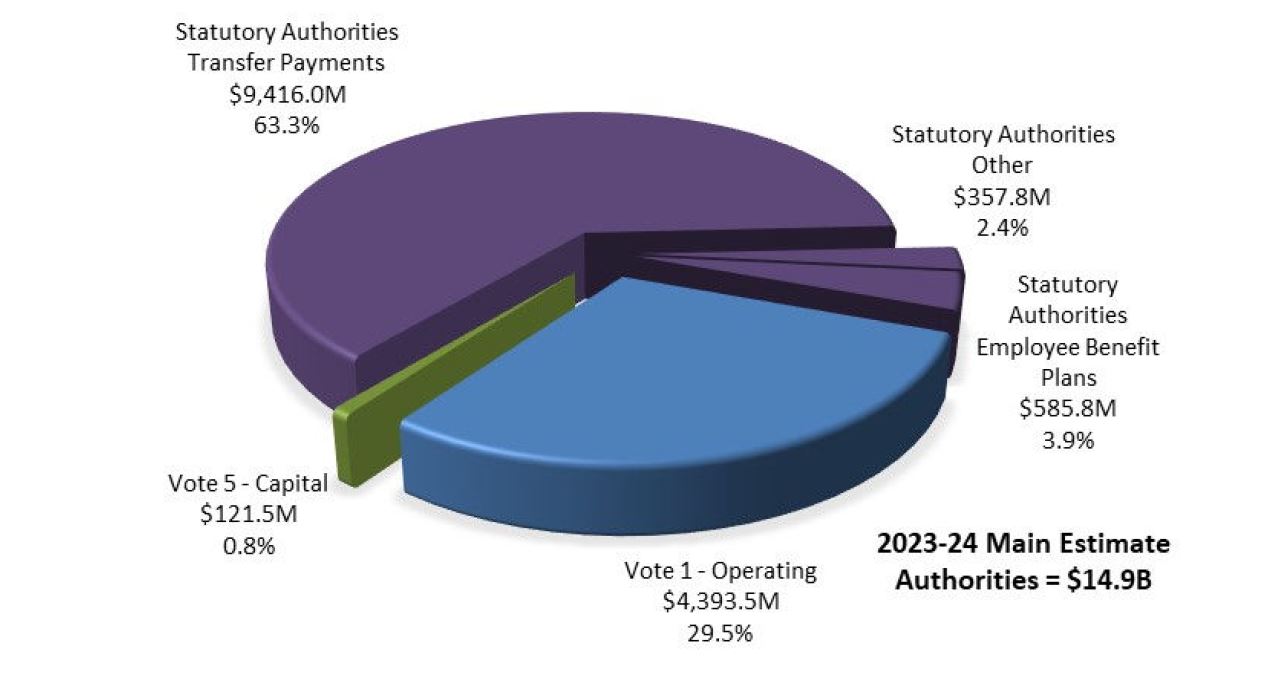

CRA’s 2023-24 Main Estimates

Text version

| Vote 1 - Operating | $4,393.5 million |

|---|---|

| Vote 5 - Capital | $121.5 million |

| Statutory Authorities Transfer Payments | $9,416.0 millionFootnote 2 |

| Statutory Authorities Other | $357.8 million |

| Statutory Authorities Employee Benefit Plans | $585.8 million |

| Total | $14,874.5 million |

Authorities

As well as its statutory authorities, the CRA has two annually voted appropriations (commonly referred to as "votes"):

Vote 1 – Operating covering the CRA's base operations, including salaries (79%) and operating expenditures such as accommodations, supplies, postage, training, travel, legal and IT services, etc.

Vote 5 – Capital covering the acquisition or creation of mainly IT assets expected to exceed $10,000.

In addition to the $14.9 billion, the 2023-24 Main Estimates include $440.6 million in revenues to cover costs associated with support the CRA provides to Employment and Social Development Canada (ESDC) in administering the Canada Pension Plan and Employment Insurance legislation.

The CRA's 2023-24 Main Estimates do not include incremental resources for announcements made by the Minister of Finance with respect to Budget 2023. If applicable, the funding required for the implementation and administration of these measures will be presented to Treasury Board Ministers through formal submissions during the year and once approved, will be included in the Supplementary Estimates.

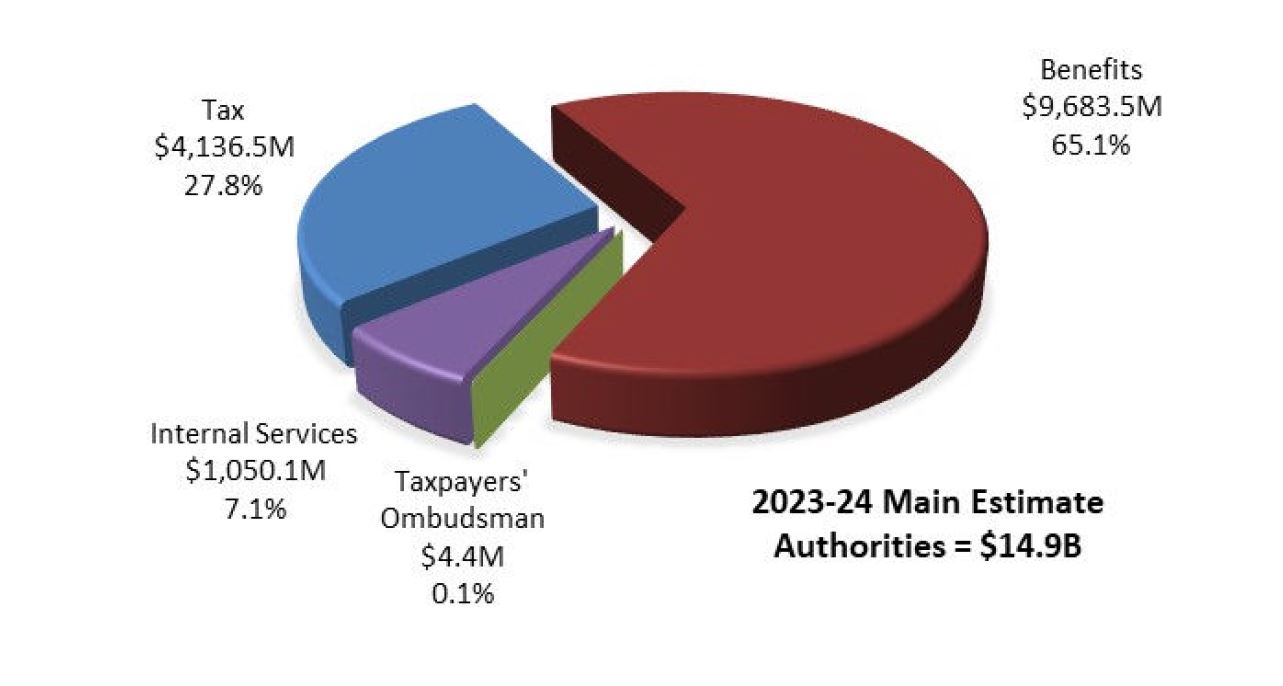

CRA’s Core responsibilities and programs

The CRA's budget supports the delivery of three core responsibilities – tax, benefits, and the Taxpayers' Ombudsperson. These in turn are supported by internal services (finance, human resources, information technology, real property, etc.).

Budgets are allocated to functional branches who in turn allocate the funding to programs across headquarters and in the regions based on negotiated work plans. The CRA has twenty-two externally reported programs, of which ten are under tax, one under benefits, one under the Taxpayers' Ombudsperson, and ten under internal services.

Text version

| Main Estimates by core responsibility | 2023-2024 Main Estimates by core responsibility | % of Total |

|---|---|---|

| Tax | $4,136.5 million | 27.8% |

| Benefits | $9,683.5 million | 65.1% |

| Taxpayers' Ombudsperson | $4.4 million | 0.1% |

| Internal Services | $1,050.1 million | 7.1% |

| Total | $14,874.5 million | 100.0% |

Internal reallocation mechanisms

The CRA has a rigorous financial management regime and system of controls over planning and budgeting. This includes a number of internal reallocation mechanisms to ensure that the disbursement of resources is done prudently and effectively, and is aligned with the strategic direction and priorities of the CRA and the government.

Most notably, this consists of two to three annual Resource Management Strategy updates to evaluate and prioritize in-year operational and emerging pressures against available financial flexibility; an Annual Resource Alignment Process to review, on a more structured basis, how long-term allocations are aligned with CRA and government priorities; and the annual preparation of the Strategic Investment Plan to facilitate the alignment between major investment decisions and priorities, on a ten-year planning horizon.

Financial reporting

Compared to most departments, the CRA has greater responsibilities from a financial reporting perspective.

The CRA is responsible for establishing and maintaining an effective system of internal control over financial reporting to enable the preparation of financial statements that are free from material misstatement, whether due to fraud or error. In this regard, the CRA establishes policies and procedures to ensure that financial information is prepared in accordance with Canadian public sector accounting standards.

The CRA's activities have been divided into two sets of financial statements as follows:

- CRA Activities - include those operational revenues and expenses which are managed by the CRA and utilized in running the organization. This type of statement is similar to those produced by most government departments.

- Administered Activities - include those revenues and expenses that are administered on behalf of the federal, provincial, and territorial governments, First Nations, and other organizations.

The Auditor General of Canada provides an audit opinion on these two sets of financial statements. The CRA financial statements are reviewed by the Agency Audit Committee and approved by the Board of Management. For fiscal year 2022-2023, the approval date is August 28, 2023.

The CRA's financial information is also reported to the Receiver General to be included in the Public Accounts of Canada which include the audited consolidated financial statements of the Government of Canada for the fiscal year, ending on March 31. The Public Accounts of Canada are typically tabled in October.

Planning and reporting

The Canada Revenue Agency (CRA) develops a number of planning and reporting documents. While some are required to meet statutory requirements, others are used internally to support strategic planning and reporting as well as communicating results to Canadians.

Corporate Business Plan

The Corporate Business Plan (CBP) is the primary planning document used by the CRA to communicate its strategic agenda over a three-year planning period.

- The Board of Management (Board) oversees the development of the CBP

- The Treasury Board of Canada (TB) approves the CBP through a TB submission, following internal approval by the Board and the Minister of National Revenue

- Following Treasury Board’s approval, the Minister of National Revenue is responsible for tabling the Summary of the CBP in Parliament within 15 sitting days of approving the Summary as legislated by the Canada Revenue Agency Act.

Currently the CBP focuses on the following four strategic priorities:

- Deliver seamless client experiences and tailored interactions that are digital first

- Combat aggressive tax planning and tax evasion

- Strengthen security and safeguard privacy

- Nurture a high-performing, diverse, and inclusive workforce in a modern, flexible, and accessible workplace

The CBP and the Summary of the CBP are nearly identical. Producing a Summary of the CBP is a requirement of the Canada Revenue Agency Act and differs from the CPB due to the exclusion of the Strategic Investment Plan (SIP).

The Summary of the Corporate Business Plan 2023-24 with perspectives to 2025-26 can be found on the CRA website.

Departmental Plan

In addition to the CBP, the CRA has a Departmental Plan requirement like other departments, but from an efficiency perspective has made them essentially the same.

The Minister of National Revenue is responsible for approving the DP before it can be submitted to the Treasury Board of Canada Secretariat (TBS) to be tabled in Parliament by the President of the Treasury Board on behalf of departmental Ministers.

Once tabled, on or before March 31, the DP is referred to Parliamentary committees, which may then report to the House of Commons.

The CRA’s 2022-23 Departmental Plan can be found on the CRA website.

Departmental Results Report

The CRA’s Departmental Results Report (DRR) is the primary reporting document used by the CRA to communicate its results to Parliament and Canadians. All federal departments and agencies are required to annually present a DRR to the President of the Treasury Board for tabling in Parliament.

The Minister of National Revenue is responsible for approving the DRR before it can be submitted to TBS to be tabled in Parliament by the President of the Treasury Board on behalf of departmental Ministers.

The DRR for the period ending March 31, 2022, can be found on the CRA website.