CRA account help - Representatives: Request authorization

You may be looking for:

After you have registered for Represent a Client (RAC), you must request and receive authorization to access a client's information.

Once you are authorized, you can access and manage information on behalf of individuals, including friends and family members, businesses, or trusts.

Get authorized to access a client's information

You can initiate the authorization process in the following ways:

Use your Represent a Client identifier

Your client, friend, or family member can authorize you with your RAC identifier.

Give your RAC identifier to your client

You received a representative identifier (RepID) when you registered with Represent a Client. You might also have registered a business number (BN) or created a group identifier (GroupID). You can give your RepID, BN, or GroupID to individuals, businesses, or trusts so they can authorize you.

Learn more:

Your client authorizes you

Your client, friend, or family member must access their CRA account and enter your RepID, BN or GroupID to add you as an authorized representative.

Once they have signed in and confirmed your authorization with the RAC identifier you gave them, you will have access to their information through Represent a Client.

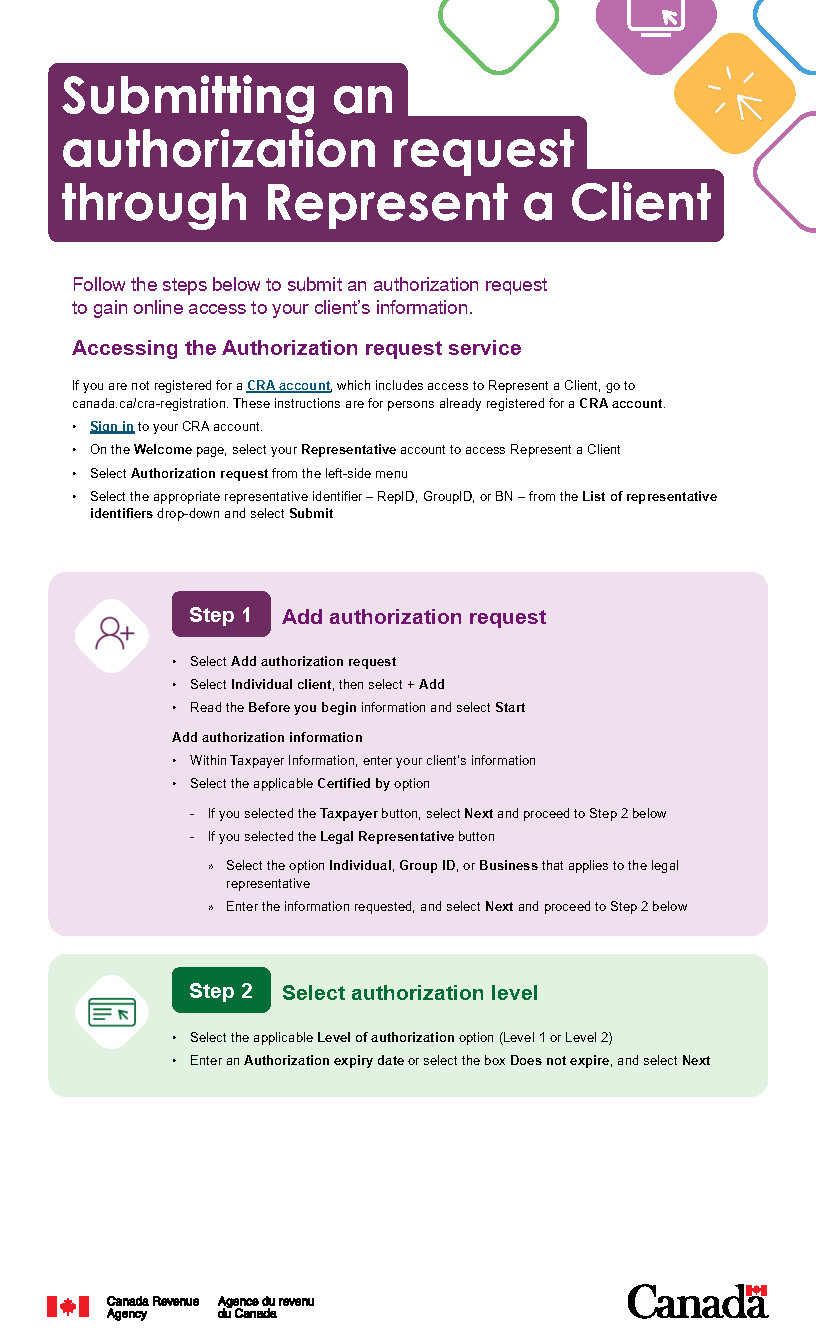

Request authorization through Represent a Client

If you have your client's information, you can initiate a request for authorization through Represent a Client.

Submit your request through Represent a Client

- Sign in to your CRA account

- Access your Representative account

- Select Authorization request

- Choose the appropriate RAC identifier (if prompted) and the type of client and select Submit

- Select Add authorization

- Provide some identifying information about your client

- For individual clients only, choose the confirmation method:

Your client will confirm in My Account

You will provide your client's tax information from a recent notice of assessment that was processed at least 6 months ago

- Add the level of authorization, expiry date, and (for businesses only) the program accounts you are requesting access to, then Confirm

- If required, submit a signature page

Wait for your authorization request to be activated

Your client may need to sign in to their CRA account and confirm your request within 10 business days. In some cases, the CRA will validate with a confirmation call.

If you chose to provide tax information for an individual client, there is no waiting period for confirmation of authorization.

If your client is a primary trustee, they must access My Trust Account through Represent a Client and confirm your request there.

Learn more: Confirm my representative's authorization request

Get authorized for offline access only

Your client can fill out Form AUT-01, Authorize a Representative for Offline Access. This form will give you access to their tax information over the phone, by mail, by fax, or in person. This form does not provide online access.

Send the form to the appropriate CRA tax centre listed on the form within 6 months of the date it is signed.

Authorization process for Represent a Client

Learn more about the process for becoming authorized to access someone else's information: Representative authorization