Calculate EI premiums deductions

You may be looking for:

How to use the EI premiums tables and how to manually calculate the amount to withhold.

On this page

Calculation methods

Reminder: There is an online calculator that will calculate the EI premiums deductions for you.

Calculate EI premiums deductions based on the type of payment:

- Regular payments (EI tables)

- Any payments (manual calculation)

- Verification – Year-end or multiple pay periods

Regular payments (EI tables)

EI premiums tables calculate the required EI premiums for you on given ranges of income for a specified pay period.

Steps

Determine if you can use EI premiums tables

EI premiums tables can be used in most situations.

Use when

- The payment is for regular employment income or for bonuses, commissions, retroactive pay or other types of payment for one of the common or uncommon pay periods for which tables are provided

Do not use when

- Your pay period does not have a table provided in the common or uncommon pay periods per year, use: Any payments (manual calculation)

- You are doing a year-end verification of your EI premiums, use: Verification – Year-end or multiple pay periods

- The employee already reached their maximum EI premiums for the year

Determine if your employee reached the maximum premiums

You must withhold EI premiums until your employee reaches the maximum without taking into account deductions made by another employer.

- Maximum annual employee EI premiums in their employment with you

- minus Employee's premiums to date for the year in their employment with you

- equals This amount is the maximum EI premiums that you can deduct from your employee's pay for the rest of the year

Calculation example

All of Joseph’s earnings were insurable for the year 2026. You have already deducted $300 in EI from his earnings with you this year.

- $1,123.07 is the maximum 2026 annual EI premiums

- minus $300 is the amount Joseph paid for the year to date (in his employment with you)

- equals $823.07 is the maximum EI premiums you can deduct

- Do not deduct EI premiums if they have reached the maximum.

- Continue to next step if they have not reached the maximum.

Get the EI premiums tables

2026 tax year

Use the EI premiums table that matches your employee's province of employment.

Outside Quebec: Option 1

Inside Quebec: Option 2

Previous years

Previous years

2025 tax year

2025 tax year

Use the EI premiums table that matches your employee's province of employment.

Outside Quebec: Option 1

Inside Quebec: Option 2

2024 tax year

2024 tax year

Use the EI premiums table that matches your employee's province of employment.

Outside Quebec: Option 1

Inside Quebec: Option 2

2023 tax year

2023 tax year

Use the EI premiums table that matches your employee's province of employment.

Outside Quebec: Option 1

Inside Quebec: Option 2

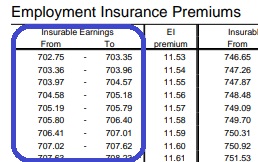

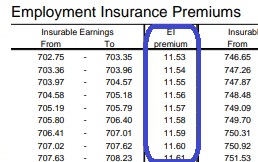

Determine the pay range

Find the range that includes your employee's insurable earnings (including any insurable taxable benefits) in the "Insurable Earnings" column

Get the amount of EI premiums to deduct

Find the amount under the "EI premium" column that corresponds with the range that includes your employee's pay for the pay period

Calculate the amount of EI premiums you have to withhold

Use one of the following amount that applies to your situation:

- If the amount in step 5 is less than step 2, withhold the amount from step 5.

- If the amount in step 5 is greater than step 2, withhold the amount from step 2.

Calculate the amount of EI premiums you have to remit

- EI premiums you have to withhold from your employee (step 6)

- multiply by 1.4 or your reduced EI rate

- equals This is your share of the EI premiums

- plus EI premiums you have to withhold (step 6)

- equals This is the total amount you have to remit: your employee's share and your share of the EI premiums

Calculation example

You have reviewed the EI premiums tables and found that the required EI premiums for Joseph’s earnings in this pay period is $300.00. You have also confirmed that this amount is not more than the remaining EI premiums that you can deduct for the rest of the year.

- $300 is Joseph's premiums

- multiply by 1.4 is your EI premium rate

- equals $420 is your share of the EI premiums

- plus $300.00 is Joseph's EI premiums you have to withhold (step 6)

- equals $720 is the total EI premiums you have to remit (Joseph's share and your share of the EI premiums)

Any payments (manual calculation)

You can use the manual calculation method to calculate the EI premiums that must be withheld for any payments made to your employees in a pay period without using the EI premiums tables.

Steps

Determine if your employee reached the maximum premiums

You must withhold EI premiums until your employee reaches the maximum without taking into account deductions made by another employer.

- Maximum annual employee EI premiums in their employment with you

- minus Employee's premiums to date for the year in their employment with you

- equals This amount is the maximum EI premiums that you can deduct from your employee's pay for the rest of the year

Calculation example

All of Joseph’s earnings were insurable for the year 2026. You have already deducted $300 in EI from his earnings with you this year.

- $1,123.07 is the maximum 2026 annual EI premiums

- minus $300 is the amount Joseph paid for the year to date (in his employment with you)

- equals $823.07 is the maximum EI premiums you can deduct

- Do not deduct EI premiums if they have reached the maximum.

- Continue to next step if they have not reached the maximum.

Calculate the total insurable income for the pay period

- Employee's gross pay for the pay period

- plus Employee's taxable benefits and allowances for the pay period

- minus Total earnings that do not require EI premiums

- equals This is the total insurable income for the pay period

Calculation example

Joseph receives a weekly salary of $500 and $50 in taxable benefits received in cash.

- $500 is Joseph's gross pay for the pay period

- plus $50 is Joseph's taxable benefits for the pay period

- minus $0 because all of Joseph's earnings require EI premiums

- equals $550 is Joseph's total insurable income for the pay period

Determine the amount of EI premiums to deduct for the pay period

- Total insurable income for the pay period (step 2)

- multiply by EI rate

- equals This amount is the EI premiums to deduct for the pay period

Calculation example

Joseph's total insurable income for the period is $550. Joseph's province of employment is Manitoba.

- $550 is Joseph's total insurable income for the pay period

- multiply by 1.63% is the 2026 EI premium rate

- equals $8.97 is the amount of EI premiums to deduct for the pay period

Calculate the amount of EI premiums you have to withhold

Use one of the following amount that applies to your situation:

- If the amount in step 3 is less than step 1, withhold the amount from step 3.

- If the amount in step 3 is greater than step 1, withhold the amount from step 1.

Calculate the amount of EI premiums you have to remit

- EI premiums you have to withhold from your employee (step 4)

- multiply by 1.4 or your reduced EI rate

- equals This is your share of the EI premiums

- plus EI premiums you have to withhold (step 4)

- equals This is the total amount you have to remit: your employee's share and your share of the EI premiums

Calculation example

You have calculated the required EI premiums for Joseph’s earnings in this pay period is $8.97. You have also confirmed that this amount is not more than the remaining EI premiums that you can deduct for the rest of the year.

- $8.97 is Joseph's EI premiums you have to withhold (step 4)

- multiply by 1.4 is your EI premium rate

- equals $12.56 is your share of the EI premiums

- plus $8.97 is Joseph's EI premiums you have to withhold (step 4)

- equals $21.53 is the total EI premiums you have to remit (Joseph's share and your share of the EI premiums)

Verification – Year-end or multiple pay periods

Use this calculation to verify an employee’s EI premiums at year-end or for multiple pay periods at any time of year. This verification is used to determine if you have deducted properly, under deducted or over deducted EI premiums.

Steps

Calculate the amount of insurable earnings for the period of employment

The following calculation must include only insurable earnings in their employment with you:

- Employee’s gross pay for the total period which will be included in box 14 of their T4 slip

- plus Employee’s taxable benefits and allowances for the total period which will be included in box 14 of their T4 slip

- minus Employee’s earnings from employment, benefits, and payments from which you do not deduct EI

- equals This amount is the insurable earnings for the period of employment

Calculation example

All of your employee Joseph’s earnings were insurable for the year of 2026. You are about to prepare his T4 and are reviewing your payroll records to confirm that you have deducted enough EI from his earnings this year.

- $35,000 is Joseph’s total salary, wages benefits, and allowances for the total period which will be included in box 14 of their T4 slip

- minus $1,000 is Joseph’s earnings from employment, benefits, and payments from which you do not deduct EI

- equals $34,000 is Joseph's insurable earnings for the period of employment

Confirm the amount of insurable earnings for the period of employment

Use one of the following amount that applies to your situation:

If the amount in step 1 is less than maximum annual insurable earnings , use the amount from step 1.

If the amount in step 1 is greater than maximum annual insurable earnings , use the maximum annual insurable earnings.

Determine the amount of required EI premiums for the period of employment

- Insurable earnings for the period of employment (step 2)

- multiply by EI rate

- equals This amount is the employee's required EI premiums for the period of employment

Calculation example

Joseph’s province of employment was Manitoba for the year of 2026.

- $34,000 is Joseph's insurable earnings for the year (step 2)

- multiply by 1.63% is the 2026 EI rate

- equals $554.20 is Joseph's required EI premiums for the period of employment

Determine if you have under or over remitted for the period of employment

- Employee's required EI premiums for the period of employment (step 3)

- minus EI premiums you deducted from the employee for the period of employment

- equals This amount should be $0 if you have deducted correctly

Calculation example

You confirmed in your payroll records that a total of $554.20 in EI was deducted from Joseph’s pay during the year of 2026.

- $554.20 is Joseph's required EI premiums for the year (step 3)

- minus $554.20 is the EI premiums you deducted from Joseph's pay for the year

- equals $0 is the amount, this means you have deducted correctly

- If the amount is positive you have under deducted for the year.

- If the amount is negative you have over deducted for the year.

To correct a deduction error:

- If you have not filed the information return, refer to: Make corrections before filing

- If you already filed the information return, refer to: Make corrections after filing

References

Multimedia

- Webinar – How to use the payroll deductions tables | 18 minutes

Legislation

- EIA: 66(1)

- Annual premium rate setting

- EIA: 66(2)

- Factors

- EIA: 67

- Employee's premium

- EIA: 68

- Employer's premium

- EIA: 69(1)

- Premium reduction – wage-loss plans

- EIA: 69(2)

- Provincial plans

- EIA: 82(1)

- Deduction and payment of premiums

- EIA: 82(2)

- Maximum deduction by a particular employer

- EIA: 82(4)

- Liability for failure to deduct

- IECPR: 2(1)

- Earnings from insurable employment

- IECPR: 2(3)

- Earnings from insurable employment

- IECPR: 3

- Calculation and payment of premiums