What to consider for newcomers

On this page

- Newcomers to Quebec

- Residency status for tax purposes

- International students

- Unsure of the residency status?

- Date of entry

- (Federal Maple leaf icon) Identification numbers

- Identification information

- Submitting income tax returns for newcomers

- Periods of residence

- Income

- (Federal Maple leaf icon) Net income while living with their spouse or common-law partner in Canada

- (Federal Maple leaf icon) Reporting foreign property over CAN$100,000

- Non-refundable tax credits

- (Federal Maple leaf icon) Refundable tax credits

- Benefits and credits

- Related topics

- Test your knowledge

Newcomers to Quebec

To be eligible for the Income Tax Assistance – Volunteer Program (ITAVP), newcomers need to be Quebec residents on December 31 of the year in question.

Residency status for tax purposes

There are different types of residency statuses for tax purposes. As a volunteer, you mainly work with individuals who are residents and newcomers.

Newcomers are individuals who left another country to come live in Canada. Newcomer status applies only for the first tax year in which they became a resident, even if they have only been in Canada for a few days. For example, an individual who arrived in Canada in 2023 is considered a newcomer for the 2023 tax year only and would not identify as a newcomer for the 2024 tax year or any year after that.

Residents are individuals who live and have enough residential ties with Canada. An individual is generally considered a resident for tax purposes from the day they arrive in Canada.

All newcomers, including refugees, may submit tax returns as residents of Canada, even if they have arrived at the end of the tax year and have not earned any income.

An individual’s residency status for tax purposes is important, as it determines whether or not they are required to submit a federal tax return and a Quebec income tax return. An individual’s residency status for tax purposes is different from their immigration status.

International students

Residency status for international students is more complex. They may not establish enough residential ties with Canada if they return to their home country on a periodic basis or for a significant amount of time in the calendar year; or leave for another country when not attending university in Canada. It is up to the student to determine their residency status for tax purposes.

An international student is considered a newcomer when they become a new resident of Canada for tax purposes for the very first time.

Newcomer status will not be applied if the international student:

- has been a resident of Canada for tax purposes for a full year

- has returned for another semester and re-established residential ties, regardless of how long their absence was as a non-resident, after having previously been established as a resident of Canada for tax purposes in a previous year

If a student would like to have more information, refer them to Taxes for International students studying in Canada.

Unsure of the residency status?

ITAVP tip

As an ITAVP volunteer, you are not responsible for determining a person's residency status or to advise them of their tax obligations.

If an individual is unsure of their residency status, refer them to:

CRA

- Individual tax enquiries line: 1-800-959-8281

- Website: Determining your residency status

Revenu Québec

- Information for individual lines:

- Quebec City area: 418-659-6299

- Montréal area: 514-864-6299

- Elsewhere: 1-800-267-6299 (toll-free)

- Website: Residence Status and Income Tax

Date of entry

The date of entry is the date when the individual became a resident of Canada for income tax purposes. This usually corresponds to the date the individual arrived in Canada.

It is important to enter the exact date of entry into the tax software, as this could affect the amounts of certain non-refundable tax credits that the individual may be eligible for.

(Federal Maple leaf icon) Identification numbers

Newcomers may have an identification number other than a social insurance number (SIN) or temporary social insurance number, such as an individual tax number (ITN) or a temporary tax number (TTN). These numbers allow individuals to submit their federal tax return and apply for benefits.

ITAVP tip

As a volunteer, you are not expected to help an individual apply for their identification numbers. However, you need to know the above-mentioned information when preparing a tax return.

If an individual wants more information about obtaining a SIN, refer them to Social Insurance Number - Overview on Canada.ca

Identification information

One of the most important steps when you use UFile CVITP to prepare tax returns is to complete the fields related to the Identification topic under the Interview tab.

For individuals with one name only, you may add the name into the last name (family name) field within the tax software and enter an asterisk (*) into the first name field. This prevents getting error messages.

Federal

Identity information such as names and date of birth must be an exact match to the identification information issued under the individual’s federal identification number to allow the federal tax return to be transmitted electronically using EFILE.

If you continue to receive error messages, it may be necessary to print the tax return and have the individual mail it to their applicable Tax Centre.

Provincial

All information identifying the individual, their spouse (or former spouse) and their dependants must be correct to ensure the individual receives an accurate notice of assessment.

Revenu Québec does not allow an income tax return to be filed electronically if the individual’s first or last name is missing.

Submitting tax returns for newcomers

Federal

The federal tax return can be transmitted by EFILE if the newcomer has a SIN, a temporary SIN or an ITN.

It may not be possible to electronically file the tax return if the individual has a TTN.

Provincial

It is generally not possible to use NetFile Québec to electronically file a newcomer's Quebec income tax return. The TP-1 must therefore be mailed.

If the tax returns cannot be electronically filed

If you cannot electronically file the tax returns, use the tax preparation software to prepare the paper tax returns.

If the individual does not have an identification number, a SIN or a temporary SIN

- enter zeros into the SIN field of the software and print the tax returns, or

- transcribe the information onto paper tax return forms and leave the SIN fields blank

Add a note to the tax returns explaining why the SIN is missing.

If the individual has a SIN or temporary SIN

- enter the SIN or temporary SIN into the SIN field of the software and print the tax returns, or

- transcribe the information onto the paper tax return forms

If the individual has an identification number other than a SIN or temporary SIN

- For the federal tax return:

- enter the identification number into the SIN field of the software and print the federal tax return, or

- transcribe the information onto the federal paper tax return forms

- For the Quebec income tax return:

- enter zeros into the SIN field of the software and print the Quebec income tax return, or

- transcribe the information onto the Quebec paper income tax return forms and leave the SIN field blank

Add a note to the tax return explaining why the SIN is missing.

For more information on how to print tax returns, refer to Printing the tax returns.

Give everything to the individual so that they can mail their tax returns to the CRA and Revenu Québec for processing. To ensure you provide the individual with the correct mailing addresses, refer to Where to mail your documents for the federal tax return and Filing your income tax return by mail for the Quebec income tax return.

Periods of residence

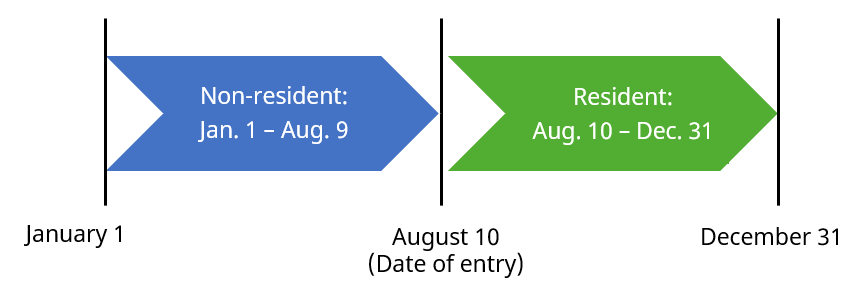

A newcomer’s first year in Canada is split into two periods:

- the non-resident period

- the resident period

In the following graphic, the date of entry is August 10. This means that the newcomer was:

- a non-resident of Canada for the period of January 1 to August 9

- a resident of Canada for the period of August 10 to December 31

Text version for the above image

Arrow indicating Non-resident: Jan 1 – Aug 9, followed by arrow indicating Resident: Aug 10 – Dec 31

Income

The income a newcomer earned before becoming a resident for tax purposes in Canada may be Canadian-sourced, or foreign-sourced.

Important note

The following examples are not considered simple tax situations and should not be completed by ITAVP volunteers:

- a newcomer has Canadian-source income for part of the year they were not a resident of Canada

- a newcomer continued to receive foreign income after becoming a resident of Canada

The foreign-sourced income earned before becoming a resident of Canada must be reported in the software. It is not taxable in Canada and UFile will not report it in the Total Income section of the tax returns. However, it will be used to calculate the amounts of certain non-refundable tax credits and benefits the newcomer may be eligible for.

Tax Tip

Remember to always convert all foreign income into Canadian dollars. The Bank of Canada has annual exchange rates available for most countries.

(Federal Maple leaf icon) Net income while living with their spouse or common-law partner in Canada

When an individual is already a resident of Canada for tax purposes and their spouse or common-law partner becomes a newcomer, the individual must:

- provide all their tax slips and income for the full year

- confirm their net income for the period when they lived with their spouse or common-law partner in Canada

You must prepare the resident’s tax return as usual with the added step of having to enter their net income from the period they lived with their spouse or common-law partner in Canada under the Immigrant, emigrant or non-resident section of the tax software.

Example

For example, Robert is a resident of Canada for tax purposes in 2023. His spouse, Jane, arrives in Canada as a newcomer on July 1, 2023. Robert provides his net income for the period between July 1, 2023 to December 31, 2023. This income is entered into Robert's profile under the Immigrant, emigrant or non-resident section of the tax software. UFile will report this income on Jane's tax return.

Generally, an individual and their spouse or common-law partner arrive in Canada on the same date. If this is the case, the tax software will automatically claim any credits the couple may be eligible for.

(Federal Maple leaf icon) Reporting foreign property over CAN$100,000

An individual does not have to report foreign property for the year they first become a resident of Canada.

Foreign property does not include any personal use property, such as a primary residence, vacation home or cottage.

Complex situation

If the individual owns foreign property worth over CAN$100,000 and was a resident of Canada in any previous year, you should not prepare the federal tax return.

Foreign property owned includes:

- bank accounts held abroad

- shares held in foreign corporations or shares held in a resident corporation but held outside of Canada

- vacant land abroad

- other income-earning foreign property

It is the individual's responsibility to convert the total cost amount of all foreign property into Canadian dollars. Refer the individual to the Bank of Canada since it has annual exchange rates available for most countries.

Non-refundable tax credits

If a newcomer earned foreign-sourced income prior to becoming a resident of Canada, the amounts they may claim for certain non-refundable tax credits will be proportional to the number of days in the year they were considered to be a resident of Canada.

If the newcomer did not earn any income prior to becoming a resident of Canada, they will be able to claim the full amounts of the non-refundable tax credits.

UFile tip

In UFile, the calculations are done automatically.

Non-Refundable tax credits that can be prorated in the tax returns

Federal

- 30000 Basic personal amount

- 30100 Age amount

- 30300 Spouse or common-law partner amount

- 30400 Amount for an eligible dependant

- 30425, 30450, 30500 Canada caregiver amounts

- 31800 Disability amount transferred from a dependant

- 32400 Tuition fees transferred from a child or grandchild

- 32600 Amounts transferred from spouse or common-law partner

Provincial

- 350 Basic personal amount

- 367 Amount for dependants and amount transferred by a child 18 or over enrolled in post-secondary studies

- 376 Amount for a severe and prolonged impairment in mental or physical functions

(Federal Maple leaf icon) Refundable tax credits

A newcomer cannot claim the Canada workers benefit (CWB) on line 45300 of the federal tax return because they were not resident of Canada throughout the year.

Benefits and credits

A newcomer may be eligible for the following benefits and credits:

Federal

- Goods and services tax/harmonized sales tax (GST/HST) credit

- Canada child benefit (CCB)

Provincial

- Solidarity tax credit

- Family Allowance

Tax tip

Since these amounts are non-taxable, no tax slips are issued for them.

Related topics

- Access UFile's instructions

- Social Insurance Number - Overview – Service Canada

- Determining your residency status – Canada.ca

- Benefits, credits, and taxes for newcomers – Canada.ca

- Annual exchange rates – Bank of Canada

Test your knowledge

Question 1

That's correct

Even if the income for the period of non-residency is non-taxable in Canada, newcomers must report their income because the software needs it in order to determine whether they are eligible for the total of the non-refundable tax credit amounts.

Sorry, that's incorrect

Even if the income for the period of non-residency is non-taxable in Canada, newcomers must report their income because the software needs it in order to determine whether they are eligible for the total of the non-refundable tax credit amounts.

Question 2

Sorry, that's incorrect

The newcomer status applies only for the first tax year the individual is a new resident in Canada. Afterwards, the individual will have been a resident for tax purposes for the entire year.

That's correct

The newcomer status applies only for the first tax year the individual is a new resident in Canada. Afterwards, the individual will have been a resident for tax purposes for the entire year.