2021–22 Departmental Results Report - Treasury Board of Canada Secretariat

On this page

President of the Treasury Board’s message

President of the Treasury Board

I am pleased to present the Departmental Results Report for the Treasury Board of Canada Secretariat (TBS) for 2021–2022. During the last fiscal year, TBS employees showed great resilience in meeting the challenges of a shifting workplace, while supporting the government’s response to the pandemic and modernizing the public service for the future.

As part of the government’s response to the pandemic, we provided advice and guidance to departments to support the implementation of measures and tracked the fiscal impact of its actions. In addition, we helped protect the safety of our workplaces, our communities and all Canadians by supporting the implementation of the Policy on COVID-19 Vaccination for the Core Public Administration Including the Royal Canadian Mounted Police.

TBS also continued to lead the government’s digitalization efforts by supporting and overseeing key digital transformation projects. These included strengthening cyber security assessment tools, advancing inclusive and accessible digital services and expanding services like GC Notify, which sent more than 23 million messages to Canadians on topics such as COVID-19 and Recalls and Safety Alerts.

In the continuing fight against climate change, our Centre for Greening Government introduced the Low‑Carbon Fuel Procurement Program and helped advance work toward the goal of using 100% clean electricity, where available, by 2022.

Building a modern public service is another TBS priority. To strengthen diversity, for example, we supported key legislative reviews and updates, such as those to the Public Service Employment Act. Wealsoimproved diversity and inclusion self-assessment tools for departments andimplemented programs to increase representation in the senior leadership ranks.

To further build a productive and effective workforce, we provided ongoing guidance to departments on remote work, facilitated public servants’ safe return to worksites and bargained in good faith to reach collective agreements with unions.

In our ongoing regulatory reform efforts, we continued to improve transparency, reduce administrative burden, harmonize regulations that maintain high safety standards and improve the competitiveness of Canadian businesses. This included proposing 46 amendments to 29 acts needed to keep Canada’s regulatory system relevant and up to date.

I would like to thank all our employees who stepped up throughout a challenging year to deliver these and other results. I invite you to read the full report to learn more about how we continue to serve Canadians.

Original signed by:

The Honourable Mona Fortier, P.C., M.P.

President of the Treasury Board

Results at a glance

-

In this section

Treasury Board of Canada Secretariat role

The Treasury Board of Canada Secretariat (TBS) provides advice and makes recommendations to the Treasury Board committee of ministers on how the government spends money, how it regulates, and how it is managed.

Highlights

In 2021–22, TBS provided oversight and leadership in relation to its four core responsibilities to help federal government departments and agencies (departments) deliver results to Canadians during the COVID‑19 pandemic.

| Core responsibility | Highlights |

|---|---|

| Spending oversight TBS oversees the federal government’s spending of taxpayers’ money by reviewing government programs, spending proposals, and spending authorities, and by reporting on it to Parliament and Canadians. |

|

| Administrative leadership TBS leads government-wide initiatives, develops policies, and sets the strategic direction for federal government administration in areas such as digital government, access to information, and the management of assets and finances. |

|

| Employer TBS develops policies and sets the strategic direction for people and workplace management in the federal public service, manages total compensation in the core public administration, and represents the government in labour relations matters. |

|

| Regulatory oversight TBS develops and oversees policies to promote sound regulatory practices within the federal government and encourage regulatory cooperation across jurisdictions, including reviews of proposed and existing regulations to improve transparency, reduce administrative burden, and ensure harmonization. |

|

Results

In 2021–22, TBS aimed to achieve 11 results that were measured using 29 performance indicators:

- Targets met or on track to meet: 22 (76%), including those related to greening government and fostering inclusive workplaces

- Targets not met: 3 (10%) related to timeliness in responding to access to information and privacy requests, as well as the ranking of Canada’s regulatory system

- Targets with data not available: 4 (14%) related to employment equity that will be included in the next TBS Employment Equity Annual Report

| Core responsibility | Targets | Met | On track to meettable 1 note * | Not met | No data |

|---|---|---|---|---|---|

Table 1 Notes

|

|||||

| Spending oversight | 2 | 2 | 0 | 0 | 0 |

| Administrative leadership | 12 | 1 | 9 | 2 | 0 |

| Employer | 10 | 6 | 0 | 0 | 4 |

| Regulatory oversight | 5 | 4 | 0 | 1 | 0 |

| Total | 29 | 13 (45%) | 9 (31%) | 3 (10%) | 4 (14%) |

In 2021–22, total actual spending for TBS was $11,067,930,305, and total actual full-time equivalents was 2,369.

For more detailed information on the Treasury Board of Canada Secretariat’s plans, priorities, and results achieved, see the “Results: what we achieved” section of this report.

Results: what we achieved

The results section outlines:

- TBS’s core responsibilities and a description of each one

- the actions taken to achieve its planned results for each and its success in delivering on them

- the financial and human resources allocated to each core responsibility

Spending oversight

Description

- Review spending proposals and authorities

- Review existing and proposed government programs for efficiency, effectiveness and relevance

- Provide information to Parliament and Canadians on government spending

Results

1. Supporting decision‑making by the Treasury Board

In 2021–22, TBS supported decision‑making during the Treasury Board submission process by working with departments as they prepared requests for funding and implementation plans for new programs.

Central to this work was TBS’s continued critical leadership role in the federal response to the COVID‑19 pandemic, which included:

- helping departments draft proposals to make sure spending aligned with government priorities under the COVID‑19 economic response plan and supported the efficient implementation of measures

- working with the Department of Finance Canada to track the fiscal impact of the government’s pandemic response and to use the data to inform decisions on spending

In addition, TBS took action to develop capacity and expertise in support of effective decision‑making by:

- working with departments on how to source, manage and use data to improve costing

- supporting the training and development of the government’s costing community

2. Setting the strategic direction for measuring, evaluating, and reporting on spending and performance

In 2021–22, the Government of Canada worked to improve the openness, effectiveness and transparency of government, including strengthening the clarity and consistency of financial and performance reporting.

To support these efforts, TBS:

- streamlined the guidance on Departmental Results Reports to make them more useful and readable

- assessed the quality of departments’ program outcome statements and performance indicators to improve results monitoring and reporting

- published reconciliations in the Main Estimates and Supplementary Estimates

- provided additional guidance to departments on measuring their performance and results in relation to government spending, as part of the Treasury Board submission review process

- improved GC InfoBase to make it easier for Canadians to find, analyze and compare results across departments, for example:

- added graphics and options for viewing data

- updated the area that shows the summary of the total COVID‑19 authorities

- added a new section on government services

Results achieved

TBS exceeded both of its spending oversight targets.

Although it exceeded the target for the percentage of Treasury Board submissions for complex projects or programs that transparently disclose financial risk and did so two years before the target date, the result fell slightly from 2020–21. TBS will continue to work in this area to ensure continued improvement.

For the percentage of government programs that have suitable measures for tracking performance and informing decision‑making, TBS improved on its previous results. TBS will continue to support departments in sustaining these improvements and making further progress in areas such as gender‑based analysis plus.

The following table shows, for spending oversight, the results achieved, the performance indicators, the targets, and the target dates for 2021–22, and the actual results for three most recent fiscal years for which actual results are available.

| Departmental results | Performance indicators | Target | Date to achieve target | 2019–20 actual results | 2020–21 actual results | 2021–22 actual results |

|---|---|---|---|---|---|---|

| Treasury Board proposals contain information that helps Cabinet ministers make decisions | Percentage of Treasury Board submissions for complex projects or programs that transparently disclose financial risk | At least 75% | March 31, 2023 | 54% | 77% | 76% |

| Government organizations measure, evaluate and report on their performance | Percentage of government programs that have suitable measures for tracking performance and informing decision-making | At least 70% | March 31, 2022 | 67% | 64% | 89% |

Financial, human resources and performance information for Treasury Board of Canada Secretariat’s Program Inventory is available in GC InfoBase.

Budgetary financial resources (dollars)

The following table shows, for spending oversight, budgetary spending and actual spending for 2021–22, as well as actual spending for that year.

| 2021–22 Main Estimates | 2021–22 planned spending | 2021–22 total authorities available for use | 2021–22 actual spending (authorities used) | 2021–22 difference (actual spending minus planned spending) |

|---|---|---|---|---|

| 3,703,065,027 | 3,703,065,027 | 1,681,106,230 | 40,194,758 | −3,662,870,269 |

Financial, human resources and performance information for Treasury Board of Canada Secretariat’s Program Inventory is available in GC InfoBase.

Human resources (full‑time equivalents)

The following table shows, in full‑time equivalents, the human resources the department needed to fulfill this core responsibility for 2021–22.

| 2021–22 planned full‑time equivalents | 2021–22 actual full‑time equivalents | 2021–22 difference (actual full‑time equivalents minus planned full‑time equivalents) |

|---|---|---|

| 303 | 284 | −19 |

Financial, human resources and performance information for Treasury Board of Canada Secretariat’s Program Inventory is available in GC InfoBase.

Administrative leadership

Description

- Lead government‑wide initiatives

- Develop policies and set the strategic direction for government administration related to:

- service delivery

- access to government information

- the management of assets, finances, information and technology

Results

1. Leading digital government transformation

TBS leads the efforts to advance digital government and improve people’s interactions with government.

In 2021–22, TBS worked with departments in several areas to lead the Government of Canada’s digital transformation. This included:

- enhancing Sign‑In Canada to support multi‑factor authentication and developing modules to facilitate migration to the platform (Sign‑In Canada enables individuals and businesses to log in once to access multiple Government of Canada online services.)

- working with 33 departments on 45 information technology (IT)‑related modernization initiatives

- helping departments modernize their applications and adopt cloud technology to reduce technical debt in IT and improve digital services, including modernizing 694 applications and migrating 244 applications to the cloud by the end of 2021–22

- publishing new standards on at‑risk IT that require departments to manage aging technology assets and replace technology no longer supported by its provider

- working on requirements for departments to meet internationally adopted accessibility standards for buying or developing information and communication technology systems

TBS took steps to improve the government’s digital services by optimizing content, enhancing tools, and developing new offerings. This work included:

- helping optimize interdepartmental web content related to key government priorities, such as the COVID‑19 response, changing travel requirements, and support for Ukraine

- providing advice and guidance to departments to make their web sites more user‑friendly, based on real-time user feedback and exit surveys

- helping design inclusive and accessible digital services for all Canadians, including Indigenous peoples, low-income Canadians, and people with disabilities

- working through the Canadian Digital Service to:

- grow GC Notify, a digital platform that allows government departments to send email or text messages automatically, to support 181 services with more than more than 23 million messages in 2021–22, including about 15 million notifications to Canadians and other stakeholders related to the COVID‑19 pandemic

- build a toolkit to promote the application of the Government of Canada Digital Standards and help public servants and departments design digital services that meet Canadians’ needs

TBS also strengthened cybersecurity in the Government of Canada including by:

- deploying a Cyber‑Maturity Self‑Assessment tool for departments to get a better understanding of the resources in place across the Government of Canada to protect against cyberattacks

- assessing the effectiveness of the Government of Canada Cyber Security Event Management Plan at improving the government’s response to potential cyberthreats, vulnerabilities and incidents

- publishing a new Standard on Enterprise Information Technology Service Common Configurations, which identifies the minimum configuration requirements for the delivery of secure digital services

In 2021–22, TBS improved the stewardship of the data and information the federal government collects, generates and holds by:

- preparing a new Standard on Systems that Manage Information and Data that enables departments to strengthen their management practices and processes

- advancing the regular review of the Directive on Automated Decision‑Making to help departments be more transparent, accountable and fair when they use artificial intelligence to improve service delivery

TBS made more information and data available to Canadians by increasing Open Government Portal holdings to roughly 33,000 datasets and records and 1.8‑million publications from about 160 federal institutions and continued to consult with departments on expanding access further.

TBS also improved the Open Government Portal by optimizing key pages and adding new features based on user feedback and by developing guidelines to facilitate the release of further datasets, records and publications.

In addition, TBS looked for other ways to make data and information more open and accessible to Canadians including by:

- continuing to examine the systems and processes, the legislative framework, and the proactive publication process of the access to information regime, including consulting with external stakeholders

- incorporating secure accounts into the Access to Information and Privacy Online Request Service so that response packages can be sent electronically

- adding ambitious new commitments to Canada’s 5th National Action Plan on Open Government

Access to Information Act review: What We Heard interim report

When the Access to Information Act was updated in 2019, a new requirement was introduced to review the act every five years to ensure it reflects and responds to changing realities.

In 2021–22, as part of the initial review, TBS consulted with stakeholders, including members of the public, provincial and territorial governments, other federal institutions, and Indigenous peoples.

The What We Heard interim report summarizes the key themes, opinions, issues and ideas it heard during the consultation process, including that the federal government should:

- expand the right of access to information to include non-Canadians outside Canada

- increase the amount of information released by making more institutions subject to the act

- examine and reduce the exemptions and exclusions under the act

- reduce processing delays

- expand proactive disclosure requirements to capture more information

- give the Information Commissioner oversight over proactive publication requirements

- improve the access to information system’s capacity by investing in human resources and technology

After analyzing the input, examining best practices in other jurisdictions, and continuing to listen to feedback from stakeholders, a final report on the review will be tabled in Parliament by the President of the Treasury Board.

2. Setting the strategic direction for the management of assets and finances

The Government of Canada is committed to the sound stewardship of government assets and finances.

In support of this commitment, TBS sets the strategic direction for:

- asset management

- financial management

A. Asset management

In 2021–22, TBS supported the management of procurement, real property, and materiel, as well as the planning and management of investments, by:

- acting on recommendations from the Horizontal Fixed Asset Review

- developing new directives, governance structures, and supporting guidance, which included new requirements for life-cycle planning, collaboration, market engagement, risk management, and obtaining best value

- consulting with key stakeholders and departments to strengthen procurement policies, including adding mandatory contracting procedures for departments to help achieve the government’s target of awarding 5% of the total value of federal contracts to Indigenous‑led and ‑managed businesses

- working with the Canada School of Public Service on implementing mandatory foundational training in project management, as well as on developing and piloting a new project management training course for senior leaders

- defining an authority model in the Directive on the Management of Projects and Programmes to help departments carry out large business transformation initiatives

- engaging in targeted recruitment efforts to hire more procurement officers throughout the Government of Canada

B. Financial management

To improve the government’s financial management practices in 2021–22, TBS took steps as part of a major migration effort to align financial systems across departments. For example, it:

- began developing a directive that defines the requirements and accountabilities for managing departmental financial management systems and for reviewing departments’ planned investments and activities to make sure they meet standard requirements and contribute to the government’s overall financial management capabilities

- supported the professional development of the financial community, including by facilitating knowledge transfer from experts in numerous aspects of financial management

TBS also supports departments in establishing and maintaining internal controls over financial management by holding working group meetings with the community at least twice a year. At these meetings, departments share best practices and learn from subject‑matter experts, who make presentations on topics related to internal controls, such as a shared‑service model and project management.

Finally, TBS updated the Policy on Transfer Payments to reduce duplication and administrative burden and to ensure its continued relevance.

3. Leading the greening of government operations

In 2021–22, TBS contributed to the Government of Canada’s commitment to fighting climate change and to reducing its greenhouse gas emissions by leading and supporting departments in implementing the Greening Government Strategy.

For example, it worked with departments to make sure new builds and major retrofit projects minimize greenhouse gas emissions over their full life cycles. This work included:

- reviewing Treasury Board submissions and investment plans to make sure they align with greening objectives

- updating guidance to help departments get the best value from investments and, at the same time, maximize greenhouse gas reductions

- issuing guidance for departments on assessing and improving the resilience of their buildings

To make it easier for departments to adopt low‑carbon forms of transportation, TBS:

- worked with the Department of National Defence, the Royal Canadian Mounted Police and the Canadian Coast Guard to develop plans for reducing emissions from national safety and security fleets with a view to becoming net‑zero by 2050; the plans are to be in place by the end of 2023–24

- established and started implementing the Low‑carbon Fuel Procurement Program to support the purchase of drop‑in low‑carbon‑intensity liquid fuels for the federal air and marine fleets

TBS continued to help the government achieve its goal of using 100% clean electricity, where available, by 2022. For example, it worked with Public Services and Procurement Canada on obtaining renewable power in places where electricity production creates higher levels of carbon.

TBS will continue to work in this area to help the government reach its goal of producing or purchasing only renewable power by 2025.

To promote transparency and accountability in relation to greening government, TBS:

- made departmental reporting on waste diversion and water use mandatory as of 2022–23

- continued to collect and publish detailed information on greenhouse gas emissions from departments

- introduced mandatory reporting for departments on actions they have taken to make their assets, services and operations more resilient to the impacts of climate change

Canada-U.S. Greening Government Initiative

In 2021, Canada and the United States announced the Greening Government Initiative, which seeks to engage governments around the world in greening government operations.

As a first step, TBS worked with the White House Council on Environmental Quality to create a forum for countries to:

- share lessons learned

- promote innovation

- explore opportunities for international cooperation

Canada participated in four Greening Government Initiative events in 2021–22. More than 100 people from about 40 countries attended each one. The events included presentations on various aspects of greening government by countries such as Germany, Finland, Malawi and Japan.

Results achieved

As of the end of 2021–22, TBS had met or was on track to meet 10 of 12 targets for administrative leadership. The unmet targets relate to response times for access to information and personal information requests.

In 2021–22, 56% of institutions (81 out of 145) responding to access to information requests met the 90% target to do so within legislated timelines, while 69% of institutions (76 out of 119) responding to personal information requests met the 85% target to do so within legislated timelines.

Institutions pointed to restrictions stemming from the COVID-19 pandemic and workload pressures as the main reasons for not meeting the timelines. TBS continued to work with the institutions that did not meet the targets to help determine how to improve their performance.

Measures included:

- establishing and implementing the framework for the Access to Information and Privacy Community Development Office

- beginning a collective external recruitment process

- co-hosting an event with the Canada School of Public Service on innovative digital tools to help facilitate the processing of both access to information and personal information requests

TBS plans to complete the review of the Access to Information Act and table a report on it in 2022–23. It will also improve the Access to Information and Privacy Online Request Service and procure modern request‑processing software to help institutions receive and process requests. These improvements are expected to help departments respond to requests faster.

In 2021–22, TBS also made more government information available for Canadians by releasing 1,991 datasets to the public.

The following table shows, for administrative leadership, the results achieved, the performance indicators, the targets, and the target dates for 2021–22, and the actual results for the three most recent fiscal years for which actual results are available.

| Departmental results | Performance indicators | Target | Date to achieve target | 2019–20 actual results | 2020–21 actual results | 2021–22 actual results |

|---|---|---|---|---|---|---|

Table 4 Notes

|

||||||

| Government service delivery is digitally enabled and meets the needs of Canadians | Degree to which clients are satisfied with the delivery of Government of Canada services, expressed as a score out of 100 | At least 60 | March 2023 | 58table 4 note * | 63 | 63table 4 note † |

| Percentage of high‑volume Government of Canada services that meet service standardstable 4 note ‡ | At least 80% | March 2024 | Not available | Not available | 46%table 4 note § | |

| Percentage of high‑volume Government of Canada services that are fully available onlinetable 4 note ‡ | At least 80% | March 2025 | Not available | Not available | 56%table 4 note § | |

| Usage of high‑volume Government of Canada online services, as a percentage of all service delivery channels, including in‑person and telephonetable 4 note ‡ | At least 75% | March 2024 | Not available | Not available | 80% | |

| Percentage of Government of Canada websites that provide digital services to citizens securely | 100% | March 2024 | 57% | 69% | 75% | |

| Degree to which clients complete tasks on Government of Canada websites | At least 70%table 4 note ‖ | March 31, 2023 | Not available: new indicator | Not available: new indicator | 64.5% | |

| Canadians have timely access to government information | Number of datasets available to the public | At least 1,000 new datasets | March 31, 2022 | 1,258 new datasets published | 1,613 new datasets published | 1,991 new datasets published |

| Percentage of access to information requests responded to within legislated timelines | At least 90% | March 31, 2022 | 67% | 70% | 42% | |

| Percentage of personal information requests responded to within legislated timelines | At least 85% | March 31, 2022 | 79% | 63% | 62% | |

| Government has good asset and financial management practices | Percentage of key financial management processes for which a system of internal controls has been established and that have reached the continuous monitoring stage | 100% | March 31, 2024 | Not available | 39% | 46% |

| Percentage of departments that maintain and manage their assets over their life cycletable 4 note # | At least 60% | March 2023 | 73% | 53% | 72% | |

| Government demonstrates leadership in making its operations net‑zero carbon | The level of overall government greenhouse gas (GHG) emissions | Reduce GHG emissions from real property and fleet operations by 40% below 2005 levels | March 31, 2026 | 34.6% below 2005 levels | 40.6% below 2005 levels | 38.4% below 2005 levelstable 4 note ** |

Financial, human resources and performance information for Treasury Board of Canada Secretariat’s Program Inventory is available in GC InfoBase.

Budgetary financial resources (dollars)

The following table shows, for administrative leadership, budgetary spending for 2021–22, as well as actual spending for that year.

| 2021–22 Main Estimates | 2021–22 planned spending | 2021–22 total authorities available for use | 2021–22 actual spending (authorities used) | 2021–22 difference (actual spending minus planned spending) |

|---|---|---|---|---|

| 104,430,352 | 104,430,352 | 118,202,002 | 111,850,599 | 7,420,247 |

Financial, human resources and performance information for Treasury Board of Canada Secretariat’s Program Inventory is available in GC InfoBase.

Human resources (full‑time equivalents)

The following table shows, in fulltime equivalents, the human resources the department needed to fulfill this core responsibility for 2021–22.

| 2021–22 planned full‑time equivalents | 2021–22 actual full‑time equivalents | 2021–22 difference (actual full‑time equivalents minus planned full‑time equivalents) |

|---|---|---|

| 608 | 754 | 146 |

Financial, human resources and performance information for Treasury Board of Canada Secretariat’s Program Inventory is available in GC InfoBase.

Employer

Description

- Develop policies and set the strategic direction for people management in the public service

- Manage total compensation (including pensions and benefits) and labour relations

- Undertake initiatives to improve performance in support of recruitment and retention

Results

1. Setting the direction to enable the public service to recruit and retain a skilled and diverse workforce; promoting official languages; and fostering a healthy, safe, accessible and inclusive work environment

In 2021–22, TBS worked with key stakeholders, including the Privy Council Office, the Public Service Commission of Canada, and the Canada School of Public Service to support the Treasury Board as the employer of the core public administration and to foster a representative and effective public service in a modern work environment.

To empower employees to contribute fully and to excel, the Government of Canada committed to building a modern public service work environment in three main areas:

- increasing diversity

- promoting official languages

- fostering a healthy and accessible workplace

A. Increase diversity in the core public service and the senior ranks, specifically in the four groups designated under the Employment Equity Act

In 2021–22, TBS’s efforts to increase representation from the designated groups (women, members of visible minorities, persons with disabilities, and Indigenous people) and to remove barriers to effective inclusion included:

- leading the implementation of the recently passed Pay Equity Act in the core public administration and in the RCMP

- supporting the amendment of the Public Service Employment Act to address systemic barriers to equity-seeking groups in public service staffing

- supporting Employment and Social Development Canada in the review of the Employment Equity Act

- co-developing the Maturity Model on Diversity and Inclusion self-assessment tool with equity‑seeking groups to help departments:

- identify their level of maturity related to diversity and inclusion across five dimensions

- determine the tangible actions they can take to improve their level of maturity

- monitor their progress

- supporting the Federal Speakers’ Forum on Diversity and Inclusion

- providing guidance and tools to departments, including an Indigenous recruitment toolbox

In 2021–22, TBS also supported departments in increasing diversity in the senior leadership of the public service by implementing:

- the Mosaic Leadership Development Program, which develops and supports potential leaders in under-represented groups; the program attracted 39 participants from 38 departments in 2021–22

- the Mentorship Plus Program, which pairs employees from equity‑seeking groups with executive mentors and sponsors to support their career development and advancement; as of March 31, 2022, 48 departments committed to implementing this program

- changes to the Executive Leadership Development Program to target candidates who self-identify as Indigenous people, visible minorities, or persons with disabilities; participation by people from these groups increased from 52% in 2020–21 to 61% in 2021–22

In addition, TBS launched a strategy to reinforce equity, diversity and inclusion in the leadership culture and to foster high‑performing, accountable, people‑first, results‑driven senior leaders. It also developed strategies with Black and Indigenous executives to reduce barriers and increase representation of people from racialized groups in the senior ranks at TBS through succession planning and leadership development.

Strengthening fairness and encouraging inclusion in staffing processes

Working with employee networks and bargaining agents, TBS supported the government in amending the Public Service Employment Act so that departments can take action to reduce barriers in the staffing process, promote more inclusive recruitment practices, and reaffirm the importance of a diverse and inclusive workforce.

The amendments received royal assent in July 2021 and introduced the following requirements:

- all new or revised qualification standards must be evaluated for bias and barriers for members of equity-seeking groups

- permanent residents must be given the same preference as Canadian citizens in appointments made through externally advertised hiring processes

- the design and application of assessment methods must include an evaluation of bias and barriers, and reasonable efforts for mitigation

In addition, the amendments give the Public Service Commission authority to audit for bias and barriers that disadvantage members of equity-seeking groups. They also give the commission and deputy heads authority to investigate bias and barriers for members of equity‑seeking groups.

B. Promoting official languages

In 2021–22, TBS took steps to strengthen bilingualism in the public service by:

- proposing the development of a new framework for second language training tailored to the diverse needs of learners

- working with the Public Service Commission to look at how to align the official languages standards in the public service with those in the education sector to help recruit bilingual young Canadians

TBS also promoted official languages by:

- monitoring federal institutions’ compliance with the Official Languages Act

- analyzing and sharing the results of the 2020 Public Service Employee Survey to help departments respond to employee feedback on official languages

- developing guidance on language of work rights when teleworking to help federal institutions meet their official languages obligations as employees worked remotely during the COVID-19 pandemic

C. Foster physically and psychologically healthy, safe, respectful, fair and accessible workplaces

In 2021–22, TBS helped support a physically healthy workplace by developing the Policy on COVID‑19 Vaccination for the Core Public Administration Including the Royal Canadian Mounted Police and guiding its implementation The policy took effect on October 2, 2021, and was suspended on June 20, 2022.

TBS also supported departments as they adapted workplaces and working conditions to respond to the specific circumstances of the COVID‑19 pandemic. This work included:

- updating the Guidebook for Departments on Easing of Restrictions to reflect changing guidance from public health authorities and policy centres

- developing tools to support gradual increases in occupancy at federal worksites as public servants return to in‑person work

TBS also strengthened the government’s preparedness for and capacity to respond to potential threats by creating a federal action plan on bilingual emergency and crisis communications and facilitating the exchange of emergency best practices among departments.

To help foster a psychologically healthy workplace, TBS launched the Federal Public Service Workplace Mental Health Dashboard, a tool departments can use to measure psychological health strengths and gaps as they implement the Federal Public Service Workplace Mental Health Strategy and the National Standard on Psychological Health and Safety in the Workplace.

In 2021–22, TBS also continued to update its suite of mental health resources for public servants. It added tools on preventing and recovering from burnout, and on addressing anxieties and other challenges related to returning to the workplace.

As part of fostering a safe and respectful workplace, TBS helped departments implement the new Directive on the Prevention and Resolution of Workplace Harassment and Violence by:

- providing tools to help hire qualified investigators

- organizing a community of practice to support staff in departments who are responsible for receiving notifications of workplace harassment and violence

TBS also took several actions in 2021–22 to make sure the public service remains a leader in accessible workplaces.

First, it improved measurement efforts to gain a better understanding of the barriers that employees with disabilities or with accommodation needs face by working with Statistics Canada on a pilot project to create a hub for departments to share data on people with disabilities who are hired into the public service.

Second, TBS tracked progress in identifying, preventing and removing barriers to participation in the public service for people with disabilities or with accommodation needs by:

- launching a self‑assessment tool that departments can use when drafting their accessibility plans

- managing and expanding the Accessibility Hub, an online repository where employers in the public service can find information and best practices on different accessibility initiatives, including the employment of persons with disabilities and workplace accessibility

Third, TBS improved workplace practices and reduced systemic barriers that contribute to the need for individual accommodations by supporting the deployment of the Government of Canada Workplace Accessibility Passport, a tool that helps employees with disabilities talk with their managers about the accommodations and supports they need to succeed in their jobs.

2. Negotiating in good faith and ensuring that terms and conditions of employment are fairly negotiated

In 2021–22, TBS fulfilled the Government of Canada’s commitment to continue to bargain in good faith with unions. It did this by:

- working with bargaining agents to negotiate agreements still outstanding from the 2018 round of bargaining

- engaging with unions to maintain professional, collaborative relationships

In the 2018 round of bargaining, the Government of Canada reached 53 tentative or final agreements with groups covering about 270,000 employees, or more than 98% of public servants in represented groups in the core public administration and separate agencies. Negotiations continue for two groups in the core public administration and two in separate agencies.

TBS also worked with unions to issue a final joint report on the Employee Wellness Support Program. It also continued negotiations to modernize the Public Service Health Care Plan. Following a competitive procurement process, the government awarded the contract to the Canada Life.

In the area of compensation, TBS continued to work with Shared Services Canada and other departments on the Next Generation Human Resources and Pay Initiative to replace the Phoenix pay system. In 2021–22, this included:

- identifying where and how a new system and its processes differ from existing Government of Canada practices

- examining opportunities to simplify pay and human resources processes and policies to make it easier to introduce the new integrated system

TBS also:

- worked with Public Services and Procurement Canada to reduce the Phoenix backlog

- worked with subject‑matter experts to develop and implement minimum standards for the prompt processing of human resources transactions related to pay

- developed strategies and tools to help departments and bargaining agents deal with outstanding Phoenix‑related grievances

- launched a claims process to compensate current and former employees represented by the Public Service Alliance of Canada for financial costs or lost investment income resulting from delays in pay, for leave taken because of health issues, and for severe damages and personal hardship

Results achieved

TBS met 6 of 10 targets relating to its responsibilities as employer. Changes to the employment equity data reconciliation process in 2021–22 meant that TBS could not report on the remaining four indicators.

The following table shows, for employer, the results achieved, the performance indicators, the targets, and the target dates for 2021–22, and the actual results for the three most recent fiscal years for which actual results are available.

| Departmental results | Performance indicators | Target | Date to achieve target | 2019–20 actual results | 2020–21 actual results | 2021–22 actual results |

|---|---|---|---|---|---|---|

Table 5 Notes

|

||||||

| Public service attracts and retains a skilled and diverse workforce | Percentage of institutions where communications in designated bilingual offices “nearly always” occur in the official language chosen by the public | At least 90% | March 2022 | 91% | 93.4% | 91.6%table 5 note * |

| Percentage of executive employees (compared with workforce availability) who are members of a visible minority group | At least 10.6% | March 2022 | 11.5% | 12.4% | Not availabletable 5 note † | |

| Percentage of executive employees (compared with workforce availability) who are women | At least 48% | March 2022 | 51.1% | 52.3% | Not availabletable 5 note † | |

| Percentage of executive employees (compared with workforce availability) who are Indigenous peopletable 5 note † | At least 5.1% | March 2023 | 4.1% | 4.4% | Not availabletable 5 note † | |

| Percentage of executive employees (compared with workforce availability) who are persons with a disability | At least 5.3% | March 2023 | 4.7% | 5.6% | Not availabletable 5 note † | |

| The workplace is healthy, safe and inclusive | Percentage of employees who believe their workplace is psychologically healthy | At least 61% | March 2022 | 61% | 68% | 68%table 5 note ‡ |

| Percentage of employees who indicate that they have been the victim of harassment on the job in the past 12 months | At most 12% | March 2022 | 14% | 11% | 11%table 5 note ‡ | |

| Percentage of employees who indicate that they have been the victim of discrimination on the job in the past 12 months | At most 8% | March 2022 | 8% | 7% | 7%table 5 note ‡ | |

| Percentage of employees who indicate that their organization respects individual differences (for example, culture, work styles and ideas) | At least 75% | March 2022 | 75% | 77% | 77%table 5 note ‡ | |

| Terms and conditions of employment are fairly negotiated | Percentage of Public Service Labour Relations and Employment Board outcomes that confirm that the Government of Canada is bargaining in good faith | 100% | March 2022 | 100% | 100% | 100%table 5 note § |

Financial, human resources and performance information for Treasury Board of Canada Secretariat’s Program Inventory is available in GC InfoBase.

Budgetary financial resources (dollars)

The following table shows, for employer, budgetary spending for 2021–22, as well as actual spending for that year.

| 2021–22 Main Estimates | 2021–22 planned spending | 2021–22 total authorities available for use | 2021–22 actual spending (authorities used) | 2021–22 difference (actual spending minus planned spending) |

|---|---|---|---|---|

| 3,114,085,837 | 3,114,085,837 | 10,947,473,459 | 10,809,702,394 | 7,695,616,557 |

Financial, human resources and performance information for Treasury Board of Canada Secretariat’s Program Inventory is available in GC InfoBase.

Human resources (full‑time equivalents)

The following table shows, in full‑time equivalents, the human resources the department needed to fulfill this core responsibility for 2021–22.

| 2021–22 planned full‑time equivalents | 2021–22 actual full‑time equivalents | 2021–22 difference (actual full‑time equivalents minus planned full‑time equivalents) |

|---|---|---|

| 414 | 606 | 192 |

Financial, human resources and performance information for Treasury Board of Canada Secretariat’s Program Inventory is available in GC InfoBase.

Regulatory oversight

Description

- Develop and oversee policies to promote good regulatory practices

- Review proposed regulations to ensure that they adhere to the requirements of government policy

- Advance regulatory cooperation across jurisdictions

Results

1. Leading the federal government’s adoption of internationally recognized regulatory practices

In 2021–22, TBS contributed to the Government of Canada’s commitment to continuing regulatory reform efforts to improve transparency and reduce administrative burden in two key ways.

First, TBS took action in several areas to improve the policies and practices used to create regulations.

TBS provided advice and guidance to departments on regulatory policies and practices, particularly on cost‑benefit analysis, to help them fulfill the requirements of the Cabinet Directive on Regulation and the related policies that support it.

TBS also oversaw targeted reviews to eliminate regulatory requirements and practices that create bottlenecks to economic growth and innovation. To do this, TBS:

- actively monitored progress on departments’ initiatives, including those from the second round of Targeted Regulatory Reviews, which focused on regulations relating to clean technology, digitization and technology‑neutral regulations, and international standards

- worked with other government departments to explore potential areas of focus for the third round of Targeted Regulatory Reviews

- renewed the mandate and membership of the External Advisory Committee on Regulatory Competitiveness

To modernize Canada’s overall regulatory policy framework to make it more efficient and agile, and less onerous for business, TBS continued its review of the Red Tape Reduction Act. This act established the one-for-one rule to control administrative burden. Under the one-for-one rule, the government must remove an existing regulation for every new regulation it implements. The review of the Red Tape Reduction Act started in 2020–21, and TBS plans to issue a report on its findings in 2022–23.

Second, TBS worked in several areas in 2021–22 to improve regulations themselves.

It worked with regulatory departments to consider the potential impact of regulations on competitiveness in areas such as innovation, trade, and process efficiency in conjunction with its efforts to help departments adopt internationally recognized best practices. A partnership with Public Services and Procurement Canada resulted in the launch of an online consultation tool to make the overall rule-making process more transparent and efficient.

To support modern and relevant rules, TBS instituted an annual legislative mechanism called the Annual Regulatory Modernization Bill. The President of the Treasury Board tabled the second bill under this initiative in Parliament on March 31, 2022.

In addition, TBS continued to work with departments to improve the regulatory environment for innovation and economic growth, including by supporting regulators in trying new approaches through experimentation.

In 2021–22, the Centre for Regulatory Innovation identified and approved five regulatory experiments and issued a call for additional experiment proposals. The centre continues to work with departments to identify, design and support new experiments.

In 2021–22, the centre also funded 12 projects designed to help regulators identify and implement solutions that make their regulatory frameworks more competitive. This included projects to research regulatory barriers to innovation, trade and economic growth in specific sectors. Projects also involved identifying tools to modernize and digitize how regulations are administered.

Bill S–6, An Act Respecting Regulatory Modernization

The second Annual Regulatory Modernization Bill responded to issues raised by businesses and Canadians about overly complicated, inconsistent or outdated requirements through 46 amendments to 29 acts administered by 12 different federal departments. The bill supports economic recovery by keeping Canada’s regulatory system relevant and up to date. All proposals were reviewed extensively to ensure that there would be no negative impact on the health, safety and security of Canadians or on the environment.

The amendments reduced administrative burden for business, facilitated digital interactions with government, simplified regulatory processes, made exemptions from certain regulatory requirements to test new products, and established more consistent and coherent rules across governments to facilitate easier cross‑border trade.

Examples of amendments included changes to:

- the Canadian Food Inspection Agency Act to enable digital services and digitization of paper-based processes

- the Canada Transportation Act to enable faster responses to international transportation safety standards

- the Department of Citizenship and Immigration Act to enable information‑sharing and support collaboration between federal departments, provinces and territories

The changes tabled in 2021–22 built on the amendments to 12 pieces of legislation introduced in the first iteration of the modernization bill included as part of the 2019 Budget Implementation Bill, which received Royal Assent on June 21, 2019.

2. Leading the advancement of regulatory cooperation among jurisdictions

TBS leads the Government of Canada’s efforts to:

- harmonize regulations that maintain high safety standards

- improve the competitiveness of Canadian businesses

- advance regulatory cooperation among jurisdictions

In 2021–22, TBS represented the Government of Canada on formal regulatory cooperation bodies and worked with departments to support 42 work plans or work plan items that could be addressed through several bodies:

- the Canada‑U.S. Regulatory Cooperation Council

- the Canada‑European Union Regulatory Cooperation Forum

- the Regulatory Reconciliation and Cooperation Table, a body that falls under the Canadian Free Trade Agreement

TBS supported Canada’s work under the Agile Nations Charter, a 2020 agreement signed by Canada, Denmark, Italy, Japan, Singapore, the United Arab Emirates and the United Kingdom to foster cooperation on rule‑making. The charter aims to make it easier for businesses to introduce and scale innovations across markets while upholding protections for citizens and the environment.

Approved in October 2021, the first Agile Nations program saw Canada work with its partners to share ideas, test solutions, and identify opportunities for regulators to better support innovative industries in areas such as cybersecurity, digital technologies, and regulatory experimentation.

TBS also raised awareness of the requirements of the Cabinet Directive on Regulation in order to underline the importance of cooperation in the regulatory development process and of alignment across jurisdictions to eliminate duplication and trade barriers.

Although TBS did not collect data on its efforts to cooperate across jurisdictions to eliminate duplication and barriers to trade, its efforts strengthened relationships with federal regulators.

Results achieved

TBS met four of five targets for regulatory oversight in 2021–22. It missed the fifth target because it fell short in one of three metrics used by the Organisation for Economic Co‑operation and Development to rank regulatory systems. Although Canada ranked in the top five for stakeholder engagement and regulatory impact analysis practices, it dropped to sixth on ex-post evaluation from fifth in the previous report in 2018. To improve this result, TBS will focus policy development efforts on identifying ways to improve the existing regulatory review requirements.

TBS will continue to lead efforts to modernize regulations, maintain high safety standards, and make Canadian businesses more competitive, including developing the third Annual Regulatory Modernization Bill.

The following table shows, for regulatory oversight, the results achieved, the performance indicators, the targets, and the target dates for regulatory oversight for 2021–22, and the actual results for three most recent fiscal years for which actual results are available.

| Departmental results | Performance indicators | Target | Date to achieve target | 2019–20 actual results | 2020–21 actual results | 2021–22 actual results |

|---|---|---|---|---|---|---|

Table 6 Notes

|

||||||

| Government regulatory practices and processes are open, transparent and informed by evidence | Percentage of regulatory initiatives that report on early public consultation undertaken prior to first publication | At least 95% | March 31, 2022 | 98% | 99.09% | 96.8% |

| Percentage of regulatory proposals that have an appropriate impact assessment (for example, cost‑benefit analysis) | At least 95% | March 31, 2022 | 97% | 96.1% | 97.6% | |

| Ranking of Canada’s regulatory system by the Organisation for Economic Co‑operation and Development | At least 5th | December 31, 2021 | In 2018,table 6 note * Canada ranked:

|

In 2018,table 6 note * Canada ranked:

|

In 2021,table 6 note † Canada ranked:

|

|

| Regulatory cooperation among jurisdictions is advanced | Number of federal regulatory programs that have a regulatory cooperation work plan | At least 39 by March 2022 | March 31, 2022 | 38 | 40 | 42 |

| Percentage of significant regulatory proposals (for example, high and medium impact) that promote regulatory cooperation considerations, when relevant | At least 95% annually | March 31, 2022 | 100% | 100% | 100% | |

Financial, human resources and performance information for Treasury Board Secretariat’s Program Inventory is available in GC InfoBase.

Budgetary financial resources (dollars)

The following table shows, for regulatory oversight, budgetary spending for 2021–22, as well as actual spending for that year.

| 2021–22 Main Estimates | 2021–22 planned spending | 2021–22 total authorities available for use | 2021–22 actual spending (authorities used) | 2021–22 difference (actual spending minus planned spending) |

|---|---|---|---|---|

| 9,039,679 | 9,039,679 | 11,318,505 | 10,218,687 | 1,179,008 |

Financial, human resources and performance information for Treasury Board of Canada Secretariat’s Program Inventory is available in GC InfoBase.

Human resources (full‑time equivalents)

The following table shows, in full‑time equivalents, the human resources the department needed to fulfill this core responsibility for 2021–22.

| 2021–22 planned full‑time equivalents | 2021–22 actual full‑time equivalents | 2021–22 difference (actual full‑time equivalents minus planned full‑time equivalents) |

|---|---|---|

| 57 | 66 | 9 |

Financial, human resources and performance information for Treasury Board of Canada Secretariat’s Program Inventory is available in GC InfoBase.

Gender‑based analysis plus, sustainability and experimentation

This section outlines the ways TBS:

- incorporated gender-based analysis plus into TBS and government decision‑making

- contributed to the Government of Canada’s efforts to implement the United Nations 2030 Agenda for Sustainable Development and achieve the UN Sustainable Development Goals

- experimented with new approaches to achieve results

Gender‑based analysis plus

In 2021–22, TBS continued to incorporate gender‑based analysis plus into its work under each of its core responsibilities.

1. Spending oversight

TBS required departments seeking new spending authorities to consider the potential impact on diverse groups to inform Treasury Board ministers of the gender, diversity and other implications of approving proposals and to develop plans to measure the outcomes in these areas.

TBS also assessed the information reported in departments’ supplementary information tables on gender‑based analysis plus. Based on its assessment, TBS worked with departments to improve their gender‑based analyses through:

- better data collection, performance measurement and evaluation activities

- developing a whole‑of‑government approach to improving the availability and collection of disaggregated data

- working with Statistics Canada to create a diversity and skills database, which provided gender‑based analysis plus measures for workforces in Canadian firms

- training employees in gender‑based analysis plus

To promote the public reporting of gender‑based analysis plus information, TBS:

- launched the Gender and Diversity: Impacts of Programs website, which consolidates links to departmental reporting and provides examples of departments’ reports on gender and diversity

- continued to mark indicators in GC InfoBase to identify those related to gender‑based analysis plus

2. Administrative leadership

In 2021–22, TBS:

- provided tools and resources to make sure its digital products met high standards for accessibility and inclusion

- amended the Guide to Gender‑Based Analysis Plus (GBA+) and Inclusive Open Government to reflect updated guidance from Women and Gender Equality Canada

- explored ways to facilitate the participation of marginalized communities in government contracts

In delivering on its commitment to identify and address representation gaps in the government’s different functional communities, TBS worked with departments to:

- create a diversity and inclusion working group for communications and comptrollership professionals

- put in place performance commitments to increase the representation of women and other equity groups in the comptrollership, information management, information technology, and cybersecurity communities

- review policies and initiatives to build a skilled, inclusive, diverse and equitable workforce in the financial management and internal audit communities

3. Employer

Under this core responsibility in 2021–22, TBS:

- continued to work with more than 20 interdepartmental equity‑seeking employee networks to make sure its initiatives and approaches meet their needs

- released disaggregated data on Canada.ca so that departments can find out about the composition of employment equity sub‑groups

- launched an online interactive data visualization tool that provides access to human resources, demographic and employment equity data for the core public administration

- worked closely with policy centres and equity‑seeking groups to publish on Canada.ca about 40 dashboards related to Public Service Employee Survey results broken down by demographic group

TBS also studied active inclusion in the administration of the Public Service Pension Plan through legislative and demographic trends analyses.

4. Regulatory oversight

TBS continued to help fulfill the Government of Canada’s commitment to incorporate gender‑based analysis plus when making regulatory decisions. For example, TBS:

- expanded its data collection on departments’ use of gender‑based analysis plus when developing regulations

- provided advice to departments to help them meet the requirement in the Cabinet Directive on Regulation to assess the social and economic impacts of each regulatory proposal on diverse groups of Canadians

In 2021–22, 95% of relevant Governor‑in‑Council regulations published provided gender‑based analysis plus information in the corresponding regulatory impact analysis statement.

Details on TBS’s actions to support gender‑based analysis plus can be found in the supplementary information table on gender‑based analysis plus.

United Nations 2030 Agenda for Sustainable Development and the Sustainable Development Goals

In 2015, Canada and all other 192 United Nations member states adopted the 2030 Agenda for Sustainable Development. All federal departments are responsible for integrating the 2030 Agenda into their work and for contributing to advancing the sustainable development goals in their areas of responsibility.

In 2021–22, TBS continued to support efforts to achieve the UN Sustainable Development Goals by working to:

- increase diversity, accessibility and inclusion in the public service, which contributed to Goal 5 (Achieve gender equality and empower all women and girls) and Goal 10 (Reduce inequality within and among countries)

- lead the greening of government operations, which contributed to Goal 12 (Ensure sustainable consumption and production patterns) and Goal 13 (Take urgent action to combat climate change and its impacts)

- expand open data initiatives, which contributed to Goal 17 (Revitalize the global partnership for sustainable development)

It also helped make sure government policy:

- was developed through an intersectional lens

- reflected the needs and aspirations of Canadians

- supported the path to net-zero

In addition, it introduced new directives that require functional heads to take socio-economic and environmental benefits into account in procurement, material management, and real property projects.

Further details on TBS’s contributions to the goals are in the Supplementary Information Table on the United Nations 2030 Agenda and the Sustainable Development Goals.

Experimentation

In 2021–22, TBS continued to experiment with new approaches to improve results in each of its core responsibilities.

1. Spending oversight

Central Performance and Impact Assessment Unit (now the Data Science, Research and Development Unit)

As part of the Innovation and Skills Plan announced in Budget 2018, TBS created the Central Performance and Impact Assessment Unit (now the Data Science, Research and Development Unit) to provide insight into the determinants of business innovation and growth.

In 2021–22, the unit worked with Statistics Canada to:

- create the Business Innovation and Growth Support database on the recipients of funding, grants and awards from federal growth and innovation programs

- connect the Business Innovation and Growth Support database to Statistics Canada’s Linkable File Environment, which brings together a range of databases containing survey and administrative data on the characteristics of Canadian enterprises

This work led to the creation of:

- new data development and analysis projects, including an exploratory research study by TBS and Statistics Canada that produced a model for estimating the net‑value impact of federal government subsidies on Canadian businesses

- a diversity and skills database, which provides novel inclusion measures for the workforces of Canadian firms

2. Administrative leadership

Talent Cloud

In 2021–22, TBS concluded its work with partner departments on the Talent Cloud, a fully public staffing platform for externally advertised, competitive processes. The platform tested new ideas, from concept through to hiring, and then to performance. Its goals included optimizing the fit between talent and team, increasing inclusion and diversity in recruitment, and reducing time to staff.

Talent Cloud was used for about 50 staffing processes, which attracted strong applicants, including those in equity-seeking and under‑represented groups.

The Talent Cloud Results Report highlights the experiment’s findings and achievements, including:

- certain practices helped complete externally advertised staffing processes in an average of three months, or about six months quicker than the Government of Canada average

- providing information about the work environment, team culture, and management leadership style in job postings helped a great deal in finding the right match

- allowing for remote work substantially improved the chances of a successful hire

- an average of 10% of applicants attracted through Talent Cloud processes in 2020 had the required skills and rated as a good fit with the hiring team’s culture and work environment, a result about eight percentage points higher than the industry average

Greening Government Fund

Administered by TBS, the Greening Government Fund provides project funding designed to help departments reduce their operational emissions. Projects test or implement innovative approaches that can be reproduced within or across departments or that pursue solutions in areas or situations where it is particularly difficult to reduce emissions.

For example, in 2021–22, the Greening Government Fund supported the creation of Buyers for Climate Action, a coalition of large government buyers from across Canada that purchase a high volume of goods and services that have a high environmental impact. By sharing knowledge and collaborating on best practices, the coalition supports the transition to a green, net‑zero carbon economy.

3. Employer

Disaggregated data

TBS explored innovative ways to analyze disaggregated data on designated employment equity groups to learn more about people’s experiences and to identify gaps in representation. TBS also took a step toward increasing the amount of reliable disaggregated data available by rolling out a modernized self‑identification form. It then analyzed findings, identified barriers and risks, and made enterprise-wide recommendations.

Centralized Enabling Workplace Fund

TBS continued to use the Centralized Enabling Workplace Fund to invest in innovative and experimental ideas, projects and initiatives aimed at improving workplace accommodation practices and, where possible, removing systemic barriers that create a need for individual accommodation.

As part of administering the fund, TBS:

- helped establish the Lending Library Service pilot project, which gives short-term public service employees with disabilities or injuries access to specialized accessibility services, workplace accommodations, and software and hardware loans

- funded a pilot project to test lighting solutions that reduce barriers for public servants with light sensitivities, in collaboration with Public Services and Procurement Canada and National Research Council Canada

- funded the Neurodiversity Recruitment Pilot Project to recruit and on-board neurodivergent talent into the federal public service, in partnership with Shared Services Canada, the Financial Transactions and Reports Analysis Centre of Canada, and the Public Service Commission of Canada

4. Regulatory Oversight

Centre for Regulatory Innovation

Through the Centre for Regulatory Innovation, TBS helped departments develop, conduct and evaluate regulatory experiments by supporting two new multi‑year initiatives:

- a Transport Canada project to test light sport aircraft in pilot training

- the Standards Council of Canada’s pilot of an assessment program for artificial intelligence management systems

In addition to funding regulatory experimentation, the centre supported government-wide capacity‑building by providing Canadian regulators with a guide on identifying, designing and carrying out regulatory experiments.

Internal services

This section contains information about TBS’s internal services:

- a description of its activities

- the actions taken to achieve planned results and the success in delivering on them

- the financial and human resources allocated to it

Description

Internal services comprises related activities and resources that the federal government considers to be services in support of programs and/or required to meet corporate obligations of an organization. Internal services refers to the activities and resources of the 10 distinct service categories that support program delivery in the organization, regardless of the internal services delivery model in a department.

The 10 service categories are:

- acquisition management services

- communication services

- financial management services

- human resources management services

- information management services

- information technology services

- legal services

- material management services

- management and oversight services

- real property management services

Results

In 2021–22, TBS allocated 28.3% of its planned operating spending and 28.2% of its planned full-time equivalents to internal services, which support the department’s four core responsibilities.

In 2021–22, TBS took steps in three areas to maintain and improve its performance.

1. Fostering employee well‑being

TBS raised awareness about mental and physical health and wellness and provided access to relevant tools and resources in different ways, including by:

- organizing online events and training sessions, such as sessions with mental health professionals

- providing information on the Employee Assistance Program and LifeSpeak, a digital education and well-being platform

- increasing the information available through TBS’s Mental Health and Wellness Hub

- monitoring and reporting on new sources of data to support a safe and healthy work environment

2. Building a diverse, inclusive and representative workforce

TBS worked toward increasing diversity, inclusion and representation in its workforce on several fronts. For example, it:

- focused recruitment and outreach activities on identifying and attracting talent from the four designated employment equity groups, including through initiatives on LinkedIn

- consulted with people from employment equity groups at TBS to come up with solutions to remove systemic barriers and improve inclusion

- developed strategies and resources to increase knowledge about employment equity, diversity and inclusion in the recruitment process

- revised guidance and training on onboarding practices to help retain employees

- started developing a plan to ensure compliance with the Accessible Canada Act, which included consulting internally to identify barriers to inclusion for persons with disabilities and identifying priorities for making buildings more accessible

3. Preparing for the future

TBS ensured that it had the capacity for virtual, hybrid and on‑site work by:

- equipping all boardrooms with 360‑degree audio‑visual devices that facilitate teamwork and collaboration

- deploying new workplace tools and improving existing ones to help employees work together better

- adapting policies, processes and tools to the new hybrid workplace

TBS also expanded the use of data analytics and enhancing workforce data by incorporating new data sources and creating new interactive dashboards to enable timely, results‑based decision‑making on approaches to a safe and flexible hybrid work model.

Budgetary financial resources (dollars)

The following table shows budgetary spending for 2021–22 for internal services, as well as actual spending.

| 2021–22 Main Estimates | 2021–22 planned spending | 2021–22 total authorities available for use | 2021–22 actual spending (authorities used) | 2021–22 difference (actual spending minus planned spending) |

|---|---|---|---|---|

| 91,541,058 | 91,541,058 | 98,193,259 | 95,963,867 | 4,422,809 |

Human resources (full‑time equivalents)

The following table shows the human resources in full‑time equivalents that the department needed to carry out its internal services for 2021–22.

| 2021–22 planned full‑time equivalents | 2021–22 actual full‑time equivalents | 2021–22 difference (actual full‑time equivalents minus planned full‑time equivalents) |

|---|---|---|

| 642 | 659 | 17 |

Spending and human resources

Spending

Spending 2019–20 to 2024–25

Actual expenditures

Departmental spending breakdown

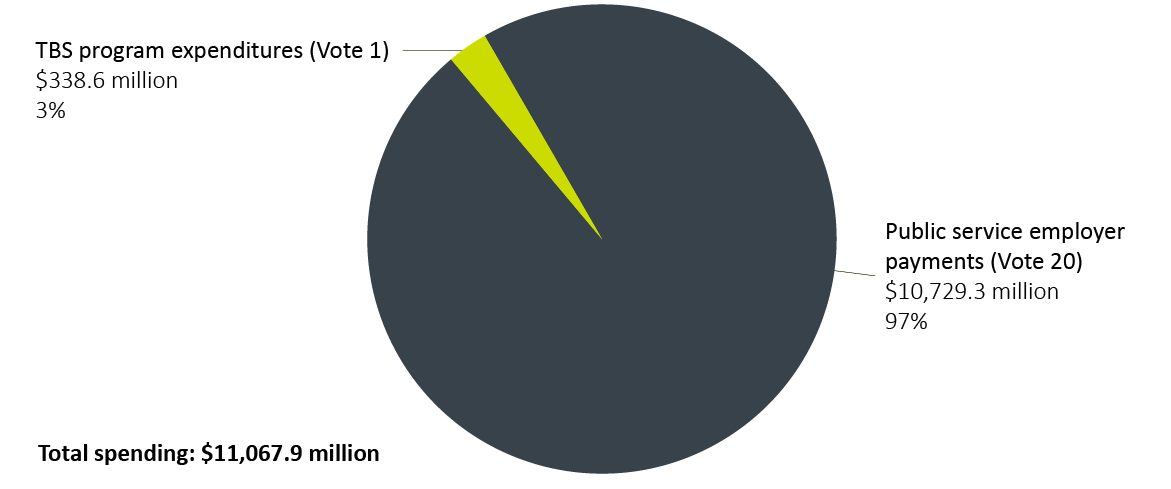

Figure 1 shows a breakdown of spending by category.

Figure 1 - Text version

| Vote/Crédit | Amount/Montant | % |

|---|---|---|

| TBS program expenditures (Vote 1) (Vote 1 + EBP + Ministers' Allowance) |

339 | 3% |

| Public service employer payments (Vote 20) Vote 20 + PSSA + Payments for the Pay Equity Settlement) |

10,729 | 97% |

| Total | 11,068 | 100% |

In 2021–22, TBS’s total spending was $11,067.9 million. The largest share of spending (97%) was for public service employer payments, which TBS makes as employer for the core public administration. The balance (3%) was for TBS program expenditures.

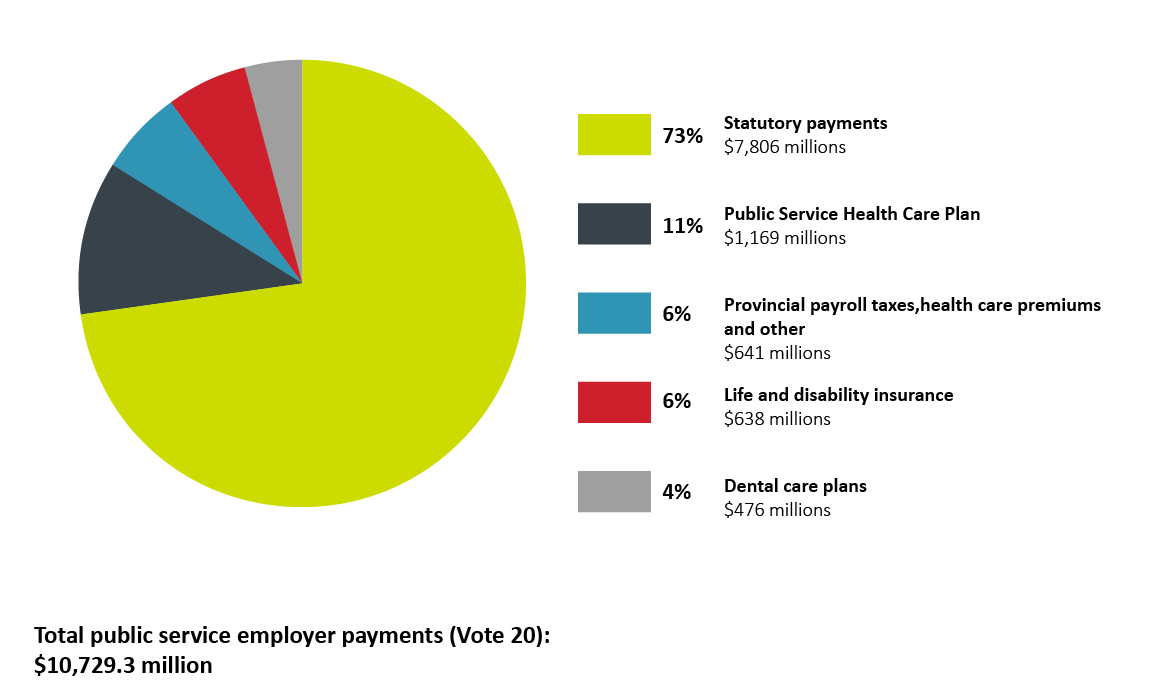

Figure 2 shows a breakdown of TBS’s spending of $10,729.3 million in public service employer payments (Vote 20) and various statutory items.

Figure 2 - Text version

| Category | Amount | % |

|---|---|---|

| Public Service Health Care Plan | 1,169 | 11% |

| Provincial payroll taxes, health care premiums and other | 641 | 6% |

| Life and disability insurance | 638 | 6% |

| Dental care plans | 476 | 4% |

| Statutory payments | 7,806 | 73% |

| Total Vote 20 + Statutory Payments | 10,729 | 100% |

These payments include the employer’s share of employee and pensioner benefit plans, provincial health care premiums and other payroll taxes, as well as statutory payments, which relate mostly to pensions.

Figure 3 presents planned (voted and statutory spending) over time. Program expenditures include operating costs such as TBS employees’ salaries, non‑salary costs to deliver programs, and statutory payments relating to the employer’s contributions to TBS employees’ benefit plans.

Figure 3 - Text version

| Fiscal years | Total | Voted | Saturtory payments |

|---|---|---|---|

| 2019-20 | 340,756,700 | 308,427,143 | 32,329,557 |

| 2020-21 | 340,753,173 | 304,869,575 | 35,883,598 |

| 2021-22 | 373,677,257 | 91,867 | 373,585,390 |

| 2022-23 | 354,999,023 | 320,060,709 | 34,938,314 |

| 2023-24 | 327,769,197 | 295,886,444 | 31,882,753 |

| 2024-25 | 335,309,603 | 304,196,676 | 31,112,927 |

As shown in Figure 3, TBS’s program expenditures decreased by $2.1 million, from 2020–21 to 2021–22 due to:

- the modernization of the financial management transformation systems program

- lower expenditures for Phoenix stabilization and HR‑to‑Pay initiatives (Budget 2021)

- a reduction in communication services and information technology projects

The decrease in expenditures is partially offset by increases in:

- demand for critical digital products and services related to the COVID‑19 pandemic

- funding requirements to advance public service job classification (Budget 2021)

- funding requirements for implementing the Policy on COVID‑19 Vaccination for the Core Public Administration Including the Royal Canadian Mounted Police, and funding for Phoenix stabilization and HR‑to‑Pay initiatives (Budget 2021)

- requirements for legal services

- work associated with bringing more departments into the Central Agency Cluster Shared Systems and with helping departments that use Free Balance migrate to other financial systems

For 2022–23 to 2024–25, total planned spending for TBS’s core responsibilities is projected to decrease by $19.7 million, mostly due to the sunsetting of the following programs or initiatives, although some may be subject to the renewal process:

- Phoenix stabilization and HR‑to‑Pay initiatives (Budget 2021)

- Policy on COVID‑19 Vaccination for the Core Public Administration including the Royal Canadian Mounted Police

- support for implementing proactive pay equity in the federal public service (Budget 2019)

- fostering a diverse and inclusive public service

- advancing public service job classification (Budget 2021)

- access to information review and action plan (Budget 2021)

- Office of Public Service Accessibility (Budget 2021)

- regulatory reviews and the External Advisory Committee on Regulatory Competitiveness (Budget 2021)

- Centralized Enabling Workplace Fund

- funding to establish the Centre of Expertise for Real Property to improve federal asset management (Budget 2021)

- Joint Learning Program

The decreases in planned spending are offset by increases in the funding needed to implement the federal Low‑carbon Fuel Procurement Program (Budget 2021).

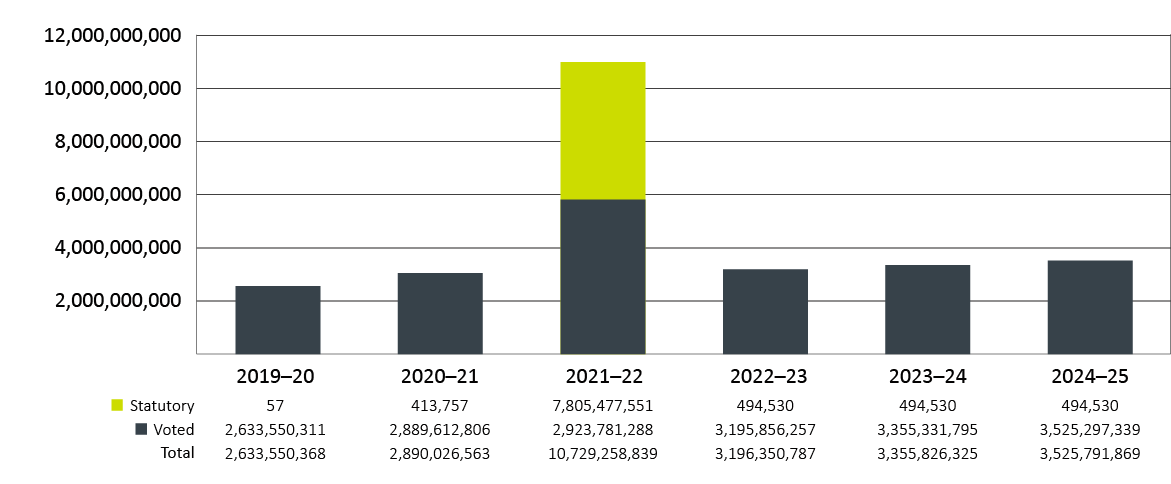

Figure 4 shows TBS’s spending on public service employer payments and statutory items for the core public administration over time.

Figure 4 - Text version

| Fiscal years | Total | Voted | Saturtory payments |

|---|---|---|---|

| 2019-20 | 2,633,550,368 | 2,633,550,311 | 57 |

| 2020-21 | 2,890,026,563 | 2,889,612,806 | 413,757 |

| 2021-22 | 10,729,258,839 | 2,923,781,288 | 7,805,477,551 |

| 2022-23 | 3,196,350,787 | 3,195,856,257 | 494,530 |

| 2023-24 | 3,355,826,325 | 3,355,331,795 | 494,530 |

| 2024-25 | 3,525,791,869 | 3,525,297,339 | 494,530 |