Transition 2025 Briefing Book

Notice to readers

This document contains information which has been redacted in accordance with provisions of Part 1 of the Access to Information Act and has been formatted to comply with the Canada.ca Content Style Guide and the Standard on Web Accessibility.

On this page

Roles of the President of the Treasury Board

The Treasury Board was established in 1867 as the first Cabinet committee and is the only one enshrined in legislation. It takes the final decision on expenditures and regulations.

The Treasury Board President is the Chair of the Treasury Board and, as such, serves as the gatekeeper to the Board and sets its agenda, supporting the management and implementation of initiatives across government.

The President is supported by the Treasury Board Secretariat in the fulfilment of his/her duties.

Treasury Board

The Treasury Board’s authority is derived from the Financial Administration Act. Treasury Board ministers make the final decision on expenditures and regulations and set the rules for the management of people, finances, technology and general public administration.

It is also the Cabinet committee designated by the Prime Minister to make recommendations to the Governor General, functioning as the Governor in Council for regulations and most orders-in-council.Footnote 1

The Treasury Board typically meets weekly while Parliament is in session and is responsible for the following:

Spending oversight

- Providing due diligence before approving the use of new money that has been set aside in the Budget, including for major procurements, new programs and grants and contributions.

- The government is responsible for over $461.8 billionFootnote 2 in planned budgetary expenditures, and the Treasury Board plays a central role in the government decision-making process.

- Reviewing spending plans on departmental initiatives and making decisions that affect services to Canadians.

Administrative leadership

- Establishing, through Treasury Board policies, the rule set for people and human resources (HR) management via the Office of the Chief Human Resources Officer, information technology and management and security via the Office of the Chief Information Officer, and financial, asset and project management via the Office of the Comptroller General.

Employer

- Determining the terms and conditions of employment for the public service.

- Approving collective agreements.

- The federal public service is Canada’s largest employer; the core public administration, which the Treasury Board employs, has about 282,000 employees.Footnote 3

Regulatory oversight

- Establishing regulations that impact the health, safety and security of Canadians, the economy, and the environment.

- Over 50 government departments and agencies have regulatory responsibilities that impact the economy and lives of Canadians.

The President of the Treasury Board chairs Treasury Board meetings and:

- acts as gatekeeper, deciding what is brought to the Treasury Board

- guides discussions to maintain focus on due diligence and impact

- plays a central role in Cabinet, bringing the Board’s focus on implementation and impact to Cabinet meetings

The Treasury Board of Canada Secretariat

The President is responsible for TBS as a department and sets the strategic direction of the organization.

As the administrative arm of the Treasury Board, TBS provides leadership to help departments effectively implement government priorities and meet citizens’ evolving expectations of government.

TBS’s four core responsibilities mirror those of the Treasury Board: spending oversight, administrative leadership, employer and regulatory oversight.

Responsibilities as minister of the Treasury Board of Canada Secretariat include:

- providing policy direction to TBS

- bringing forward Treasury Board submissions related to TBS’s mandate

- approving and presenting proposals to Cabinet related to TBS’s mandate

- establishing the form and tabling of the Estimates

- establishing the form and tabling of the Public Accounts

- receiving and tabling a wide range of reports under legislation or Treasury Board policies

Please see Annex A in Tab 6 for more information on the responsibilities and authorities of the Treasury Board and the President of the Treasury Board.

The Treasury Board of Canada

Established in 1867, the Treasury Board is the only statutory Cabinet committee. It has two distinct functions:

Treasury Board

Part A

Management Board

Makes decisions about:

- funds (expenditure manager)

- authorities, rules and compliance (management board)

- people (employer)

Treasury Board responsibilities are delegated by the Financial Administration Act, which creates the Board’s public service support: Secretary, Comptroller General, Chief Human Resources Officer and Chief Information Officer of Canada.

Part B

Governor in Council

Since 2003, the Treasury Board has been designated as the Cabinet committee responsible for considering Governor in Council matters.

Treasury Board makes recommendations to the Governor General about:

- regulations

- most orders-in-council (that is, non-appointment orders-in-council)

In addition to the Financial Administration Act, over 20 other statutes establish the Treasury Board’s roles and authorities. Powers and responsibilities are also set out in regulations, orders-in-council, policies, guidelines and practices.

How Treasury Board helps implement the government’s agenda

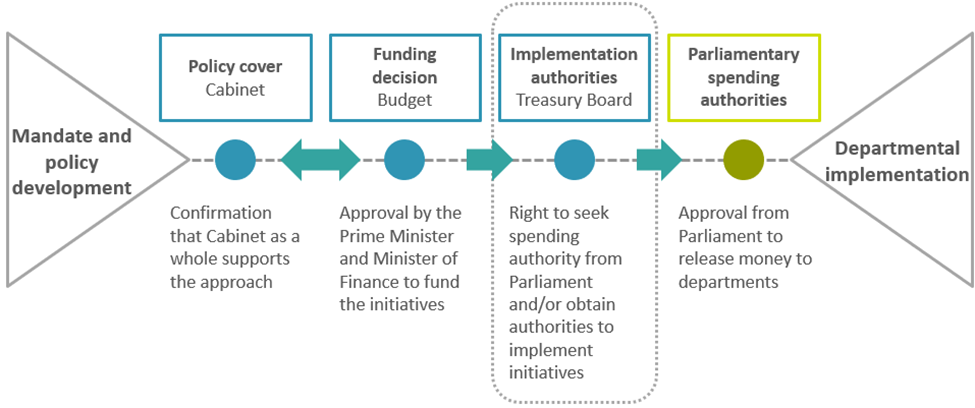

Between the genesis of a policy idea and its implementation by a department, ministers must secure certain approvals to ensure policy alignment, affordability and feasibility. Combined, these key decisions help ensure the government can implement its agenda.

This process can be understood in simplified terms as a series of six steps:

- Mandate and policy development

- Policy cover by Cabinet, which includes confirmation that Cabinet as a whole supports the approach

- A funding decision through the Budget, which includes approval by the Prime Minister and the Minister of Finance to fund the measures

- Implementation authorities by Treasury Board, which includes the right to seek spending authority from Parliament and/or to carry out certain operational steps

- Parliamentary spending authorities, which includes approval from Parliament to release money to departments

- Departmental implementation

Figure 1 - Text version

Graphic showing the process from policy idea to implementation by a department.

- The first step is mandate and policy development.

- The second step is policy cover by Cabinet, which includes confirmation that Cabinet as a whole supports the approach.

- The third step is a funding decision through the Budget, which includes approval by the Prime Minister and the Minister of Finance to fund the measures.

- The fourth step is implementation authorities by Treasury Board, which includes the right to seek spending authority from Parliament and/or to carry out certain operational steps.

- The fifth step is parliamentary spending authorities, which includes approval from Parliament to release money to departments.

- The final step is departmental implementation.

The fourth step (implementation authorities by Treasury Board) is circled to indicate where Treasury Board fits within the process.

Treasury Board’s role occurs at the fourth step, when implementation authorities are sought. It applies the following lenses to proposals:

- Alignment: does the proposal align with the government’s policy goals?

- Design: how is the proposal or regulation designed?

- Value: does the proposal represent good value?

- Risk: are solid risk mitigation plans in place for the overall risks of the proposal?

- Implementation capacity: does the proposal work within the department’s existing administrative capacity?

- Impact: will it achieve outcomes? How will these be measured?

The Treasury Board applies these lenses to proposals in the following areas, divided between Part A (Management Board) and Part B (Governor in Council).

Part A

Expenditure manager

- Oversees government expenditure plans and the stewardship of public funds (2024–25 Main Estimates and Supplementary Estimates (A) presented $461.8 billion in planned budgetary spending)

- Ensures that government decisions with financial implications are included in Estimates and supply bills for parliamentary approval

- Sets policies and rules for departments on how they spend money

Management board

- Sets rules on how government is managed (the Treasury Board is responsible for 25 policies, such as the Policy on Results, the Policy on Financial Management and the Policy on Government Security)

- Provides authorities for new programs, projects, transfer payments, and contracts

Employer

- Oversees collective bargaining and labour relations (total of about 282,000 employees)Footnote 4

- Sets rules for employee management

- Sets policies to support the public service (for example, the Policy on People Management and its supporting instruments, such as the Directive on Conflict of Interest and the Directive on Mandatory Training)

- Sets terms and conditions of employment (which are the basis of collective agreements)

Part B

Regulatory oversight

- Oversees most orders-in-council and regulations

- Regulations in areas such as food and drug safety, environmental protection, and transportation safety

- Orders-in-council can include authorities to enter into international agreements and bring legislation into force

How the Treasury Board operates

Ministers play a corporate role as opposed to representing their own departmental perspectives.

The Treasury Board is the highest-volume Cabinet committee with a wide scope of decision-making authority, taking more than 1,000 decisions per year.

TBS officials present proposals, unlike at Cabinet, where ministers present their proposals:

- officials’ advice is provided to all Treasury Board ministers, not just the Chair

- Treasury Board material is not shared or reviewed by Treasury Board ministers’ departments

Quorum for Part A is three ministers and for Part B is four ministers.

Due diligence

Submissions are reviewed for:

- clarity, completeness and quality

- business case and value for money

- compliance with existing legal and policy requirements

- program operations and viability

- risk and mitigation

- design and implementation

- international alignment

- regulatory quality and adherence to the Cabinet Directive on Regulation

Meeting documentation

Treasury Board ministers receive materials in advance of the meeting that contain:

- sponsoring ministers’ signed submissions

- TBS’s advice

- regulatory proposals and order-in-council submissions

Agenda management

- Not all cases are formally presented or discussed

- TBS officials present the cases flagged for discussion (please see the appendix to this note for more information)

- Members can ask for any case to be presented

- TBS officials answer questions on any item

Role of Treasury Board ministers

For Part A, members either:

- approve as proposed

- approve with conditions

- defer the decision

- do not approve

For Part B, members:

- consider draft regulations for public comment (beginning of process)

- consider regulations and Orders-in-Council for final approval (end of process)

- can only approve, not approve, or defer decisions

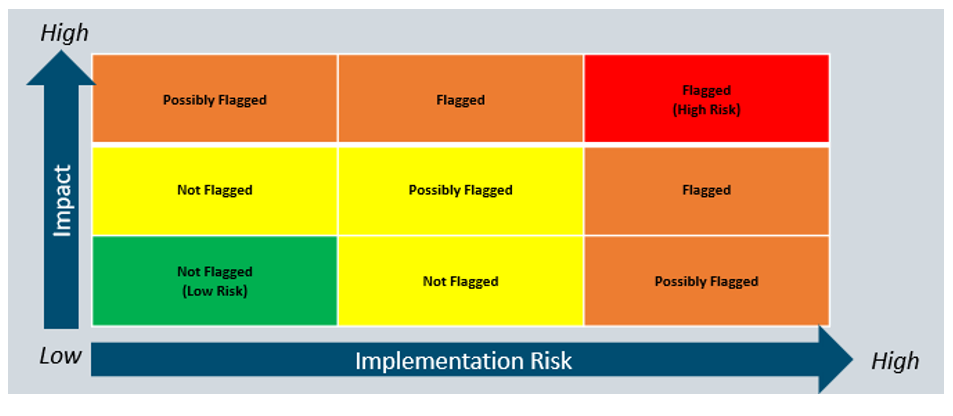

Appendix: how impact and implementation risks are assessed

A Treasury Board submission is considered to have a high impact when it has one or more of the following:

- has a significant impact on a large number of Canadians and stakeholders or a specific group of stakeholders or regions

- high level of public interest

- high level of involvement or dependencies on other levels of government

- sets a precedent

- has a large service component

- significant financial investment

A submission is considered to have a high implementation risk when it includes one or more of the following elements:

- highly complex plan

- novel or untested approach to delivery

- transformational or requiring significant change management

- department has limited capability to deliver or enforce

- department has poor past performance

- cyber or security concerns

- high legal risk: high likelihood of successful challenge

- results are not well articulated or there is concern that the plan will not achieve the results

- challenges with costing certainty: not clear that results can be achieved with the available funding

Figure 2 - Text version

Three-by-three grid showing implementation risk on the horizontal axis and impact on the vertical axis. Impact increases from bottom to top and implementation risk increases from left to right.

This grid demonstrates when a Treasury Board submission can be flagged for presentation and discussion to the Treasury Board:

- Low implementation risk, low-impact items are not flagged

- Low implementation risk, medium-impact items are not flagged

- Low implementation risk, high-impact items are possibly flagged

- Medium implementation risk, low-impact items are not flagged

- Medium implementation risk, medium-impact items are possibly flagged

- Medium implementation risk, high-impact items are flagged

- High implementation risk, low-impact items are possibly flagged

- High implementation risk, medium-impact items are flagged

- High implementation risk, high-impact items are flagged

For Part A only: In circumstances where risks have not been appropriately mitigated by the department, the Assistant Secretaries may recommend conditions or adjustments to the authorities to be provided (for example, less money, requirement to return to the Board, etc.).

The Treasury Board of Canada Secretariat: roles and functions

The Treasury Board of Canada Secretariat (TBS) acts both as a central agency with a central coordinating function for the Government of Canada, promoting coherence across programs and services, and also as a department.

| As a central agency | As a department |

|---|---|

| Sets the government-wide management agenda and provides policy direction and guidance to departments on a wide range of management issues | Subject to this agenda and guidance |

| Performs a challenge function and advises ministers on proposals brought forward by departments (for example, on Memoranda to Cabinet, Budget items, and Treasury Board submissions) | Submits proposals to Cabinet for the President’s own initiatives |

People management

TBS in exercising its Employer role is responsible for government-wide direction and leadership on people management to recruit and retain talent, support a work environment in which employees can thrive, and manage human resources using the best possible tools and evidence.

The Office of the Chief Human Resources Officer supports the Treasury Board’s mandate by:

- developing policies and providing strategic direction, and its enabling systems and processes, for people and workplace management in the public service

- leading negotiations with bargaining agents and managing total compensation to ensure fair and sustainable terms for collective agreements, pensions and benefits

- establishing terms and conditions of employment, including the management of talent and performance for the executive cadre

- monitoring the conditions of the workplace and workforce through data acquisition and analysis

- leading the heads of the human resources community to foster collaboration, innovation and coherence across the Government of Canada

The Office of Public Service Accessibility is responsible for supporting the Canadian public service in meeting the requirements of the Accessible Canada Act. The Office supports TBS’s mandate by providing strategic advice to government departments and agencies regarding issues related to accessibility and inclusion through:

- equipping public servants with knowledge on how to better design and deliver accessible programs and services

- providing practical guidance and tools for removing barriers through initiatives such as the online Accessibility Hub

- providing strategic advice, informed by engagement with persons with disabilities, to government departments and agencies

- improving recruitment, retention and promotion of persons with disabilities

- enhancing the accessibility of the physical workspace

- making technology usable by all

Comptrollership

The Office of the Comptroller General supports the Treasury Board’s mandate by:

- developing policies and providing government-wide coordination and strategic direction for comptrollership in the public service, including internal audit, financial management, project management and the management of procurement and real property

- providing strategic direction and oversight for chief financial officers and chief audit executives across the Government of Canada

- providing proactive analysis and recommendations on management and policy issues such as departmental management and spending authorities and contributing to government-wide oversight by providing assurance and advice

- providing analysis and advice on Treasury Board submissions, including on cost estimates and financial risks

Digital and technology

The Office of the Chief Information Officer of Canada supports the Treasury Board’s mandate by:

- developing policies and strategic direction on digital transformation, service delivery, security, information management and information technology in the public service

- providing analysis and advice on Treasury Board submissions, including on the use of digital technology and issues related to privacy

- working with departments and agencies to improve their digital service capacity, support the use of digital approaches in government operations and develop tools and resources to meet users’ needs

- leading the Government of Canada chief information officers’ community to advance the adoption of best practices for information management and digital and service delivery

Greening government

The Centre for Greening Government works to ensure that the Government of Canada leads by example in having government operations that are net-zero emissions, climate-resilient, and green. The Centre for Greening Government supports TBS’s mandate by:

- providing strategic advice to other federal departments and agencies regarding net-zero, resilient and green operations

- tracking and publicly disclosing government environmental performance information, including greenhouse gas emissions reductions for federal operations

- administering the Greening Government Fund to reduce emissions and support projects that can be replicated within and across departments, including the new Low-Carbon Fuel Procurement Program

- working with Public Services and Procurement Canada on common procurement tools that incorporate greening criteria

Advancing the government agenda

Expenditure management

The Expenditure Management Sector (EMS) plays a central role in the planning and coordination of federal spending. EMS supports the Treasury Board by:

- ensuring that Parliament has oversight and approval of how money is spent following the funding decision

- providing transparency in expenditures to Parliament and Canadians

EMS is also responsible for refining and strengthening the Quality of Life Framework and advancing its implementation across government.

Program sectors

Program sectors are the interface with departments preparing proposals for the Treasury Board. There are four program sectors:

- Government Operations

- Social and Cultural

- Economic

- International Affairs, Security and Justice

Program sectors support the Treasury Board by:

- reviewing Memoranda to Cabinet and Treasury Board submissions from federal organizations

- providing advice on and presenting proposals to Treasury Board Ministers

- providing advice, guidance and support to federal organizations in their implementation and application of policies

Regulatory affairs

The Regulatory Affairs Sector (RAS) establishes policies and strategies to support the federal regulatory system by:

- supporting and coordinating efforts to foster regulatory cooperation with key domestic and international partners

- leading horizontal regulatory modernization efforts

- undertaking targeted regulatory reviews

RAS supports the Treasury Board in its role as a Committee of the Privy Council by:

- providing advice on and presenting regulatory submissions and non-appointment orders-in-council to Treasury Board Ministers

Enabling functions

Enabling functions support the internal operations of TBS. In some cases, they may also work with other organizations to advance the department’s mandate.

Strategic Communications and Ministerial Affairs

Responsible for departmental communications and government-wide communications policy direction, secretariat support for meetings of the Treasury Board, Cabinet and Parliamentary Affairs, departmental Access to Information and Privacy, and correspondence.

Human Resources

Responsible for providing strategic human resources advice, guidance and services to TBS’s senior leaders, managers and supervisors, and employees.

Corporate Services and Chief Financial Officer

Provides support to the Secretary of the Treasury Board in financial management, security, information management and technology, facilities and materiel management, and Phoenix-related damages claims processing.

Internal Audit and Evaluation

Provides independent, neutral and objective assurance and evaluation services to support the departmental mandate and priorities.

Priorities and Planning

Provides policy capacity, coordination and integration to advance priorities of the President, Secretary and TBS deputy ministers. Priorities and Planning also supports the department in corporate governance, public reporting and liaison with external stakeholders.

Departmental Legal Services

Provides legal advice to the Treasury Board and TBS.

Please see Annex B for the TBS organization chart and Annex C for biographies of TBS deputy ministers.

Key partners and stakeholders

Key interlocutors

| Name | Contact information |

|---|---|

Bill Matthews |

Bill.Matthews@tbs-sct.gc.ca |

Dominique Blanchard |

Dominique.Blanchard@tbs‑sct.gc.ca |

Additional TBS deputy ministers

| Name | Contact information |

|---|---|

Jacqueline Bogden |

Jacqueline.Bogden@tbs‑sct.gc.ca |

Francis Trudel |

Francis.Trudel@tbs‑sct.gc.ca |

Dominic Rochon |

Dominic.Rochon@tbs‑sct.gc.ca |

Annie Boudreau |

Annie.Boudreau@tbs‑sct.gc.ca |

Canada School of Public Service

| Name | Contact information |

|---|---|

Taki Sarantakis |

373 Sussex Dr |

Agents and officers of Parliament

| Name | Contact information |

|---|---|

Nancy Bélanger |

410 Laurier Ave W, 8th floor |

Harriet Solloway |

60 Queen St, 4th Floor |

Raymond Théberge |

30 Victoria St |

The Honourable Konrad W. von Finckenstein, C.M., K.C. |

66 Slater St, 22nd Floor |

Karen Hogan |

240 Sparks St |

Yves Giroux |

900-99 Bank St |

Philippe Dufresne |

30 Victoria St |

Caroline Maynard |

30 Victoria St |

People management

| Name | Contact information |

|---|---|

Sharon DeSousa |

233 Gilmour St |

Sean O’Reilly |

250 Tremblay Rd |

Nathan Prier |

1800-350 Albert St |

Brian Sauvé |

220 Laurier Ave W |

Rob Hawkins |

193 Richmond Rd |

Roy Goodall |

865 Shefford Rd |

Deborah Orida |

135 Laurier Ave W |

Stephanie Cadieux |

|

Deborah Lyons |

125 Sussex Dr |

Amira Elghawaby |

amira.elghawaby@pch.gc.ca |

Privy Council Office contacts

| Name | Contact information |

|---|---|

John Hannaford |

80 Wellington St |

Christiane Fox |

80 Wellington Street |

Working Group on Public Service Productivity

| Name | Contact information |

|---|---|

Wendy Carroll |

|

Laura Dawson |

|

Shingai Manjengwa |

|

Benoît Robidoux |

|

Trevor Tombe |

|

Neil Yeates |

[redacted] |

Key Files, Treasury Board Business and High-Visibility Communications Items

-

In this section

Immediate key TBS files

Financial management

- Main Estimates, business of supply, and departmental plans

- Special warrants

- Spending reviews

Economic response

- Red tape reduction and regulatory reform

- Regulatory cooperation / Mutual recognition

- Procurement spending as an economic lever

[redacted]

People management

- Public service workforce

- Non-permitted pension surplus

- Collective bargaining [redacted]

- Tabling of official languages regulations

Digital and technology

- Implementation plan for the artificial intelligence strategy for the public service

Implementing the government’s agenda

- Procurement reform

- Treasury Board oversight and enablement (for example, Treasury Board approvals)

[redacted]

High-visibility communications issues

- Size of the public service

- Workforce adjustment

- Thompson class action (Litigation brought by Black employees)

- Hybrid work model

- Productivity in the public service

- Government spending and use of professional services

- Government transparency and access to information

- Government of Canada cyber security and privacy incident management

Annexes

Annex A: responsibilities and authorities of the Treasury Board and the President

Treasury Board

The Treasury Board consists of the President of the Treasury Board (the President), the Minister of Finance and four other members of the King’s Privy Council for Canada that are designated as members by an order in council. The composition of the Treasury Board is set out in the Financial Administration Act, which also provides for the appointment of alternates who can serve in the place of members. The Treasury Board’s quorum is three members (including alternates).

The Treasury Board exercises authority over a range of issues, and its role can generally be classified into powers of supervision, recommendation, decision, approval, reporting and regulation-making. While the primary statute setting out the role of the Treasury Board is the Financial Administration Act, there are over 20 other statutes that also establish its roles and authorities. The Treasury Board’s powers and responsibilities are also set out in regulations, orders-in-council, policies, guidelines and practices.

Treasury Board (Governor in Council)

Since December 2003, the members of the Treasury Board have also been asked to serve as members of the Committee of the Privy Council advising the Governor in Council. This role is often referred to as “Treasury Board, Part B.” The principal role of Treasury Board, Part B, is to provide regulatory oversight, reviewing and approving most regulations and orders-in-council.

When advising the Governor in Council, the quorum for Treasury Board, Part B is four members. The composition of the Treasury Board, Part B, is not specified by the Financial Administration Act. In the absence of a sufficient number of Treasury Board members, other Cabinet ministers may be invited to participate.

President of the Treasury Board

Responsibilities and key accountabilities

The responsibilities assigned to the President as Chair of the Treasury Board are implicitly inseparable from the Treasury Board’s mandate: the management, expenditure and employer responsibilities that fall to the Treasury Board are also the President’s own responsibilities and form the basis for their key accountabilities.

Specific responsibilities assigned directly to the President include:

- coordinating the activities of the Secretary of the Treasury Board, Comptroller General, Chief Human Resources Officer and the Chief Information Officer of Canada and delegating responsibility to the Secretary or other officials accordingly

- recommending external members of Departmental Audit Committees

- establishing the form and tabling of the Public Accounts

- publishing a consolidated quarterly report on Crown corporations

- receiving and tabling a wide range of reports under legislation or Treasury Board policies

The Treasury Board may delegate to the President (in addition to other officials) any of the powers or functions it is authorized to exercise under any Act of Parliament or by any order made by the Governor in Council. The Treasury Board may make the delegation subject to terms and conditions it considers appropriate. In turn, the Financial Administration Act provides that such delegated powers can be further delegated. Any sub-delegation is subject to the terms and conditions of the original delegation.

Other statutes assign specific authorities to either the President or the Treasury Board. For example, the President has the authority to:

- establish policies with respect to the administration of the Access to Information Act and the Privacy Act

- coordinate the implementation of the Official Languages Act

- administer components of the Public Servants Disclosure Protection Act

The Treasury Board’s authority to act as the Employer for the core public administration is established under various statutes. As the Chair of the Treasury Board, the President supports the Treasury Board’s employer responsibilities. Legislation gives the Treasury Board the authority to:

- engage in collective bargaining under the Federal Public Sector Labour Relations Act

- make rules respecting deployments, probation and promotion under the Public Service Employment Act

- set pay levels for Canadian Armed Forces members under the National Defence Act

Legislative portfolio

The President maintains overall responsibility for the statutes within their legislative portfolio. Should the government decide to amend these statutes, the President would be responsible for sponsoring any bills introduced in the House of Commons and tabling any required Government Response. The appendix contains a list of statutes that fall under the President’s legislative portfolio.

Ministerial portfolio

The President is the minister responsible for the Treasury Board of Canada Secretariat and the Canada School of Public Service. The Canada School of Public Service provides a common, standardized curriculum to support the learning and development of public servants.

Operating at arm’s length and reporting to Parliament through the President of the Treasury Board are the Public Sector Pension Investment Board, the Office of the Commissioner of Lobbying of Canada and the Office of the Public Sector Integrity Commissioner of Canada.

The President’s ministerial portfolio is subject to change based on ministerial or machinery decisions by a new government.

Treasury Board of Canada Secretariat

TBS was established as a department in 1966 as the administrative arm of the Treasury Board. It supports the Treasury Board by making recommendations and providing advice on program spending, regulations, and management policies and directives, while respecting the primary responsibility of deputy heads in managing their organizations and in their roles as accounting officers before Parliament. In this way, TBS helps to strengthen government performance, results and reporting and supports good governance and sound stewardship.

The business lines of TBS are expressed through its Departmental Results Framework, which sets out the following core responsibilities for the organization:

- spending oversight

- administrative leadership

- employer

- regulatory oversight

- internal services

The Departmental Results Framework also focuses on the results the department is aiming to achieve in these core areas, as well as how progress will be assessed. This information helps support TBS’s reporting to Parliament through its Departmental Plan and Departmental Results Report. The Departmental Plan, tabled in the spring, describes what TBS will do over the next three years to achieve results for Canadians and the resources that are required to do so. The Departmental Results Report, tabled in the fall, describes TBS’s actual performance and the resources it used during the previous fiscal year.

The Secretary of the Treasury Board

The Secretary of the Treasury Board is the deputy head of TBS. The Secretary is appointed by the Governor in Council.

Subsection 12(1) of the Financial Administration Act sets out the powers assigned to deputy heads in the core public administration, which include, among others:

- determining the learning, training and development requirements of public service employees

- establishing standards of discipline and setting penalties (including termination of employment, suspension, demotion or financial penalties)

- providing for the termination of employment or demotion of public service employees for disciplinary reasons, unsatisfactory performance or other non-disciplinary reasons

The Secretary is an accounting officer pursuant to sections 16.1 through 16.4 of the Financial Administration Act, as are all other deputy heads and chief executive officers. Accounting officers are senior officials that can be called to testify before a parliamentary committee regarding the management of their department and the performance of their duties.

Under section 16.5 of the Financial Administration Act, the Secretary has a role in providing guidance on the interpretation of policies, directives or standards issued by the Treasury Board in disputes between deputy heads (as accounting officers) and ministers.

Although the Secretary oversees TBS, three other senior officials within the department, established under the Financial Administration Act and appointed by order in council, have specific government-wide leadership responsibilities:

- The Comptroller General of Canada provides leadership, direction and oversight of financial management, internal audit, and investment management.

- The Chief Human Resources Officer:

- provides leadership on people management through policies, programs and strategic engagements

- centrally manages labour relations, compensation, pensions and benefits

- contributes to the management of executives

- The Chief Information Officer of Canada provides leadership, direction and oversight of information management, information technology, government security, access to information, privacy and internal and external service delivery.

The Treasury Board may delegate to the Secretary any of the powers or functions it is authorized to exercise under any Act of Parliament or by any order made by the Governor in Council (section 6(4) of the Financial Administration Act). The Treasury Board may also delegate some of its powers to the three other senior officials listed above, in addition to other officials (sections 6(4), (4.1) and (4.11) of the Financial Administration Act). Such delegated powers can be further delegated. Any sub-delegation is subject to the terms and conditions of the original delegation (section 6(6) of the Financial Administration Act).

Overview of the legislative mandate of the Treasury Board and the President

The Financial Administration Act is the primary statute that outlines the role of the Treasury Board and the President. Other federal laws also contain provisions that implicate the Treasury Board and the President.

Financial management and administrative policy

1. General

The Financial Administration Act provides that the Treasury Board may act for the King’s Privy Council for Canada in specified areas, including general administrative policy in the federal public administration, the organization of the federal public administration, financial management, and the review of departmental spending plans and programs. The Act also provides for various powers of delegation.

The Financial Administration Act also provides important rules for the financial administration of the Government of Canada, the establishment and maintenance of the accounts of Canada and the control of Crown corporations. A variety of other statutes also grant authorities to the Treasury Board on financial matters such as presenting financial statements to the Auditor General for audit and approving rates of remuneration, travel expenses and other allowances.

The appropriation acts implement the Main Estimates and Supplementary Estimates. They are approved by the Treasury Board and tabled in the House of Commons by the President.

2. Management of assets

The Federal Real Property and Federal Immovables Act provides for the authorization and regulation of the acquisition, administration, and disposition of real property by or on behalf of the Crown. Under that Act, the Treasury Board is given authority to establish financial or other limits, restrictions or requirements respecting any real property transaction or class of transactions. Policies have been adopted ensuring proper stewardship of Crown property and maximization of value for any property acquired or disposed. Although the Act has delegated full authority to ministers to complete most transactions, certain transactions are subject to Cabinet approval (Governor in Council) on the recommendation of the Treasury Board. The President acts as the minister responsible for this Act.

3. Access to information and privacy

The Access to Information Act provides a right of access to records under the control of government institutions, requires a range of institutions to proactively publish specified information, and establishes the Office of the Information Commissioner. The President is one of the ministers designated by the Governor in Council for the purposes of the Act. As such, the President is responsible for:

- initiating a review of the Act every five years

- providing direction and guidance (for example, through administrative policies) to government institutions regarding the operation of the Act and for reviewing the management of records under the control of government institutions to ensure compliance with the Act

- publishing the following annually

- a list containing the names of government institutions, their responsibilities and the classes of records kept by them

- a summary report of statistics on institutional compliance with the Act

The Privacy Act establishes rules to protect personal information held by government institutions, provides individuals with a right to access and correct their personal information that is held by government institutions, and establishes the Office of the Privacy Commissioner. The President is the minister designated by the Governor in Council for the purposes of certain provisions of the Act. As such, the President is responsible for:

- providing direction and guidance (for example, through administrative policies) to government institutions regarding the operation of the Act

- reviewing the use of personal information banks and for reviewing the management of such banks to ensure compliance with the Act

- publishing annually an index of:

- personal information banks, including the names of government institutions controlling the banks and the purposes for which the personal information was collected

- classes of personal information that are not contained in personal information banks

4. Official languages

The President is responsible for exercising leadership within the Government of Canada in relation to the implementation of the Official Languages Act and, in consultation with the other ministers of the Crown, for coordinating the implementation of the Act and ensuring good governance of the Act.

The Treasury Board is responsible for the general direction and coordination of the policies and programs relating to the implementation of Part IV (Communications with and Services to the Public), Part V (Language of Work) and Part VI (Participation of English-Speaking and French-Speaking Canadians), subsection 41(5) (Positive Measures) and paragraph 41(7)(a.1) (Inclusion of linguistic clauses in agreements with provincial or territorial governments) of the Official Languages Act within all federal institutions except:

- the Senate

- the House of Commons

- the Library of Parliament

- the Office of the Senate Ethics Officer

- the Office of the Conflict of Interest and Ethics Commissioner

- the Parliamentary Protective Service

- the Office of the Parliamentary Budget Officer

The President must submit an annual report to Parliament concerning the implementation of these programs. The President may also be designated by the Governor in Council to undertake public consultations on proposed regulations.

The Act was amended and received royal assent on June 20, 2023.

These amendments strengthen the roles and responsibilities of the Treasury Board and its President:

- the President of the Treasury Board is now the Minister responsible for providing leadership within the Government of Canada in regard to the implementation, coordination and good governance of the Act

- Treasury Board is now required to monitor and verify compliance with official languages policies, directives and regulations

- Treasury Board is required to evaluate the effectiveness and efficiency of federal policies and programs relating to official languages

Treasury Board’s functions have also been expanded to include monitoring the compliance of measures taken by federal institutions to implement commitments made under Part VII of the Act.

5. Auditor General

The Auditor General Act establishes the position of Auditor General, who is responsible for verifying the accuracy of the government’s financial statements and providing Parliament with independent information, assurance and advice regarding the stewardship of public funds. With respect to the Auditor General, the President:

- Tables the Public Accounts of Canada in the fall, which contain the Auditor General’s opinion on the government’s financial statements. The Auditor General also issues a Commentary on the Financial Audits, which includes the observations from the financial statement audit.

- Contributes to the Government of Canada’s public response to performance audits conducted by the Auditor General, which determine whether the government is appropriately managing its activities and resources. The findings of performance audits are summarized in the Auditor General’s reports, which are generally tabled in Parliament twice per year (spring and fall). Prior to tabling, the Auditor General typically offers to meet with the President to provide an overview of the audits implicating TBS. The President leads the briefing of Cabinet on the findings of the Auditor General’s performance audits and, with the implicated ministers, discusses communications strategies. If an audit implicates TBS, the President will also issue a specific response relating to its findings.

- Receives copies of the Auditor General’s special examinations, which determine whether Crown corporations are managed efficiently and effectively, and whether their assets are reasonably safeguarded. Special examinations must be conducted at least once every 10 years for each Crown corporation, and the results are generally tabled in Parliament annually as part of the Auditor General’s spring reports.

6. Red tape reduction

The Red Tape Reduction Act provides that the President may establish policies or issue directives respecting the way the One-for-One Rule is applied. The One-for-One Rule requires federal government regulators to offset the cost increases of administrative burdens on businesses and remove one regulation for every new regulation added that imposes an administrative burden. The President is also responsible for publishing a report each year. The regulations provide that the Treasury Board may exempt a regulation from the One-for-One Rule in certain circumstances.

7. Service Fees Act

The Service Fees Act requires responsible authorities, before certain fees are fixed, to develop fee proposals for consultation and to table them in Parliament. It also requires that performance standards and procedures for refunding certain fees be established in accordance with Treasury Board policies or directives. It adjusts certain fees on an annual basis in accordance with the Consumer Price Index. Furthermore, it requires responsible authorities to table a report on their fees in Parliament in accordance with Treasury Board policies and directives. Finally, the President is required to publish a report that consolidates the information set out in the reports tabled in Parliament.

Human resources management

1. General

The Treasury Board acts as the Employer for the core public administration and, as such, the Financial Administration Act gives it general responsibility for the organization of the public service and personnel management within the public administration, including the determination of the terms and conditions of employment of persons employed in it. It further allows the Treasury Board to delegate to the Chief Human Resource Officer any of its powers and functions – other than its power to make regulations – in relation to human resources management, official languages, employment equity, values and ethics and its authorities under the Public Service Employment Act.

The Financial Administration Act also provides direct authority for certain aspects of personnel management in the hands of deputy heads, subject to policies and directives of the Treasury Board. Deputy head responsibilities include determining learning and developmental requirements, providing for awards and setting standards of discipline and imposing penalties (up to and including termination) and the termination or demotion of employees for unsatisfactory performance or other non-disciplinary reasons.

2. Staffing

The Public Service Employment Act provides for the appointment of public servants in the public service and other related matters.

Under the Act, staffing in the public service is based on the core values of merit, excellence, non-partisanship, representativeness and the ability to serve members of the public with integrity in the official language of their choice. The Act defines merit, assigns certain functions directly to the employer and creates arrangements for staffing recourse. The Public Service Commission of Canada has the authority to make appointments, and this authority can be delegated to deputy heads. The Commission can also conduct investigations and audits on matters within its jurisdiction.

The Federal Public Sector Labour Relations and Employment Board is responsible for the resolution of staffing complaints related to internal appointments and layoffs in the federal public service.

3. Labour relations

The Federal Public Sector Labour Relations Act establishes a labour relations regime within the public service, provides for the negotiation of collective agreements with unions representing public servants and establishes a grievance process for public servants. The Act provides for a labour relations regime based on cooperation and consultation between the employer and bargaining agents, notably by requiring labour-management consultation committees, enabling co-development of workplace improvements and enhancing collaboration. The Act also establishes an essential services regime whereby, although the employer determines the level at which services are to be provided during a strike, an essential services agreement must be entered between the employer and the bargaining agent prior to the bargaining agent being in a strike position. The Act provides for the establishment of informal conflict resolution system within departments and for comprehensive grievance resolution provisions.

The Federal Public Sector Labour Relations Act was amended in 2017 to include a new collective bargaining and labour relations regime for the Royal Canadian Mounted Police.

The Federal Public Sector Labour Relations and Employment Board is responsible for administering the collective bargaining and grievance adjudication systems in the federal public service.

4. Employment equity

The Employment Equity Act aims to ensure that members of designated groups (women, Aboriginal peoples, persons with disabilities, and members of visible minorities) are equitably represented in both the federal public service and the federally regulated private sector (which includes airlines, interprovincial rail, ship or ferry operations, radio broadcasting stations and banks). While the Minister of Labour is the responsible minister, the Act specifies that the Treasury Board and the Public Service Commission of Canada are responsible for carrying out obligations in the Act, as employer. Moreover, the Treasury Board plays an important role in the implementation of the Act for the Canadian Armed Forces, the Royal Canadian Mounted Police and the Canadian Security Intelligence Service. The President is responsible for tabling in Parliament an annual report on the state of employment equity in the public service.

5. Disclosure of wrongdoing and reprisal protection

The Public Servants Disclosure Protection Act establishes a regime to enable public servants to make disclosures of information that they believe could show that a wrongdoing has occurred in relation to the public sector. The regime includes access to the Public Sector Integrity Commissioner. The Act also provides protection from reprisal to public servants who have made a protected disclosure or have cooperated in an investigation into a disclosure under the Act.

The Treasury Board, as required by the Act, has created a code of conduct for the public sector. The Treasury Board is also responsible for approving the procedures for handling disclosures that must be set up by certain public sector organizations that are excluded from the Act (the Canadian Armed Forces, the Canadian Security Intelligence Service and Communications Security Establishment Canada).

Under the Act, the President is responsible for:

- promoting ethical practices in the public sector, fostering a positive environment for making disclosures of wrongdoing by disseminating information about the Act, its purposes and its processes

- tabling annually in each House of Parliament a report prepared by the Chief Human Resources Officer that provides an overview of activities regarding certain disclosures made under the Act

6. Health and safety

Part II of the Canada Labour Code creates a regime of requirements and recourse to prevent work-related accidents and illness that is applicable to employers and employees subject to federal jurisdiction. The Treasury Board is currently the largest employer subject to Part II of the Code. The Treasury Board is also subject to Part IV of the Code, which establishes an administrative monetary penalty regime for violations of Part II of the Code.

7. Pensions

The Treasury Board and the President have responsibilities in relation to a number of legislated pension plans.

The President is the responsible minister for:

- the Public Service Superannuation Act, which provides pension benefits to public service employees and their survivors; it is compulsory for all members of the public service (including some Crown agencies and Crown corporations) and provides a defined benefit plan based on years of pensionable service and salary

- the Members of Parliament Retiring Allowances Act, which provides pension benefits to Senators and Members of the House of Commons and their survivors

- the Diplomatic Service (Special) Superannuation Act, an Act to provide superannuation benefits for senior appointees of the Department of Foreign Affairs, Trade and Development serving outside of Canada

- certain sections of the Public Pensions Reporting Act, which require the Chief Actuary to conduct actuarial reviews and issue valuation reports in respect of prescribed pension plans

- the Public Service Pension Adjustment Act, which provides a framework to adjust for persons in receipt of more than one public service pension

- the Special Retirement Arrangements Act, which authorizes the establishment of retirement compensation arrangements

- the Supplementary Retirement Benefits Act, which provides for pension indexing

- the Public Sector Pension Investment Board Act, which establishes the Public Sector Pension Investment Board; since March 31, 2000, contributions made by the government and employees are invested in securities markets under the Public Service Superannuation Act, the Royal Canadian Mounted Police Superannuation Act andthe Canadian Forces Superannuation Act plans

The Canadian Forces Superannuation Act, Defence Services Pension Continuation Act, Royal Canadian Mounted Police Superannuation Act and the Royal Canadian Mounted Police Pension Continuation Act provide pension benefits to all Canadian Armed Forces personnel, to members of the Royal Canadian Mounted Police and their survivors, and to retired officers of the military or Royal Canadian Mounted Police who were part of the old Defence Services Pension Act and Royal Canadian Mounted Police Act and their survivors. The Minister of National Defence and the Minister of Public Safety and Emergency Preparedness are responsible for each of their respective plans. However, the President is accountable to Parliament for funding and financial policies for these plans and thus has a shared responsibility.

8. Pay equity

The Pay Equity Act came into force on August 31, 2021. The Act creates a proactive pay equity regime that applies to the federal public service as well as to federally regulated businesses in Canada. The Act requires employers to establish and maintain a pay equity plan and to identify and correct differences in compensation between predominantly male and predominantly female job classes where the work performed is of equal value. Under the Act, the Treasury Board of Canada is the employer for the core public administration, the Canadian Armed Forces and the Royal Canadian Mounted Police and will be responsible for developing and maintaining the pay equity plans for these workplaces. TBS may be called on to provide guidance to separate agencies in the establishment of their plans.

Government ethics and lobbying

1. Conflict of Interest Act

The Conflict of Interest Act establishes ethical rules for public office holders to protect the integrity of government decision-making. The Conflict of Interest and Ethics Commissioner administers the Act by reviewing confidential reports submitted to their Office, investigating possible contraventions of the Act and tabling reports to Parliament. Although the Act does not assign any specific legislative responsibilities to the President, the Act falls under the President’s legislative portfolio.

2. Lobbying Act

The Lobbying Act establishes the Office of the Commissioner of Lobbying and provides for the appointment of the Commissioner of Lobbying. The Commissioner of Lobbying is mandated to establish and maintain the registry of lobbyists, which includes information about all registered lobbyists as well as their activities. Although the Act does not assign any specific legislative responsibilities to the President, the Act falls under the President’s legislative portfolio.

Appendix: statutes for which the President is named as responsible minister

- Access to Information Act (note: the President’s responsibility is shared with the Minister of Justice)

- Alternative Fuels Act

- Auditor General Act

- Canada School of Public Service Act

- Conflict of Interest Act

- Diplomatic Service (Special) Superannuation Act

- Federal Real Property and Federal Immovables Act

- Government Services Act, 1999

- Government Services Resumption Act

- Lieutenant Governors Superannuation Act

- Lobbying Act

- Members of Parliament Retiring Allowances Act

- Privacy Act (note: the President’s responsibility is shared with the Minister of Justice)

- Public Pensions Reporting Act (note: the President’s responsibility is shared with the Minister of Employment and Social Development)

- Public Sector Compensation Act

- Public Sector Pension Investment Board Act

- Public Servants Disclosure Protection Act

- Public Service Employment Act (note: the President’s responsibility is shared with the President of the King’s Privy Council for Canada and the Minister of Canadian Heritage)

- Public Service Pension Adjustment Act

- Public Service Superannuation Act

- Red Tape Reduction Act

- Special Retirement Arrangements Act

- Supplementary Retirement Benefits Act

Annex B: Treasury Board of Canada Secretariat organization chart

President of the Treasury Board

Associate Secretary

Dominique Blanchard

Secretary of the Treasury Board

Bill Matthews

Chief of Staff

Riley Hennessey

Program sectors

International Affairs, Security and Justice

Jen O’Donoughue

Social and Cultural

David Peckham

Government Operations

Heather Sheehy

Economic

Anuradha Marisetti

Policy sectors

Expenditure Management

Antoine Brunelle-Côté

Regulatory Affairs

Michael DeJong

Centre for Greening Government

Nick Xenos

Enabling functions

Priorities and Planning

Brian Gear

Strategic Communications and Ministerial Affairs

James Stott

Corporate Services

Annie Boyer

Human Resources

Marie-Pierre Jackson

Internal Audit and Evaluation

Elena Petrus (acting)

Office of the Chief Human Resources Officer

Chief Human Resources Officer

Jacqueline Bogden

Associate Chief Human Resources Officer

Francis Trudel

Strategic Directions

Michèle Kingsley

Digital Solutions

Pankaj Sehgal

People and Culture

Vidya ShankarNarayan

Employee Relations

Carole Bidal

Total Compensation

David Prest

Office of the Comptroller General

Comptroller General

Annie Boudreau

Financial Management

Martin Krumins

Internal Audit

Sheri Ostridge

Investment Management

Samantha Tattersall

Financial Management Transformation

Lynn Gibault

Office of the Chief Information Officer

Chief Information Officer of Canada

Dominic Rochon

Chief Technology Officer

Luc Gagnon

Chief Data Officer, Data and Digital Policy

Stephen Burt

Security Policy Modernization

Mike MacDonald

Digital Talent and Leadership

Len Bastien

Chief Information Security Officer

Po Tea-Duncan

Office of Public Service Accessibility

Assistant Deputy Minister

Alfred MacLeod

Department of Justice Canada

Legal Services

Carol McLean

Annex C: The Treasury Board of Canada Secretariat’s deputy ministers and heads of portfolio organizations

Treasury Board of Canada Secretariat Deputy Ministers

Bill Matthews, Secretary of the Treasury Board

On May 24, 2024, the Prime Minister announced the appointment of Bill Matthews to the position of Secretary of the Treasury Board.

Prior to his most recent appointment, Mr. Matthews held the position of Deputy Minister of National Defence between January 2022 and June 2024, Deputy Minister of Public Services and Procurement between January 2019 and January 2022, Senior Associate Deputy Minister of National Defence between October 2017 and January 2019, and served as the Comptroller General of Canada between July 2014 and October 2017.

Bill has also held various senior-level positions within the Office of the Comptroller General and the Treasury Board of Canada Secretariat with responsibilities in the areas of financial management policy, estimates, evaluation, and expenditure management.

Bill is a chartered professional accountant and was named a Fellow by the Chartered Professional Accountants in October 2016. He holds a bachelor of commerce from Dalhousie University.

Dominique Blanchard, Associate Secretary of the Treasury Board

Dominique Blanchard was appointed Associate Secretary of the Treasury Board in July 2022.

Dominique arrived from the Privy Council Office, where she had been Assistant Secretary to the Cabinet, COVID-19 Coordination since March 2020. She was previously Assistant Deputy Minister at Environment and Climate Change Canada from 2017 to 2020. Prior to that, Dominique served in various executive positions since 2008, including at Agriculture and Agri-Food Canada, Transport Canada, and the Privy Council Office.

Dominique holds a Bachelor of Arts degree in Economics from Brandon University.

Jacqueline Bogden, Chief Human Resources Officer

Education: Bachelor of Arts, University of Ottawa

Professional experience

- Since February 2023: Chief Human Resources Officer, Treasury Board of Canada Secretariat

- 2022–23: Deputy Secretary to the Cabinet (Emergency Preparedness and COVID Recovery), Privy Council Office

- 2019–22: Assistant Deputy Minister, Controlled Substances and Cannabis Branch, Health Canada

- 2020: Assistant Deputy Minister, COVID-19 Task Force, Health Canada

- 2016–19: Assistant Deputy Minister, Cannabis Legalization and Regulation Branch, Health Canada

- 2013–16: Vice-President, Audit and Data Services Branch, Public Service Commission of Canada

- 2012–13: Director General, Delegation and Accountability, Policy Branch, Public Service Commission of Canada

- 2010–12: Executive Director, Equitable Compensation, Compensation and Labour Relations Sector, Treasury Board of Canada Secretariat

- 2007–10: Director General, Strategic Communications, Communications and Consultations Secretariat, Privy Council Office

- 2006–07: Director General, Operations, Communications and Consultations Secretariat, Privy Council Office

- 2004–06: Director, Regional Communications, Communications and Consultations Secretariat, Privy Council Office

Francis Trudel, Associate Chief Human Resources Officer

Francis Trudel is the Associate Chief Human Resources Officer at the Treasury Board Secretariat, a position he has held since being appointed in October 2022.

Francis joined the federal public service in January 1998 as a special projects officer at the Department of National Defence (DND). In 2006, he was appointed as Director of the Office of Human Resources Business Transformation at DND.

In 2007, Francis joined Global Affairs Canada as Director General of Planning and Operations. At the request of the Associate Deputy Minister, he led a departmental task force on risk analysis on financial management and human resources.

From 2010 to 2012, Francis served as the Ambassador of Canada to the Eastern Republic of Uruguay.

In 2014, Francis was appointed as Assistant Deputy Minister of Human Resources at Global Affairs, where he played an active role in the overall HR agenda of the public service, including serving as an elected member of the HR Council for many years.

Francis holds a master’s degree in industrial relations from the Université du Québec en Outaouais.

Annie Boudreau, Comptroller General

Annie Boudreau was appointed Comptroller General of Canada effective April 15, 2024.

As Comptroller General, she is responsible for government-wide direction and leadership for financial management, internal audit, investment planning, procurement, project management, and the management of real property and materiel. She also leads the initiative to modernize the delivery of financial management services across the Government of Canada.

Ms. Boudreau entered the public service in 2002. In 2006, she joined the Canada Revenue Agency, holding various executive positions in Financial Reporting, Internal Audit and Resource Management. Prior to being appointed Comptroller General, she was Assistant Secretary, Expenditure Management Sector, at the Treasury Board of Canada Secretariat. Before joining the Secretariat, she served as Chief Finances, Results and Delivery Officer at Crown-Indigenous Relations and Northern Affairs Canada, where she oversaw sound financial management and reporting functions for the organization, as well as led on corporate planning and risk management.

Ms. Boudreau is a Chartered Professional Accountant (CPA) and a Chartered Accountant (CA), and holds a Bachelor of Business Administration from Université Laval.

Dominic Rochon, Chief Information Officer

Dominic Rochon was appointed Deputy Minister at the Treasury Board of Canada Secretariat (TBS) and Chief Information Officer of Canada on February 12, 2024.

Before joining TBS, he was the Associate Deputy Minister at Transport Canada, following three years as the Senior Assistant Deputy Minister of National Security and Cybersecurity at Public Safety Canada. He has also held senior roles in central agencies, including the Privy Council Office and TBS, and with Communications Security Establishment Canada.

Dominic has extensive experience in strategic policy, strategic planning, strategic communications and in overseeing a range of operational issues within the Government of Canada.

Dominic received his B.A. (Honours) in Political Science, International Politics from the University of Ottawa. He is married with two children.

Heads of portfolio organizations

The President also has oversight responsibilities for four portfolio organizations, including responsibility for the legislation governing these bodies and tabling any amendments in Parliament.

Canada School of Public Service, departmental corporation

- Taki Sarantakis, President (reappointed July 2023)

- Provides training and learning for the federal public administration

- Reports to Parliament through the President of the Treasury Board

Commissioner of Lobbying of Canada, Agent of Parliament (arm’s length)

- Nancy Bélanger, Commissioner (Appointed December 2017; reappointed December 30, 2024)

- Establishes and maintains the Registry of Lobbyists, the Lobbyists’ Code of Conduct and conducts investigations

- Reports directly to Parliament on matters under the mandate

- Reports to Parliament through the President on accountability and budgetary matters

Public Sector Integrity Commissioner, Agent of Parliament (arm’s length)

- Harriet Solloway, Commissioner (appointed June 2023)

- Provides an independent mechanism for public servants to disclose potential wrongdoing in the workplace

- Reports directly to Parliament on matters under the mandate

- Reports to Parliament through the President on accountability and budgetary matters

Public Sector Pension Investment Board, Crown corporation (arm’s length)

- Deborah K. Orida, President and Chief Executive Officer (appointed September 2022)

- The Crown corporation is tasked with managing employer and employee contributions to public service pension plans

- Reports to Parliament through the President of the Treasury Board

Roles of the Treasury Board

-

In this section

The Treasury Board (TB) is a unique committee of Cabinet, both in its responsibilities and its format.

The Treasury Board of Canada Secretariat (TBS) is the department that supports the President of the Treasury Board and meetings of the Treasury Board.

Roles of the Treasury Board

It is the only Cabinet committee created in statute, with its mandate derived from the Financial Administrative Act. The Treasury Board has a number of key roles.

1. Expenditure manager

- Oversees government expenditure plans and stewardship of public funds (provides authorities for projects, contracts, funding)

- Prepares the Estimates before they are tabled in Parliament (Estimates are officially tabled in Parliament by the President of the Treasury Board)

2. Management board

- Sets rules on how government is managed (policies for managing people, finances, technology, procurement, real property, and other areas of public administration)

3. Employer

- Sets the policy framework for people management, oversees the collective bargaining and labour relations (total of approximately 280,000 employees, close to 250,000 represented or unionized, 28 collective agreements)

4. Regulatory oversight

- The Treasury Board has also been designated by the Prime Minister to serve the Governor in Council (for example, authorities to enter into international agreements, bring legislation into force or sell land) and regulations (for example, in such areas as food and drug safety, environmental protections, transportation safety)