Infographic – Maternity or parental leave – Phoenix impacts

Download the alternative format

(PDF format, 1 MB, 1 page)

Organization: Treasury Board of Canada Secretariat

Type: Infographic

Published: 2019-02-14

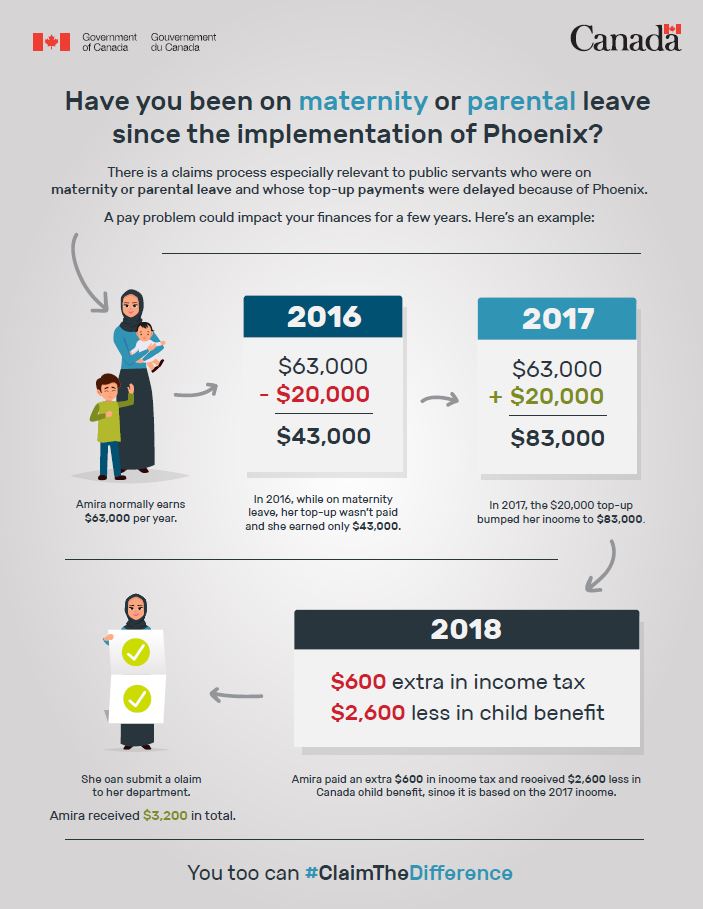

There is a claims process especially relevant to public servants who were on maternity or parental leave and whose top-up payments were delayed because of Phoenix.

A pay problem could impact your finances for a few years. Here’s an example:

- Amira normally earns $63,000 per year.

- In 2016, while on maternity leave, her top-up wasn’t paid and she earned only $43,000.

- In 2017, the $20,000 top-up bumped her income to $83,000.

- Amira paid an extra $600 in income tax and received $2,600 less in Canada child benefit, since it is based on the 2017 income.

- She can submit a claim to her department.

- Amira received $3,200 in total.

You too can #ClaimTheDifference

Learn how: Claim for impacts to income taxes and government benefits