Claim expenses and financial losses due to Phoenix: impacts to income taxes and government benefits

Claims for impacts to income taxes and government benefits

On this page

The Government of Canada is doing everything possible to ensure that no employee suffers financial losses because of Phoenix.

If you were owed salary from one year that was paid the following year (for example, salary owed from 2016 was paid in 2017), you might incur a financial loss related to:

- paying a higher rate of income tax

- reduced government benefits and credits, such as the Canada child benefit

Who can submit a claim

This claims process applies to all employees who experienced problems caused by the Phoenix pay system.

To submit a claim for impacts to income taxes and government benefits, you must meet all of the following requirements:

- You must be a current or former federal public servant (includes students and casual employees) whose pay is or was administered by the Phoenix pay system

- You were owed salary from one year that was paid the following year (for example, salary owed from 2016 was paid in 2017)

- The time taken to receive your outstanding salary exceeded normal service standards

This claims process applies to all employees who experienced problems caused by the Phoenix pay system. If you experienced greater financial impacts or missed investments opportunities, you may be eligible for compensation for damages under the Phoenix pay system damages agreement.

What is your situation?

- Did you or will you pay too much income tax because your pay issues put you in a higher income bracket?

- Were your government benefits and credits, such as the Canada child benefit or subsidized daycare, lower because, once the salary owed to you was paid out, your annual income was greater than usual?

If you have been on maternity or parental leave since the implementation of Phoenix, you might be eligible to file a claim.

You may be in a unique situation not described here. Our goal is to ensure that no one affected by Phoenix suffers financial losses.

If you have incurred a financial loss because of Phoenix, fill out a claim and provide as much information as you can. Our goal is to correct each situation and review each claim on a case-by-case basis.

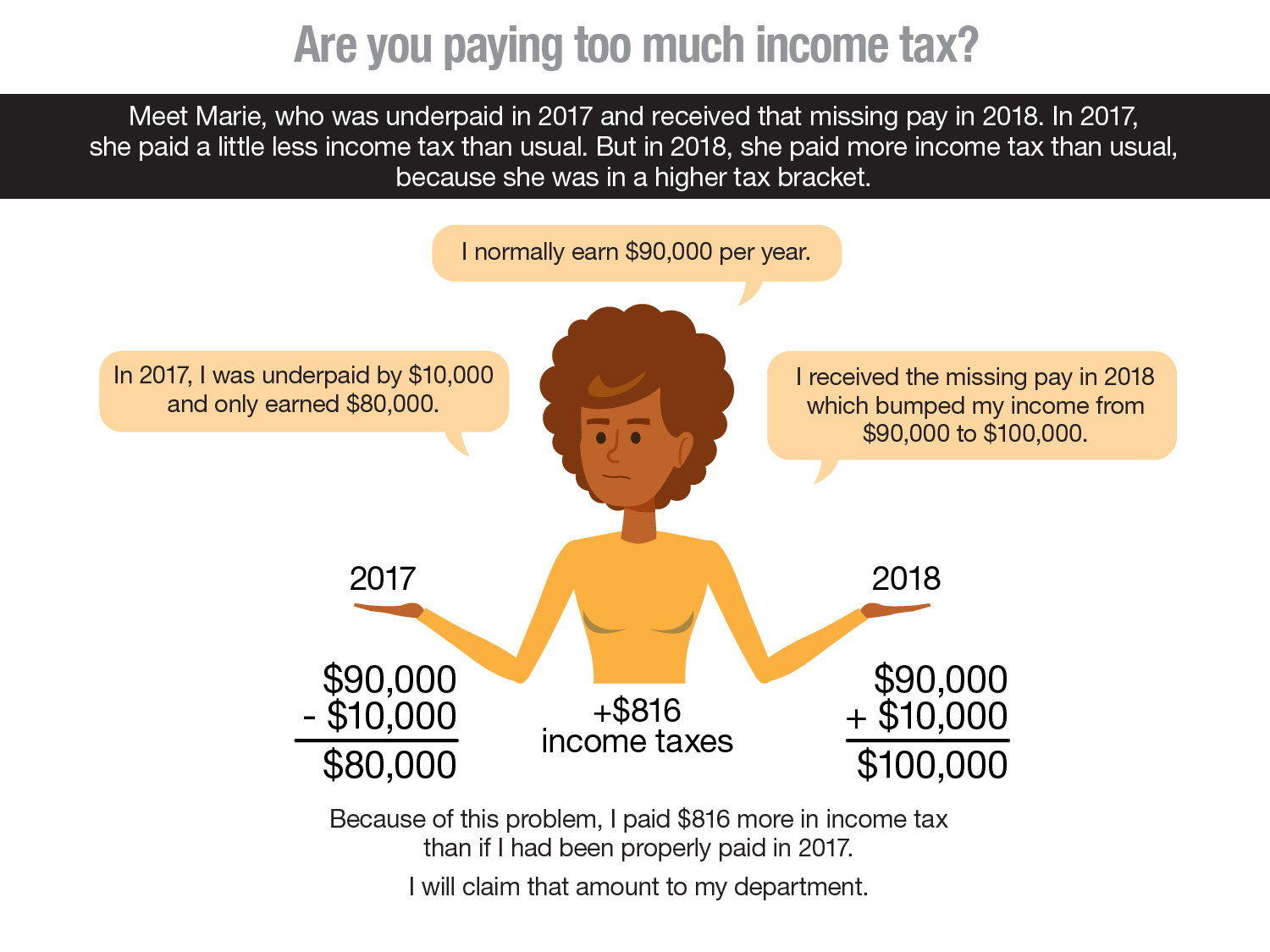

Paying too much income tax

Figure 1 - Text version

Meet Marie, who was underpaid in 2017 and received that missing pay in 2018. In 2017, she paid a little less income tax than usual. But in 2018, she paid more income tax than usual, because she was in a higher tax bracket.

- Marie normally earns $90,000 per year (she lives and works in Ontario)

- In 2017 she was underpaid by $10,000, earning a total of $80,000 that year

- She subsequently received the missing $10,000 in 2018, which bumped her income from $90,000 to $100,000

- Because of this pay problem, Marie paid $816 more in income taxes than if she had been properly paid and taxed in 2017

| In dollars $ | Normal (no Phoenix issues) | Actual (Phoenix issues) |

Difference | ||||

|---|---|---|---|---|---|---|---|

| 2017 | 2018 | Total | 2017 | 2018 | Total | ||

| Income | 90,000 | 90,000 | 180,000 | 80,000 | 100,000 | 180,000 | 0 |

| Income Taxes | -20,486 | -20,118 | -40,604 | -17,166 | -24,254 | -41,420 | 816 |

| After Tax Income | 69,514 | 69,882 | 139,396 | 62,834 | 75,746 | 138,580 | -816 |

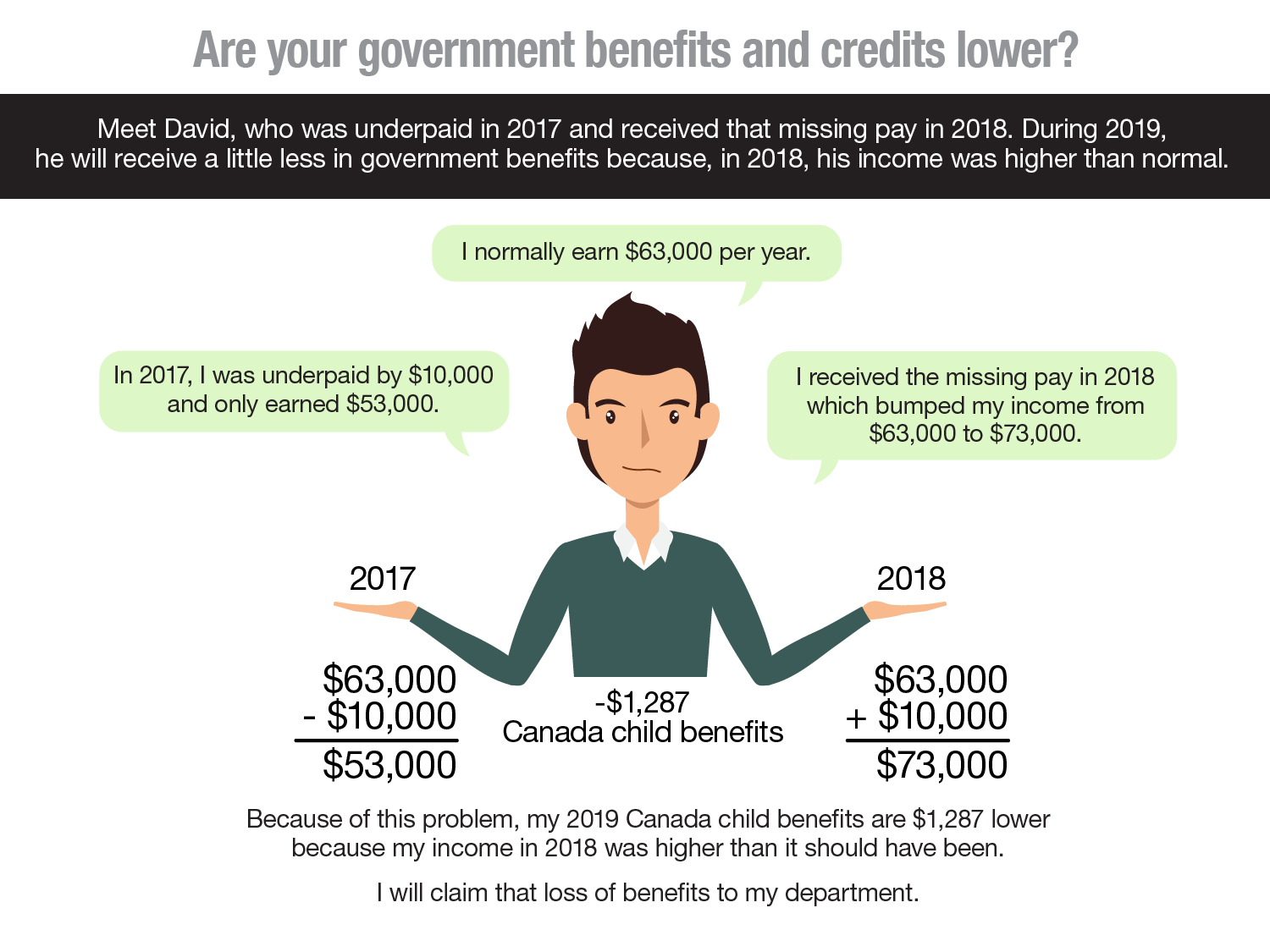

Entitlements to government benefits and credits

Your government benefits and credits, such as the Canada child benefit or subsidized daycare, may be lower because, once the salary owed to you was paid out, your annual income was greater than usual.

Figure 2 - Text version

Meet David, who was underpaid in 2017 and received that missing pay in 2018. During 2019, he will receive a little less in government benefits because, in 2018, his income was higher than normal.

- David normally earns $63,000 per year (he lives and works in Manitoba)

- In 2017 he was underpaid by $10,000, earning a total of $53,000 that year

- He subsequently received the missing $10,000 in 2018, which bumped his income from $63,000 to $73,000

- Because of this pay error, David received $1,287 less in social benefits as a result the higher-than-normal income in 2018

| Amount description | 2018 (normal) | 2018 (Phoenix) | Difference |

|---|---|---|---|

Table 1 Notes

|

|||

| Normal salary | $63,000 | $63,000 | $0 |

| 2017 underpayment | $0 | $10,000 | $10,000 |

| Revised income | $63,000 | $73,000 | $10,000 |

| Social benefits Return to table 1 note * | $13,860 | $12,573 | -$1,287 |

How to submit a claim

To submit a claim for impacts to your income tax

- you will need your notices of assessment from the Canada Revenue Agency and Revenu Québec (where appropriate) for all applicable years paid by Phoenix.

- Use form TBS‑SCT330323.pdf.

If your claim also covers impacts to your government benefits,

- you will need all pertinent federal, provincial or municipal government benefit statements for all applicable years paid by Phoenix.

- Use form TBS‑SCT330324.pdf.

Please note that claims for impacts to government benefits are taxable. If you receive a taxable payment through this claims process, the Treasury Board of Canada Secretariat (address: 90 Elgin, Ottawa, Ontario) will send you tax slips in February of the following year to submit with your income tax return.

Read the frequently asked questions carefully for more information on how to complete your claim.

Fill out the forms as best you can. Attach a separate document to your claim if you need to provide additional explanations.

If there is any missing information, we will follow up with you or your department.

Filing a claim will not impact your pay since claims are not processed through the Phoenix pay system.

Keep a copy for your records!

Privacy notice statement

Provision of the personal information requested in this form is collected under the authority of the Financial Administration Act and will be used for assessing your claim in accordance with the Directive on Payments. Refusal to provide the requested information may delay or prevent the processing of your claim.

The personal information you provide may be shared with the Treasury Board of Canada Secretariat’s Claims Office and with Public Services and Procurement Canada. Your personal information will be protected, used and disclosed in accordance with the Privacy Act and as described in Personal Information Bank PSU 931 (Accounts Payable). Your information may also be used or disclosed for financial reporting and program evaluation. The information will be retained for seven years following the last administrative action and then destroyed. Under the act, individuals have rights to request access to and correction of their personal information. If you wish to avail yourself of these rights or require clarification about this Privacy Notice Statement, please contact your organization’s Privacy Coordinator. If you are not satisfied with the response to your privacy concern, you may wish to communicate with the Office of the Privacy Commissioner by telephone at 1-800-282-1376.