Employment Insurance Monitoring and Assessment Report for the fiscal year beginning April 1, 2017 and ending March 31, 2018

Chapter 2 - 5 Employment Insurance work-sharing benefits

From: Employment and Social Development Canada

On this page

2.5. Employment Insurance Work-Sharing benefits

Work-Sharing is an adjustment program designed to help employees and employers avoid layoffs of all or a number of a firm’s employees when there is a temporary reduction in the normal level of the business activities that is beyond the control of the employer. Layoffs are avoided by offering temporary income support to all employees eligible for EI regular benefits who accept to work a temporary reduced work week while their employer recovers. The goal is for all participating employees to return to normal working hours by the end of the term of the Work-Sharing agreement.

For employers to qualify for Work-Sharing, they must be a publicly-held company, private business or non-profit organization experiencing temporary shortages of work and reductions in business activity that are beyond their control, and must be in operation year-round in Canada for at least two years. The employer must also employ a minimum of two EI-eligible employees within a work unit, and agreements must be signed by the employer, the affected employees and Service Canada. The employer must demonstrate a recent decrease in business activity of approximately 10% and submit and implement a recovery plan which demonstrates how the business will return to normal working hours by the end of the Work-Sharing agreement. Employers who are experiencing a reduced-level of business activity attributable to a predictable seasonal shortage or any other recurring production slowdown are not eligible to participate in the Work-Sharing program. Those who are involved in work stoppages from a labour dispute are also not eligible to participate.

To be eligible for Work-Sharing benefits, affected workers must be year-round permanent full-time or part-time employees who are required to carry out the everyday functions of normal business activityFootnote 75. They must be eligible to receive EI regular benefits; and must agree to a reduction of their normal working hours and share the available work over a specified period of time in order to participate in a Work-Sharing agreement.

By participating in the Work-Sharing program, employers are able to retain skilled employees, thus avoiding the costly process of recruiting and training new employees once the business activities return to normal level. At the same time, participating workers can maintain their employment and skills by supplementing the reduced wages with Work-Sharing benefits for the days they are not working.

Employer initiated skills enhancements, whether on-the-job training or off-site courses, may take place during the period of a Work-Sharing agreement. Depending on the cause of the work shortage, the employer’s recovery plan may include plans to initiate training activities for members of the Work-Sharing unit.

The salary costs of employees taking part in training activities during normal scheduled working hours/days cannot be compensated through the Work-Sharing agreement. Employer sponsored training could take place during the non-working days/hours for which the Work-Sharing unit employees are compensated through the Work-Sharing agreement (i.e. during hours/days missed due to participation in Work-Sharing), however attendance would be optional.

Example: Receiving Employment Insurance Work-Sharing benefits (illustrative example)

Samantha works as a full-time employee at an engineering firm in the Mining and oil and gas extraction industry in Edmonton, Alberta, and earns $40,000 per year (weekly earnings of $769). Due to the global downturn in commodity prices, the firm is experiencing a significant reduction in workload, and is considering laying off a quarter of its employees. The firm decides to enter into a Work-Sharing agreement with Service Canada. Under this Work-Sharing agreement, all eligible employees in Samantha’s work unit agree to reduce their work hours per week by 35% and receive EI Work-Sharing benefits for days where they are not working.

If Samantha and her co-workers did not agree to voluntarily reduce their work hours to participate in the Work-Sharing program and were laid off, each of them would have been entitled to receive 55% of their weekly income ($423), by applying for EI regular benefits. By participating in the Work-Sharing program, Samantha and her co-workers receive 35% less of their regular weekly income (earning $500 per week); and collect EI benefits for that 35% of their average hours worked per week (equal to 55% of the value of the insurable earnings she would have received from the firm, which is $148).

By participating in the Work-Sharing program, Samantha and her co-workers are able to earn a total of $648 per week ($500 worth of income from working at the firm plus $148 from Work-Sharing benefits), compared to $423 if they had been on EI regular benefits following a layoff. This enables Samantha and her co-workers to maintain more of their earnings, keep their jobs, and retain their skills. At the same time, the firm is able to retain its skilled and experienced workforce.

Normally, Work-Sharing agreements are signed for an initial duration period of between 6 to 26 weeks. This period can be extended for up to 12 additional weeks (up to 38 weeks total) under exceptional circumstances, such as an unanticipated and prolonged period of economic contraction.

In Budget 2016, the Government of Canada extended the maximum duration of Work-Sharing agreements from 38 weeks to 76 weeks, for agreements that began or ended between April 1, 2016 and March 31, 2017. This temporary special measure was put in place to assist employers and workers affected by the downturn in the commodities sector.

On June 1, 2017, as part of Canada’s Softwood Lumber Action Plan, the Government of Canada announced temporary special Work-Sharing measures to support re-employment and needs for long-term adjustments in the forestry sector. These temporary special Work-Sharing measures, which included extending the duration of Work-Sharing agreements across Canada from a maximum of 38 weeks to 76 weeks, came into effect on July 30, 2017 and will continue until March 28, 2020.

For the purpose of this section, EI Work-Sharing claims refers to any claims for which at least one dollar of Work-Sharing benefit was paid.

2.5.1 Employment Insurance Work-Sharing agreements

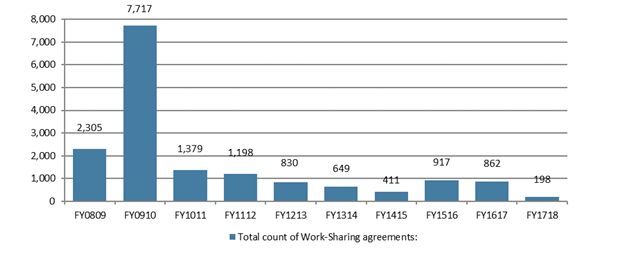

The number of Work-Sharing agreements established in a given fiscal year increases during periods of economic shocks and uncertainty, and decreases during periods of economic growth and stability. This countercyclical pattern can be observed by looking at the number of Work-Sharing agreements established in Canada in the past few years (see Chart 30).

The total number of Work-Sharing agreements decreased significantly from 862 agreements established in FY1617 to 198 agreements in FY1718, which is consistent with the recovery of the Canadian economy that was observed during past years (see Chapter 1). The number of agreements decreased in all provinces, with the largest decrease reported in Alberta (-92.6%), Saskatchewan (-90.2%) and Manitoba (-83.3%). In absolute terms, the number of agreements dropped more in Alberta (-428 agreements), Quebec (-72 agreements) and Ontario (-52 agreements). The highest number of Work-Sharing agreements was established in Ontario (71 agreements), representing 35.9% of all agreements, followed by Quebec with 55 agreements (27.8%) of all agreements.

Chart 30 – Text version

| FY0809 | FY0910 | FY1011 | FY1112 | FY1213 | FY1314 | FY1415 | FY1516 | FY1617 | FY1718 | |

|---|---|---|---|---|---|---|---|---|---|---|

| Total count of Work-Sharing agreements | 2,305 | 7,717 | 1,379 | 1,198 | 830 | 649 | 411 | 917 | 862 | 198 |

- Source: Employment and Social Development Canada, Common System of Grants and Contributions.

Continuing with the trend observed in previous years, the goods-producing industries represented the majority of all Work-Sharing agreements established in FY1718 (see Table 41).

When assessed by firm size, small-sized enterprises (with fewer than 50 employees) comprised 66.7% of all Work-Sharing agreements in the fiscal year examined, down from 78.4% reported in the previous fiscal year. Combined, small and medium-sized enterprises (SMEs) with fewer than 500 employees accounted for 99.5% of all Work-Sharing agreements in FY1718, which is similar to the level in the previous fiscal year. The number of Work-Sharing agreements involving large-sized enterprise (with 500 employees or more) dropped from five agreements in FY1617 to only one agreement in FY1718. This was consistent with the general trend observed since the 2008 recession, as Work-Sharing agreements have been primarily initiated to assist SMEs in recovering from economic shocks to their normal levels of business activity.

| Industry | FY1314 | FY1415 | FY1516 | FY1617 | FY1718 |

|---|---|---|---|---|---|

| Goods-producing industries | 446 (68.7%) |

267 (65.0%) |

638 (69.6%) |

606 (70.3%) |

130 (65.7%) |

| Mining, quarrying, and oil and gas extract | 20 (3.1%) |

6 (1.5%) |

53 (5.8%) |

90 (10.4%) |

3 (3.0%) |

| Construction | 36 (5.5%) |

28 (6.8%) |

52 (5.7%) |

86 (10.0%) |

14 (7.1%) |

| Manufacturing | 382 (58.9%) |

227 (55.2%) |

526 (57.4%) |

426 (49.4%) |

109 (55.1%) |

| Services-producing industries | 203 (31.3%) |

144 (35.0%) |

279 (30.4%) |

256 (29.7%) |

68 (34.3%) |

| Wholesale trade | 44 (6.8%) |

34 (8.3%) |

80 (8.7%) |

65 (7.5%) |

14 (7.1%) |

| Retail trade | 24 (3.7%) |

17 (4.1%) |

21 (2.3%) |

26 (3.0%) |

12 (6.1%) |

| Professional, scientific and technical services | 79 (12.2%) |

55 (13.4%) |

84 (9.2%) |

66 (7.7%) |

25 (12.6%) |

| Rest of services-producing industries | 56 (8.6%) |

38 (9.2%) |

94 (10.3%) |

99 (11.5%) |

17 (8.6%) |

| Canada | 649 (100.0%) |

411 (100.0%) |

917 (100.0%) |

862 (100.0%) |

198 (100.0%) |

- Source: Employment and Social Development Canada, Common System of Grants and Contributions.

2.5.2 Employment Insurance Work-Sharing claims and amounts paid

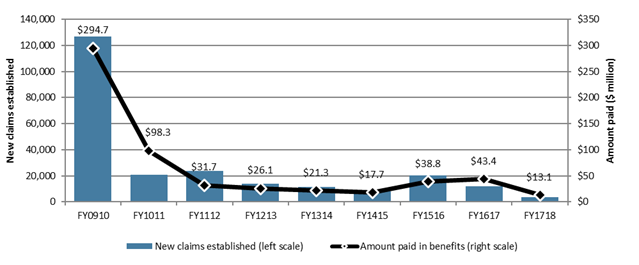

The use of Work-Sharing benefits is linked to the trends observed in Work-Sharing agreements, and is countercyclical to economic conditions (similar to the number of new claims established and amounts paid under EI regular benefits). As with the number of Work-Sharing agreements, the total number of Work-Sharing claims established and the total amounts paid in Work-Sharing benefits increase during labour market contraction and economic uncertainties, and decrease during periods of economic expansion.

Chart 31 illustrates the number of Work-Sharing claims and benefits paid from FY0910 to FY1718. The number of Work-Sharing claims and benefits paid peaked to just over 127,000 claims and $294.7 million paid in FY0910, corresponding to the recession in 2008 and the temporary special Work-Sharing measures introduced in response, such as extending agreement duration, streamlining the administrative process and easing eligibility requirements for employers.Footnote 76 The number of Work-Sharing claims has declined significantly since then as the economy began to recover after the recession, before increasing once again in FY1516 when the number of Work-Sharing claims (20,500) more than doubled from the previous fiscal year. This was attributable to the downturn in global commodity prices which represented an external economic shock impacting many firms in affected industries and commodity-based regions that experienced sudden and unexpected declines in business activity.

In FY1718, like the previous year, the total number of Work-Sharing claims established declined significantly by 68.9% from 11,900 claims in FY1617 to 3,700 claims in FY1718, reflecting the improved economic conditions observed in the fiscal year examined. The total amount paid in Work-Sharing benefits decreased from $43.4 million in FY1617 to $13.1 million in FY1718, representing a decrease of -69.8%.

Chart 31 – Text version

| FY0910 | FY1011 | FY1112 | FY1213 | FY1314 | FY1415 | FY1516 | FY1617 | FY1718 | |

|---|---|---|---|---|---|---|---|---|---|

| New claims established (left scale) | 127,033 | 20,929 | 23,755 | 13,890 | 11,673 | 8,024 | 20,521 | 11,936 | 3,708 |

| Amount paid in benefits ($ millions) (right scale) | $294.7 | $98.3 | $31.7 | $26.1 | $21.3 | $17.7 | $38.8 | $43.4 | $13.1 |

- Note: Includes all claims for which at least $1 of work-sharing benefits was paid.

- Source: Employment and Social Development Canada, Employment Insurance (EI) administrative data. Data are based on a 100% sample of EI administrative data, data on amount paid are based on a 10% sample..

Employment Insurance Work-Sharing claims and amount paid, by province, gender, age and industry

In FY1718, most regions reported a significant decrease in the number of Work-Sharing claims established, compared to the previous fiscal year, except for Nova Scotia and New Brunswick. As outlined in Table 42, in absolute terms, the most notable decline was in Alberta (-4,500 claims), followed by Quebec (-1,800 claims). Claimants from Ontario established the largest share of total new claims (46.8%), followed by claimants from Quebec (25.4%) and Alberta (10.9%); however, in terms of amount paid, claims established in Alberta received the largest share of total amount paid with 31.4%, followed by claims established in Ontario (25.1%) and Quebec (24.6%) in FY1718.

| New claims established | Amount paid ($ millions) | ||||

|---|---|---|---|---|---|

| FY1617 | FY1718 | FY1617 | FY1718 | ||

| Region | |||||

| Atlantic provinces | 212 (1.8%) |

231 (6.2%) |

$0.9 (2.2%) |

$0.4 (3.4%) |

|

| Quebec | 2,737 (22.9%) |

941 (25.4%) |

$6.5 (15.0%) |

$3.2 (24.6%) |

|

| Ontario | 2,017 (16.9%) |

1,737 (46.8%) |

$4.7 (10.9%) |

$3.3 (25.1%) |

|

| Manitoba and Saskatchewan | 1,492 (12.5%) |

196 (5.3%) |

$5.3 (12.3%) |

$1.5 (11.1%) |

|

| Alberta | 4,872 (40.8%) |

403 (10.9%) |

$23.5 (54.1%) |

$4.1 (31.4%) |

|

| British Columbia | 606 (5.1%) |

200 (5.4%) |

$2.4 (5.4%) |

$0.6 (4.4%) |

|

| Gender | |||||

| Men | 8,883 (74.4%) |

2,487 (67.1%) |

$32.3 (74.4%) |

$10.1 (76.6%) |

|

| Women | 3,053 (25.6%) |

1,221 (32.9%) |

$11.1 (25.6%) |

$3.1 (23.4%) |

|

| Age category | |||||

| 24 years old and under | 718 (6.0%) |

151 (4.1%) |

$2.3 (5.3%) |

$0.4 (3.3%) |

|

| 25 to 54 years old | 8,691 (72.8%) |

2,478 (66.8%) |

$32.5 (74.9%) |

$8.9 (67.6%) |

|

| 55 years old and over | 2,527 (21.2%) |

1,079 (29.1%) |

$8.6 (19.8%) |

$3.8 (29.1%) |

|

| Industry | |||||

| Goods-producing industries | 9,315 (78.0%) |

3,031 (81.7%) |

$30.1 (69.3%) |

$9.7 (73.8%) |

|

| Manufacturing | 8,474 (71.0%) |

2,855 (77.0%) |

$27.4 (63.1%) |

$8.9 (67.8%) |

|

| Rest of goods-producing industries | 841 (7.0%) |

176 (4.7%) |

$2.7 (6.2%) |

$0.8 (6.0%) |

|

| Service-producing industries | 2,439 (20.4%) |

633 (17.1%) |

$12.8 (29.4%) |

$3.4 (25.6%) |

|

| Wholesale trade | 1,017 (8.5%) |

180 (4.9%) |

$3.8 (8.7%) |

$1.1 (8.3%) |

|

| Professional, scientific and technical services | 543 (4.5%) |

282 (7.6%) |

$2.6 (5.9%) |

$1.1 (8.1%) |

|

| Rest of service-producing industries | 879 (7.4%) |

171 (4.6%) |

$6.5 (14.9%) |

$1.2 (9.2%) |

|

| Canada | 11,936 (100.0%) |

3,708 (100.0%) |

$43.4 (100.0%) |

$13.1 (100.0%) |

|

- Note: Data may not add up to the total due to rounding. Percentage share is based on unrounded numbers. Includes claims for which at least $1 of Employment Insurance (EI) Work-Sharing benefits was paid. No Work-Sharing claim was established in the Northwest Territories, Yukon or Nunavut in FY1718.

- r Revised data.

- Source: Employment and Social Development Canada, EI administrative data. Data on claims established are based on a 100% sample of EI administrative data, data on amount paid are based on a 10% sample.

Men continue to be more likely to make use of the Work-Sharing program—a trend that has been persistent over the years. In FY1718 men accounted for 67.1% of new Work-Sharing claims and 76.6% of total benefits paid. Workers aged 25 to 54 years accounted for 66.8% of all new Work-Sharing claims and 67.6% of Work-Sharing benefits. Similar to previous years, youth were under-represented among new Work-Sharing claims established (4.1%) and benefits paid (3.3%) compared with their total share of employment (13.3%) in FY1718.Footnote 77

From an industry perspective, the Work-Sharing program was most frequently used by workers in the Manufacturing industry, which is consistent with historical patterns. Employees in the Manufacturing industry accounted for 77.0% of new EI Work-Sharing claims in FY1718, up from 71.0% in the previous fiscal year. These workers accounted for 67.8% of the total EI Work-Sharing benefits paid, up from 63.1% FY1617 (see Table 42), which was disproportionate to their share of total employment (which was around 9.4% in recent years).Footnote 78

Among the services-producing industries, workers in the Professional, scientific and technical services industry accounted for the largest share of Work-Sharing claims (7.6%), followed by workers in the Wholesale trade industry (4.9%). In terms of amount paid, workers from the Wholesale trade industry accounted for the largest share of total Work-Sharing benefits paid (8.3%) in FY1718, closely followed by workers in the Professional, scientific and technical services industry, who accounted for 8.1% of total Work-Sharing benefits paid in FY1718. See Annex 2.22.1 for detailed information on new claims established and Annex 2.22.4 for amount paid by industry.

2.5.3 Level and duration of Employment Insurance Work-Sharing benefits

The Work-Sharing program is designed to provide income support for workers in firms that experience temporary reductions in demand for reasons beyond the employer’s control. In view of this, the program provides partial income stabilization to offset reductions in hours that are agreed upon by the employees participating in the program, but is not meant to provide full coverage of insurable hours or insurable earnings. As a result, the data reported on Work-Sharing claims are not directly comparable to other types of EI benefits. This is particularly true of the weekly benefit rates paid to claimants, which are meant to only cover up to 60% of a regular work week for affected employees in a work unit subject to a Work-Sharing agreement, depending on the agreed upon decrease in work levels. Because of this, the weekly benefit rates for Work-Sharing claimants are lower on average than for other types of EI benefits. Because the weekly Work-Sharing benefit rate is determined by employee's wage and the degree of reductions in the hours worked, significant variability is also observed across industries in the reported weekly benefit rates.

In FY1718, the average weekly Work-Sharing benefit rate decreased by -12.5% to $109, down from the average weekly benefit rate of $125 in the previous fiscal year (see Table 43). This represents the second consecutive decrease in the average weekly benefit rate after increasing for four previous consecutive years. Similar to the previous years, a high degree of variability can be observed among the average weekly benefit paid in each province in the fiscal year examined; for example, the highest average weekly benefit rate was in Saskatchewan ($160), followed by Newfoundland and Labrador ($153), while the lowest was in New Brunswick ($71). Like the previous year, the average weekly Work-Sharing benefit rate for both men and women decreased in FY1718. Men received an average weekly benefit rate of $115 in FY1718, down from $131 in FY1617; while women received an average weekly benefit rate of $99 in FY1718, down from $107 in FY1617. The average weekly benefit rate for all age groups decreased, at $110 for workers aged 25 to 54 years, which was a little higher than for workers aged 55 years and older ($108) and those aged 24 years and under ($102).

| FY1617 | FY1718 | Change (%) | |

|---|---|---|---|

| Region | |||

| Atlantic provinces | $153 | $113 | -26.2% |

| Quebec | $113 | $109 | -2.9% |

| Ontario | $118 | $102 | -13.7% |

| Manitoba | $101 | $113 | +12.4% |

| Saskatchewan | $142 | $160 | +12.7% |

| Alberta | $137 | $124 | -9.7% |

| British Columbia | $114 | $118 | +3.0% |

| Gender | |||

| Men | $131 | $115 | -12.6% |

| Women | $107 | $99 | -7.7% |

| Age category | |||

| 24 years old and under | $120 | $102 | -14.8% |

| 25 to 54 years old | $126 | $110 | -12.2% |

| 55 years old and over | $124 | $108 | -13.0% |

| Industry | |||

| Goods-producing industries | $124 | $106 | -14.2% |

| Agriculture, forestry, fishing and hunting | $116 | $133 | +14.3% |

| Mining and oil and gas extraction | $126 | $107 | -14.6% |

| Manufacturing | $122 | $106 | -13.4% |

| Construction | $148 | $112 | -24.3% |

| Service-producing industries | $129 | $123 | -4.4% |

| Wholesale trade | $111 | $113 | +1.4% |

| Accommodation and food services | $125 | $114 | -9.0% |

| Other services (excl. public administration) | $151 | $101 | -33.2% |

| Canada | $125 | $109 | -12.5% |

- Note: Percentage change is based on unrounded numbers. Includes claims for which at least $1 of Work-Sharing benefits was paid. No Work-Sharing claim was established in the Northwest Territories, Yukon or Nunavut in FY1718.

- r Revised data.

- Source: Employment and Social Development Canada, Employment Insurance (EI) administrative data. Data are based on a 100% sample of EI administrative data.

The average weekly Work-Sharing benefit rate in goods-producing industries declined by 14.2% to $106 in FY1718, from $124 reported in the previous fiscal year. Workers in the Agriculture, forestry, fishing and hunting industry received the highest amount of average weekly benefits ($133) in the goods-producing sector. The average weekly Work-Sharing benefit rate decreased in FY1718 to $123 from the previous fiscal year ($129) in service-producing industries. See Annex 2.21.3 for detailed information on average Work-Sharing weekly benefit rate by industry.

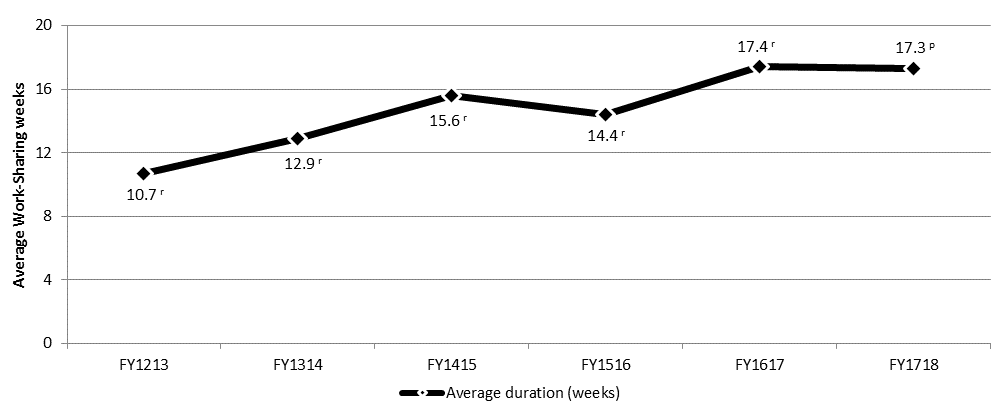

The average duration of Work-Sharing claims completed in FY1718 was 17.3 weeks, relatively unchanged from FY1617 (17.4 weeks). Over the period FY1213 to FY1617, the average duration has increased every year with the exception of FY1516 (see Chart 32). The higher average durations observed in FY1617 and FY1718 could be explained in part by the temporary measures extending the maximum duration of Work-Sharing agreements in certain industries during that period.

Chart 32 – Text version

| FY1213 | FY1314 | FY1415 | FY1516 | FY1617 | FY1718 | |

|---|---|---|---|---|---|---|

| Average duration (weeks) | 10.7r | 12.9r | 15.6r | 14.4r | 17.4r | 17.3p |

- Note: Includes all claims for which at least $1 of Work-Sharing benefits was paid.

- *In previous EI Monitoring and Assessment Reports, the average actual duration of Work-Sharing benefits were reported based on all claims established during the reporting fiscal year, with statistical adjustments to account for claims that were still not completed by the time of reporting. Starting with this year’s report, actual duration estimates for Work-Sharing benefits are based on claims that were completed (that is, claims that are terminated or for which no activity was reported as of August of the following fiscal year) during the reporting fiscal year. This methodology is expected to provide more precise duration estimates relative to the former one, and is identical to the one used to estimate actual durations for almost all other types of EI benefits provided in this report. Compared to other types of EI benefits, the number of Work-Sharing claims is much lower, which makes the variability in the revised average actual durations for past years much higher.

- r Revised data.

- p Preliminary estimates.

- Source: Employment and Social Development Canada, Employment Insurance (EI) administrative data. Data are based on a 100% sample of EI administrative data.

2.5.4 Employment Insurance Work-Sharing agreements subject to early termination

When a firm returns to normal levels of business activity ahead of recovery plan timelines, or withdraws from the Work-Sharing agreement for other reasons (e.g., the firm is shutting down or deciding to go ahead with layoffs), the Work-Sharing agreement ends before the anticipated end date—this is referred to as early termination. During the last five fiscal years, just over one third (36%) of agreements were terminated earlier than their scheduled end date and almost three quarters (72%) of firms returned to their normal level of employment.

Effectiveness of the Work-Sharing program over the years

A recent study* examined the usage of the Work-Sharing program since 2000 and estimated the number and distribution of layoffs averted by the Work-Sharing program, and the number of shutdowns by employers who participated in the program. The study found that Work-Sharing claims that started at the beginning of a recession and that ended during it were most likely associated with a layoff after the agreement had terminated, whereas claims that started once the recession was already underway and ended as the economy recovered were less likely associated with a subsequent layoff. For example, during the economic slowdown in 2001, the proportion of net layoffs averted** improved from 34% in FY0001 to 67% in FY0102. Again during the 2008 recession, the proportion of net layoffs averted improved from 26% in FY0708 to 51% in FY0809, and 69% in FY0910. Following the economic slowdown because of the decline in commodity prices in FY1415, the proportion of net layoffs averted improved from 42% in FY1415 to 58% in FY1516.

The study also looked at the incidence of shutdowns among employers who participated in the Work-Sharing program and those who did not. It was found that in the short to medium term, the cumulative shutdown rate among non-Work-Sharing employers was about six percentage points higher than for employers who participated in the program. The shutdown rate for non-Work-Sharing employers was almost 20 percentage points higher than for participating employers in the longer term.

* ESDC, Usage of the Work-Sharing Program: 2000/2001 to 2016/2017 (Ottawa: ESDC, Evaluation Directorate, 2018).

** The methodology used to estimate the number of layoffs averted assumes a perfect substitution between one hour of work reduction with the Work-Sharing program and one hour of work reduction through the layoff alternative (a conversion rate of 1.0). The number of layoffs that occurred subsequent to the program was subtracted from the estimated number of layoffs averted to calculate the net layoffs averted.