Claiming the additional residency amount

Pre-test question

Sorry, that is incorrect

Individuals must have lived permanently in a prescribed zone for at least six consecutive months, beginning or ending in the tax year for which they are preparing a tax return.

That is correct

Individuals must have lived permanently in a prescribed zone for at least six consecutive months, beginning or ending in the tax year for which they are preparing a tax return.

Instructions

- Open the tax software

- Review the Background information and Required slips (tax slips, receipts, etc.)

- Provide all required information for the appropriate sections of the tax software

- Once completed, compare your results with the solution provided

- Afterwards, refer to Key points of the tax software and the Takeaway points

Background information

Situation

Pierre and Bora are employees of Lumber Inc. in a Zone A – Prescribed Northern Zone. They also live in Zone A and are eligible to claim the northern residents deduction for the full year. Although Pierre and Bora are both eligible to claim the basic residency amount, they have decided it is more beneficial for Pierre to claim both the basic residency amount and the additional residency amount because Bora works part-time.

| Category | Information |

|---|---|

| Name | Pierre Jack |

| Social insurance number (SIN) | 000 000 000 |

| Address | 123 Main Street City, Province X0X 0X0 |

| Date of birth (DOB) | May 5, 1988 |

| Marital status | Married to: |

Required slips

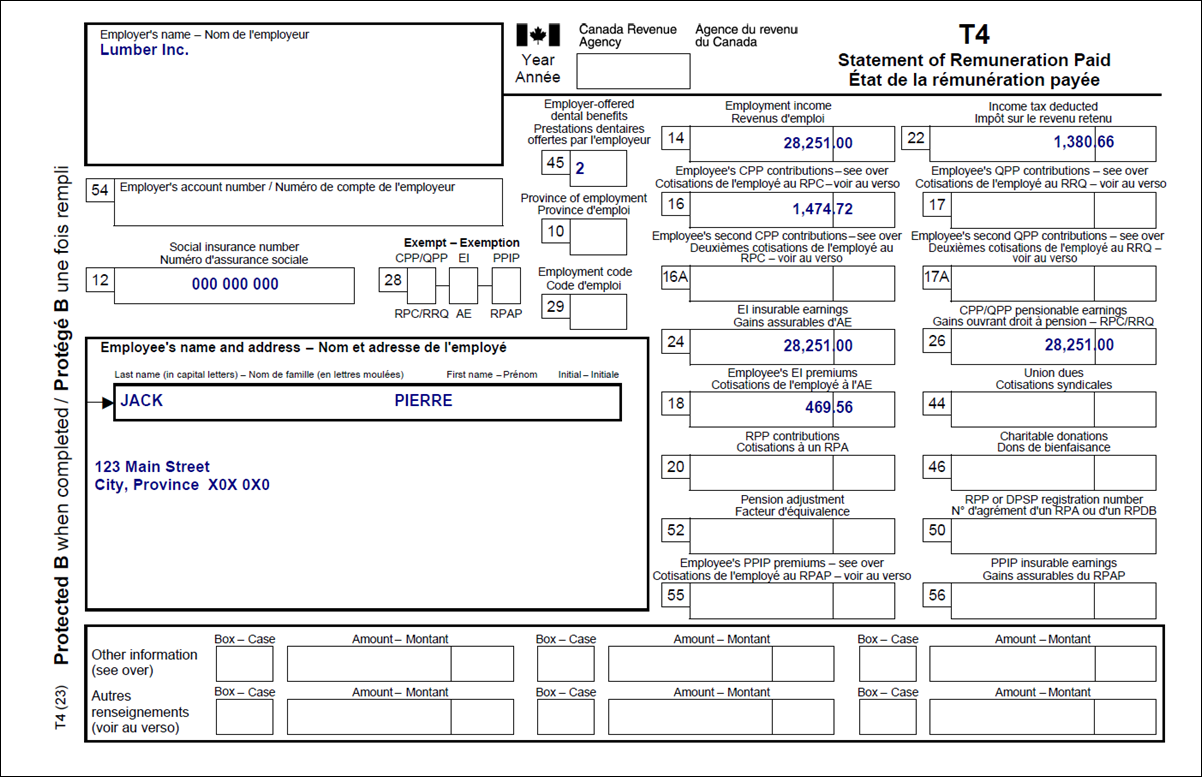

T4 – Statement of Remuneration Paid (Pierre) (Lumber Inc.)

Text version of the above image

T4 – Statement of Remuneration Paid

Protected B

Employer’s name: Lumber Inc.

Employee’s name and address:

Last name: Jack

First name: Pierre

123 Main Street

City, Province X0X 0X0

Box 12: Social insurance number: 000 000 000

Box 14: Employment income: 28,251.00

Box 16: Employee’s CPP contributions – see over: 1,474.72

Box 18: Employee’s EI premiums: 469.56

Box 22: Income tax deducted: 1,380.66

Box 24: EI insurable earnings: 28,251.00

Box 26: CPP/QPP pensionable earnings: 28,251.00

Box 45: Employer-offered dental benefits: 2

T4 – Statement of Remuneration Paid (Bora) (Lumber Inc.)

Text version of the above image

T4 – Statement of Remuneration Paid

Protected B

Employer’s name: Lumber Inc.

Employee’s name and address:

Last name: Jack

First name: Bora

123 Main Street

City, Province X0X 0X0

Box 12: Social insurance number: 000 000 000

Box 14: Employment income: 15,000.00

Box 16: Employee’s CPP contributions – see over: 787.00

Box 18: Employee’s EI premiums: 248.56

Box 22: Income tax deducted: 806.00

Box 24: EI insurable earnings: 15,000.00

Box 26: CPP/QPP pensionable earnings: 15,000.00

Box 45: Employer-offered dental benefits: 1

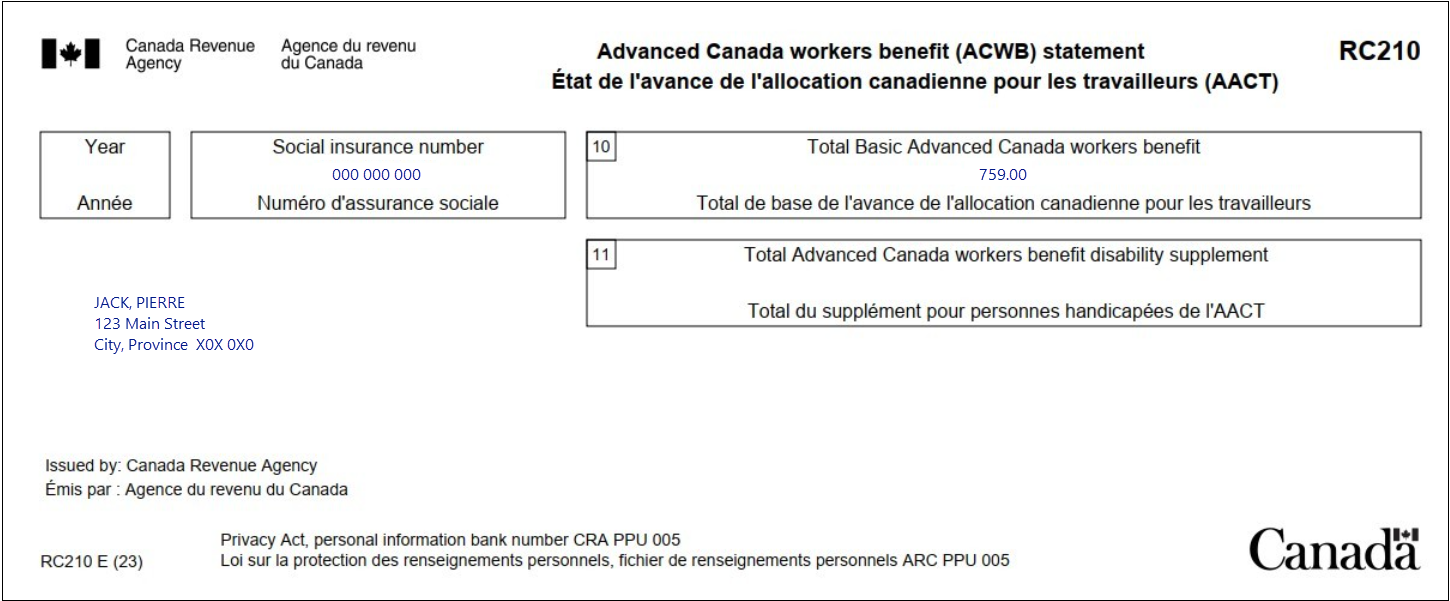

RC210 – Advanced Canada workers benefit (ACWB) statement

Text version of the above image

RC210 – Advanced Canada workers benefit (ACWB) statement

Issued by: Canada Revenue Agency

Jack, Pierre

123 Main Street

City, Province X0X 0X0

Social insurance number: 000 000 000

Box 10: Total Basic Advanced Canada workers benefit: 759.00

Review your results

Solution to Claiming the additional residency amount.

Key points of the tax software

Important note

To access complete instructions on the various steps of entering data into the software, click on the title of each section below.

Pierre's interview

- Click T4 and employment income in the left-side menu

- Click the + sign next to T4 income (earned in any province except Quebec)

- Enter the required information from the tax slip

Advanced Canada workers benefit (RC210)

- Click Other information slips in the left-side menu

- Click the + sign next to RC210 – Canada workers benefit advance payments statement [Federal line 41500]

- Enter the information from the tax slip

- Click Other deductions and credits in the left-side menu

- Click the + sign next to Federal line 25500 – T2222 – Northern residents deduction

- Select Zone A (Resident of prescribed northern area) from the Area for which you are claiming the Northern residents deduction drop-down menu

- Enter the start and end dates of the northern residence into the Basic residency amount, beginning (dd-mm-yyyy) and Basic residency amount, end (dd-mm-yyyy) fields

- Enter the number of days into the Number of days to consider for the additional residency amount field

Bora's interview

- Repeat the same steps you did for Pierre

Takeaway points

- Pierre and Bora are eligible for the Northern residents deductions because they lived in a prescribed zone for at least 6 months in the tax year

- To determine if an individual’s residence is within one of these zones, refer to line 25500 on the CRA website or verify in the tax software

- There are two northern resident deductions:

- a residency deduction

- a travel deduction

- Pierre is only claiming the residency deduction which has two parts:

- the basic residency amount

- the additional residency amount

- Pierre is eligible to claim the basic and additional residency amounts because Bora is not claiming the residency deduction

- he can claim the deductions for the number of days he lived in the prescribed zone in the year

- The tax software automatically calculates the amount of the deductions on form T2222 and claims the total amount on line 25500 of the tax return