Claiming the disability tax credit and caregiver amount for a dependant

Pre-test question

That is correct

An individual may not claim the disability amount transferred from a dependant for a child for whom they had to pay child support. However, if someone was separated from their spouse or common-law partner for only part of the year because of a breakdown in the relationship, special rules may apply.

Sorry, that is incorrect

An individual may not claim the disability amount transferred from a dependant for a child for whom they had to pay child support. However, if someone was separated from their spouse or common-law partner for only part of the year because of a breakdown in the relationship, special rules may apply.

Instructions

- Open the tax software

- Review the Background information and Required slips (tax slips, receipts, etc.)

- Provide all required information for the appropriate sections of the tax software

- Once completed, compare your results with the solution provided

- Afterwards, refer to Key points of the tax software and the Takeaway points

Background information

Situation

Rebecca is a single parent who lives with her son David in her own home. David has a physical impairment and has been approved for the disability tax credit. David relies on Rebecca to provide him with food, shelter and clothing. He does not have any income and has no other caregivers. Rebecca wants to claim David as a dependant and claim all related credits.

| Category | Data |

|---|---|

| Name | Rebecca Healy |

| Social insurance number (SIN) | 000 000 000 |

| Address | 123 Main Street City, Province X0X 0X0 |

| Date of birth (DOB) | March 8, 1980 |

| Marital status | Divorced |

| Dependant | Son: David Healey SIN: 000 000 000 DOB: March 8, 2015 |

Required slips

T4 – Statement of Remuneration Paid (987654 Canada Ltd.)

Text version of the above image

T4 – Statement of Remuneration Paid

Protected B

Employer’s name: 987654 Canada Ltd.

Employee’s name and address:

Last name: Healy

First name: Rebecca

123 Main Street

City, Province X0X 0X0

Box 12: Social insurance number: 000 000 000

Box 14: Employment income: 31,224.00

Box 16: Employee’s CPP contributions - see over: 493.34

Box 18: Employee’s EI premiums: 246.67

Box 22: Income tax deducted: 2,244.00

Box 24: EI insurable earnings: 31,224.00

Box 26: CPP/QPP pensionable earnings: 31,224.00

Box 45: Employer-offered dental benefits: 1

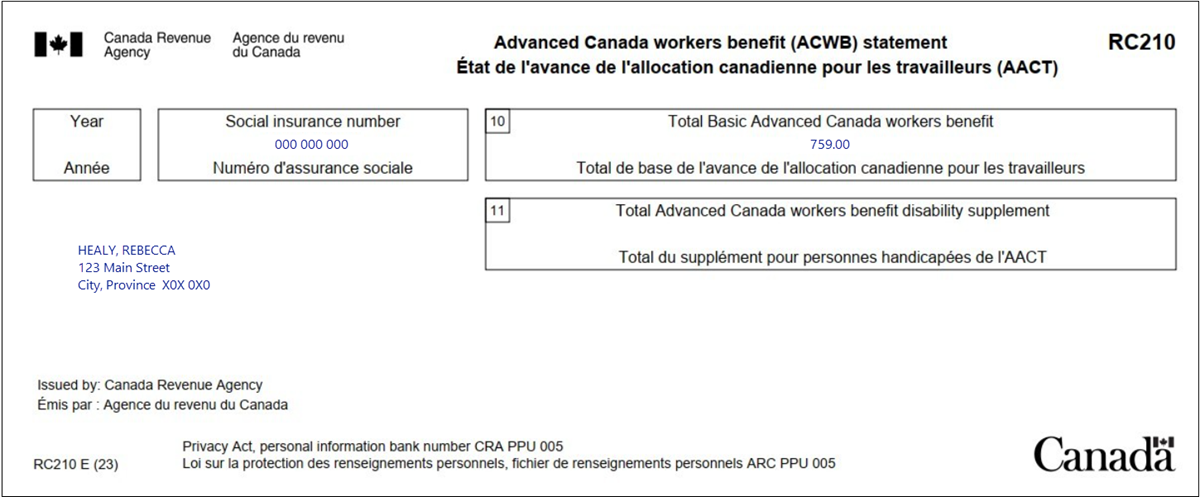

RC210 – Advanced Canada workers benefit (ACWB) statement

Text version of the above image

RC210 – Advanced Canada workers benefit (ACWB) statement

Issued by: Canada Revenue Agency

Healy, Rebecca

123 Main Street

City, Province X0X 0X0

Social insurance number: 000 000 000

Box 10: Total Basic Advanced Canada workers benefit: 759.00

Review your results

Solution to Claiming the disability tax credit and caregiver amount for a dependant.

Key points of the tax software

Important note

To access complete instructions on the various steps of entering data into the software, click on the title of each section below.

Rebecca's interview

- Click T4 and employment income in the left-side menu

- Click the + sign next to T4 income (earned in any province except Quebec) in the T4 and T4E section

- Enter the information from the tax slip

Advanced Canada workers benefit (RC210)

- Click Other information slips in the left-side menu

- Click the + sign next to RC210 – Canada workers benefit advance payments statement [Federal line 41500]

- Enter the information from the tax slip

David's interview

- Click Dependant ID in the left-side menu

- Select the appropriate option from the Relationship drop-down menu

- Enter the child’s date of birth

- Select No from the Did this dependant have any income in 20XX? drop-down menu

Disability tax credit (T2201) and Canada caregiver amount

- Click Medical and disability in the left-side menu

- Click the + sign next to Infirmity and disability amounts for the dependant* in the Disability deductions, caregiver section

- Enter the applicable information into the Name or description of dependant’s infirmity: field

- Select Yes from the Does the dependant’s infirmity provide entitlement to the Canada caregiver amount? drop-down menu

Takeaway points

- Individuals must have an approved Form T2201, Disability Tax Credit Certificate with the CRA to claim the disability tax credit (DTC)

- The tax software automatically calculates and claims the disability amount transferred from David on line 31800 of Rebecca’s tax return

- Name or description of dependant’s infirmity is a mandatory field in the tax software

- Unknown can be entered if the information is not given

- The DTC includes a supplement for individuals who are under 18 years of age on December 31 of the tax year

- Individuals who provide support to a dependant because of a physical or mental impairment may be eligible to claim the Canada caregiver amount

- Support involves providing some or all of the basic necessities of life, such as food, shelter, and clothing

- The tax software automatically calculates the amount of the credit on schedule 5 and claims the amount on the appropriate line of the tax return

- in this case, the amount is claimed on line 30500 of Rebecca’s tax return because David is her child, under 18 years of age and eligible for the DTC