Claiming nursing home fees

Pre-test question

Sorry, that is incorrect

Alexei must choose to either claim the DTC or the fees paid for full-time care in a nursing home as a medical expense but may not claim both.

That is correct

Alexei must choose to either claim the DTC or the fees paid for full-time care in a nursing home as a medical expense but may not claim both.

Instructions

- Open the tax software

- Review the Background information and Required slips (tax slips, receipts, etc.)

- Provide all required information for the appropriate sections of the tax software

- Once completed, compare your results with the solution provided

- Afterwards, refer to Key points of the tax software and the Takeaway points

Background information

Situation

Alexei received Canada Pension Plan (CPP) and old age security (OAS) benefits while living in a nursing home for all of 20XX. He pays $16,200 per year to the nursing home. The receipt provided by the nursing home is not broken down for meals, accommodation or attendant care services. Alexei has been previously approved for the disability tax credit (DTC).

| Name | Alexei Reznikov |

|---|---|

| Social insurance number (SIN) | 000 000 000 |

| Address | 123 Main Street City, Province X0X 0X0 |

| Date of birth | February 4, 1958 |

| Marital status | Widowed |

Required slips

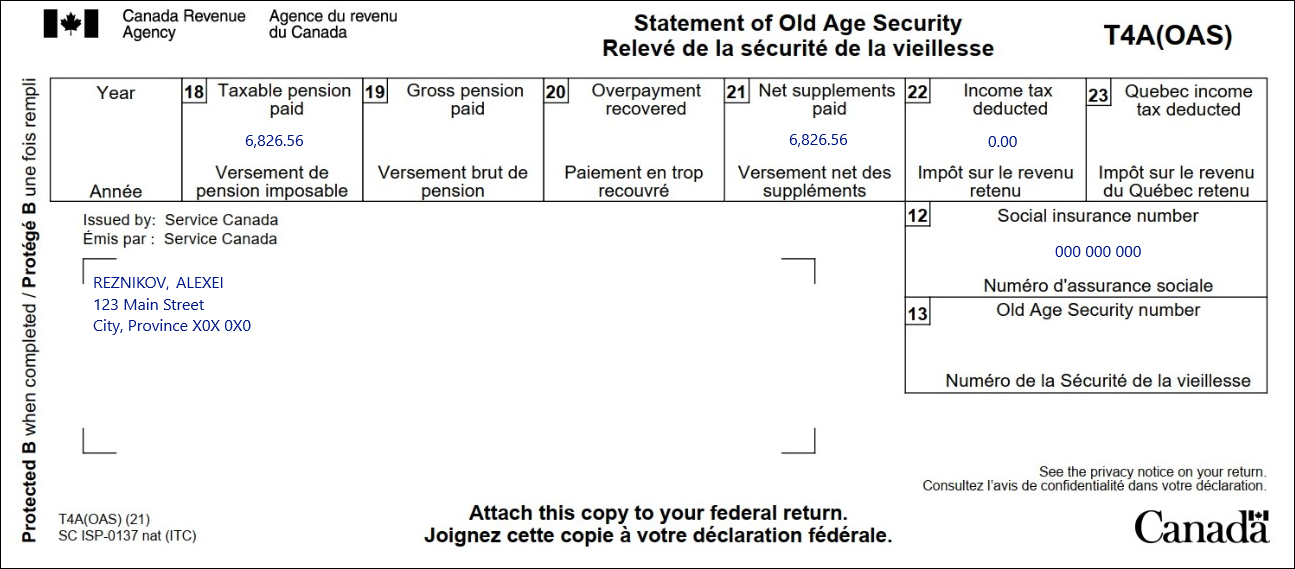

T4A(OAS) – Statement of Old Age Security (for Alexei)

Text version of the above image

T4A(OAS) – Statement of Old Age Security

Protected B

Issued by: Service Canada

Reznikov, Alexei

123 Main Street

City Province X0X 0X0

Box 12: Social insurance number: 000 000 000

Box 18: Taxable pension paid: 6,826.56

Box 21: Net supplements paid: 6,826.56

Box 22: Income tax deducted: 0.00

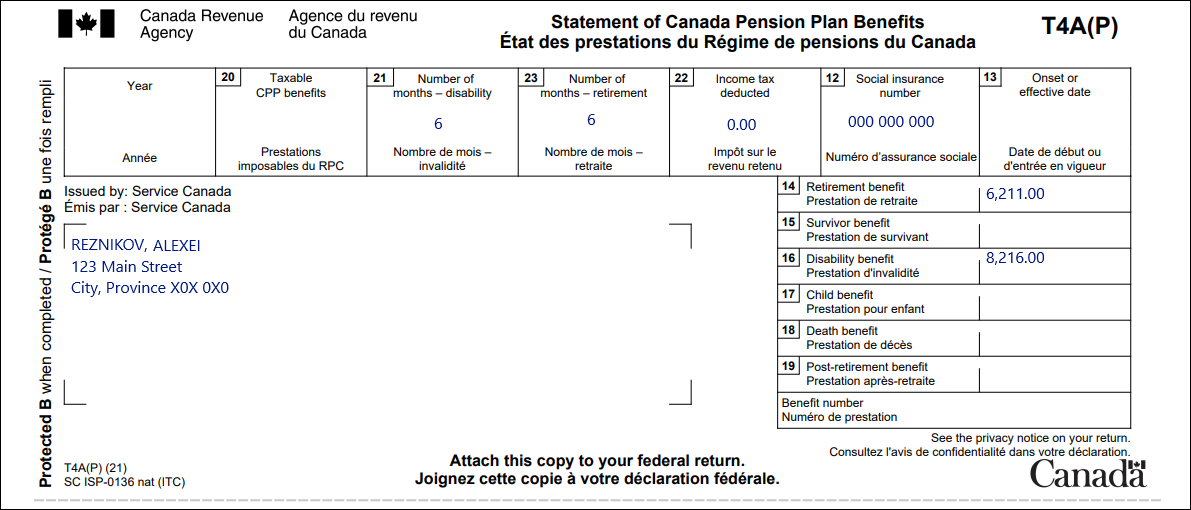

T4A(P) – Statement of Canada Pension Plan Benefits (for Alexei)

Text version of the above image

T4A(P) – Statement of Canada Pension Plan Benefits

Protected B

Issued by: Service Canada

Reznikov, Alexei

123 Main Street

City Province X0X 0X0

Box 12: Social insurance number: 000 000 000

Box 20: Taxable CPP benefits: 15,828.00

Box 23: Number of months – retirement: 12

Box 22: Income tax deducted: 0.00

Box 14: Retirement benefit: 15,828.00

Review your results

Solution to Claiming nursing home fees.

Key points of the tax software

Important note

To access complete instructions on the various steps of entering data into the software, click on the title of each section below.

Alexei's interview

Pension and saving plans – T4A(OAS), T4A(P)

- Click Interview setup in the left-side menu

- Tick the box next to Pension income, other income and split pension income, COVID-19 benefits (T4A, T4FHSA, T4A(OAS), T4A(P), T4A-RCA, T4RSP, T4RIF, T1032) in the Pension and other income section

- Click T4A, T4FHSA and pension income in the left-side menu

- Click the + sign next to:

- T4A(OAS) – Old age security pension

- T4A(P) – Statement of Canada or Québec pension plan benefits

- Enter the amounts for each tax slip into the corresponding fields

- Click Medical, disability, caregiver in the left-side menu

- Click the + sign next to Medical expenses in the Medical expenses section

- In the Specified medical expenses (not claimed elsewhere) section, select Fees for a residential and long-term care centre from the drop-down menu

- Enter the nursing home fees into the next field

- Click Medical, disability, caregiver in the left-side menu

- Click the + sign next to Infirmity and Disability amounts claim for yourself* (line 31600) in the Disability deductions, caregiver section

- Enter Unknown into the Name or description of infirmity field

- Select Claim disability amount (default) from the Are you eligible for the disability amount on federal line 31600? drop-down menu

- Select No from the Does this infirmity provide entitlement to the Canada caregiver amount? drop-down menu

- In the Special rules when claiming the disability amount and attendant care as medical expenses section:

- select Let MaxBack decide from the Indicate how you wish to handle the disability amount and attendant care as medical expenses drop-down menu

Takeaway points

Disability tax credit and Medical expenses

- Since Alexei qualifies for the disability amount, he has the option to claim the disability amount or the full nursing home fees, but not both

- In this case, it is more beneficial to claim the full nursing home fees as a medical expense instead of the disability tax credit

- If you enter the DTC and medical expenses for a residential and long‑term care centre for the same tax return, the tax software does not claim the DTC

- Alexei’s medical expenses amount is claimed on line 33099 of the tax return