Reporting tax-exempt social assistance payments

Pre-test question

Sorry, that's incorrect

Not all income is tax exempt under the Indian Act, regardless of where the individual lives or works. For example, old age security (OAS) benefits are not tax exempt under the Indian Act.

That's correct

Not all income is tax exempt under the Indian Act, regardless of where the individual lives or works. For example, old age security (OAS) benefits are not tax exempt under the Indian Act.

Instructions

- Open the tax software

- Review the Background information and Required slips (tax slips, receipts, etc.)

- Provide all required information for the appropriate sections of the tax software

- Once completed, compare your results with the solution provided

- Afterwards, refer to Key points of the tax software and the Takeaway points

Background information

Situation

Rosa lives on a reserve, she received $6,000 in OAS payments and $12,500 in Canada Pension Plan (CPP) of which $10,000 is tax exempt. Rosa also received $5,000 in social assistance from the band council for which she has a letter from the band council that explains the social assistance payments.

| Category | Value |

|---|---|

| Name | Rose Oakland |

| Social insurance number (SIN) | 000 000 000 |

| Address | 123 Main Street City, Province X0X 0X0 |

| Date of birth | November 22, 1939 |

| Marital status | Single |

Required slips

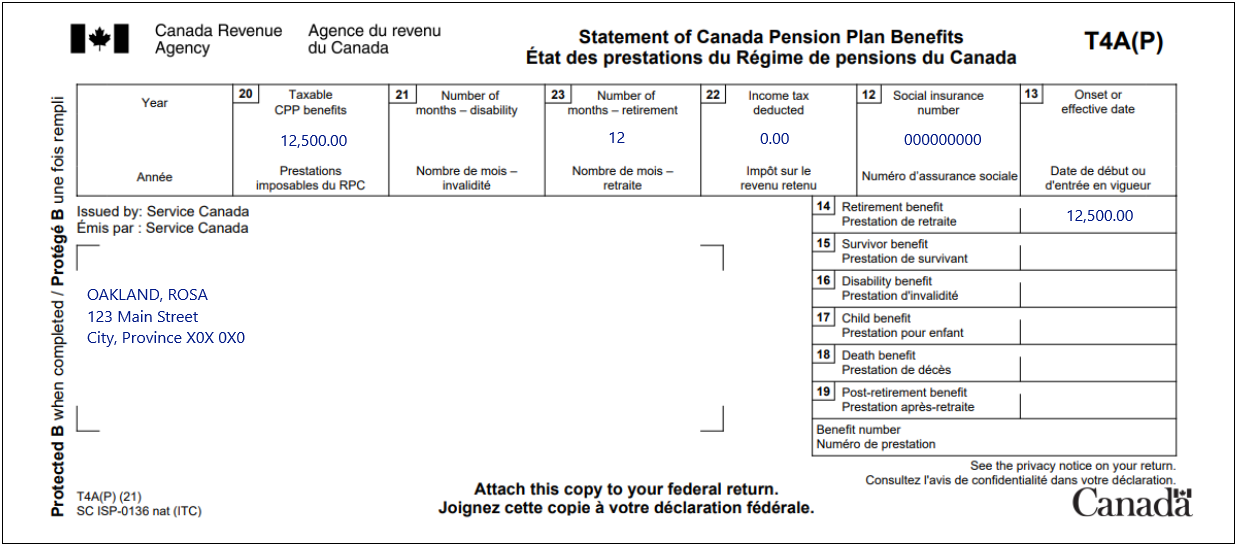

T4A(P) - Statement of Canada Pension Plan Benefits

Text version of the above image

T4A(P) - Statement of Canada Pension Plan Benefits

Protected B

Issued by Service Canada

Oakland, Rosa

123 Main Street

City, Province X0X 0X0

Box 20: Taxable CPP benefits: 12,500.00

Box 23: Number of months – retirement: 12

Box 22: Income tax deducted: 0.00

Box 12: Social insurance number: 000 000 000

Box 14: Retirement benefit: 12,500.00

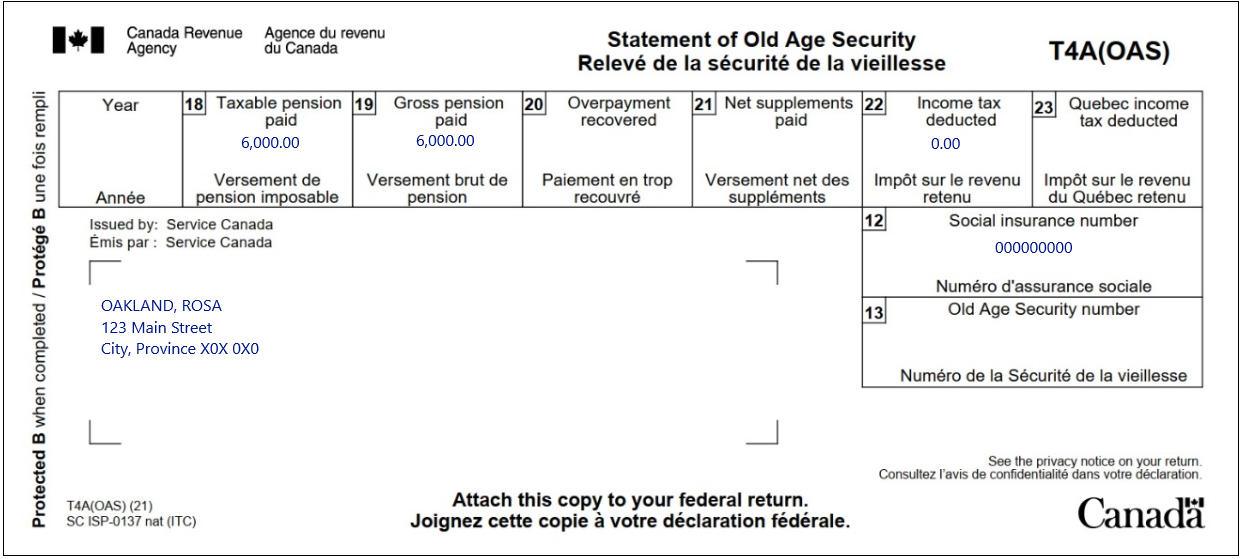

T4A(OAS) – Statement of Old Age Security

Text version of the above image

T4A(OAS) – Statement of Old Age Security

Protected B

Issued by: Service Canada

Oakland, Rosa

123 Main Street

City, Province X0X 0X0

Box 18: Taxable pension paid: 6,000.00

Box 19: Gross pension paid: 6,000.00

Box 22: Income tax deducted: 0.00

Box 12: Social insurance number: 000 000 000

Review your results

Solution to reporting tax-exempt social assistance payments.

Key points of the tax software

Important note

To access complete instructions on the various steps of entering data into the software, click on the title of each section below.

Rosa's interview

Tax return for a Status Indian

- Click Interview setup in the left-side menu

- Tick the box next to Tax return for a Status Indian in the Specific situations section

- Click Status Indian in the left-side menu

- Select Yes from the Please confirm that you are a registered Indian, or entitled to be registered as an Indian under the Indian Act. drop-down menu

- Enter the tax-exempt amounts into the Exempt CPP/QPP benefits and Social assistance payments received from a First Nation/band council (not included in a T5007)(T90 Line 12) fields

Pensions and saving plans – T4A(P), T4A(OAS)

- Click Interview setup in the left-side menu

- Tick the box next to Pension income, other income and split pension income, COVID-19 benefits (T4A, T4FHSA, T4A(OAS), T4A(P), T4A-RCA, T4RSP, T4RIF, T1032) in the Pension and other income section

- Click T4A, T4FHSA and pension income in the left-side menu

- Click the + sign next to:

- T4A(P) – Statement of Canada or Québec pension plan benefits

- T4A(OAS) – Old age security pension income

- Enter the amounts for each tax slip into the corresponding fields

Takeaway points

Tax-exempt social assistance payments

- Rosa’s social assistance payments are tax exempt because she lives on a reserve, has Indian status and received the payments from a First Nation or band council

- they are not reported on line 14500 and there is no deduction on line 25000

Form T90 Income Exempt from Tax under the Indian Act

- The Form T90, Income Exempt From Tax Under the Indian Act is used by the CRA to calculate the Canada workers benefit (CWB) and the Canada training credit limit (CTCL), if an individual is eligible for them

- the tax software automatically reports tax-exempt income on the form

- In this case, Rosa’s social assistance payments and the tax-exempt portion of the Canada pension plan benefits are reported on form T90

- the old age security pension is not reported on the form because it is not tax exempt