Reporting tips and additional Canada Pension Plan contributions

Pre-test question

Sorry, that is incorrect

The individual is responsible for providing you with any amounts they earned that are not reported on their T4 slip because these amounts must be reported on their tax return.

That is correct

The individual is responsible for providing you with any amounts they earned that are not reported on their T4 slip because these amounts must be reported on their tax return.

Instructions

- Open the tax software

- Review the Background information and Required slips (tax slips, receipts, etc.)

- Provide all required information for the appropriate sections of the tax software

- Once completed, compare your results with the solution provided

- Afterwards, refer to Key points of the tax software and the Takeaway points

Background information

Situation

Sandra worked at ABC Ltd. and Le Gourmet at the same time. She informed the volunteer that she received tips while working at Le Gourmet for a total of $2,000, which was not included on her T4 slip. Sandra would like to make additional Canada Pension Plan (CPP) contributions for the tips she earned. She also received Advanced Canada workers benefit payments.

| Categories | Datas |

|---|---|

| Name | Sandra Couture |

| Social insurance number (SIN) | 000 000 000 |

| Address | 123 Main Street City, Province X0X 0X0 |

| Date of birth | May 5, 1995 |

| Marital status | Single |

Required slips

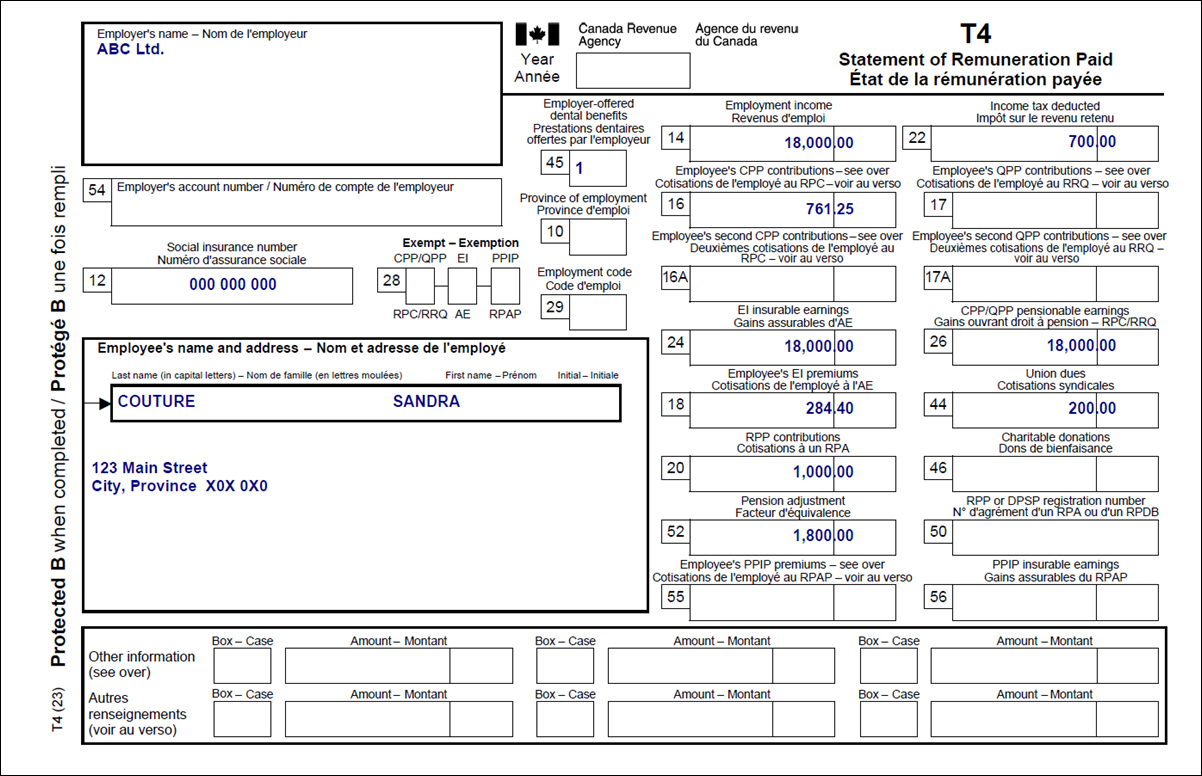

T4 – Statement of Remuneration Paid (ABC Ltd.)

Text version for the above image

T4 – Statement of Remuneration Paid

Protected B

Employer’s name: ABC Ltd.

Employee’s name and address:

Last name: Couture

First name: Sandra

123 Main Street

City, Province X0X 0X0

Box 12: Social insurance number: 000 000 000

Box 14: Employment income: 18,000.00

Box 16: Employee’s CPP contributions – see over: 761.25

Box 18: Employee’s EI premiums: 284.40

Box 20: RPP contributions: 1,000.00

Box 52: Pension adjustment: 1,800.00

Box 22: Income tax deducted: 700.00

Box 24: EI insurable earnings: 18,000.00

Box 26: CPP/QPP pensionable earnings: 18,000.00

Box 44: Union dues: 200.00

Box 45: Employer-offered dental benefits: 1

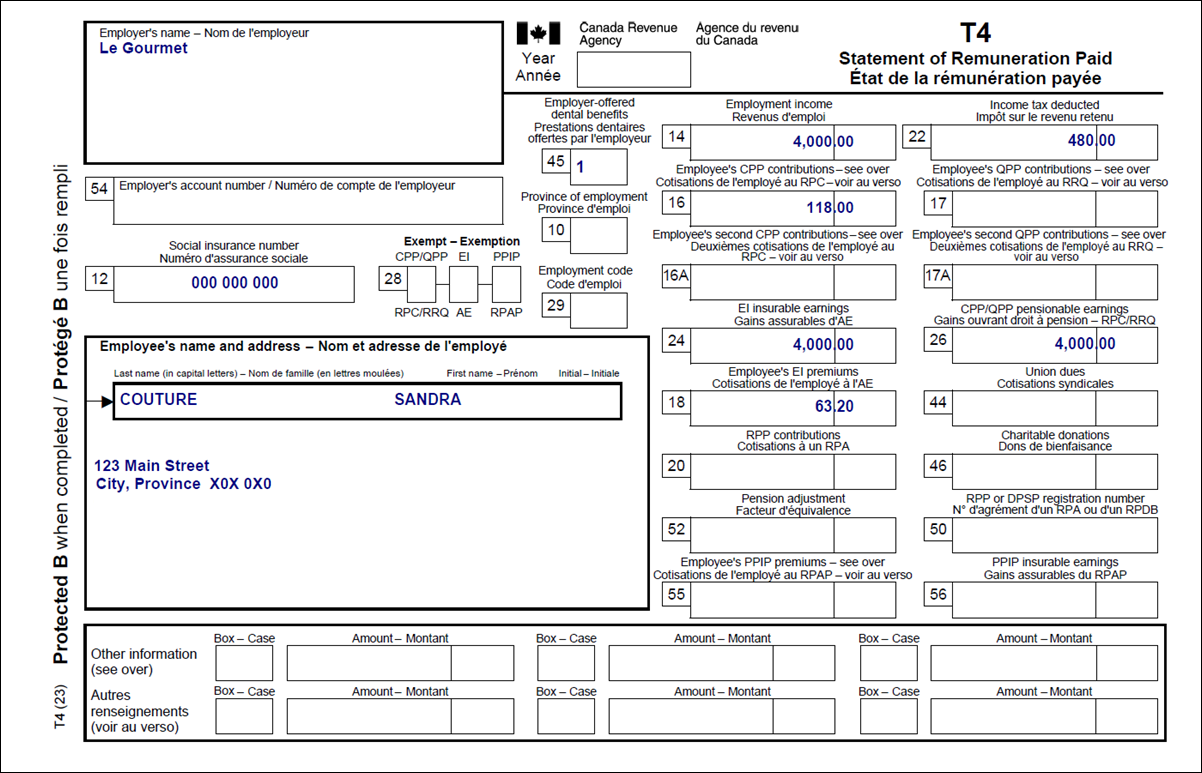

T4 – Statement of Remuneration Paid (Le Gourmet)

Text version for the above image

T4 – Statement of Remuneration Paid

Protected B

Employer’s name: Le Gourmet

Employee’s name and address:

Last name: Couture

First name: Sandra

123 Main Street

City, Province X0X 0X0

Box 12: Social insurance number: 000 000 000

Box 14: Employment income: 4,000.00

Box 16: Employee’s CPP contributions – see over: 118.00

Box 18: Employee’s EI premiums: 63.20

Box 22: Income tax deducted: 480.00

Box 24: EI insurable earnings: 4,000.00

Box 26: CPP/QPP pensionable earnings: 4,000.00

Box 45: Employer-offered dental benefits: 1

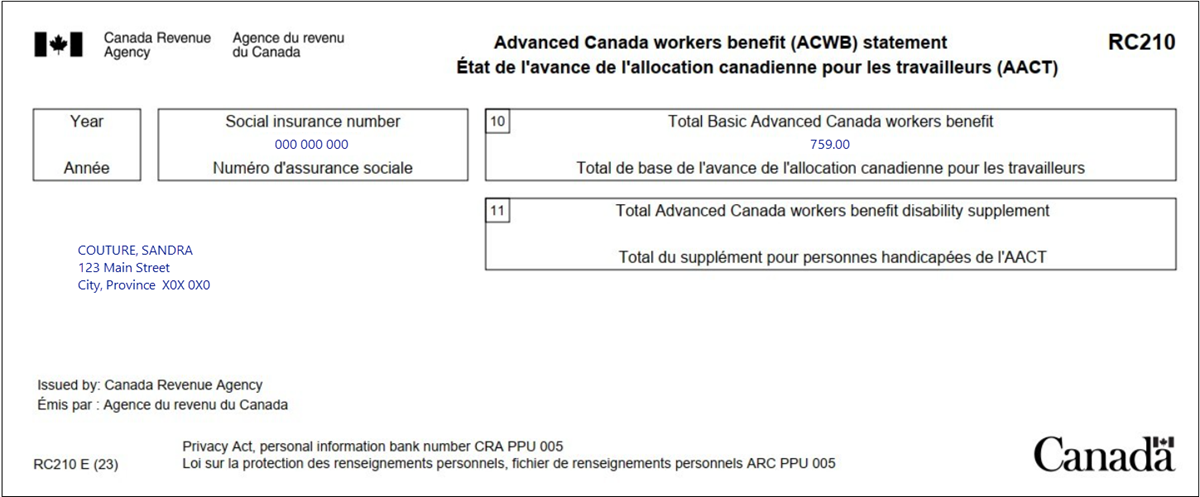

RC210 – Advanced Canada workers benefit (ACWB) statement

Text version for the above image

RC210 – Advanced Canada workers benefit (ACWB) statement

Issued by: Canada Revenue Agency

Couture, Sandra

123 Main Street

City, Province X0X 0X0

Social insurance number: 000 000 000

Box 10: Total Basic Advanced Canada workers benefit: 759.00

Review your results

Solution to Reporting tips and additional CPP contributions.

Key points of the tax software

Important note

To access complete instructions on the various steps of entering data into the software, click on the title of each section below.

Sandra's interview

- Click T4 and employment income in the left-side menu

- Click the + sign next to T4 income (earned in any province except Quebec) in the T4 and T4E section

- Enter the information from the individual’s T4 slips into the corresponding fields

Other employment income (tips and gratuities)

- Click T4 and employment income in the left-side menu

- Click the + sign next to Tips in the Other section

- Enter the total amount of tips not included on their T4 slip

Canada Pension Plan contributions payable on tips and gratuities

- Click T4 and employment income in the left-side menu

- Click the + sign next to CPT20 – CPP Election for Other employment earnings in the CPT20 section

- Select B Employment received tips, gratuities, or other earnings from the Select the type of employment on which you elect to pay CPP contributions (CPT20) drop-down menu

- Enter the type of income (in this case, Tips) into the first Other employment income, enter the gross amount earned field

- Enter the amount the individual wants to make additional CPP contributions for into the second Other employment income, enter the gross amount earned field

Advanced Canada workers benefit (RC210)

- Click Other information slips in the left-side menu

- Click the + sign next to RC210 – Canada workers benefit advance payments statement [Federal line 41500]

- Enter the information from the tax slip

Takeaway points

Canada Pension Plan contributions payable on tips and gratuities

- Individuals can make additional Canada Pension Plan (CPP) contributions on tips through their income tax return on line 42100

- The tax software automatically calculates the additional CPP contributions with the information entered