Canada’s 2030 Emissions Reduction Plan - Chapter 2

Canada's climate actions to date have resulted in the decoupling of economic growth from emissions growth. This is a massive step forward, but in order to further reduce emissions in every part of the economy, Canada needs to do more. This means implementing strategies that apply to the entire economy, and others that are targeted to specific sectors. This chapter begins by looking at strategies for emissions reductions and economic growth across the entire economy, then at strategies for key sectors.

Every economic sector has a role to play and a responsibility to act. At the same time, each sector and the workforces and communities they support are distinct. This diversity means that every sector will have a unique transition pathway. The policy tools employed to reduce emissions will need to take into account the realities of the regions and people they impact. Economic sectors are linked and interdependent; decarbonizing one sector will often have positive spillover effects to enable reductions from another sector. For example, reducing emissions from Canada's electricity sector by transitioning to a net zero-emissions grid will allow other zero-emissions technologies that rely on electrification, like zero-emission cars, trucks, and buses, to yield greater emissions reductions.

Canada's climate actions carefully consider the need to increase climate ambition, while also maintaining or enhancing equity, creating jobs, and growing a strong economy where everyone has a fair chance at success. As Canada works to achieve its 2030 and 2050 goals, maintaining this balance will be paramount. As emphasized by the Net-Zero Advisory Body in their Foundational Values and Design Principles for Pathways to Net-Zero report, the guiding force behind Canada's efforts to 2030 and 2050 will be to seize the upsides of the transition, and pursue measures with the broadest benefits for individuals, families, workers, businesses, society as a whole, and future generations.

Working to build a prosperous, net-zero economy in every region of Canada

The global shift to net-zero presents a significant opportunity for Canada to grow its economy significantly and sustainably, creating jobs and economic prosperity now and into the future. Each region of the country is uniquely positioned to take advantage of new markets emerging from the transition while creating jobs and reducing GHG emissions. This is why, over the coming years, the Government of Canada is proposing to work in partnership with provinces and territories, Indigenous Peoples, industry and others towards building Canada's net zero economy. The Government proposes to accelerate regional growth opportunities and energy systems transformation through a $25 million investment in Regional Strategic Initiatives that will drive economic prosperity and the creation of sustainable jobs in a net-zero economy.

The Government of Canada acknowledges the requirement under the Canadian Net-Zero Emissions Accountability Act to take into account Indigenous Knowledge when setting emission reduction targets, as well as the requirement to consider the United Nations Declaration on the Rights of Indigenous Peoples in the establishment of emission reduction plans. Recognizing these requirements and the time constraints in the development of this 2030 Emission Reduction Plan, the Government of Canada will work in partnership with Indigenous Peoples to enable future emissions reduction plans to meaningfully incorporate Indigenous Knowledge, which could include efforts to emphasize the importance of building a net-zero emissions future that is just and resilient for generations to come, and reflect the lived realities of Indigenous Peoples. In order to better apply the principles within the UN Declaration, the Government will continue to work with Indigenous partners to co-develop an approach to enable a stronger presence of the Indigenous perspective in other elements of emission reduction plans, as well as work to better incorporate the multi-dimensional solutions offered by Indigenous Peoples, which could include returning to the land, food security, local and green power solutions, and language revitalization.

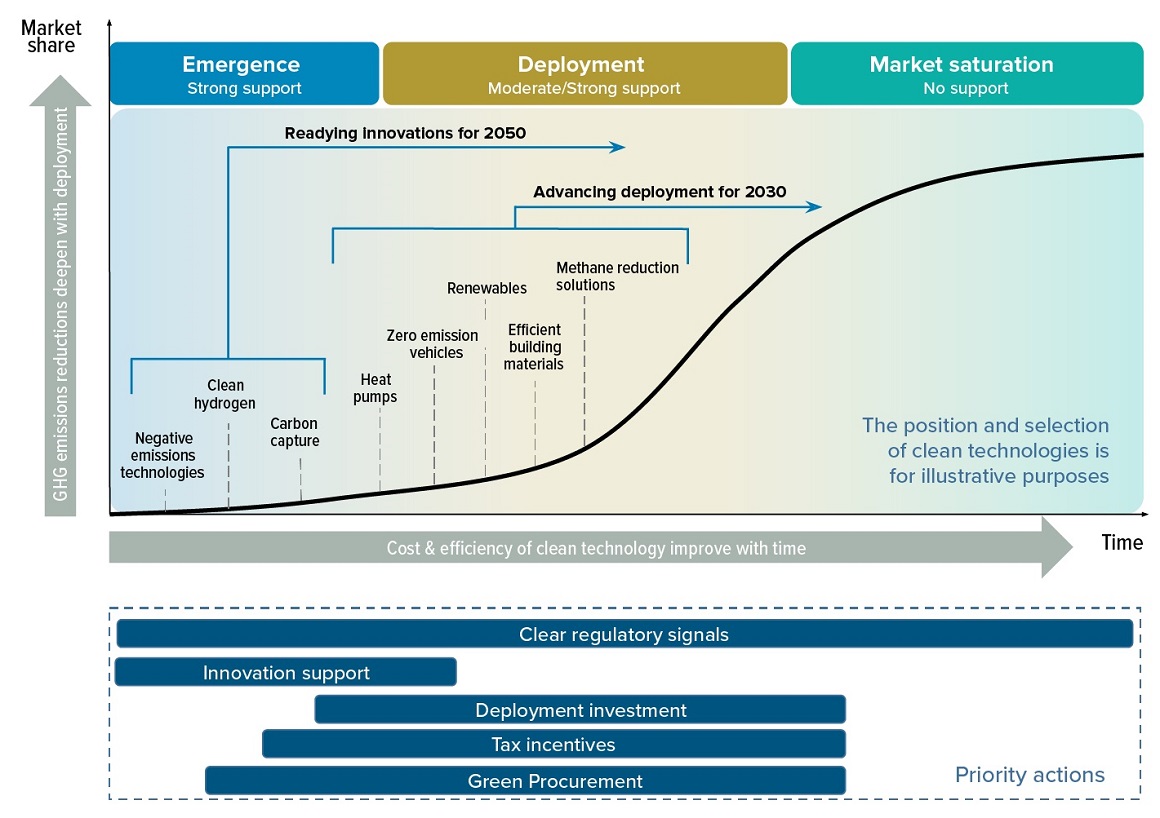

Reaching Canada's enhanced NDC of 40-45% below 2005 levels will require a significant increase in ambition across all economic sectors, and the measures and strategies outlined in this plan reflect this reality. Factors like the pace and scale of clean technology adoption, additional actions from other governments, and emerging market opportunities will all influence Canada's emissions trajectory to 2030—but, it is unclear at this point how these factors will evolve over time. To try to reflect these influences, the Government uses economic modelling to estimate how mitigation measures and strategies could impact Canada's emission levels in 2030. The updated projections to 2030 presented in Chapter 3 provide insight into how the measures in this 2030 ERP could influence Canada's pathway to 2030, and shed light on additional areas of ambition for the Government to pursue going forward.

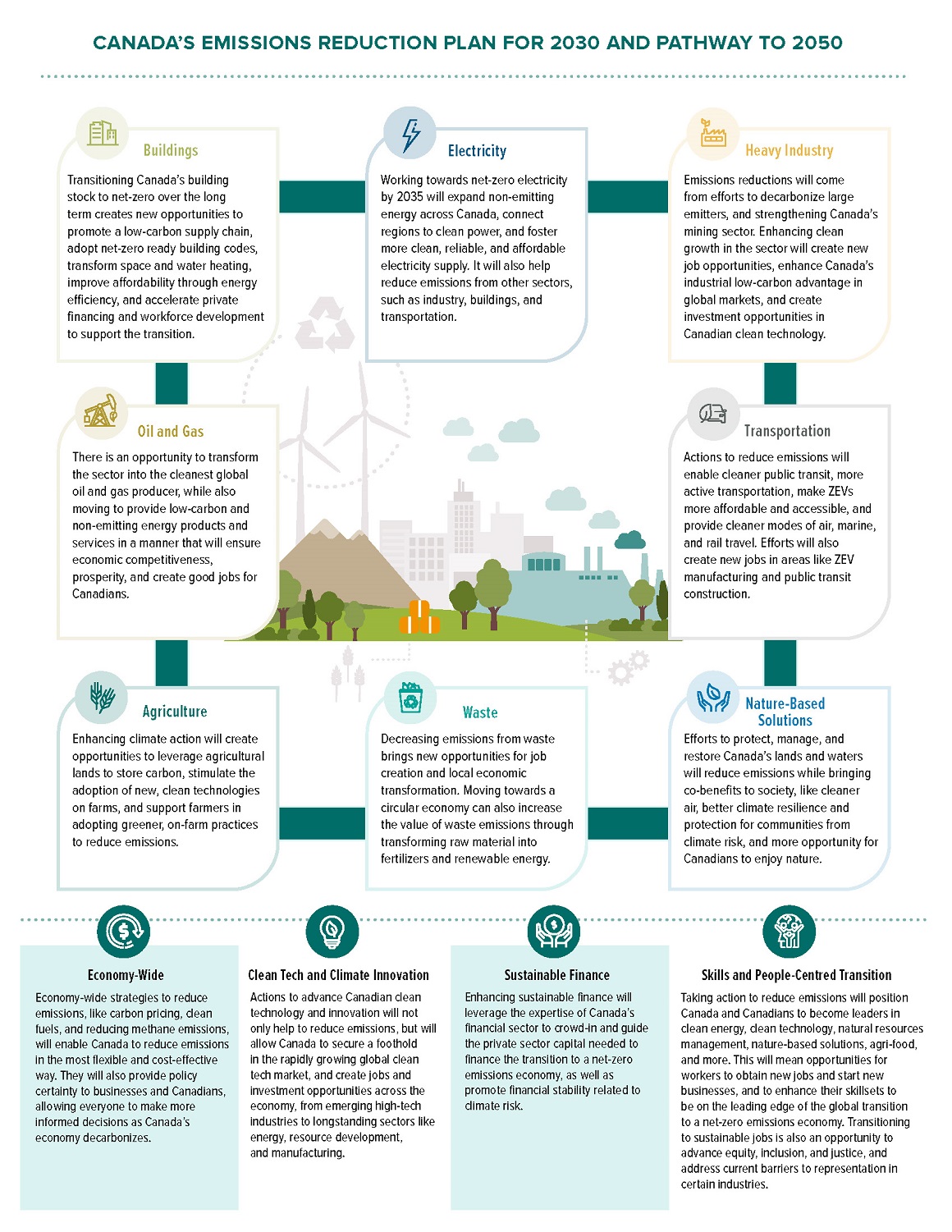

Canada's emissions reduction plan for 2030 and pathway to 2050

Long description

2030 Emissions Reduction Plan (ERP): Canada's decarbonization framework

The 2030 ERP will reflect Canada's proposed decarbonization framework, setting clear policy signals on how the government intends to achieve its 2030 target, including focus on reductions from key sectors (such as oil & gas, transport, agriculture), and create pathways to meet net-zero emissions by 2050.

Reaching Canada's 2030 and 2050 targets will require transformation across the economy. Enhancing mitigation measures with horizontal enabling measures to support and facilitate the transition is needed.

Mitigation opportunities for 2030 and 2050

Economy-wide:

- Continue carbon pricing trajectory, with increase of $15 per tonne from 2023-30, and increased stringency of the benchmark

- Champion adoption of global minimum standard on carbon pricing

Industry:

- Cap oil and gas emissions at current levels with five-year targets to achieve net-zero by 2050

- Implement the Global Methane Pledge

- CCUS tax credit

- Implement the Net-Zero Accelerator

- Launch Critical Minerals Strategy

- Introduce Buy Clean Strategy

- And other measures

Electricity:

- Clean Electricity Standard

- Pan-Canadian Grid Council

- Reduce reliance on diesel by 2030

- Support transition lines and the integration of renewables and clean fuels

- Continue to invest in renewables

- And other measures

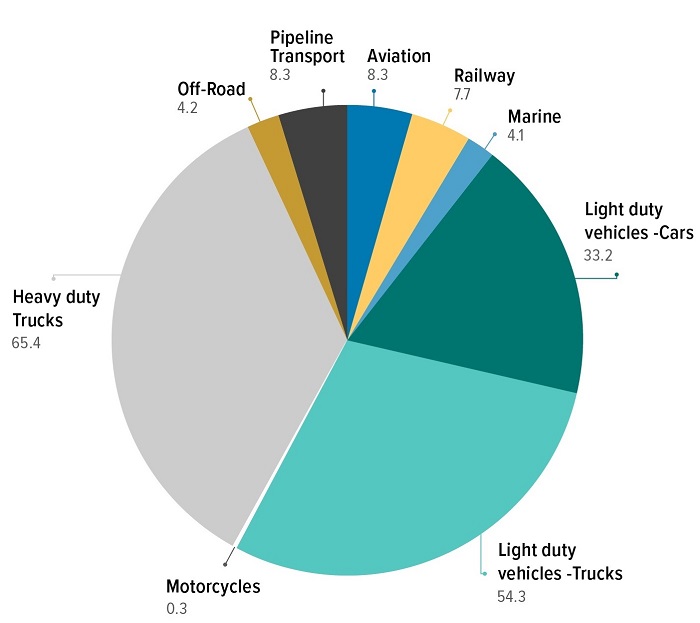

Transportation:

- Regulated sales mandate of 50% zero-emission LDVs in 2030; 100% in 2035

- Regulated sales mandate of 100% zero-emission MDV/HDVs by 2040

- Decarbonize on-road freight

- Add 50,000 EV chargers and hydrogen stations

- Accelerate public/active transit

- And other measures

Buildings:

- National Net-Zero Emissions Building Strategy

- Net-zero emissions building and model retrofit code by 2024

- National Infrastructure Assessment

- Low-carbon building materials innovation hub

- And other measures

Agriculture and waste:

- Integrate climate risk management into business risk management programs

- Triple funding for clean tech on farms

- Work to reduce methane and fertilizer emissions

- Develop agricultural policy framework, with climate at the core

- Create No-Waste Food Fund

- And other measures

Natural climate solutions:

- Advance Natural Climate Solutions Fund

- And other measures

Cross-cutting opportunities for 2030 and 2050

Clean technology and climate innovation:

- Advance Canada's clean technology ecosystem to align with 2030 and 2050 goals, and explore Canada's climate innovation trajectory, through efforts such as regulatory ambition, investments in clean tech deployment, low-carbon procurement, and more

Sustainable finance:

- Advance mandatory climate-related financial disclosures in partnership with PTs, and require federally-regulated institutions to issue climate-related financial disclosures

- Launch Canada's first federal green bond and develop a net-zero capital allocation strategy with the Sustainable Finance Action Council

Skills and people-centered transition:

- Advance Just Transition legislation and create a New Futures Fund to support affected workers

- Launch Clean Jobs Training Centre and redesign Canada Training Benefit to help workers gain skills to thrive in a net-zero economy

- Increase inclusion in the clean energy workforce by creating more opportunities for under-represented people

2.1. Economy-wide

Economy-wide strategies to reduce emissions allow for maximum flexibility at the lowest overall cost. Policies with long-term targets and price trajectories provide policy certainty, allowing Canadians and businesses to make informed investment decisions.

2.1.1. Putting a price on carbon pollution

Supreme Court decision on the price on carbon pollution

On March 25, 2021, the Supreme Court of Canada released its judgment on the Greenhouse Gas Pollution Pricing Act, where a strong majority ruled to uphold the validity of the Act. In doing so, the Court confirmed that Parliament has the authority under its peace, order, and good government power to legislate to establish minimum national standards of GHG price stringency to reduce emissions.

In the Court's own words:

"Climate change is real. It is caused by greenhouse gas emissions resulting from human activities, and it poses a grave threat to humanity's future. The only way to address the threat of climate change is to reduce greenhouse gas emissions."

"The evidence reflects a consensus, both in Canada and internationally, that carbon pricing is integral to reducing GHG emissions."

"Any province's failure to act threatens Canada's ability to meet its international obligations, which in turn hinders Canada's ability to push for international action to reduce GHG emissions. Therefore, a provincial failure to act directly threatens Canada as a whole."

It is much harder to cut pollution if it is free to pollute. The principle is straightforward: a price on carbon pollution establishes how much businesses and households need to pay for their carbon pollution. The higher the price, the greater the incentive to pollute less, conserve energy, and invest in low-carbon solutions.

Canadians and businesses understand that putting a price on carbon pollution spurs the development of new technologies and services that can help reduce their emissions cost-effectively, from how they heat their homes to what kind of energy they use to do so. It also provides Canadians and businesses with an incentive to adopt these changes or solutions into their lives. That's why experts consistently recommend carbon pollution pricing as an efficient, effective approach to reducing emissions.

Canada is leading the charge on sending the necessary price signals needed to transform the economy. At COP 26 in Glasgow, Canada called for global leaders to work together to triple the global emissions covered by carbon pollution pricing to 60% by 2030.

What have we done so far?

Since 2019, every jurisdiction in Canada has had a comparable price on carbon pollution. Not only does this help fight climate change, it puts more money back into people's pockets. Canada's approach is flexible: any province or territory can design its own pricing system tailored to local needs, or it can choose the federal pricing system. The Government of Canada sets minimum national stringency standards (the "benchmark") that all systems must meet to ensure they are comparable and effective in reducing GHG emissions. If a province decides not to price carbon pollution, or proposes a system that does not meet these standards, the federal system is applied. In August 2021, the Government of Canada published strengthened benchmark criteria that all systems will need to meet from 2023-2030.

A key element of the federal benchmark is the price on carbon pollution.Footnote 1 The price on carbon pollution started at $20 per tonne of emissions in 2019 – and has been rising at a predictable rate of $10 per year to reach $50 in 2022. Starting in 2023, the price will start rising by $15 per year until it reaches $170 per tonne in 2030. The price schedule is laid out to 2030 to create certainty, which is important for attracting private sector investment.

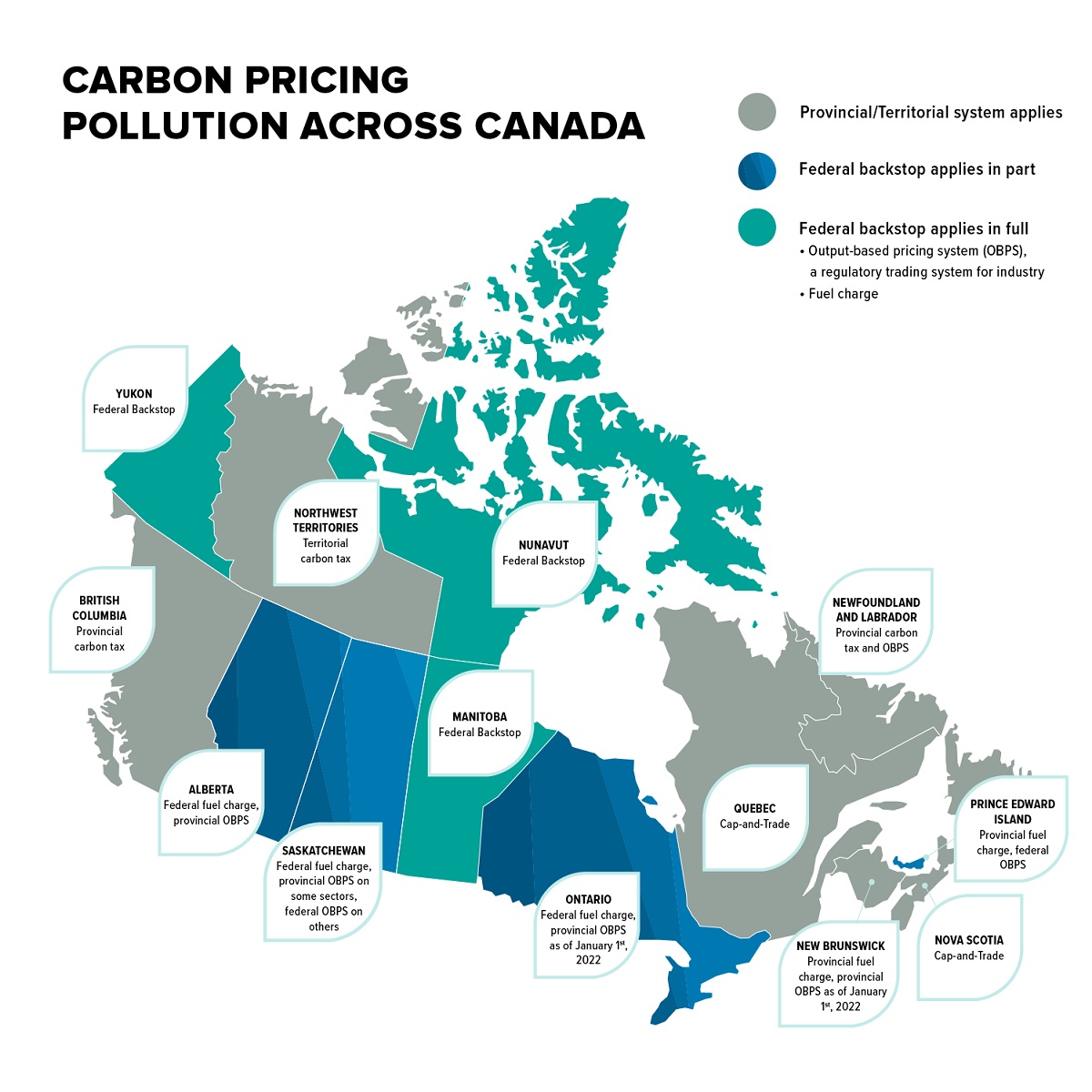

The federal carbon pollution pricing system has two parts: a regulatory charge on fossil fuels like gasoline and natural gas (the "fuel charge"), and a performance-based emissions trading system for industries, known as the Output-Based Pricing System (OBPS).

Long description

Grey: Provincial/Territorial system applies

Blue: Federal backstop applies in part

Teal: Federal backstop applies in full

- Output-Based Pricing System (OBPS), a regulatory trading system for industry

- Fuel charge

Provinces/territories and the system that applies in each:

- Newfoundland and Labrador (grey): Provincial carbon tax and OBPS

- Nova Scotia (grey): cap-and-trade

- Prince Edward Island (teal): provincial fuel charge, federal OBPS

- New Brunswick (grey): provincial fuel charge, provincial OBPS as of January 1, 2021

- Quebec (grey): cap-and-trade

- Ontario (teal): federal fuel charge, provincial OBPS as of January 1, 2022.

- Manitoba (blue): federal backstop

- Saskatchewan (teal): federal fuel charge, provincial OBPS on some sectors, federal OBPS on others

- Alberta (teal): federal fuel charge, provincial OBPS.

- British Columbia (grey): provincial carbon tax

- Yukon (blue): federal backstop

- Northwest Territories (grey): territorial carbon tax

- Nunavut (blue): federal backstop

Ensuring that provincial and territorial pricing systems continue to meet federal benchmark criteria is key to realizing the significant emissions reductions from the price on carbon pollution by 2030. The Canadian Climate Institute reviewed the state of the price on carbon pollution across Canada and recommended that "to support effectiveness and address competitiveness and fairness issues, federal, provincial, and territorial governments should work towards developing a common standard of emissions coverage for carbon pricing."

Fuel Charge

The federal fuel charge applies in Ontario, Manitoba, Saskatchewan, Alberta, Yukon, and Nunavut. Applying the fuel charge at higher rates over time will help to reduce GHG emissions and support clean growth. It also sends a signal to markets and provides an increasing incentive to choose cleaner sources of energy and reduce energy use through conservation and efficiency measures.

Output-Based Pricing System

The OBPS applies to industrial emitters that are emissions intensive and trade exposed. It ensures there is a price incentive for industrial emitters to reduce their emissions, spurring innovation and encouraging the adoption of cleaner technologies and fuels while minimizing competitiveness and "carbon leakage" risks (i.e. the risk of industrial facilities moving from one region to another to avoid paying a price on carbon pollution). The federal OBPS applies in Prince Edward Island, Manitoba, Yukon, Nunavut, and partially in Saskatchewan. All other provinces and territories are implementing their own pricing systems for industrial emitters, aligned with the federal benchmark.

Carbon pollution pricing proceeds

Ensuring that the proceeds of the federal price on carbon pollution remain in the province or territory where they were collected is an important component of the federal pricing system.

Return of Federal carbon pollution proceeds

The federal carbon pollution pricing system returns all direct proceeds back to the jurisdiction where they were collected. Some provinces and territories receive the funds directly and can use them as they see fit. In other provinces, the federal government uses the proceeds to support to individuals, Indigenous Peoples, families, and businesses through direct payments and federal programming.

The majority of households in jurisdictions that receive Climate Action Incentive payments under the federal backstop system receive more money than they pay in fuel charges. Direct payments to households work because they help make the price on carbon pollution affordable, and enable households to make investments to increase energy efficiency and further reduce emissions.

| Ontario | Manitoba | Saskatchewan | Alberta | |

|---|---|---|---|---|

| Average cost impact per household1 of the federal system | $ 578 | $ 559 | $ 734 | $ 700 |

| Average Climate Action Incentive payment per household2 | $ 712 | $ 788 | $ 1053 | $ 1038 |

Source: Department of Finance Canada calculations using inputs from Environment and Climate Change Canada, Canada Revenue Agency and Statistics Canada.

1 The estimated average impact per household reflects the impact on household spending costs, accounting for direct impacts (reflecting consumption of fuels to which the federal carbon pollution pricing system applies) and indirect impacts (reflecting consumption of goods and services with federal carbon pollution pricing embedded in them). These impacts are inclusive of carbon pollution pricing embedded in imports that households purchase from other provinces/territories on which a federal carbon pollution price is applied. They do not include the costs associated with other carbon pricing systems; accordingly, they do not include the costs associated with the provincial systems for large industrial facilities such as those in Saskatchewan and Alberta. Estimates also assume full pass-through from businesses to consumers.

2 The 2022-23 Climate Action Incentive payment amounts include an adjustment for over-distributions made with respect to proceeds generated in previous years in each of the above provinces respectively. As a result, the average payment amount per household also reflects this adjustment.

What was heard from the 2030 ERP engagement process?

- Canadians and stakeholders recognized that putting a price on carbon pollution is one of the best tools to fight climate change, and that support for vulnerable households will be critical as the price increases. Sound investment decisions will demand long-term certainty and a clear trajectory.

- A number of jurisdictions are working on new or updated climate change plans or related strategies, emissions targets, and carbon pollution pricing approaches for 2023-2030 that will comply with federal requirements.

- Indigenous submissions emphasized that market-based solutions have limitations, and the path toward net-zero should be a holistic process leading to a just, equitable, and resilient future for generations to come, founded on Indigenous Peoples' right to self-determination.

What's next?

Carbon pricing is the cornerstone of Canada's approach to climate action. The Government of Canada has established a globally-recognized pricing system focused on the return of revenue, putting money back in the pockets of Canadians, and incentivizing decarbonization throughout the economy. Ensuring that the federal benchmark price will rise by $15 per year, increasing to $170 per tonne by 2030, is key to achieving Canada's climate objectives. This requires that provinces and territories update their carbon pollution pricing systems where necessary to align with the strengthened benchmark.

Ensuring carbon pricing certainty

To enhance long-term certainty, the Government of Canada will explore measures that help guarantee the future price of carbon pollution. This includes, for example, investment approaches like carbon contracts for differences, which enshrine future price levels in contracts between the Government and low-carbon project investors, thereby de-risking private sector low-carbon investments. This also includes exploring legislative approaches to support a durable price on carbon pollution. The Government of Canada will provide an update on these exploratory efforts in Canada's 2023 Progress Report under the Canadian Net-Zero Emissions Accountability Act.

Border carbon adjustments

Countries around the world are considering how to take strong climate action while mitigating carbon leakage and competitiveness risks for domestic industries. Currently in Canada, these risks are addressed through the design of domestic carbon pollution pricing systems by reducing average costs. Another complementary approach is to apply border carbon adjustments – import charges and potentially export rebates – to account for differences between countries in carbon costs incurred in producing emissions-intensive goods that are traded internationally. Such a policy can support ambitious carbon pollution pricing by leveling the playing field between domestic producers and their international competitors. The Government of Canada is exploring border carbon adjustments as a potential policy tool that could complement domestic carbon pollution pricing to allow for greater ambition and stringency.

Developing Canada's domestic offset system

The Government is developing a Federal Greenhouse Gas (GHG) Offset System under the Greenhouse Gas Pollution Pricing Act (GGPPA). The Federal GHG Offset System will encourage voluntary project activities across Canada that reduce GHG emissions or remove them from the atmosphere by allowing the generation of offset credits. Finalizing the Federal GHG Offset System will encourage cost-effective, voluntary emissions reductions and removals from activities that go beyond legal requirements and common practice, as well as those not covered by the price on carbon pollution expanding the financial incentives to reduce carbon pollution across the economy.

Facilities covered by the Federal OBPS can use federal offset credits as a compliance option, while other groups, including governments and businesses, can use federal offset credits to meet other climate objectives. The initial set of protocols under development will create a financial incentive to reduce emissions from activities such as landfill methane recovery and destruction, replacing high global warming potential (GWP) gases in refrigeration systems, sustainable agriculture land management practices which enhance storage of organic carbon in soil, and improving forest and livestock feed management. Moving forward the Government will continue to develop protocols under the Federal GHG Offset Program for activities in the agriculture, forestry and waste sectors, as well as for the commercial and industrial activities not covered by pricing and activities that result in long-term storage of CO2.

Continuing to return carbon pollution proceeds

Beginning in 2022, the Government of Canada will return proceeds collected through the federal fuel charge to families on a quarterly basis. The Government of Canada will also provide targeted support that recognizes the unique circumstances of Indigenous Peoples, farmers, and small and medium-sized businesses.

Using funds collected under the federal OBPS, the Government of Canada has introduced the Decarbonization Incentive Program and the Future Electricity Fund. The Decarbonization Incentive Program will support the deployment of clean technology projects to further reduce GHG emissions by incentivizing long-term decarbonization of Canada's industrial sectors. The Future Electricity Fund will support the production and delivery of clean electricity as well as its efficient use.

2.1.2. Production and use of clean fuels

Low carbon intensity fuels – or clean fuels – have significantly lower emissions over their lifecycle than conventional fuels. Examples include ethanol, biodiesel, advanced biofuels such as renewable diesel, liquid synthetic fuels, renewable natural gas, and low carbon intensity hydrogen.

Clean fuels can be produced from a variety of feedstocks, such as sustainably harvested agricultural and forest biomass, wastes (including agricultural, forestry, and municipal solid wastes), renewable electricity, and/or from fossil fuel sources with CCUS.

The IEA's World Energy Outlook underlines the importance of low carbon intensity fuels to reduce emissions in several hard to abate sectors (shipping, aviation, heavy-duty trucking, and industrial processes). Currently, low carbon intensity fuels make up less than 6% of Canada's total energy supply. Barriers preventing clean fuels production in Canada from reaching its full potential include investment uncertainty, up-front capital costs and commercial readiness.

What have we done so far?

Recognizing the essential role of clean fuels on the road to net-zero, Canada has published proposed Clean Fuel Regulations, worked with key stakeholders on the Hydrogen Strategy for Canada, and made investments to grow the clean fuels market through investments such as the Energy Innovation Program and the Clean Fuels Fund.

The Clean Fuel Regulations will require liquid fossil fuel (gasoline and diesel) suppliers to reduce the carbon intensity of the fuels they produce and import for use in Canada over time. By adopting regulations that focus on emissions throughout the lifecycle of fuels, the Government of Canada is following similar approaches that already exist in British Columbia, California, Oregon and other jurisdictions.

The $1.5 billion Clean Fuels Fund is designed to de-risk the capital investment for building new or retrofitting or expanding existing clean fuel production facilities. The Energy Innovation Program funds research, development, and demonstration projects, and other related scientific activities that advance clean energy technologies.

The emerging hydrogen economy will reduce GHG emissions across Canada, while supporting energy transition, regional economic development, and new employment opportunities for energy workers. The Hydrogen Strategy for Canada is a call to action, developed jointly by the Government of Canada, other levels of government, Indigenous partners, industry, and other stakeholders. The Strategy lays out an ambitious framework for actions that will reinforce hydrogen as a tool to achieve our goal of net-zero emissions by 2050 and position Canada as a global, industrial leader in clean fuels.

What's next?

Initiatives to support the production and use of clean fuels are particularly important for hard to decarbonize sectors of the economy, such as heavy industry and some transportation modes. To meet Canada's 2030 target and lay the groundwork for net-zero emissions by 2050, the Government will also explore the feasibility of a bioenergy strategy to optimize how Canada uses its agricultural, forestry and municipal waste resources to generate net-zero energy in the medium and long term.

Additionally, the Government will continue consulting on the Clean Fuel Regulation to ensure it continues to play a meaningful role in the decarbonization of the transportation sector, driving investments in clean fuels and zero-emissions vehicle technology. In light of other related measures, such as the increased price on carbon pollution and the commitment to establish a cap on oil and gas emissions, the Government is consulting on increasing the stringency of the Clean Fuel Regulations. This change would lead to a decrease of approximately 15% (below 2016 levels) in carbon intensity of liquid fossil fuels by 2030. This change would also help enable the Clean Fuel Regulations in delivering significant emissions reductions from liquid fossil fuels used in Canada.

2.1.3. Supporting the transition to a clean growth economy

Deployment of innovative and efficient technologies and processes remains critical to unlocking transformational change and achieving decarbonization. Programs that target specific barriers can help industry, governments and the public adopt technologies and approaches that reduce carbon emissions. Programs targeting Indigenous participation in a clean growth economy can enhance socio-economic outcomes for communities while increasing buy-in and the eventual success of key projects.

What have we done so far?

Low Carbon Economy Challenge Fund

To date, approximately $300 million in approved active projects will reduce GHG emissions by 1Mt in 2030. Supported projects include:

- City of Saint John received up to $5.9 million for the District Energy System Project to install a renewable heating and cooling system in a commercial complex, as well as to perform energy retrofits in up to 50 municipal buildings throughout the city.

- City of Peterborough received up to $6.1 million for the Peterborough Organics Project to develop a centralized composting centre to divert food, leaf, and yard waste from landfills

- Cowessess First Nation received over $630,000 for the Community Buildings Solar Project to install solar arrays on five community-owned buildings.

- Centre de Traitement de Biomasse de la Montérégie received up to $3 million to install new equipment to convert organic and food waste into renewable energy and hygienic dried bio-fertilizer.

The Government of Canada has committed over $100 billion in 2016-2021 to target specific barriers and encourage early adoption of new technologies, help Canada meet its GHG targets, transition to a clean growth economy and protect the environment.

The Low-Carbon Economy Fund supports provincial and territorial programs through the Leadership Fund, while the Challenge Fund provides over $500 million to a wide range of recipients, including provinces and territories, businesses, municipalities, not-for-profits, and Indigenous communities and organizations.

The Climate Action and Awareness Fund is investing over $200 million over five years to support projects that help build capacity and raise awareness in an effort to reduce Canada's GHG emissions.

The Canada Infrastructure Bank (CIB) was established to ensure that Canadians benefit from modern and sustainable infrastructure through partnerships between governments and the private sector. The Government has allocated $35 billion for the CIB to fulfill its purpose, which Parliament approved, and set out priority investment areas for the CIB, which include green infrastructure ($5 billion), public transit ($5 billion) and clean power ($5 billion). With this government direction, the CIB is helping to fight climate change and achieve Canada's emissions reduction targets by investing in a range of projects, including for zero-emission buses, public and commercial building retrofits, electricity transmission and storage, and renewable energy sources.

Canada's Greening Government Strategy

As the owner and manager of the largest fixed asset portfolio in Canada—with 32,000 buildings, 20,000 engineered assets such as bridges and dams, as well as 40,000 vehicles—federal action is making a critical contribution to meeting Canada's climate objectives. The Government of Canada is also the largest public procurer in Canada, and is well-positioned to leverage its procurement power to stimulate market demand for low-carbon products (e.g., low-carbon cement) and Canada's emerging clean technology sector.

The Greening Government Strategy, created in 2017 and updated in 2020, commits the Government of Canada to transition to net-zero carbon and climate-resilient operations, and reduce environmental impacts on waste, water and biodiversity. The Government of Canada has committed to ensuring its operations will be net-zero emissions by 2050 including government-owned and leased real property, fleets, and procurement of goods and services. Emissions from federal operations are declining, with total federal GHG emissions from real property and conventional fleet operations 40.6% lower in 2020-21 when compared to 2005-06.

What's next?

Broad funding programs will continue to play an important role in meeting Canada's decarbonization objectives. These programs support tangible GHG reductions and provide a direct contribution to meeting Canada's 2030 and 2050 goals. They can also help increase knowledge and build capacity in Canadian society around opportunities for taking positive climate action. As such, the Government of Canada will expand the Low Carbon Economy Fund through a $2.2 billion recapitalization. The funding aims to leverage further climate actions from provinces and territories, municipalities, universities, colleges, schools, hospitals, businesses, not-for-profit organizations, and Indigenous communities and organizations.

2.1.4. Taking a holistic approach to reduce methane

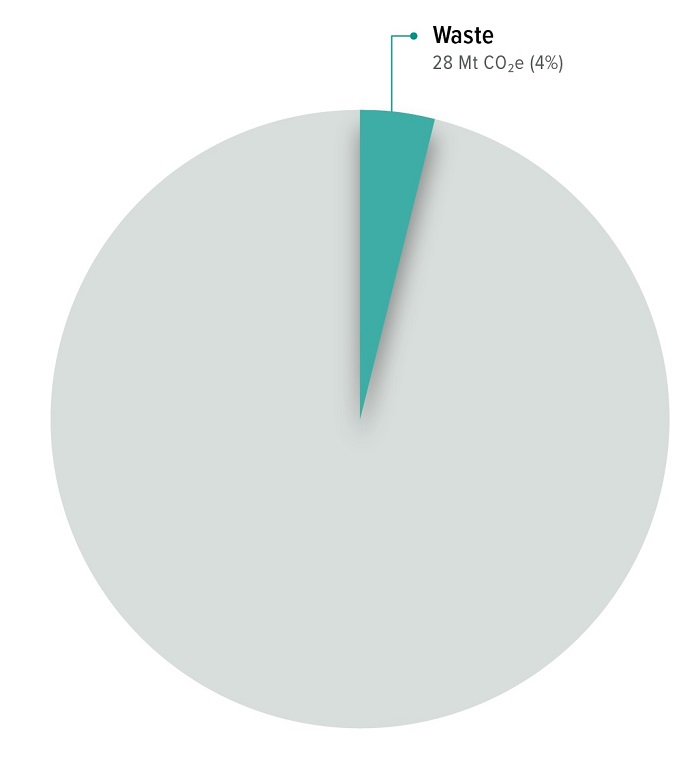

Methane is a potent greenhouse gas. Once released into the atmosphere, it has 86 times the warming power of carbon dioxide over a 20-year period. According to Canada's current national inventory, published in April 2021, methane accounted for 13% (98 Mt CO2e) of total 2019 GHG emissions in Canada. Over 90% of these emissions were from three key sectors: oil and gas, agriculture and waste.

What have we done so far?

In November 2021, Canada was a global leader in joining the Global Methane Pledge. This pledge has now been signed by over 100 countries, who will work together to reduce global anthropogenic methane emissions across all sectors by at least 30% below 2020 levels by 2030. In support of this Pledge, the Government of Canada is developing a plan to reduce methane emissions across the broader Canadian economy.

In 2018, Canada demonstrated global leadership by publishing the first national-level oil and gas regulations that specifically target methane emission reductions. In March 2022, the Government of Canada launched consultations to inform the design of more stringent regulations to achieve at least a 75 percent reduction in methane emissions from the oil and gas sector by 2030. In addition, regulations and other measures are being developed and consulted upon to address methane emissions from landfills and support the diversion of organics from landfills across the country. Additionally, a number of measures have been put in place to support Canadian businesses in this transition, such as the:

- $750 million Emissions Reduction Fund to support methane reductions in oil and gas;

- Energy Innovation Program's Canadian Emissions Reduction Innovation Network to develop and deploy methane reduction technologies;

- $20 million Food Waste Reduction Challenge and,

- Clean Fuels Fund support for clean fuels projects including those using waste biomass for low-carbon energy.

Enhancing scientific knowledge and continuous improvement in emissions measurement and quantification is essential to inform policy decisions. That is why the Government of Canada is working with academics, scientific experts, industry, and clean technology companies to better understand methane emission sources and improve quantification to mitigate emissions.

The IEA Global Methane tracker recently pointed to underreporting of actual methane emissions in the UNFCCC National Inventory Reports. Canada had identified that issue, and in 2021, committed to revising its methodology to estimate oil and gas sector fugitive emissions. This significantly improves methane emission estimates. A new fugitive emission model is now in place to estimate carbon dioxide and methane emissions in the upstream oil and gas industry. It resulted in methodological improvements that will be published in Canada's 2022 National Inventory Report (NIR). Furthermore, Canada adjusted its methodology to estimate landfill methane emissions to address underestimation of emissions in its 2021 NIR.

What's next?

The Government of Canada intends to release its plan to reduce methane emissions across the economy this year, aligned with Canada's methane reduction commitments.

This plan will highlight science and clean technology innovation for measurement and quantification to inform reporting, policy development, and mitigation measures across the Canadian economy. The strategy will strengthen the clean technology sector, provide tools to industry and governments to achieve methane emission reductions effectively, and protect our climate, reaffirming Canada's global leadership and providing tools and best practices for other countries to achieve emission reductions. Further, the Government of Canada has committed to establishing a global centre of excellence on methane detection and elimination.

2.2. Buildings

Decarbonizing the buildings sector is critical to Canada's pathway to 2030 and 2050. Emissions in the buildings sector have been trending upwards since 2005 as Canada's building stock continues to grow. In particular, more than 80% of Canada's building stock will be made up of existing buildings that are still in operation in 2030. It is also imperative that new buildings are net-zero ready and energy efficient, to avoid the need for future retrofits.

Current sector emissions

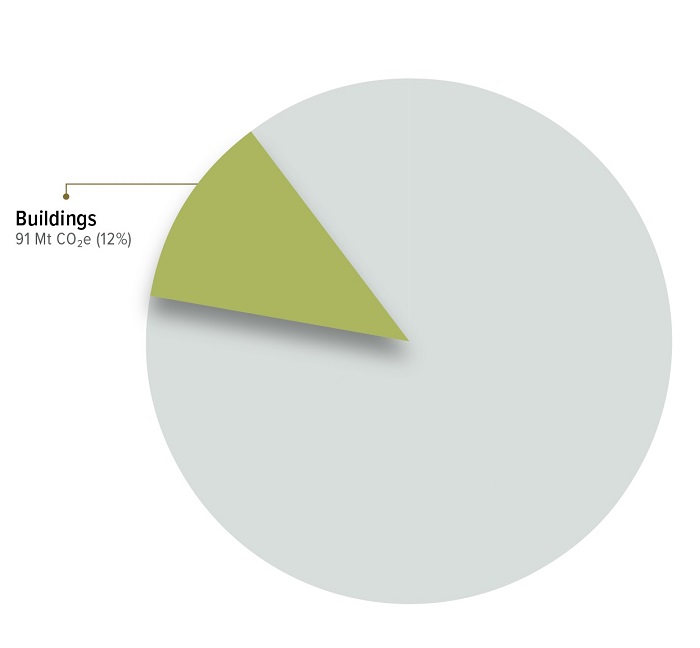

Canada's Buildings Emissions, 2019

Long description

Canada's buildings emissions, 2019. Buildings: 91 megatonnes of carbon dioxide equivalent (Mt CO2e), 12%.

Buildings accounted for 12% of Canada's direct GHG emissions in 2019, or 91 Mt (2021 NIR). Off-site generation of electricity for use in buildings brings the total to around 17%. This percentage could increase further if accounting for embodied carbon from the manufacturing of building materials such as concrete and steel.

Over 85% of buildings sector emissions come from space and water heating, due to the use of fossil fuel equipment, such as natural gas furnaces, and extra energy demand to heat and cool buildings with insufficient envelope performance. Remaining emissions come from electricity used to power appliances, lighting, and auxiliary equipment.

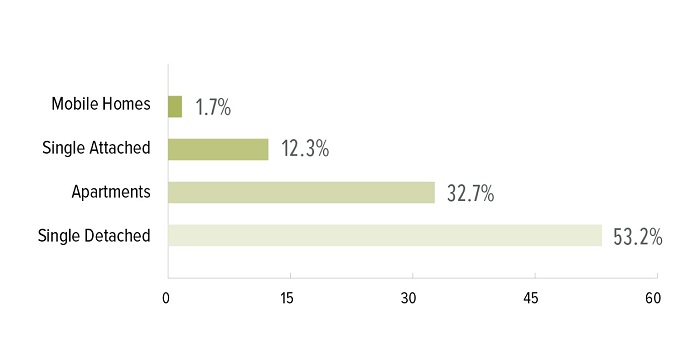

Breakdown of Canada's Building Stock

Percentage of total residential buildings

Source: NEUD 2017.

Long description

- Mobile homes: 1.7%

- Single attached: 12.3%

- Apartments: 32.7%

- Single detached: 53.2%

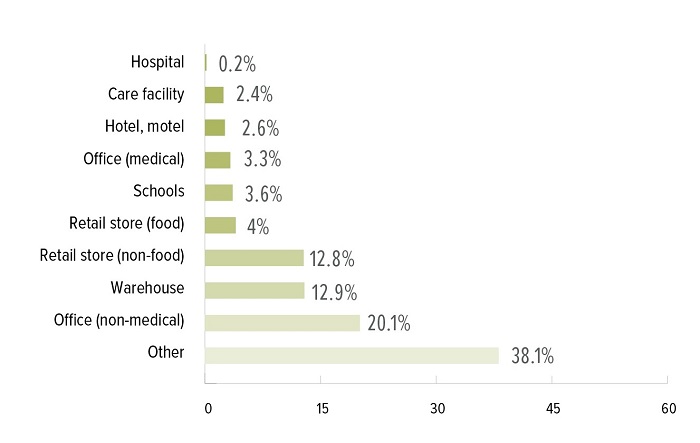

Percentage of total commercial buildings

Source: NEUD 2017.

Long description

- Hospital: 0.2%

- Care facility: 2.4%

- Hotel, motel: 2.6%

- Office (medical): 3.3%

- Schools: 3.6%

- Retail store (food): 4.0%

- Retail store (non-food): 12.8%

- Warehouse: 12.9%

- Office (non-medical): 20.1%

- All other commercial/industrial buildings: 38.1%

The buildings sector in context: key drivers

Challenges to decarbonization in the buildings sector remain, but can be overcome

Canada has a vast building stock

Significant efforts will be required to retrofit existing buildings to achieve Canada's decarbonization goals. The Pembina Institute projects that reaching net-zero in 2050 will require carrying out retrofits at an annual pace of nearly 600,000 homes (11.4 million in total) and the equivalent of 32 million m2 of commercial property until 2040, at a cost of roughly $21 billion per year. While a foundation for progress has been laid through federal investments, such as the Canada Greener Homes Grant, the Energy Efficient Buildings program, the Green Municipal Fund, and the Green and Inclusive Community Buildings program, additional investments from the public and private sector are required.

Much of the technology needed to decarbonize the buildings sector exists today. For example, electrification of heating by switching from fossil-fuels (e.g. oil, natural gas) to electric heat pumps is an economic and viable option in most parts of Canada, particularly as electrical grids expand capacity and decarbonize in parallel. Energy efficiency measures such as upgrading the building envelope with improved insulation, replacing windows and doors, or air sealing are also essential for decarbonization. Combined with fuel switching, energy efficiency can lower heating and cooling loads, minimize demand on the electricity grid, help control energy costs, and reduce the cost of heating with low-carbon technologies. The market up-take for some of these technologies has been slow; however, further innovation will improve affordability and support broader adoption. Reducing embodied carbon in construction materials such as steel and concrete is a key opportunity to further lower emissions in the buildings sector. New research and development will continue to deliver lower cost, higher performing technologies and approaches, creating even more opportunities to economically decarbonize the sector.

Building codes are key enablers of a net-zero buildings sector

Strong building codes set the baseline for building performance and lock in best practices in construction. The Government of Canada actively works with industry as well as provincial and territorial governments on the development of increasingly stringent, performance-based model building codes, including to introduce net-zero energy-ready model codes for new construction and the code for retrofits to existing buildings. Wide-scale adoption of these codes will go a long way to improving the performance of Canada's building stock.

Decarbonization of the buildings sector will provide economic opportunities and create jobs

Decarbonizing Canada's building sector will create new well-paying local jobs in every part of the country and could stimulate new markets for Canadian industry. Canada's building sector workforce will need to grow dramatically to meet increasing demand, including professional and trades people in construction, renovation, equipment manufacturing, installation and repair, building maintenance, energy assessment and management. Decarbonization of the buildings sector is also expected to create new entry points for workers with diverse professions and identities.

Greening government buildings

As the owner of a significant number of public facilities, the Government of Canada has a role and responsibility to reduce emissions from federal buildings. The Government of Canada has already taken action to this end, including by committing to: ensure all new federal buildings are net-zero emissions and that major building retrofits are low-carbon; ensure that, starting in 2030, 75% of domestic office new lease and lease renewal floor space will be in net-zero carbon, climate resilient buildings; and support emerging clean technologies through procurement to reduce emissions from federal buildings.

What have we done so far?

Canada Greener Homes Grant

The Canada Greener Homes Grant helps homeowners make their homes more energy-efficient grow domestic green supply chains, and fight climate change. It provides up to 700,000 grants of up to $5,000 to help homeowners make energy efficient retrofits to their homes, supported by an EnerGuide evaluation. To date, there have been over 130,000 applicants to the program.

Green and inclusive community buildings

To help tackle emissions from community buildings across Canada – including community centres, sport facilities, and cultural spaces – the Government launched the Green and Inclusive Community Buildings program. This program commits $1.5 billion to projects that improve energy efficiency through retrofits, repairs or upgrades, and new builds, 10% of which is reserved for projects benefiting Indigenous communities.

Canada Infrastructure Bank's Growth Plan

As part of its Growth Plan, the Canada Infrastructure Bank (CIB) has targeted $2 billion in financing for large-scale public and commercial building retrofits. The CIB aims to create a model for investment and procurement for energy performance projects that can be self-perpetuating as the market normalizes and accelerates towards net zero targets in 2050.

Energy efficiency in Indigenous housing

First Nation Infrastructure Fund (FNIF) supports energy efficiency on reserve and the Northern REACHE program supports Inuit and Indigenous communities in the north with renewable energy and energy efficiency projects.

What was heard from the 2030 ERP engagement process?

- Canadians and stakeholders expressed support for incentives and grants for home retrofits, including support for transitioning homes to cleaner energy sources. There is also support for low-carbon materials in construction.

- Energy efficiency and retrofits are a priority for many Indigenous governments. At the same time, Indigenous Peoples emphasized the need to address the housing crisis they are facing. Nearly 20% of Indigenous people live in housing that needs major repairs, and 20% live in housing that's overcrowded.

- Provinces, territories, and municipalities are also prioritizing emissions reduction efforts in the buildings sector, with support for greater alignment of programs and incentives between governments.

- The Net-Zero Advisory Body noted the importance of laying out a clear path forward for the sector, and using regulations and complementary actions to further the transition. They also encouraged: leveraging building codes and equipment regulations; ensuring that enabling and financing systems are put in place to support and scale up deeper retrofits; accounting for embodied carbon associated with building materials; and, leading by example.

What's next?

A whole-of-government and whole-of-economy effort focusing on regulatory, policy, investment, and innovation levers is needed to drive decarbonization of the buildings sector. The Government of Canada will continue to put in place actions to provide the certainty and market signals needed by the private sector to make investment decisions. Complementary actions from all orders of government will be needed to accelerate building code adoption, transform space and water heating, and build the workforce needed to achieve net-zero. Successful decarbonization of the buildings sector will also depend on a number of enabling conditions, such as electrification and clean grids, a zero/low-carbon supply chain, innovation in construction practices, and private financing. To meet Canada's 2030 target and prepare for net-zero emissions by 2050, the Government of Canada will:

Chart a path to net-zero emissions

To lay the foundation for a net-zero buildings sector, the Government will invest $150 million to develop a national net zero by 2050 buildings strategy, the Canada Green Buildings Strategy. Working with partners, the strategy will build off existing initiatives and set out new policy, programs, incentives and standards needed to drive a massive retrofit of the existing building stock, and construction to the highest zero carbon standards. The Buildings Strategy will:

- develop a Low Carbon Building Materials Innovation Hub to drive further research, building code reform, and demonstration activities, all promoting the use of lower carbon construction materials (e.g., wood, steel, cement, etc.) in the built environment

- develop regulatory standards, and an incentive framework to support the transition off fossil-fuels for heating systems

- develop an approach to require EnerGuide labeling of homes at the time of sale, and design a complementary Climate Adaptation Home Rating Program

- launch a new Net Zero Building Code Acceleration Fund to accelerate adoption and implementation of the highest performance tiers of the national model energy codes, incentivizing stakeholder participation while addressing persistent challenges in Canada's codes system and paving the way to a code for alterations for existing buildings

- improve federal capacity and technical support to provinces, territories and key stakeholders for the development and adoption of net zero emission codes, and alteration to existing buildings codes

- develop an approach to increase the climate resilience of the built environment

The Net-Zero Advisory Body recommended accelerating the adoption of national model building codes, and supporting research and development for innovative net-zero technologies, such as developing readily available and affordable net-zero building materials. The Buildings Strategy proposed in this plan aligns with this advice.

Accelerating retrofits and net-zero new builds in communities across Canada

Supporting communities to upgrade homes and buildings, including affordable housing, is key to reaching Canada's climate goals. To help meet those goals, the following additional investments are being made:

- $458.5 million in contribution and loan funding to support the low-income stream of the Greener Homes Loan Program, which will support increased energy savings.

- $33 million to establish a Greener Neighbourhoods Pilot Program, which will retrofit homes or units in up to six communities across the country using an aggregated building retrofits approach based on the Dutch "Energiesprong" model. This support for community-level home retrofits aligns with the Net-Zero Advisory Body's recommendation to seek out opportunities to decarbonize multiple buildings at once.

- $200 million to support deep retrofits of large buildings through a retrofit accelerator initiative, which will provide help to address barriers to deep retrofits (such as audits or project management).

- $183 million to support a decarbonized and climate resilient construction sector through the development of standards and building codes, the establishment of a Centre of Excellence, research and development activities – including a concrete and cement R&D initiative, timber construction R&D initiative, and multi-sector collaboration challenges – and a procurement challenge.

Going further – the Government of Canada commits to explore additional opportunities, including:

- Mobilize private sector financing to support deep retrofits in existing residential, commercial, and institutional buildings.

- Mobilize Indigenous sector financing to support deep retrofits and clean energy initiatives.

- Link infrastructure funding (e.g., public transit) to housing outcomes.

- Review of Canadian Mortgage and Housing Corporation's market tools to promote climate compatibility in new construction and within the existing housing stock.

- Increase energy efficiency standards of National Housing Strategy (NHS) programs.

- Lead by example by decarbonizing the federal government's highest emitting buildings.

2.3. Electricity

A clean, affordable, and reliable electricity system is essential for Canada to build a prosperous low-carbon future, as it will help reduce emissions from other sectors of the economy including industry, transportation and buildings as those sectors electrify.

Current sector emissions

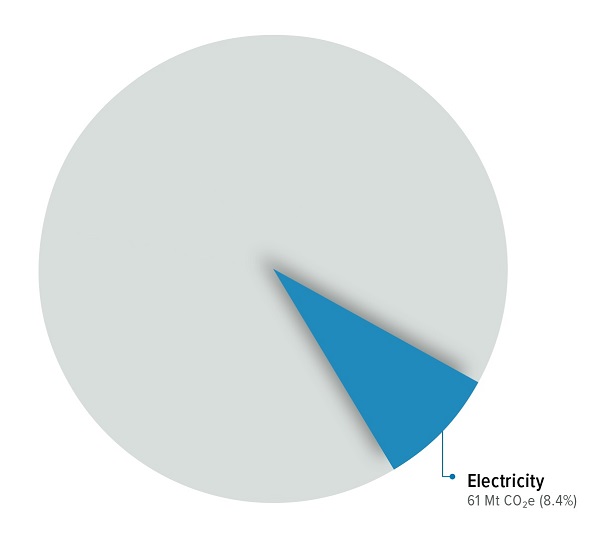

Canada's Electricity Emissions, 2019

Long description

Canada's electricity emissions, 2019. Electricity: 61 megatonnes of carbon dioxide equivalent (Mt CO2 eq), 8.4%.

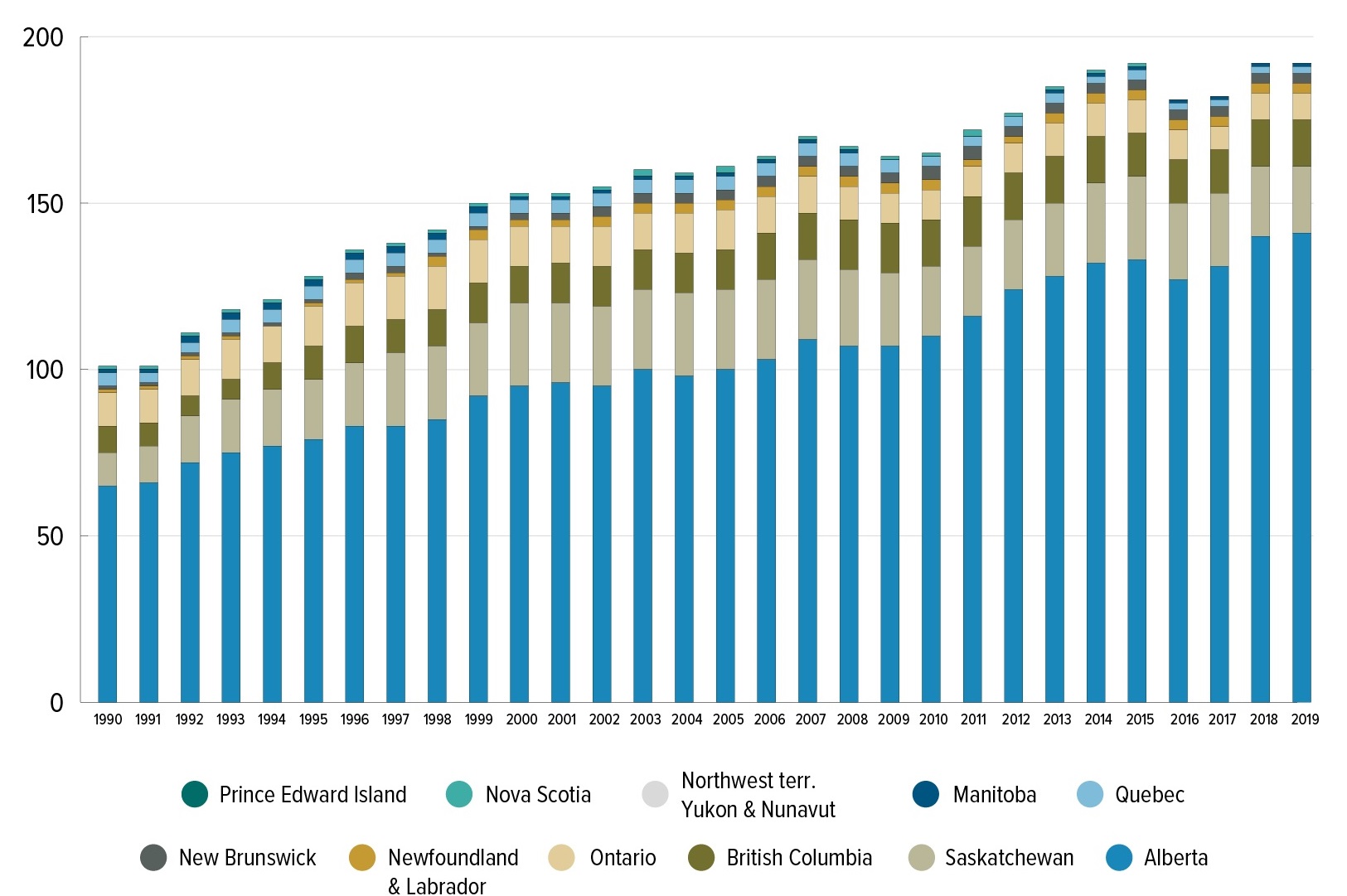

Canada is a world leader in clean electricity with an electricity sector that is currently 82% non-emitting. Canada's electricity sector emissions have also declined more than any other sector in Canada since 2005.

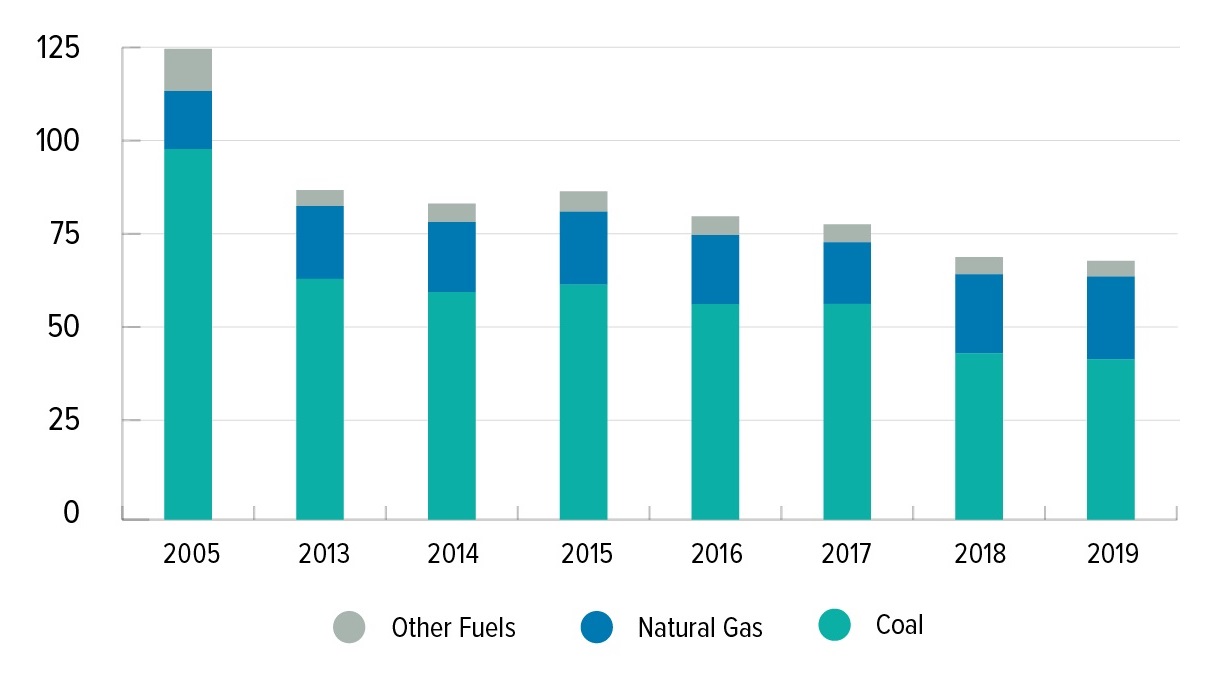

Canada's Electricity Sector Emissions by Year (Mt CO2e)

Long description

| Kilotonnes of CO2e | 2005 | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 |

|---|---|---|---|---|---|---|---|---|

| Coal | 98200 | 63800 | 60300 | 62300 | 57100 | 57200 | 44100 | 42500 |

| Natural Gas | 15400 | 19300 | 18600 | 19300 | 18300 | 16300 | 20900 | 21900 |

| Other Fuels | 11200 | 4260 | 4860 | 5400 | 5020 | 4800 | 4610 | 4200 |

Source: NRCan Energy Fact Book

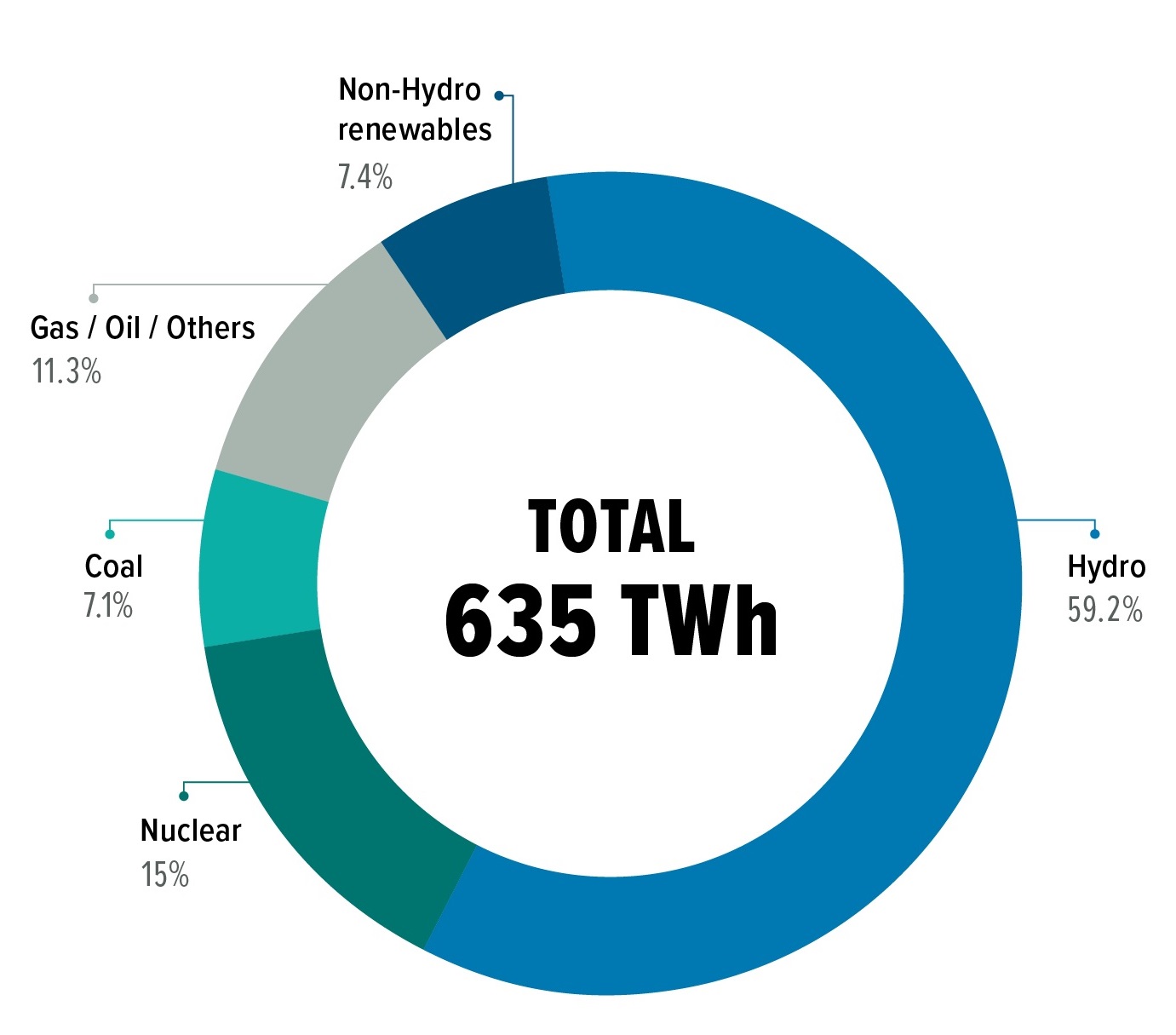

Canada's electricity generation by type

Long description

| Type of electricity generation | Percentage (%) of total in terawatt-hours (TWh) |

|---|---|

| Hydro | 59.2% |

| Nuclear | 15% |

| Coal | 7.1% |

| Gas, oil and others | 11.3% |

| Non-hydro renewables | 7.4% |

| Total | 100% |

Canada's electricity sector is 82% non-emitting

The electricity sector in context: key drivers

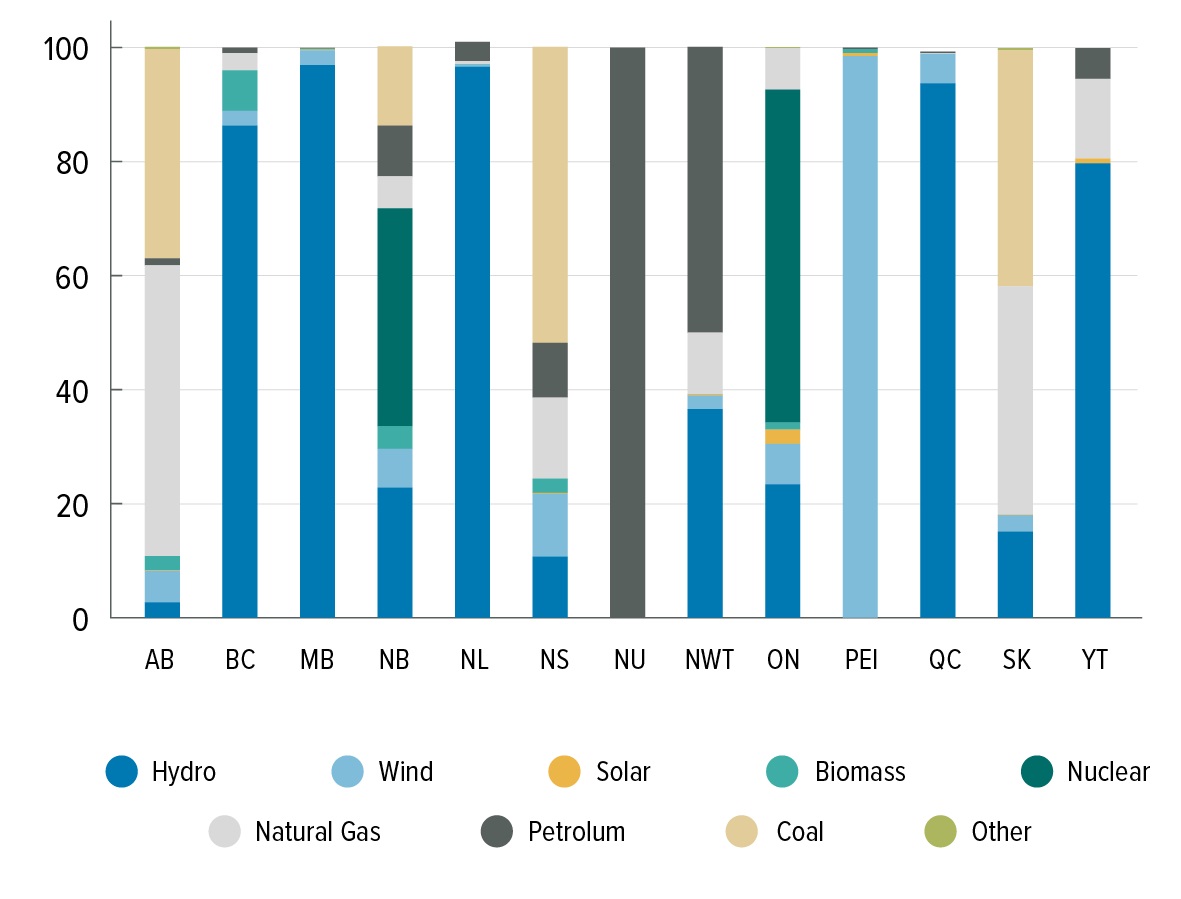

There are significant regional differences in electricity systems

Electricity market types and generation sources, which fall under provincial jurisdiction, vary greatly by region. Some provinces such as Quebec, Manitoba, and British Colombia have vast hydroelectricity resources providing them with abundant low-cost, non-emitting electricity. Prince Edward Island also uses large amounts of power from renewable sources, with almost all of its electricity coming from wind. Other regions, including Alberta, New Brunswick, Nova Scotia, and Saskatchewan, are currently reliant on fossil fuels for electricity generation. Ontario and New Brunswick use nuclear energy to provide large proportions of their non-emitting power, but both provinces still rely on fossil fuels for some of their electricity generation. There are also over 200 remote and Indigenous communities in Canada that currently rely on diesel for electricity.

Breakdown of Provincial and Territorial Electricity Generation by Source, 2019 (%)

Long description

| Emissions source | Megatonnes of carbon dioxide equivalent (Mt CO2 eq) | Percentage (%) of total |

|---|---|---|

| Mining | 9 | 12% |

| Non-ferrous metals | 10 | 13% |

| Pulp and paper | 8 | 11% |

| Iron and steel | 15 | 20% |

| Cement | 11 | 14% |

| Lime and gypsum | 2 | 3% |

| Chemicals and fertilizers | 21 | 28% |

| Total | 76 | 100% |

Source: 2021 National Inventory Report.

A diverse mix of energy sources is key to affordability and reliability

Canadians expect the electricity that powers their homes, businesses, and industries to be clean, reliable and affordable. As unabated fossil fuel-fired power plants are replaced with non-emitting sources of electricity, such as solar, wind, hydro, and nuclear, or are reconfigured to accept low carbon or renewable fuels, additional investments in energy storage and grid stability will be required to ensure affordability and reliability. Investments may also occur in emerging technologies such as geothermal, long duration energy storage and small modular nuclear reactors. Finally, carbon capture, utilization and storage (CCUS) technologies, or switching from natural gas to hydrogen, may also have potential to help natural gas plants provide non-emitting flexible generation.Footnote 2

Electricity demand is expected to increase as Canada's economy decarbonizes

The phase-out of unabated fossil fuel-fired electricity generation and increased demand for electricity in other parts of the economy, such as space heating and on-road transportation, will lead to a significant increase in demand for non-emitting electricity. Multiple reports have estimated that, by 2050, Canada will require two to three times the current generating capacity.Footnote 3 The overall increase in demand will require large investments in grid modernization and new non-emitting generating capacity, as well as regional interties to allow clean power to flow from jurisdictions with surplus capacity to jurisdictions that need more clean power. Also important is the need to reduce electricity demand through smarter energy use and energy efficiency actions in order to achieve optimized electricity systems and keep costs down.

What have we done so far?

Accelerated the coal phase-out, natural gas regulations and put a price on carbon pollution

Coal-fired power is currently the biggest source of emissions in the electricity sector. The Government of Canada has passed regulations to accelerate the phase out of unabated coal-fired electricity by 2030, which is expected to cut carbon pollution by approximately 13 Mt in 2030.

The federal natural gas regulations complement the coal regulations and impose attainable performance standards on new natural gas generators. Carbon pollution pricing also applies to all electricity generators in provinces under the Federal OBPS to provide an economic signal to decarbonize generation.

Funded cleaner grids

To meet the rising demand for non-emitting electricity, the Government of Canada has invested in several programs to deliver more clean and reliable power. These include the $964 million Smart Renewable Electrification Pathways Program, which funds smart renewable energy and electrical grid modernization projects; the $100 million Smart Grids program that invests in demonstration and deployment of smart grid technologies and systems; and the $200 million Emerging Renewable Power program that supports new renewable power projects to expand Canada's portfolio of commercially viable resources. The Canada Infrastructure Bank also has a priority investment area in clean power which has funded projects such as the Oneida Battery Storage—a 1,000 megawatt-hour energy storage development project made in partnership with the Six Nations community in Ontario.

Made connections through grid interties

Building regional interties allows regions to distribute abundant non-emitting power to regions with more emissions-intensive grids. The Government of Canada has been working with provinces and territories, as well as the Canada Infrastructure Bank, to make progress on regional interties, such as the Atlantic Loop. This work has been supported through the $25 million Strategic Interties Predevelopment Program.

Case study: The Kivalliq Hydro-Fibre Link

The Kivalliq Hydro-Fibre Link is an electric transmission system extending from Manitoba into the Kivalliq region of Nunavut. This Inuit-led project will bring renewable, sustainable and reliable hydroelectricity to modernize electricity systems and potentially reduce reliance on diesel power while supporting economic development in remote communities. Additionally, the link would supply broadband connectivity, enhancing telecommunication services to the region.

The Canadian Northern Economic Development Agency invested nearly $3 million to build on a prior feasibility study examining the development of the Kivalliq Hydro-Fibre Link. The Canada Infrastructure Bank signed a memorandum of understanding with the Kivalliq Inuit Association to provide advisory services on the Kivalliq Hydro-Fibre Link. Budget 2021 proposed an investment of $40.4 million over three years, starting in 2021-22, to support feasibility and planning of hydroelectricity and grid interconnection projects in the North.

Reduced reliance on diesel in remote and Indigenous communities

Over 200 remote communities in Canada are reliant on diesel for electricity and heat. These communities consume on average 680 million litres of diesel fuel every year. The Government of Canada is currently supporting more than 160 renewable energy and capacity building projects across Canada. The Government is investing an additional $300 million over five years to ensure that rural, remote and Indigenous communities that currently rely on diesel have the opportunity to be powered by clean, reliable energy. This transition will help advance reconciliation, Indigenous-led climate action and support local economic development and jobs while reducing pollution.

Supporting the development of small modular reactors

In December 2020, the Government of Canada launched the Small Modular Reactor (SMR) Action Plan to lay out the next steps to develop and deploy this technology as a potential tool to reduce emissions within Canada and abroad. The Government will continue to work with utilities, as well as provinces and territories, Indigenous Peoples and communities, industry, innovators, laboratories, academia, and civil society to advance SMRs through Canada's SMR Action Plan.

What was heard from the 2030 ERP engagement process?

- Canadians and stakeholders highlighted support for increased renewable energy sources, grid modernization, storage and a national clean electricity standard. Enabling low-carbon technologies, infrastructure investments and expanding the workforce were also noted to support the increased demand for clean electricity as Canada transitions to net-zero emissions.

- The full, effective and meaningful participation of Indigenous partners in the transition to a net-zero electricity sector is key. Indigenous partners encouraged expanded efforts to support remote, northern, and Indigenous communities transition off-diesel, as well as community-owned and led renewable energy projects.

- Supporting a clean electricity sector is also a priority for a number of provinces and territories, building on efforts to phase-out coal-fired electricity and increase the production of renewable energy.

What's next?

To meet Canada's 2030 target and lay the groundwork to net-zero emissions by 2050, Canada commits to:

Require net-zero electricity by 2035 through a Clean Electricity Standard

Developing a Clean Electricity Standard (CES) to support a net-zero electricity grid by 2035 will provide a clear path forward and certainty for industry. To achieve this goal, the Government has released a discussion paper and launched a collaborative process with provinces, territories, and Indigenous partners to inform the design and scope of the standard. This process will help ensure that the design of the CES provides a clear and workable basis for provinces and territories to be able to plan and operate their grids in a way that will continue to deliver clean, reliable and affordable electricity to Canadians. Establishing a net-zero-emitting electricity sector will require substantial effort from provinces and territories, and a CES will provide the regulatory signal to support decision-making at all levels of government to achieve this goal.

Expand non-emitting energy deployment and development

Continued and enhanced support for the deployment of commercially ready renewable energy technologies will support grid decarbonization in the near term. Looking out to 2050, investments in emerging technologies such as geothermal, tidal, SMRs, carbon capture and storage, and electricity storage will allow Canada to be a world leader in these new technologies. To support the development and deployment of these technologies, the Government will make additional investments:

- $600 million to the Smart Renewables and Electrification Pathways Program to support additional renewable electricity and grid modernization projects.

- $250 million to support predevelopment work for large clean electricity projects, in collaboration with provinces, through the Electricity Predevelopment Program.

- $2.4 million for the creation of the Pan-Canadian Grid Council to provide external advice to the Government of Canada to promote clean electricity infrastructure investments.

Connect regions to clean power

The challenges of reducing emissions from Canada's existing electricity sector will fall disproportionally on some regions due to the current energy composition of their grids. One of the key tools to ensure that these regions are able to meet future needs while also participating in the transition to net-zero, will be investments in regional interties. To help connect regions with clean power, the Government will:

- Supported by a $25 million investment, establish Regional Strategic Initiatives to work with provinces, territories and relevant stakeholders to develop regional net-zero energy plans (see Chapter 2 introduction).

- Lead engagement across Atlantic Canada to shape a clear path forward for the Atlantic Loop initiative.

- Support de-risking and accelerating the development of transformational, nation-building inter-provincial transmission lines that connect supplies of clean power to locations that currently rely heavily on fossil fuels for power generation.

Going further – the Government of Canada will also explore additional opportunities to increase the availability of clean electricity, such as approaches to support municipal-level climate planning, which could include community energy generation.

2.4. Heavy industry

Canada's heavy industry sector – which includes mining and manufacturing of various industrial and commercial products, such as metals, chemicals and fertilizers, cement, and pulp and paper—plays an essential role in Canada's economy. It supports regional jobs and builds prosperous communities across Canada. Decarbonizing this sector is essential for meeting Canada's 2030 climate target, and especially net-zero emissions by 2050, while creating jobs and building a sustainable, globally-competitive economy.

The Government of Canada is committed to assisting Canadians and businesses as they transition to a net-zero emissions future, meet the demands of domestic and global consumers for low-carbon goods and services, and create middle-class jobs.

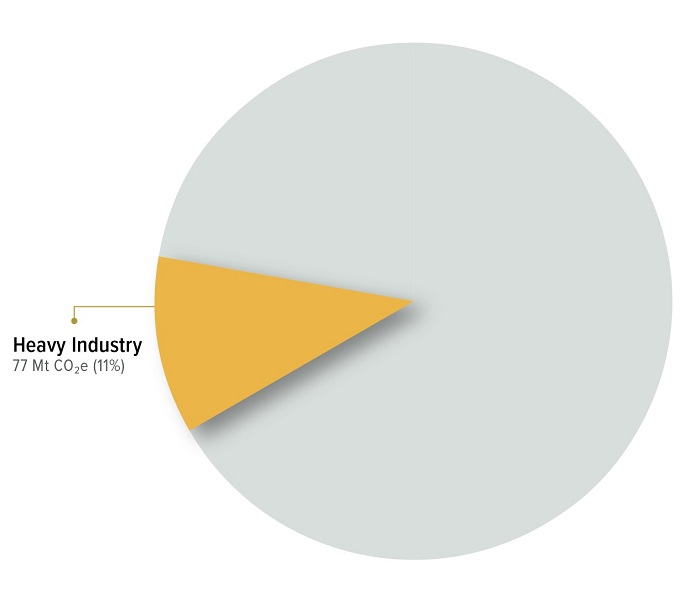

Current sector emissions

Canada's current heavy industry sector emissions rank as the fourth highest emitting sector.

Canada's Heavy Industry Emissions, 2019

Long description

Canada's heavy industry emissions, 2019. Heavy industry: 77 megatonnes of carbon dioxide equivalent (Mt CO2 eq), 11%.

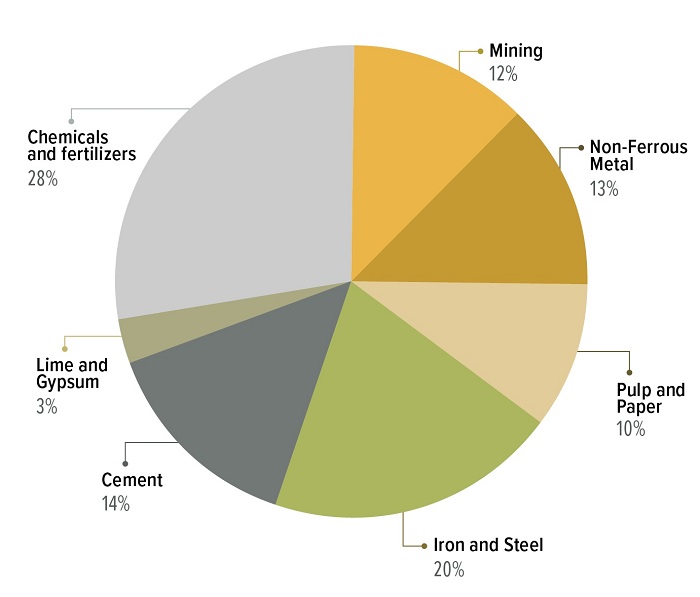

Long description

| Emissions source | Megatonnes of carbon dioxide equivalent (Mt CO2 eq) | Percentage (%) of total |

|---|---|---|

| Oil, natural gas and CO2 transmission | 11 | 6% |

| Oil sands (mining, in-situ, upgrading) | 83 | 43% |

| Petroleum refining | 19 | 10% |

| Natural gas distribution | 1 | 1% |

| Natural gas production and processing | 53 | 28% |

| Conventional oil production | 25 | 13% |

| Total | 192 | 100% |

Since 2005, emissions from heavy industry have decreased by roughly 10%, driven in part by cleaner, more efficient manufacturing processes.

Heavy industry in context: key drivers

Increasing emphasis on clean growth will help promote Canadian industrial competitiveness

A growing number of Canadian companies, including those in all industrial sectors, are producing or adopting clean and low emissions technologies to drive growth and remain competitive. This emphasis on clean growth, coupled with emerging opportunities in areas such as critical minerals, electrification, low-carbon construction materials and an array of clean technologies, will help lay the groundwork for further reducing Canada's industrial emissions and meeting demand for clean products.

Industry Leadership

As part of its plans to allocate approximately $1 billion of capital expenditures annually to decarbonize its global assets, Dow has announced the construction of the petrochemical industry's first net-zero ethylene and derivatives complex at its Fort Saskatchewan, Alberta site. This investment would more than triple the Fort Saskatchewan site's ethylene and polyethylene capacity, while retrofitting the entire complex to reach net-zero emissions by 2030 – a reduction of 1 Mt of GHG emissions. The company credits its investment decision to Canada's strong, stable, and rising price on carbon pollution, as well as access to competitive energy, feedstock, and CO2 infrastructure.

A combination of regulation and investment is key to further decarbonizing the industry sector

Canadian industry has already started to work on overcoming challenges to decarbonization, such as energy intensive processes, emissions inherent in producing industrial goods, the high cost and long lifespan of equipment, hard-to-abate process emissions associated with chemical processes, and trade exposure. Competitiveness in a low carbon economy will require the heavy industry sector to use energy more efficiently, effectively engage and partner with Indigenous communities, rely more on clean electricity and low-carbon intensity fuels (clean fuels), and seize opportunities unlocked by innovative new technologies (e.g., carbon capture, utilization, and storage). Although carbon pollution pricing sends signals to decarbonize, and regulations in some sectors will advance emission reductions, additional public and private investments are required. These investments will help to accelerate the development and adoption of the new technologies, clean fuels and innovative processes needed to transition to a net-zero economy.

Enabling measures and consultations with stakeholders will support decarbonization

Technologies and changes to industrial processes are only part of the effort required to drive clean growth in the sector. The Government of Canada is also focused on having the backs of workers and putting people first by making significant investments in skills training to ensure that workers succeed in the low-carbon economy of the future, and continuing consultations on the development of legislation to ensure a just transition through creation of sustainable jobs.

What have we done so far?

Strategic Innovation Fund – Net Zero Accelerator (SIF-NZA)

The Government of Canada has launched the $8 billion Net Zero Accelerator to support the decarbonization and sustainable growth of Canada's largest industrial emitters through investments in the adoption of clean technology and processes that will dramatically reduce the GHG footprint of these industries by 2030, and create pathways to net zero by 2050.

Low Carbon Economy Fund

The Low-Carbon Economy Fund supports a wide range of provincial and territorial programs through the Leadership Fund, while the Challenge Fund provided over $500 million to a wide range of recipients, including provinces and territories, businesses, municipalities, not-for-profits, and Indigenous communities and organizations.

Cutting corporate taxes for makers of zero emissions technology

The Government of Canada proposed in Budget 2021 to reduce by half the general corporate and small business income tax rates for businesses that manufacture zero-emission technologies. The Government has also put in place Accelerated Capital Cost write-offs that are available for the purchase of new manufacturing equipment and investments in clean energy.

Clean Growth Program

In 2017, the Government of Canada launched a $155 million program to invest in clean technology research, development, and demonstration in the Canadian energy, mining, and forestry sectors.

Accelerating industrial decarbonization through SIF-NZA

- Government of Canada is investing $400 million in a $1.8-billion project to decarbonize the steel production process at ArcelorMittal Dofasco's Hamilton, Ontario facility. This investment will help transition the facility to a hydrogen-ready direct reduced iron fed electric arc furnace, which will allow it to meet growing demand for low-carbon steel among North America's automotive, medical, and consumer packaging industries. The project will make a significant contribution toward Canada's climate objectives by reducing GHG emissions by up to 3 Mt per year by 2030.

- Through an investment of $25 million in Svante to support its $97-million project, the Government is supporting the development and commercialization of a low-cost carbon capture technology for industrial applications like cement and blue hydrogen. This investment will help the Burnaby, BC company manufacture and commercialize carbon capture systems with the ability to capture up to 2,000 tonnes of CO2 per day using a novel solid filter. This technology is one of the tools that will help Canada transform difficult-to-abate industries and reach its goal of net zero by 2050.

- The Government is investing $60 million in a $558-million large-scale demonstration project led jointly by Alcoa Corporation and Rio Tinto Aluminum. Located in Saguenay–Lac-Saint-Jean, Quebec, the project will pilot a transformative production process that has the potential to virtually eliminate the Canadian aluminum industry's carbon footprint, while strengthening the already well-integrated Canada-US aluminum and manufacturing supply chain. Once fully implemented across the industry, the technology could reduce annual GHG emissions by approximately 6.5 Mt, the equivalent of taking more than 1.8 million passenger vehicles off the road or nearly the number of passenger vehicles in Toronto, Montréal, and Vancouver combined.

In May 2021, the Government of Canada and Canada's cement sector announced a joint partnership to support the development and implementation of a 'Roadmap to Net-Zero-Carbon Concrete' to provide Canadian cement and concrete industry with the technologies, tools and policy needed to achieve net-zero carbon concrete by 2050.

What was heard from the 2030 ERP engagement process?

- Canadians and stakeholders supported incentives, regulations, and support for clean technologies as key tools to effectively reduce emissions for industries, such as cement and steel.

- Provinces and territories are taking action to reduce emissions from the heavy industry sector, including efforts related to decarbonizing the industrial sector through clean fuels and renewable energy, as well as sustainable mining of critical minerals to support the manufacturing of batteries.

What's next?

The World Bank estimates that global climate commitments will create new investment opportunities in emerging economies – an estimated $23 trillion between 2016 and 2030. Canada is well equipped to take advantage of these opportunities and attract global investment in Canadian clean technology. For example, based on analysis by the World Bank, the Canadian Climate Institute in their Charting our Course report found that Canada's mining sector is well positioned to take advantage of increased global demand for clean technology, as Canada is home to significant deposits of almost all critical minerals and metals for clean technologies.

To meet Canada's 2030 target and lay the groundwork for net-zero emissions by 2050, the Government of Canada commits to:

Enhance efforts to decarbonize large emitters

The Government of Canada will make further investments to support new technologies and projects that will reduce emissions now while developing low-emissions technologies for a net-zero future. In addition, the Government has committed to introducing new Buy Clean Strategy for federal investments to support and prioritize the use of made-in-Canada low-carbon products in Canadian infrastructure projects. The Government will also invest:

- Invest $194 million to expand the Industrial Energy Management Program to support ISO50001 certification, energy managers, cohort-based training, audits, and energy efficiency-focused retrofits for key small-to-moderate projects, thus filling a gap in the federal suite of industrial programming; and,

- Develop a comprehensive CCUS Strategy to guide the development and deployment of CCUS technologies to mitigate GHG emissions from a range of industrial sectors in Canada, such as steel, cement, chemicals, and the oil and gas sector.

Strengthen Canada's mining sector while reducing emissions

Building on actions such as the Canadian Minerals and Metals Plan, the Government of Canada has committed to improving the critical mineral supply chain resiliency to support the green and digitized economy, as well as the Mines to Mobility Strategy.

Net-Zero Challenge

First announced in Canada's strengthened climate plan, A Healthy Environment and a Healthy Economy, the Net-Zero Challenge is a voluntary initiative that aims to encourage businesses to develop and implement credible and effective plans to transition their facilities and operations to net-zero emissions by 2050. The goals of the Net-Zero Challenge are to normalize net-zero planning so that it becomes the default business practice, build momentum through guidance and leadership, and reduce greenhouse gas emissions from industrial and other sectors. The Net-Zero Challenge will be launched soon.

2.5. Oil and gas

As a major economic contributor to the country and Canada's largest source of greenhouse gas emissions, the oil and gas sector has a critical role to play in meeting Canada's climate objectives.

Industry leadership

Individual oil and gas players are setting ambitious climate goals. For example, Shell Global has set a target to reduce absolute emissions by 50% by 2030, relative to their 2016 baseline.

The Oil Sands Pathways Alliance, which represents 95% of Canada's oil sands production, was formed in order to keep the sector competitive in a decarbonizing economy by drastically reducing its carbon footprint to achieve net zero emissions by 2050.

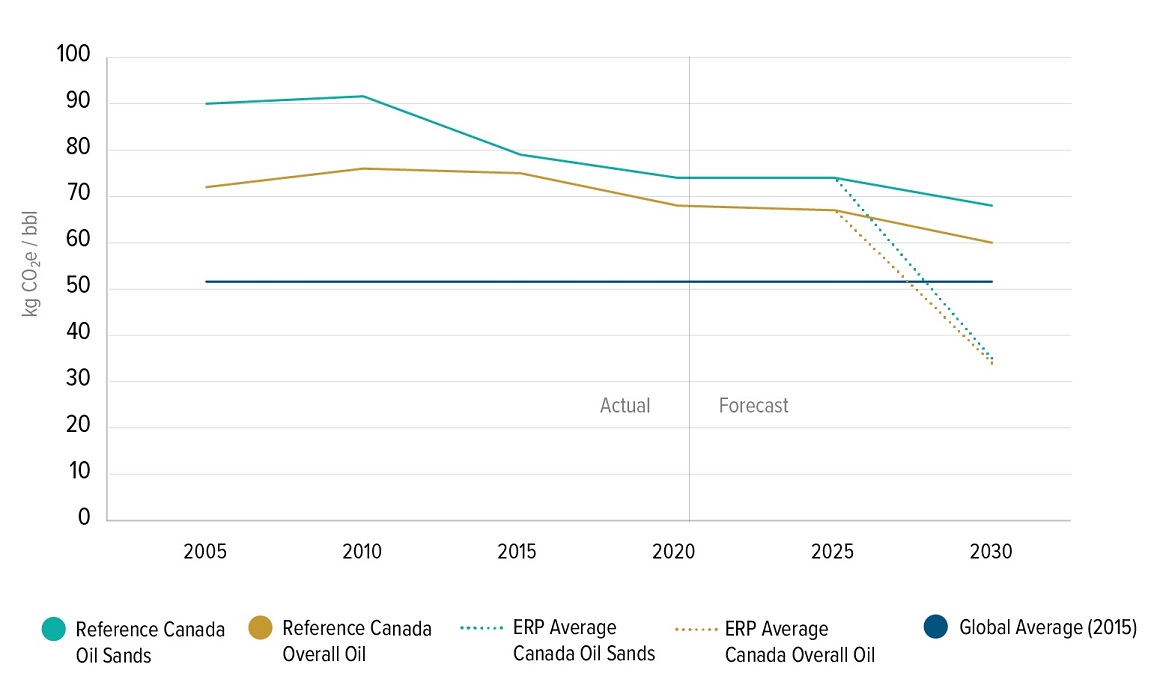

The sector faces a major transformation as the world moves away from fossil fuels to address climate change and to enhance energy security. The International Energy Agency forecasts that to limit warming to less than 1.5 °C, global oil demand will have to decline from 100 million barrels per day in 2020 to 24 million barrels by 2050. To remain competitive in a tighter future market, Canadian production will have to reduce its carbon intensity while the sector also explores opportunities to transition to non-emitting products and services.

Modelling of the most economically efficient pathway to meeting Canada's 2030 target projects that the oil and gas sector would make a significant contribution (see Chapter 3). Drawing on that analysis, Canada's oil and gas sector emissions would decline by about 31% from 2005 levels to reach 110 Mt in 2030. This projected sectoral contribution represents about a 42% reduction from current levels, because overall emissions from the sector have been rising rather than falling. The projected sectoral contribution will guide the Government of Canada's work with industry, stakeholders, provinces and territories, Indigenous Peoples and others to define and develop the cap on oil and gas emissions.

Clean B.C. Roadmap to 2030: Reducing emissions from the oil and gas sector

British Columbia's oil and gas sector is currently responsible for 20% of provincial emissions. As part of its Clean B.C. Roadmap, the Government of British Columbia set a target to reduce emissions from its oil and gas sector by 33-38% below 2007 levels by 2030. This is being implemented through a number of policies and programs, including strengthening British Columbia's methane regulations, modernizing its royalty system, and introducing a new industrial climate program, to be released in 2023.

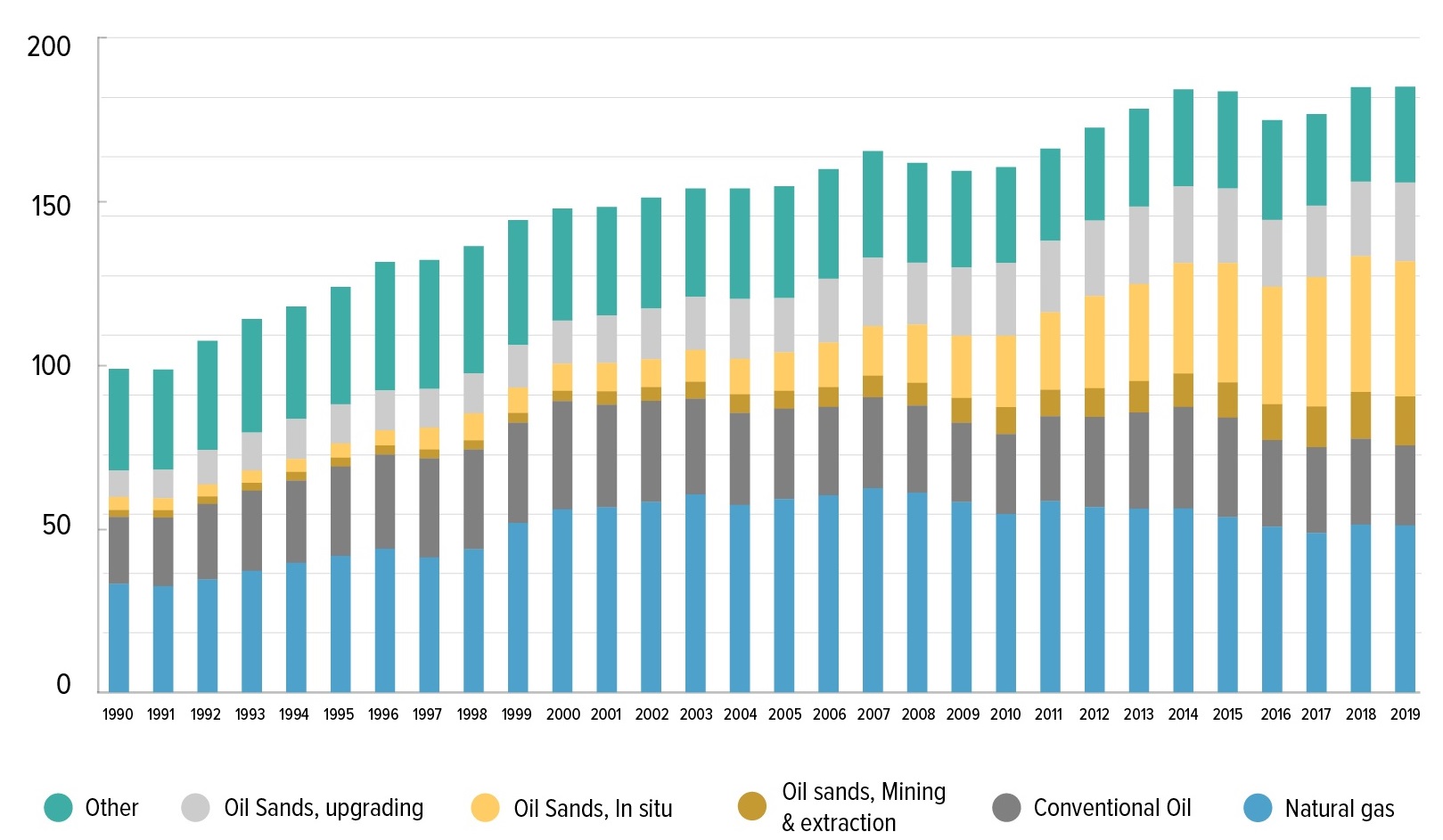

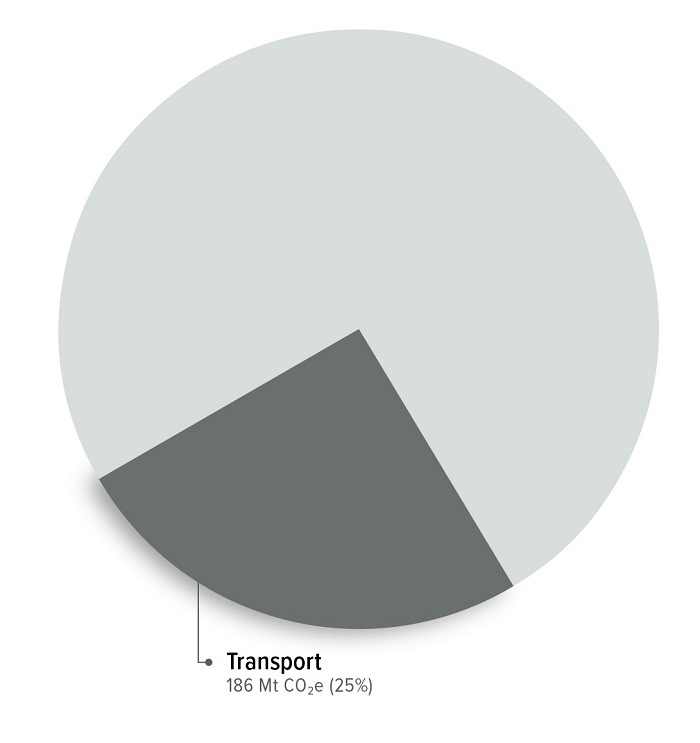

Current sector emissions

In 2019, the oil and gas sector produced 26% of national emissions. While performance has improved, with a 20% reduction in emissions intensity since 2005, overall emissions have climbed due to significant production growth. The oil sands are the biggest driver of new production and emissions growth, with emissions rising 137% since 2005.