Treasury Board of Canada Secretariat 2024–25 Departmental Plan

On this page

From the President

The Honourable Anita Anand

President of the Treasury Board

The 2024–25 Departmental Plan for the Treasury Board of Canada Secretariat (TBS) outlines our plans and our priorities for the fiscal year ahead.

In 2024–25, TBS will continue to lead efforts that refocus government spending. This means that we will be looking prudently at our operations and expenditures across government to reallocate funds from across government departments, including at TBS. In turn, these funds will be reallocated to priorities that matter most to Canadians.

In addition to the ongoing spending review, we will focus on advancing the digitization of government to provide Canadians with services that are more secure, accessible, and reliable. This includes developing standards for departments that will allow them to share data faster and improve government services, while ensuring that the privacy of citizens is protected throughout the process.

We will also continue to protect the integrity and security of the government’s data and information technology infrastructure from cyber security threats by bolstering our actions to guide the way that organizations manage cyber security.

To help fight climate change, TBS will remain focused on leading the government’s action towards low-carbon, climate-resilient and green operations. This will include helping to find cleaner energy options in locations with carbon intensive electricity production.

We will also continue to modernize the public service by advancing on priorities of equity, diversity, and inclusion, including by acting on the recommendations of the Employment Equity Act Review Task Force. Other important initiatives in this area include implementing the Black Public Servants Action Plan through dedicated mental health supports and career leadership development programs to support the advancement of Black public servants in the public service, and implementing the Restorative Engagement Program.

To stimulate economic recovery and growth, TBS will continue to build a modern regulatory system that helps businesses be more competitive and eases the time and financial burden for Canadians.

As President of the Treasury Board, I am focused on managing government effectively. Canadians expect high-quality programs and services from their government, and they want effective and efficient use of their tax dollars. I invite you to read this report to see what we are doing to deliver on these commitments.

Original signed by:

The Honourable Anita Anand, P.C., M.P.

President of the Treasury Board

Plans to deliver on core responsibilities and internal services

Core responsibilities and internal services

Spending oversight

Description

The Treasury Board of Canada Secretariat (TBS) reviews spending proposals and authorities and existing and proposed government programs for efficiency, effectiveness and relevance and provides information to Parliament and Canadians on government spending.

Quality of life impacts

By helping to ensure efficient, effective and relevant government programs that report on their performance, TBS’s spending oversight core responsibility contributes to the confidence in institutions indicator under the good governance domain of the Quality of Life Framework.

Results and targets

The following table shows the indicator, the results from the 3 most recently reported fiscal years, and the 2024–25 target and date to achieve it for the departmental result related to spending oversight.

Table 1: Indicator, results and targets for departmental result: Government organizations measure, evaluate and report on their performance.

Indicator |

2020–21 result |

2021–22 result |

2022–23 result |

2024–25 target |

Date to achieve 2024–25 target |

|---|---|---|---|---|---|

Percentage of government programs that have suitable measures for tracking performance and informing decision-making |

64% |

89% |

87% |

At least 90% |

March 2025 |

The financial, human resources and performance information for the TBS’s program inventory is available on GC InfoBase.

Plans to achieve results

1. Reviewing departmental proposals for new and existing programs

Through the Refocusing Government Spending Initiative in Budget 2023, the government committed to refocusing $14.1 billion over the next 5 years, starting in 2023–24, and by $4.1 billion annually after that. In 2023-24, TBS began the exercise by refocusing $500 million as reported in Supplementary Estimates (B) 2023-24. The initiative aims to refocus spending toward priorities that matter most to Canadians, such as housing and healthcare.

In the 2023 Fall Economic Statement, the government announced that it will refocus an additional $345.6 million in 2025–26 and $691 million ongoing to deliver responsible government spending.TBS will also continue to work with departments to ensure that their Treasury Board proposals:

- align with Treasury Board policies and government priorities

- support value for money and comply with rules and policies

- explain the results to be achieved and how they will be measured

- contain clear risk assessments and risk management strategies, including financial risk

2. Improving results-based management

To help ensure suitable measures for tracking performance and informing decision‑making in departments, TBS will continue to provide guidance and support to departments on results‑based management by:

- finalizing the Policy on Results review and responding to its recommendations

- reviewing government‑wide programs for effectiveness

- working with departments to improve data collection on gender and diversity and to enhance annual reporting required by the Canadian Gender Budgeting Act

- consolidating data and improving impact assessment methodologies to analyze the economic effects of business innovation and growth support programs across government

- making sure Canadians have timely access to data on federal government spending and results through GC InfoBase and the Open Government Portal

- continuing to streamline departmental plans and departmental results reports to make them more accessible and to improve the user experience

- working with departments, professional associations and the Canada School of Public Service to further build capacity in evaluation and performance measurement communities, as well as among users of results information

TBS will continue to integrate the Quality of Life Framework into government decision‑making processes to help ensure that investments benefit Canadians’ quality of life. TBS will continue to advance well‑being approaches by working with domestic and international experts, including the Organisation for Economic Cooperation and Development. TBS will also work with Statistics Canada to refine and strengthen the Quality of Life Framework and to improve data collection and reporting on quality of life outcomes. This will help to support coordinated, evidence-based decisions that benefit Canadians.

Snapshot of planned resources in 2024–25

- Planned spending: $5,164,159,416

- Planned full-time resources: 303

Related government priorities

Gender-based analysis plus

In 2024–25, TBS will continue to ensure that proposals identify the impact on different groups based on gender and other identity factors and include a plan to collect and report gender‑based analysis plus data. It will also direct departments to new TBS guidance to support these activities.

As part of reviewing Treasury Board submissions, TBS will ensure that proposals contain:

- sufficient information for decision makers on the potential impact of the programs on gender and diversity

- a plan to track the impact of their proposals on gender and other intersecting identity factors

TBS will also continue to require departments to update Parliament and Canadians on their progress on gender‑based analysis plus in departmental plans and departmental results reports.

See TBS’s Gender‑based analysis plus supplementary information table for more information.

United Nations 2030 Agenda for Sustainable Development and the UN Sustainable Development Goals

In 2024–25, TBS will continue to support the integration of economic, social, environmental and governance aspects of sustainable development into government decision‑making through the Quality of Life Framework.

TBS will also develop the sustainability and resilience lens of the Quality of Life Framework and ensure that Treasury Board submissions consider sustainable development, where appropriate.

In consultation with federal partners, TBS will continue to ensure that departmental plans and departmental results reports inform readers on efforts to advance sustainable development across government.

More information on TBS’s contributions to the Federal Implementation Plan on the 2030 Agenda and the Federal Sustainable Development Strategy can be found in the TBS Departmental Sustainable Development Strategy for 2023 to 2027.

Program inventory

Spending oversight is supported by the following programs in the program inventory:

- Expenditure Data, Analysis and Reviews

- Oversight and Treasury Board Support

Supporting information on planned expenditures, human resources and results related to TBS’s program inventory is available on GC InfoBase.

Administrative leadership

Description

TBS leads government‑wide initiatives, develops policies and sets the strategic direction for government administration related to service delivery and access to government information, as well as the management of assets, finances, information and technology.

Quality of life impacts

By helping departments deliver services to Canadians using modern technology and data and supporting departments in the stewardship of government finances and assets, TBS’s administrative leadership core responsibility contributes to the confidence in institutions indicator under the good governance domain and to the greenhouse gas emissions indicator under the environment domain of the Quality of Life Framework.

Results and targets

The following tables show the indicators, the results from the 3 most recently reported fiscal years, and the 2024–25 targets and dates to achieve them for each departmental result related to administrative leadership.

Table 2: Indicators, results and targets for departmental result: Government service delivery is digitally enabled, accessible and meets the needs of Canadians

Indicator |

2020–21 result |

2021–22 result |

2022–23 result |

2024–25 target |

Date to achieve 2024–25 target |

|---|---|---|---|---|---|

Percentage of high volume Government of Canada services that meet service standardstable 2 note* |

Not available |

46% |

49% |

At least 80% |

March 2025 |

Percentage of Government of Canada business applications assessed as healthy |

36% |

37% |

38% |

At least 40% |

March 2025 |

Table 2 Notes

|

|||||

Table 3: Indicators, results and targets for departmental result: Government has good asset and financial management practices

Indicator |

2020–21 result |

2021–22 result |

2022–23 result |

2024–25 target |

Date to achieve 2024–25 target |

|---|---|---|---|---|---|

Percentage of key financial management processes for which the system of internal controls is at the continuous monitoring stage |

39% |

45% |

66% |

100%table 2 note* |

March 2025 |

Table 3 Notes

|

|||||

The financial, human resources and performance information for the TBS’s program inventory is available on GC InfoBase.

Plans to achieve results

1. Leading digital government transformation

Canada’s Digital Ambition helps the government work to meet Canadians’ expectations of simple, secure and efficient delivery of services and benefits through the effective use of modern technology and data.

To ensure that Canada’s Digital Ambition responds to the needs of Canadians, TBS will continue to update it as required. TBS originally published this 3-year plan for the government’s service, information, data, information technology (IT) and cyber security in 2022.

In 2024–25, TBS will focus on the 4 strategic themes set out in the plan:

- Excellence in technology and operations

- Data-enabled digital services and programs

- Action-ready digital strategy and policy

- Structural evolution in funding, talent and culture

-

Excellence in technology and operations

As cyber security threats continue to increase, protecting the integrity and security of the government’s data and information technology infrastructure becomes more critical to delivering secure services to Canadians. TBS will continue to support departments through strategies, guidance, and communication and to ensure that the government continues to secure all its websites and web services as soon as possible. TBS will also help departments mitigate compliance challenges due to the continued use of legacy information technology systems. This will build on efforts in previous years to ensure that departments understood and met policy requirements in Appendix G: Standard on Enterprise Information Technology Service Common Configurations.

In 2024–25, TBS will also support departments as they continue with their service improvement activities through quarterly workshops and facilitating access to experts. TBS will also help departments achieve application health by providing guidance and promoting its importance through outreach.

In addition, TBS will respond to the Auditor General’s October 2023 Report 7 —Modernizing Information Technology Systems by working with departments to:

- review targets and timelines

- deliver a comprehensive strategy to address their needs

- explore ways to ensure adequate funding

-

Data-enabled digital services and programs

In 2024–25, TBS will continue to support the release of high-value, high-quality government data, including by managing interdepartmental working groups, providing training sessions, and guidance on releasing open data and using the Open Government Portal. It will also continue to refine and update the Open Government Guidebook, as necessary.

TBS will continue to leverage the 2023–2026 Data Strategy for the Federal Public Service to manage, secure and use Canadians’ data. The strategy focuses on 4 key areas:

- considering data-by-design in all stages of government initiatives

- stewarding data for decision-making

- enabling data-driven services

- empowering the public service with the talent and tools it needs

In 2024–25, TBS will work to implement the targets in the 2023–2026 Data Strategy for the Federal Public Service, such as developing government-wide standards on data interoperability and promoting and improving data careers in the public service.

TBS will lead new activities to advance open data initiatives through the 2022–2024 National Action Plan on Open Government, including:

- establishing an open data advisory body to help inform open data priorities and reporting

- consulting on and developing open data service standards

- developing maturity models for open government and open data

TBS expects these initiatives to be completed by December 2024.

TBS will develop additional open government policy requirements and launch a long-term strategy, as well as hold a public consultation on and publish the Sixth National Action Plan on Open Government. TBS will continue to address the conclusions of the Access to Information Review Report to Parliament. This work will help TBS prepare for the next legislated review of the legislation planned for June 2025. This work will include:

- publishing guidance to help reduce the number of extensions related to access to information requests

- providing advice to help improve government information management practices and support timeliness in responses to access to information requests

- leading innovative recruitment processes and providing capacity-building sessions and evergreen training products to support the access to information and privacy communities

TBS will work to improve Indigenous access to information and support Indigenous-led information and data strategies. In 2024–25, TBS will engage with Indigenous organizations to:

- work to address administrative and operational barriers to access

- advance policy areas outlined in the Access to Information Review Report to Parliament that relate to the United Nations Declaration on Indigenous Peoples

These efforts will build on TBS’s previous engagement with Indigenous peoples that delivered input and submissions from 12 organizations in 2022–23 and identified their issues and concerns with access to information.

TBS will also update the personal information request manual to assist departments in interpreting the Privacy Act and in meeting legislated timelines.

-

Action-ready digital strategy and policy

TBS will continue to incorporate digital standards into its policy suites and to ensure that policy, legislation and governance support and guide digital government effectively. This includes using the Policy on Service and Digital to guide the way that organizations manage service delivery, information and data, information technology, and cyber security in the digital era.

TBS will also continue to help departments improve services to Canadians by:

- measuring the administrative burden of services on users

- assessing departments’ abilities to develop and deliver services

- monitoring and refreshing security requirements essential to enterprise hybrid Information technology environments

-

Structural evolution in funding, talent and culture

TBS will continue to move forward with the Government of Canada Digital Talent Strategy to help ensure that the government attracts, develops and retains digital and service talent, which will help departments deliver excellent services. Specifically, TBS will focus its efforts in the following areas:

-

Attract and recruit digital talent

TBS will work to improve recruitment processes and tools to help the government meet its digital talent needs. For example, it will lead innovative recruitment processes and provide ongoing capacity-building sessions and training products to support the access to information and privacy communities. It will also continue to use tools to help departments find the right digital talent, such as through the GC Digital Talent platform.

-

Develop and retain digital talent

TBS will create digital and service skills development initiatives to enable digital talent to keep pace with the continuous evolution of technology and to help create career pathways with meaningful advancement for employees and leaders. TBS will also continue to support departments in implementing the Directive on Digital Talent to support the development and sustainability of the digital community by advancing business intelligence and interdepartmental coordination related to planning, talent sourcing, talent management and leadership.

TBS will also work with Veterans Affairs Canada, the Department of National Defence and the Canadian Armed Forces on talent initiatives that will help to increase the number of veterans in digital jobs across the government. The collaboration will explore an apprenticeship program for veterans modelled after the successful IT Apprenticeship Program for Indigenous Peoples. This work will include:

- defining career pathways from active service to digital community public service jobs

- developing cyber security expertise

- reducing barriers to streamline recruitment into the government’s digital community

-

Build fit-for-purpose processes, policies and tools

TBS will work to develop processes, policies and tools that support organizational agility, reduce administrative burden, and prepare its talent and the enterprise for digital change.

This includes continuing to develop an interdepartmental partnership with National Research Council Canada, Transport Canada, and Natural Resources Canada, called GCOnboard. The initiative uses innovative onboarding approaches to foster a better sense of belonging among new employees, improve long-term retention, modernize the process and ease the burden for managers.

-

Create a digital culture defined by diversity, accessibility, equity and inclusion

TBS will strengthen key partnerships with external stakeholders to help increase access to employment for underrepresented talent and put people first to drive service delivery excellence. TBS plans to use the IT Apprenticeship Program for Indigenous Peoples as a model to help increase recruitment of other underrepresented groups.

In addition to the Digital Talent Strategy, TBS will work to create qualified candidate pools related to access to information positions as a strategy to decrease the number of vacancies. This will happen in conjunction with ongoing capacity-building and training products to help the access to information community apply the Access to Information Act and Privacy Act consistently across the federal institutions subject to them.

-

2. Developing policies and setting the strategic direction for the management of assets and finances

-

Asset management

TBS will continue to strengthen the management of assets and acquired services as well as departmental capacity in project management, procurement, real property, materiel and investment management through policies, guidance and professional development.

This will include:

- collaborating with departments and agencies to develop and implement a risk-based authority model for real property transactions to improve management of real property assets

- implementing a new professional development framework for procurement and materiel management professionals

- working with the Canada School of Public Service to strengthen training on procurement for public servants

- working with Public Services and Procurement Canada to integrate accessibility criteria into all assets and acquired services

TBS will also continue to work with Indigenous Services Canada, Public Services and Procurement Canada, and Indigenous partners to support departments in meeting the phased implementation of the government-wide minimum target of 5% of the value of federal contracts awarded to Indigenous businesses.

-

Financial management

TBS will continue to provide assurance and improve its framework for sound stewardship of the financial management function, including financial management policies and guidance, costing, transfer payments, and government accounting and reporting.

Specifically, with TBS expecting 100% of departments to reach the continuous monitoring stage for internal controls over financial management by March 2024, a shift in the oversight in this area will occur in 2024–25. TBS will require departments to demonstrate continuous improvement and adapt their established systems of internal controls to evolving risks and trends.

TBS will also engage with departments to support the renewal of the Policy on Transfer Payments and launch consultations with key stakeholders on specific elements to advance this policy renewal and innovation agenda.

From a learning perspective, TBS works with departments to increase collaboration and share best practices across the financial management function. Numerous initiatives will set the stage for the continued modernization of the financial management function through structured idea generation, departmental innovation and interdepartmental collaboration to facilitate sharing and scaling up of best practices.

TBS will continue to build on existing initiatives to strengthen the financial management community, including advancing data literacy skill sets, as well as identify and address barriers to advance diversity, inclusion and accessibility in the public service. TBS will collaborate with departments to optimize recruitment processes and review the learning curriculum to align with the skills of the future.

TBS will continue to coordinate and provide oversight on the preparation of the Government of Canada’s consolidated financial statements and the audit of these statements by the Office of the Auditor General of Canada with the goal of achieving an unmodified audit opinion for the 26th consecutive year. An unmodified opinion means that the Office of the Auditor General of Canada found that the government presented its financial statements fairly and according to accepted accounting principles. TBS will also continue to put new accounting standards in place to ensure increased transparency and to foster continuous improvement in financial reporting throughout the government. This will help to ensure the availability of useful information to Canadians.

In addition, TBS will continue to lead the consolidation and reduction of financial management systems across government to support the migration of departments and agencies from legacy technology to modern system solutions.

TBS will work with departments to transform financial management and materiel management functions and to reduce the government’s technical debt, which refers to the difference between the technology in place and the minimum required for a modern and functioning system. TBS will do this by innovating practices, standardizing and automating processes and transactions, improving data management, analytics and real time reporting. These changes will strengthen internal controls and help provide better and faster information to decision makers.

3. Supporting effective communications

TBS will review the Policy on Communications and Federal Identity and the Directive on the Management of Communications to address potential systemic barriers, constraints or gaps. This review will help to ensure that communications policies remain up to date and accessible, and to identify areas for additional policy guidance.

To help ensure non-partisan government advertising, all campaigns with budgets of more than $250,000 must undergo a mandatory external review. Ads will be reviewed and must meet all criteria before being published or aired. In addition, departments can submit advertising campaigns with budgets of less than $250,000 for review.

4. Leading the greening of government operations

TBS will continue to support departments in implementing the Greening Government Strategy in 3 key areas:

- coordinating emissions reductions

- increasing climate resilience

- greening government initiatives in federal operations

-

Coordinating emission reductions

TBS will continue to work with departments to ensure that all major building retrofits complete a life cycle cost analysis to determine the optimal greenhouse gas emission reductions. In addition, all new buildings must be net-zero carbon; if net-zero cannot be achieved, TBS requires departments to determine the maximum emissions reductions possible in the most economical way. In addition, TBS will continue to help departments adopt zero-emission vehicles in their light-duty fleets where suitable options exist and meet operational needs.

Clean electricity purchases make up another important federal emissions reduction measure. TBS will support Public Services and Procurement Canada in continuing to find clean options for departments operating in provinces with higher-carbon electricity grids. TBS will continue to report on the Government of Canada’s progress on greening procurement.

Through management of the Greening Government Fund, TBS will continue to support departmental projects to reduce greenhouse gas emissions in operations. This fund aims to develop innovative approaches that can be reproduced within or across departments or to find solutions in areas or situations where reducing greenhouse gas emissions can be difficult.

TBS will continue to support departments with national safety and security fleets to develop decarbonization plans. These plans must outline each department’s efforts to reduce operational emissions that align with the government’s 2050 net-zero target.

To further support the decarbonization of federal air and marine fleet operations, TBS will continue to roll out the Low-carbon Fuel Procurement Program. The government plans to purchase up to 200 million litres of neat low-carbon fuel by the end of 2030–31 cumulatively. Neat refers to the total volume of low-carbon fuel contained in blends with conventional fuels.

-

Improve climate resilience

TBS will continue to lead the federal government’s efforts to increase the understanding of the risks posed to federal assets, services and operations by climate change and to encourage action to reduce them.

TBS asked departments to prioritize climate risk assessments for real property and engineering assets identified as essential to the delivery of critical services and activities. This includes bridges, dams, docks and highways. TBS will report on these assessments and any related risk-reduction measures starting in 2024–25.

Section 23 of the Canadian Net-Zero Emissions Accountability Act requires the Minister of Finance to prepare an annual report outlining the government’s key measures in managing its financial risks and opportunities related to climate change. TBS will continue to support the Department of Finance Canada in developing the scope of the report in relation to the financial aspects of climate resilience and of moving to net-zero greenhouse gas emissions from government operations.

-

Greening government initiatives in federal operations

Under the Policy on Green Procurement, TBS will publish the emission reductions reported by departments under the Standard on Embodied Carbon in Construction for their 2023–24 construction projects and continue with annual reporting. The standard aims to reduce the embodied carbon in ready-mix concrete used in major construction projects.

Starting in 2024–25, TBS will also collect, consolidate and report annually on government procurement processes with major suppliers under the Standard on the Disclosure of Greenhouse Gas Emissions and the Setting of Reduction Targets. The standard requires departments to ensure that procurement processes of more than $25 million induce suppliers to adopt a science-based target in line with the United Nations Framework Convention on Climate Change’s Paris Agreement and to disclose supply chain greenhouse gas emissions. TBS aims to ensure that 100% of procurement processes with major suppliers comply with this standard in 2024–25.

Beginning in 2024–25, TBS will publish the annual rates of diversion from landfill by departments of both non-hazardous operational and construction, demolition and renovation waste.

TBS will promote transparency in greening operations by supporting departments in their public reporting on the environmental performance of their operations on the TBS website, the Open Government Portal and in Departmental Sustainable Development Strategies.

Snapshot of planned resources in 2024–25

- Planned spending: $117,984,693

- Planned full-time resources: 541

Related government priorities

Gender-based analysis plus

TBS will also continue to develop and deliver capacity-building and talent management strategies and initiatives to help create a skilled, inclusive, diverse, accessible and equitable workforce in the government’s various relevant communities of practice.

This includes selecting and appointing Departmental Audit Committee members with a focus on building a skilled, inclusive, diverse, accessible and equitable workforce in line with gender-based analysis plus initiatives. TBS also gathers and reports data annually on the membership of Departmental Audit Committees and its alignment with gender-based analysis plus priorities.

TBS will also develop standards for sex and gender information practices to enable data interoperability government-wide to help improve capacity for gender-based analysis plus.

See TBS’s Gender-based analysis plus supplementary information table for more information.

United Nations 2030 Agenda for Sustainable Development and the UN Sustainable Development Goals

Goal 12 (Ensure sustainable consumption and production patterns) and Goal 13 (Take urgent action to combat climate change and its impacts)

TBS will continue to work with Environment and Climate Change Canada on implementing the 2023–26 Federal Sustainable Development Strategy and on meeting commitments related to greening government in Goals 12 and 13 by:

- working with all departments on implementing the Greening Government Strategy and the Policy on Green Procurement

- providing advice and guidance to departments on drafting the parts of their 2023–27 Departmental Sustainable Development Strategies that relate to greening their operations

Goal 16 (Promote peaceful and inclusive societies for sustainable development, provide access to justice for all and build effective, accountable and inclusive institutions at all levels)

TBS will work to address the recommendations of the Access to Information Review Report to Parliament, which will help reduce delays in responding to access to information requests and advance Indigenous reconciliation by supporting Indigenous-led information and data strategies.

Goal 17 (Strengthen the means of implementation and revitalize the Global Partnership for Sustainable Development)

In 2024–25, TBS will continue to advance domestic and international open data through the Open Government Partnership. Releasing more open data and improving data quality will facilitate better information sharing within government and with external partners, which helps to advance citizen-driven activities and collaboration and provide greater transparency and accountability of government actions related to sustainable development.

More information on TBS’s contributions to the Federal Implementation Plan on the 2030 Agenda and the Federal Sustainable Development Strategy can be found in the TBS Departmental Sustainable Development Strategy for 2023 to 2027.

Program inventory

Administrative leadership is supported by the following programs in the program inventory:

- Comptrollership

- Digital Government

- Communications and Federal Identity Policies and Initiatives

- Public Service Accessibility

Supporting information on planned expenditures, human resources, and results related to TBS’s program inventory is available on GC InfoBase.

Summary of changes to reporting framework since last year

Previously part of TBS’s administrative leadership core responsibility, the Canadian Digital Service moved to Employment and Social Development Canada in 2023–24. This transfer saw 1 departmental‑level result and 2 program‑level results removed from TBS’s 2024–25 Departmental Results Framework.

Employer

Description

TBS develops policies and sets the strategic direction for people management in the public service, manages total compensation (including pensions and benefits) and labour relations, and undertakes initiatives to improve performance in support of recruitment and retention objectives.

Quality of life impacts

By continuing to ensure that the government develops and nurtures the diverse talent it needs to deliver programs and services to Canadians, TBS’s employer core responsibility contributes to the employment, wages and job satisfaction indicators under the prosperity domain and to the representation in senior leadership positions and confidence in institutions indicators under the good governance domain of the Quality of Life Framework.

Results and targets

The following tables show the indicators, the results from the 3 most recently reported fiscal years, and the 2024–25 targets and dates to achieve them for each departmental result related to the employer core responsibility.

Table 4: Indicators, results and targets for departmental result: The public service has good people management practices

Indicator |

2020–21 result |

2021–22 result |

2022–23 result |

2024–25 target |

Date to achieve 2024–25 target |

|---|---|---|---|---|---|

Percentage of employees who believe their workplace is psychologically healthy |

68% |

68% |

68% |

More than 68% |

March 2025 |

Percentage of employees who responded positively to “my department or agency implements activities and practices that support a diverse workplace” |

78% |

78% |

79% |

At least 75% |

March 2025 |

Percentage of employees who indicate that their organization respects individual differences (e.g. culture, workstyles and ideas) |

77% |

77% |

75% |

At least 80% |

March 2025 |

Percentage of institutions where communications in designated bilingual offices “nearly always” occur in the official language chosen by the public |

93.4% |

91.6% |

91.6% |

At least 90% |

March 2025 |

Table 5: Indicators, results and targets for departmental result: Terms and conditions of public service employment are negotiated in good faith

Indicator |

2020–21 result |

2021–22 result |

2022–23 result |

2024–25 target |

Date to achieve 2024–25 target |

|---|---|---|---|---|---|

Percentage of Public Service Labour Relations and Employment Board outcomes that confirm that the Government of Canada is bargaining in good faith |

100% |

100% |

100% |

March 2025 |

|

Table 5 Notes

|

|||||

The financial, human resources and performance information for the TBS’s program inventory is available on GC InfoBase.

Plans to achieve results

In 2024–25, TBS will focus on 6 core areas:

- Creating a diverse, equitable, accessible and inclusive workforce

- Supporting health and safety

- Strengthening and modernizing the public service

- Reinforcing the values and ethics of the public service

- Promoting official languages

- Bargaining in good faith

1. Creating a diverse, equitable, accessible and inclusive workforce

TBS will continue to work with the Privy Council Office to support departments in advancing the plans outlined in their responses to the Call to Action on Anti-Racism, Equity and Inclusion in the Public Service.

This work includes:

- a Mental Health Fund for Black employees

- programs to support career advancement of employees from equity‑seeking groups, including Black, Indigenous and other racialized employees

- initiatives to raise awareness of challenges faced by equity-seeking employees and promote culture change toward inclusive workplaces

- contributions to the government’s response to the report of the Employment Equity Act Review Task Force

- consultations and engagement with equity‑seeking employee networks

- policy guidance to partners and departments on people management responsibilities for employment equity, diversity and inclusion

- disaggregated data to track progress

In addition to continuing to engage with equity‑seeking networks and addressing emerging priorities when they arise, TBS will develop approaches and tools to help departments improve diversity, equity, accessibility and inclusion within their organizations, such as:

- measuring progress using a maturity model

- designating senior officials to participate in employment equity, diversity, accessibility and inclusion communities of practice

TBS will continue to develop a restorative engagement program that will offer safe and confidential spaces for employees to share their lived experiences of harassment and discrimination. The knowledge, ideas and insights shared by employees will help the government develop additional ways to address issues of workplace harassment and discrimination and ensure a better future public service. TBS will also carry out a review of the processes to address past and present complaints of harassment, violence and discrimination.

In addition, TBS will respond to the Auditor General’s October 2023 Report 5 — Inclusion in the Workplace for Racialized Employees by:

- providing guidance and best practices to help organizations establish performance indicators to measure and report on equity and inclusion outcomes and expected behaviours

- supporting organizations as they examine their existing complaints resolution processes and ensure they specifically address instances of racism and identify root causes of disadvantage for racialized employees in the workplace

TBS will continue to use existing programs and activities to help increase diversity and inclusion, including:

- Executive Talent Management

- the Executive Leadership Development Program

- the Mosaic Leadership Development Program

- Mentorship Plus

- the Federal Speakers’ Forum on Lived Experience

- the Maturity Model on Diversity and Inclusion

TBS will continue to develop a strategy for diverse, accountable and high‑performing leadership, including an update of key leadership competencies. This will help reinforce values and ethics by underlining the expectation that public service leaders cultivate diversity, equity and inclusion.

TBS will work with bargaining agents to conduct a joint review of existing training available to federal employees on equity, diversity, accessibility and inclusion. This review will also examine and make recommendations to improve existing informal conflict management in the core public administration.

TBS will work to modernize the self‑identification questionnaire and launch a centralized platform for departments to collect data that goes beyond the 4 designated equity‑seeking groups. This will provide a more comprehensive view of employee demographic diversity that will help to improve measurement, reporting and programming and move the government toward a more inclusive workplace.

2. Supporting health and safety

TBS will continue to develop resources and tools to support organizations in aligning with the National Standard of Canada for Psychological Health and Safety in the Workplace. TBS will also continue to implement actions that support psychologically health and safe workplaces, practices, and behaviours.

In addition, TBS will consult with bargaining agents through the National Joint Council of the Public Service of Canada to develop resources and tools that help departments prevent and resolve workplace violence and harassment.

TBS recognizes that public servants, retirees and their dependants experienced issues with the Public Service Health Care Plan after Canada Life took over its administration on July 1, 2023. In 2024–25, TBS will collaborate with Public Services and Procurement Canada as the contract authority to continue to engage in ongoing discussions with Canada Life to address plan member concerns, provide guidance where needed, and press for timely resolutions to problems. TBS will also continue to communicate with plan members with the goal of increasing Public Service Health Care Plan awareness.

With Canada Life being awarded the contract to administer the Pensioners’ Dental Services Plan and the Public Service Dental Care Plan beginning in 2024, TBS will collaborate with Public Services and Procurement Canada to work with Canada Life to apply lessons learned from the transition of the Public Service Health Care Plan to support a smooth transition for dental plan members.

3. Strengthening and modernizing the public service

TBS will continue to analyze federal public service needs as it keeps pace with changes in society and technology that affect its services, service delivery and employee management.

As part of these efforts, TBS will work with the Privy Council Office and consult with public sector unions to strengthen and modernize the public service, which includes:

- planning for the future of work

- simplifying and modernizing HR‑to‑Pay administration

TBS will complete a policy and legal review to ensure the alignment of directives and guidance under the Policy on People Management with the objectives of the Canadian Human Rights Act and Accessible Canada Act.

TBS will also use a series of innovative projects to explore ways to enhance the employee experience in a hybrid work environment, with accessibility as a key priority.

4. Reinforcing the values and ethics of the public service

TBS will continue to work with the Privy Council Office and the Canada School of Public Service to support departments and employee networks in fostering a clear understanding of the Values and Ethics Code for the Public Sector and in equipping public servants to apply it in their daily work. These efforts will build on the work of the Clerk’s Deputy Ministers’ Task Team on Values and Ethics announced in a Message from the Clerk: Bringing our values and ethics to life in our changing environment and the findings of the Deputy Ministers’ Task Team on Values and Ethics Report to the Clerk of the Privy Council released in December 2023.

This work will help to reinforce values and ethics in all aspects of public service life and to mobilize values and ethics communities of practice to support deputy ministers in continuing dialogue, developing and updating guidance, and reviewing and modernizing values and ethics training materials.

TBS will continue to support the task force reviewing the Public Servants Disclosure Protection Act as it considers opportunities to strengthen protection and support for public servants who come forward to disclose wrongdoing. Recommendations from the task force on possible amendments to the Public Servants Disclosure Protection Act will serve to further reinforce the ethical climate of the public service.

5. Promoting official languages

With the modernization of the Official Languages Act in 2023, TBS assumed responsibility for supporting the President of the Treasury Board in coordinating its implementation and ensuring its good governance. Responsibility for government-wide governance and coordination mechanisms will be transferred from Canadian Heritage to TBS in April 2024. This will include the Committee of Assistant Deputy Ministers on Official Languages. A new horizontal coordination and accountability framework will be launched in 2024 to lay out roles and responsibilities for the new official languages governance approach.

Begun in 2023, the development of regulations related to promoting linguistic duality and enhancing the vitality of linguistic minority communities will continue to be a priority in 2024–25 and will include consultation with stakeholders. The Official Languages Regulations Reapplication Exercise launched in September 2023 will also continue. TBS estimated that the exercise would result in about 700 federal offices and points of service being newly designated as bilingual by 2027, based on linguistic data from the most recent census.

TBS will also develop a new second language training framework to provide guidance and tools to assist departments in their approach to language training, help enhance bilingual capacity, foster workplace bilingualism, strengthen linguistic security and increase the regular use of second official language skills.

6. Bargaining in good faith

In 2024–25, TBS will work to maintain collaborative, professional and respectful relationships with Canada’s public service unions by negotiating on:

- modern, competitive and fiscally sustainable compensation packages

- harmonized and simplified language in collective agreements to improve their administration and the administration of certain employee benefits

TBS will also consult with bargaining agents and other stakeholders to review compensation directives to modernize terms and conditions of employment.

In 2024–25, TBS will also continue to develop pay equity plans for the core public administration and the RCMP through pay equity committees.

Snapshot of planned resources in 2024–25

- Planned spending: $3,954,592,665

- Planned full-time resources: 520

Related government priorities

Gender-based analysis plus

TBS uses information from Labour Canada related to harassment and occupational health and safety to report on this area. This includes the number of cases with allegations linked to the 13 prohibited grounds of the Canadian Human Rights Act.

See TBS’s Gender‑based analysis plus supplementary information table for more information.

United Nations 2030 Agenda for Sustainable Development and the UN Sustainable Development Goals

Goal 5 (Achieve gender equality and empower all women and girls)

TBS will continue to help achieve gender equality by leading the implementation of the Pay Equity Act in the core public administration and the RCMP. TBS will also monitor the design and use of benefit plans with gender considerations in mind.

Goal 10 (Advance reconciliation with Indigenous peoples and take action to reduce inequality)

TBS helps to advance reconciliation and reduce inequalities through its work to address employment barriers and to advance diversity, equity, accessibility and inclusion in the public service.

TBS also contributes to this goal through its other, employer‑related initiatives. For example, as part of the procurement process for new health care and dental care plans for public servants and pensioners, TBS ensured that providers must contribute $4.5 million in direct or indirect benefits annually to Indigenous communities.

Direct benefits will include Indigenous development and buying from Indigenous firms, while indirect benefits will include career development, community outreach and grants that help Indigenous communities meet their economic development needs.

Goal 13 (Take urgent action to combat climate change and its impacts)

As the contractors for the public service health care and dental care plans, Canada Life must document its greenhouse gas emission reduction targets in a corporate green strategy document and share it with TBS.

More information on TBS’s contributions to the Federal Implementation Plan on the 2030 Agenda and the Federal Sustainable Development Strategy can be found in the TBS Departmental Sustainable Development Strategy for 2023 to 2027.

Program inventory

Employer is supported by the following programs in the program inventory:

- Employer

- Public Service Employer Payments

Supporting information on planned expenditures, human resources, and results related to TBS’s program inventory is available on GC InfoBase.

Regulatory oversight

Description

TBS develops and oversees policies to promote good regulatory practices, reviews proposed regulations to ensure that they adhere to the requirements of government policy, and advances regulatory cooperation across jurisdictions.

Quality of life impacts

By ensuring a modern effective regulatory framework, performing regulatory reviews and enhancing regulatory policies, guidance and programs, TBS’s regulatory oversight core responsibility contributes to the confidence in institutions and Canada’s place in the world indicators under the good governance domain of the Quality of Life Framework.

Results and targets

The following tables show the indicators, the results from the 3 most recently reported fiscal years, and the 2024–25 targets and dates to achieve them for each departmental result related to regulatory oversight.

Table 6: Indicators, results and targets for departmental result: The federal regulatory system protects and advances the public interest, including sustainable economic growth

Indicator |

2020–21 result |

2021–22 result |

2022–23 result |

2024–25 target |

Date to achieve 2024–25 target |

|---|---|---|---|---|---|

Ranking of Canada’s regulatory system by the Organisation for Economic Co-operation and Development for stakeholder engagement |

3rd |

3rd |

3rd |

Canada to rank in the top 5 in the next issue of the report |

December 2024 |

Ranking of Canada’s regulatory system by the Organisation for Economic Co-operation and Development on Regulatory Impact Assessment |

4th |

5th |

5th |

Canada to rank in the top 5 in the next issue of the report |

December 2024 |

Ranking of Canada’s regulatory system by the Organisation for Economic Co-operation and Development for ex-post evaluation |

5th |

6th |

6th |

Canada to rank in the top 5 in the next issue of the report |

December 2024 |

The financial, human resources and performance information for the TBS’s program inventory is available on GC InfoBase.

Plans to achieve results

1. Encourage regulatory cooperation and harmonization

In 2024–25, TBS will continue to advance regulatory cooperation initiatives in various fora to inform Canada’s regulatory policy suite. For example, it will engage with the Organisation for Economic Cooperation and Development’s Regulatory Policy Committee to stay abreast of advances in internationally recognized good regulatory practices.

TBS will also engage with a broad cross‑section of stakeholders, including Canadians, on regulatory issues through the:

- Comment on proposed regulations online consultation tool

- Let’s Talk Federal Regulations platform

- External Advisory Committee on Regulatory Competitiveness

TBS will also continue to address and implement recommendations of the Expert Advisory Committee on Regulatory Competitiveness on ways to promote and advance regulatory excellence and support the modernization of Canada’s regulatory system. This includes meeting with stakeholders to discuss challenges and best practices to ensure that regulations meet their objectives and to explore ways to improve their effectiveness.

TBS will also engage internationally to help further regulatory excellence in Canada. For example, meetings with the Government of Australia will help to understand its lessons learned in becoming a leader in certain areas of regulatory reform. In 2021, Australia ranked second overall in ex-post evaluation in the Organisation for Economic Cooperation and Development’s ranking of regulatory systems. This work will help to inform advice to the President of the Treasury Board.

2. Review regulations

In 2024–25, TBS will focus the third round of Targeted Regulatory Reviews on Canada’s oceans economy and supply chains. In addition, TBS will consult stakeholders on regulatory irritants to inform targeted regulatory reviews, the Annual Regulatory Modernization Bill and other modernization initiatives.

TBS will also perform a challenge function to ensure that regulators conduct impact assessments that meet the requirements of the Cabinet Directive on Regulation and its related policy suite.

TBS plans to provide expert advice and leadership in the community of practice on the development of regulatory impact assessments, cost‑benefit analysis, and other tools that support the regulatory development process.

Through the Centre for Regulatory Innovation, TBS will continue to help regulators:

- identify new opportunities to innovate and support them in the innovation process

- explore or develop innovative regulatory approaches through new resources and knowledge sharing

- explore innovation concepts and share knowledge through webinars and workshops

TBS anticipates that doing this work earlier in the innovation life cycle will help to identify opportunities and support new ideas to advance regulatory modernization.

3. Reduce regulatory burdens

TBS will continue with its ongoing review to enhance policies, guidance and programs related to the Cabinet Directive on Regulation.

TBS expects this work to reduce regulatory burden, which will help to:

- enhance stakeholder engagement and consultation during the regulatory life cycle

- identify opportunities to support economic growth and innovation

- track, assess and report on departments’ integration of regulation reviews at different stages in the life cycle to inform the approach

Snapshot of planned resources in 2024–25

- Planned spending: $13,178,032

- Planned full-time resources: 74

Related government priorities

Gender-based analysis plus

TBS will continue to review regulatory proposals prepared for Governor in Council approval to ensure that information on gender‑based analysis plus complies with the Cabinet Directive on Regulation and its associated policy instruments.

See TBS’s Gender‑based analysis plus supplementary information table for more information.

United Nations 2030 Agenda for Sustainable Development and the UN Sustainable Development Goals

United Nations 2030 Agenda for Sustainable Development and the UN Sustainable Development Goals

TBS will continue to support departments in integrating sustainable development impact analysis into their the regulatory development processes under the Cabinet Directive on Regulation. This directive requires an integrated cost and benefit analysis of regulations on society, the economy and the environment.

More information on TBS’s contributions to the Federal Implementation Plan on the 2030 Agenda and the Federal Sustainable Development Strategy can be found in the TBS Departmental Sustainable Development Strategy for 2023 to 2027.

Program inventory

Regulatory oversight is supported by the following programs in the program inventory:

- Regulatory Policy, Oversight, and Cooperation

Supporting information on planned expenditures, human resources, and results related to TBS’s program inventory is available on GC InfoBase.

Internal services

Description

Internal services are the services that are provided within a department so that it can meet its corporate obligations and deliver its programs. There are 10 categories of internal services:

- management and oversight services

- communications services

- legal services

- human resources management services

- financial management services

- information management services

- information technology services

- real property management services

- materiel management services

- acquisition management services

Plans to achieve results

TBS allocates 24.7% of its planned operating spending and 32% of its planned full-time equivalents to internal services, which supports the department’s 4 core responsibilities by:

- fostering employee well-being

- building a diverse, inclusive and accessible workplace

- preparing for the future

1. Fostering employee well-being

In 2024–25, TBS will continue to foster its employee well-being by providing them access to:

- mental and physical health and wellness tools, training and resources

- the Employee Assistance Program

In addition, TBS will establish designated safe spaces where employees and managers can engage in constructive discussions concerning workplace issues to promote open dialogue. This will include strategies for the prevention and mitigation of workplace harassment and violence.

2. Building a diverse, inclusive and accessible workplace

In 2024–25, TBS will continue to foster a diverse, inclusive and accessible workplace for its employees by:

- monitoring initiatives outlined in the TBS Letter on Implementation of the Call to Action on Anti-Racism, Equity and Inclusion and ensuring alignment to support the Call to Action forward direction message to deputies

- focusing recruitment and outreach activities on applicants in employment equity groups and tracking progress on hiring and promotion goals

- advancing reconciliation and cultural understanding through learning activities and exchanges

- overseeing TBS’s Accessibility Plan

- piloting a training series on accessible documents

- working to ensure compliance with the Accessible Canada Act

- continuing to collaborate with employee networks on career development, the employee experience, and inclusive, accessible and diverse workplaces

- promoting use of the GC Workplace Accessibility Passport across the public service

3. Preparing for the future

In 2024–25, TBS will work with its managers and employees to ensure that they are supported by efficient, technology-enabled and user-centric internal processes, policies and tools.

TBS will respond to its evolving workplace demands, ensure that its policies and processes adapt to meet needs and optimize the hybrid approach.

TBS will continue its research and data analysis by:

- leveraging new data sources and predictive analytics to expand data analytics capabilities to identify trends and inform decision-making

- conducting skills assessments for key communities and classification groups to identify current capabilities and determine learning and development paths to address future needs

- adopting user-centric onboarding and offboarding processes to promote employee engagement, increase efficiency and retain corporate knowledge

TBS will continue to demonstrate the value of cloud computing, including its contribution to reducing the department’s carbon footprint, and invest in secure departmental asset management processes and systems by upgrading tools and introducing additional control measures.

Snapshot of planned resources in 2024–25

- Planned spending: $94,378,223

- Planned full-time resources: 658

Related government priorities

Planning for contracts awarded to Indigenous businesses

To support the government’s commitment to award at least 5% of the total value of contracts to Indigenous businesses annually, TBS will work with the Office of the Comptroller General and Indigenous Services Canada to review, evaluate and build on the actions and initiatives taken in 2023–24 to award contracts to Indigenous vendors where opportunities exist.

TBS will ensure its procurement officers will continue to work with clients from the planning stage to:

- ensure that they consider Indigenous vendors, where opportunities exist

- make every effort to use a Decision to set aside a procurement under the Procurement Strategy for Indigenous Business, where opportunities exist

- reduce barriers in the evaluation process to allow Indigenous vendors equal opportunities to be considered

TBS will ensure all procurement officers complete mandatory indigenous procurement training and develop internal messaging and education initiatives to help it to achieve the 5% target.

Table 7: Results and planned results for contracts to Indigenous businesses

5% reporting field |

2022-23 actual result |

2023-24 forecasted result |

2024-25 planned result |

|---|---|---|---|

Total percentage of contracts with Indigenous businesses |

1.5% |

6% |

6% |

Planned spending and human resources

This section provides an overview of TBS’s planned spending and human resources for the next 3 fiscal years and compares planned spending for 2024–25 with actual spending from previous years.

Spending

Text description of figure 1

Core responsibility |

Amount ($) |

Percentage (%) |

|---|---|---|

Spending oversight |

5,164,159,416 |

55.27% |

Employer |

3,954,592,665 |

42.32% |

Administrative leadership |

117,984,693 |

1.26% |

Internal services |

94,378,223 |

1.01% |

Regulator oversight |

13,178,032 |

0.14% |

Total planned spending |

9,344,293,029 |

100% |

Explanation of figure 1

TBS’s planned spending for 2024–25 consists of the following allocations:

- $5,164.2 million for the core responsibility of spending oversight, mainly to top up central vote funding held in TBS’s reference levels.

- $3,954.6 million for the core responsibility of employer, for public service insurance payments related to TBS’s role as the employer of the core public administration.

- $225.5 million for the administrative leadership and regulatory oversight core responsibilities, and for internal services, to run TBS and to fulfill the President’s other mandate letter commitments.

TBS manages both departmental and central votes. Except for Vote 20, public service insurance, funding in central votes is transferred from TBS to individual departments once specified criteria are met. TBS’s spending consists of Vote 1, program expenditures, and Vote 20, public service insurance.

Text description of figure 2

Vote |

Amount ($) |

Percentage (%) |

|---|---|---|

Central votes |

5,118,500,000 |

54.78% |

Public service insurance (Vote 20) |

3,844,180,107 |

41.14% |

Program expenditures (Vote 1) |

381,612,922 |

4.08% |

Total planned spending |

9,344,293,029 |

100% |

Explanation of figure 2

Salary and operating expenditures to deliver TBS’s mandate are managed under the departmental vote, Vote 1, Program expenditures.

The employer’s share of pensioner and employee insurance and benefits plans, and provincial and federal legislated taxes are managed under Vote 20, Public Service Insurance.

Under the spending oversight core responsibility, TBS manages six central votes.

Table 8: Government wide funds central votes related to TBS spending oversight core responsibility

Vote |

Name |

Description |

|---|---|---|

5 |

Government contingencies |

Provides departments with temporary advances for urgent or unforeseen expenditures between Parliamentary supply periods |

10 |

Government wide initiatives |

Supports the implementation of strategic management initiatives across the federal public service |

15 |

Compensation adjustments |

Provides funding for adjustments made to terms and conditions of service or employment in the federal public administration as a result of collective bargaining |

25 |

Operating budget carry forward |

Allows departments to carry forward unused funds from the previous fiscal year (up to 5% of Main Estimates gross operating vote) |

30 |

Paylist requirements |

Covers the cost of meeting the government’s legal requirements as employer for items such as parental benefits and severance payments |

35 |

Capital budget carry forward |

Allows departments to carry forward unused funds from the previous fiscal year (up to 20% of capital vote) |

Table 9: Actual spending summary for core responsibilities and internal services ($ dollars)

The following table shows information on spending for each of TBS’s core responsibilities and for its internal services for the previous 3 fiscal years. Amounts for the current fiscal year are forecasted based on spending to date.

Core responsibilities and internal services |

2021–22 actual expenditures |

2022–23 actual expenditures |

2023–24 forecast spending |

|---|---|---|---|

Spending oversight |

40,194,758 |

44,076,954 |

2,680,659,291 |

Administrative leadership |

111,850,599 |

135,056,295 |

124,195,432 |

Employer |

10,809,702,394 |

3,871,345,553 |

4,055,327,765 |

Regulatory oversight |

10,218,687 |

11,961,210 |

13,483,580 |

Subtotal |

10,971,966,438 |

4,062,440,012 |

6,873,666,068 |

Internal services |

95,963,867 |

99,750,988 |

111,810,414 |

Total |

11,067,930,305 |

4,162,191,000 |

6,985,476,482 |

Explanation of table 9

Actual spending decreased by $6,905.7 million from 2021–22 to 2022–23. The decrease is due to a decrease in public service employer payments that stemmed mainly from a $7,805.0 million contribution to the public service pension plan in 2021–22 to address an actuarial shortfall under the public service superannuation account in accordance with the triennial actuarial valuation of the plan as at March 31, 2020.

Total forecast spending for 2023–24 is $2,823.3 million more than the expenditures in 2022–23 due to central votes that are held in TBS’s reference levels. This funding is expected to be transferred to departments or lapsed by year‑end.

Table 10: Budgetary planning summary for core responsibilities and internal services (dollars)

The following table shows information on spending for each of TBS’s core responsibilities and for its internal services for the upcoming 3 fiscal years.

Core responsibilities and internal services |

2024–25 budgetary spending (as indicated in Main Estimates) |

2024–25 planned spending |

2025–26 planned spending |

2026–27 planned spending |

|---|---|---|---|---|

Spending oversight |

5,164,159,416 |

5,164,159,416 |

5,151,321,094 |

5,145,965,955 |

Administrative leadership |

117,984,693 |

117,984,693 |

126,387,786 |

130,134,794 |

Employer |

3,954,592,665 |

3,954,592,665 |

4,044,277,653 |

4,217,318,971 |

Regulatory oversight |

13,178,032 |

13,178,032 |

10,811,526 |

10,837,524 |

Subtotal |

9,249,914,806 |

9,249,914,806 |

9,332,798,059 |

9,504,257,244 |

Internal services |

94,378,223 |

94,378,223 |

92,255,643 |

90,385,417 |

Total |

9,344,293,029 |

9,344,293,029 |

9,425,053,702 |

9,594,642,661 |

Explanation of table 10

Planned spending for 2025–26 is $80.8 million more than planned spending for 2024–25 mainly due to increased funding requirements for the public service insurance plans and programs under the employer core responsibility. The increase is partially offset by decreases in planned spending due to:

- sunsetting of the implementation of proactive pay equity in the federal public service

- reduced funding for Phoenix stabilization and HR‑to‑Pay initiatives

- sunsetting of the extension of targeted regulatory reviews and the External Advisory Committee on Regulatory Competitiveness

Planned spending for 2026–27 is $169.6 million more than planned spending for 2025–26 mainly due to increased funding requirements for the public service insurance plans and programs under the employer core responsibility. The increase is partially offset by decreases in planned spending due to decreases in currently approved funding for the action plan for Black public servants and the sunsetting of Phoenix stabilization and HR‑to‑Pay initiatives. This funding is subject to review and renewal.

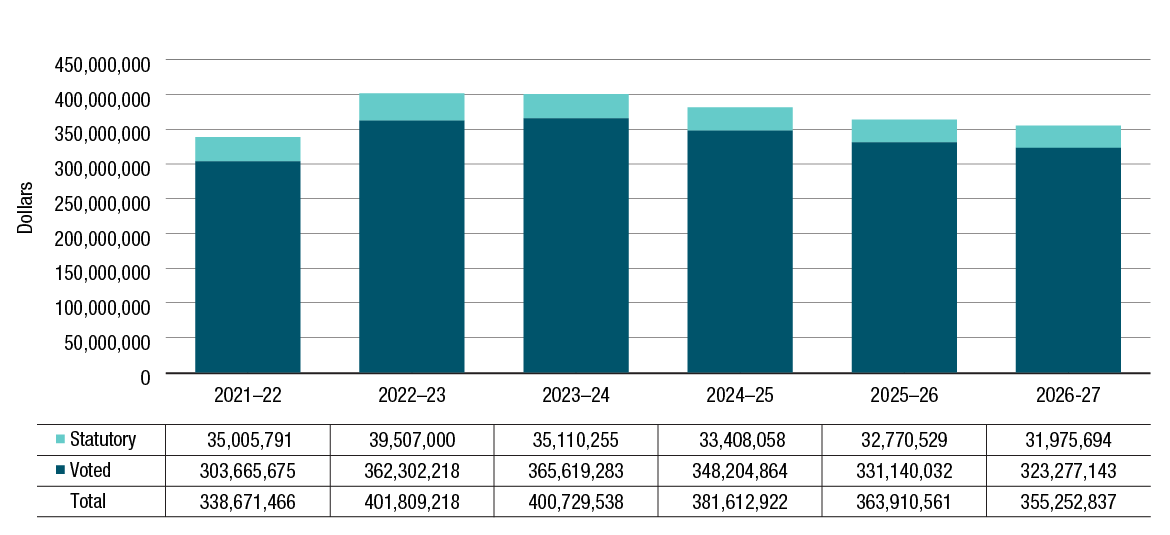

Funding

The following graph presents program expenditures (Vote 1) planned spending (voted and statutory expenditures) over time.

Text description of figure 3

Fiscal year |

Total |

Voted |

Statutory |

|---|---|---|---|

2021–22 |

338,671,466 |

303,665,675 |

35,005,791 |

2022–23 |

401,809,218 |

362,302,218 |

39,507,000 |

2023–24 |

400,729,538 |

365,619,283 |

35,110,255 |

2024–25 |

381,612,922 |

348,204,864 |

33,408,058 |

2025–26 |

363,910,561 |

331,140,032 |

32,770,529 |

2026–27 |

355,252,837 |

323,277,143 |

31,975,694 |

TBS’s program expenditures include salaries, non‑salary costs to deliver programs and statutory items related to the employer’s contributions to TBS’s employee benefit plans.

Program expenditures in 2022–23 were $63.1 million more than 2021–22 mainly due to:

- funding for out‑of‑court settlements

- an increase in digital strategy, planning and oversight program expenditures for the Office of the Chief Information Officer digital initiatives

- requirements for legal services

Forecast spending for 2023–24 is $1.1 million less than actual expenditures in 2022–23 mainly due to the Refocusing Government Spending Initiative, the transfer of Canadian Digital Services to the Department of Employment and Social Development Canada, and various sunsetting initiatives. The reduction is partially offset by funding for collective agreements.

Planned spending for 2024–25 is $19.1 million less than forecast spending in 2023–24 mainly due to:

- the sunsetting of funding to oversee human resources, pay and pension matters and solutions

- reductions for refocusing government spending

Planned spending for 2025–26 is $17.7 million less than planned spending in 2024–25 mainly due to:

- the sunsetting of the implementation of proactive pay equity in the federal public service

- the sunsetting of the extension of targeted regulatory reviews and the External Advisory Committee on Regulatory Competitiveness

- the sunsetting of funding to provide continued leadership in cloud governance to help departments in their transition to cloud technologies

- the Refocusing Government Spending Initiative

Planned spending for 2026–27 is $8.7 million less than planned spending in 2025–26 mainly due to the currently approved funding for the action plan for Black public servants, which is subject to review and renewal, as well as the Refocusing Government Spending Initiative.

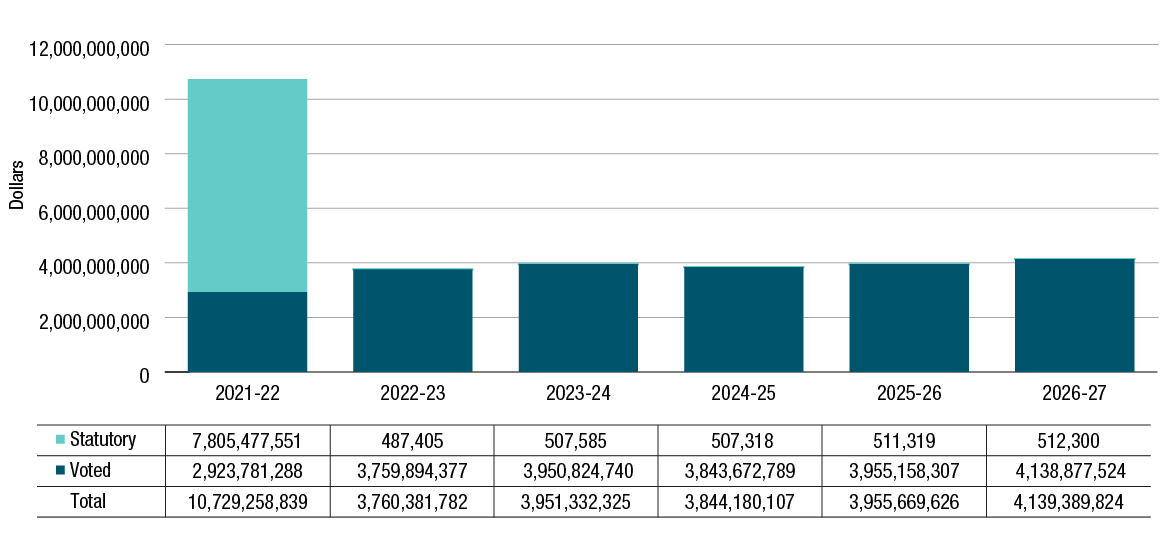

The following graph presents public service insurance (Vote 20) planned spending (voted and various statutory expenditures) over time.

Text description of figure 4

Fiscal year |

Total |

Voted |

Statutory |

|---|---|---|---|

2021–22 |

10,729,258,839 |

2,923,781,288 |

7,805,477,551 |

2022–23 |

3,760,381,782 |

3,759,894,377 |

487,405 |

2023–24 |

3,951,332,325 |

3,950,824,740 |

507,585 |

2024–25 |

3,844,180,107 |

3,843,672,789 |

507,318 |

2025–26 |

3,955,669,626 |

3,955,158,307 |

511,319 |

2026–27 |

4,139,389,824 |

4,138,877,524 |

512,300 |

TBS’s public service insurance includes the employer’s share of group benefit coverage to employees of the core public service under the various plans, plus salaries and non-salary costs to deliver the program.

The $6,968.9 million decrease in actual spending from 2021–22 to 2022–23 is mainly attributable to a decrease in public service employer payments due to a $7,805.0 million decrease in public service pension plan contributions that addressed an actuarial shortfall under the public service superannuation account.

The year-to-year change in actual expenditures and planned spending between 2022–23 to 2026–27 is mainly attributable to funding requirements for the public service insurance plans and programs.

Estimates by vote

Information on TBS’s organizational appropriations is available in the 2024–25 Main Estimates.

Future-oriented condensed statement of operations

The future-oriented condensed statement of operations provides an overview of TBS’s operations for 2023–24 to 2024–25.

The forecast and planned amounts in this statement of operations were prepared on an accrual basis. The forecast and planned amounts presented in other sections of the Departmental Plan were prepared on an expenditure basis. Amounts may therefore differ.

A more detailed future-oriented statement of operations and associated notes, including a reconciliation of the net cost of operations with the requested authorities, are available on TBS’s website.

Table 11: Future-oriented condensed statement of operations for the year ending March 31, 2025 (dollars)

Financial information |

2023–24 forecast results |

2024–25 planned results |

Difference (2024–25 planned results minus 2023–24 forecast results) |

|---|---|---|---|

Total expenses |

4,479,123,830 |

4,355,732,856 |

-123,390,974 |

Total revenues |

92,150,868 |

108,260,868 |

16,110,000 |

Net cost of operations before government funding and transfers |

4,386,972,962 |

4,247,471,988 |

-139,500,974 |

Total expenses comprise public service employer payments ($3.96 billion in 2023–24 and $3.84 billion in 2024–25) and TBS program expenses ($524 million in 2023–24 and $517 million in 2024–25). Public service employer payments are used to fund the employer’s share of the Public Service Health Care Plan, the Public Service Dental Care Plan and other insurance and benefit programs provided to federal public service employees.

Planned public service employer payments for 2024–25 are $117 million (3.0%) less than forecast results for 2023–24. As 2024–25 planned results are based on approved funding to date, the variance is mainly due to the sunsetting of funding received in 2023–24 that will be subject to the renewal process.

Planned TBS program expenses for 2024–25 are $6 million (1.2%) less than forecast results for 2023–24, mainly because of the 2022–23 carry forward to 2023–24, the larger budget reduction in 2024–25 stemming from the Budget 2023 spending review; the higher retroactive compensation adjustments in 2023–24 following the implementation of new collective agreements, and the transfer of funding for the Canadian Digital Service to Employment and Social Development Canada in accordance with order in council 2023-0784. This is partially offset by greater SAP contractual obligations in 2024–25 and greater funding in 2024–25 for implementing proactive pay equity in the federal public service.