Strategic Framework Summary for the Canada Revenue Agency’s Indigenous Portfolio

The Canada Revenue Agency (CRA) has a number of programs that impact Indigenous peoples with an overall goal of supporting full participation in the Canadian tax and benefit system. A key focus is ensuring that anyone who is eligible for benefits and credits can and will access them. The Strategic Framework for the CRA’s Indigenous Portfolio (the Framework) encompasses the CRA’s entire Indigenous portfolio, supporting coordination of related activities across the CRA, and outlining the Agency’s objectives in this area.

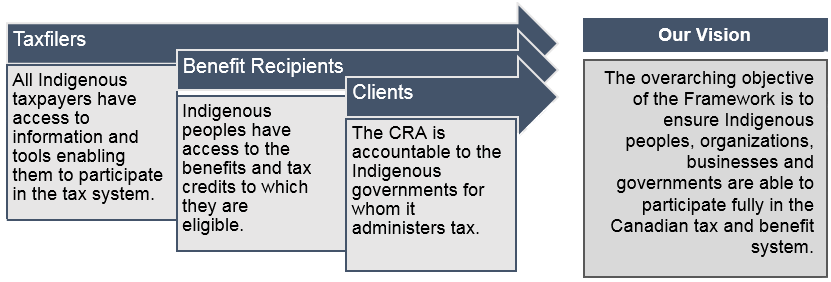

The CRA interacts with Indigenous individuals and entities in three distinct capacities, and the Framework holds a commitment to each.

Image description

Our Vision

The overarching objective of the Framework is to ensure Indigenous peoples, organizations, businesses and governments are able to participate fully in the Canadian tax and benefit system.

- Taxfilers – All Indigenous taxpayers have access to information and tools enabling them to participate in the tax system.

- Benefit Recipients – Indigenous peoples have access to the benefits and tax credits to which they are eligible.

- Clients – The CRA is accountable to the Indigenous governments for whom it administers tax.

Significant efforts have been undertaken by the CRA to improve its understanding of barriers to tax-filing, and to increase Indigenous peoples' uptake of benefits and credits, including the Canada child benefit (CCB).

These initiatives include:

- Research to better understand barriers to tax-filing:

- Two public opinion research studies were conducted (one with Indigenous peoples on-reserve, the other with vulnerable populations more broadly, including urban Indigenous peoples) to identify barriers to tax-filing and benefit uptake.

- A quantitative research project, led by Statistics Canada, to establish a baseline for measuring tax-filing and benefit uptake.

These research projects are being used as a basis to inform more targeted outreach efforts.

- Direct engagement to offer support and information directly to taxpayers:

- To increase awareness of benefits and credits available through the tax system, the Agency conducted 637 in-person visits with Indigenous communities in partnership with Service Canada between Fall 2016 and Spring 2018. These visits have been ongoing since.

- In 2017-2018, 343 Indigenous-focused organizations participated in the Community Volunteer Income Tax Program, serving both urban and reserve-based or northern Indigenous communities. In Quebec the Income Tax Assistance–Volunteer Program offered in partnership with Revenu Québec is also available.

- Communication materials, including posters and fact sheets on benefits and credits, were translated into various Indigenous languages.

- The CRA is launching a Benefits and Credits advertising campaign to encourage taxpayers to claim the credits and benefits to which they are entitled, and will specifically target Indigenous populations through traditional and social media.

The CRA continues to expand its outreach presence and the availability of volunteer tax clinics in Indigenous communities.

- Simplifying CRA processes and forms to make it easier to file a return and apply for benefits:

- For the 2018 tax filing season, the CRA launched the File My Return initiative. Over 950,000 eligible Canadians with low income or a fixed income, which remains mostly unchanged from year-to-year, were invited to file their return by answering a series of questions from an automated phone service, without having to do any calculations.

- The Automated Benefits Application (ABA) was expanded with availability in the Northwest Territories, allowing parents to apply for the CCB on the birth registration form for a newborn child. The ABA is also available in all provinces.

- Individuals registered under the Indian Act may be eligible to use a simplified tax return called the Taxes and benefits for Indigenous peoples.

Given the diversity of taxpayers' personal circumstances, the CRA accepts letters from third parties as supporting documentation when determining a taxpayer's entitlement to child benefit payments, including letters from band councils.

Next Steps

The CRA will continue to build on the progress made to ensure that all Indigenous peoples and governments have the information, tools, and support they require to participate fully in the tax and benefit system.