Draft GST/HST Technical Information Bulletin B-103, Harmonized Sales Tax – Place of supply rules for determining whether a supply is made in a province

GST/HST Technical Information Bulletin B-103

June 2012

Note: This Technical Information Bulletin supersedes the version dated June 2010.

The information in this bulletin does not replace the law found in the Excise Tax Act (the Act) and its regulations. It is provided for your reference. As it may not completely address your particular operation, you may wish to refer to the Act or appropriate regulation, or contact a Canada Revenue Agency (CRA) GST/HST rulings office for more information. A ruling should be requested for certainty in respect of any particular GST/HST matter. Pamphlet RC4405, GST/HST Rulings – Experts in GST/HST Legislation explains how to obtain a ruling and lists the GST/HST rulings offices. If you wish to make a technical enquiry on the GST/HST by telephone, please call 1-800-959-8287.

This publication explains the place of supply rules (including new place of supply rules included in the New Harmonized Value-added Tax System Regulations published on June 9, 2010) that determine whether a supply is made in a province for purposes of determining whether the supply is made in a participating province and consequently subject to the provincial part of the HST in addition to the federal part of the HST.

Unless otherwise indicated, all legislative references in this bulletin refer to the Excise Tax Act and its regulations and all references to supplies are to taxable (other than zero-rated) supplies made in Canada.

If you are located in Quebec and wish to make a technical enquiry or obtain a ruling related to the GST/HST, please contact Revenu Québec at 1-800-567-4692. You may also visit their Web site at www.revenu.gouv.qc.ca to obtain general information.

Table of Contents

- Introduction

- Tangible personal property

- Real property

- Intangible personal property

- Overview

- Intangible personal property – General rules

- General rule 1 – Intangible personal property that can only be used primarily in non-participating provinces

- General rule 2 – Intangible personal property that can only be used primarily in participating provinces

- General Rule 3 – Intangible personal property that can be used otherwise than only primarily in participating provinces and otherwise than only primarily outside participating provinces

- General Rule 4 – Participating provinces with the same highest tax rate

- Intangible personal property that relates to passenger transportation services

- Intangible personal property that relates to tangible personal property

- Rule 1 – Intangible personal property that relates to tangible personal property that is not ordinarily located primarily in participating provinces

- Rule 2 – Intangible personal property that relates to tangible personal property ordinarily located primarily in participating provinces

- Rule 3 – Highest tax rate

- Rule 4 – Same highest tax rate

- Intangible personal property that relates to real property

- Intangible personal property that relates to real property in Canada and outside Canada

- Rule 1 – Intangible personal property that relates to real property that is not situated primarily in participating provinces

- Rule 2 – Intangible personal property that relates to real property situated primarily in participating provinces

- Rule 3 – Highest tax rate

- Rule 4 – Same highest tax rate

- Services

- Overview

- Services – General rules

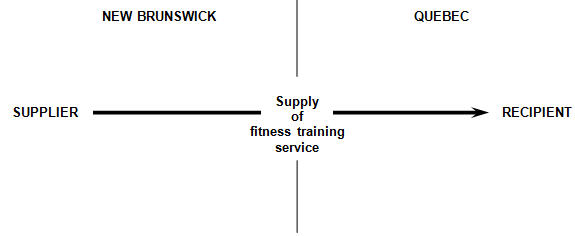

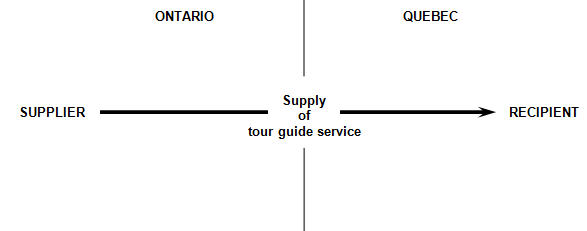

- Personal services

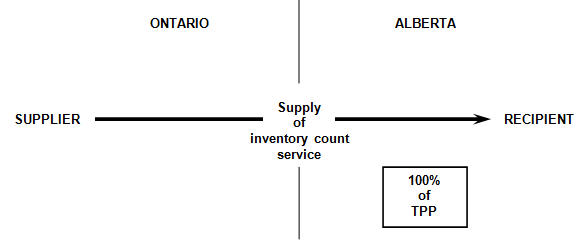

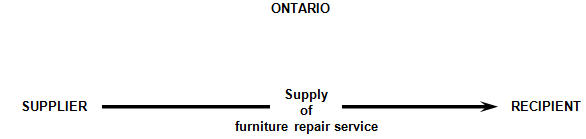

- Services in relation to tangible personal property

- Services in relation to real property

- Services in relation to a location-specific event

- Services rendered in connection with litigation.

- Customs brokerage services

- Repairs, maintenance, cleaning, adjustments, alterations and photographic-related goods

- Services of a trustee in respect of a trust governed by an RRSP, RRIF, RESP, TFSA or RDSP

- 1-900 or 976 service

- Computer-related services and Internet access

- Air navigation services

- Passenger transportation

- Freight transportation services

- Postage and mail delivery services

- Telecommunication services

- Deemed supplies

- Appendix A – List of examples

- Appendix B – Sales of specified motor vehicles

- Appendix C – Place of supply rules for supplies of intangible personal property

- Appendix D – Place of supply rules for services

This publication sets out examples illustrating how the place of supply rules apply to each of the various situations discussed. Appendix A provides a reference list of all of the examples included in this publication along with the applicable legislative references.

Introduction

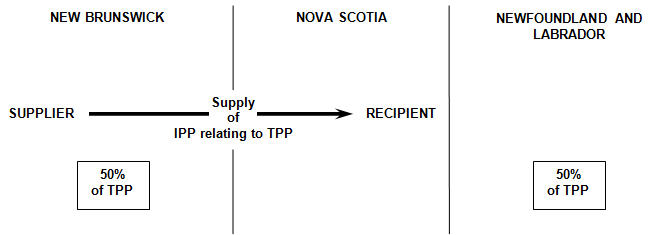

Generally, before July 1, 2010, taxable supplies made in Canada were subject to the goods and services tax (GST) at a rate of 5% unless they were made in the participating provinces of Nova Scotia, New Brunswick or Newfoundland and Labrador, in which case they were subject to the harmonized sales tax (HST) of 13% (of which 5% represented the federal part and 8% the provincial part). Schedule IX to the Act and the previous Place of Supply (GST/HST) Regulations set out the place of supply rules to determine whether supplies that were made in Canada were made in those three participating provinces or in the rest of Canada.

The following changes occurred effective July 1, 2010:

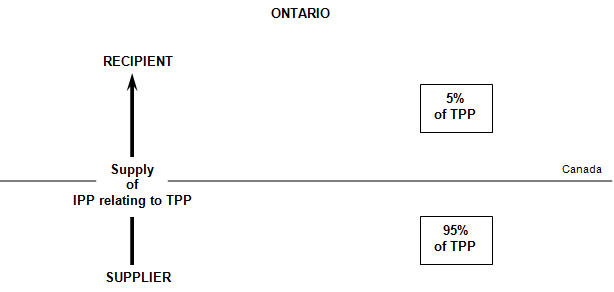

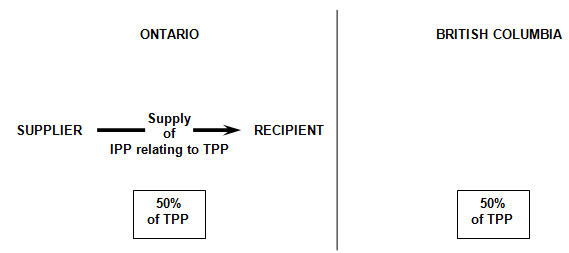

- The Government of Ontario introduced a 13% HST, of which 5% represents the federal part and 8% the provincial part.

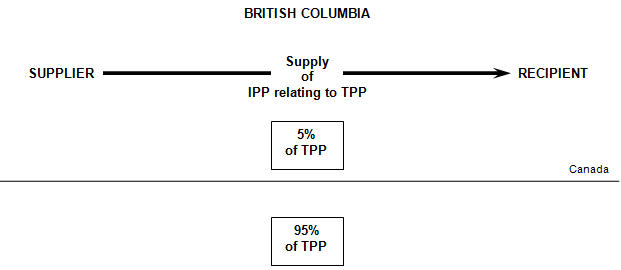

- The Government of British Columbia introduced a 12% HST, of which 5% represents the federal part and 7% the provincial part. On August 26, 2011, Elections BC announced that British Columbians have voted in favour of eliminating the HST in British Columbia. On February 17, 2012, the Department of Finance published a news release, Department of Finance Announces Transitional Rules for the Elimination of the Harmonized Sales Tax in British Columbia (2012-017), announcing proposed transitional rules for the provincial decision to eliminate the HST in British Columbia (B.C.). The proposed transitional rules specify how and when the B.C. part of the HST would cease to apply to transactions that straddle that date. The implementation date for the transition from the HST to the GST on taxable supplies made in B.C. would be April 1, 2013, subject to the approval of the British Columbia Legislature.

- The Government of Nova Scotia increased the provincial part of the HST from 8% to 10%. The HST rate in Nova Scotia is now 15%, of which 5% represents the federal part and 10% the provincial part. On April 2, 2012, the Government of Nova Scotia announced that the province's surplus will be significant enough in 2014 to lower the HST by one percentage point, and another percentage point in the following year, bringing the rate of the HST back to 13% in 2015.

- On April 18, 2012, the Government of Prince Edward Island announced they were entering into formal negotiations with the federal government to implement an HST, effective April 1, 2013. The combined HST rate will be 14% with a provincial part of 9% and a federal part of 5%.

Because different tax rates came into effect in July 1, 2010, and to modernize the rules, a number of changes were required to be made to the place of supply rules, including the introduction of some new place of supply rules. For this reason, the Place of Supply (GST/HST) Regulations were repealed and replaced by Part 1 of the New Harmonized Value-added Tax System Regulations, that set out the new place of supply rules applicable to certain supplies made:

- on or after May 1, 2010; and

- after February 25, 2010 and before May 1, 2010 unless any part of the consideration for the supply became due or was paid before May 1, 2010.

The place of supply rules explained in this publication are set out in Schedule IX and the New Harmonized Value-added Tax System Regulations . Under section 144.1, a supply is deemed to be made in a province if it is made in Canada and it is deemed to be made in the province under the place of supply rules in Schedule IX, but is deemed to be made outside the province in any other case. Also, a supply that is made in Canada that is not made in any participating province is deemed to be made in a non-participating province. Pursuant to section 3 of Part IX of Schedule IX, notwithstanding the place of supply rules in any other Part of Schedule IX, a supply of property or a service is made in a province if it is prescribed to be made in the province by Part 1 of the New Harmonized Value-Added Tax System Regulations. Unless otherwise indicated, all references to the place of supply rules in this publication are to these place of supply rules, and any references to the Regulations are to these regulations, unless otherwise indicated.

The GST (or federal part of the HST) is imposed under subsection 165(1) in respect of taxable supplies that are made in Canada. The provincial part of the HST is imposed under subsection 165(2) in addition to the federal part of the HST in respect of taxable supplies that are made in a participating province.

The provincial part of the HST does not always apply at the same rate to supplies made in the participating provinces, nor does it apply to supplies made outside the participating provinces. Consequently, the place of supply rules are complemented by new rules requiring self-assessment of the provincial part of the HST where personal property and services are brought into a participating province from a non-participating province, or another participating province or from outside Canada for consumption, use or supply in the participating provinces. These rules are set out in Division IV.1, Schedule X, and Part 5 of the New Harmonized Value-Added Tax System Regulations No. 2, including proposed amendments issued on January 28, 2011. Rebates of the provincial part of the HST paid on supplies of property or services made in the participating provinces may also be available if the property or services are removed from a participating province for consumption, use or supply outside the participating province. These rules are set out in Division VI and Part 5 of the New Harmonized Value-Added Tax System Regulations No. 2, including proposed amendments issued on January 28, 2011. In addition, changes have been made to the imported taxable supply rules to ensure that the provincial part of the HST applies consistently irrespective of whether a supply is made in Canada, or outside Canada. These rules are set out in Division IV.

It should be noted that generally, selected listed financial institutions (SLFIs), as defined in subsection 225.2(1), are not required to self-assess the provincial part of the HST under Division IV.1, and are not entitled to claim any rebates in respect of the provincial part of the HST. Also, SLFIs are not generally required to self-assess the provincial part of the HST under Division IV. Instead, SLFIs generally account for the provincial part of the HST through adjustments to their net tax calculation under subsection 225.2(2), and related regulations, including proposed regulations issued on January 28, 2011.

Issues to consider in applying the place of supply rules

The place of supply rules explained in this publication apply to determine whether a supply that is made in Canada is made in a province for purposes of determining whether the supply is made in a participating province and is consequently subject to the provincial part of the HST in addition to the federal part of the HST. This publication is intended to explain the application of these place of supply rules. However, there are several issues that must be considered in order to properly determine the application and relevancy of the place of supply rules.

i) Single and multiple supplies

In determining the place of supply, it is necessary to determine whether a transaction consisting of several elements is a single supply or multiple supplies. This is necessary because the application of certain place of supply rules can provide a different result depending on whether single or multiple supplies are involved, which can in turn result in the application of different tax rates. The determination of whether single or multiple supplies are made can also affect which place of supply rule applies. For instance, where it is determined that a single supply consisting of different types of elements is made, it would generally be the relevant general place of supply rule that would apply to that supply, rather than the specific place of supply rule that would apply to each of the elements of the supply if they were instead determined to be supplied separately.

For GST/HST purposes, the determination of whether a transaction consisting of several elements is to be regarded as a single supply or multiple supplies is based on a determination of fact. The following principles are used to determine whether a transaction consisting of several elements is to be regarded as a single supply or multiple supplies:

- Every supply should be regarded as distinct and independent.

- A supply that is a single supply from an economic point of view should not be artificially split.

- There is a single supply where one or more elements constitute the supply and any remaining elements serve only to enhance the supply.

There are various issues to consider in conducting a single/multiple supply analysis.

It is necessary to identify the various elements of a supply. An element of a supply is any property or service that could reasonably be supplied on its own. In identifying and analyzing the various elements of a package of property and/or services, a distinction must be made between elements that are actually supplied to the recipient and those that are simply inputs consumed or used in making a supply.

Consideration of the following issues can help to determine whether a transaction consists of a single supply or multiple supplies:

- Whether the property/services are provided by two or more suppliers.

- Whether there is more than one recipient.

- What the supplier is providing for the consideration received.

- Whether the recipient is made aware of the elements (in detail) that are part of the package.

- Whether, in the context of the particular transaction, the recipient has the option to acquire the elements separately or to substitute elements.

Incidental supplies

(Section 138)

If a single/multiple supply analysis concludes that there are multiple supplies, it is then necessary to determine whether one of those supplies is incidental to another and whether it may consequently be deemed to form part of a single supply pursuant to section 138. To be considered incidental, a supply generally plays only a minor or subordinate role in relation to the provision of another supply.

Section 138 deems a supply to form part of another supply provided that they are supplied together for a single consideration. For this provision to apply, it must be reasonably regarded that the provision of one property or service is incidental to the supply of the other. With respect to the conditions that must be met for section 138 to apply, see GST/HST Policy Statement P-159, Meaning of the Phrase "reasonably regarded as incidental" and GST/HST Policy Statement P-160, Meaning of the Phrase "where a particular property or service is supplied together with any other property or service".

There are also several legislative provisions that deem single or multiple supplies to be made, some of which are explained in the relevant sections of this publication.

The above explanation is merely intended to highlight the relevant issues to consider in conducting a single/multiple supply analysis. The determination of whether a single or multiple supplies are made requires consideration of the relevant facts of each case. The examples throughout this publication are based on an assumption of fact that single or multiple supplies are being made in those examples based on a single/multiple supply analysis. For further information regarding this issue, refer to GST/HST Policy Statement P-077, Single and Multiple Supplies.

ii) Characterization of supplies

The determination of the nature of a supply is relevant for various GST/HST purposes. It is relevant for purposes of the place of supply rules because there are different place of supply rules that apply to different types of supplies.

Defined terms

(Subsection 123(1))

There are several general legislative definitions that are relevant to the determination of the nature of a supply.

"Property" means any property, whether real or personal, movable or immovable, tangible or intangible, corporeal or incorporeal, and includes a right or interest of any kind, a share and a chose in action, but does not include money.

"Personal property" means property that is not real property.

"Real property" includes:

- in respect of property in the Province of Quebec, immovable property and every lease thereof,

- in respect of property in any other place in Canada, messuages, lands and tenements of every nature and description and every estate or interest in real property, whether legal or equitable, and

- a mobile home, a floating home and any leasehold or proprietary interest therein.

Tangible personal property generally means personal property that may be seen and touched, and that is movable at the time the supply is made. Intangible personal property generally means property other than tangible personal property and real property.

As an exception, the manner in which a supply of real property or tangible personal property is made can affect its characterization and the place of supply rules that consequently apply to that supply. For example, a supply, by way of lease, licence or similar arrangement, of the use or right to use real property or tangible personal property is deemed under the Act to be a supply of real property or tangible personal property, as the case may be. There are also different place of supply rules that apply to sales and leases of tangible personal property.

A "service" means anything other than:

- property,

- money, and

- anything that is supplied to an employer by a person who is or agrees to become an employee of the employer in the course of or in relation to the office or employment of that person.

Determining whether a supply of intangible personal property or a service is made continues to be important for purposes of the general place of supply rules that apply to these types of supplies. The definition of property includes a right or interest of any kind and can therefore include a wide range of rights. A service generally includes anything other than property.

In determining whether a particular supply is a supply of intangible personal property or a supply of a service, a number of factors must be considered. The nature of the agreement between the supplier and the customer, and whether the agreement is in substance for work (or work and materials), or for property (including a right or interest of any kind) must be determined. A key factor in making the distinction between a supply of intangible personal property and a service is whether the supply includes the provision of any rights and if so, whether those rights are the predominant element of the supply. If the supply includes the provision of rights and the rights are the predominant part of the supply, the supply is likely a supply of intangible personal property. If the rights are merely incidental, the supply is likely a supply of a service.

Factors that generally indicate that a supply is one of intangible personal property are:

- a right in a product or a right to use a product for personal or commercial purposes is provided, such as:

- intellectual property or a right to use intellectual property (e.g., a copyright), or

- rights of a temporary nature (e.g., a right to view, access or use a product while on-line);

- a product is provided that has already been created or developed, or is already in existence;

- a product is created or developed for a specific customer, but the supplier retains ownership of the product; and

- a right to make a copy of a digitized product is provided.

Factors that generally indicate that a supply is a service are:

- the supply does not include the provision of rights (e.g., technical know-how), or if there is a provision of rights, the rights are incidental to the supply;

- the supply involves specific work that is performed by a person for a specific customer; and

- there is human involvement in making the supply.

There are specific place of supply rules that apply to supplies of specific types of property and services. Therefore, once a supply has been characterized as a supply of property or a service, it must sometimes also be determined whether it is a supply of a specific type of property or service. For example, in some cases it is necessary to determine whether a supply that is made is a supply of a general service or a service in relation to tangible personal property.

A supply that has been characterized as a specific type of supply for which there is a specific place of supply rule may be subject to the general place of supply rule for that type of supply where the conditions for the application of the specific place of supply rule have not been met.

The manner in which a supply is made can also affect its characterization and the place of supply rules that consequently apply to that supply. For example, a supply made by way of lease, licence or similar arrangement, of the use or right to use real property or tangible personal property is deemed under the Act to be a supply of real property or tangible personal property, as the case may be. There are also are different place of supply rules that apply to supplies of tangible personal property made by way of lease, licence or similar arrangement.

There are more specific legislative definitions and interpretative positions that are relevant to the determination of the nature of certain supplies as explained in this publication.

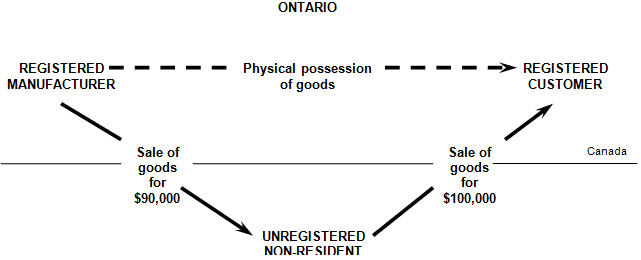

iii) Place of supply rules for Canada

The place of supply rules explained in this publication only apply to determine whether a supply that is made in Canada is made in a province. Before considering the application of the place of supply rules, it is therefore necessary to determine whether the supply is made in Canada. Different place of supply rules determine whether a supply is made in or outside Canada for purposes of determining whether the GST or the federal part of the HST applies to the supply. These rules, that are also based on the nature of the supply that is made, are explained in GST/HST Memorandum 3.3, Place of Supply. In some cases, a supply may be deemed to be made outside Canada based on the status of the recipient, such as with respect to supplies involving drop-shipments as explained in GST/HST Memorandum 3.3.1 Drop-Shipments. In other cases, a supply may be deemed to be made outside Canada based on the status of the supplier such as where the supply is made by a non-resident who is not registered and is not carrying on business in Canada. If a supply is made outside Canada based on these place of supply rules, it is not necessary to consider the application of the place of supply rules explained in this publication.

iv) Tax status of supplies

The place of supply rules explained in this publication are only relevant for purposes of determining whether a supply is made in a province for purposes of determining whether the provincial part of the HST is payable in respect of taxable supplies that are made in Canada. Such a determination is not necessary with respect to exempt supplies (supplies included in Schedule V) in respect of which tax is not payable and zero-rated supplies (supplies included in Schedule VI) in respect of which the rate of tax is 0%. For more information on zero-rated and exempt supplies, refer to Chapters 4 and 5 of the GST/HST Memoranda Series.

Tangible personal property

For the purposes of the place of supply rules that determine whether a supply is made in a province,

- a floating home and a mobile home that is not affixed to land are each deemed to be tangible personal property and not real property; and

- where an agreement for a supply of tangible personal property is entered into but the property is never delivered to the recipient, the property is deemed to have been delivered where the property was to be delivered, as the case may be, under the terms of the agreement.

Tangible personal property supplied by way of sale

(Section 1 of Part II of Schedule IX)

The place of supply rules for sales of tangible personal property have not changed. A "sale", in respect of property, includes any transfer of the ownership of the property and a transfer of the possession of the property under an agreement to transfer ownership of the property.

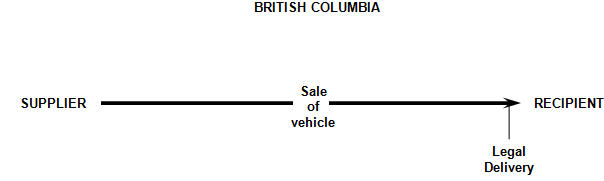

Generally, a sale of tangible personal property is deemed to be made in a province if the supplier delivers the property or makes it available in the province to the recipient of the supply.

This rule is generally based on the province in which legal delivery of the goods to the recipient occurs which can generally be determined by reference to the terms of the agreement for the sale of the goods and the applicable sale of goods law.

A new place of supply rule which is explained later would apply with respect to the sale of a specified motor vehicle in certain circumstances.

Deemed delivery

(Section 3 of Part II of Schedule IX)

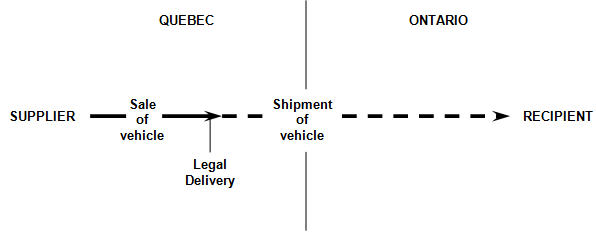

The above place of supply rule is generally based on the province in which legal delivery of the goods to the recipient occurs. However, for the purposes of this rule, tangible personal property is also deemed to be delivered in a particular province, and not in any other province, if the supplier either:

- ships the property to a destination in the particular province that is specified in the contract for carriage of the property;

- transfers possession of the property to a common carrier or consignee that the supplier has retained on behalf of the recipient to ship the property to such a destination;

This rule requires the supplier to be sufficiently involved in securing the transportation of the good by the common carrier or consignee. The supplier must retain a common carrier or consignee on behalf of the recipient (rather than on the supplier's behalf or on behalf of a person other than the recipient) to have the good shipped to a province pursuant to terms negotiated, and instructions provided, by the supplier. A supplier that merely contacts a common carrier or consignee to indicate that the good is ready to be transported pursuant to an arrangement that has already been established by the recipient with the carrier or consignee, or that is merely made aware of such an arrangement, is not considered to have retained the carrier or consignee on behalf of the recipient. - sends the property by mail or courier to an address in the particular province.

Example 1

A supplier in Ontario sells a good to a purchaser in British Columbia. Based on the terms of delivery in the agreement for the supply of the good, legal delivery of the good to the purchaser occurs in British Columbia.

Because legal delivery of the good to the purchaser occurs in British Columbia, the supply is made in British Columbia and is subject to HST at a rate of 12%.

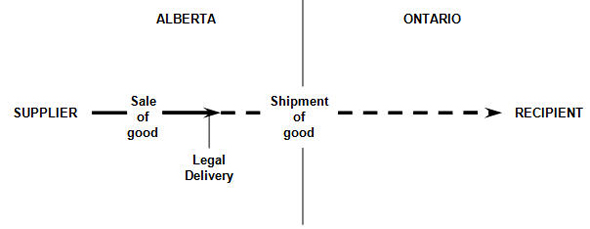

Example 2

A supplier in Alberta sells a good to a purchaser in Ontario. Based on the terms of delivery in the agreement for the supply, legal delivery of the good to the purchaser occurs in Alberta. However, the supplier also hires a common carrier to ship the good to the purchaser in Ontario. Ontario is specified as the destination in the contract for carriage of the good. The carrier invoices the supplier for the freight service. The supplier pays the amount to the carrier and invoices the purchaser for the amount.

Although legal delivery of the good to the purchaser occurs in Alberta, delivery of the good to the purchaser occurs in Ontario because the supplier ships the good to Ontario. Therefore, the supply of the good is made in Ontario and is subject to HST at a rate of 13%.

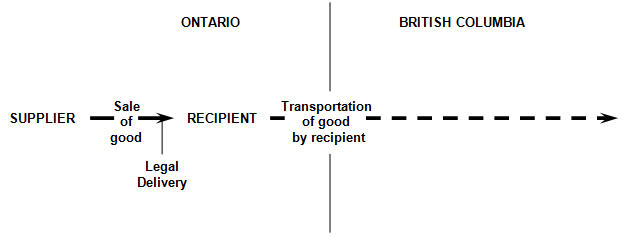

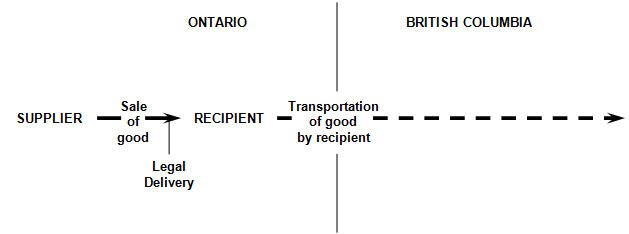

Example 3

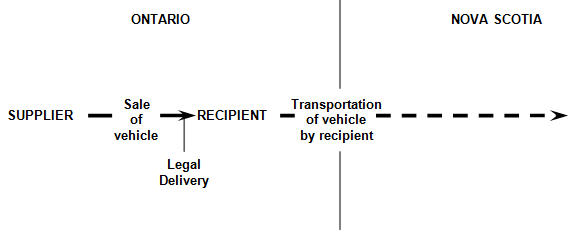

A retailer in Ontario sells a good to a purchaser that is a resident of British Columbia and is visiting Ontario. The purchaser picks up the good at the retailer's premises in Ontario and then transports it by car to British Columbia. Legal delivery of the good occurs at the Ontario company's premises.

The good is delivered to the purchaser in Ontario. Therefore, the supply is made in Ontario and is subject to HST at a rate of 13%.

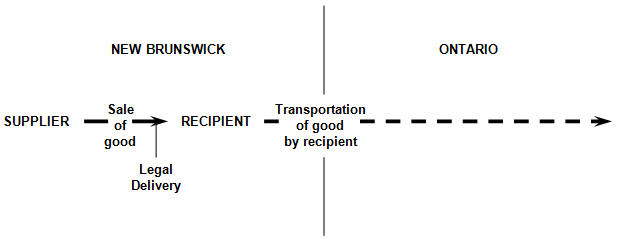

Example 4

A company in New Brunswick sells a good to a company in Ontario. The Ontario company picks up the good at the New Brunswick company's premises using its own truck and then transports it to Ontario. Legal delivery of the good occurs at the New Brunswick company's premises.

The good is delivered to the purchaser in New Brunswick. Therefore, the supply is made in New Brunswick and is subject to HST at a rate of 13%.

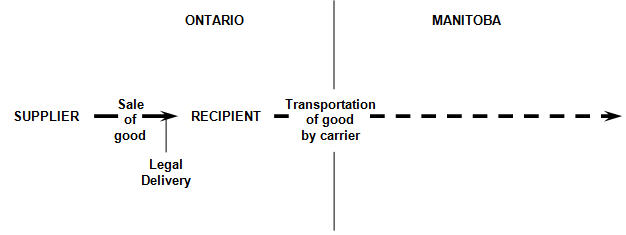

Example 5

A manufacturer in Ontario sells a good to a wholesaler in Manitoba. Legal delivery of the good occurs in Ontario at the manufacturer's premises. The wholesaler regularly purchases goods from the manufacturer and establishes freight terms with a common carrier for the regular transportation of goods from the manufacturer's premises to Manitoba whenever required. The wholesaler instructs the manufacturer to contact the carrier directly to advise the carrier whenever goods are ready for pick-up. The carrier invoices the wholesaler for any transportation service that is provided pursuant to their arrangement.

The good is delivered to the purchaser in Ontario. Therefore, the supply is made in Ontario and is subject to HST at a rate of 13%.

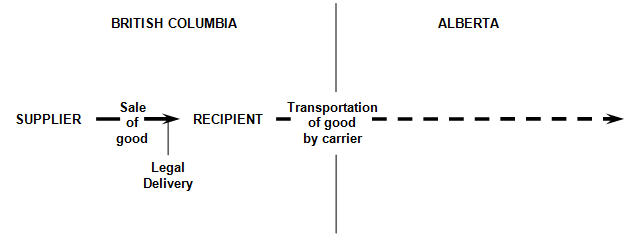

Example 6

A wholesaler in British Columbia sells a good to a retailer in Alberta. Legal delivery of the good occurs in British Columbia at the wholesaler's premises. The retailer requests that the wholesaler retain a carrier on its behalf for carriage of the goods to its Alberta premises. The wholesaler negotiates freight terms with a common carrier on behalf of the retailer and provides the carrier with instructions regarding the shipment of the goods to Alberta. The wholesaler pays the carrier for the cost of the freight and is reimbursed for the cost by the retailer.

Although legal delivery of the good to the purchaser occurs in British Columbia, delivery of the good to the purchaser occurs in Alberta because the supplier retains a common carrier on behalf of the recipient to ship the good to Alberta. Therefore, the supply of the good is made in Alberta and is subject to GST at a rate of 5%.

Example 7

A manufacturer in Ontario sells a good to a company headquartered in British Columbia. The British Columbia company arranges to have one of its branches in Ontario pick up the good at the manufacturer's premises in Ontario with its own truck and then transport it to British Columbia.

The good is delivered to the purchaser in Ontario. Therefore, the supply is made in Ontario and is subject to HST at a rate of 13%.

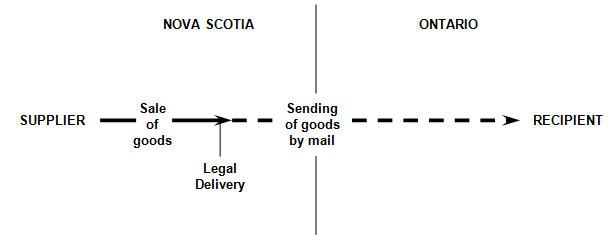

Example 8

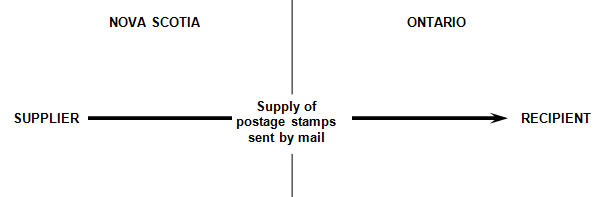

A mail-order company located in Nova Scotia sells goods to customers across Canada. The company places some of the packages of goods in the mail for delivery to its customers in Ontario.

Although legal delivery of the goods occurs in Nova Scotia, delivery of the goods occurs in Ontario because they are sent by the supplier to Ontario by mail. The supply of the goods is made in Ontario and is subject to HST at a rate of 13%.

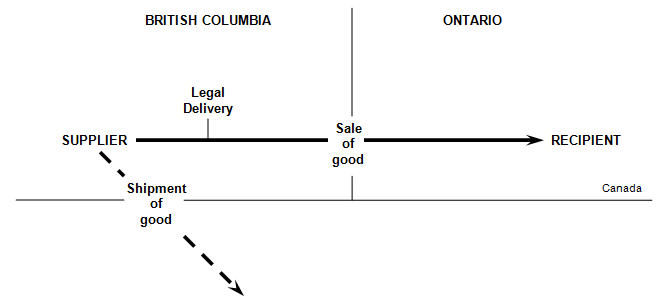

Example 9

A supplier in British Columbia sells a good to an Ontario company. Based on the terms of delivery for the supply of the good, legal delivery to the purchaser occurs in British Columbia. The supplier hires a courier to send the good to an address outside Canada.

Although the supply of the good is made in British Columbia, the supply is zero-rated as an export under section 12 of Part V of Schedule VI because the supplier sends the good by courier to an address outside Canada.

Delivery of tangible personal property on exercise of option

(Subsection 136.1(1.1))

For GST/HST purposes, a recipient of a supply by way of lease, licence or similar arrangement of tangible personal property that exercises an option to purchase the property under the arrangement is, for greater certainty, deemed to take delivery of the property supplied by way of sale at the place and time at which the recipient ceases to have possession of the property as a lessee and begins to have possession of the property as a purchaser. Therefore, the place of supply rules for the sale of the tangible personal property are based on the place at which the recipient begins to have possession of the property as a purchaser rather than the place where the recipient first obtained possession of the property as a lessee.

New place of supply rule for sales of specified motor vehicles

A "specified motor vehicle" is defined in the Act to mean a vehicle that is, or that would be, if it were imported, classified under one of several tariff items in Schedule I to the Customs Tariff. Generally, this includes all motor vehicles, other than racing cars classified under heading number 87.03, and any prescribed motor vehicles.

As explained in GST/HST Info Sheet GI-119, Harmonized Sales Tax – New Place of Supply Rule for Sales of Specified Motor Vehicles, for purposes of administrative simplification, the Department of Finance has indicated that it intends at the earliest opportunity to recommend a regulatory change to the place of supply rules made under the Excise Tax Act that would deem the supply of a specified motor vehicle by way of sale to be made in the particular province in which the vehicle is registered if that registration occurs within seven days after the day on which delivery of the vehicle to the recipient in a participating province (other than the particular province) occurs. The proposed regulatory change would be published in the Canada Gazette in accordance with the federal regulatory process and would come into force at that time. However, it will be proposed that the regulatory change have retrospective application in some circumstances to July 1, 2010.

In anticipation of the recommendation by the Department of Finance of such a regulatory change and to allow affected parties to benefit from the administrative simplification that it would provide, the CRA has begun administering the new place of supply rule, where suppliers choose to apply the rule. Therefore, as an exception to the general place of supply rule for sales of goods, where a supplier makes a supply by way of sale of a specified motor vehicle, the supply would be administratively considered by the CRA to be made in a particular province if:

- the vehicle is registered (other than on a temporary basis) by or on behalf of the recipient under the laws of the particular province relating to the registration of motor vehicles within seven days after the day on which the vehicle is delivered or made available to the recipient in a participating province (other than the particular province), and

- the supplier maintains evidence satisfactory to the Minister of National Revenue of that registration.

The documentary evidence that a supplier would be required to maintain in its records to substantiate the application of the new place of supply rule would be:

- a dated copy of the permanent registration of the vehicle in the province in the recipient's name, and

- a copy of the vehicle purchase agreement, or other sales document such as a bill of sale, that indicates the date of delivery of the vehicle.

In order to substantiate to the relevant vehicle registration authority of a particular participating province that self-assessment of the provincial part of the HST is not required when the vehicle is registered in the particular participating province, a recipient would be required to make available to the vehicle registration authority a copy of the vehicle purchase agreement or other sales document such as a bill of sale showing the date of delivery of the vehicle in another participating province and that the provincial part of the HST in respect of the particular participating province is payable, or has been paid, in respect of the supply.

Based on the recommendation to be made by the Department of Finance, the new administrative place of supply rule would apply to:

- any supply of a specified motor vehicle made by way of sale on or after the date of final publication of the regulatory change in the Canada Gazette; and

- any supply of a specified motor vehicle made by way of sale on or after July 1, 2010, and before the date of final publication of the regulatory change in the Canada Gazette, in respect of which the rule has been applied (i.e. based on the rule, the supplier has collected the provincial part of the HST, if any, of the province in which the vehicle was registered within seven days after the day on which it was delivered or made available to the recipient).

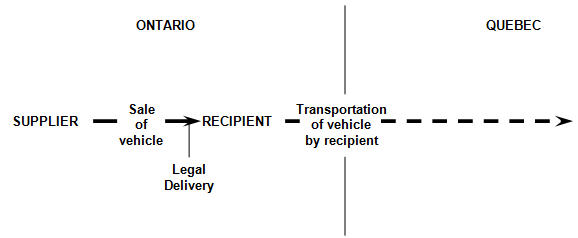

Example 10

An automobile dealer located in Ontario sells a specified motor vehicle to a recipient who is resident in Quebec. Delivery of the vehicle to the recipient occurs in Ontario at the location of the dealership. Before delivery of the vehicle to the recipient in Ontario, the dealer registers the vehicle in Quebec on behalf of the recipient. The recipient subsequently drives the vehicle to Quebec.

Although delivery of the vehicle to the recipient occurs in Ontario, the supply of the vehicle would be deemed under the new rule to be made in Quebec because the vehicle is registered in Quebec on behalf of the recipient within seven days after the date of delivery of the vehicle to the recipient in Ontario. The dealer would therefore collect GST at a rate of 5% in respect of the supply of the vehicle.

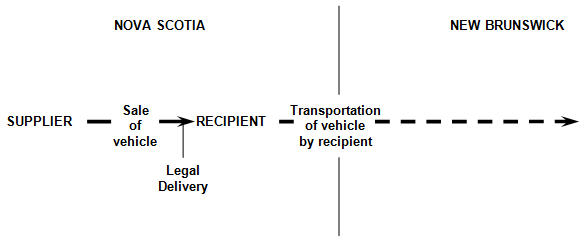

Example 11

An automobile dealer located in Nova Scotia sells a specified motor vehicle to a recipient who is resident in New Brunswick. Delivery of the vehicle to the recipient occurs in Nova Scotia at the location of the dealership. Before delivery of the vehicle to the recipient in Nova Scotia, the dealer registers the vehicle in New Brunswick on behalf of the recipient. The recipient subsequently drives the vehicle to New Brunswick.

The supply of the vehicle would be deemed under the new rule to be made in New Brunswick because the vehicle is registered in New Brunswick on behalf of the recipient within seven days after the date of delivery of the vehicle to the recipient in Nova Scotia. The dealer would therefore collect HST at a rate of 13% in respect of the supply of the vehicle.

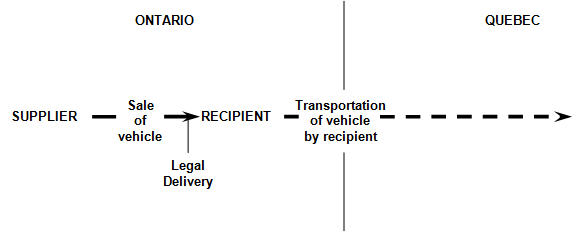

Example 12

An automobile dealer located in Ontario sells a specified motor vehicle to a recipient who is resident in Quebec. The recipient takes delivery of the vehicle in Ontario at the location of the dealership and subsequently drives it to Quebec. Ten days later, the recipient registers the vehicle in Quebec.

Delivery of the vehicle to the recipient occurs in Ontario. Although the vehicle is registered in Quebec by the recipient, the new rule would not apply since the vehicle was not registered within seven days after the date of delivery of the vehicle to the recipient in Ontario. The supply of the vehicle is therefore made in Ontario and the dealer is required to collect HST at 13% in respect of the supply. The recipient would be eligible for a rebate of the 8% Ontario part of the HST that the recipient paid to the dealer (for further information, see GST/HST Info Sheet G-119, Harmonized Sales Tax – New Place of Supply Rule for Sales of Specified Motor Vehicles and Form GST495, Rebate Application for Provincial Part of Harmonized Sales Tax (HST ) .

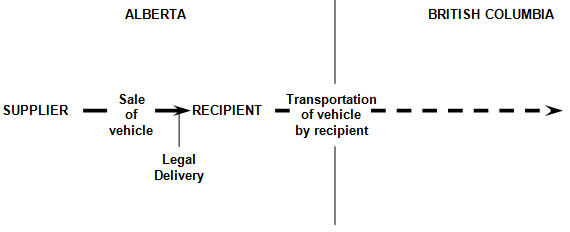

Example 13

An automobile dealer located in Alberta sells a specified motor vehicle to a recipient who is resident in British Columbia. Delivery of the vehicle to the recipient occurs in Alberta at the location of the dealership. Before delivery of the vehicle to the recipient in Alberta, the recipient registers the vehicle in British Columbia and provides the dealer with a copy of the registration. The recipient subsequently drives the vehicle to British Columbia.

Because delivery of the vehicle to the recipient occurs in Alberta, a non-participating province, the new rule would not apply. The supply of the vehicle is deemed under the general place of supply rule to be made in Alberta. The dealer is therefore required to collect GST at a rate of 5% in respect of the supply. The recipient is required to pay the 7% British Columbia part of the HST to the provincial motor vehicle registration authority in British Columbia upon registering the vehicle in British Columbia.

Example 14

An automobile dealer located in British Columbia sells a specified motor vehicle to a recipient who is resident in British Columbia. Delivery of the vehicle to the recipient occurs in British Columbia at the location of the dealership. Before delivery of the vehicle to the recipient in British Columbia, the dealer registers the vehicle in British Columbia on behalf of the recipient.

Because delivery of the vehicle to the recipient occurs in British Columbia, the same participating province in which the vehicle is registered, the new rule would not apply. The supply of the vehicle is deemed under the general place of supply rule to be made in British Columbia. The dealer is therefore required to collect HST at a rate of 12% in respect of the supply.

Example 15

An automobile dealer located in Quebec sells a specified motor vehicle to a recipient who is resident in Ontario. The Quebec dealer agrees to ship the vehicle to the recipient in Ontario. Before delivery of the vehicle to the recipient in Ontario, the dealer registers the vehicle in Ontario on behalf of the recipient.

Because delivery of the vehicle to the recipient occurs in Ontario, the same participating province in which the vehicle is registered, the new rule would not apply. The supply of the vehicle is deemed under the general place of supply rule to be made in Ontario. The dealer is therefore required to collect HST at a rate of 13% in respect of the supply.

Example 16

An automobile dealer located in Ontario sells a specified motor vehicle to a recipient who is resident in Nova Scotia. The recipient takes delivery of the vehicle in Ontario at the location of the dealership. The dealer collects HST at a rate of 13% in respect of the supply of the vehicle. After taking delivery of the vehicle at the dealership, the recipient drives the vehicle to Nova Scotia the same day. The following day, the recipient registers the vehicle in Nova Scotia. The dealer does not obtain any evidence of the registration of the vehicle in Nova Scotia.

Although the vehicle is registered in Nova Scotia within seven days after the date of delivery of the vehicle to the recipient in Ontario, the new place of supply rule would not apply in this case since the dealer does not maintain any evidence of that registration. As a result, because delivery of the vehicle to the recipient occurs in Ontario, the supply is made in that province and the supplier is required to collect HST at a rate of 13% in respect of the supply. Upon registering the vehicle in Nova Scotia, the recipient will be required to pay HST to the provincial motor vehicle registration authority in Nova Scotia calculated based on a rate of 2% (10% Nova Scotia provincial rate – 8% Ontario provincial rate).

Appendix B includes a table that provides an overview of the application of the provincial part of the HST to sales of vehicles in various circumstances, including those in which the new administrative place of supply rule has been applied by the supplier. For further information, see GST/HST Info Sheet GI-119, Harmonized Sales Tax – New Place of Supply Rule for Sales of Specified Motor Vehicles.

Tangible personal property supplied otherwise than by way of sale

The place of supply rules for tangible personal property supplied otherwise than by way of sale have not changed.

Deemed supply of tangible personal property

(Subsection 136(1))

A supply, by way of lease, licence or similar arrangement, of the use or right to use tangible personal property is deemed to be a supply of tangible personal property.

Period of more than three months – Specified motor vehicle

(Subparagraph 2(b)(i) of Part II of Schedule IX)

A specified motor vehicle is defined to mean a vehicle that is, or that would be, if it were imported, classified under certain tariff items in Schedule I to the Customs Tariff. Generally, this includes almost all motor vehicles, other than racing cars classified under tariff heading number 87.03, and any prescribed motor vehicles.

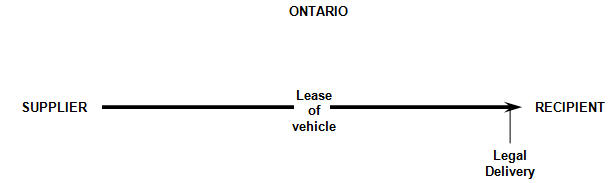

A supply of a specified motor vehicle otherwise than by way of sale under an arrangement under which continuous possession or use of the vehicle is provided for more than three months is deemed to be made in a province if the vehicle is required to be registered under the laws of the province relating to the registration of motor vehicles at the time the supply is made.

Lease intervals – Deemed supplies of tangible personal property

(Subsection 136.1(1))

Where a supply of property is made by way of lease, licence or similar arrangement for consideration that is attributable to a period (referred to as a "lease interval") that is the whole or a part of the period during which possession or use of the property is provided under the arrangement, a separate supply of the property for separate consideration is deemed to be made by the supplier and received by the recipient for each lease interval. The supply for each lease interval is deemed to be made on the earliest of

- the first day of the lease interval,

- the day on which the lease payment attributable to that interval becomes due, and

- the day that payment is made.

The separate supplies of tangible personal property that are deemed to be made for each lease interval can be subject to HST at a different rate to the extent that those supplies can be deemed to be made in a different province based on the application of the place of supply rules for tangible personal property supplied otherwise than by way of sale. Therefore, the province in which a supply of a specified motor vehicle for each lease interval is made and the applicable rate of tax can vary based on the province in which the vehicle is required to be registered at a particular time.

Example 17

A car leasing company located in Ontario leases a vehicle to a person pursuant to a two-year lease requiring monthly lease payments. The lessee picks up the vehicle at the supplier's premises in Ontario and the vehicle is required to be registered in Ontario throughout the lease.

The supplies of the vehicle that relate to each of the lease payments are made in Ontario and are subject to HST at a rate of 13% because the vehicle is required to be registered in Ontario throughout the lease.

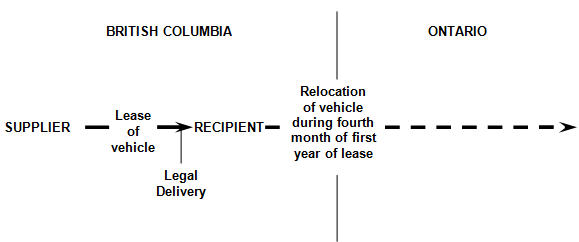

Example 18

A car leasing company located in British Columbia leases a vehicle to a person pursuant to a four-year lease requiring monthly lease payments. The lessee picks the vehicle up at the dealer's location in British Columbia and is required to register the vehicle in British Columbia at that time. At the end of the fourth month of the first year of the lease, the lessee moves to Ontario and is required to register the vehicle in Ontario.

The supplies of the vehicle that relate to each of the lease payments for the first four months of the lease are made in British Columbia and are subject to HST at a rate of 12% because the vehicle is required to be registered in British Columbia at the beginning of those lease intervals. The supplies of the vehicle that relate to each of the lease payments for the remaining months of the lease are made in Ontario and are subject to HST at a rate of 13% because the vehicle is required to be registered in Ontario at the beginning of those lease intervals.

Period of more than three months – Tangible personal property (other than a specified motor vehicle)

(Subparagraph 2(b)(ii) of Part II of Schedule IX)

A supply of tangible personal property (other than a specified motor vehicle) by way of lease, licence or similar arrangement for more than three months is deemed to be made in a province if the ordinary location of the property, as determined at the time the supply is made, is in the province. Again, a separate supply of the property is deemed to be made for each lease interval on the earliest of

- the first day of the lease interval,

- the day on which the lease payment attributable to that interval becomes due, and

- the day that payment is made.

Ordinary location of property

(Section 4 of Part I of Schedule IX)

For purposes of the place of supply rules, the ordinary location of property is deemed to be the location where the supplier and the recipient mutually agree that the ordinary location of the property is to be at a particular time. In other words, the mutual agreement of the supplier and recipient is determinative even where the property is actually located at a different place at the relevant time from what had been agreed upon. The mutual agreement of the parties may change from time to time. Therefore, even if the original written agreement for a supply of property specified that the property would be located in a particular province, the parties may mutually agree subsequent to the signing of the contract that the property is to be moved at a particular time to a location in another province. In this case, the latter location would be the ordinary location of the property at that particular time.

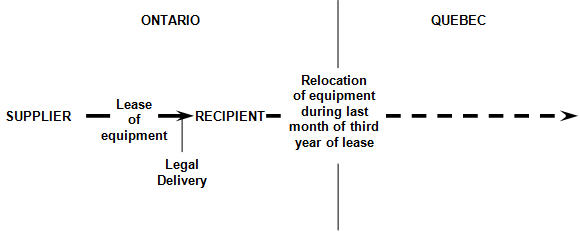

Example 19

Pursuant to a five-year lease, a national leasing company based in Quebec leases equipment to a construction company operating in Ontario. The monthly lease payments are due and paid at the beginning of each month. The construction company takes delivery of the equipment in Ontario. The equipment is usually stored and maintained at the construction company's facilities in Ontario. However, at the end of the last month of the third year of the lease, the construction company expands its operations to Quebec and, with the agreement of the Quebec company, the equipment is relocated to the company's new facilities in Quebec.

The supply of the leased equipment is made in Canada since the construction company is given possession of the equipment in Ontario. A supply of the equipment is deemed to be made for each lease interval. In this case, the supplies of the equipment to which the lease payments for the first three years relate are made in Ontario and are subject to HST at a rate of 13% since the equipment is ordinarily located in Ontario during that time. The supplies of the equipment to which the lease payments relate for the remaining two years are made in Quebec and subject to GST at a rate of 5% since the equipment is ordinarily located in Quebec during that time.

Period of three months or less

(Paragraph 2(a) of Part II of Schedule IX)

A supply of tangible personal property otherwise than by way of sale under an arrangement under which continuous possession or use of the property is provided for a period of no more than three months is deemed to be made in the province in which the supplier delivers the property or makes it available to the recipient of the supply.

Deemed delivery

(Section 3 of Part II of Schedule IX)

This place of supply rule is generally based on the province in which legal delivery of the property to the recipient occurs. However, for purposes of this rule, tangible personal property is also deemed to be delivered in a particular province, and not in any other province, if the supplier either:

- ships the property to a destination in the particular province that is specified in the contract for carriage of the property;

- transfers possession of the property to a common carrier or consignee that the supplier has retained on behalf of the recipient to ship the property to such a destination; or

- sends the property by mail or courier to an address in the particular province.

Single determination of place of supply based on initial delivery

(Section 4 of Part II of Schedule IX)

The province in which the supply of tangible personal property is made in the case of a lease, licence or similar arrangement of three months or less is determined only once based on the initial delivery of the property and does not change for subsequent lease intervals, if any, under the arrangement.

Example 20

A consumer rents and takes possession of a vehicle in British Columbia to use while travelling on a trip throughout Canada. The rental agreement is for a one-month period.

The lease of the vehicle to the consumer is made in British Columbia and is subject to HST at a rate of 12% because the consumer is leasing the vehicle for a period that does not exceed three months and takes delivery of the vehicle in British Columbia.

Railway rolling stock supplied otherwise than by way of sale

(Section 26 of Part 1 of the Regulations)

The place of supply rules for a supply of railway rolling stock otherwise than by way of sale have not changed.

Rule 1

A supply of railway rolling stock otherwise than by way of sale is made in a province if the supplier delivers the rolling stock or makes it available to the recipient of the supply in that province.

This place of supply rule is generally based on the province in which legal delivery of the rolling stock to the recipient occurs. However, for purposes of the rule, the rolling stock is also deemed to be delivered in a particular province, and not in any other province, if the supplier ships the rolling stock to a destination in the province that is specified in the contract for carriage of the rolling stock or transfers possession of the rolling stock to a common carrier or consignee that the supplier has retained on behalf of the recipient to ship the rolling stock to such a destination.

Rule 2

Despite Rule 1, the province in which the supply of the rolling stock is determined to be made for the first lease interval is the province in which all supplies of the rolling stock for subsequent lease intervals are deemed to be made.

Rule 3

Subject to Rule 4 and Rule 5, if continuous possession or use of railway rolling stock is given by a supplier to a recipient throughout a period under two or more successive leases, licenses or similar arrangements entered into between the supplier and the recipient (i.e., where the arrangement is renewed), the rolling stock is deemed to have been delivered or made available to the recipient under each of those arrangements at the location at which it is delivered or made available to the recipient under the first of those arrangements.

Rule 4

A special transitional rule applies where a supply of railway rolling stock is made under a particular lease agreement that is in effect on April 1, 1997, and under the particular agreement, the rolling stock was delivered or made available to the recipient before that day. In this case,

- the rolling stock is deemed to have been delivered or made available to the recipient under the particular agreement outside the participating provinces; and

- if the recipient retains continuous possession or use of the rolling stock under an agreement (the "renewal agreement") with the supplier that immediately succeeds the particular agreement, Rule 3 applies as if the renewal agreement were the first arrangement between the supplier and the recipient for the supply of the rolling stock.

Rule 5

A special transitional rule applies where a supply of railway rolling stock is made under a particular lease agreement that is in effect on July 1, 2010, and under the particular agreement, the rolling stock was delivered or made available to the recipient in Ontario or British Columbia before that day. In this case,

- the rolling stock is deemed to have been delivered or made available to the recipient under the particular agreement outside the participating provinces; and

- if the recipient retains continuous possession or use of the rolling stock under an agreement (the "renewal agreement") with the supplier that immediately succeeds the particular agreement, Rule 3 applies as if the renewal agreement were the first arrangement between the supplier and the recipient for the supply of the rolling stock.

Example 21

A company in Ontario enters into a lease agreement to supply a railway car to a company in Quebec. The Quebec company takes delivery of the railway car in Ontario.

The supply of the railway car throughout the period covered by the lease is made in Ontario because the railway car is delivered to the recipient in Ontario. As a result, the lease payments for the railway car are subject to HST at a rate of 13%.

Real property

(Section 1 of Part IV of Schedule IX)

The place of supply rule for supplies of real property has not changed. A supply of real property is deemed to be made in a province if the property is situated in the province.

Deemed supply of real property

(Subsection 136(1))

A supply, by way of lease, licence or similar arrangement, of the use or right to use real property is deemed to be a supply of real property.

Supply of real property partly in a province

(Section 136.2)

For purposes of determining in which participating province, if any, a taxable supply of real property is made and determining the provincial part of the HST payable, if any, in respect of the supply, a deeming rule applies where the supply of real property includes the provision of real property that is partly situated in a particular province and partly in one or more other provinces or outside Canada. In this case, the provision of the part of the real property that is situated in the particular province and the provision of the part of the real property that is situated in the other province or outside Canada are each deemed to be a separate taxable supply made for separate consideration equal to the portion of the total consideration for all the property that is reasonably attributable to each part of the real property. As a result, it is only the provision of the part of the real property that is situated in the participating provinces that is subject to HST.

A purported single supply of real property that is situated in a particular province and in one or more other provinces or outside Canada may, in fact, be separate supplies of real property—a supply of real property made in the particular province and a separate supply of real property made in each other province or outside Canada.

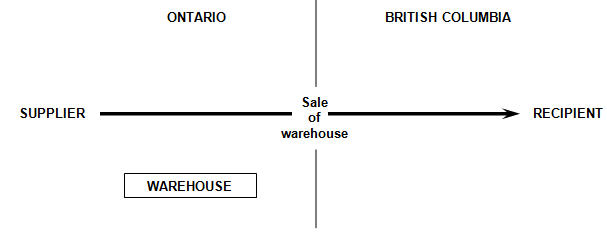

Example 22

A company based in Ontario sells one of its warehouses that is situated in Ontario to a company in British Columbia.

The sale of the warehouse is made in Ontario and is subject to HST at a rate of 13%.

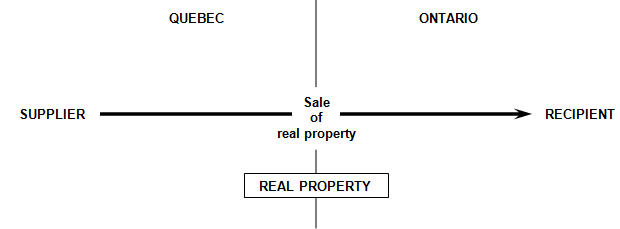

Example 23

A company in Quebec sells taxable commercial real property to an Ontario company. The real property is situated in Ontario and Quebec.

The provision of each part of the real property is deemed to be a separate supply for consideration equal to the portion of the total consideration for all the property that is reasonably attributable to the part that is situated in each province. The supply of the part of the real property that is situated in Ontario is therefore made in Ontario and is subject to HST at a rate of 13%. The supply of the part of the real property that is situated in Quebec is therefore made in Quebec and subject to GST at a rate of 5%.

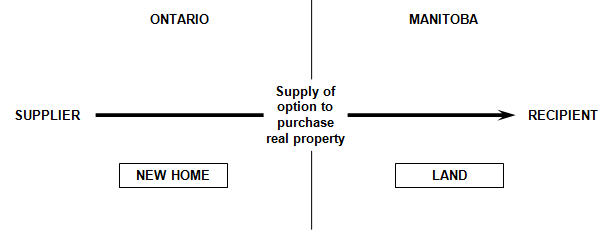

Example 24

A builder in Ontario is selling a new home in Ontario for $1,000,000 to a purchaser in Manitoba. The same builder owns 20 acres of land in Manitoba worth $10,000. The builder makes a single supply of granting an option to the purchaser for $101,000 (10% of the total purchase price) to purchase both the Ontario home and the Manitoba land for $1,010,000. The purchaser may exercise the option to purchase the two properties anytime within five years of the date the option is granted.

The supply of an option to purchase real property is considered to be a supply of real property for GST/HST purposes. The supply of the option to purchase the two properties is therefore a taxable supply of real property. Since the properties are situated in more than one province, the supply of the real property is deemed to be two separate supplies made for separate consideration. HST at 13% applies to $100,000 which is reasonably attributable to the deemed supply of the option to purchase the home in Ontario, and GST at 5% applies to $1,000 which is reasonably attributable to the deemed supply of the option to purchase the Manitoba land.

Lease intervals – Deemed supplies of real property

(Subsection 136.1(1))

Where a supply of property is made by way of lease, licence or similar arrangement for consideration that is attributable to a period (referred to as a "lease interval") that is the whole or a part of the period during which possession or use of the property is provided under the arrangement, a separate supply of the property for separate consideration is deemed to be made by the supplier and received by the recipient for each lease interval. The supply for each lease interval is deemed to be made on the earliest of

- the first day of the lease interval,

- the day on which the lease payment attributable to that interval becomes due, and

- the day that payment is made.

Example 25

Pursuant to a lease agreement, a company in New Brunswick leases a commercial office building situated in New Brunswick to a company in Ontario for a period of ten years.

Intangible personal property

(Division 2 of Part 1 of the Regulations)

Overview

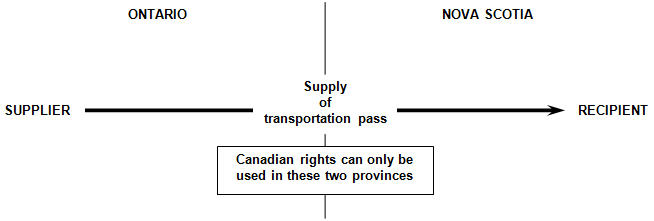

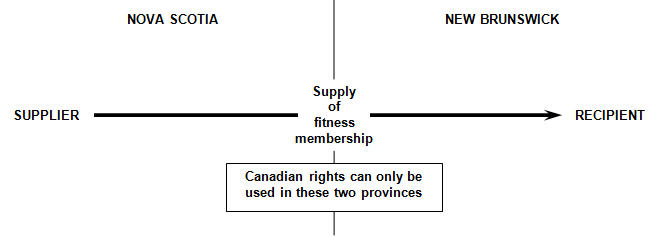

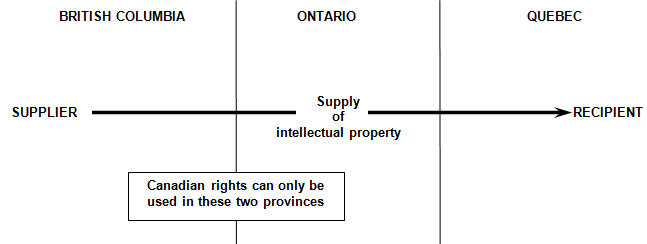

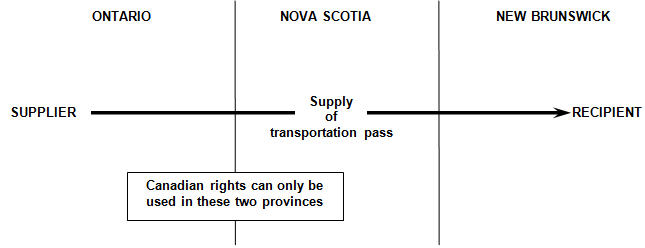

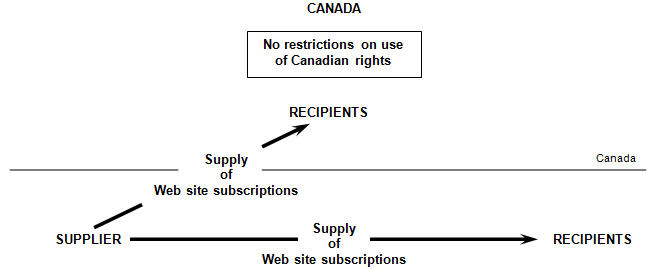

The place of supply rules for supplies of intangible personal property have changed significantly. Although the general rules continue to be based on the location where the rights may be used, some of these rules are now also generally based on the home or business address of the recipient (or another address of the recipient) in Canada that the supplier obtains in the ordinary course of its business. However, the general rules are subject to specific place of supply rules that can apply to certain types of intangible personal property.

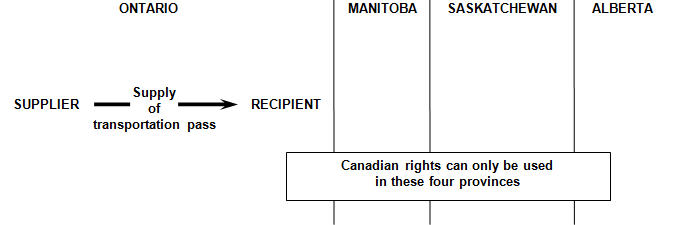

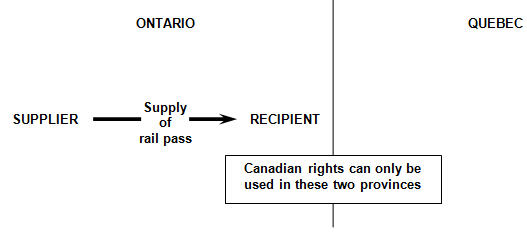

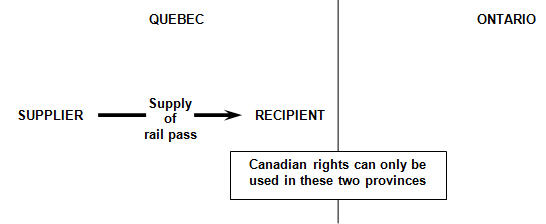

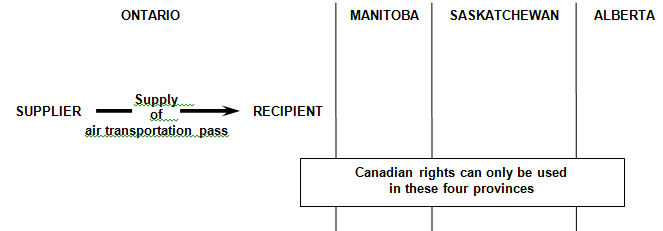

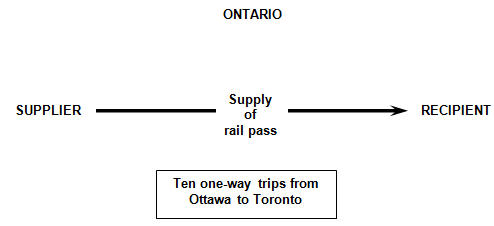

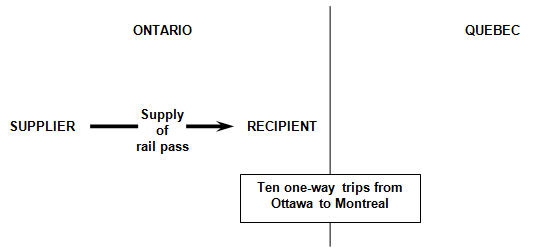

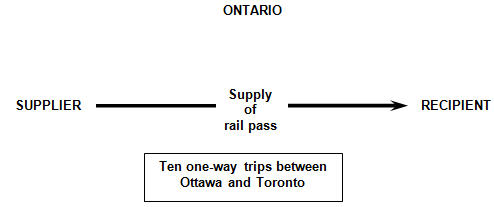

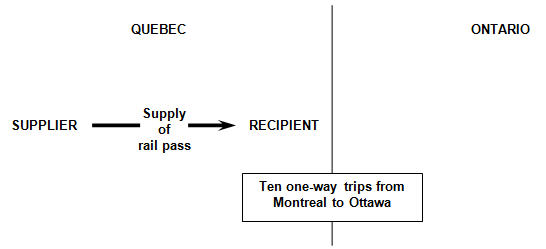

Where the specific place of supply rules do not determine the place of supply of a particular type of intangible personal property because the conditions for the application of those rules are not met, it is the general place of supply rules that determine the place of supply of the intangible personal property. For example, there are specific place of supply rules for supplies of intangible personal property that are, or are similar to, passenger transportation passes that entitle an individual to passenger transportation services. However, where it is not possible to determine the place of supply of the intangible personal property that is a passenger transportation pass under the specific rules for such supplies (which for example can be the case due to a lack of restrictions regarding the place where the intangible personal property may be used), the place of supply are determined under the general place of supply rules.

Note: Appendix C contains a flow chart that summarizes the place of supply rules for supplies of intangible personal property.

Exceptions

(Section 5 of Division 2 of Part 1 of the Regulations)

The place of supply rules explained in this section do not apply to supplies of intangible personal property to which the specific place of supply rules for postage (Part VII of Schedule IX) and telecommunication services (Part VIII of Schedule IX) apply.

Intangible personal property – General rules

(Sections 6, 7, 8 and 11 of Division 2 of Part 1 of the Regulations)

There are four general place of supply rules that apply to supplies of intangible personal property that can be summarized as follows:

- Supplies of intangible personal property that can be used in Canada that can only be used primarily Footnote 1 outside the participating provinces are deemed to be made in a non-participating province and subject to GST.

- Supplies of intangible personal property that can be used in Canada that can only be used primarily in the participating provinces are deemed to be made in a participating province and subject to HST.

- The place of supply for supplies of intangible personal property that can be used in Canada and can be used other than only primarily in the participating provinces and other than only primarily outside the participating provinces depends on a number of additional factors.

- Another rule applies where the above rules do not apply because two or more relevant participating provinces have the same highest rate for the provincial part of the HST (the "tax rate").

Exceptions

(Sections 9 and 10 of Division 2 and section 22 of Division 4 of Part 1 of the Regulations)

The general place of supply rules for intangible personal property do not apply to supplies of intangible personal property that relate to real property or tangible personal property. Also, they are subject to specific place of supply rules that apply to certain supplies of intangible personal property that are, or are similar to, passenger transportation passes entitling an individual to one or more passenger transportation services.

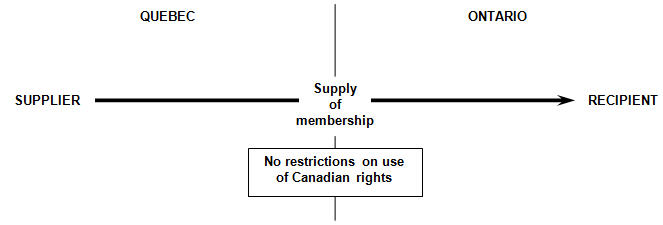

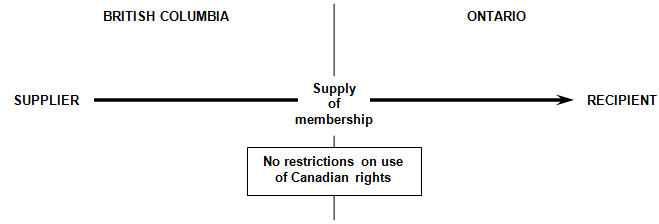

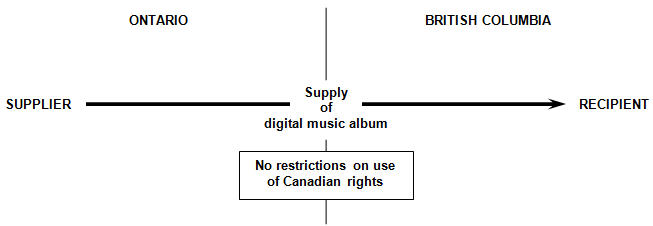

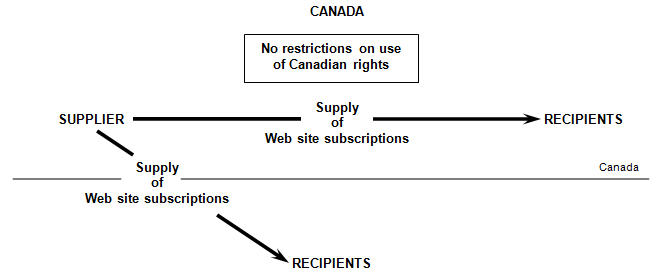

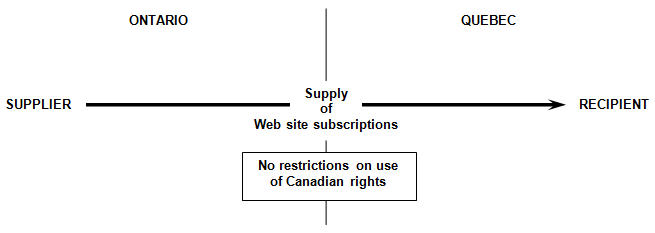

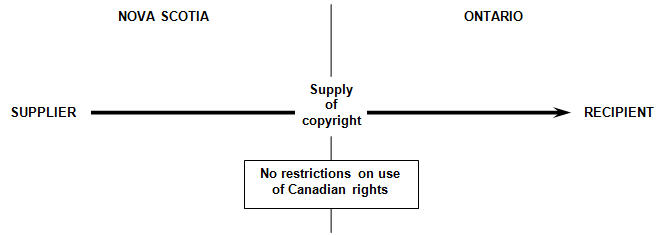

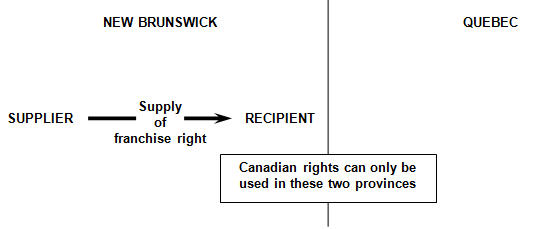

The general place of supply rules can require a determination of the extent, if any, to which the use of the Canadian rights Footnote 2 is limited to one or more provinces. The terms of the agreement for the supply governing the use of the rights generally determine the extent, if any, to which the rights can be used in one or more provinces. The use of the rights may be limited to one or more provinces by the nature of the rights being supplied without such a restriction being explicitly stated in the terms of the agreement. For instance, if as a matter of fact, the right that is supplied could only ever be used from a single location in a single province, then the use of the right would be considered to be limited to that province regardless of whether this is explicitly stated in the terms of the agreement. If there are no limitations with respect to the province in which the rights can be used and it is possible for those rights to be used in a particular province, then the rights can be, but are not limited to being, used in that particular province.

General rule 1 – Intangible personal property that can only be used primarily in non-participating provinces

(Section 7 of Division 2 of Part 1 of the Regulations)

A supply of intangible personal property in respect of which the Canadian rights can only be used primarily in non-participating provinces is made in a non-participating province.

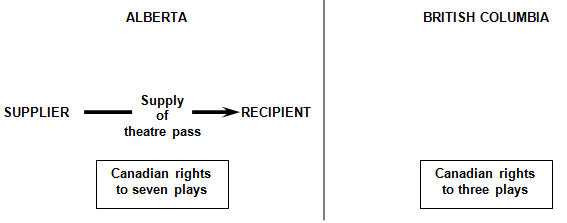

Example 26

An individual in Alberta purchases a theatre pass that provides the right to attend seven plays in Alberta and three plays in British Columbia from a supplier in Alberta.

The supply is made in a non-participating province since the intangible personal property can only be used primarily in Alberta. Therefore, the supply is subject to GST at a rate of 5%.

General rule 2 – Intangible personal property that can only be used primarily in participating provinces

(Section 6 of Division 2 of Part 1 of the Regulations)

Rule 2A – Intangible personal property that can only be used primarily in participating provinces with province of primary use

(Subsection 6(1) of Division 2 of Part 1 of the Regulations)

If the Canadian rights in respect of a supply of intangible personal property can only be used primarily in the participating provinces, the supply is made in a participating province if an equal or greater proportion of the Canadian rights cannot be used in another participating province.

This rule applies where the Canadian rights can only be used primarily in the participating provinces and the province in which the greatest proportion of those rights can be used can be determined because the use of at least some of those rights is specifically limited to one or more of those provinces. This rule does not apply if the use of the rights is not specifically limited to one or more of the participating provinces, which would be the case, for example, if the rights can be used on an unlimited basis in more than one of those provinces.

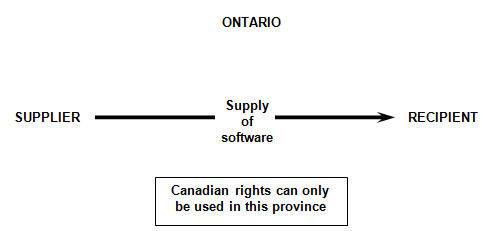

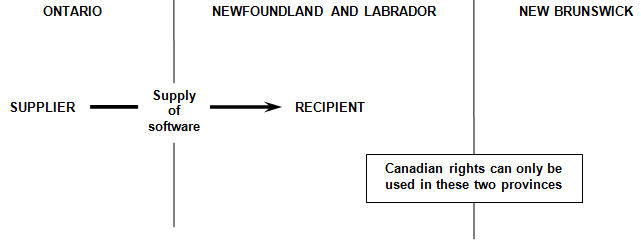

Example 27

A supplier in Ontario supplies software by way of licence to a company in Ontario for use by its employees at its head office in Ontario. The software is downloaded electronically over the Internet. The licence provides that the software can only be used from the head office of the Ontario company.

The Canadian rights in respect of the software can only be used primarily in participating provinces and an equal or greater proportion of the Canadian rights cannot be used in a participating province other than Ontario. Therefore, the supply of the intangible personal property is made in Ontario and subject to HST at a rate of 13%.

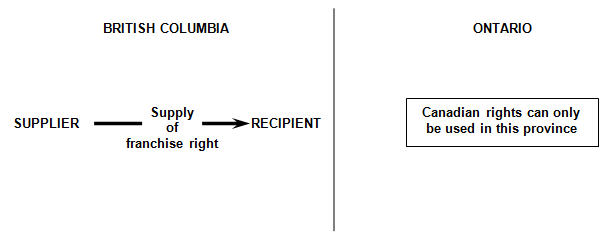

Example 28

A franchise company in British Columbia supplies a franchise to a British Columbia company that provides the right to operate a franchise retail business in Ontario.

The Canadian rights in respect of the franchise can only be used primarily in participating provinces and an equal or greater proportion of the Canadian rights cannot be used in a participating province other than Ontario. Therefore, the supply of the intangible personal property is made in Ontario and subject to HST at a rate of 13%.

Example 29

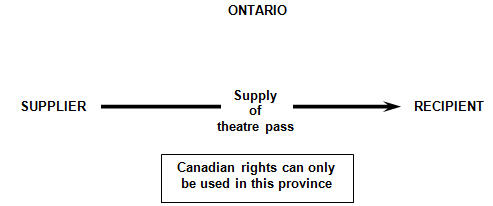

An individual purchases a pass in Ontario that entitles the individual to admission to three plays at a theatre in Ontario.

The Canadian rights in respect of the pass can only be used primarily in participating provinces and an equal or greater proportion of the Canadian rights cannot be used in a participating province other than Ontario. Therefore, the supply of the intangible personal property is made in Ontario and subject to HST at a rate of 13%.

Example 30

An individual purchases a pass in Ontario that entitles the individual to admission to two plays at two theatres in Ontario and to admission to one play at a theatre in British Columbia.

The Canadian rights in respect of the pass can only be used primarily in participating provinces and an equal or greater proportion of the Canadian rights cannot be used in a participating province other than Ontario. Therefore, the supply of the intangible personal property is made in Ontario and subject to HST at a rate of 13%.

Generally, four rules apply where the Canadian rights in respect of a supply of intangible personal property can only be used primarily in participating provinces, but Rule 2A does not apply because it is not possible to determine the participating province in which the greatest proportion of those rights can be used. This would be the case where there are no limitations with respect to the extent to which the rights can be used in any of those provinces.

Rule 2B – Intangible personal property that can only be used primarily in participating provinces with no province of primary use

(Subsection 6(2) and section 11 of Division 2 of Part 1 of the Regulations)

If the value of the consideration for the supply of the intangible personal property is $300 or less, the supply is made in a participating province if:

- the supply is made through a "specified location" of the supplier (a permanent establishment of the supplier or a vending machine) located in the province in the presence of an individual who is, or who acts on behalf of, the recipient, and

- the intangible personal property can be used in the province.

Permanent establishment

(Subsections 132.1(2) and (3))

Subsection 132.1(2) generally defines "permanent establishment" for the purposes of section 132.1 and Schedule IX. The definition relies on the meanings assigned to "permanent establishment" under certain provisions of the Income Tax Regulations. The definition also relies on the definition of "business" under subsection 248(1) of the Income Tax Act, which is defined to mean a profession, calling, trade, manufacture or any undertaking and generally an adventure or concern in the nature of trade, but does not include an office or employment.

In the case of an individual, the estate of a deceased individual or a trust that carries on a business, the meaning of "permanent establishment" is as defined for purposes of Part XXVI of the Income Tax Regulations. It therefore includes a fixed place of business of the individual including an office, a branch, a mine, an oil well, a farm, a timberland, a factory, a workshop, or a warehouse. Also, if an individual carries on business through an employee or agent, established in a particular place, who has general authority to contract for his employer or principal or who has a stock of merchandise owned by his employer or principal from which he regularly fills orders which he receives, the individual is deemed to have a permanent establishment in that place. If an individual uses substantial machinery or equipment in a particular place at any time in a taxation year, the individual is deemed to have a permanent establishment in that place. For purposes of this definition, the fact that an individual has business dealings through a commission agent, broker or other independent agent or maintains an office solely for the purchase of merchandise, does not on its own mean that the individual has a permanent establishment.

The same definition under Part XXVI of the Income Tax Regulations also applies with respect to the permanent establishment of a member of a partnership, where the member is an individual, the estate of a deceased individual or a trust, and the establishment relates to a business carried on through the partnership.

In the case of a corporation that carries on a business, the meaning of "permanent establishment" is as defined under Part IV of the Income Tax Regulations. It therefore includes a fixed place of business of the corporation, including an office, a branch, a mine, an oil well, a farm, a timberland, a factory, a workshop, or a warehouse. Also,

- where the corporation does not have any fixed place of business, it means the principal place in which the corporation's business is conducted;

- where a corporation carries on business through an employee or agent, established in a particular place, who has general authority to contract for his employer or principal or who has a stock of merchandise owned by his employer or principal from which he regularly fills orders which he receives, the corporation is deemed to have a permanent establishment in that place;

- an insurance corporation is deemed to have a permanent establishment in each province and country in which the corporation is registered or licensed to do business;

- where a corporation, otherwise having a permanent establishment in Canada, owns land in a province, such land is deemed to be a permanent establishment;

- where a corporation uses substantial machinery or equipment in a particular place at any time in a taxation year, it is deemed to have a permanent establishment in that place;

- if, but for this bullet, a corporation would not have a permanent establishment, the corporation is deemed to have a permanent establishment at the place designated in its incorporating documents or bylaws as its head office or registered office;

- the fact that a corporation has business dealings through a commission agent, broker or other independent agent or maintains an office solely for the purchase of merchandise shall not on its own mean that the corporation has a permanent establishment; and

- the fact that a corporation has a subsidiary controlled corporation in a place or a subsidiary-controlled corporation engaged in trade or business in a place does not on its own mean that the corporation is operating a permanent establishment in that place.

The same definition under Part IV of the Income Tax Regulations also applies with respect to the permanent establishment of a member of a partnership, where the member is a corporation and the establishment relates to a business carried on by the partnership.

Where a member of a particular partnership is also a partnership, the permanent establishment of the member is determined by the other rules under subsection 132.1(2), provided the establishment relates to a business carried on by the particular partnership.

Finally, under subsection 132.1(2), where a person's permanent establishment cannot be determined using the rules above, the meaning of "permanent establishment" of the person is as defined under Part IV of the Income Tax Regulations as if the person were a corporation and its activities were a business for purposes of the Income Tax Act.

Subsection 132.1(3) provides that a prescribed person, or a person of a prescribed class, is deemed, under prescribed circumstances and for prescribed purposes, to have a permanent establishment in a prescribed province. Under subsection 2(1) of the New Harmonized Value-Added Tax System Regulations No. 2, the classes of persons that are prescribed for purposes of subsection 132.1(3) are:

- charities;

- non-profit organizations; and

- selected public service bodies as defined in section 259.

"Selected public service body" is defined in section 259 to mean:

- a school authority, a university or a public college that is established and operated otherwise than for profit;

- a hospital authority;

- a municipality;

- a facility operator; or

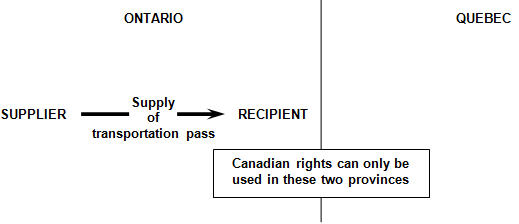

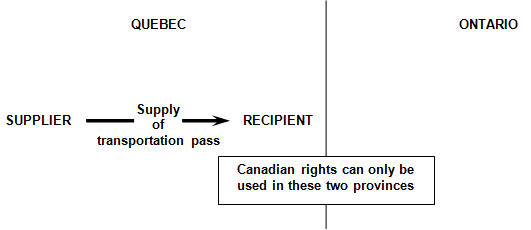

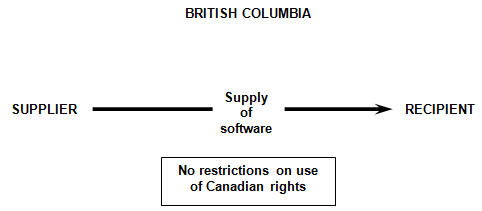

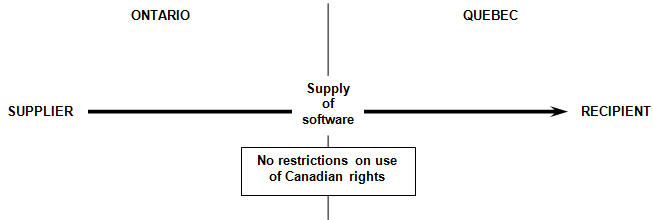

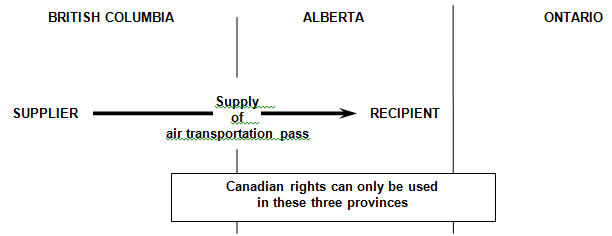

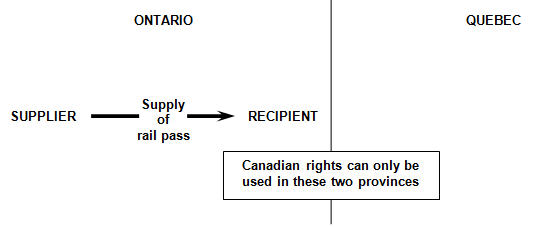

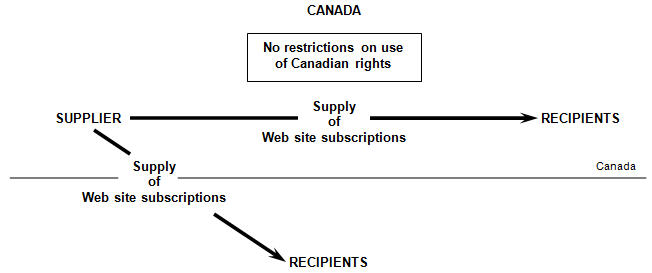

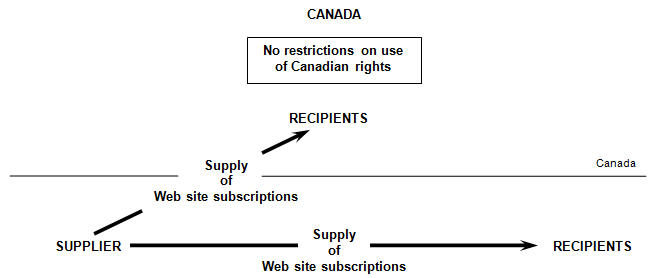

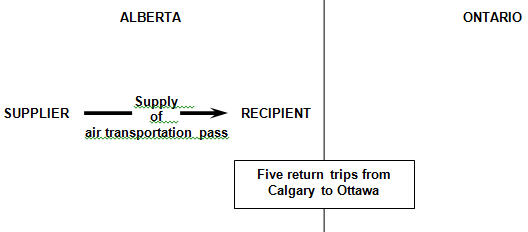

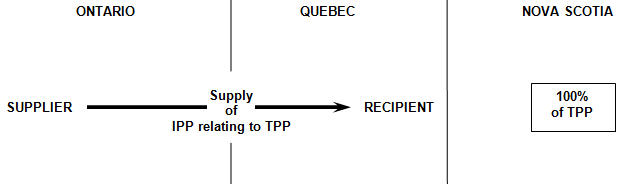

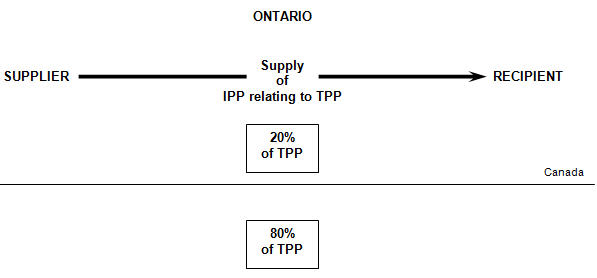

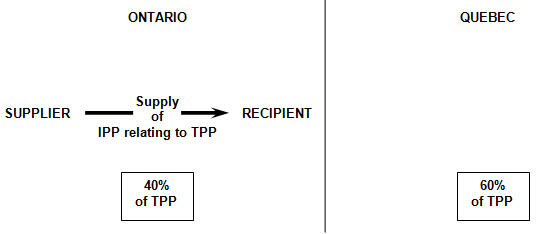

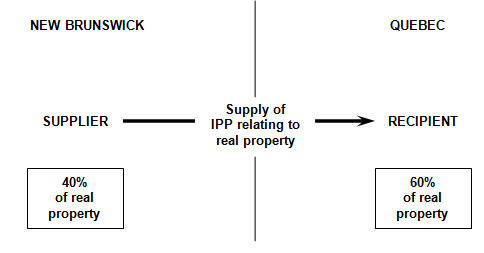

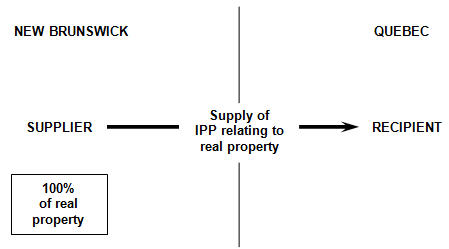

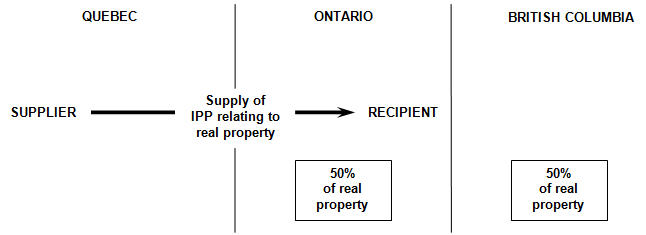

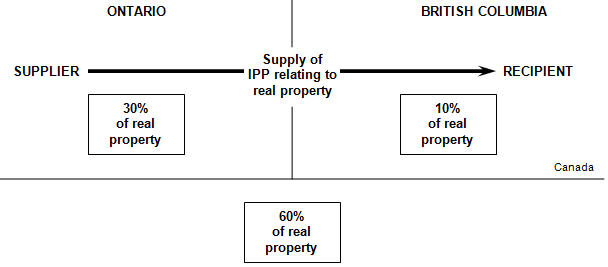

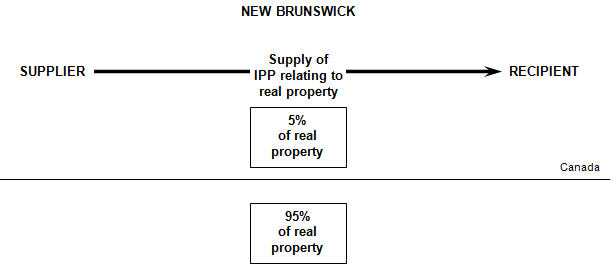

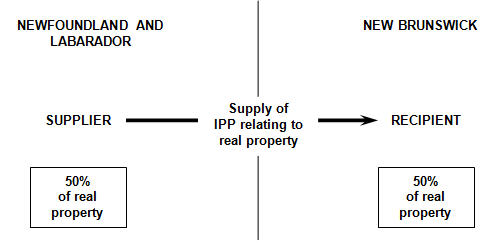

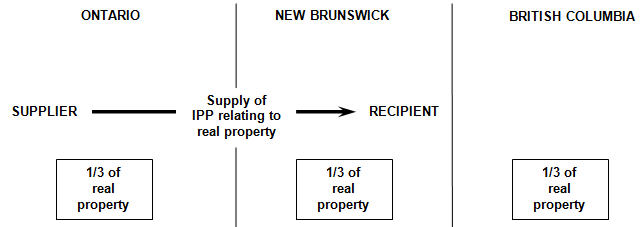

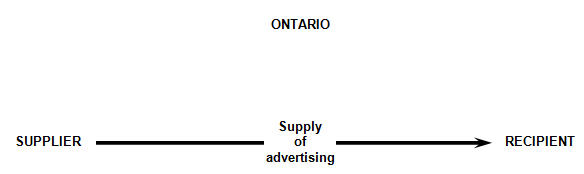

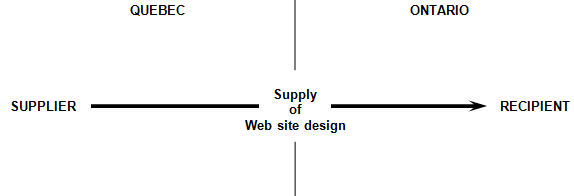

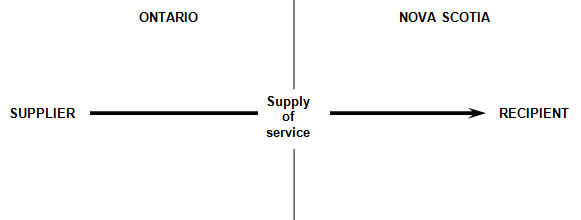

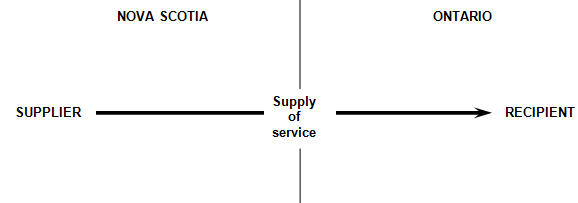

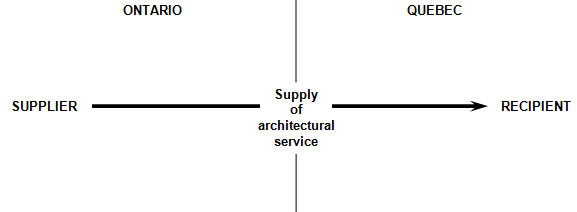

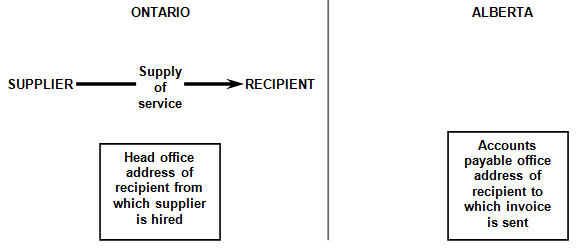

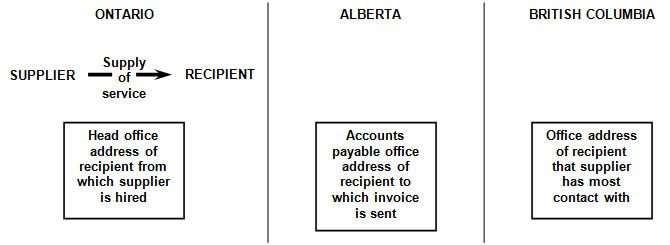

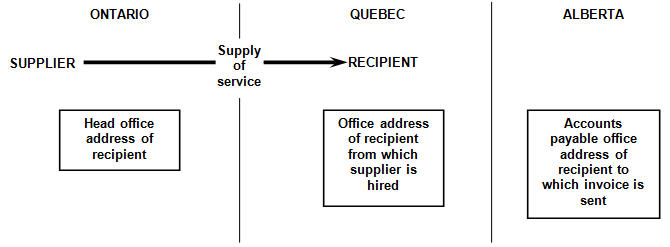

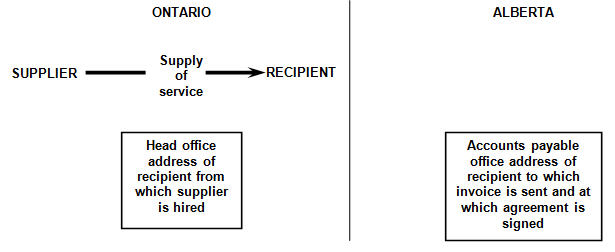

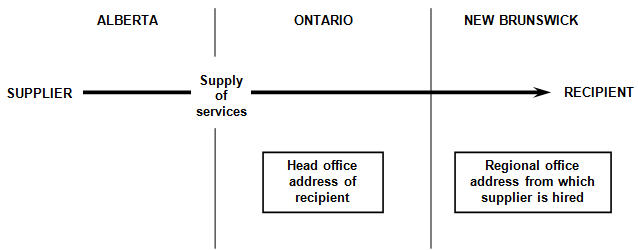

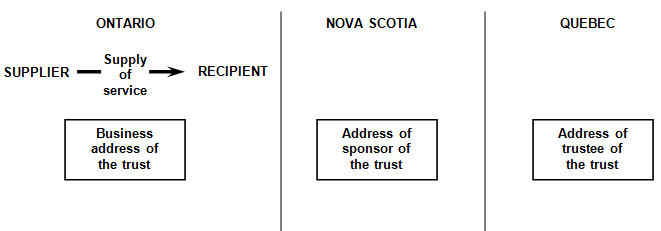

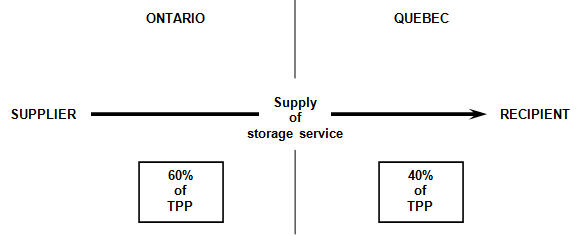

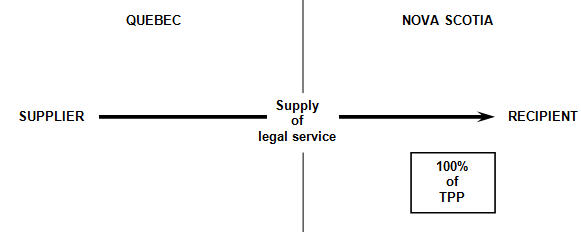

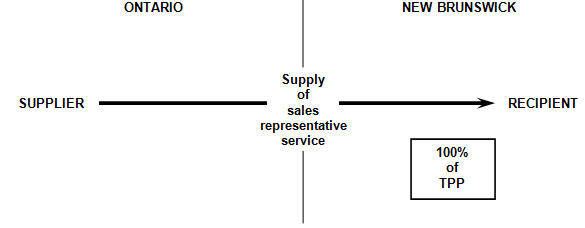

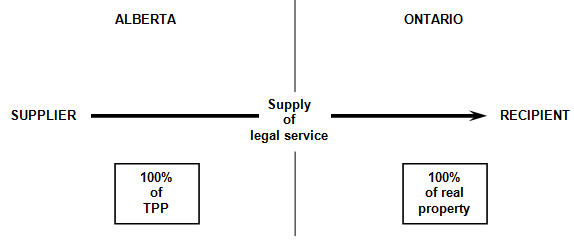

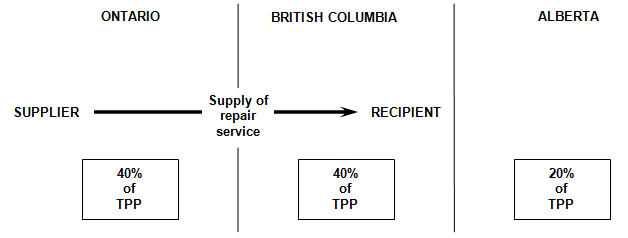

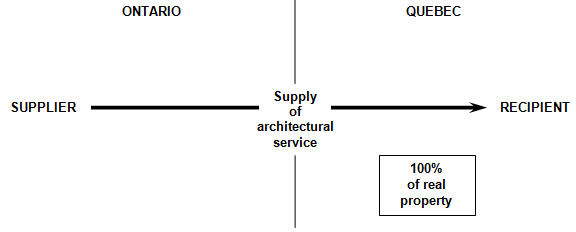

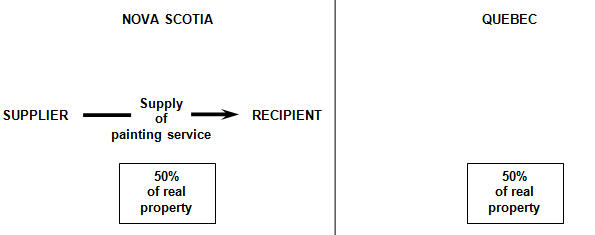

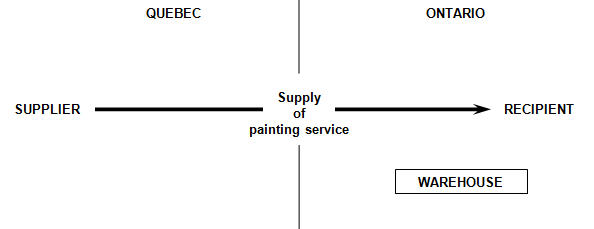

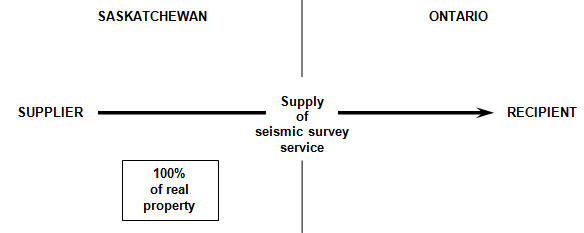

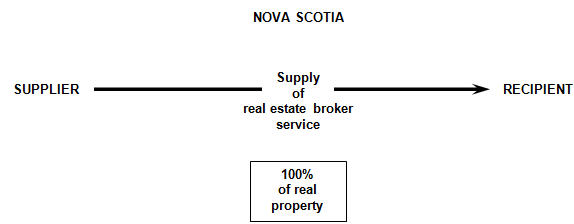

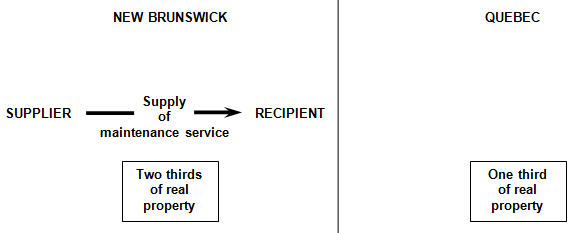

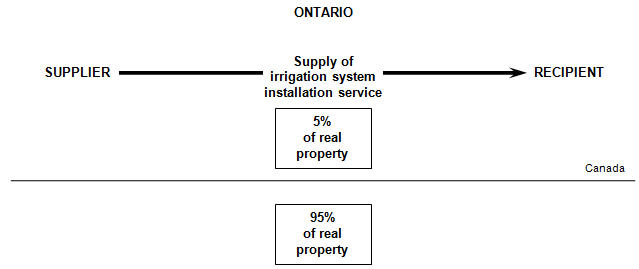

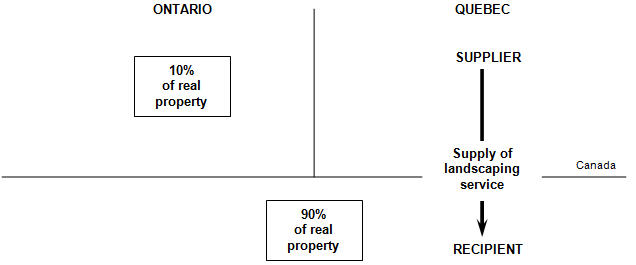

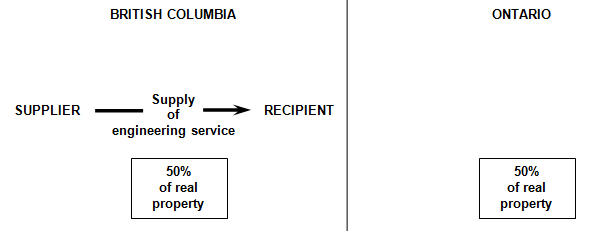

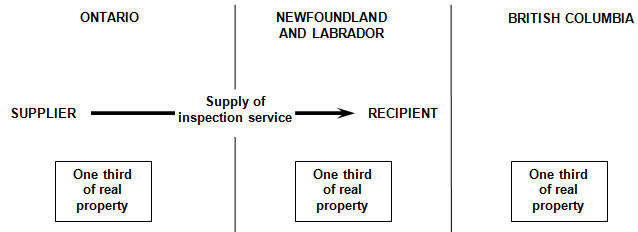

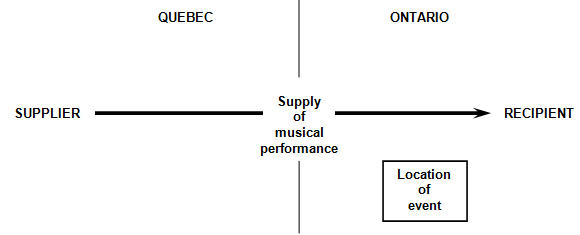

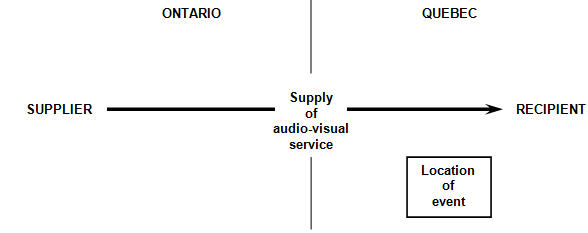

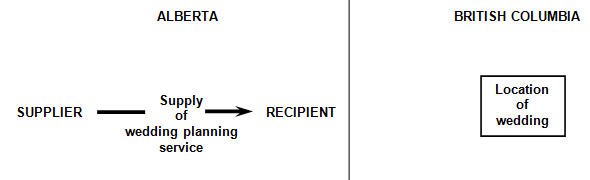

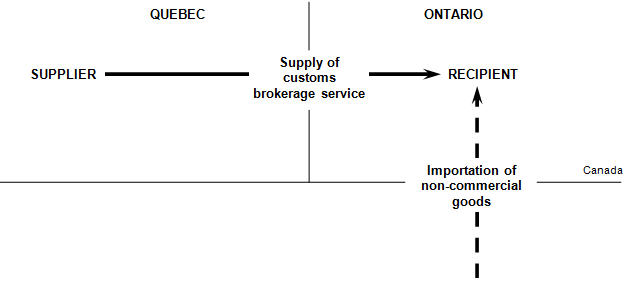

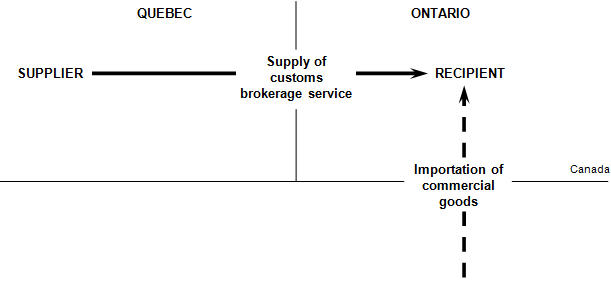

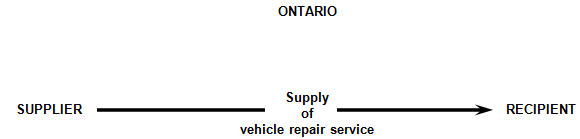

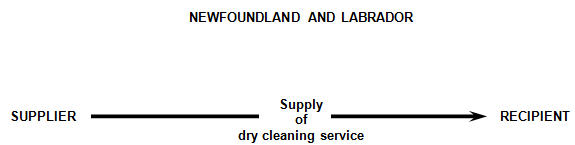

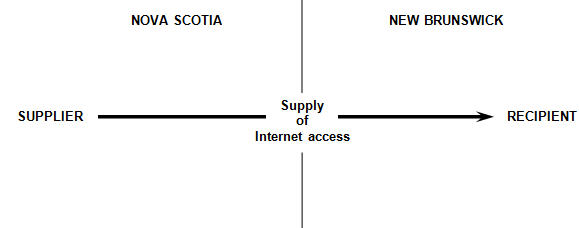

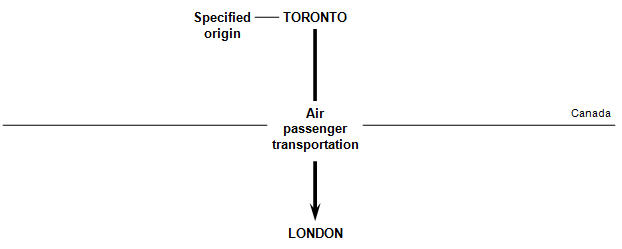

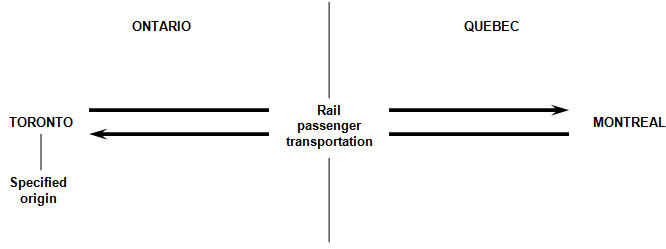

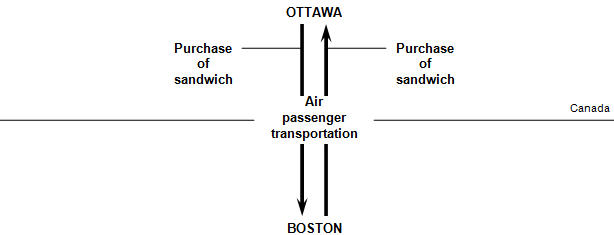

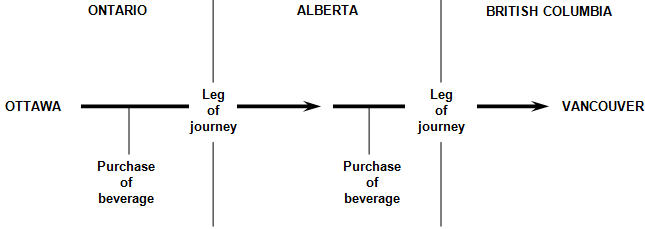

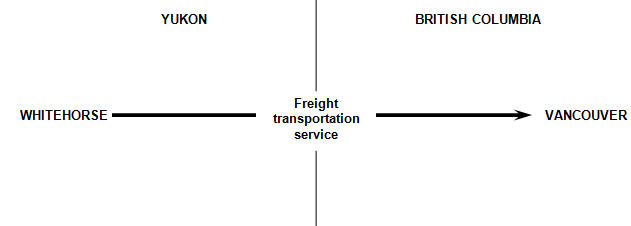

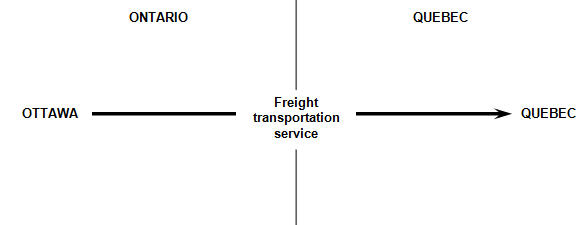

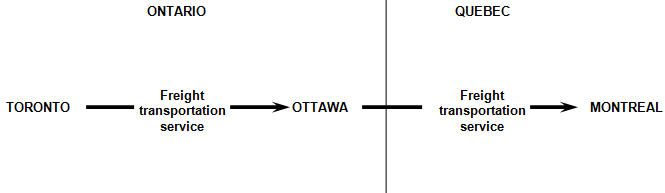

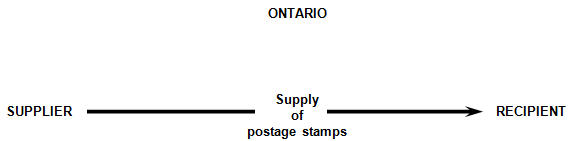

- an external supplier.