T4A-NR slip – Payments to non-residents for services provided in Canada

On this page

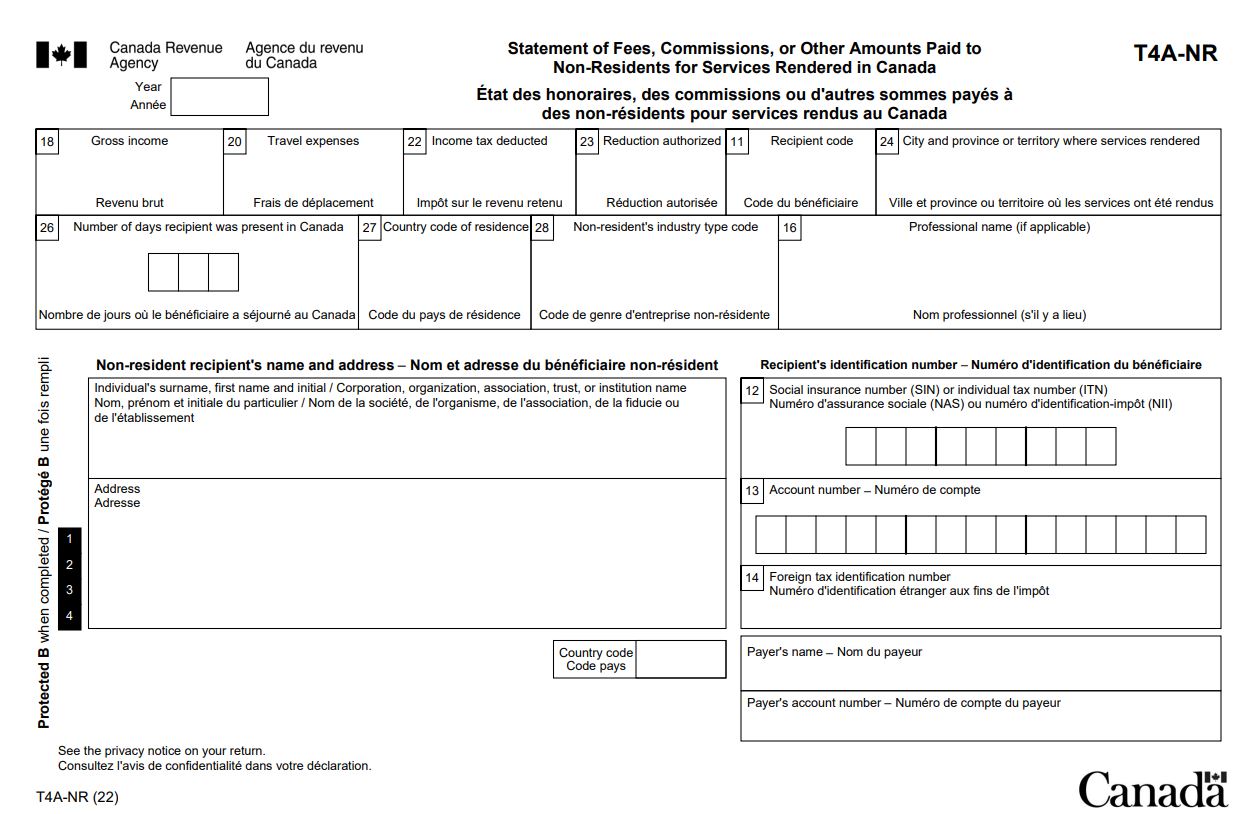

What is a T4A-NR slip

A T4A-NR slip identifies payments made during a calendar year to non-resident individuals, partnerships, or corporations for services they performed in Canada other than in employment situations.

You can get a Form T4A-NR in a PDF or PDF fillable/saveable format to file on paper.

When to issue

You must issue a T4A-NR slip when all of the following apply:

- Payment was made to non-resident individuals, partnerships, or corporations

- Payment was made for services the non-resident performed in Canada that they did not perform in the ordinary course of an office or employment regardless of the amount paid or the taxes withheld

What to report

What to report and not report on a T4A-NR

Report

- Payment to non-resident individuals, partnerships, and corporations for services they performed in Canada that they did not perform in the ordinary course of an office or employment

- Payments for acting services of a stage performer or stage actor, or services for behind-the-scenes personnel are reported on a T4A-NR slip

Do not report

- Payments to non-resident employees who performed regular and continuous employment services in Canada use: T4 slips – Information for employers

- Directors' fees paid to a non-resident director use: T4 slips – Information for employers

- Amounts for acting services of a non-resident actor in a film, television, or video production rendered in Canada. Learn more: NR-4 slips and Non-resident actors

What are the guidelines for filling out slips

Do

- If you have multiple payroll accounts, file a separate T4A-NR return for each payroll account based on the account that the payments were made from

- Amounts are reported on a T4A-NR slip for the year in which it is paid

- Report, in dollars and cents, all amounts you paid during the year

- Report all amounts in Canadian dollars, even if they were paid in another currency. Learn more about the average exchange rates: Exchange rates

Do not

- Do not show negative dollar amounts on slips, to make changes to previous years. Learn more: Make corrections after filing

- If a box does not have a value, do not enter "nil" or "N/A", leave the box blank

- Do not change the headings of any of the boxes

- Do not enter hyphens or dashes between numbers

- Do not enter the dollar sign ($)

How to fill out

Year

Enter the 4 digits of the calendar year in which you made the payment to the recipient.

Box 18 – Gross income

Report the gross amount of fees, commissions, or other amounts you paid to the non-resident for services rendered in Canada.

Do not include travel expenses that you reported in box 20.

Do not include GST/HST or PST in the amount reported in box 18.

Learn more: Payments of fees for services.

Box 20 – Travel expenses

Report all travel expenses you paid directly to third parties for the benefit of the non-resident, and travel expenses you reimbursed to the non-resident.

Travel expenses are restricted to reasonable expenses incurred for transportation, accommodation, and meals.

Keep vouchers to support these travel expenses if the invoice from the non-resident does not provide enough details of the expenses or if the amount may not seem reasonable.

Do not report these expenses in box 18.

Box 22 – Income tax deducted

Report the amount of income tax you deducted from the recipient during the year.

Leave this box blank if you did not deduct income tax.

Box 23 – Reduction authorized

| Situation | Code to enter |

|---|---|

| If you have received written authorization from the Canada Revenue Agency (CRA) to reduce or waive the required withholding on the gross payment to the non-resident | 1 |

| If both you and the non-resident fill out Form R105-S, Simplified Waiver Application, allowing for a reduction or waiver of the withholding tax due | 2 |

Box 11 – Recipient code

Enter the appropriate code from the following list:

| Recipient code | Type of recipient |

|---|---|

| 1 | Individual |

| 3 | Corporation |

| 4 | Other (for example, association, trust, including fiduciary-trustee, nominee, estate, or partnership) |

| 5 | Government, government enterprise, or international organizations and agencies |

Box 24 – City and province or territory where services rendered

Enter the name of the city and the appropriate code from the following list to indicate where the non-resident performed the services:

| Province or territory | Code |

|---|---|

| Alberta | AB |

| British Columbia | BC |

| Manitoba | MB |

| New Brunswick | NB |

| Newfoundland and Labrador | NL |

| Northwest Territories | NT |

| Nova Scotia | NS |

| Nunavut | NU |

| Ontario | ON |

| Prince Edward Island | PE |

| Quebec | QC |

| Saskatchewan | SK |

| Yukon | YT |

Box 26 – Number of days recipient was present in Canada

Enter the total number of days the non-resident was present in Canada (continuous or not) during the calendar year while under contract with you.

You need to include weekends and holidays.

Box 27 – Country code of residence

Enter the 3-letter code for the country in which the recipient is a resident for tax purposes.

Generally, the recipient's country for tax and mailing purposes will be the same. However, if they are different, you must always enter the country of residency for tax purposes.

List of 3-letter codes and related countries

| Codes | Countries |

|---|---|

| AFG | Afghanistan |

| ALA | Åland Islands |

| ALB | Albania |

| DZA | Algeria |

| ASM | American Samoa |

| AND | Andorra |

| AGO | Angola |

| AIA | Anguilla |

| ATA | Antarctica |

| ATG | Antigua and Barbuda |

| ARG | Argentina |

| ARM | Armenia |

| ABW | Aruba |

| AUS | Australia |

| AUT | Austria |

| AZE | Azerbaijan |

| BHS | Bahamas (the) |

| BHR | Bahrain |

| BGD | Bangladesh |

| BRB | Barbados |

| BLR | Belarus |

| BEL | Belgium |

| BLZ | Belize |

| BEN | Benin |

| BMU | Bermuda |

| BTN | Bhutan |

| BOL | Bolivia (Plurinational State of) |

| BES | Bonaire, Sint Eustatius and Saba |

| BIH | Bosnia and Herzegovina |

| BWA | Botswana |

| BVT | Bouvet Island |

| BRA | Brazil |

| IOT | British Indian Ocean Territory (the) |

| BRN | Brunei Darussalam |

| BGR | Bulgaria |

| BFA | Burkina Faso (Upper Volta) |

| BDI | Burundi |

| KHM | Cambodia (Kampuchea) |

| CMR | Cameroon |

| CPV | Cabo Verde |

| CYM | Cayman Islands (the) |

| CAF | Central African Republic (the) |

| TCD | Chad |

| CHL | Chile |

| CHN | China (Mainland) |

| CXR | Christmas Island (Australia) |

| CCK | Cocos (Keeling) Islands (the) |

| COL | Colombia |

| COM | Comoros (the) |

| COG | Congo (the) |

| COD | Congo (the Democratic Republic of the) (formerly Zaire) |

| COK | Cook Islands (the) |

| CRI | Costa Rica |

| CIV | Côte d'Ivoire (Ivory Coast) |

| HRV | Croatia |

| CUB | Cuba |

| CUW | Curaçao |

| CYP | Cyprus |

| CZE | Czech Republic (the) |

| DNK | Denmark |

| DJI | Djibouti |

| DMA | Dominica |

| DOM | Dominican Republic (the) |

| ECU | Ecuador |

| EGY | Egypt |

| SLV | El Salvador |

| GNQ | Equatorial Guinea |

| ERI | Eritrea |

| EST | Estonia |

| SWZ | Eswatini |

| ETH | Ethiopia |

| FLK | Falkland Islands (the) (Malvinas) |

| FRO | Faroe Islands (the) |

| FJI | Fiji |

| FIN | Finland |

| FRA | France |

| GUF | French Guiana |

| PYF | French Polynesia |

| ATF | French Southern Territories (the) |

| GAB | Gabon |

| GMB | Gambia (the) |

| GEO | Georgia |

| DEU | Germany |

| GHA | Ghana |

| GIB | Gibraltar |

| GRC | Greece |

| GRL | Greenland |

| GRD | Grenada |

| GLP | Guadeloupe |

| GUM | Guam |

| GTM | Guatemala |

| GGY | Guernsey |

| GIN | Guinea |

| GNB | Guinea-Bissau |

| GUY | Guyana |

| HTI | Haiti |

| HMD | Heard Island and McDonald Islands |

| VAT | Holy See (the) |

| HND | Honduras |

| HKG | Hong Kong |

| HUN | Hungary |

| ISL | Iceland |

| IND | India |

| IDN | Indonesia |

| IRN | Iran (Islamic Republic of) |

| IRQ | Iraq |

| IRL | Ireland |

| IMN | Isle of Man |

| ISR | Israel |

| ITA | Italy |

| JAM | Jamaica |

| JPN | Japan |

| JEY | Jersey |

| JOR | Jordan |

| KAZ | Kazakhstan |

| KEN | Kenya |

| KIR | Kiribati |

| PRK | Korea (the Democratic People's Republic of) (North) |

| KOR | Korea (the Republic of) (South) |

| KWT | Kuwait |

| KGZ | Kyrgyzstan |

| LAO | Lao People's Democratic Republic (the) |

| LVA | Latvia |

| LBN | Lebanon |

| LSO | Lesotho |

| LBR | Liberia |

| LBY | Libya |

| LIE | Liechtenstein |

| LTU | Lithuania |

| LUX | Luxembourg |

| MAC | Macao |

| MDG | Madagascar |

| MWI | Malawi |

| MYS | Malaysia |

| MDV | Maldives |

| MLI | Mali |

| MLT | Malta |

| MHL | Marshall Islands (the) |

| MTQ | Martinique |

| MRT | Mauritania |

| MUS | Mauritius |

| MYT | Mayotte |

| MEX | Mexico |

| FSM | Micronesia (Federated States of) |

| MDA | Moldova (the Republic of) |

| MCO | Monaco |

| MNG | Mongolia |

| MNE | Montenegro |

| MSR | Montserrat |

| MAR | Morocco |

| MOZ | Mozambique |

| MMR | Myanmar (Burma) |

| NAM | Namibia |

| NRU | Nauru |

| NPL | Nepal |

| NLD | Netherlands (the) |

| NCL | New Caledonia |

| NZL | New Zealand |

| NIC | Nicaragua |

| NER | Niger (the) |

| NGA | Nigeria |

| NIU | Niue |

| NFK | Norfolk Island |

| MKD | North Macedonia |

| GBR | Northern Ireland and the United Kingdom of Great Britain |

| MNP | Northern Mariana Islands (the) |

| NOR | Norway |

| OMN | Oman |

| PAK | Pakistan |

| PLW | Palau |

| PAN | Panama |

| PNG | Papua New Guinea |

| PRY | Paraguay |

| PER | Peru |

| PHL | Philippines (the) |

| PCN | Pitcairn |

| POL | Poland |

| PRT | Portugal |

| PRI | Puerto Rico |

| QAT | Qatar |

| REU | Réunion |

| ROU | Romania |

| RUS | Russian Federation (the) |

| RWA | Rwanda |

| BLM | Saint Barthélemy |

| SHN | Saint Helena, Ascension and Tristan da Cunha |

| KNA | Saint Kitts and Nevis |

| LCA | Saint Lucia |

| MAF | Saint Martin (French part) |

| SPM | Saint Pierre and Miquelon |

| VCT | Saint Vincent and the Grenadines |

| WSM | Samoa |

| SMR | San Marino |

| STP | Sao Tome and Principe |

| SAU | Saudi Arabia |

| SEN | Senegal |

| SRB | Serbia |

| SYC | Seychelles |

| SLE | Sierra Leone |

| SGP | Singapore |

| SXM | Sint Maarten (Dutch part) |

| SVK | Slovakia (Slovak Republic) |

| SVN | Slovenia |

| SLB | Solomon Islands |

| SOM | Somalia |

| ZAF | South Africa |

| SGS | South Georgia and the South Sandwich Islands |

| SSD | South Sudan |

| ESP | Spain |

| LKA | Sri Lanka |

| SDN | Sudan (the) |

| SUR | Suriname |

| SJM | Svalbard and Jan Mayen |

| SWE | Sweden |

| CHE | Switzerland |

| SYR | Syrian Arab Republic (the) |

| TWN | Taiwan |

| TJK | Tajikistan |

| TZA | Tanzania, the United Republic of |

| THA | Thailand |

| TLS | Timor-Leste |

| TGO | Togo |

| TKL | Tokelau |

| TON | Tonga |

| TTO | Trinidad and Tobago |

| TUN | Tunisia |

| TUR | Turkey |

| TKM | Turkmenistan |

| TCA | Turks and Caicos Islands (the) |

| TUV | Tuvalu |

| UGA | Uganda |

| UKR | Ukraine |

| ARE | United Arab Emirates |

| GBR | United Kingdom of Great Britain and Northern Ireland (the) |

| USA | United States of America (the) |

| UMI | United States Minor Outlying Islands (the) |

| URY | Uruguay |

| UZB | Uzbekistan |

| VUT | Vanuatu (New Hebrides) |

| VEN | Venezuela (Bolivarian Republic of) |

| VNM | Viet Nam |

| VGB | Virgin Islands (British) |

| VIR | Virgin Islands (U.S.) |

| WLF | Wallis and Futuna |

| PSE | West Bank and Gaza Strip |

| ESH | Western Sahara |

| YEM | Yemen |

| ZMB | Zambia |

| ZWE | Zimbabwe |

Box 28 – Non-resident's industry type code

Enter the following classification system codes that best describes the non-resident's industry:

| Code | Type of industry for the non-resident |

|---|---|

| 21 | Mining, oil, or gas extraction |

| 23 | Construction |

| 48 | Transportation |

| 49 | Warehousing |

| 50 | Film industry 1 |

| 51 | Information and cultural industries |

| 54 | Professional technical and scientific services |

| 61 | Educational services |

| 62 | Health care and social assistance |

| 71 | Arts, entertainment, and recreation 2 |

| 81 | Other personal services (except public administration) |

| 91 | Public administration |

1 Code 50 is for non-residents working in the film or television industry, including commercials, but does not include film actors.

2 For non-residents involved in live performances or sporting events, including stage actors, use code 71 "Arts, entertainment, and recreation."

Box 16 – Professional name (if applicable)

If the professional or operating name is different from the real or legal name of the non-resident, enter the professional name in this box.

Non-resident recipient's name and address

If you are preparing the T4A-NR slip for an individual, enter their last name, followed by the first name and initial. Otherwise, enter the name of the corporation, organization, association, trust, or institution.

Do not enter the name of the secretary-treasurer or any other individual who has signing authority.

Enter the recipient's full mailing address as follows:

- Lines 1 and 2

Enter the street address (civic number, street name, and post office box number or rural route number)

- Line 3

For Canadian addresses, enter the city, 2-letter code for the province or territory, and the postal code.

For addresses outside Canada and the United States, enter the postal code and then the city name.

For U.S. addresses enter the city, 2-letter state, territory or possession codes and the zip code:

List of state, territory or possession and related code

State, territory or possession and related code State, territory or possession Code Alabama AL Alaska AK American Samoa AS Arizona AZ Arkansas AR Armed Forces Americas (except Canada) AA Armed Forces Africa

Armed Forces Canada

Armed Forces Europe

Armed Forces Middle EastAE Armed Forces Pacific AP California CA Colorado CO Connecticut CT Delaware DE District of Columbia DC Florida FL Georgia GA Guam GU Hawaii HI Idaho ID Illinois IL Indiana IN Iowa IA Kansas KS Kentucky KY Louisiana LA Maine ME Marshall Islands MH Maryland MD Massachusetts MA Michigan MI Micronesia, Federated States of FM Minnesota MN Mississippi MS Missouri MO Montana MT Nebraska NE Nevada NV New Hampshire NH New Jersey NJ New Mexico NM New York NY North Carolina NC North Dakota ND Northern Mariana Islands MP Ohio OH Oklahoma OK Oregon OR Palau PW Pennsylvania PA Puerto Rico PR Rhode Island RI South Carolina SC South Dakota SD Tennessee TN Texas TX United States Minor Outlying Islands UM Utah UT Vermont VT Virgin Islands, U.S. VI Virginia VA Washington WA West Virginia WV Wisconsin WI Wyoming WY - Line 4

Enter the full country name (if Canada, leave blank but enter CAN in the country code box)

Country code

Enter the 3-letter country code of residence that corresponds to the country you entered on line 4. The country code is for mailing purposes only.

Box 12 – Social insurance number (SIN) or individual tax number (ITN)

Enter the Canadian social insurance number (SIN) assigned to the non-resident individual.

If a SIN has not been assigned, ask the non-resident if they have been assigned an individual tax number (ITN) or a temporary tax number (TTN) by the CRA . You must enter the ITN or the TTN in this box.

An ITN is normally assigned to a non-resident individual if they have applied for a waiver or a reduction of withholding or if they have previously filed a Canadian tax return. If a SIN, ITN, or TTN has not been assigned to the non-resident, leave the box blank.

Box 13 – Account number

If the recipient of the reported amount is a business (sole proprietor, partnership, or corporation), enter the recipient's business number (for example, 123456789RT0001).

Box 14 – Foreign tax identification number

Enter the tax identification number (such as the social security number or other account number) assigned to the non-resident for tax purposes by their country of residence.

Payer's name

Enter your operating or trade name in the space provided.

Payer's account number

Enter your 15-character payroll account number (for example, 123456789RP0001) on your copy and the copy you send to the CRA only.

Do not enter your payroll account on the copies you give to the recipients.