Claiming medical expenses

Pre-test question

That's correct

Individuals may claim eligible medical expenses if they were not claimed in a prior year. They must have been paid for within a 12‑month period that ended in the tax year they are submitting.

Sorry, that's incorrect

Individuals may claim eligible medical expenses if they were not claimed in a prior year. They must have been paid for within a 12‑month period that ended in the tax year they are submitting.

Instructions

- Open the tax software

- Review the Background information and Required slips (tax slips, receipts, etc.)

- Provide all required information for the appropriate sections of the tax software

- Once completed, compare your results with the solution provided

- Afterwards, refer to Key points of the tax software and the Takeaway points

Background information

Situation

Michael Schneider and Elizabeth Jones-Schneider are married and live with their son, Jack. They also support Elizabeth's father, Adam Jones, who lives in low-income housing. Michael works for the XYZ Inc. company and Elizabeth has a part‑time job at Sunny Grocers. Michael also received Advanced Canada workers benefit payments. Their son has no income to report and Elizabeth's father, who is widowed, receives Canada Pension Plan benefits and old age security payments. Adam’s medical expenses were paid for by Michael and Elizabeth. Mr. Schneider has provided you with all of his tax slips and medical receipts. Although you are only expected to transmit the tax returns for Michael and Elizabeth, you must still provide complete information for Adam.

| Category | Data |

|---|---|

| Name | Michael Schneider |

| Social insurance number (SIN) | 000 000 000 |

| Address | 123 Main Street City, Province X0X 0X0 |

| Date of birth (DOB) | September 25, 1971 |

| Marital status | Married to: Elizabeth Jones-Schneider on June 6, 1996 SIN: 000 000 000 DOB: July 17, 1975 |

| Dependant 1 | Jack Schneider |

| Dependant 2 | Adam Jones |

Medical receipts provided

Adam:

- $1,500.00 – 2024-12-02 – Hearing aid – receipt indicates: 80% was reimbursed by a medical insurance plan. The amount was not claimed on a 2024 tax return

- $600.00 – 2025-11-21 – Dental services – fillings and routine cleanings – receipt indicates: no amount was reimbursed

Jack:

- $3,500.00 – 2025-03-12 – Orthodontic braces – receipt indicates: $2,000 reimbursed by a medical insurance plan

- $850.00 – 2024-12-29 – Prescription eyeglasses – receipt indicates: $200 was reimbursed by a medical insurance plan. The amount was not claimed on a 2024 tax return

Elizabeth:

- $550.00 – 2025-05-06 – Prescription contact lenses – receipt indicates: $200 was reimbursed by a medical insurance plan

- $300.00 – 2025-05-23 – Prescription for Vitamin B12 for Elizabeth's anemia – receipt indicates: 80% was reimbursed by a medical insurance plan

Michael:

- $800.00 – 2025-06-11 – Prescription drugs – receipt indicates: 80% was reimbursed by a medical insurance plan

Slips required

T4 – Statement of Remuneration Paid for Michael Schneider (XYZ Inc.)

Text version of the above image

T4 – Statement of Remuneration Paid

Protected B

Employer’s name: XYZ Inc.

Employee’s name and address:

Last name: Schneider

First name: Michael

123 Main Street

City, Province X0X 0X0

Box 12: Social insurance number: 000 000 000

Box 14: Employment income: 27,500.00

Box 16: Employee’s CPP contributions – see over: 678.00

Box 18: Employee’s EI premiums: 395.00

Box 22: Income tax deducted: 2,385.00

Box 24: EI insurable earnings: 27,500.00

Box 26: CPP/QPP pensionable earnings: 27,500.00

Box 45: Employer-offered dental benefits: 3

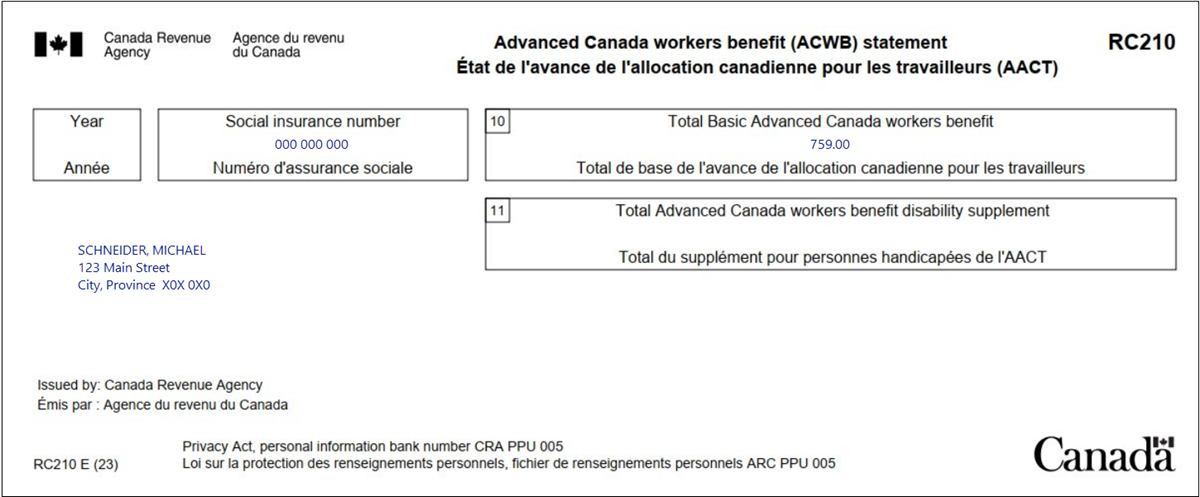

RC210 – Advanced Canada workers benefit (ACWB) statement for Michael Schneider

Text version of the above image

RC210 – Advanced Canada workers benefit (ACWB) statement

Issued by: Canada Revenue Agency

Schneider, Michael

123 Main Street

City, Province X0X 0X0

Social insurance number: 000 000 000

Box 10: Total Basic Advanced Canada workers benefit: 759.00

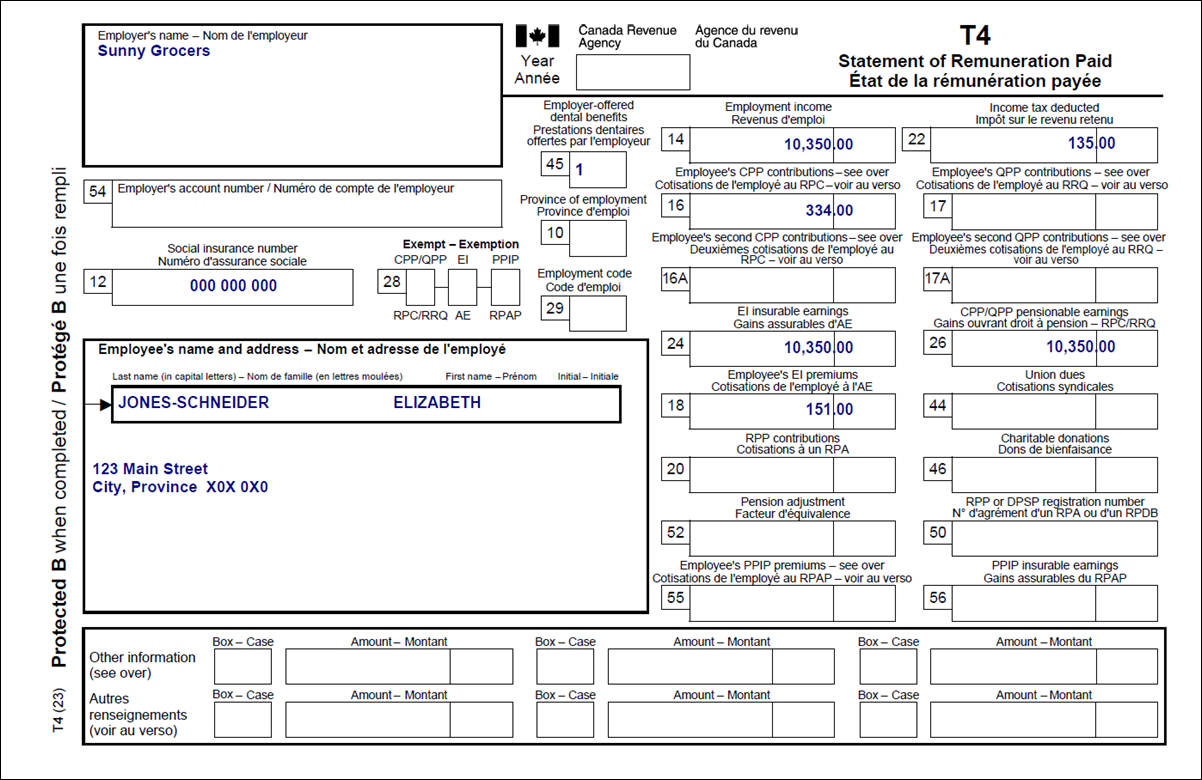

T4 – Statement of Remuneration Paid for Elizabeth Jones-Schneider (Sunny Grocers)

Text version of the above image

T4 – Statement of Remuneration Paid

Protected B

Employer’s name: Sunny Grocers

Employee’s name and address:

Last name: Jones-Schneider

First name: Elizabeth

123 Main Street

City, Province X0X 0X0

Box 12: Social insurance number: 000 000 000

Box 14: Employment income: 10,350.00

Box 16: Employee’s CPP contributions – see over: 334.00

Box 18: Employee’s premiums: 151.00

Box 22: Income tax deducted: 135.00

Box 24: EI insurable earnings: 10,350.00

Box 26: CPP/QPP pensionable earnings: 10,350.00

Box 45: Employer-offered dental benefits: 1

T4A(OAS) – Statement of Old Age Security for Adam Jones

Text version of the above image

T4A(OAS) – Statement of Old Age Security

Protected B

Issued by: Service Canada

Jones, Adam

14-300 Queen Street

City, Province X0X 0X0

Box 18: Taxable pension paid: 7,277.52

Box 21: Net supplements paid: 4,101.24

Box 12: Social insurance number: 000 000 000

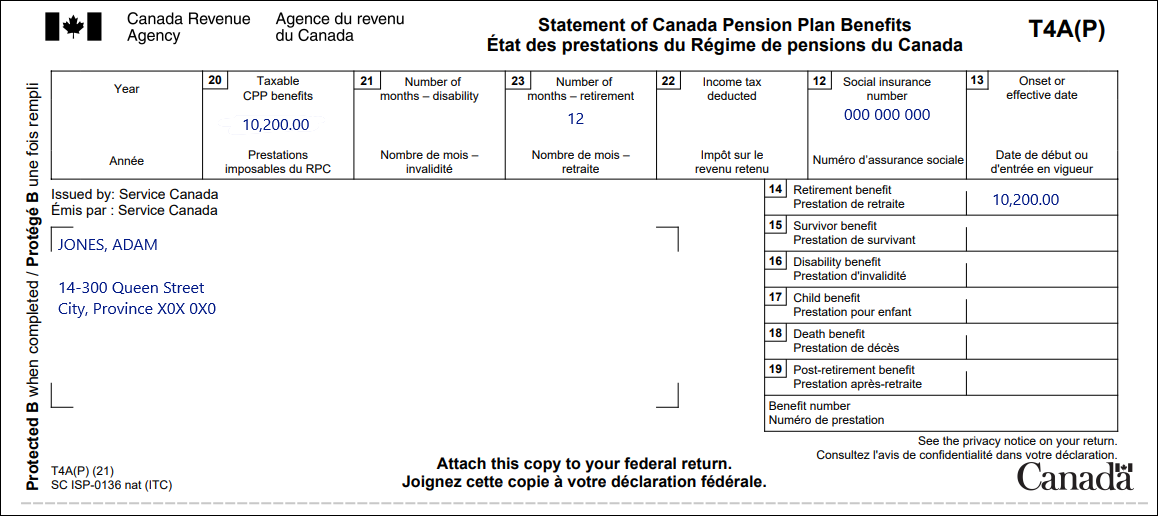

T4A(P) – Statement of Canada Pension Plan Benefits for Adam Jones

Text version of the above image

T4A(P) – Statement of Canada Pension Plan Benefits

Protected B

Issued by: Service Canada

Jones, Adam

14-300 Queen Street

City, Province X0X 0X0

Box 20: Taxable CPP benefits: 10,200.00

Box 23: Number of months – retirement: 12

Box 12: Social insurance number: 000 000 000

Box 14: Retirement benefit: 10,200.00

Review your results

Solution to Claiming medical expenses.

Key points of the tax software

Important note

To access complete instructions on the various steps of entering data into the software, click on the title of each section below.

Michael's interview

- Click T4 and employment income in the left-side menu

- Click the + sign next to T4 income (earned in any province except Quebec) in the T4 and T4E section

- Enter the information from the tax slip

Advanced Canada workers benefit (RC210)

- Click Other information slips in the left-side menu

- Click the + sign next to RC210 – Canada workers benefit advance payments statement [Federal line 41500]

- Enter the information from the tax slip

- Click Interview setup in the left-side menu

- Tick the box next to Medical expenses, disability, caregiver in the Common tax deductions section

- Click Medical, disability, caregiver in the left-side menu

- Click the + sign next to Medical expenses in the Medical expenses section

- In the Medical expenses section:

- enter the description of the eligible medical expenses into the Description field

- enter the total amount of their eligible medical expenses into the next field

Elizabeth's interview

- Repeat the same steps you did for Michael

- Repeat the same steps you did for Michael

Jack's interview

- Click Medical and disability in the left-side menu

- In the Medical expenses section, click the + sign next to Medical expenses for the dependant

- In the Medical expenses section:

- enter the description of the eligible medical expenses into the Descriptions field

- enter the total amount of their eligible medical expenses into the next field

Adam's interview

- Click Dependant ID in the left-side menu

- Select the appropriate option from the Relationship drop-down menu

- Enter the dependant’s date of birth

- Select Yes from the Did this dependant have any income in 20XX? drop-down menu

Pensions and saving plans – T4A(OAS), T4A(P)

- Click Interview setup in the left-side menu

- Tick the box next to Pension income, other income and split pension income, COVID-19 benefits (T4A, T4FHSA, T4A(OAS), T4A(P), T4A-RCA, T4RSP, T4RIF, T1032) in the Pension and other income section

- Click on T4A, T4FHSA and pension income, split pension in the left-side menu

- Click the + signs next to:

- T4A(OAS) – Old age security pension income

- T4A(P) – Statement of Canada or Québec pension plan

- Enter the information from the tax slips

- Repeat the same steps you did for Jack

Takeaway points

Advanced Canada workers benefit

- The Advanced Canada workers benefit is not taxable but it must be reported on the tax return

- The tax software cannot determine if a medical expense is eligible or not. Part of a volunteer’s responsibilities is to determine, to the best of their abilities, whether a medical expense is eligible and what amount to enter:

- in this case, vitamin B12 is an eligible medical expense when prescribed by a health care professional according to the List of common medical expenses

- in this case, the medical receipts paid in December of 2024 can be claimed on the 2025 tax return since they were paid within a 12-month period ending in the same year as the tax return being prepared and were never claimed before

- It is not necessary to enter each medical receipt individually, instead enter See list into the Description field and indicate the total amount of eligible medical expenses

- The eligible medical expenses claimed must be reduced by any amount that has been reimbursed

- Medical expenses are entered in the profile of the family member that directly benefited from those expenses, even if they were paid for by another family member

- The tax software determined it is more beneficial to claim all the medical expenses for the family on Michael’s tax return

- The medical expenses for Michael, Elizabeth, and their son Jack are claimed on line 33099 of the tax return

- The medical expenses for Michael’s father-in-law, Adam, are claimed on line 33199 of the tax return

- Michael can claim the medical expenses paid for Adam even though they do not live at the same residence because:

- Adam is Elizabeth’s father

- Adam depends on them for support

- Michael and Elizabeth paid for the medical expenses

- Michael can claim the medical expenses paid for Adam even though they do not live at the same residence because:

Refundable medical expense supplement

- Since Michael earns a modest working income and is claiming a large amount of medical expenses for his family, he is eligible for the refundable medical expense supplement

- The tax software automatically calculates and claims the amount on line 45200 of the tax return