Newcomer couple with refugee status

Pre-test questions

Question One

That's correct

Not all newcomers have a SIN. Some may have an individual tax number (ITN) or a temporary tax number (TTN). These numbers allow individuals without a SIN to submit their tax return and apply for benefits.

Sorry, that's incorrect

Not all newcomers have a SIN. Some may have an individual tax number (ITN) or a temporary tax number (TTN). These numbers allow individuals without a SIN to submit their tax return and apply for benefits.

Question Two

That's correct

The CRA considers an individual a newcomer to Canada for the first year they are a resident of Canada.

Sorry, that's incorrect

The CRA considers an individual a newcomer to Canada for the first year they are a resident of Canada.

Instructions

- Open the tax software

- Review the Background information and Required slips (tax slips, receipts, etc.)

- Provide all required information for the appropriate sections of the tax software

- Once completed, compare your results with the solution provided

- Afterwards, refer to Key points of the tax software and the Takeaway points

Background information

Situation

Jeet and Mia immigrated to Canada from Indonesia on March 1, 2025. They have refugee status and work permits. Jeet and Mia both worked at the same Indonesian school in 2025 where Jeet’s world income outside of Canada was CAN$3,000 and Mia’s was CAN$1,600. Jeet and Mia did not earn income from Canada when they lived in Indonesia. After their arrival in Canada, Jeet worked part-time for two companies and received social assistance, while Mia has not earned any income in Canada. Jeet and Mia do not own any foreign property.

| Categories | Datas |

|---|---|

| Name | Jeet Mann |

| Social insurance number (SIN) | 000 000 000 |

| Address | 123 Main Street City, Province X0X 0X0 |

| Date of birth (DOB) | January 9, 1986 |

| Marital status | Married to: |

Required slips

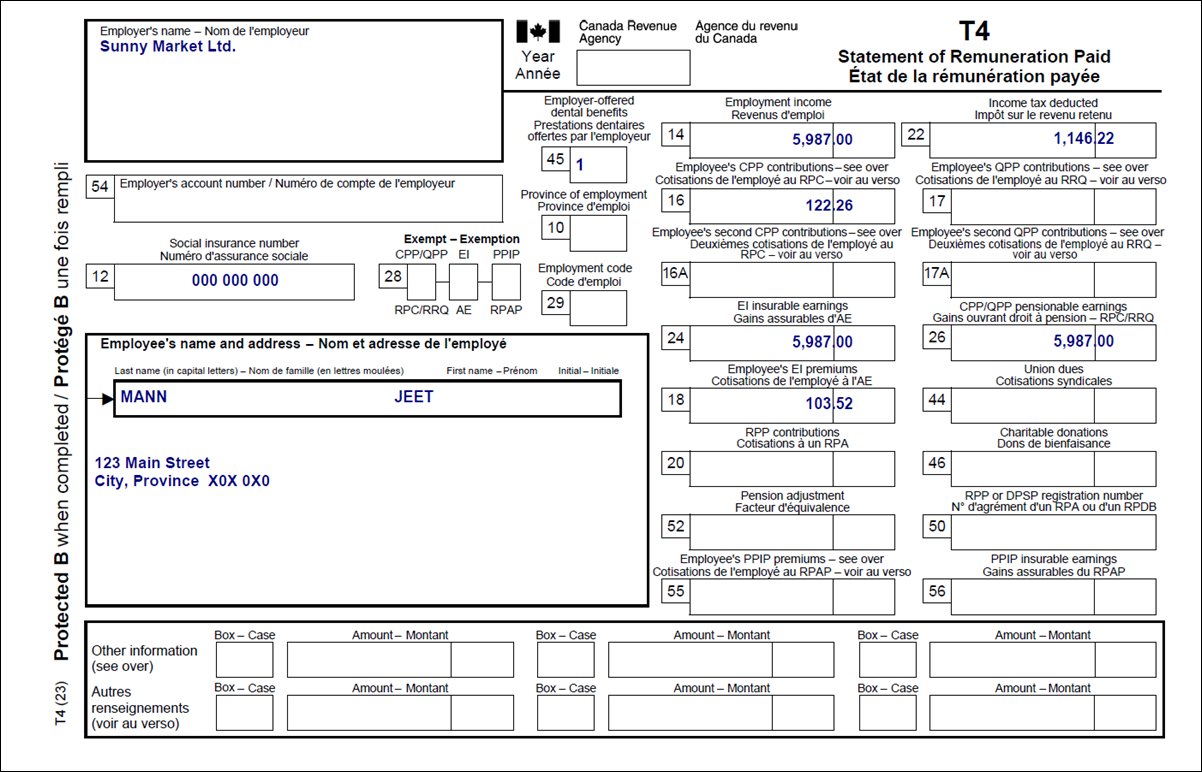

T4 – Statement of Remuneration Paid (Sunny Market Ltd.) (for Jeet)

Text version for the above image

T4 – Statement of Remuneration Paid

Protected B

Employer’s name: Sunny Market Ltd.

Employee’s name and address:

Last name: Mann

First name: Jeet

123 Main Street

City, Province X0X 0X0

Box 12: Social insurance number: 000 000 000

Box 14: Employment income: 5,987.00

Box 16: Employee’s CPP contributions – see over: 122.26

Box 18: Employee’s EI premiums: 103.52

Box 22: Income tax deducted: 1,146.22

Box 24: EI insurable earnings: 5,987.00

Box 26: CPP/QPP pensionable earnings: 5,987.00

Box 45: Employer-offered dental benefits: 1

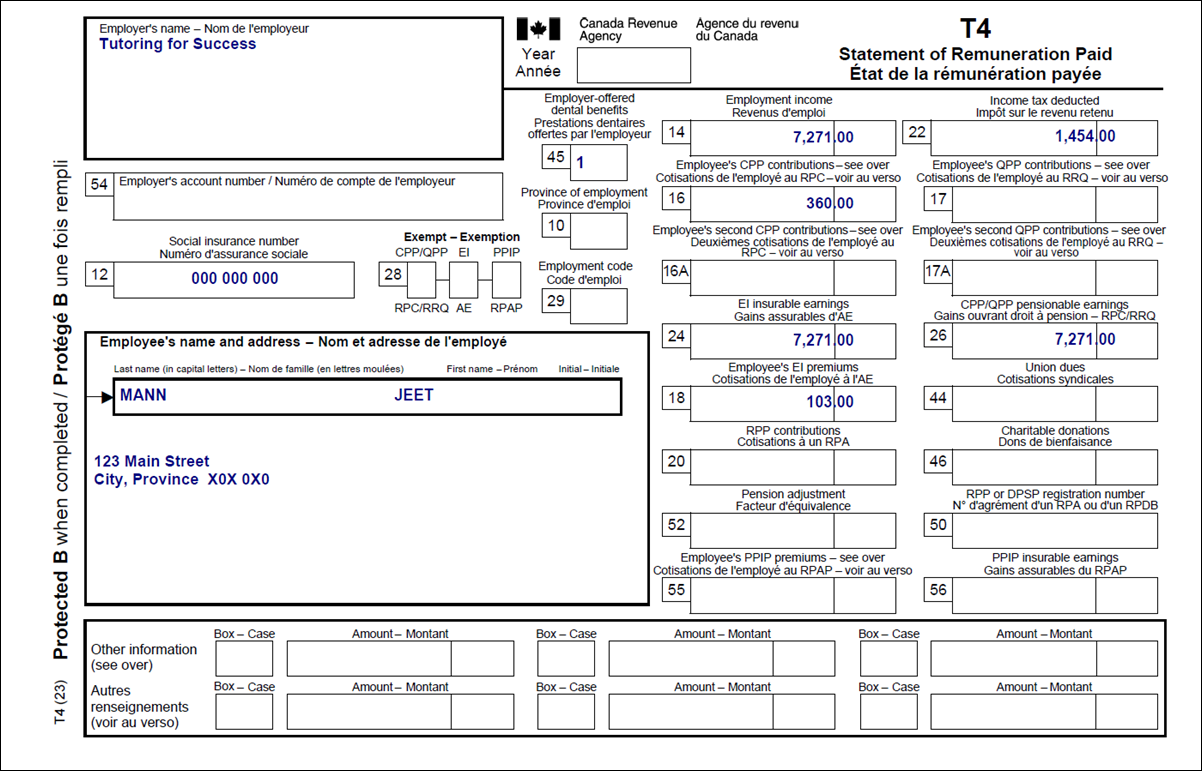

T4 – Statement of Remuneration Paid (Tutoring for Success) (for Jeet)

Text version for the above image

T4 – Statement of Remuneration Paid

Protected B

Employer’s name: Tutoring for Success

Employee’s name and address:

Last name: Mann

First name: Jeet

123 Main Street

City, Province X0X 0X0

Box 12: Social insurance number: 000 000 000

Box 14: Employment income: 7,271.00

Box 16: Employee’s CPP contributions – see over: 360.00

Box 18: Employee’s EI premiums: 103.00

Box 22: Income tax deducted: 1,454.00

Box 24: EI insurable earnings: 7,271.00

Box 26: CPP/QPP pensionable earnings: 7,271.00

Box 45: Employer-offered dental benefits: 1

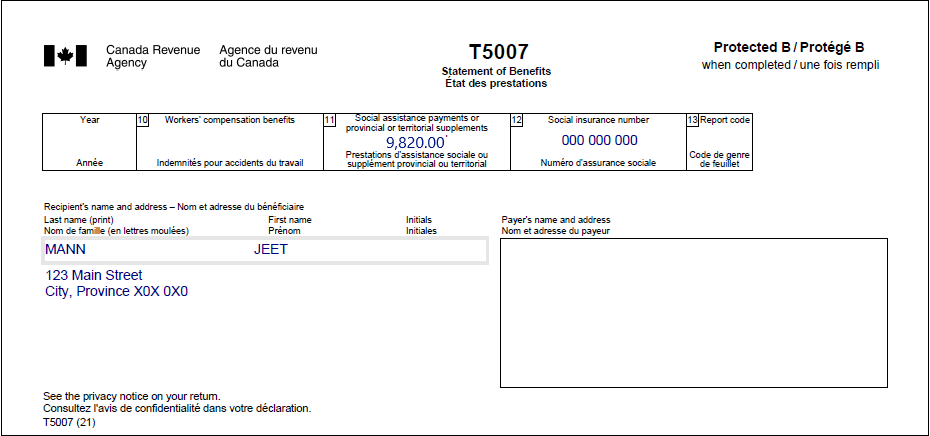

T5007 – Statement of Benefits (for Jeet)

Text version for the above image

T5007 – Statement of Benefits

Protected B

Recipient’s name and address:

Last name: Mann

First name: Jeet

123 Main Street

City, Province X0X 0X0

Box 11: Social assistance payments or provincial or territorial supplements: 9,820.00

Box 12: Social insurance number: 000 000 000

Review your results

Solution to Newcomer couple with refugee status.

Key points of the tax software

Important note

To access complete instructions on the various steps of entering data into the software, click on the title of each section below.

Jeet's interview

- Select Yes from the Are you filing an income tax return with the CRA for the very first time? drop-down menu

- Select No from the Do you have Canadian citizenship? drop-down menu

- Click Interview setup in the left-side menu

- Tick the box next to Immigrant, emigrant, non resident taxpayer, you are a Canadian resident and your spouse immigrated to Canada in the year in the Specific situations section

- In the Immigrant, emigrant, non-resident or factual resident section, click the + sign next to You immigrated to Canada in 20XX

- Enter the date into the Date of entry (dd-mm-yyyy) field

- Leave the Your net income while you were living in Canada with your spouse field empty

- In the Canadian sourced income (excluding Part XIII income) earned when you were not a resident of Canada section:

- select Income from employment in Canada from the Source of income drop-down menu

- enter 0 into the next field

- In the Canadian source Part XIII income PLUS foreign sourced income earned when you were not a resident of Canada section:

- enter the country into the Name of country field

- select Net employment income from the Source of income drop-down menu

- enter the foreign sourced income amount into the next field

- Click T4 and employment income in the left-side menu

- Click the + sign next to T4 income (earned in any province except Quebec)

- Enter the required information from the T4 slips

Social assistance payments (T5007)

- Click Interview setup in the left-side menu

- Tick the box next to Social assistance, worker’s compensation (T5007/RL-5) in the Employment and other benefits section

- Click Social assistance, worker’s compensation in the left-side menu

- Click the + sign next to T5007 – Workers’ compensation benefits, social assistance, etc. (federal lines 14400, 14500, 14600)

- Enter the required information from the T5007 slip

- Select Yes from the Did you live with your spouse or common-law partner when you received the social assistance benefits? drop-down menu

- Select Family Head from the Select the person whose name appears on the slip drop-down menu

Mia's interview

- Repeat the same steps you did for Jeet

- Repeat the same steps you did for Jeet

Takeaway points

- The date of entry is the date when the individual became a resident of Canada

- it is important to enter the exact date, as this could affect the amounts of certain non-refundable tax

Income earned before becoming a resident of Canada

- Foreign sourced income earned before becoming a resident of Canada must be entered in the tax software

- it is not taxable in Canada

- it is used to calculate the amounts of certain non-refundable tax credits and benefits the individual may be eligible for

- The tax software automatically reduced the basic personal amount (line 30000) for Jeet and Mia in their tax returns and the spouse or common-law partner amount (line 30300) for Jeet

- these amounts are prorated by the tax software based on the number of days he lived in Canada in the tax year