Reporting a T4A slip with income in box 48

Pre-test questions

Question One

Sorry, that is incorrect

The amount in box 048 of a T4A slip is reported as self-employment or business income on line 13500 of the tax return and must also be reported on Form T2125, Statement of Business or Professional Activities.

That is correct

The amount in box 048 of a T4A slip is reported as self-employment or business income on line 13500 of the tax return and must also be reported on Form T2125, Statement of Business or Professional Activities.

Question Two

Sorry, that is incorrect

Generally, an individual reporting self-employment or business income would not be considered to have a simple tax situation and would not be eligible to use the CVITP services. However, the situation may be considered simple if all of the following conditions apply:

- Income is under $1,000.00 and found in box 048 of the T4A slip

- No expenses are claimed

- The individual is neither registered for, nor required to register for GST/HST

That is correct

Generally, an individual reporting self-employment or business income would not be considered to have a simple tax situation and would not be eligible to use the CVITP services. However, the situation may be considered simple if all of the following conditions apply:

- Income is under $1,000.00 and found in box 048 of the T4A slip

- No expenses are claimed

- The individual is neither registered for, nor required to register for GST/HST

Instructions

- Open the tax software

- Review the Background information and Required slips (tax slips, receipts, etc.)

- Provide all required information for the appropriate sections of the tax software

- Once completed, compare your results with the solution provided

- Afterwards, refer to Key points of the tax software and the Takeaway points

Background information

Situation

Marc was employed by a landscaping business (Hard Rock Landscaping) during the summer. To earn extra money, he worked as a film extra and was paid as a subcontractor. He did not have any expenses.

| Category | Information |

|---|---|

| Name | Marc Caron |

| Social insurance number (SIN) | 000 000 000 |

| Address | 123 Main Street City, Province X0X 0X0 |

| Date of birth | June 16, 1994 |

| Marital status | Single |

Required slips

T4 – Statement of Remuneration Paid

Text version of the above image

T4 – Statement of Remuneration Paid

Protected B

Employer’s name: Hard Rock Landscaping

Employee’s name and address:

Last name: Caron

First name: Marc

123 Main Street

City, Province X0X 0X0

Box 12: Social insurance number: 000 000 000

Box 14: Employment income: 18,568.00

Box 16: Employee’s CPP contributions – see over: 745.94

Box 18: Employee’s EI premiums: 250.18

Box 22: Income tax deducted: 1,062.62

Box 24: EI insurable earnings: 18,568.00

Box 26: CPP/QPP pensionable earnings: 18,568.00

Box 45: Employer-offered dental benefits: 1

T4A – Statement of Pension, Retirement, Annuity, and Other Income

Text version of the above image

T4A – Statement of Pension, Retirement, Annuity, and Other Income

Protected B

Payer’s name: Skyline Film Production

Recipient’s name and address:

Last name: Caron

First name: Marc

123 Main Street

City, Province X0X 0X0

Box 012: Social insurance number: 000 000 000

Box 048: Fees for services: 800.00

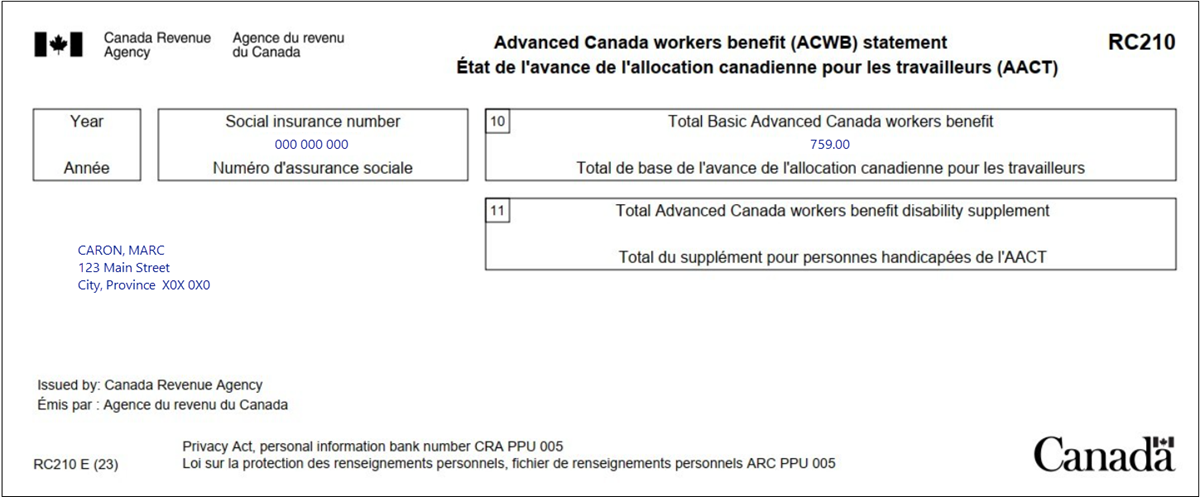

RC210 – Advanced Canada workers benefit (ACWB) statement

Text version of the above image

RC210 – Advanced Canada workers benefit (ACWB) statement

Issued by: Canada Revenue Agency

Caron, Marc

123 Main Street

City, Province X0X 0X0

Social insurance number: 000 000 000

Box 10: Total Basic Advanced Canada workers benefit: 759.00

Review your results

Solution to Reporting a T4A slip with income in box 48.

Key points of the tax software

Important note

To access complete instructions on the various steps of entering data into the software, click on the title of each section below.

Marc's interview

- Click T4 and employment income in the left-side menu

- Click the + sign next to T4 income (earned in any province except Quebec) in the T4 and T4E section

- Enter the required information from the T4 slip

Pensions and saving plans (T4A)

- Click Interview setup in the left-side menu

- Tick the box next to Pension income, other income and split pension income, COVID-19 benefits (T4A, T4FHSA, T4A(OAS), T4A(P), T4A-RCA, T4RSP, T4RIF, T1032) in the Pension and other income section

- Click T4A, T4FHSA and pension income in the left side menu

- Click the + sign next to T4A - Pension, retirement, annuity and other income (COVID-19 benefits)

- Enter the information from the T4A slip into the corresponding fields

Self-employment income (T4A box 048)

- Click Interview setup in the left-side menu

- Tick the box next to Self-employed business income in the Self-employment section

- Click Self-employment income in the left side menu

- Click the + sign next to T2125 - Business income

- Complete the fields in the Business identification section

- Select 711512, Independent actors, comedians and performers from the Enter the North American Industrial Classification System code (NAICS) that best describes the business’s main revenue-generating business activity. drop-down menu

- Click Income, expenses in the left-side menu

- Enter the amount from box 048 into the Fees for Services (T4A Box 048) field

Advanced Canada workers benefit (RC210)

- Click Other information slips in the left-side menu

- Click the + sign next to RC210 – Canada workers benefit advance payments statement [Federal line 41500]

- Enter the information from the RC210 slip

Takeaway points

Self-employment income (T4A box 048)

- Self employed individuals are eligible for the CVITP if:

- box 048 of the T4A is under $1,000.00

- no expenses are being claimed

- the individual is not registered or required to register for GST/HST

- The tax software will report the amount from box 048 of a T4A on line 13500 of the tax return and on form T2125

- Form T2125 must be included with the tax return

- It is mandatory to report this income in both places

- this does not duplicate the income on the tax return

- An NAICS code must be selected in the tax software, however, the tax return can still be submitted if an incorrect code is selected