Reporting U.S. Social Security benefits

Pre-test question

Sorry, that's incorrect

Individuals may claim a deduction equal to 15% of their U.S. Social Security benefits or increase the deduction to 50% if they meet certain conditions.

That's correct

Individuals may claim a deduction equal to 15% of their U.S. Social Security benefits or increase the deduction to 50% if they meet certain conditions.

Instructions

- Open the tax software

- Review the Background information and Required slips (tax slips, receipts, etc.)

- Provide all required information for the appropriate sections of the tax software

- Once completed, compare your results with the solution provided

- Afterwards, refer to Key points of the tax software and the Takeaway points

Background information

Situation

Doris is employed at a bakery (Chez Suzie) and started receiving U.S. Social Security benefits last year. Doris wants to claim the deduction for individuals receiving U.S. Social Security benefits.

| Category | Value |

|---|---|

| Name | Doris Cromwell |

| Social insurance number | 000 000 000 |

| Address | 123 Main Street City, Province X0X 0X0 |

| Date of birth | June 13, 1960 |

| Marital status | Single |

Required Slips

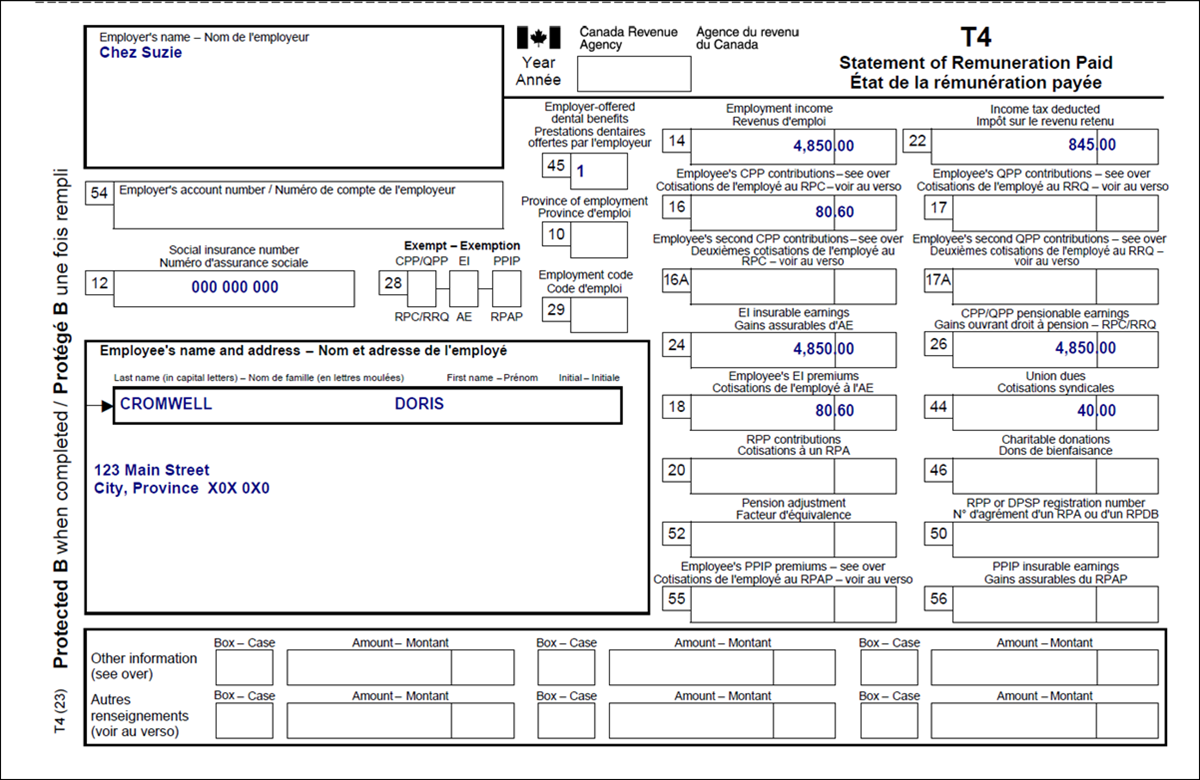

T4 – Statement of Remuneration Paid (Chez Suzie) (for Doris)

Text version of the above image

T4 – Statement of Remuneration Paid

Protected B

Employer’s name: Chez Suzie

Employee’s name and address:

Last name: Cromwell

First name: Doris

123 Main Street

City, Province X0X 0X0

Box 12: Social insurance number: 000 000 000

Box 14: Employment income: 4,850.00

Box 16: Employee’s CPP contributions – See over: 80.60

Box 18: Employee’s EI premiums: 80.60

Box 22: Income tax deducted: 845.00

Box 24: EI insurable earnings: 4,850.00

Box 26: CPP/QPP pensionable earnings: 4,850.00

Box 44: Union dues: 40.00

Box 45: Employer-offered dental benefits: 1

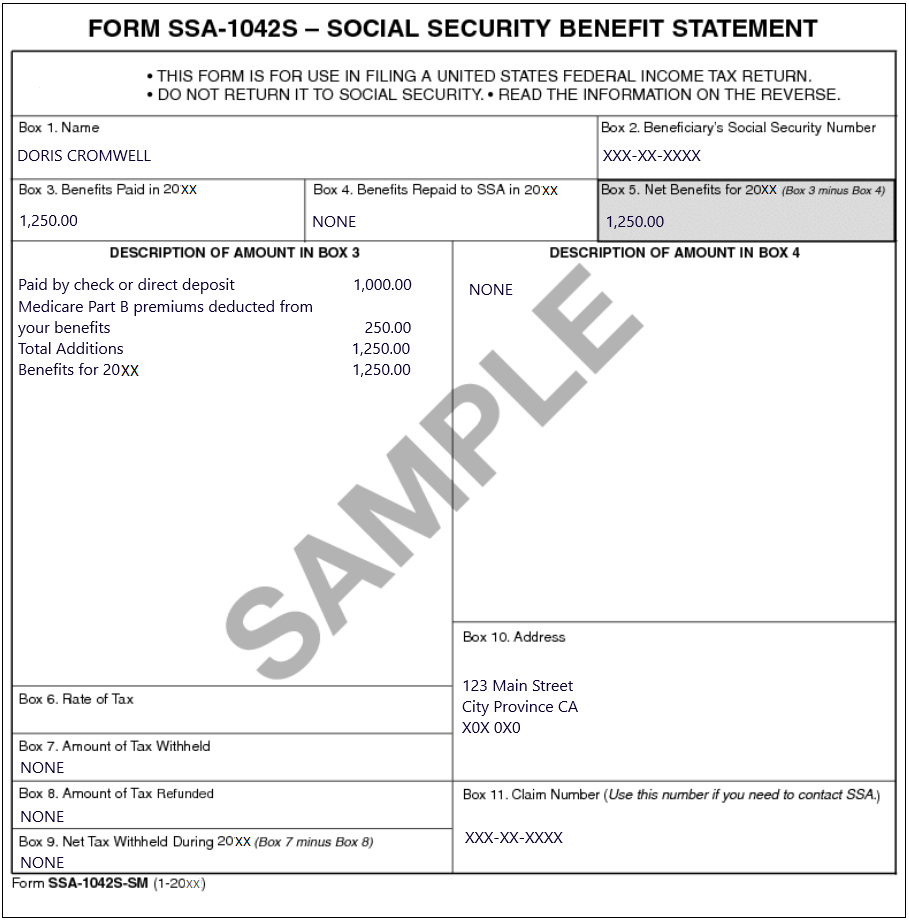

SSA-1042S – U.S. Social Security Benefit Statement (foreign pension income)

Text version of the above image

Form SSA-1042S – Social Security Benefit Statement – SAMPLE

This form is for use in filing a United States federal income tax return. Do not return it to social security. Read the information on the reverse.

Box 1: Name: Doris Cromwell

Box 2: Beneficiary’s Social Security Number: XXX-XX-XXXX

Box 3: Benefits Paid in 20XX: 1,250.00

Box 4: Benefits Repaid to SSA in 20XX: NONE

Box 5: Net Benefits for 20XX (Box 3 minus Box 4): 1,250.00

Description of amount in box 3: Paid by check or direct deposit: 1,000.00

Medicare Part B premiums deducted from your benefits: 250.00

Total Additions: 1,250.00

Benefits for 20XX: 1,250.00

Description of amount in box 4: NONE

Box 7: Amount of Tax Withheld: NONE

Box 8: Amount of Tax Refunded: NONE

Box 9: Net Tax Withheld During 20XX (Box 7 minus Box 8): NONE

Box 10: Address

123 Main Street

City Province CA

X0X 0X0

Box 11: Claim Number (Use this number if you need to contact SSA): XXX-XX-XXXX

RC210 – Advanced Canada workers benefit (ACWB) statement

Text version of the above image

RC210 – Advanced Canada workers benefit (ACWB) statement

Issued by: Canada Revenue Agency

Cromwell, Doris

123 Main Street

City, Province X0X 0X0

Social insurance number: 000 000 000

Box 10: Total Basic Advanced Canada workers benefit: 759.00

Review your results

Solution to Reporting U.S. Social Security benefits.

Key points of the tax software

Important note

To access complete instructions on the various steps of entering data into the software, click on the title of each section below.

Doris' interview

- Click T4 and employment income in the left-side menu

- Click the + sign next to T4 income (earned in any province except Quebec) in the T4 and T4E section

- Enter the required information in the corresponding fields

- Click Interview setup in the left-side menu

- Tick the box next to Foreign income or foreign property (T1135) in the Investment income and expenses section

- Click Foreign income and property in the left-side menu

- Click the + sign next to Foreign pension income (includes U.S. social security benefits) in the Foreign non-business income section

- Select United States (tax treaty with Canada) from the Country from where you received the foreign income drop-down menu

- Enter U.S. Social Security into the Description of the source of the foreign income field

- Enter the applicable exchange rate for the year into the Exchange rate to apply field

- Select United states social security benefits (15%) from the Type of foreign pension income drop-down menu

- Enter the amount that Doris received into the Amount of foreign income received field

Advanced Canada workers benefit (RC210)

- Click Other information slips in the left-side menu

- Click the + sign next to RC210 – Canada workers benefit advance payments statement [Federal line 41500]

- Enter the information from the tax slip

Takeaway points

United States Social Security benefits

- United States social security benefits are taxable and must be reported in Canadian dollars on the tax return

- the tax software automatically applies the exchange rate that is entered (in this case, an exchange rate of 1 was entered)

- the benefit amount is reported on line 11500 of the tax return

- Doris is allowed a 15% deduction on line 25600 of the tax return because she started receiving the benefits after 1995