Factsheet: The Underused Housing Tax (UHT) - Who is affected?

Affected owners are residential property owners who must file a UHT return and pay the tax. This factsheet will help you find out if you’re an affected owner.

Factsheet description

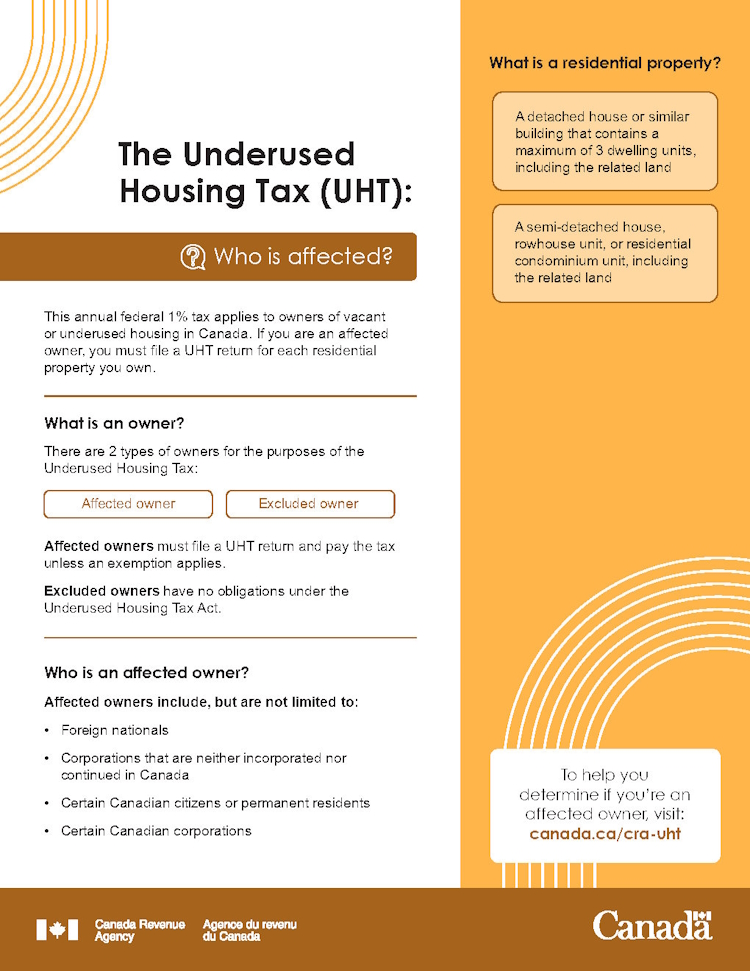

The Underused Housing Tax (UHT): Who is affected?

This annual federal 1% tax applies to owners of vacant or underused housing in Canada. If you are an affected owner, you must file a UHT return for each residential property you own.

What is an owner?

There are 2 types of owners for the purposes of the Underused Housing Tax:

- Affected owner

- Excluded owner

Affected owners must file a UHT return and pay the tax unless an exemption applies.

Excluded owners have no obligations under the Underused Housing Tax Act.

Who is an affected owner?

Affected owners include, but are not limited to:

- Foreign nationals

- Corporations that are neither incorporated nor continued in Canada

- Certain Canadian citizens or permanent residents

- Certain Canadian corporations

What is a residential property?

- A detached house or similar building that contains a maximum of 3 dwelling units, including the related land

- A semi-detached house, rowhouse unit, or residential condominium unit, including the related land

To help you determine if you’re an affected owner, visit: canada.ca/cra-uht.